Disc Brakes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432206 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Disc Brakes Market Size

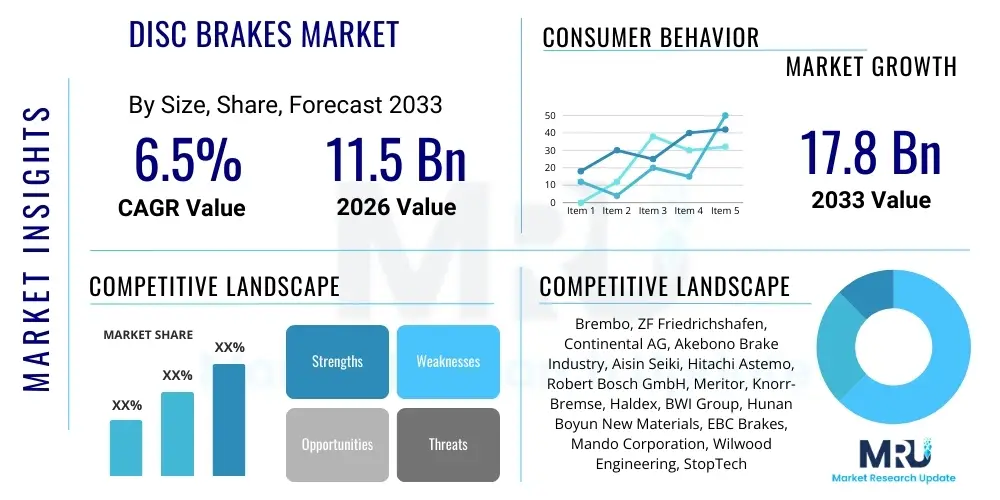

The Disc Brakes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 17.8 Billion by the end of the forecast period in 2033.

Disc Brakes Market introduction

The Disc Brakes Market encompasses the manufacturing, distribution, and utilization of braking systems employing calipers and rotors to decelerate or stop vehicles. These systems are fundamental components in nearly all modern automotive, motorcycle, and heavy vehicle platforms, offering superior heat dissipation, anti-fade characteristics, and consistent performance compared to traditional drum brakes. The primary products include fixed calipers, floating calipers, brake pads (friction material), rotors (discs), and associated hydraulic components.

Major applications of disc brakes span across passenger vehicles (sedans, SUVs, hatchbacks), light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and high-performance motorcycles. The inherent benefits, such as enhanced safety, reliability under strenuous conditions, and reduced stopping distances, position disc brakes as a critical safety feature mandated or highly preferred globally. Furthermore, the rapid integration of disc brakes into two-wheeler segments, driven by stringent safety regulations and rising consumer awareness, significantly propels market expansion.

Key driving factors include the escalating global vehicle production, especially in emerging economies, continuous technological advancements leading to lighter and more durable materials (like carbon ceramics and high-strength aluminum alloys), and global regulatory initiatives focused on improving road safety standards. The shift towards electric vehicles (EVs), which often require optimized braking systems for regenerative capabilities and weight management, also serves as a substantial catalyst for innovation and market growth.

Disc Brakes Market Executive Summary

The Disc Brakes Market is poised for significant expansion, driven primarily by robust business trends centered on vehicle electrification and the increasing adoption of advanced driver-assistance systems (ADAS), which necessitate highly responsive and precise braking mechanisms. Strategic collaborations between original equipment manufacturers (OEMs) and brake system suppliers are focusing on developing lighter components and integrating sensors for predictive maintenance and enhanced safety features. The aftermarket segment is witnessing growth due to the rising average age of vehicles and the increasing consumer preference for performance-oriented replacement parts, reinforcing the dual-channel revenue stream for market participants.

Regionally, Asia Pacific (APAC) continues to dominate the market volume, fueled by high manufacturing output in countries like China and India and increasing disposable incomes leading to higher vehicle ownership rates. North America and Europe, while mature markets, are leading in value growth due to stringent regulatory frameworks mandating advanced braking technologies, such as electronic stability control (ESC) and automatic emergency braking (AEB), which rely heavily on robust disc brake performance. Investment in manufacturing capacity expansion in Eastern Europe and Southeast Asia is also diversifying the global supply chain, mitigating risks associated with reliance on singular manufacturing hubs.

Segmentation trends indicate a strong shift towards high-performance materials, particularly in premium vehicle categories and motorsport applications, driving the material segment towards composites and specialized aluminum alloys. The floating caliper design maintains prevalence due to cost-effectiveness, though fixed calipers are favored in high-end, heavy-duty applications requiring superior stiffness and consistent pedal feel. The aftermarket segment is prioritizing easy-to-install, long-lasting pads and rotors, emphasizing lower dust emission and noise reduction, catering directly to consumer quality-of-life demands.

AI Impact Analysis on Disc Brakes Market

User queries regarding AI in the Disc Brakes Market primarily revolve around how machine learning can enhance braking performance, reliability, and maintenance. Common themes include the role of AI in predictive failure analysis (determining when pads or rotors need replacement based on driving patterns and sensor data), optimizing regenerative braking blending in EVs, and improving manufacturing precision. Users are also concerned about the integration of complex AI algorithms with foundational safety systems like ABS and how this affects system redundancy and certification. The overarching expectation is that AI will transform disc brakes from purely mechanical/hydraulic components into smart, data-driven subsystems critical for autonomous vehicle operation and overall system health management.

The immediate impact of Artificial Intelligence (AI) and machine learning (ML) is visible in the evolution of Electronic Braking Systems (EBS) and Brake-by-Wire architectures. AI algorithms analyze vast datasets collected from embedded sensors regarding temperature, wear rate, hydraulic pressure fluctuations, and driver behavior to optimize braking force distribution in real-time, significantly reducing wear variance across components and improving overall system lifespan. Furthermore, AI contributes substantially to sophisticated simulation environments used during the research and development phase, allowing manufacturers to iterate quickly on design improvements tailored for specific vehicle dynamics and load conditions, ultimately decreasing time-to-market for next-generation disc brake systems.

In the realm of predictive maintenance, AI processes telemetry data to alert vehicle owners and fleet managers precisely when maintenance is required, moving away from time- or mileage-based schedules. This optimization minimizes unexpected failures, reduces operational downtime for commercial fleets, and ensures maximum safety compliance. Integrating deep learning models into supply chain logistics also enables manufacturers to forecast material demands more accurately, manage inventory, and optimize the production flow for highly customized or specialized disc brake components, enhancing efficiency and reducing production costs across the board.

- AI optimizes brake force distribution in real-time, improving stability and reducing component wear.

- Machine learning algorithms enable highly accurate predictive maintenance of pads, rotors, and hydraulics.

- AI enhances manufacturing quality control by processing high-resolution imaging data for defect detection.

- Intelligent systems are crucial for blending friction braking with regenerative braking efficiently in electric vehicles.

- AI supports advanced simulation and testing, accelerating the development of new material formulations and component designs.

- Natural Language Processing (NLP) aids in analyzing complex sensor feedback for diagnostics and technical support.

DRO & Impact Forces Of Disc Brakes Market

The Disc Brakes Market is propelled by strong Drivers (D), primarily safety regulations and technological advancements in vehicle performance, while facing certain Restraints (R), such as the high cost associated with advanced materials like carbon ceramics and the complexity of integrating braking systems into EV architectures. Significant Opportunities (O) emerge from the rapid growth of the electric vehicle segment and the global push toward lightweighting technologies. These factors collectively exert powerful Impact Forces (IF) on the market structure, compelling manufacturers to focus on innovation, cost reduction, and compliance with increasingly stringent environmental and safety standards globally.

Key drivers include the global harmonization of safety standards, such as the UN Regulation No. 13-H for passenger cars, which necessitates high-performance braking systems. The continuous increase in vehicle average speeds and weight (especially due to battery integration in EVs) mandates stronger, fade-resistant disc brakes. Furthermore, the robust growth in emerging economies drives new vehicle sales, creating a fundamental demand base for both OEM and aftermarket disc brake components. The competitive landscape forces continuous product improvement, leading to faster adoption of innovations like performance coatings and optimized thermal management systems, thereby elevating the market standard.

Conversely, major restraints involve the inherent cost disadvantage of disc brakes compared to drum brakes in certain low-end or entry-level vehicle segments, particularly in the two-wheeler market where cost sensitivity is high. Environmental concerns regarding brake dust particle emissions (non-exhaust emissions) are emerging as a major regulatory hurdle, requiring substantial R&D investment into low-wear or specialized friction materials. The complexity of integrating traditional hydraulic braking with new electro-mechanical systems (like brake-by-wire) and coordinating friction braking with regenerative functions in EVs presents significant engineering and certification challenges, potentially slowing adoption rates for cutting-edge solutions.

Segmentation Analysis

The Disc Brakes Market is intricately segmented based on Type, Vehicle Type, End-User, and Material, reflecting the diverse applications and performance requirements across the automotive and transportation industries. Understanding these segmentations is critical for market participants to tailor their product offerings, whether focusing on high-volume passenger vehicle components or specialized, high-performance aftermarket kits. The segmentation framework provides clarity on where regulatory pressures and technological breakthroughs are having the most pronounced impact, such as the rapid shift in material use driven by EV weight considerations.

The segmentation by Vehicle Type remains the most influential dimension, with Passenger Vehicles consuming the largest share due to sheer volume, followed by Commercial Vehicles, which demand heavy-duty, durable systems capable of handling extreme loads and sustained heat. The End-User segmentation differentiates between the OEM segment, characterized by high volume, tight quality specifications, and long-term contracts, and the Aftermarket segment, driven by price sensitivity, immediate availability, and consumer brand loyalty for replacement parts. This duality requires distinct manufacturing, distribution, and marketing strategies from suppliers.

Technological differentiation is primarily captured through the Type (Fixed vs. Floating Caliper) and Material segments. Fixed calipers dominate the high-performance and luxury vehicle segments due to their superior rigidity and responsiveness, while floating calipers are ubiquitous in mainstream vehicles due to their cost-efficiency and easier maintenance. The ongoing innovation in friction materials, including low-copper or copper-free formulations mandated by environmental legislation (like the North American copper restriction laws), dictates the competitive positioning within the material segment, pushing development toward advanced ceramic and composite matrices.

- Type:

- Fixed Caliper Disc Brakes

- Floating Caliper Disc Brakes

- Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Two-Wheelers (Motorcycles and Scooters)

- End-User:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement)

- Material Type:

- Cast Iron

- Aluminum Alloys

- Composites (Carbon Ceramic Matrix)

Value Chain Analysis For Disc Brakes Market

The Value Chain for the Disc Brakes Market commences with upstream activities involving the sourcing and processing of raw materials, primarily specialized ferrous alloys (cast iron), aluminum, high-grade polymers, and friction components like resins and fibers. Key upstream suppliers include material foundries and chemical manufacturers specializing in high-temperature friction compounds. The integration of advanced metallurgy is critical at this stage, as the properties of the rotor material directly determine braking efficiency, heat resistance, and longevity. Consolidation among material suppliers is common, influencing procurement costs for system manufacturers.

Midstream activities involve core manufacturing, assembly, and quality testing. Major Tier 1 suppliers like Continental, Bosch, and Brembo undertake precision casting, machining, forging, and the complex assembly of caliper units and brake systems. Strict quality control processes, including non-destructive testing and endurance trials, are paramount, given the safety-critical nature of the product. Manufacturers invest heavily in automated production lines to maintain tight tolerances and achieve the high volumes required by global OEMs, creating significant entry barriers for new participants.

The downstream component involves distribution and sales, segmented into direct and indirect channels. Direct distribution dominates the OEM segment, where systems are delivered Just-In-Time (JIT) directly to vehicle assembly lines through long-term contracts. The aftermarket segment relies on indirect channels, utilizing a vast network of independent distributors, wholesalers, regional repair shops, and increasingly, e-commerce platforms. This multi-tiered distribution network ensures global availability of replacement parts, but also introduces complexities related to counterfeit product management and inventory optimization across diverse geographical regions.

Disc Brakes Market Potential Customers

The primary customer base for the Disc Brakes Market includes two broad categories: Original Equipment Manufacturers (OEMs) and the expansive Aftermarket consumer. OEMs represent the largest customer volume segment, comprising global automotive manufacturers (like Ford, Toyota, Volkswagen, and Tesla), heavy-duty truck manufacturers (like Daimler Trucks, Volvo, and PACCAR), and major two-wheeler producers (like Honda, Yamaha, and Bajaj). These customers seek long-term partners capable of delivering customized, integrated braking systems that meet stringent performance, weight, and durability standards, often requiring complex mechatronic integration.

The aftermarket customers are vastly diverse, encompassing individual vehicle owners, independent repair shops (IRSPs), franchised dealer service centers, and commercial fleet operators. Individual consumers typically prioritize reliability, ease of replacement, and cost-effectiveness for standard vehicles, but high-performance vehicle owners seek specialized, high-grade materials for enhanced track performance. Commercial fleet operators (e.g., logistics companies, public transport providers) are highly cost-sensitive and focus heavily on brake longevity, low maintenance requirements, and overall total cost of ownership (TCO) to minimize downtime and maximize operational efficiency. Specialized markets, such as racing teams and military vehicle producers, also constitute a niche, high-value customer segment demanding ultra-premium, bespoke solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 17.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brembo, ZF Friedrichshafen, Continental AG, Akebono Brake Industry, Aisin Seiki, Hitachi Astemo, Robert Bosch GmbH, Meritor, Knorr-Bremse, Haldex, BWI Group, Hunan Boyun New Materials, EBC Brakes, Mando Corporation, Wilwood Engineering, StopTech, Alcon, Baer Brakes, Endless Brake Technology, TMD Friction. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disc Brakes Market Key Technology Landscape

The technological landscape of the Disc Brakes Market is rapidly evolving, driven by the dual pressures of vehicle electrification and the mandatory requirement for enhanced safety performance, particularly in high-speed and autonomous driving scenarios. A major trend involves the migration toward Brake-by-Wire (BBW) systems, which replace traditional hydraulic connections with electronic signals, offering precise control, faster response times, and easier integration with ADAS and autonomous driving software. This electro-mechanical evolution requires sophisticated sensor integration for continuous monitoring of brake performance parameters, thermal status, and wear indicators, transforming the brake system into a critical data node on the vehicle network.

Another significant development centers on advanced material science and manufacturing processes aimed at lightweighting and thermal management. The adoption of two-piece rotors (hat and friction ring) made from different materials, typically aluminum for the hat and cast iron or ceramic for the ring, significantly reduces unsprung weight, improving vehicle handling and fuel efficiency (or range in EVs). Furthermore, research into friction materials is focused intensely on developing copper-free and low-emissions compounds that meet emerging environmental regulations while maintaining or exceeding current performance standards. Carbon-ceramic matrix (CCM) brakes, once exclusive to supercars, are seeing incremental adoption in high-end SUVs and performance EVs due to their unparalleled heat resistance and longevity.

In manufacturing, additive manufacturing (3D printing) is being explored for prototyping complex caliper designs that optimize stiffness-to-weight ratios. Furthermore, specialized surface treatments and coatings (e.g., tungsten carbide coatings on rotors) are being utilized to minimize wear, reduce corrosion, and decrease the output of fine particulate matter, extending the lifespan of the braking components and aligning the technology with stringent environmental health targets. The core challenge for engineers remains balancing superior thermal efficiency and durability with the necessity of achieving cost-effective high-volume production required by the global automotive industry.

Regional Highlights

The global Disc Brakes Market exhibits heterogeneous growth patterns, heavily influenced by regional regulatory environments, manufacturing concentrations, and consumer adoption rates of new vehicle technologies, particularly EVs.

Asia Pacific (APAC) stands as the powerhouse of the global market, accounting for the highest market share in terms of volume and witnessing the fastest growth rate. This dominance is attributed to the massive scale of automotive manufacturing in China, India, Japan, and South Korea. Rapid urbanization, rising middle-class income, and the subsequent surge in vehicle sales, coupled with stricter government mandates on mandatory Anti-lock Braking System (ABS) and Combined Braking System (CBS) features, particularly in the two-wheeler segment, are the primary growth catalysts. The region is also becoming a key manufacturing hub for advanced disc brake systems, leveraging lower operational costs and large domestic supply chains.

Europe represents a mature market characterized by extremely high safety standards and a leading role in EV adoption. The focus in Europe is heavily skewed towards high-performance and low-emission braking solutions. Stringent regulations like Euro 7, which may impose limits on non-exhaust particulate emissions (brake dust), are forcing manufacturers to rapidly innovate in materials science, promoting the adoption of advanced coated rotors and new friction formulations. The transition to electric and hybrid vehicles drives demand for specialized regenerative braking blending systems that incorporate electro-mechanical components.

North America is a crucial market, defined by high average vehicle weight (SUVs and light trucks) and a strong consumer demand for high-performance and aftermarket personalization. The region is leading in the implementation of safety technologies, such as Automatic Emergency Braking (AEB), which require extremely reliable disc brake actuation. Furthermore, regional environmental regulations, particularly the phase-out of copper in brake pads across several states, are dictating R&D priorities, leading to significant investment in sustainable friction materials.

Latin America and Middle East & Africa (MEA) represent significant growth opportunities. In Latin America, vehicle production recovery and increasingly standardized safety regulations are boosting demand for quality disc brake systems, often shifting away from drum brakes in entry-level models. The MEA region, particularly the GCC countries, sees steady demand driven by infrastructure projects and commercial fleet expansion, often requiring robust, heat-resistant systems capable of operating reliably in extreme temperatures.

- Asia Pacific (APAC): Dominates volume and growth; driven by manufacturing hubs (China, India) and mandatory ABS/CBS adoption.

- Europe: Value leader focused on low-emission brakes (due to potential Euro 7 standards) and rapid integration of brake-by-wire for EVs and autonomous vehicles.

- North America: Driven by demand for heavy-duty performance and adherence to state-level copper-free legislation (e.g., California, Washington).

- Latin America: Rising safety awareness and vehicle fleet modernization driving replacement of older technologies.

- Middle East & Africa (MEA): Steady growth fueled by commercial vehicle expansion and demand for heat-resistant braking solutions suitable for arid conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disc Brakes Market. These companies are pivotal in driving innovation, setting industry standards, and influencing global market dynamics through their expansive product portfolios and strategic global manufacturing footprints.- Brembo S.p.A.

- ZF Friedrichshafen AG (TRW Automotive)

- Continental AG

- Akebono Brake Industry Co., Ltd.

- Aisin Seiki Co., Ltd.

- Hitachi Astemo, Ltd. (a merger of Hitachi Automotive Systems, Keihin, Showa, and Nissin Kogyo)

- Robert Bosch GmbH

- Meritor, Inc.

- Knorr-Bremse AG

- Haldex AB

- BWI Group

- Hunan Boyun New Materials Co., Ltd.

- EBC Brakes

- Mando Corporation

- Wilwood Engineering, Inc.

- StopTech (Centric Parts)

- Alcon Components Ltd.

- Baer Brakes

- Endless Brake Technology Co., Ltd.

- TMD Friction Group (A part of Nisshinbo Holdings)

Frequently Asked Questions

Analyze common user questions about the Disc Brakes market and generate a concise list of summarized FAQs reflecting key topics and concerns.How is the growth of Electric Vehicles (EVs) impacting the design and demand for disc brakes?

EV growth significantly impacts disc brake design by emphasizing weight reduction and integration with regenerative braking systems. EVs primarily use regenerative braking, meaning friction brakes are used less frequently but must remain reliable and corrosion-resistant. This drives demand for lightweight rotors (e.g., two-piece or composite designs) and specialized friction materials optimized for low-wear, minimal dusting, and superior performance during emergency stops.

What is Brake-by-Wire (BBW) technology, and how will it change traditional disc brake systems?

Brake-by-Wire (BBW) is an emerging technology that replaces the mechanical or hydraulic link between the brake pedal and the calipers with electronic sensors and actuators. BBW offers faster, more precise, and independently controllable braking force at each wheel, which is essential for advanced ADAS features like automated parking and emergency braking. It enables superior performance blending with regenerative braking and is foundational for future autonomous vehicle platforms.

What are the primary factors driving innovation in disc brake material science?

Innovation in disc brake material science is predominantly driven by two factors: regulatory demands for reducing environmental pollutants and the OEM need for lightweight, high-performance components. Environmental regulations, such as copper elimination mandates in North America and potential European limits on non-exhaust particulate emissions (brake dust), necessitate the development of new, copper-free, low-dust ceramic and composite friction compounds. Lightweighting, particularly for rotors, is driven by the need to offset battery weight in EVs.

What is the difference between fixed caliper and floating caliper disc brake systems?

A floating (or sliding) caliper system uses one or two pistons on the inboard side, relying on the caliper sliding mechanism to apply equal force to both sides of the rotor. They are cost-effective and common in mainstream vehicles. A fixed caliper system uses pistons positioned on both sides of the rotor, remaining stationary relative to the wheel. Fixed calipers offer greater rigidity, superior heat management, and more consistent pedal feel, making them preferred for heavy-duty, performance, and luxury vehicle applications.

Which geographical region holds the largest market share for disc brakes, and why?

The Asia Pacific (APAC) region currently holds the largest volume market share for disc brakes, primarily due to the immense scale of vehicle manufacturing and sales in countries such as China and India. Rapid motorization, combined with increasing regulatory requirements mandating basic safety features like ABS and CBS on motorcycles and passenger vehicles, ensures a consistently high demand for both original equipment and replacement disc brake systems across the region.

Future Market Outlook and Strategic Implications

The Disc Brakes Market is positioned at a crucial inflection point, transitioning from purely hydraulic components to sophisticated mechatronic systems integral to vehicle safety and operational efficiency. The strategic trajectory for major market players involves heavy investment in software integration, focusing on perfecting the seamless blending of friction braking with electrified powertrain management. Future market growth will not only be quantified by unit volume but increasingly by the value derived from intelligent braking solutions, data collection capabilities, and integration into the vehicle’s central computational architecture. Suppliers must evolve into system integrators capable of managing complex data flows related to predictive maintenance and autonomous control commands.

From a strategic standpoint, differentiation will hinge on sustainable manufacturing practices and advanced material application. Companies that successfully navigate the shift to copper-free and low-dust friction materials while maintaining competitive pricing will gain a significant long-term competitive advantage, particularly in regulated markets like North America and Europe. Furthermore, streamlining the supply chain to secure high-quality, lightweight materials, such as specialized aluminum alloys and carbon-ceramic precursors, will be essential to meet the burgeoning demand from the high-performance and premium EV segments, where reducing unsprung mass is a top priority for maximizing vehicle dynamics and range.

The aftermarket sector presents a growing opportunity, particularly as vehicle complexity increases. While OEMs drive innovation, the aftermarket relies on efficient distribution and brand trust. Strategic implications here include leveraging e-commerce platforms and digital diagnostics tools to assist repair shops and consumers with component selection and installation. Successful companies will implement robust anti-counterfeiting measures and offer extended-life, premium replacement parts that justify a higher price point through superior performance characteristics, such as reduced noise, lower dusting, and extended wear cycles, meeting the demands of an increasingly discerning global consumer base.

Regulatory Landscape and Standardization

The global regulatory environment exerts immense pressure on the disc brakes market, acting as a primary driver for innovation and standardization. Safety regulations related to minimum stopping distance, brake system redundancy, and mandatory inclusion of ADAS features like Electronic Stability Control (ESC) and Automatic Emergency Braking (AEB) directly dictate the functional requirements for disc brake systems. These global standards, enforced by bodies like the UNECE (World Forum for Harmonization of Vehicle Regulations), ensure a baseline of high performance, compelling manufacturers to continuously upgrade materials and electronic integration capabilities. The ongoing review and update of these standards mean that systems designed today must be forward-compatible with emerging safety benchmarks, impacting product development cycles and costs.

Beyond safety, environmental legislation is becoming increasingly influential. The most significant example is the phase-out of copper in brake pads (reaching trace levels by 2025 in parts of the U.S.) to prevent waterway pollution. This has forced massive research investment into alternative friction material matrices, replacing copper with less environmentally persistent materials such as mineral compounds, specialized ceramics, and advanced metallic sulfides. Furthermore, discussions surrounding non-exhaust emissions—specifically the fine particulate matter generated by brake wear—are gaining traction, particularly in Europe. If regulatory bodies impose limits on brake dust, it will necessitate a wholesale shift toward ultra-low wear materials, sophisticated rotor coatings (e.g., tungsten carbide layers), and potentially even enclosed braking systems, leading to a substantial technological transformation.

Standardization bodies, including ISO and national organizations, play a crucial role in establishing performance testing protocols, material composition requirements, and interface specifications for brake-by-wire components. Compliance with these standards is mandatory for market access and global trade. The complexity of integrating BBW and ADAS features means that software validation and cybersecurity standards related to braking systems are rapidly emerging as critical compliance areas. Manufacturers must demonstrate not only mechanical robustness but also the digital integrity and security of their electronic braking components to meet evolving regulatory scrutiny globally.

Sustainability and Circularity in Disc Brakes

Sustainability is no longer a peripheral consideration but a core pillar of product strategy within the Disc Brakes Market, driven by environmental mandates and consumer preference for eco-friendly products. The concept of circularity is being integrated across the product lifecycle, starting with the selection of raw materials. Manufacturers are increasingly utilizing recycled content in cast iron and aluminum rotors, reducing the energy intensity associated with primary metal production. Furthermore, efforts are concentrated on developing friction materials that are free from heavy metals and potentially harmful substances, ensuring that the components are less toxic during their wear phase and easier to dispose of or recycle at the end of their service life.

The manufacturing process itself is undergoing a transformation towards greater energy efficiency and waste reduction. Adoption of dry machining techniques, minimizing the use of lubricating and cooling fluids, reduces hazardous waste streams. Optimization of casting and forging processes to reduce material scrap rates is a continuous improvement focus. Major suppliers are also investing in closed-loop systems for collecting and processing used brake pads and rotors. While the physical recycling of highly specialized composite materials (like carbon ceramics) remains challenging, advancements are being made in separating and reusing components, focusing initially on maximizing the material recovery from heavy-duty commercial vehicle brakes due to their larger mass and more controlled service environment.

Product longevity is inherently linked to sustainability; longer-lasting components reduce the frequency of replacement and material consumption. This drives the development of high-durability friction materials and corrosion-resistant rotor coatings. Companies are also exploring remanufacturing programs, particularly for expensive components like fixed calipers and specialized actuators, which involves meticulously rebuilding the used parts to OEM specifications. Promoting remanufactured components not only reduces waste but also provides a cost-effective, sustainable option for the aftermarket, aligning environmental responsibility with strong business economics.

Impact of Electrification on Component Dynamics

The rapid global transition toward electric vehicles (EVs) represents the single most disruptive force affecting the fundamental dynamics of the Disc Brakes Market. EVs utilize regenerative braking to recover energy, which drastically reduces the workload and frequency of use for the friction braking system. This change introduces two primary challenges: corrosion and system optimization. Since the friction brakes are used less often, rotors are more prone to rust and corrosion, potentially leading to reduced effectiveness when emergency braking is required. Manufacturers are responding by using anti-corrosion coatings and materials specifically designed for low-usage, high-reliability requirements.

Component optimization in EVs centers on weight reduction and enhanced integration. The heavy battery packs increase the overall vehicle mass, necessitating powerful, yet lightweight, braking systems to maintain performance and safety standards without compromising EV range. This fuels the demand for high-strength aluminum calipers and multi-material rotors that reduce unsprung weight. Moreover, the integration must be seamless: the electronic control unit (ECU) must efficiently manage the transition between regenerative braking (where the motor slows the vehicle) and friction braking (when greater deceleration is needed), demanding highly responsive and precise electronic actuators and sophisticated software calibration to ensure smooth pedal feel and optimal energy recovery under varying driving conditions.

The adoption of Electric Park Brakes (EPB) and the migration toward full Brake-by-Wire systems are direct results of electrification. BBW simplifies the system architecture, removes complex hydraulic lines, and allows for much more sophisticated electronic control, which is essential for maximizing regenerative efficiency and supporting L2+ and L3 autonomous driving functions. The future disc brake system in an EV is fundamentally a smart, electronically controlled safety module, requiring electrical engineers and software specialists in addition to traditional mechanical and material scientists, fundamentally changing the competitive skill set required in this market.

Competitive Landscape Analysis and Strategic Benchmarking

The competitive landscape of the Disc Brakes Market is characterized by the dominance of a few multinational Tier 1 suppliers that maintain deep, long-standing relationships with global OEMs. These major players, including Continental, Bosch, ZF, and Brembo, invest substantially in advanced R&D, holding key patents related to lightweighting, advanced metallurgy, and brake-by-wire technology. Their strategy typically involves offering integrated chassis and brake control systems, moving beyond component supply to become full system solutions providers, which is essential for capturing high-value contracts in the evolving EV and autonomous vehicle segments. Competition is intense, particularly in the high-volume OEM segment where cost efficiency and global supply chain reliability are non-negotiable prerequisites for success.

Mid-sized and niche players, such as EBC Brakes and Wilwood Engineering, focus primarily on the specialized performance and high-end aftermarket segments. Their competitive strategy often involves rapid customization, superior material compositions (e.g., specific racing compounds), and strong brand recognition among enthusiasts. While they lack the massive production scale of the Tier 1 giants, their agility allows them to cater quickly to evolving consumer tastes for personalization and extreme performance upgrades. This duality in the market—volume-driven OEM competition versus niche-focused aftermarket specialization—requires distinct operational and marketing strategies from different classes of competitors.

Benchmarking activities reveal that system performance in adverse conditions (heat fade resistance, wet braking consistency) and noise/vibration/harshness (NVH) characteristics are the critical non-cost differentiators sought by OEMs. Companies must continuously benchmark material wear rates and dust emission levels against emerging environmental standards. The integration capacity, specifically the ability to provide certified, cybersecurity-compliant electronic modules for BBW systems, is rapidly becoming the main barrier to entry for smaller or less technologically advanced suppliers, concentrating future market power in the hands of those with robust software engineering capabilities.

Impact of Supply Chain and Raw Material Fluctuations

The stability and cost structure of the Disc Brakes Market are highly sensitive to fluctuations in the global raw material supply chain. Cast iron, high-grade steel, and specialized aluminum alloys are fundamental components, and their sourcing relies heavily on global commodity markets. Recent periods have seen significant volatility in the prices of iron ore, aluminum, and rare earth elements used in certain friction compounds. This volatility introduces significant risk, particularly for suppliers operating on tight margins within long-term fixed-price OEM contracts. Successful mitigation strategies involve comprehensive forward hedging, dual-sourcing agreements with multiple global suppliers, and optimizing inventory management through advanced predictive analytics to buffer against sudden supply shocks or price spikes.

Furthermore, geopolitical factors and global logistics bottlenecks continue to impact the delivery timeline and overall cost of finished components. The globalization of the automotive industry necessitates complex cross-border supply chains, requiring efficient and reliable transportation networks. Delays in shipping or disruptions at key manufacturing hubs (e.g., due to regional lockdowns or natural disasters) can halt vehicle assembly lines, leading OEMs to enforce penalties on suppliers. To enhance resilience, many Tier 1 manufacturers are pursuing regionalization strategies, often referred to as "local-for-local" production, setting up manufacturing facilities closer to their key OEM customers in North America, Europe, and Asia, thereby reducing transportation dependency and shortening lead times, albeit often at a higher capital expenditure cost.

The supply chain for specialized friction materials, particularly copper-free and ceramic components, presents unique challenges due to limited suppliers possessing the necessary proprietary technology. As regulatory deadlines approach, the dependence on a small number of chemical manufacturers capable of producing high-performance, compliant compounds increases, creating potential bottlenecks and exerting upward pressure on material costs in this specialized niche. Effective supply chain management in the coming decade will require deeper vertical integration or strategic partnerships to secure access to these patented, next-generation material formulations essential for future compliance and performance standards.

Marketing and Distribution Strategies

Marketing and distribution in the Disc Brakes Market must effectively cater to two fundamentally different customer bases: the highly professionalized OEM procurement teams and the fragmented, brand-conscious aftermarket consumers. For the OEM segment, marketing is primarily technical and relationship-driven, focusing on demonstrating system integration capabilities, adherence to stringent quality control (QC) metrics, and guaranteed supply reliability. Suppliers utilize technical conferences, detailed performance white papers, and direct engineering consultations to secure long-term, high-volume contracts. Pricing in this segment is highly competitive and often based on sophisticated cost-plus models with yearly negotiation cycles.

In contrast, the aftermarket segment requires extensive branding, accessible distribution, and targeted consumer education. Marketing efforts here heavily emphasize performance upgrades (e.g., reduced fade, higher initial bite), ease of installation, and durability. E-commerce has transformed aftermarket distribution, allowing specialist brands to reach global consumers directly. Strategic distribution involves maintaining extensive warehouse inventory across key regional markets to ensure immediate availability for repair shops and DIY consumers, minimizing vehicle downtime. Successful aftermarket distributors utilize advanced digital inventory management systems and robust online product information databases to manage thousands of SKUs covering diverse vehicle makes and models.

Channel strategy segmentation is critical. While OEM channels are direct, aftermarket distribution leverages wholesalers, auto parts retailers (both physical and online), and specialized performance tuning shops. For performance-oriented products, the channel strategy often includes sponsoring motorsport teams and leveraging social media influencers to build brand credibility and showcase extreme usage conditions. For standard replacement parts, the focus is on value proposition—balancing quality assurance with competitive pricing to capture the high-volume maintenance market, often competing directly with cheaper, non-branded imports, necessitating strong regional anti-counterfeiting measures and quality certification documentation for consumer assurance.

Risk Assessment and Mitigation in Disc Brakes Manufacturing

The manufacturing and supply of safety-critical components like disc brakes carry inherent risks that require robust assessment and mitigation strategies. Operational risk is significant, encompassing manufacturing defects (e.g., microscopic cracks in rotors, inconsistent friction material density) that could lead to catastrophic system failure. Mitigation relies on implementing rigorous quality assurance processes, including 100% component testing, advanced Non-Destructive Testing (NDT) techniques (such as eddy current testing and ultrasonic inspection), and adherence to global automotive quality management standards like IATF 16949. Traceability is paramount, requiring comprehensive tracking of raw materials and production batches for rapid recall management if required.

Financial risk is associated with the substantial capital expenditure required for automated production lines and the high R&D intensity needed for next-generation systems like BBW. The long lead times for securing OEM contracts mean that large investments must be made years before production volume begins. Mitigation involves strategic financial planning, securing diversified funding sources, and entering into multi-year, volume-guaranteed supply agreements. Currency fluctuation risk for globally traded materials is mitigated via hedging instruments and balancing regional sales revenue against sourcing costs.

Technological and regulatory risk involves the possibility of being locked into obsolete technology or failing to comply with sudden shifts in safety or environmental mandates. For instance, reliance solely on traditional hydraulic systems could rapidly diminish market relevance as EVs adopt BBW. Mitigation involves maintaining parallel R&D tracks, collaborating closely with regulatory bodies during standards development, and dedicating significant resources to software development and cybersecurity protocols, ensuring that the electronic elements of the brake system are protected against hacking or malfunction, which is a growing concern in networked vehicles. Continuous risk assessment is integrated into the core product lifecycle management (PLM) framework to proactively address emerging threats to system integrity and market viability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager