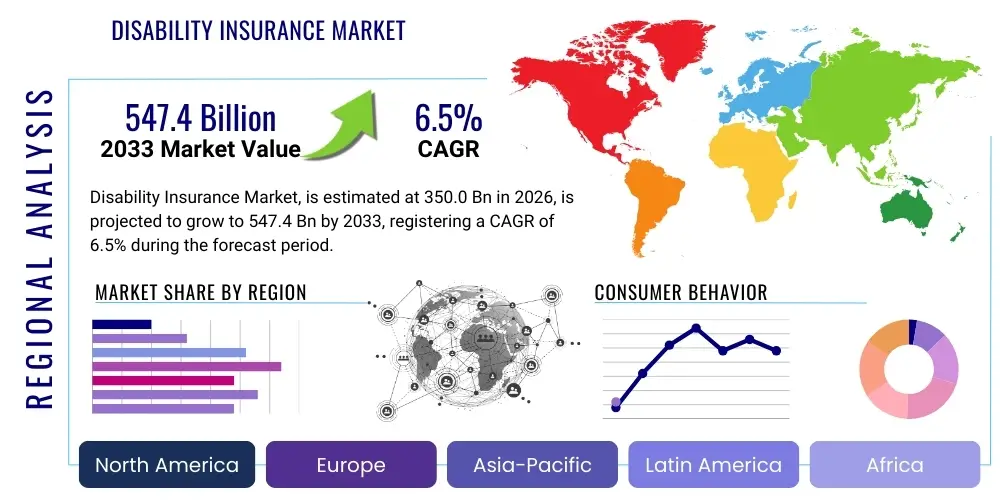

Disability Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439384 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Disability Insurance Market Size

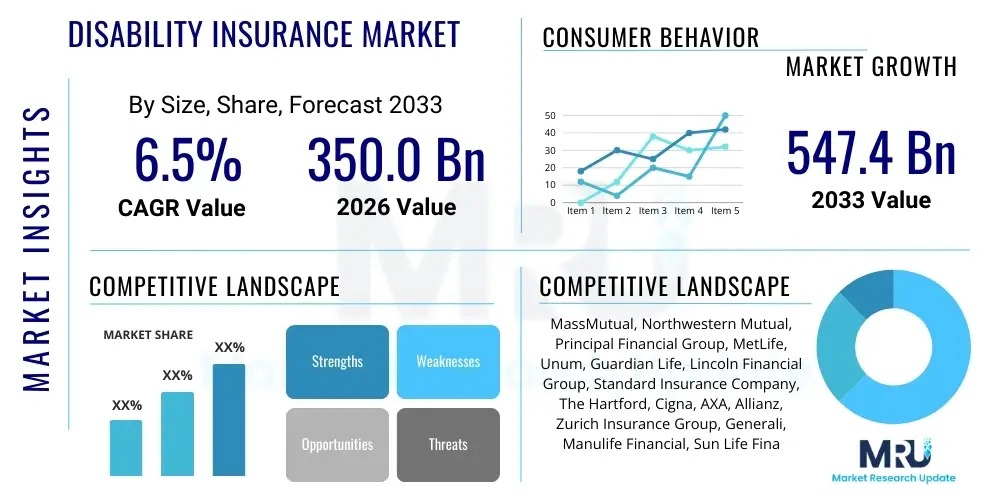

The Disability Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350.0 billion in 2026 and is projected to reach USD 547.4 billion by the end of the forecast period in 2033.

Disability Insurance Market introduction

The disability insurance market provides an indispensable financial safety net, meticulously designed to offer crucial income replacement to individuals who become physically or mentally unable to perform their occupational duties due to illness, injury, or accident. This vital financial product is expertly engineered to mitigate the profound economic risks associated with unforeseen health challenges, thereby ensuring a degree of financial stability and continuity when primary income sources are abruptly interrupted. Policies within this dynamic market are predominantly categorized into Short-Term Disability (STD) and Long-Term Disability (LTD) insurance, each serving distinct coverage durations. STD typically offers benefits for limited periods, usually ranging from a few weeks to several months, addressing temporary incapacities that require a short recovery. Conversely, LTD extends coverage for prolonged periods, potentially spanning years, or even up to retirement age, providing a robust and enduring shield against significant, long-term loss of earning capacity. The market is highly diverse, encompassing a broad array of products meticulously tailored for various demographics, from individual coverage plans for self-employed professionals to comprehensive group policies predominantly offered through employers, effectively catering to the distinct needs of a wide spectrum of the global workforce.

Furthermore, the market's trajectory is significantly bolstered by a powerful confluence of driving factors. Prominent among these drivers is the heightened public and corporate awareness regarding financial vulnerabilities in an increasingly uncertain global economic landscape, coupled with the pervasive trend of an aging global workforce which inherently faces a higher propensity for age-related health issues and injuries. The escalating global prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and mental health disorders, further exacerbates the risk of long-term incapacitation, fueling a consistent and growing demand for robust income protection solutions. Proactive employer initiatives to offer attractive and comprehensive benefits packages play a pivotal role in talent acquisition and retention strategies, thereby expanding the lucrative group segment of the market. Concurrently, evolving regulatory landscapes across various jurisdictions are increasingly contributing to market expansion, either by mandating certain levels of disability coverage or by implementing policies that actively incentivize its uptake among both individuals and businesses. The growing understanding among consumers regarding the statistical likelihood of experiencing a disabling event during their working lives, coupled with the recognized inadequacy and limitations of public safety nets in numerous regions, consistently underscores the critical and irreplaceable role of private disability insurance in contemporary financial planning and holistic risk management strategies, propelling this sector into a period of sustained and significant growth.

Disability Insurance Market Executive Summary

The Disability Insurance Market is currently navigating a period of dynamic and sustained expansion, primarily propelled by several overarching business trends that are fundamentally reshaping its operational and strategic landscape. Insurers are increasingly prioritizing extensive product innovation, manifesting in offerings such as highly flexible policy options, specialized riders meticulously designed for specific medical conditions, and innovative hybrid products that seamlessly integrate disability benefits with other forms of coverage like life insurance or critical illness protection, offering holistic financial security. A discernible and significant shift is underway towards digital distribution channels, with the proliferation of user-friendly online platforms and intuitive mobile applications that simplify the historically complex application process, significantly enhance overall customer engagement, and improve accessibility for a wider demographic. Furthermore, the formation of strategic partnerships between prominent insurance providers and specialized employee benefits consultants is playing a crucial role in substantially expanding market reach, particularly within the lucrative group segment, ensuring broader access to essential coverage for corporate employees. Concurrently, underwriting processes are undergoing continuous modernization and becoming considerably more sophisticated, effectively leveraging advanced data analytics and predictive modeling techniques to assess risk with greater accuracy, thereby enabling the offering of more competitively priced and personalized premiums. The burgeoning demand for highly customizable policies that meticulously cater to unique individual and occupational risk profiles represents another prominent business trend, compelling insurers to innovate beyond conventional, one-size-fits-all insurance solutions to provide truly bespoke protection.

AI Impact Analysis on Disability Insurance Market

The integration of Artificial Intelligence (AI) is ushering in a transformative era for the disability insurance market, directly addressing common user inquiries and concerns that revolve around operational efficiency, policy personalization, ethical fairness, and robust data security. Policyholders and prospective customers are increasingly keen to understand precisely how AI technologies will streamline traditionally opaque, complex, and time-consuming processes such as underwriting and claims management. The expectation is that AI will lead to significantly faster policy approvals, more efficient and transparent claim payouts, and a generally frictionless customer journey. A major area of interest also centers on AI's inherent capability to enable hyper-personalized insurance policies, moving beyond standardized, generic offerings to develop coverage options that accurately reflect specific individual risks based on an exhaustive analysis of lifestyle, occupational hazards, and detailed health data. While the benefits are clear, there are significant user concerns regarding the ethical implications of AI deployment, particularly concerning the privacy and security of sensitive personal health data, the potential for algorithmic biases that could inadvertently lead to discriminatory practices in pricing or coverage, and the broader impact of automation on employment within the insurance industry. However, the overarching expectation and strategic goal for insurers remain that AI will profoundly enhance market accessibility, substantially reduce operational costs, fortify capabilities for sophisticated fraud detection, and ultimately contribute to the availability of more affordable, relevant, and comprehensive insurance products for a broader consumer base, thereby fundamentally reshaping the competitive landscape of disability insurance.

- Enhanced Underwriting Accuracy and Speed: AI-powered predictive analytics tools are capable of ingesting and analyzing colossal datasets—including anonymized electronic health records, genomic data (where permissible and with explicit consent), lifestyle indicators from wearables, socioeconomic factors, and detailed occupational risk profiles. This sophisticated analysis allows for significantly more precise risk assessment, leading to highly individualized premiums that accurately reflect a policyholder's true risk, dramatically reducing the time required for underwriting decisions from weeks to mere minutes or hours, and improving the overall fairness of pricing by correlating premiums more directly with individual risk factors.

- Automated Claims Processing and Verification: The deployment of Natural Language Processing (NLP) and Machine Learning (ML) algorithms enables automated review and interpretation of complex medical documents, diagnostic reports, physician statements, and intricate policy terms. This drastically reduces manual intervention, accelerates claim validation and payout processes, minimizes human error, and ensures consistency and objectivity in claim decisions, thereby significantly enhancing policyholder satisfaction during a vulnerable time while substantially cutting administrative costs for insurers.

- Personalized Product Development and Dynamic Pricing: AI facilitates the creation of highly customized insurance products and flexible benefit structures meticulously tailored to an individual's unique health status, employment type (e.g., gig worker, traditional employee), evolving financial needs, and various life stages. This allows for dynamic pricing models that can adapt to changes in a policyholder's risk profile over time, potentially offering incentives for healthy living or adjusting coverage based on career progression, moving beyond static, predefined policy templates to truly responsive and consumer-centric insurance solutions.

- Sophisticated Fraud Detection and Prevention: AI algorithms excel at identifying subtle patterns, anomalies, and inconsistencies within vast amounts of claims data that might indicate fraudulent activity, such as suspicious medical billing, exaggerated claims, or coordinated schemes. This proactive and highly efficient fraud detection capability significantly reduces financial losses for insurers, which can translate into more stable and potentially lower premiums for all policyholders, fostering greater trust and integrity within the insurance ecosystem.

- Improved Customer Experience and Engagement: AI-powered chatbots, virtual assistants, and intelligent recommendation engines provide instant, 24/7 support to policyholders and prospective clients. These tools can answer complex policy-related questions, guide applicants seamlessly through the underwriting and application process, facilitate efficient claim submissions, and offer personalized advice on coverage options, significantly enhancing convenience, accessibility, and overall customer satisfaction through immediate and highly relevant interactions, reducing the need for human intervention in routine queries.

- Proactive Risk Management and Wellness Programs: Leveraging AI to analyze population health trends, individual biometric data (with explicit consent), and demographic information allows insurers to develop and offer proactive wellness programs and preventative care initiatives. These programs aim to mitigate disability risks before they occur, benefiting both the policyholder by improving health outcomes and the insurer by potentially reducing future claim frequencies and severity, aligning incentives for long-term well-being and promoting a healthier society.

- Data-Driven Actuarial Modeling and Risk Prediction: AI significantly enhances traditional actuarial science by providing more powerful tools for forecasting future claims, assessing long-term liabilities, and refining reserve calculations with unprecedented accuracy and granularity. By processing complex variables and identifying non-obvious correlations, AI models enable insurers to make more informed strategic decisions regarding product pricing, capital allocation, and risk management, ensuring the long-term financial stability and sustainability of disability insurance products in an ever-changing economic environment.

- Seamless Integration with Emerging Technologies: AI serves as a foundational technology for seamlessly integrating other cutting-edge innovations like blockchain for secure and transparent data management, IoT devices (wearables and smart sensors) for real-time health monitoring, and advanced telematics for occupational risk assessment. This holistic integration creates a more connected and intelligent insurance ecosystem, offering greater transparency, personalized insights, and responsive services, while carefully navigating the ethical implications of data usage and privacy regulations.

- Operational Efficiency and Cost Reduction: By automating numerous repetitive and rule-based tasks across underwriting, policy administration, and claims processing, AI and Robotic Process Automation (RPA) significantly reduce operational overheads and human error. This substantial efficiency gain allows insurers to reallocate valuable human resources to more complex tasks, focus on strategic growth initiatives, and potentially pass cost savings on to consumers in the form of more competitive premiums, thereby enhancing market competitiveness and expanding accessibility.

- Ethical AI Frameworks and Regulatory Compliance: As AI becomes increasingly pervasive within the insurance sector, insurers are also making significant investments in developing and implementing robust ethical AI frameworks and comprehensive governance models. This ensures transparency, fairness, and non-discrimination in algorithm design and deployment, actively mitigating the risks of bias. This crucial focus on responsible AI development is fundamental for building and maintaining consumer trust, ensuring strict compliance with evolving data privacy regulations (e.g., GDPR, CCPA), and addressing a key concern among users about the responsible and equitable use of their sensitive data in critical insurance decisions.

DRO & Impact Forces Of Disability Insurance Market

The disability insurance market is propelled by a powerful confluence of critical drivers, key among them being the rising awareness among both individuals and employers about the profound financial vulnerability posed by unexpected disabilities. This heightened understanding of risk underscores the necessity for proactive income protection. Demographic shifts, specifically an aging global population and a workforce that is extending its working years, naturally increase the statistical likelihood of age-related illnesses, chronic conditions, and injuries, thereby significantly escalating the intrinsic demand for robust income protection solutions. Furthermore, the increasing global prevalence of chronic diseases, such as diabetes, cardiovascular conditions, mental health disorders, and musculoskeletal issues, significantly contributes to long-term disability claims and consequently boosts the market by creating a more pronounced need for comprehensive coverage. Regulatory mandates in certain regions that actively encourage or even require employers to provide disability coverage also serve as a strong and consistent market driver, shaping corporate benefits policies. The pervasive economic uncertainties and the recognized inadequacy of public social security nets in many countries further underscore the critical need for private disability insurance, driving both individual and group policy uptake as a primary means of financial security.

Despite these significant drivers, the market faces several notable and persistent restraints that can impede its growth. High premium costs remain a major barrier to entry for many potential policyholders, particularly those in lower-income brackets or small businesses with limited operational budgets, leading to underinsurance or non-coverage. The inherent complexity of policy terms and conditions, often laden with arcane jargon, intricate benefit structures, and numerous exclusions, can actively deter consumers, leading to a perception that disability insurance is unduly difficult to understand or navigate, reducing consumer confidence. A persistent lack of comprehensive awareness about the true economic impact of disability and the specific, tangible benefits of insurance still permeates certain demographics and emerging markets, limiting demand. Additionally, macroeconomic factors such as economic downturns and recessions can lead to reduced disposable income, causing consumers to postpone or cancel insurance purchases, and can also impact employers' financial capacity to offer generous group benefits. Stringent underwriting processes, while absolutely necessary for sound risk management, can be time-consuming and may discourage some applicants, particularly those with complex medical histories or pre-existing conditions, due to perceived barriers to entry.

Opportunities within the disability insurance market are abundant and primarily revolve around leveraging technological innovation, expanding into new geographical territories, and tailoring products to evolving consumer needs. The advent and proliferation of advanced digital platforms and intuitive mobile applications offer unprecedented avenues for streamlined distribution, easier and more transparent application processes, and significantly enhanced customer engagement, making insurance more accessible. Leveraging sophisticated big data analytics and artificial intelligence (AI) can lead to the development of more personalized products, dynamic pricing models based on individual risk profiles, and significantly more efficient claims processing, thereby creating substantial competitive advantages for innovative insurers. Untapped markets, particularly in rapidly developing economies with burgeoning middle classes and growing workforces, present significant expansion opportunities where insurance penetration is traditionally low. The strategic development of specialized products meticulously tailored for the dynamic gig economy, the rapidly expanding segment of self-employed professionals, and specific high-risk occupations also represents a substantial growth area that addresses unique needs. Moreover, fostering stronger, collaborative partnerships with independent financial advisors, employee benefits consultants, and even healthcare providers can profoundly enhance consumer education and product penetration, while a strategic focus on wellness programs and preventative care initiatives can reduce claims frequency and foster long-term policyholder loyalty and better health outcomes. These opportunities, when strategically pursued, have the immense potential to significantly reshape, expand, and invigorate the disability insurance market.

The impact forces profoundly influencing the disability insurance market are multifaceted and constantly evolving. Technological advancements, particularly in data analytics, artificial intelligence (AI), machine learning (ML), and telematics, are profoundly altering traditional underwriting practices, claims assessment protocols, and customer service models. These innovations are pushing insurers towards greater operational efficiency, enhanced data accuracy, and unprecedented personalization in their offerings. Regulatory shifts, whether involving the tightening of consumer protection laws, mandating specific coverage types, or introducing new data privacy requirements, directly impact product design, pricing strategies, and overall market conduct, necessitating continuous adaptation from insurers. Socio-economic factors, such such as fluctuating unemployment rates, changing income levels, demographic shifts (e.g., aging populations), and the emergence of public health crises (like global pandemics), significantly affect both the demand for disability insurance and the frequency and severity of claims. Changing consumer preferences, characterized by a growing demand for digital interaction, greater transparency, more flexible policies, and faster service, are actively forcing insurers to innovate their product offerings and service delivery models. Lastly, the dynamic competitive landscape, with the emergence of new entrants offering niche products, insurtech-driven solutions, or disruptive business models, constantly pressures established players to adapt, evolve, and differentiate their offerings, ensuring continuous innovation and responsiveness to ever-changing market needs and expectations.

Segmentation Analysis

The disability insurance market is meticulously segmented to effectively cater to the highly diverse and evolving needs of individuals and groups, reflecting a wide spectrum of varying risk profiles, income levels, and occupational hazards. These intricate segmentations are absolutely crucial for insurance providers to strategically develop highly targeted products, rigorously optimize their pricing structures, and meticulously design the most effective and far-reaching distribution strategies, ultimately ensuring that comprehensive income protection becomes genuinely accessible to every potential policyholder, regardless of their specific circumstances. A deep and nuanced understanding of these distinct market segments is indispensable, as it allows for a more granular, precise, and insightful analysis of specific demand drivers, complex competitive dynamics, and emerging growth opportunities that exist within particular niches of the insurance landscape. This segmented approach ensures that products are not only relevant but also highly efficient in addressing the unique requirements of different consumer groups, fostering market penetration and customer satisfaction, and promoting sustainable growth across the industry.

By dissecting the market along critical dimensions such as the type of coverage offered, the primary distribution channels utilized, and diverse end-user demographics, insurers can effectively identify underserved populations and develop innovative, responsive solutions. For example, the fundamental distinction between Short-Term Disability (STD) and Long-Term Disability (LTD) policies allows for tailored responses to temporary versus prolonged incapacitation events, aligning coverage with the expected duration of income loss. Similarly, segmenting the market by end-user into individual, group, or self-employed categories highlights the vastly different purchasing behaviors, benefit expectations, and risk tolerances across these distinct groups, necessitating specialized product design. Such granular analysis significantly aids in optimized resource allocation, precisely targeted marketing efforts, and continuous product innovation, moving away from a generalized, one-size-fits-all approach to a highly specialized and client-centric one. This strategic segmentation is a cornerstone for sustained growth, enabling insurers to adapt swiftly to market changes, anticipate future needs, and maintain a formidable competitive edge by consistently delivering precise and compelling value propositions to each identified segment, thereby maximizing both market share and profitability in the highly competitive disability insurance sector while serving broader societal needs for financial security.

- By Type: This segmentation differentiates policies based on the duration of benefits provided, addressing the varying nature and expected recovery periods of disabilities.

- Short-Term Disability (STD) Insurance: Provides crucial income replacement for a limited and usually temporary period, typically ranging from a few weeks up to a maximum of six months, for temporary incapacitations that are expected to be short-lived. It often features a significantly shorter elimination period before benefits commence.

- Long-Term Disability (LTD) Insurance: Offers extended income protection, often for several years or even until retirement age, for severe, chronic, or permanent disabilities that result in prolonged loss of earning capacity. It generally involves a longer elimination period before benefits become payable, reflecting its long-term nature.

- By Coverage: This crucial category defines the specific conditions under which a policyholder is considered "disabled" and therefore eligible for benefits, impacting policy scope and cost.

- Own Occupation Disability Insurance: Considers you disabled if you cannot perform the essential duties of your specific, chosen occupation, even if you might be physically capable of performing another, less specialized job. This type is highly sought after by specialists, high-income professionals, and those in unique fields, offering superior protection.

- Any Occupation Disability Insurance: Considers you disabled only if you are completely unable to perform the duties of any occupation for which you are reasonably suited by education, training, or experience. This definition is broader and generally results in less expensive premiums but offers less specialized protection.

- Modified Own Occupation Disability Insurance: Represents a hybrid approach that protects your "own occupation" for an initial, defined period (e.g., the first 2-5 years of disability), after which it typically shifts to an "any occupation" definition. This provides initial specialized protection followed by a broader safety net.

- By Distribution Channel: Refers to the diverse avenues through which disability insurance policies are effectively sold and delivered to consumers, influencing market reach and customer engagement.

- Agents & Brokers: Traditional and enduring channels offering personalized advice, expert comparison shopping across multiple carriers, and invaluable assistance with complex applications. They provide human interaction, build trust, and deliver tailored solutions through deep market knowledge.

- Direct Sales (Online, Company Websites): A rapidly growing segment, offering unparalleled convenience, transparency in pricing, and often lower premiums due to reduced intermediary costs. This channel is particularly popular among tech-savvy and self-directed consumers seeking quick, efficient purchasing options.

- Bancassurance: Strategic partnerships between financial institutions (banks) and insurance companies, leveraging the bank's extensive customer base and trusted brand to distribute insurance products. This model offers integrated financial solutions and convenient access for bank clients.

- Other Channels (e.g., Financial Advisors, Affinity Groups): Includes sales through independent financial planning professionals who meticulously integrate disability insurance into holistic financial plans, or through professional associations, unions, and employer groups that offer specialized coverage to their members.

- By End-User: Categorizes policyholders based on their employment status, organizational affiliation, or business structure, highlighting distinct needs and purchasing behaviors.

- Individual: Policies purchased directly by individuals, often including self-employed professionals, freelancers, or those seeking to supplement existing employer-provided group coverage with enhanced personal protection.

- Group (Employer-Sponsored, Associations): Policies offered by employers to their employees or by professional associations to their members. These typically feature lower rates, easier underwriting requirements due to pooled risk, and are a key component of comprehensive employee benefits packages.

- Self-Employed Professionals: A critical and expanding segment necessitating robust individual policies as their sole source of income protection. They often require highly customizable policies to precisely match their variable income streams and unique occupational hazards, making tailored coverage paramount.

- Gig Economy Workers: A rapidly growing segment characterized by flexible work arrangements and often irregular income, driving significant demand for innovative, flexible, and modular disability insurance solutions that can adapt to their unique employment patterns and income volatility.

- By Policy Type: Defines the renewability and premium stability features of a disability insurance policy, impacting long-term security and cost predictability for the policyholder.

- Non-Cancellable: Offers the highest level of security, as the insurer cannot cancel the policy or increase premiums as long as payments are consistently made. This provides maximum long-term stability in terms of coverage and cost.

- Guaranteed Renewable: The insurer cannot cancel the policy, but they retain the right to increase premiums for an entire class of policyholders (not just an individual policyholder) based on actuarial experience. This offers security of coverage but less premium stability.

- Conditional Renewable: Policy can be renewed only if specific conditions are met by the insured, often based on employment status, health changes, or age limits. This type offers the least security in terms of guaranteed renewal.

Value Chain Analysis For Disability Insurance Market

The value chain of the disability insurance market is an intricate and multi-faceted ecosystem, encompassing a sequential yet interconnected series of stages that span from conceptual product design and rigorous risk assessment to efficient policy issuance and sensitive, empathetic claims management. This entire process is robustly supported by a diverse array of upstream and downstream activities that are absolutely essential for market operation and efficacy. Upstream activities predominantly involve the foundational elements of actuarial science, advanced data analytics, and innovative product development. In this critical phase, insurers engage in close collaboration with specialized data providers, sophisticated risk modeling experts, medical professionals, and legal advisors to meticulously design policy structures, accurately assess applicant risk profiles, and strategically set competitive premiums. This initial stage is absolutely paramount for ensuring the long-term financial viability and overall competitiveness of insurance products, relying heavily on the accuracy of vast datasets and the precision of sophisticated analytical tools to predict future claims liabilities, assess long-term financial obligations, and ensure regulatory compliance. Key informational inputs at this stage include comprehensive health data, prevailing demographic trends, meticulous economic forecasts, and evolving regulatory requirements, all of which collectively inform the precise articulation of product features and the strategic calibration of pricing strategies, forming the bedrock of sound and sustainable insurance offerings.

Disability Insurance Market Potential Customers

The potential customer base for disability insurance is remarkably broad and incredibly diverse, encompassing individuals across various demographics, employment statuses, and income levels who possess a shared fundamental need to protect their future earning capacity and financial well-being. A primary and substantial segment includes salaried employees, particularly those whose employer-provided benefits might be insufficient or who proactively wish to augment their existing group coverage with more robust individual policies. These individuals astutely recognize the significant and potentially devastating financial impact a disabling event could have on their ability to meet ongoing financial obligations, such as critical mortgage payments, educational expenses for their children, and daily living costs, thereby driving a consistent demand for comprehensive income protection solutions. The increasing public awareness about the limitations and often insufficient nature of state social security disability benefits and workers' compensation further propels this demographic towards securing private, more tailored insurance solutions. This segment is particularly sensitive to product features that offer long-term stability, guaranteed renewability, and policy benefits that align seamlessly with their career trajectories and personal financial objectives, making customized offerings highly attractive.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.0 billion |

| Market Forecast in 2033 | USD 547.4 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MassMutual, Northwestern Mutual, Principal Financial Group, MetLife, Unum, Guardian Life, Lincoln Financial Group, Standard Insurance Company, The Hartford, Cigna, AXA, Allianz, Zurich Insurance Group, Generali, Manulife Financial, Sun Life Financial, Aflac, Nippon Life, Swiss Re, Munich Re |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disability Insurance Market Key Technology Landscape

The disability insurance market is experiencing a profound and rapid technological transformation, fundamentally driven by an accelerating pace of innovation specifically aimed at substantially improving operational efficiency, enhancing data accuracy, and delivering a superior customer experience across every facet of the value chain. At the forefront of this revolution are advanced data analytics and artificial intelligence (AI), which are fundamentally reshaping the landscape of underwriting. These technologies enable insurers to meticulously process and analyze colossal volumes of diverse data—ranging from comprehensive electronic health records and genetic information (where legally and ethically permissible) to detailed lifestyle indicators gleaned from digital footprints and highly specific occupational risk profiles. This analytical prowess facilitates a significantly more precise risk assessment, allowing for the generation of highly personalized premiums that accurately reflect an individual policyholder's true risk exposure. Critically, AI and machine learning (ML) algorithms are also increasingly deployed for sophisticated predictive modeling, not only in identifying potential claims before they materialize but also in dramatically enhancing fraud detection capabilities by recognizing subtle, often invisible, suspicious patterns and anomalies in claims data that conventional human analysis might overlook. This dual impact leads to more robust risk assessment frameworks, a significant reduction in fraudulent claims, and ultimately, the ability to offer more competitive and equitable pricing to legitimate policyholders. The ethical deployment of AI and ML, with an unwavering focus on ensuring fairness, transparency, and stringent data privacy, remains an paramount consideration and a strategic imperative for all market participants, driving trust and responsible innovation.

Regional Highlights

- North America: This region fundamentally dominates the global disability insurance market, characterized by an exceptionally high penetration rate, a robust and mature regulatory framework, and significant awareness levels among both consumers and employers regarding the imperative of income protection. The United States and Canada are the principal contributors, driven by a strong cultural emphasis on private insurance, a highly developed employee benefits market, and extensive advisory networks. Furthermore, innovations in digital platforms, AI-driven personalization, and integrated wellness programs are particularly prominent here, setting global benchmarks for market advancement.

- Europe: Representing a mature and complex market, Europe is characterized by a sophisticated interplay of strong national social welfare systems and a steadily growing private disability insurance sector. Countries such as the UK, Germany, France, and the Netherlands consistently demonstrate significant demand, particularly for comprehensive long-term disability coverage, reflecting an aging population and changing social security landscapes. The region is witnessing an accelerating increase in employer-sponsored plans and a strategic focus on integrating proactive wellness programs directly with insurance offerings, aiming for a holistic approach to employee well-being and risk mitigation.

- Asia Pacific (APAC): This region is dynamically emerging as the fastest-growing market segment for disability insurance, fueled by robust economic development, rapidly increasing disposable incomes, and the rise of a burgeoning middle class across its diverse economies. Key contributing countries include China, India, Japan, and Australia, where, while awareness is still building, rapid urbanization, evolving lifestyles, and expanding workforces are collectively driving significant and untapped opportunities for substantial market expansion and product adoption. Insurers are increasingly tailoring products to address the specific cultural and economic nuances of this diverse region.

- Latin America: This region presents substantial untapped potential within the disability insurance market, driven by improving macroeconomic conditions, increasing insurance penetration rates, and a growing recognition of the importance of financial planning. Brazil, Mexico, and Argentina are notable and developing markets where a rising awareness of financial vulnerabilities and the critical need for income protection is steadily boosting demand for disability insurance products. Regulatory reforms and efforts to formalize labor markets are also playing a crucial role in fostering market development and encouraging greater insurance uptake.

- Middle East and Africa (MEA): This region represents a nascent but steadily developing market for disability insurance. Economic diversification efforts, increasing foreign investments, and a growing expatriate population in some Gulf Cooperation Council (GCC) countries are creating new and promising avenues for market growth. However, the region faces unique challenges related to comparatively lower general awareness, influential cultural factors regarding risk perception, and widely varying regulatory landscapes, all of which need to be strategically addressed for sustained growth and deeper market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disability Insurance Market.- MassMutual

- Northwestern Mutual

- Principal Financial Group

- MetLife

- Unum

- Guardian Life

- Lincoln Financial Group

- Standard Insurance Company

- The Hartford

- Cigna

- AXA

- Allianz

- Zurich Insurance Group

- Generali

- Manulife Financial

- Sun Life Financial

- Aflac

- Nippon Life

- Swiss Re

- Munich Re

Frequently Asked Questions

Analyze common user questions about the Disability Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is disability insurance and why is it critically important for robust financial planning and security?

Disability insurance serves as an indispensable financial safety net, providing a vital stream of income replacement if you become physically or mentally unable to perform your work duties due to illness, injury, or accident. It is critically important for comprehensive financial planning because a disabling event can abruptly halt your income-earning capacity, yet your financial obligations—such as critical mortgage payments, ongoing utility bills, educational expenses for dependents, and daily living costs—persist. Without this essential coverage, individuals and families face a high risk of rapidly depleting their lifelong savings, accumulating significant and often unmanageable debt, and potentially losing valuable assets, thereby jeopardizing long-term financial goals and overall quality of life. It offers crucial peace of mind and proactively safeguards your economic future against unforeseen health challenges that could otherwise be devastating.

What are the key differences between Short-Term Disability (STD) and Long-Term Disability (LTD) insurance policies, and which one is right for me?

The primary distinction between Short-Term Disability (STD) and Long-Term Disability (LTD) insurance lies fundamentally in the duration of the benefits provided. STD insurance is designed to cover temporary incapacitations, typically offering income replacement for a limited period, usually ranging from a few weeks up to a maximum of six months, following a relatively short elimination period (waiting period). In contrast, LTD insurance provides extended income protection for severe, chronic, or permanent disabilities, with benefits potentially lasting for several years, or even until retirement age, often after a longer elimination period of 90 to 180 days. While STD addresses immediate, short-lived income interruptions, LTD offers a more robust and enduring financial safety net against prolonged or permanent loss of earning capacity. The choice depends on your specific financial situation, employer benefits, and risk tolerance, often requiring both for comprehensive protection.

Which factors do insurers meticulously consider when calculating disability insurance premiums, and how can I potentially influence them?

Insurers meticulously determine disability insurance premiums based on a multitude of factors, each reflecting a component of your individual risk profile. Key considerations include your age at the time of application (younger applicants typically pay less over time), your occupation's inherent risk level (e.g., highly physical or hazardous jobs lead to higher premiums than administrative roles), your comprehensive health status (including medical history, existing conditions, family health history, and lifestyle choices like smoking or extreme sports), the specific benefit amount you choose, the desired length of coverage, and the elimination period (the waiting time before benefits commence). You can potentially influence your premiums by opting for a longer elimination period, maintaining a healthy lifestyle, avoiding high-risk activities, and choosing a policy with a benefit amount that adequately covers your essential needs without being unnecessarily excessive. Regular review of your policy can also ensure it remains cost-effective and aligned with your current circumstances and financial goals.

Are self-employed professionals eligible for disability insurance, and how do their policies often differ from traditional group plans?

Absolutely, self-employed professionals, independent freelancers, and entrepreneurs are not only fully eligible but are strongly encouraged to obtain robust disability insurance, as they typically lack access to traditional employer-sponsored benefits. Their policies are generally structured as individual disability insurance, which differs significantly from traditional group plans. Individual policies are highly customizable, offering substantially greater flexibility in terms of chosen benefit amounts, elimination periods, and crucial definitions of disability (e.g., "own occupation" coverage, which specifically protects their ability to work in their unique and specialized field). While often initially more expensive than group plans due to individualized risk assessment and a lack of pooled risk, they provide critical, personalized income protection that is absolutely essential for maintaining financial stability when their ability to generate income is directly and entirely linked to their capacity to work, making them an indispensable tool for their financial security.

How is Artificial Intelligence (AI) actively transforming the future landscape and operational efficiency of the disability insurance market?

Artificial Intelligence (AI) is rapidly and profoundly transforming the disability insurance market by introducing unprecedented levels of efficiency, personalization, and accuracy across the entire value chain. AI-powered tools are revolutionizing underwriting through advanced predictive analytics, allowing for more precise risk assessment and highly personalized premium calculations based on extensive and diverse datasets, including health and lifestyle information. It is also dramatically streamlining claims processing via automated review and verification using Natural Language Processing (NLP) and machine learning (ML), significantly reducing payout times, minimizing administrative burdens, and ensuring greater consistency. Furthermore, AI substantially enhances fraud detection capabilities, enabling insurers to identify suspicious patterns with greater precision and speed. While ongoing concerns regarding data privacy and potential algorithmic bias necessitate robust ethical frameworks and vigilant regulatory oversight, AI is fundamentally making disability insurance more accessible, efficient, and meticulously tailored to individual needs, potentially leading to more competitive pricing and an overall elevated customer experience, thereby redefining the industry's future operational and strategic landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Life, Pension, Health and Disability Insurance Industry Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Term Insurance, Permanent Insurance), By Application (Life insurance, Health insurance, Disability insurance, Pension insurance), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Life, Pension, Health and Disability Insurance Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Term Insurance, Permanent Insurance), By Application (Life Insurance, Health Insurance, Disability Insurance, Pension Insurance), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager