Dishwashing Liquid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433047 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Dishwashing Liquid Market Size

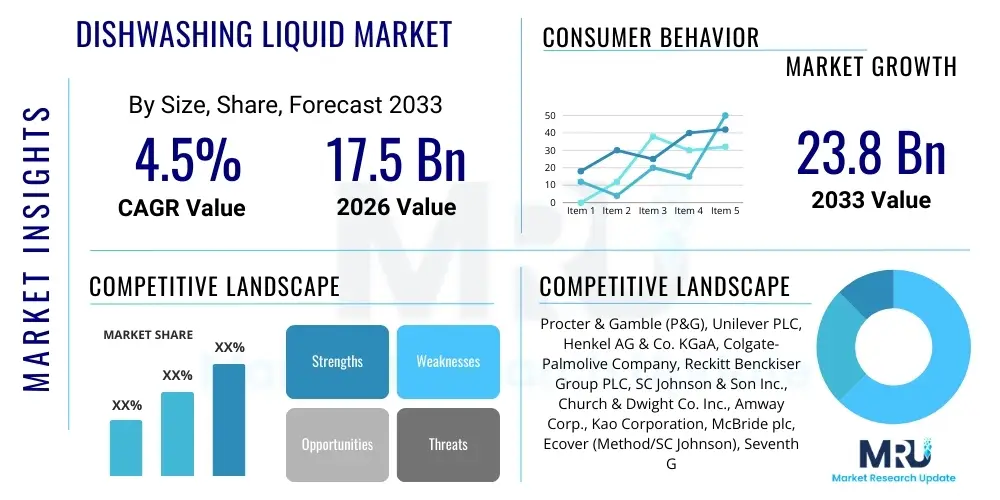

The Dishwashing Liquid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 23.8 Billion by the end of the forecast period in 2033. This growth trajectory is fueled by increasing urbanization, heightened consumer focus on hygiene, and continuous innovation in product formulations that promise better cleaning efficacy and environmental safety.

Dishwashing Liquid Market introduction

The Dishwashing Liquid Market encompasses the global consumption and trade of specialized liquid detergents designed for manually cleaning kitchenware, crockery, and utensils. These products are complex chemical formulations primarily comprising surfactants, which reduce surface tension and lift grease, alongside enzymes, foaming agents, and stabilizing chemicals. Dishwashing liquids serve as an essential component of household and commercial kitchen hygiene routines, providing effective removal of food residue, grease, and grime, ensuring both aesthetic cleanliness and sanitary standards for food contact surfaces.

Major applications span across residential households, institutional settings such as hospitals and schools, and commercial food service establishments including restaurants and catering operations. The primary benefit derived by consumers is the efficient emulsification of fats and oils, rapid rinsing capability, and formulation advancements that protect skin health and utilize natural ingredients. The continuous development of concentrated, specialized formulations (e.g., anti-bacterial, eco-friendly, or specific purpose liquids for baby bottles) maintains robust consumer demand and drives market expansion.

Key driving factors accelerating market growth include increasing disposable incomes in emerging economies, leading to higher consumption rates of cleaning products; growing awareness about the role of kitchen hygiene in preventing foodborne illnesses; and significant marketing investments by multinational corporations emphasizing convenience and premium product attributes. Furthermore, regulatory shifts in several regions promoting biodegradable and phosphate-free ingredients mandate innovation, which often results in superior, though sometimes premium-priced, market offerings, thus expanding the overall market value.

- Product Description: Aqueous cleaning solutions based on anionic, nonionic, and amphoteric surfactants, used for manual dishwashing.

- Major Applications: Residential households, Hotels, Restaurants, Cafes (HoReCa), Institutional kitchens, and Commercial catering services.

- Benefits: Effective grease removal, hygienic cleaning, germ reduction, skin sensitivity formulations, and pleasant fragrance profiles.

- Driving Factors: Urbanization, rising sanitation standards, product innovation in concentration and sustainability, and growth in the HoReCa sector.

Dishwashing Liquid Market Executive Summary

The Dishwashing Liquid Market is currently defined by significant shifts towards sustainability and concentrated formats, influencing global business trends. Key market players are heavily investing in Research and Development to meet stringent environmental regulations, particularly concerning biodegradable surfactants and reduced plastic packaging (e.g., refill pouches). The business landscape is marked by intense competition, high marketing spend, and strategic acquisitions focusing on niche segments like organic or plant-based cleaning solutions, which are experiencing above-average growth rates compared to conventional products.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, driven by rapid population growth, increasing household income, and improving penetration of packaged cleaning goods in rural areas. North America and Europe, while mature, are leading the trend in premiumization, demanding highly efficacious products coupled with strong ecological credentials (e.g., EU Ecolabel certification). Regulatory harmonizing across trading blocs concerning chemical safety and ingredient disclosure also shapes market entry and operational strategies for major international brands.

Segmentation trends indicate robust growth in the concentrated liquid segment due to consumer preference for cost-efficiency and reduced environmental footprint associated with smaller packaging. The institutional segment is also expanding, driven by stricter hygiene protocols in commercial settings post-pandemic, favoring bulk purchases of professional-grade, high-performance detergents. Product type differentiation, particularly the move away from traditional sulfates towards milder, naturally derived surfactants, is a key metric for long-term segment success and consumer loyalty.

AI Impact Analysis on Dishwashing Liquid Market

Common user questions regarding AI's impact on the dishwashing liquid sector typically revolve around supply chain optimization, predictive consumer analytics for inventory management, and the potential for smart dispensing systems in commercial kitchens. Users are keen to understand how AI can reduce manufacturing waste, forecast regional demand fluctuations with greater accuracy, and personalize marketing campaigns based on detailed purchase histories and lifestyle indicators. A significant area of concern focuses on whether AI-driven manufacturing processes can ensure consistent product quality while handling complex, bio-based ingredient mixtures, and how this technology might influence pricing strategies across different demographics.

The primary influence of Artificial Intelligence in the dishwashing liquid market is realized in operational efficiency and consumer relationship management. AI algorithms are being deployed in manufacturing facilities to monitor ingredient batch quality, optimize mixing times, and minimize energy consumption during production cycles. This shift towards smart manufacturing reduces operational costs and enhances product consistency, which are crucial differentiators in a high-volume, low-margin industry. Furthermore, predictive maintenance powered by machine learning minimizes downtime, ensuring a steady supply chain.

On the commercial front, AI is revolutionizing inventory management and promotional targeting. Retailers and manufacturers use machine learning models to analyze vast datasets encompassing seasonality, competitor pricing, localized weather patterns, and specific shopper behaviors to predict exact stock requirements for different retail channels. This predictive capability significantly reduces instances of stockouts or overstocking, leading to fresher shelf inventory and enhanced profitability. Moreover, AI-driven digital marketing tailors ad content and placement, efficiently reaching consumers who prioritize specific product attributes, such as sustainability or scent profile, thereby improving marketing ROI.

- Supply Chain Optimization: Predictive analytics for ingredient sourcing, demand forecasting, and inventory reduction.

- Manufacturing Efficiency: AI-driven process control systems optimizing chemical mixing, temperature regulation, and quality assurance.

- Consumer Insights: Machine learning used to segment consumer preferences for scent, sensitivity, and ecological attributes, driving targeted product development.

- Smart Appliances Integration: Potential development of smart dispensing systems integrated with commercial dishwashers or household sinks, optimized by AI for precise dosage.

- Pricing Strategy: Dynamic pricing models based on real-time competitor analysis and regional demand elasticity.

DRO & Impact Forces Of Dishwashing Liquid Market

The dynamics of the Dishwashing Liquid Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces shaping its evolution. Major market drivers include the accelerating global standard of personal and household hygiene, fueled partly by increased public health awareness and urbanization. Restraints often center on the volatility of raw material prices, particularly petrochemical-derived surfactants, and intense regulatory scrutiny concerning environmental impact, which can necessitate costly product reformulation. Opportunities lie predominantly in capitalizing on the rapidly expanding demand for specialty products, such as ultra-concentrated formulas, sustainable packaging, and specialized liquids formulated for sensitive skin or baby care, allowing manufacturers to access premium pricing tiers.

The primary impact forces acting upon the market are substitution threats and supplier power. The threat of substitution is relatively low in the immediate term, as manual dishwashing remains widespread, but potential future alternatives like highly efficient automated dishwashers or advanced, single-use, waterless cleaning technologies pose long-term risks. Supplier power is moderate; while raw material suppliers (especially for specialty surfactants and enzymes) hold some leverage due to limited specialization, the high volume of purchasing by multinational consumer goods conglomerates moderates this influence. High capital requirements for sophisticated production facilities and established distribution networks create significant barriers to entry for new competitors, further solidifying the market structure.

Specifically, the environmental sustainability imperative acts as a strong, non-negotiable impact force. Consumer boycotts and NGO campaigns targeting non-biodegradable or microplastic-containing ingredients force immediate and costly R&D adjustments. Conversely, this pressure drives innovation, creating competitive opportunities for firms that successfully navigate the shift toward certified sustainable ingredients (e.g., RSPO certified palm oil derivatives, or plant-based alternatives). Regulatory bodies, particularly in Europe and North America, impose strict limits on substances like phosphates and certain volatile organic compounds (VOCs), driving market leaders towards safer, yet technically challenging, green chemistry solutions, thereby dictating product differentiation and market structure.

Segmentation Analysis

The Dishwashing Liquid Market is extensively segmented based on formulation type, application, distribution channel, and concentration level, reflecting diverse global consumer needs and purchasing behaviors. The segmentation based on formulation is critical, differentiating standard liquids from specialized, anti-bacterial, or eco-friendly variants. Eco-friendly products, often characterized by plant-derived ingredients and minimal environmental toxicity, are rapidly gaining market share, driven by environmentally conscious millennials and Gen Z consumers across developed economies, forcing traditional manufacturers to adjust their core offerings.

Segmentation by concentration level—standard versus concentrated—is a key metric for evaluating market maturity and efficiency. Highly concentrated formulas, while sometimes possessing a higher unit price, offer enhanced cost-in-use benefits and significantly reduce transportation and packaging costs, aligning with sustainability goals. The application segmentation clearly delineates the Household segment, which is dominated by smaller packaged units and strong brand loyalty, from the Commercial/Institutional segment, which demands high-volume, heavy-duty formulations designed for rapid cleaning in high-turnover food service environments.

Furthermore, the distribution channel segmentation highlights the evolving retail landscape. While traditional supermarkets and hypermarkets remain dominant, the rapid rise of e-commerce platforms provides manufacturers with direct-to-consumer opportunities and allows niche brands to achieve wider geographical reach without the requirement for extensive physical retail infrastructure. The performance of a brand within a specific distribution channel often determines its regional success, necessitating tailored pricing and promotional strategies across various retail formats, including discount chains and specialized bulk suppliers for the institutional segment.

- By Product Type:

- Standard Liquid

- Concentrated Liquid

- Eco-friendly/Plant-Based Liquid

- Anti-bacterial Liquid

- By Application/End-User:

- Household/Residential

- Commercial (HoReCa, Catering)

- Institutional (Hospitals, Schools)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores/Bulk Suppliers

Value Chain Analysis For Dishwashing Liquid Market

The value chain for the Dishwashing Liquid Market begins with the upstream segment, encompassing the sourcing and processing of raw materials. This segment is dominated by chemical manufacturers providing key ingredients: surfactants (petrochemical or oleochemical derived), builders, sequestering agents, enzymes, and fragrances. Volatility in the price of crude oil and palm oil significantly affects the cost of goods sold, placing high importance on securing stable supply contracts and leveraging alternative, bio-based chemistries to mitigate risks. R&D in this upstream phase focuses on enhancing ingredient sustainability and optimizing cost-effectiveness while adhering to increasingly strict regulatory standards regarding toxicity and biodegradability.

The midstream involves the manufacturing and formulation process, where ingredients are mixed, tested for quality control, and packaged. This phase requires significant capital investment in blending equipment, automated filling lines, and sophisticated quality assurance labs. Key activities include optimizing the dilution process for concentrated formulas, ensuring packaging compatibility, and complying with GHS (Globally Harmonized System) labeling requirements. Downstream activities involve distribution and retail, moving finished goods through various channels—from large container shipments to distribution centers, and finally to physical retailers or direct e-commerce fulfillment centers. Efficient logistics and warehousing are paramount given the high volume and relatively low value-per-unit characteristic of cleaning products.

Distribution channels are multifaceted, categorized into direct sales (primarily to large commercial or institutional clients) and indirect sales (through retail intermediaries). Indirect sales dominate the household segment via supermarkets, hypermarkets, and online platforms. The shift towards e-commerce requires manufacturers to adapt packaging design to withstand complex shipping logistics and often involves strategic partnerships with major online retailers like Amazon or Alibaba. Successful companies manage this value chain by integrating advanced IT systems for demand forecasting and inventory management, thereby ensuring optimal product placement and minimal supply chain friction between the production facility and the end consumer.

Dishwashing Liquid Market Potential Customers

Potential customers for dishwashing liquid span a broad demographic, segmented primarily into residential users and high-volume commercial/institutional buyers, each possessing distinct purchasing criteria and product needs. Residential users, constituting the largest volume segment, prioritize brand trust, scent appeal, skin sensitivity, and perceived cleaning power. Within this segment, there is a growing niche of affluent, health-conscious buyers who are willing to pay a premium for certified organic, hypoallergenic, or environmentally labeled products, seeking transparency regarding ingredient sourcing and chemical safety.

The commercial and institutional sector represents the high-frequency, bulk purchase customer base. This includes restaurants, hotels (HoReCa sector), schools, corporate cafeterias, and hospitals. These end-users prioritize efficacy, especially grease-cutting performance in cold water, rapid foam dissipation (for efficient rinsing), and, crucially, cost-in-use metrics based on high concentration ratios. Procurement decisions in this sector are often centralized and highly sensitive to regulatory compliance, requiring proof of high-grade sanitation capabilities, such as NSF certification or equivalent standards necessary for food safety compliance.

Furthermore, specialized end-users, such as manufacturers of baby care products or medical device cleaning companies, represent smaller but highly valuable segments. These buyers require ultra-specific formulations that are residue-free, non-toxic, and often fragrance-free, aligning with the highest safety standards for vulnerable populations. Targeting these diverse potential customer groups requires highly differentiated product lines, tailored packaging sizes (from small retail bottles to industrial 55-gallon drums), and distinct marketing narratives emphasizing either convenience and sensorial experience (household) or efficiency and compliance (commercial).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 23.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Procter & Gamble (P&G), Unilever PLC, Henkel AG & Co. KGaA, Colgate-Palmolive Company, Reckitt Benckiser Group PLC, SC Johnson & Son Inc., Church & Dwight Co. Inc., Amway Corp., Kao Corporation, McBride plc, Ecover (Method/SC Johnson), Seventh Generation (Unilever), Green Works (Clorox), Frosch (Werner & Mertz), Lion Corporation, Wipro Consumer Care and Lighting, Godrej Consumer Products Limited, Dabur India Ltd., Ecolab Inc., Zep Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dishwashing Liquid Market Key Technology Landscape

The technological landscape in the Dishwashing Liquid Market is predominantly driven by advancements in green chemistry, enzyme technology, and sophisticated dispensing systems, focusing intensely on achieving high performance with minimal environmental impact. A primary focus is the development of next-generation surfactants, specifically non-ethoxylated and bio-based alternatives derived from fermentation or natural oils, replacing conventional petroleum-based ingredients like Linear Alkylbenzene Sulfonate (LAS). These innovations address consumer demand for reduced chemical footprint and meet regulatory requirements aimed at improving aquatic biodegradability and reducing dermal irritation, positioning technology as a direct competitive lever.

Enzyme technology represents another critical frontier, where specialized enzymes (lipases, proteases, and amylases) are engineered to break down complex food soils like starch, proteins, and fats even in low-temperature or cold water washing conditions. This enzymatic inclusion allows for the creation of ultra-concentrated formulas that require significantly less scrubbing action and reduce overall water and energy consumption during cleaning. Manufacturers are utilizing proprietary encapsulation technologies to stabilize these sensitive enzymes, ensuring they remain highly active throughout the product's shelf life, providing a measurable performance advantage over traditional purely surfactant-based products.

Furthermore, technology is redefining product delivery, particularly in the institutional segment. The rise of automated and controlled dosing systems utilizes IoT integration to ensure precise chemical dilution, minimizing waste and optimizing cost-per-wash. In the consumer space, packaging technology is advancing rapidly, focusing on recyclable plastics (PCR content), refill pods, and innovative pouches that drastically reduce plastic use. The integration of QR codes and blockchain technology is also emerging to enhance supply chain traceability and provide consumers with transparent information regarding the sourcing and sustainability profile of the ingredients used in the liquid detergent.

Regional Highlights

Regional dynamics significantly influence the growth and strategic focus of the global dishwashing liquid market, reflecting variations in economic development, regulatory environments, and entrenched cultural cleaning habits. Asia Pacific (APAC) currently dominates the market in terms of volume and exhibits the highest growth rate, primarily driven by population expansion, increasing penetration of FMCG products in densely populated developing economies like India and China, and rising disposable incomes that enable a shift from rudimentary cleaning agents to branded, packaged liquid detergents. Manufacturers in APAC prioritize affordability and large-volume packaging to cater to the high-density residential segment.

North America and Europe represent mature, high-value markets characterized by a strong consumer preference for premium, specialty, and sustainable products. In Europe, stringent environmental regulations, particularly concerning phosphate bans and microplastic usage, mandate continuous reformulation, positioning European firms as leaders in green chemistry and certified eco-labeling (e.g., Nordic Swan, EU Ecolabel). North America drives innovation in specific niche categories, such as professional-grade formulas for the rapidly expanding HoReCa sector and premium plant-based household detergents, leveraging strong digital marketing and sophisticated distribution networks.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions experiencing robust expansion, albeit marked by economic volatility. LATAM markets, such as Brazil and Mexico, are increasingly adopting liquid formats over traditional powder detergents, driven by modernization and urbanization. The MEA region shows high potential, particularly in the GCC countries, where institutional demand (hotels, malls) is significant. However, these regions face challenges related to logistics infrastructure and the need to offer a wide price spectrum to cater to vastly differing socioeconomic groups, requiring a strategic mix of value brands and aspirational premium offerings.

- Asia Pacific (APAC): Highest volume growth, driven by urbanization and increasing hygiene awareness, focus on value and anti-bacterial formulations. Key markets: China, India, Indonesia.

- North America: Mature market focusing on premiumization, specialized niche products (e.g., baby dish soap), and sustainable packaging innovation. Key markets: U.S., Canada.

- Europe: Regulatory leader driving green chemistry, high demand for certified biodegradable and concentrated formulas. Key markets: Germany, UK, France.

- Latin America (LATAM): Rapid conversion from solid to liquid formats, increasing adoption driven by household convenience and modernization. Key markets: Brazil, Mexico.

- Middle East & Africa (MEA): Growing institutional demand fueled by hospitality sector expansion; focus on cost-efficiency and high performance under variable water quality conditions. Key markets: UAE, Saudi Arabia, South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dishwashing Liquid Market.- Procter & Gamble (P&G)

- Unilever PLC

- Henkel AG & Co. KGaA

- Colgate-Palmolive Company

- Reckitt Benckiser Group PLC

- SC Johnson & Son Inc.

- Church & Dwight Co. Inc.

- Amway Corp.

- Kao Corporation

- McBride plc

- Ecover (Method/SC Johnson)

- Seventh Generation (Unilever)

- Green Works (Clorox)

- Frosch (Werner & Mertz)

- Lion Corporation

- Wipro Consumer Care and Lighting

- Godrej Consumer Products Limited

- Dabur India Ltd.

- Ecolab Inc.

- Zep Inc.

Frequently Asked Questions

Analyze common user questions about the Dishwashing Liquid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift towards concentrated dishwashing liquids?

The shift towards concentrated formulas is driven by environmental concerns regarding plastic waste and logistics efficiency. Concentrates require smaller packaging, reducing transportation fuel use and cost-per-wash, appealing strongly to both sustainable consumers and institutional buyers seeking operational savings.

How significant is the influence of environmental regulations on product development?

Environmental regulations are highly significant, especially in North America and Europe, mandating the removal of phosphates and specific VOCs. This forces manufacturers to invest heavily in green chemistry, developing biodegradable, plant-derived surfactants and sourcing sustainably certified ingredients, transforming product composition and branding.

Which regional market holds the highest growth potential for dishwashing liquid?

The Asia Pacific (APAC) region, specifically emerging economies like India and China, holds the highest growth potential due to rapid urbanization, rising disposable incomes, and the ongoing transition of consumers from basic soaps to specialized liquid cleaning products, increasing penetration rates substantially.

What role do enzymes play in modern dishwashing liquid formulations?

Enzymes, such as lipases and proteases, are incorporated to effectively break down tough food soils (grease, starch, protein) in lower temperatures or with less mechanical action. This technological inclusion enhances cleaning efficiency, allows for cold-water washing, and supports the formulation of ultra-concentrated, high-performance liquids.

What are the primary factors consumers consider when choosing a dishwashing liquid?

Consumers prioritize four primary factors: cleaning efficacy (grease removal), skin gentleness (dermatological safety), scent profile, and increasingly, sustainability credentials (biodegradability and packaging recyclability). Brand loyalty and price point also remain foundational purchasing determinants.

The preceding analysis details the core market structure, technological influences, and consumer dynamics characterizing the global Dishwashing Liquid Market. The sustained demand for household hygiene products, coupled with significant innovation focused on sustainability, ensures steady growth and continued investment across all major geographical regions, making it a critical segment within the broader household and commercial cleaning industry.

Further analysis of the competitive landscape reveals that multinational corporations maintain market dominance through extensive distribution networks and continuous marketing efforts. However, smaller, agile companies specializing in niche segments like organic or zero-waste products are successfully disrupting market share by leveraging strong digital engagement and catering directly to specific, environmentally conscious consumer demographics, demonstrating the dynamic nature of competitive rivalry within the sector.

Looking ahead, future trends point towards personalized cleaning solutions, potentially incorporating diagnostic elements (e.g., smart kitchen sensors detecting residue type) that could further optimize detergent usage and inventory management. This integration of smart technology into routine household tasks represents the next phase of modernization for the dishwashing liquid industry, ensuring long-term relevance and efficiency in evolving consumer kitchens.

The global regulatory environment continues to exert pressure, particularly concerning the registration and safety assessment of novel chemical substances. Compliance with regulations such as REACH in Europe requires substantial R&D expenditure to replace legacy ingredients, impacting cost structures but simultaneously creating opportunities for certified green products to command a market premium. This regulatory push-and-pull dynamic will remain central to strategic planning for all market participants throughout the forecast period.

The detailed market segmentation highlights that the commercial sector, especially HoReCa, is a highly lucrative but challenging segment due to high performance expectations and intense price competition. Successful penetration requires not only superior product performance but also robust technical support, bulk supply capabilities, and reliable, high-tech dispensing systems that minimize manual handling and guarantee consistent operational standards. This specialized requirement separates commercial suppliers from general household FMCG providers.

Investment patterns across key players indicate a strategic shift towards securing raw material supply chains for oleochemicals, driven by the desire to reduce reliance on petrochemical derivatives. Companies are forming strategic alliances with agricultural suppliers and bio-refineries to ensure a steady, certified sustainable source of ingredients, mitigating risk and reinforcing brand claims related to environmental stewardship, which is increasingly mandatory for securing retail shelf space in developed economies.

The digital transformation of the retail experience is also profoundly influencing packaging and marketing strategies. The necessity of creating visually appealing and informative e-commerce listings means packaging must serve dual purposes: functional protection during transit and effective digital merchandising. Furthermore, online customer reviews and transparency mandates have placed a higher emphasis on verifiable product performance claims, increasing the burden of proof for advertised benefits like "cold-water cleaning" or "streak-free shine."

In summary, the Dishwashing Liquid Market remains resilient, benefiting from non-discretionary consumer spending on hygiene essentials. Growth will be moderate but highly specialized, driven by performance enhancements through biotechnology, strict adherence to global sustainability goals, and the continued geographical expansion into rapidly developing economies where market penetration is still below established Western standards.

The market faces inherent challenges related to the price elasticity of demand in the mass market segment, where minor price increases can lead to consumer down-trading to store brands or lower-cost alternatives. Companies must therefore balance innovation costs with maintaining highly competitive pricing structures, necessitating continuous operational excellence and supply chain cost reduction through automation and bulk sourcing efficiencies. This persistent pressure ensures the market remains highly cost-sensitive.

The ongoing fragmentation of consumer preferences means that future market success depends not on a single flagship product, but on maintaining a diversified portfolio capable of addressing distinct needs—from ultra-sensitive skin solutions to heavy-duty industrial degreasers. This portfolio approach requires significant ongoing investment in specialized R&D teams and decentralized manufacturing capabilities to tailor products effectively to local water conditions, cultural expectations, and regulatory nuances across continents.

The regulatory framework concerning public health, particularly post-pandemic, has reinforced the importance of anti-bacterial and sanitizing claims in dishwashing products, temporarily elevating their market prominence. While efficacy remains paramount, the long-term trend strongly favors products that offer a blend of high cleaning power with documented ecological safety, signaling a shift from 'clean at all costs' to 'responsible cleaning.'

Specific technological advancements, such as micro-encapsulation for fragrance release, provide competitive advantages by enhancing the sensory experience, a key differentiator in the crowded household segment. These subtle technological improvements, combined with innovative packaging design that facilitates easy use and promotes refill culture, collectively contribute to market value expansion and consumer willingness to pay for premium attributes.

Finally, the long-term outlook for the Dishwashing Liquid Market suggests a continued consolidation among major players seeking economies of scale, offset by the emergence of disruptive start-ups focused exclusively on circular economy models, such as subscription-based refill services. This dual dynamic ensures a vibrant, competitive landscape driven by both global reach and hyper-local specialization.

The strategic importance of the institutional market cannot be overstated, as these customers often represent stable, large volume contracts. Companies like Ecolab and Zep specialize in creating systems-based solutions, integrating the liquid detergent with advanced mechanical dispensers and providing necessary training and compliance documentation. This value-added service model locks in commercial clients, presenting a formidable entry barrier for competitors primarily focused on the consumer retail channel.

Furthermore, the environmental marketing claims are under increasing regulatory scrutiny (e.g., greenwashing concerns). Manufacturers must now provide substantiated evidence for claims such as "plant-derived" or "100% natural," which requires significant internal audit capabilities and third-party verification. This heightened standard of transparency is shaping advertising practices and pushing the industry towards verifiable and certified sustainable sourcing protocols.

The use of recycled content (PCR) in packaging is now a non-negotiable metric for securing contracts with major retailers globally, especially in Europe. This technological challenge requires robust investment in PCR material processing and a complete redesign of existing molds and filling lines to accommodate the slightly different mechanical properties of recycled plastic, representing a substantial capital expenditure across the industry.

The increasing complexity of surfactant blends, moving away from simple single-surfactant systems to synergistic combinations, requires sophisticated analytical chemistry capabilities. These tailored blends are engineered to perform optimally under specific water hardness levels common in different geographical zones, enhancing perceived efficacy and reducing consumer complaints, thereby requiring localized product modifications and rigorous regional testing protocols.

In conclusion, successful navigation of the Dishwashing Liquid Market requires a continuous cycle of innovation driven by consumer health concerns, environmental imperatives, and operational efficiency gains, underpinned by robust global supply chain management and proactive regulatory compliance strategies.

The growing popularity of automated dishwashers, although a direct competitor to manual dishwashing, also indirectly influences the liquid market by forcing product differentiation. Manual dishwashing liquids must continuously enhance their offering—often through moisturizing agents, superior skin care, and unique scents—to maintain relevance, especially for the cleaning of delicate items or specific utensils not suitable for automated washing cycles.

The market for concentrated liquids is further segmented by dosage format, including pods or capsules for highly controlled dispensing, which is popular in regions prioritizing convenience and minimal waste. While currently more common in laundry and automated dishwashing, this capsule technology is gradually being adapted for ultra-concentrated manual products, especially within the premium retail segments, symbolizing ongoing product format evolution.

The strategic development of specialized dishwashing liquids for specific dietary needs, such as formulations specifically targeting gluten or allergen removal, represents a micro-niche opportunity. Although small in volume, these segments allow manufacturers to demonstrate advanced formulation expertise and cater to highly sensitive consumer groups, reinforcing a premium, trustworthy brand image.

Finally, the proliferation of private labels and store brands, particularly in discount retail chains in Europe and North America, imposes significant downward pressure on pricing in the standard segment. Major brand manufacturers counteract this by focusing on patentable technological improvements and maintaining substantial advertising budgets to emphasize intangible brand value and product trust, distinguishing their premium offerings from generic alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager