Disc Springs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433756 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Disc Springs Market Size

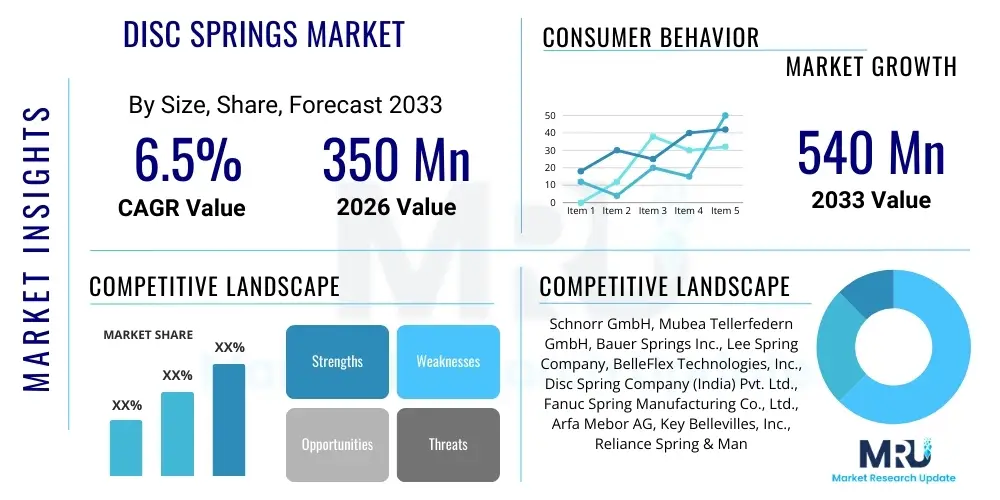

The Disc Springs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 540 Million by the end of the forecast period in 2033.

Disc Springs Market introduction

Disc springs, often referred to as Belleville washers, are conical shell washers designed to be loaded along the axis. Their primary function is to provide high spring force within a limited installation space, making them crucial components in numerous heavy-duty and precision applications. These components are manufactured from high-strength materials, predominantly spring steel alloys such as 50CrV4 or 51CrV4, and specialized materials like stainless steel or Inconel for corrosive or high-temperature environments. The versatility in stacking configurations—including parallel, series, or combined arrangements—allows engineers to precisely tailor the load-deflection characteristics required for specific operational demands, optimizing performance in clutch mechanisms, valve systems, and overload protection devices.

The core utility of disc springs lies in their ability to absorb high loads with minimal deflection, offering superior reliability compared to traditional coil springs in dynamic systems prone to heavy wear or fatigue. Key applications span across the automotive industry, particularly in braking and transmission systems; the heavy machinery sector, including construction equipment and agricultural machinery; and high-reliability environments such as aerospace and power generation turbines. The robust nature and predictable performance curve of these springs are significant driving factors, ensuring safety and efficiency in critical mechanical assemblies worldwide. Furthermore, their inherent durability contributes to reduced maintenance requirements and extended operational lifecycles for the equipment they are integrated into.

The market expansion is heavily driven by increasing global industrialization, particularly in the Asia-Pacific region, coupled with the stringent demand for precision-engineered components in advanced manufacturing processes. Benefits derived from utilizing disc springs include exceptional shock absorption capabilities, superior fatigue resistance under high dynamic loads, and precise load control. The growing adoption of automated industrial processes and the subsequent need for highly reliable clamping, sealing, and dampening mechanisms further solidify the foundational demand for high-quality, specialized disc spring products, pushing manufacturers toward innovation in material science and production precision.

Disc Springs Market Executive Summary

The Disc Springs Market is experiencing robust growth fueled primarily by global industrial automation trends and escalating demand from the heavy machinery and electric vehicle (EV) sectors. Business trends indicate a shift towards high-performance materials and customized solutions, where precision forging and advanced surface treatments (such as shot peening and specialized coatings) are becoming critical differentiators among key players. Manufacturers are focusing on reducing material consumption while maximizing load-bearing capacity, often integrating computational tools like Finite Element Analysis (FEA) into the design process to optimize geometry and minimize fatigue failure, reflecting a growing emphasis on lifecycle predictability.

Regionally, Asia Pacific (APAC) stands out as the primary engine for market expansion, driven by massive investments in infrastructure development, rapid urbanization, and the flourishing automotive and manufacturing bases in China, India, and Southeast Asian nations. North America and Europe, while mature, maintain dominance in high-precision, high-value applications, including aerospace, defense, and renewable energy sectors, where stringent quality control and material traceability are paramount. The European market, guided by rigorous safety standards, continues to be a leader in adopting advanced materials for applications requiring extended operational safety margins, specifically in critical machinery components.

Segment trends reveal that the use of specialized alloy steels and non-ferrous materials is growing faster than standard carbon steel, catering to niche markets requiring corrosion resistance or extreme temperature tolerance. By application, the industrial machinery segment, including press tools and lifting equipment, accounts for the largest market share due to the ubiquitous need for powerful clamping forces and reliable load absorption. Furthermore, the burgeoning demand for disc springs in energy storage systems and high-voltage circuit breakers is creating lucrative opportunities for specialized product lines designed for electrical isolation and high-speed switching mechanisms.

AI Impact Analysis on Disc Springs Market

User queries regarding the impact of Artificial Intelligence (AI) on the Disc Springs Market often center on how AI can enhance component design, predict failure rates, and optimize manufacturing precision. The primary themes involve leveraging machine learning (ML) algorithms for material selection to achieve specific load-deflection curves under complex environmental conditions (e.g., extreme heat or high vibration). Users are keenly interested in predictive maintenance models where AI monitors system vibration and temperature data to anticipate disc spring fatigue failure long before mechanical indicators become apparent, thereby drastically reducing unplanned downtime in critical machinery. Concerns frequently raised relate to the cost of integrating AI-driven simulation tools into traditional manufacturing workflows and ensuring the integrity of the data used for training these complex models, especially for safety-critical components.

AI's influence is transforming the design and production lifecycle of disc springs, moving away from purely empirical methods towards data-driven engineering. By utilizing Generative Design techniques, AI can quickly propose thousands of optimized spring geometries that minimize weight while meeting specific performance criteria, far exceeding the speed and capacity of human designers. Furthermore, AI-powered quality control systems, utilizing computer vision in conjunction with robotic inspection during the manufacturing process, ensure micro-tolerances are maintained consistently, reducing the rate of defects and improving overall product reliability, which is essential for high-stress applications like aircraft landing gear or heavy-duty clutches.

The strategic deployment of AI tools in the disc spring sector will primarily result in enhanced product customization and shortened development cycles. ML algorithms are being applied to supply chain management to predict raw material price fluctuations and optimize inventory levels, mitigating risks associated with material cost volatility. Moreover, the shift toward smart manufacturing environments, where production parameters (such as heat treatment temperature and forming speed) are autonomously adjusted based on real-time feedback, promises unprecedented levels of manufacturing precision and efficiency, fundamentally changing the competitive landscape for high-volume, high-precision disc spring production.

- AI-driven Generative Design optimizes disc spring geometry for maximum force and minimal material use.

- Machine learning algorithms enhance predictive maintenance by modeling component fatigue life based on operational data.

- AI-powered visual inspection systems ensure ultra-high precision and tolerance adherence during manufacturing.

- Optimization of heat treatment processes using AI to improve material crystalline structure and fatigue resistance.

- AI aids in dynamic material selection, matching specific environmental requirements (temperature, corrosion) to optimal alloys.

- Improved supply chain predictability and risk mitigation through demand forecasting and raw material price analysis.

DRO & Impact Forces Of Disc Springs Market

The dynamics of the Disc Springs Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping market trajectory and competitive intensity. A major Driver is the continuous growth in industrial automation and mechanization across emerging economies, necessitating high-performance dampening and load-bearing components in automated production lines, robotics, and heavy machinery. The rise of electric vehicles (EVs) also provides a significant boost, as disc springs are crucial for robust battery pack clamping mechanisms, maintaining consistent force despite thermal expansion, and ensuring electrical contact integrity in high-voltage switchgear. Simultaneously, the inherent precision and compact design of these springs make them irreplaceable in safety-critical applications, ensuring sustained demand regardless of immediate economic fluctuations.

However, the market faces significant Restraints, primarily centered around the volatility of raw material prices, particularly specialized alloy steels and nickel-based materials used for high-end applications. The complex manufacturing process requires extremely tight tolerances and specialized heat treatments, leading to high production costs and barriers to entry for new competitors. Furthermore, the risk of fatigue failure, which is magnified by incorrect application or poor quality control, poses a continuous challenge, requiring intensive research into advanced surface finishing techniques and material purity. Substituting disc springs with other spring types in less demanding applications, while rare, also represents a marginal restraint, particularly in cost-sensitive industrial sectors.

Opportunities for market expansion are vast, primarily through diversification into the renewable energy sector, including sophisticated blade pitch control systems in wind turbines and advanced fluid control in concentrated solar power (CSP) systems. The increasing demand for customized solutions, tailored to proprietary OEM specifications in the defense and aerospace industries, offers high-margin opportunities for specialized manufacturers. Moreover, advancements in additive manufacturing (3D printing) of specialized metal alloys present a long-term opportunity to create novel disc spring designs with optimized geometries and integrated features that were previously unattainable through traditional cold-forming or stamping methods, potentially disrupting current production economics and precision capabilities.

Segmentation Analysis

The Disc Springs Market is primarily segmented based on material, application, and type, providing granular insights into demand patterns across various industrial ecosystems. Analyzing these segments is crucial for understanding how technological advancements, particularly in material science, are influencing product adoption. The market structure reflects a clear bifurcation between high-volume, standard carbon steel disc springs utilized in general industrial applications and low-volume, high-value springs made from exotic alloys, which cater exclusively to mission-critical systems in aerospace, oil and gas, and extreme temperature environments. This comprehensive segmentation allows market players to strategically focus on vertical markets where their manufacturing expertise, whether in precision forming or material handling, provides a distinct competitive advantage.

- By Material: Carbon Steel, Alloy Steel (e.g., 50CrV4, 51CrV4), Stainless Steel, Special Alloys (e.g., Inconel, Nimonic).

- By Type: Standard Disc Springs, High-Force Springs, Slotted Disc Springs, Serrated Disc Springs, Bearing Preload Disc Springs.

- By Application: Automotive (Brakes, Clutches, Transmissions), Industrial Machinery (Presses, Tools, Valves), Power Generation (Turbines, Circuit Breakers), Aerospace & Defense, Oil & Gas (Valves, Blowout Preventers), Medical Devices.

- By End-User Industry: Automotive OEMs, Heavy Equipment Manufacturing, Energy Sector, Construction, General Engineering.

Value Chain Analysis For Disc Springs Market

The value chain for the Disc Springs Market begins with the highly specialized Upstream Analysis involving the sourcing of high-grade raw materials, specifically spring steel billets and specialized alloys. Manufacturers rely on a select group of steel suppliers who can guarantee material traceability, consistent chemical composition, and strict metallurgical properties necessary for subsequent cold forming and heat treatment processes. This upstream segment is characterized by complex procurement contracts and long-term relationships due to the non-negotiable quality requirements, as material defects directly translate into performance failures in the final product, especially under high cyclic loading. Investment in advanced materials testing and pre-processing capabilities by disc spring manufacturers is essential to mitigate material risk at this foundational stage.

The Midstream component encompasses the core manufacturing processes: stamping, cold forming, precision grinding, specialized heat treatment (austempering or hardening and tempering), and rigorous quality assurance. Manufacturing complexity escalates significantly for high-force or special-geometry springs, demanding high-precision CNC equipment and proprietary knowledge regarding surface preparation, such as shot peening, which enhances fatigue life. Distribution Channels are critical, involving a mix of Direct and Indirect sales. Direct sales are predominant for OEM clients in the automotive and aerospace sectors, where technical collaboration and stringent certification processes necessitate close communication between the manufacturer and the end-user engineering teams. These direct relationships often involve long-term supply agreements and customized component design.

The Downstream Analysis focuses on distribution to the aftermarket and smaller industrial users, often handled by specialized industrial distributors or third-party wholesalers who manage inventory and logistics for standard products. These indirect channels provide geographical reach and fast delivery for replacement parts, which is crucial for minimizing downtime in repair and maintenance operations. The value chain concludes with the final integration of the disc springs into larger mechanical systems by end-user industries, where performance consultation and post-sale technical support become the final value-add. The overall efficiency and profitability of the value chain are intrinsically linked to maintaining high quality standards, minimizing waste during manufacturing, and optimizing logistics to global assembly points.

Disc Springs Market Potential Customers

Potential customers and end-users of disc springs span a vast array of high-stakes industrial and commercial sectors, characterized by the need for reliable, high-force spring action in confined spaces. The largest segment of buyers comprises Automotive OEMs and Tier 1 suppliers. These manufacturers utilize disc springs extensively in safety-critical systems, including clutch mechanisms, heavy-duty braking systems (especially for commercial vehicles and rail transport), and in transmission components to maintain consistent force and dampen vibration. The transition to electric vehicles is generating new customer requirements, specifically for battery pack clamping systems that manage significant thermal stresses and provide reliable sealing forces over the vehicle's lifespan, demanding customized spring geometries and materials that can withstand complex electrochemical environments.

Another crucial customer segment is the Heavy Equipment Manufacturing industry, including producers of construction machinery, agricultural equipment, and large industrial presses. In these applications, disc springs function as robust load-bearing elements in hydraulic cylinders, overload protection devices, and large valve assemblies, where resistance to shock loading and environmental contaminants is paramount. These buyers typically require springs capable of handling exceptionally high forces and maintaining structural integrity over millions of operational cycles. Purchasing decisions in this sector are heavily influenced by supplier credentials related to material certifications, proven fatigue life data, and the ability to deliver components compliant with international quality standards like ISO/TS 16949.

High-value sectors, such as Aerospace and Defense, and Power Generation facilities, represent key potential customers seeking specialized, non-standard disc springs. Aerospace buyers require components manufactured from aerospace-grade materials (e.g., Inconel) for use in jet engine components, landing gear retraction systems, and precision control valves, prioritizing extreme reliability, low weight, and performance at high temperatures. Similarly, power generation clients, particularly those managing steam and gas turbines or high-voltage circuit breakers, require springs that ensure fail-safe operation and rapid response times. These end-users demand rigorous documentation, complete material traceability, and often partner with manufacturers capable of co-developing springs for highly specific, complex mechanical challenges.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 540 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schnorr GmbH, Mubea Tellerfedern GmbH, Bauer Springs Inc., Lee Spring Company, BelleFlex Technologies, Inc., Disc Spring Company (India) Pvt. Ltd., Fanuc Spring Manufacturing Co., Ltd., Arfa Mebor AG, Key Bellevilles, Inc., Reliance Spring & Manufacturing Co., Inc., CEI Spring, VSR Industries, Saint-Gobain Performance Plastics, Emuge-Franken, Tecnica S.r.l. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disc Springs Market Key Technology Landscape

The technological landscape of the Disc Springs Market is rapidly evolving, driven by the need for enhanced durability, higher load capacity, and precise dimensional control. A fundamental technology is the implementation of advanced Computer Numerical Control (CNC) precision forming and stamping machinery. These automated systems ensure that the conical angle and inner/outer diameters are maintained within micron-level tolerances, critical for achieving the specified load-deflection curve when springs are stacked. Furthermore, continuous investment in specialized cold forming processes allows manufacturers to create smoother surface finishes before heat treatment, significantly reducing stress concentration points and thereby extending the fatigue life of the final product under cyclic loads.

Materials science and surface engineering represent another critical technological domain. Modern disc springs increasingly utilize high-performance spring alloys such as Chrome Vanadium (50CrV4/51CrV4) and specialized stainless steels (like 17-7PH) that offer superior corrosion resistance and performance stability at elevated temperatures. A pivotal technological process is controlled Shot Peening, which involves bombarding the spring surface with high-velocity media. This process induces compressive residual stresses on the surface layers, which effectively counteracts tensile stresses generated during loading, drastically improving resistance to stress corrosion cracking and prolonging fatigue life, a mandatory requirement for springs used in highly dynamic or aggressive environments, such as offshore oil platforms or high-speed machinery.

Furthermore, technology related to testing and simulation is transforming product development. Finite Element Analysis (FEA) software is now standard, allowing engineers to simulate complex stacking configurations, predicted failure points, and performance under extreme static and dynamic loads before committing to physical prototyping. This digital twin approach shortens the development cycle and optimizes material usage. Additionally, the development of specialized coatings, such as zinc phosphate, anti-friction molybdenum disulfide, or proprietary polymer coatings, represents a key technology focus, aimed at reducing friction between adjacent springs in a stack and minimizing wear, thereby ensuring consistent force transmission and reducing the loss of preload over time in critical industrial assemblies.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and is anticipated to witness the highest growth rate during the forecast period. This growth is primarily fueled by extensive infrastructural development, substantial government investment in rail networks and public transport, and the rapid expansion of the manufacturing sectors, particularly automotive assembly and heavy industrial machinery production in China, India, and Southeast Asia. The region’s cost-effective manufacturing base also positions it as a major global exporter of disc springs.

- North America: North America represents a mature, high-value market characterized by robust demand from the aerospace, defense, and high-precision engineering sectors. Stringent regulatory standards, especially concerning material traceability and component reliability in the oil and gas industry and nuclear power generation, drive demand for premium, specialized disc springs often manufactured from exotic alloys. Technological innovation, particularly in advanced materials and digital quality assurance, is a key focus for regional manufacturers.

- Europe: Europe is a key market, driven by its established automotive industry, especially in Germany and Italy, and its leadership in heavy machinery manufacturing. European demand is highly influenced by strict environmental and safety regulations, requiring disc springs with certified long fatigue life and high resistance to wear and tear. The increasing adoption of automation and robotics in industrial processes across Central and Eastern Europe further sustains the market for precision components.

- Latin America (LATAM): The LATAM market growth is steady, largely tied to the mining, construction, and agricultural sectors, especially in Brazil and Mexico. Demand focuses on robust, high-force disc springs suitable for heavy machinery applications and maintenance of existing industrial infrastructure. Economic stability and industrial investment remain key determinants of market expansion in this region, with a growing reliance on imported specialized springs.

- Middle East and Africa (MEA): The MEA market is heavily influenced by the cyclical nature of the oil and gas industry, where disc springs are essential components in high-pressure valves, pipelines, and blowout preventers. Significant investment in industrial diversification, renewable energy projects (particularly solar power), and infrastructure development in the UAE and Saudi Arabia are opening new opportunities for specialized, corrosion-resistant spring products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disc Springs Market.- Schnorr GmbH

- Mubea Tellerfedern GmbH

- Bauer Springs Inc.

- Lee Spring Company

- BelleFlex Technologies, Inc.

- Disc Spring Company (India) Pvt. Ltd.

- Fanuc Spring Manufacturing Co., Ltd.

- Arfa Mebor AG

- Key Bellevilles, Inc.

- Reliance Spring & Manufacturing Co., Inc.

- CEI Spring

- VSR Industries

- Saint-Gobain Performance Plastics

- Emuge-Franken

- Tecnica S.r.l.

- Hyperco (MW Industries, Inc.)

- Lesjöfors AB

- Adolf Schnorr GmbH & Co. KG

- Chattillon Springs

- Coilcraft Inc.

Frequently Asked Questions

Analyze common user questions about the Disc Springs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Disc Springs Market?

The primary driver is the accelerating global trend toward industrial automation, mechanization, and the associated need for highly compact, high-force components in heavy machinery, robotics, and safety-critical systems. Furthermore, the rise in electric vehicle (EV) manufacturing, requiring robust solutions for battery pack clamping and high-voltage switchgear, significantly boosts specialized disc spring demand.

How do disc springs contribute to safety and reliability in industrial applications?

Disc springs offer predictable and high load-bearing capacity with minimal deflection, acting as reliable safety components in clutch mechanisms, overload protection systems, and high-pressure valve sealing. Their customizable stacking options allow engineers to precisely control force output, ensuring systems operate within safe design parameters and minimizing the risk of mechanical failure or unintended load release.

Which material segments are experiencing the fastest growth in the Disc Springs Market?

The fastest-growing material segments are specialized alloy steels and non-ferrous materials such as Stainless Steel (particularly 17-7PH) and high-nickel alloys like Inconel. This growth is fueled by increasing demand from high-performance applications in aerospace, defense, and oil and gas, which require superior corrosion resistance and stable performance under extreme thermal conditions, where standard carbon steel is inadequate.

What role does advanced manufacturing technology play in disc spring production?

Advanced manufacturing technologies, including high-precision CNC stamping, controlled heat treatment processes, and critical surface treatments like shot peening, are essential. These technologies ensure the final component meets stringent geometric tolerances and achieves maximum fatigue life, thereby enhancing the component's durability and reliability under dynamic and continuous cyclic loading environments.

Why is the Asia Pacific region dominating the global Disc Springs Market?

The Asia Pacific region dominates the market due to its immense manufacturing capacity, extensive infrastructure investment, and rapid industrialization, particularly within the automotive and heavy industrial machinery sectors in countries like China and India. This large-scale manufacturing base not only consumes high volumes of disc springs domestically but also serves as a major global export hub for these components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager