Disc Prostheses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436114 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Disc Prostheses Market Size

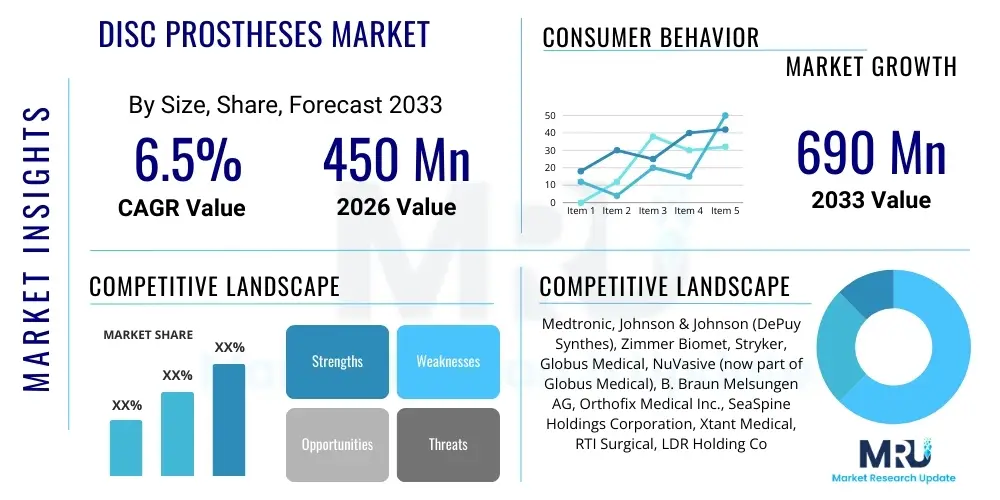

The Disc Prostheses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 690 million by the end of the forecast period in 2033.

Disc Prostheses Market introduction

The Disc Prostheses Market encompasses the industry dedicated to developing, manufacturing, and commercializing artificial intervertebral discs used as an alternative treatment for degenerative disc disease (DDD) and other painful spinal conditions, primarily affecting the cervical and lumbar regions. These devices, known as total disc replacements (TDRs) or artificial disc implants, are designed to restore physiological motion, maintain spinal stability, and alleviate chronic pain resulting from disc degeneration, offering a dynamic alternative to traditional spinal fusion procedures. The product portfolio includes both cervical disc prostheses (CDP) and lumbar disc prostheses (LDP), differentiated by their design, material composition, and biomechanical requirements specific to the spinal segment they replace.

Major applications for disc prostheses primarily involve symptomatic DDD that has failed conservative treatment, typically in younger, more active patients where motion preservation is a clinical priority. The key benefit of TDRs over fusion is the potential to prevent adjacent segment disease (ASD) by maintaining natural motion and reducing stress on neighboring vertebrae. Furthermore, these procedures are associated with quicker recovery times and superior long-term functional outcomes in carefully selected patient cohorts. The increasing prevalence of chronic lower back and neck pain globally, coupled with the aging demographic, are significant driving factors fueling the adoption of motion-preserving spinal technologies.

Market growth is substantially driven by technological advancements in materials science, leading to the development of highly durable and biocompatible implants, coupled with increasing clinical evidence supporting the long-term efficacy and safety of TDR procedures. Additionally, enhanced surgical techniques, including minimally invasive approaches, are broadening the patient pool eligible for disc replacement surgery. Favorable reimbursement scenarios in developed economies and rising patient awareness regarding motion preservation options further contribute to the market’s positive trajectory, positioning disc prostheses as a viable and preferred treatment option for select spinal pathologies.

Disc Prostheses Market Executive Summary

The Disc Prostheses Market is experiencing a robust period of expansion characterized by strong technological innovation and shifting clinical paradigms favoring motion preservation over rigid spinal fusion. Key business trends include aggressive mergers and acquisitions among major orthopedic companies aiming to consolidate their spinal portfolios, and a strategic focus on developing next-generation materials, such particularly highly cross-linked polyethylene and ceramic interfaces, which promise improved wear resistance and longevity. Additionally, there is a growing emphasis on custom and patient-specific implant sizing enabled by advanced imaging and manufacturing technologies, addressing limitations inherent in one-size-fits-all designs. This competitive landscape is driving down manufacturing costs through economies of scale while simultaneously increasing the quality and functional performance of the devices available to surgeons globally.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated surgical infrastructure, rapid regulatory approval processes for novel devices, and a high incidence of spinal disorders coupled with robust reimbursement policies. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market segment, primarily driven by improving healthcare access in countries like China and India, increasing disposable incomes, and a rapidly expanding medical tourism sector catering to advanced spinal procedures. European growth is steady, bolstered by centralized healthcare systems that are increasingly recognizing the cost-effectiveness and long-term patient benefits associated with disc arthroplasty, particularly for cervical applications, though reimbursement challenges remain more pronounced in some individual member states compared to the US market.

Segment trends highlight the cervical disc prostheses (CDP) segment as the dominant category, outpacing lumbar disc prostheses (LDP) adoption, largely because cervical degenerative disc disease is more readily treated with TDR and demonstrates superior short-term clinical outcomes compared to lumbar applications, where biomechanical stress is significantly higher. In terms of materials, the metal-on-polyethylene category continues to hold the largest share due to established track records and familiarity among surgeons, yet the metal-on-metal and advanced ceramic-on-ceramic designs are gaining momentum due to promises of reduced wear debris and enhanced long-term biocompatibility. The hospital end-user segment remains the primary revenue generator, but the shift towards ambulatory surgical centers (ASCs) is accelerating, particularly for single-level cervical procedures, driven by cost containment pressures and efficiency gains.

AI Impact Analysis on Disc Prostheses Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are being integrated into the disc prostheses lifecycle, particularly focusing on improving surgical precision, personalizing implant design, and optimizing patient selection. Common questions revolve around the use of AI in pre-operative planning—specifically, how algorithms can analyze complex spinal imaging (MRIs, CT scans) to predict spinal biomechanics and determine the ideal size, trajectory, and placement of the artificial disc, thereby minimizing the risk of malpositioning and subsequent failure. Concerns often center on data privacy, the validation robustness of AI-driven predictive models, and ensuring equitable access to these technologically advanced surgical aids. Expectations are high that AI will lead to a significant reduction in revision rates, enhanced patient stratification based on probability of successful outcome, and the creation of highly customized implants that perfectly match individual patient anatomy and motion profiles, moving the field towards truly personalized spinal arthroplasty.

- AI-Enhanced Pre-operative Planning: Utilizes machine learning to analyze patient-specific imaging data, predicting optimal implant size and placement trajectory for improved kinematic outcomes and reduced surgical time.

- Robotic Surgical Assistance: AI algorithms guide robotic platforms to execute precise bone preparation and implant insertion, minimizing human error and enhancing procedural consistency, particularly beneficial in complex lumbar cases.

- Personalized Implant Design: ML models process massive datasets of anatomical variability to automate the design of patient-specific prostheses, improving fit and potentially reducing long-term wear and tear.

- Outcome Prediction and Patient Selection: AI tools analyze demographic, clinical, and imaging data to predict the likelihood of successful disc arthroplasty versus fusion, optimizing patient stratification for better clinical results.

- Post-Market Surveillance and Wear Analysis: Advanced computer vision and deep learning techniques monitor long-term implant performance, detecting subtle signs of wear or subsidence earlier than traditional manual follow-up methods.

- Supply Chain and Inventory Optimization: Predictive analytics forecasts demand for specific prosthesis types and sizes based on regional epidemiological trends and surgical center scheduling, streamlining logistics and reducing overhead costs.

DRO & Impact Forces Of Disc Prostheses Market

The Disc Prostheses Market is shaped by a confluence of influential forces. The primary drivers include the escalating global prevalence of degenerative disc disease, accelerated by aging populations and sedentary lifestyles, which necessitate effective motion-preserving interventions. Furthermore, the strong clinical evidence establishing the long-term efficacy of TDR procedures, particularly in the cervical spine, compared to fusion, acts as a significant catalyst for adoption among both surgeons and patients. Technological advancements in biomaterials, offering reduced wear debris and improved longevity, further propel market growth, enhancing the appeal of arthroplasty as a definitive treatment option. These factors collectively create a positive demand environment, particularly in high-income countries where access to advanced orthopedic care is widespread and insurance coverage for these procedures is routine.

Restraints, however, temper this growth trajectory. The most significant constraint is the high upfront cost associated with disc prosthesis devices and the sophisticated surgical procedure required, which can limit access in low- and middle-income regions and create resistance from payers globally. Regulatory complexity and the rigorous requirement for long-term clinical data to demonstrate safety and effectiveness pose substantial barriers to entry for new innovations, slowing down product development cycles. Furthermore, the learning curve associated with TDR surgery and the preference among many established spinal surgeons for traditional, well-proven fusion techniques present persistent resistance to change, particularly in the lumbar segment where fusion remains the gold standard for many indications. These restraints demand continuous innovation aimed at reducing costs and proving unambiguous clinical superiority over established fusion techniques.

Opportunities for expansion are abundant, particularly in the domain of bioresorbable and hybrid disc replacement technologies, which could offer temporary mechanical support while promoting biological restoration, potentially minimizing long-term material-related complications. The untapped potential of emerging economies, characterized by rapidly developing healthcare infrastructure and a growing patient base, represents a crucial geographical opportunity for market expansion. Moreover, increasing clinical acceptance and refinement of TDR techniques for multi-level disc disease offer a pathway to broadening the addressable market beyond single-level indications. The interplay of these drivers, restraints, and opportunities, mediated by stringent regulatory environments, defines the impact forces shaping the market's competitive structure and long-term evolution towards motion preservation.

Segmentation Analysis

The Disc Prostheses Market is comprehensively segmented primarily based on the anatomical location (cervical versus lumbar), the type of material used in the articulating surfaces, and the end-user setting where these procedures are performed. This granular segmentation allows for a detailed understanding of market dynamics, as clinical preferences, technological maturity, and reimbursement conditions vary significantly across these segments. The cervical segment generally commands higher adoption rates due to lower complication risks and more widespread surgical consensus compared to the mechanically challenging lumbar segment.

Material segmentation reflects ongoing innovation aimed at maximizing durability and minimizing wear debris; while traditional metal-on-polyethylene designs hold market share, newer high-performance materials like ceramics and specialized alloys are gaining traction based on superior biomechanical characteristics. End-user segmentation reveals a dual-focus strategy, with hospitals generating the highest revenue volume, while the rapidly growing segment of Ambulatory Surgical Centers (ASCs) is capturing increasing market share, driven by cost-efficiency and procedural specialization for select single-level surgeries, reflecting broader trends in healthcare delivery towards outpatient settings.

- By Type:

- Cervical Disc Prostheses (CDP)

- Lumbar Disc Prostheses (LDP)

- By Material:

- Metal-on-Polyethylene

- Metal-on-Metal

- Ceramic-on-Ceramic

- Others (e.g., Hybrid, Polycarbonate Urethane)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Orthopedic Clinics

Value Chain Analysis For Disc Prostheses Market

The value chain for the Disc Prostheses Market is inherently complex and capital-intensive, starting with the upstream sourcing of high-grade, biocompatible raw materials. This initial stage involves specialized material science companies providing medical-grade titanium alloys (like Ti-6Al-4V), cobalt-chromium alloys, and ultra-high molecular weight polyethylene (UHMWPE) or advanced ceramic composites. Quality assurance and regulatory compliance are paramount at this stage, as material integrity directly dictates implant safety and longevity. Key upstream activities include material refining, advanced component manufacturing (e.g., precision machining, forging), and the integration of novel processes like additive manufacturing for rapid prototyping and customized component creation, requiring stringent supplier qualification protocols.

Midstream activities encompass the core intellectual property development, device design, rigorous preclinical and clinical testing, and large-scale manufacturing. This phase is characterized by significant R&D investment aimed at optimizing implant kinematics, minimizing material wear, and achieving favorable regulatory clearance across major markets. Manufacturing requires specialized cleanroom environments, sophisticated sterilization processes, and automated quality control systems to ensure device reliability. The integration of advanced computational modeling and simulation techniques is vital here for optimizing design parameters based on predicted in vivo performance, which necessitates substantial internal expertise and strategic partnerships with bioengineering institutions.

Downstream distribution channels are highly specialized, relying predominantly on direct sales forces composed of clinical specialists who educate surgeons and support procedures, ensuring optimal technical application of the complex devices. Indirect channels, involving third-party distributors, are utilized primarily for market penetration in regions where establishing a direct presence is cost-prohibitive. The final link involves the end-users (Hospitals and ASCs) and post-market surveillance activities, where patient outcomes and long-term data are collected and analyzed, feeding back into the R&D cycle for continuous product improvement and demonstrating cost-effectiveness to healthcare payers. The effectiveness of surgical training and ongoing technical support is a defining factor in the downstream success of a disc prosthesis product.

Disc Prostheses Market Potential Customers

The primary customers for disc prostheses are specialized healthcare institutions and professionals who directly perform the implantation procedures and manage patient care. These include major tertiary care hospitals, which handle the majority of complex spinal surgeries, especially multi-level and revision procedures. Hospitals represent the largest volume segment due to their comprehensive infrastructure, capacity for inpatient stays, and established relationship with spinal surgery departments. Procurement departments in these settings prioritize devices with strong clinical evidence, positive reimbursement profiles, and comprehensive training and support packages from the manufacturer.

A rapidly growing customer segment is Ambulatory Surgical Centers (ASCs), particularly in markets like the United States. ASCs focus on high-volume, cost-effective outpatient procedures. They are increasingly adopting single-level cervical disc replacements due to shorter recovery times and favorable outpatient management, driven by pressure to reduce healthcare costs while maintaining quality. ASCs are seeking devices that are streamlined for quick implantation and require minimal instrumentation, favoring suppliers that offer comprehensive consignment programs and efficient logistics management tailored for high throughput surgical environments.

Finally, individual spinal surgeons and orthopedic specialists act as key decision-makers who influence purchasing patterns within hospitals and ASCs. Their adoption hinges on rigorous clinical data, peer recommendations, familiarity with the surgical technique, and the perceived long-term reliability and kinematic performance of the specific disc design. Therefore, pharmaceutical and device representatives target these clinical experts directly through continuous medical education, surgical workshops, and sponsorship of clinical trials, ensuring that the technology aligns with evolving best practices in motion preservation surgery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 million |

| Market Forecast in 2033 | USD 690 million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, Stryker, Globus Medical, NuVasive (now part of Globus Medical), B. Braun Melsungen AG, Orthofix Medical Inc., SeaSpine Holdings Corporation, Xtant Medical, RTI Surgical, LDR Holding Corporation, Centinel Spine, Simplify Medical, Premia Spine. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disc Prostheses Market Key Technology Landscape

The technology landscape of the Disc Prostheses Market is defined by continuous evolution across three critical areas: materials science, design kinematics, and surgical instrumentation. In materials, the shift is moving away from basic metal-on-polyethylene towards high-performance alternatives designed for enhanced longevity and reduced inflammatory response. Advanced alloys, such as highly porous titanium structures that promote bone integration, are being utilized for the endplates, while articulating surfaces are increasingly featuring highly cross-linked polyethylene (HXLPE) or ceramic-on-ceramic interfaces to minimize wear debris generation, which is a major determinant of long-term implant success. Research is also heavily focused on incorporating hydrogel or polymeric cores that better mimic the native nucleus pulposus, potentially offering superior shock absorption and kinematic properties over traditional rigid designs.

In terms of design, next-generation disc prostheses focus on restoring physiological center of rotation (COR) and segmental motion in three planes—flexion/extension, lateral bending, and axial rotation—to a degree that traditional earlier generations failed to achieve. Contemporary designs often incorporate features such as variable constraint mechanisms or semi-constrained articulations to balance mobility and stability. Computational modeling, including Finite Element Analysis (FEA), is a crucial technology utilized during the development phase to predict stress distribution and long-term fatigue behavior under physiological loading conditions. Furthermore, the development of patient-specific instrumentation (PSI) and 3D printing technologies allows manufacturers to create customized endplates based on pre-operative CT scans, ensuring a more accurate fit and potentially improving clinical outcomes by minimizing sizing mismatch.

The integration of digital health and navigation technologies is profoundly impacting the surgical delivery of disc prostheses. Computer-assisted surgery (CAS) and robotic systems are becoming standard tools, providing real-time intraoperative guidance for precise implant placement, which is especially critical in challenging multi-level or revision cases. These technologies leverage advanced optical tracking and intraoperative imaging (e.g., O-arm, fluoroscopy) to ensure accurate alignment, potentially mitigating the risks associated with manual insertion and reducing fluoroscopy time. This technological convergence—from customized material composition and kinematic design to precision surgical execution—is pivotal in driving greater surgeon confidence and broader patient acceptance of disc arthroplasty as a sophisticated alternative to spinal fusion.

Regional Highlights

North America, comprising the United States and Canada, represents the largest and most mature market for disc prostheses globally. This dominance is attributed to several factors: highly advanced healthcare infrastructure, high awareness and acceptance among patients and surgeons regarding motion-preserving techniques, favorable and established reimbursement policies for both cervical and increasingly for lumbar TDR procedures, and the presence of major industry players driving continuous innovation. The U.S. market is characterized by substantial clinical trial activity and rapid adoption of advanced surgical technologies, including robotic navigation systems, which enhance the precision and safety of disc arthroplasty. The high prevalence of degenerative disc disease due to an aging population further solidifies North America’s leading position.

Europe constitutes the second-largest market, exhibiting steady growth, driven primarily by Germany, the UK, and France. European markets benefit from centralized healthcare systems that, while sometimes slower to adopt new high-cost technologies, offer robust coverage once clinical efficacy and cost-effectiveness are firmly established. Germany, in particular, demonstrates high adoption rates due to advanced medical technology acceptance and a structured reimbursement environment. Market penetration is strong for cervical devices, while lumbar TDR remains subject to more conservative clinical guidelines. Regulatory consistency provided by the CE marking process facilitates market entry across the European Union, making it an attractive region for device manufacturers, although pricing pressures remain higher compared to the U.S.

Asia Pacific (APAC) is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by massive demographic shifts, particularly the increasing average age and the subsequent rise in spinal degenerative conditions in populous nations like China, Japan, and India. Economic development in key countries is leading to significant investments in healthcare infrastructure and rising disposable incomes, making advanced spinal surgeries more accessible. While initial adoption rates were low due to cost constraints, increasing medical tourism and the strategic efforts of international manufacturers to establish local distribution and manufacturing hubs are accelerating market growth in this region, marking APAC as the most crucial growth opportunity for the coming decade. South Korea and Japan, with their advanced technological integration, lead the region in adopting sophisticated TDR systems.

- North America (US and Canada): Market leader due to high healthcare spending, established reimbursement, and rapid adoption of robotic surgery and next-generation implant materials.

- Europe (Germany, UK, France): Stable growth driven by aging populations and high acceptance of cervical TDR; characterized by robust, albeit cautious, regulatory and reimbursement structures.

- Asia Pacific (China, Japan, India): Fastest-growing region, propelled by rising prevalence of spinal disorders, expanding healthcare infrastructure, and increasing medical tourism.

- Latin America (Brazil, Mexico): Emerging market potential, constrained by economic volatility and inconsistent reimbursement, but showing gradual growth in private healthcare sectors.

- Middle East and Africa (MEA): Limited adoption, primarily concentrated in Gulf Cooperation Council (GCC) countries, driven by high-end private hospitals catering to affluent populations and medical tourists.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disc Prostheses Market.- Medtronic

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet

- Stryker

- Globus Medical

- NuVasive (now part of Globus Medical)

- B. Braun Melsungen AG

- Orthofix Medical Inc.

- SeaSpine Holdings Corporation

- Xtant Medical

- RTI Surgical

- LDR Holding Corporation

- Centinel Spine

- Simplify Medical

- Premia Spine

- Spineart SA

- Aurora Spine Corporation

- Life Spine, Inc.

- Precision Spine, Inc.

- Vertebral Technologies, Inc.

Frequently Asked Questions

Analyze common user questions about the Disc Prostheses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Disc Prostheses and Spinal Fusion?

Disc prostheses (Total Disc Replacement or TDR) are designed to replace a diseased disc while maintaining natural motion in the spinal segment, whereas spinal fusion procedures permanently join two or more vertebrae together, eliminating motion and stabilizing the segment.

Are cervical or lumbar disc replacements more widely adopted?

Cervical disc prostheses (CDP) currently show wider adoption and superior market penetration compared to lumbar disc prostheses (LDP), primarily due to lower biomechanical stress in the cervical spine and strong long-term clinical evidence supporting favorable outcomes.

What materials are commonly used in modern artificial disc implants?

Modern artificial discs primarily utilize combinations of advanced materials including medical-grade titanium or cobalt-chromium alloys for the endplates, and bearing surfaces often composed of ultra-high molecular weight polyethylene (UHMWPE) or specialized ceramics to minimize wear debris.

How does the implementation of AI impact the efficacy of disc replacement surgery?

AI impacts efficacy by optimizing pre-operative planning, utilizing machine learning algorithms to analyze patient anatomy and predict ideal implant sizing and placement, significantly improving surgical precision and potentially reducing the risk of implant failure and revision surgery.

Which geographical region is expected to exhibit the fastest growth in the Disc Prostheses Market?

The Asia Pacific (APAC) region, driven by expanding healthcare access, a high prevalence of spinal disorders among aging populations, and increasing medical technology investment, is forecasted to experience the highest Compound Annual Growth Rate (CAGR).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager