Disilane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431770 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Disilane Market Size

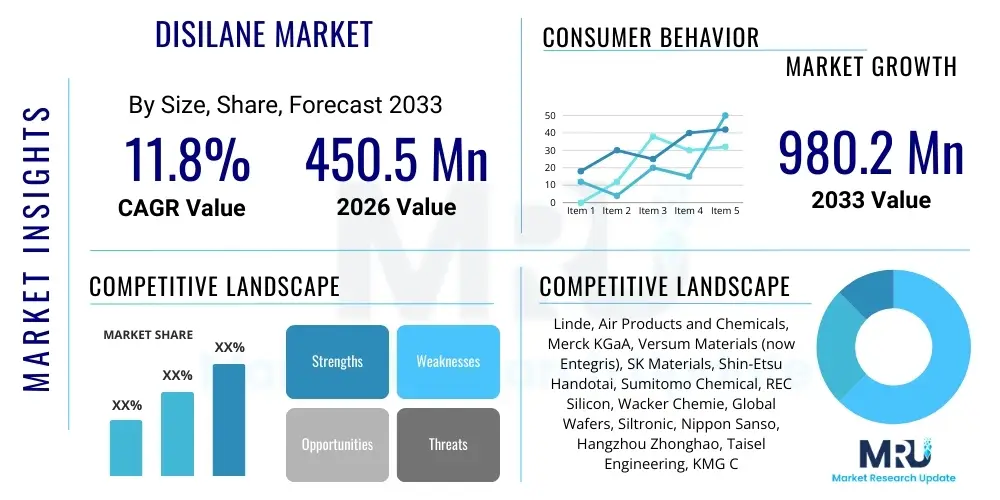

The Disilane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 980.2 Million by the end of the forecast period in 2033.

Disilane Market introduction

The Disilane (Si2H6) market encompasses the production, distribution, and utilization of this highly specialized, pyrophoric gas, primarily serving as a precursor chemical in advanced material deposition processes. Disilane is a critical enabler in the fabrication of high-performance semiconductor devices, playing a key role in Chemical Vapor Deposition (CVD) and Atomic Layer Deposition (ALD) for depositing silicon and silicon-containing films with superior uniformity and conformity compared to traditional silane (SiH4). Its major applications are concentrated within the microelectronics industry for manufacturing intricate integrated circuits (ICs), memory chips (NAND/DRAM), and high-efficiency transistors, along with its increasing use in photovoltaic (solar cell) manufacturing for thin-film amorphous silicon deposition.

The core benefit of utilizing Disilane over Monosilane in deposition processes stems from its inherent lower thermal stability, which allows for lower process temperatures during film growth. This capability is paramount in advanced semiconductor manufacturing where thermal budgets are tightly controlled to prevent undesirable diffusion or damage to sensitive underlying device structures. Furthermore, Disilane often facilitates higher deposition rates, enhancing manufacturing throughput, and enabling the precise control required for scaling down feature sizes to the nanoscale, particularly in FinFET and Gate-All-Around (GAA) structures. The driving factors for market expansion include the sustained global demand for advanced consumer electronics, the proliferation of data centers requiring high-density memory, and robust governmental support for domestic semiconductor production capacities across major economic regions.

Disilane’s unique chemical properties, characterized by the presence of a silicon-silicon bond, offer distinct advantages in precursor chemistry, allowing for novel film properties and reduced impurity incorporation compared to alternatives. High-purity grades (e.g., 6N and 7N) are essential to prevent defect formation in high-k dielectrics and ultra-thin gate oxides, making the purification process a significant determinant of market value. The market structure is highly dependent on stringent safety and handling protocols due to the gas’s pyrophoric nature and high pressurization requirements, necessitating specialized infrastructure for transportation and point-of-use delivery systems. Consequently, demand is intensely concentrated among a specialized base of semiconductor fabrication plants (fabs) and large-scale solar cell manufacturers.

Disilane Market Executive Summary

The Disilane market is poised for significant expansion, driven primarily by accelerating technological migration in the semiconductor sector towards smaller process nodes, demanding greater precision in thin-film deposition. Key business trends include substantial capital expenditure investments in new fabrication facilities (fabs) globally, particularly in North America and Asia Pacific, aimed at securing supply chain resilience and advancing domestic chip manufacturing capabilities. These investments directly fuel the consumption of high-purity precursor gases like Disilane. Regionally, the Asia Pacific market, led by China, Taiwan, and South Korea, maintains dominance due to the presence of the world's largest memory and logic chip manufacturers, while North America and Europe are exhibiting the fastest growth rates spurred by government subsidies and strategic reshoring initiatives focused on advanced packaging and R&D facilities.

Segment trends highlight a pronounced shift towards ultra-high purity grades (7N+) of Disilane, essential for producing advanced logic devices operating at 3nm and 2nm nodes, where even trace impurities can render a wafer unusable. Application-wise, Atomic Layer Deposition (ALD) is emerging as the fastest-growing deposition technique utilizing Disilane, capitalizing on its superior ability to achieve perfect step coverage and conformal coatings required for complex 3D structures like 3D NAND flash memory. The competitive landscape is characterized by high entry barriers, stringent regulatory requirements, and intense competition among a few established industrial gas and specialty chemical suppliers who possess the necessary expertise for safe production, purification, and distribution.

Strategic market evolution is centered on supply chain reliability and sustainability, particularly addressing the volatile nature of precursor chemical sourcing. Manufacturers are increasingly focusing on vertical integration and long-term supply agreements with major fabs to stabilize revenue streams. Furthermore, the convergence of Disilane consumption with the rapidly expanding compound semiconductor market (e.g., SiC and GaN devices) presents latent opportunities, as novel deposition techniques for incorporating silicon components into these materials are explored. The immediate outlook suggests continued price stability, provided that global logistics chains remain functional, with volume growth intrinsically linked to the commissioning schedules of newly announced semiconductor fabrication plants through the latter half of the decade.

AI Impact Analysis on Disilane Market

Common user inquiries regarding AI's influence on the Disilane market center on process optimization, demand forecasting accuracy, and the eventual impact on precursor consumption rates within semiconductor fabs. Users are keenly interested in whether AI-driven manufacturing environments will lead to reduced waste, higher material utilization, or if the increased complexity of chips designed for AI applications will simply necessitate higher volumes of advanced materials. The core themes revolve around using AI for predictive maintenance of CVD/ALD tools, real-time process control to minimize off-spec deposition runs, and optimizing the blend ratio and flow dynamics of Disilane delivery systems. Expectations are high that AI implementation will significantly enhance manufacturing efficiency, thereby stabilizing operational costs, but this efficiency gain might be counterbalanced by the escalating demand for high-performance memory and logic crucial for training and deploying large language models (LLMs) and other AI systems.

The indirect impact of Artificial Intelligence is far more profound than its direct application in precursor management. AI technologies fundamentally drive the demand for Disilane by necessitating the production of increasingly sophisticated hardware, specifically advanced CPUs, GPUs, and specialized AI accelerators (like TPUs). These components require the smallest process nodes and complex 3D stacking architectures, making Disilane an indispensable precursor for high-aspect-ratio etching masks, spacer layers, and high-quality silicon films achieved through ALD. As AI capabilities expand, the data center footprint and edge computing infrastructure grow proportionally, sustaining a robust, long-term demand for the advanced memory and logic chips that utilize Disilane in their core manufacturing processes.

Moreover, AI is already being integrated into semiconductor manufacturing execution systems (MES) to manage the delicate balance of purity, flow rates, and temperature stability critical when handling pyrophoric gases like Disilane. Machine learning algorithms analyze vast datasets generated during deposition runs to predict potential anomalies, adjusting precursor delivery in milliseconds to maintain uniformity across 300mm wafers. This enhanced control reduces material wastage associated with imperfect runs and helps maintain the required 7N+ purity integrity during handling and delivery, directly improving the utilization rate and operational safety surrounding Disilane usage within the fab environment, ultimately favoring suppliers capable of integrating smart monitoring solutions into their delivery apparatus.

- AI optimizes CVD/ALD recipes, minimizing Disilane consumption waste per wafer.

- Increased complexity of AI chips (GPUs, specialized accelerators) drives higher overall demand for advanced Disilane-enabled films.

- Predictive maintenance using AI reduces downtime for precursor delivery systems, ensuring reliable Disilane supply.

- Machine learning algorithms enhance quality control, validating the required ultra-high purity (UHP) grades of Si2H6 in real-time.

- AI-driven supply chain optimization improves logistics and inventory management for volatile precursor chemicals.

DRO & Impact Forces Of Disilane Market

The Disilane market is propelled by the relentless technological demands of the semiconductor industry, characterized by the need for low-temperature processing and highly conformal thin-film deposition necessary for sub-5nm nodes. However, market growth is constrained significantly by the extreme safety risks and high operational costs associated with handling and purifying this highly pyrophoric gas. Opportunities lie in the diversification into non-silicon deposition applications, such as incorporating Si into compound semiconductor devices and expanding its use in next-generation flexible display technologies. These factors collectively exert powerful influence, with the core impact forces being technological advancement in microelectronics and stringent regulatory mandates concerning chemical safety and environmental responsibility.

Drivers: The foremost driver is the global transition to advanced semiconductor manufacturing processes, where Disilane offers kinetic advantages over Monosilane, specifically enabling film deposition at lower temperatures and with greater uniformity, essential for multi-patterning and high-aspect-ratio features. The exponential growth in 3D NAND flash memory production, which relies heavily on ALD processes for building vertical structures, requires massive volumes of precursors like Disilane. Additionally, the increasing focus on advanced logic devices (e.g., GAA structures) further solidifies Disilane’s position as a preferred silicon source. A secondary driver is the moderate but steady growth in the high-efficiency thin-film solar market, where Disilane is used to produce higher-quality amorphous silicon layers, boosting cell performance.

Restraints: The primary restraint remains the hazardous nature of Disilane; its pyrophoric property requires extremely specialized handling, storage, and transportation infrastructure, significantly elevating operational expenditures (OpEx) for both suppliers and end-users. The high cost associated with achieving and maintaining ultra-high purity grades (7N+) necessary for advanced nodes poses a considerable barrier, restricting its use to premium applications where performance outweighs material cost. Furthermore, potential competition from alternative precursor chemistries, particularly proprietary silicon sources developed by specialty chemical companies that claim improved safety profiles or deposition efficiencies, presents a latent competitive threat that could temper future demand growth.

Opportunities: Significant market opportunities are concentrated in the rapidly expanding Compound Semiconductor sector, particularly the integration of silicon layers into SiC and GaN devices used in power electronics and 5G/6G infrastructure, potentially opening up new high-value, low-volume applications. The development of next-generation packaging technologies, such as fan-out wafer-level packaging (FOWLP) and 3D heterogeneous integration, requires sophisticated dielectrics and passivation layers often deposited using Disilane-based ALD. Lastly, focused R&D into safer, non-pyrophoric delivery systems or encapsulated forms of Disilane could unlock greater adoption across broader application segments by mitigating the handling risks that currently suppress market access.

- Drivers: Adoption of sub-7nm semiconductor nodes; Expansion of 3D NAND fabrication; Lower temperature processing capability compared to silane.

- Restraints: High safety risks and specialized handling requirements (pyrophoric nature); High purification costs to meet 7N+ standards; Regulatory compliance burden.

- Opportunities: Increased integration in power electronics (SiC/GaN); Growth in flexible display manufacturing; Development of safer delivery chemistries.

- Impact Forces: Technological advancements in deposition methods (ALD/PECVD); Stringent semiconductor quality standards; Global geopolitical dynamics affecting precursor supply chains.

Segmentation Analysis

The Disilane market segmentation is critically defined by the purity requirements dictated by end-user applications, the specific deposition technique employed, and the ultimate industry served. Purity grade (5N to 7N+) is the most crucial differentiator, directly influencing material price and suitability for advanced semiconductor nodes. The segmentation by application distinguishes between the high-volume needs of Chemical Vapor Deposition (CVD) for bulk film growth and the high-precision requirements of Atomic Layer Deposition (ALD) for ultra-thin, conformal layers. This structure provides a granular view of market dynamics, highlighting the premium segment dedicated to advanced microelectronics versus the higher volume, lower purity requirements prevalent in certain photovoltaic manufacturing processes.

Segmentation by purity reflects the technological maturity of the end-user. The 5N (99.999%) and 6N (99.9999%) segments serve general semiconductor and standard photovoltaic applications, where performance demands are less stringent or feature sizes are larger. Conversely, the 7N+ (99.99999% and above) segment is the fastest-growing and highest-value category, exclusively dedicated to leading-edge logic and memory production (e.g., 3nm/2nm), where metallic and particulate contaminants must be virtually eliminated. Manufacturers who can consistently achieve and maintain these ultra-high purity levels command significant market premiums and hold a strategic advantage, often necessitating bespoke purification and analysis equipment.

Analyzing the end-user segments reveals the dominance of the Semiconductor industry, which represents the primary consumer of high-grade Disilane due to the intensive requirements of advanced wafer fabrication. Within this sector, the demand is bifurcated between memory manufacturing (DRAM and 3D NAND), which drives volume, and logic/foundry services (CPUs, GPUs), which dictate the highest purity standards. The Photovoltaics segment provides a secondary, steadier demand stream, focused on amorphous silicon deposition for thin-film solar cells, though its growth is less explosive compared to the microelectronics segment. Understanding this segmentation is essential for suppliers to tailor product specifications, packaging, and delivery logistics, ensuring compliance with the varying demands for safety and cleanliness across different industrial environments.

- By Purity Grade:

- 5N (99.999%)

- 6N (99.9999%)

- 7N and Above (7N+)

- By Application:

- Chemical Vapor Deposition (CVD)

- Atomic Layer Deposition (ALD)

- Epitaxial Growth

- Other Thin Film Technologies

- By End-User Industry:

- Semiconductors (Logic, Memory, Foundry)

- Photovoltaics (Thin-Film Solar Cells)

- Optoelectronics

- Microelectromechanical Systems (MEMS)

Value Chain Analysis For Disilane Market

The Disilane market value chain is highly integrated and complex, starting with the synthesis of silicon intermediates and culminating in high-precision deposition within highly controlled cleanrooms. Upstream activities are dominated by specialized industrial gas companies that possess the unique infrastructure for handling and synthesizing reactive silicon precursors, often converting metallurgical-grade silicon into Monosilane and then subsequently into Disilane through advanced chemical reactions, followed by intensive purification processes crucial for achieving 7N grades. Downstream, the distribution is characterized by highly specialized logistics involving pressure cylinders and proprietary gas delivery systems designed for safety and purity maintenance, leading directly to the tier-one semiconductor foundries and IDMs (Integrated Device Manufacturers) that are the primary buyers.

Upstream analysis focuses heavily on technological barriers and purity control. The synthesis and subsequent refinement of Disilane are energy-intensive and require significant capital investment in purification columns and analytical equipment capable of detecting parts-per-billion impurities. Key raw materials often include high-purity hydrogen and metallurgical-grade silicon. This stage is critical as the quality established here directly determines the suitability of the product for advanced microelectronics. Suppliers often maintain proprietary control over their synthesis processes to ensure competitive differentiation in purity and cost-effectiveness, locking in specialized knowledge about handling this hazardous precursor.

The distribution channel for Disilane is overwhelmingly direct, focusing on long-term contracts between precursor suppliers and major fabs globally, rather than relying on standard chemical distributors. The inherent dangers of Disilane necessitate dedicated, certified logistics—specialized tankers and highly resistant cylinders—which only a few industrial gas majors can reliably provide. Indirect sales, though minimal, might occur through specialized regional distributors catering to smaller R&D facilities or localized photovoltaic operations. Downstream, the economic power is concentrated in the hands of major foundries (TSMC, Samsung) and memory manufacturers (Micron, SK Hynix), whose large volume consumption and exacting quality specifications dictate pricing power and require suppliers to be geographically proximate to minimize logistics risks and expedite just-in-time delivery.

Disilane Market Potential Customers

The core potential customers and end-users of Disilane are the world’s leading Integrated Device Manufacturers (IDMs) and pure-play foundry operators within the semiconductor sector, complemented by large-scale thin-film solar cell manufacturers. These customers require ultra-high purity Disilane (6N and 7N+) for their critical deposition steps, including the formation of gate dielectrics, high-k metal gates, and highly conformal spacer layers essential for advanced transistor architecture. The semiconductor industry's demand is characterized by high volume, low impurity tolerance, and a non-negotiable requirement for secure, redundant supply chains due to the catastrophic financial impact of production interruptions.

Within the semiconductor landscape, specific potential buyers include companies specializing in advanced logic (e.g., processors for AI and high-performance computing), which demand the highest purity Disilane for sub-5nm fabrication nodes to maintain electrical performance and yield. Furthermore, the burgeoning memory segment, specifically manufacturers scaling 3D NAND to higher layers (e.g., 176 layers and beyond), are massive consumers, utilizing Disilane in complex ALD sequences to achieve the necessary vertical aspect ratios and film conformity within the memory stacks. The purchasing decisions in this sector are driven less by marginal cost differences and more by guaranteed consistency, reliable logistics, and supplier technical support regarding safe handling and utilization.

Secondary but crucial customer groups include equipment manufacturers and material science research institutions. Original Equipment Manufacturers (OEMs) of CVD and ALD tools often collaborate with Disilane suppliers for process qualification and recipe development, indirectly influencing consumption. The Photovoltaics sector represents a substantial potential buyer base focused on cost-efficiency and large-scale supply contracts for 5N and 6N Disilane used in continuous thin-film amorphous silicon deposition. As photovoltaic efficiency standards increase, the quality requirements in this segment are also gradually rising, opening up opportunities for suppliers capable of offering a balance between cost-effectiveness and improved purity grades suitable for next-generation solar technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 980.2 Million |

| Growth Rate | CAGR 11.8 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde, Air Products and Chemicals, Merck KGaA, Versum Materials (now Entegris), SK Materials, Shin-Etsu Handotai, Sumitomo Chemical, REC Silicon, Wacker Chemie, Global Wafers, Siltronic, Nippon Sanso, Hangzhou Zhonghao, Taisel Engineering, KMG Chemicals (now Cabot Microelectronics), Dow, Solvay, Gelest, Entegris, Praxair. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disilane Market Key Technology Landscape

The technological landscape surrounding the Disilane market is highly advanced, centered on ultra-high purity gas generation, sophisticated deposition equipment, and pioneering delivery systems designed for optimal safety and material efficiency. The core technologies driving consumption are low-temperature Chemical Vapor Deposition (LTCVD) and Atomic Layer Deposition (ALD), which leverage Disilane's reactivity to deposit uniform silicon films, amorphous silicon, or silicon nitride/oxide layers. These processes are essential for creating complex, high-performance semiconductor structures, requiring precise control over temperature, pressure, and gas flow dynamics to prevent premature decomposition or particulate generation, which would compromise the wafer yield.

A critical technology component is the method used for achieving and verifying Ultra-High Purity (UHP) grades. Disilane purification relies on complex, multi-stage distillation and proprietary adsorption techniques to remove trace metallic impurities, moisture, and residual hydrocarbons down to parts-per-trillion levels. The analytical technology landscape, including advanced gas chromatography-mass spectrometry (GC-MS) and continuous wave cavity ring-down spectroscopy (CW-CRDS), plays an equally vital role, ensuring that the delivered product consistently meets the non-negotiable 7N+ purity standards required by advanced fabs. Suppliers are constantly investing in improving these purification technologies to support the industry’s continuous shrink in feature sizes.

Furthermore, the safety and delivery technology segment is foundational due to Disilane’s pyrophoric nature. This includes the innovation of safer packaging, such as specialized high-pressure cylinders with internal passivation layers to maintain gas stability, and sophisticated, automated gas cabinets (point-of-use systems) equipped with leak detection, purging mechanisms, and emergency shutdown capabilities. The shift towards proprietary precursor blend technologies, where Disilane might be mixed with inert carrier gases or delivered in encapsulated forms, represents an emerging technological area aimed at improving safety profiles and boosting deposition efficiency, especially in novel plasma-enhanced ALD (PEALD) applications for advanced memory architectures.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the Disilane market, primarily due to housing the largest concentration of semiconductor manufacturing facilities, including major foundries and all major memory producers (NAND and DRAM). Countries like China, South Korea, and Taiwan are the epicenter of global microelectronics production and, consequently, the highest consumers of UHP Disilane. Robust governmental support (e.g., China’s Big Fund) for domestic chip production and the region's massive end-user electronics market ensure sustained, high-volume demand. APAC is the primary region driving volume growth, heavily influenced by the expansion schedules of companies like TSMC, Samsung, and SK Hynix.

- North America: North America represents a high-growth region, driven by significant governmental initiatives like the CHIPS Act, intended to onshore advanced semiconductor manufacturing and R&D activities. While consumption volume is currently lower than APAC, the focus is on leading-edge technology nodes (sub-5nm), demanding the absolute highest purity grades (7N+). The presence of major IDMs (Intel, Micron) and leading ALD/CVD equipment providers drives innovation in precursor utilization and delivery system development, positioning the region as a critical hub for future technological advancements in Disilane application.

- Europe: The European market, though smaller, is gaining strategic importance through initiatives like the European Chips Act, aimed at strengthening the regional semiconductor ecosystem. Demand is concentrated in specialized sectors, including automotive electronics, industrial IoT, and compound semiconductor manufacturing (e.g., SiC power devices). Consumption focuses on specialized applications requiring precise deposition, with suppliers focusing on localizing production and enhancing supply chain security to serve specialized captive fabs and advanced research institutes in Germany, France, and Ireland.

- Latin America: The Latin American market for Disilane is relatively nascent, with limited direct manufacturing of advanced semiconductors. Demand is primarily derived from localized photovoltaic manufacturing operations and R&D centers focused on material science. Consumption volumes are low, and the market relies almost entirely on imports from major APAC and North American suppliers. Future growth potential is tied to regional investments in renewable energy infrastructure and any potential establishment of microelectronics assembly or packaging facilities.

- Middle East and Africa (MEA): The MEA region exhibits minimal direct consumption of Disilane. The market activity is limited to small-scale academic research or specialized niche applications, often imported via European distributors. However, the Gulf nations’ strategic focus on diversifying their economies, coupled with significant investments in renewable energy projects (solar farms), presents a long-term, albeit speculative, opportunity for Disilane use in thin-film photovoltaic production if substantial local manufacturing capabilities are established.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disilane Market.- Linde

- Air Products and Chemicals

- Merck KGaA

- Versum Materials (now Entegris)

- SK Materials

- Shin-Etsu Handotai

- Sumitomo Chemical

- REC Silicon

- Wacker Chemie

- Global Wafers

- Siltronic

- Nippon Sanso

- Hangzhou Zhonghao

- Taisel Engineering

- KMG Chemicals (now Cabot Microelectronics)

- Dow

- Solvay

- Gelest

- Entegris

- Praxair

Frequently Asked Questions

Analyze common user questions about the Disilane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Disilane in the semiconductor industry?

Disilane (Si2H6) is predominantly used as a precursor gas in advanced semiconductor manufacturing for Chemical Vapor Deposition (CVD) and Atomic Layer Deposition (ALD). Its primary roles include depositing high-quality silicon films, spacer layers, and silicon compounds (silicon oxide or nitride) required for fabricating high-performance logic devices, 3D NAND flash memory, and DRAM chips, particularly at process nodes smaller than 7nm.

Why is Disilane preferred over Monosilane (SiH4) in modern fabrication processes?

Disilane is favored over Monosilane because it possesses a silicon-silicon bond, making it chemically more reactive and enabling film deposition at significantly lower process temperatures (LTCVD/ALD). Lower temperatures are critical in advanced chip manufacturing to prevent thermal damage, dopant diffusion, and ensure structural integrity during the complex, multi-layered construction of modern transistors and memory cells.

What is the main challenge associated with the supply chain and handling of Disilane?

The chief challenge is the pyrophoric nature of Disilane, meaning it ignites spontaneously upon contact with air. This inherent hazard necessitates extremely rigorous safety protocols, specialized high-pressure delivery systems, and extensive safety infrastructure in transportation and storage, leading to high operational costs and dependency on highly specialized industrial gas suppliers for ultra-safe logistics.

Which purity grade of Disilane is essential for leading-edge semiconductor manufacturing?

Leading-edge semiconductor fabrication, targeting 5nm and 3nm nodes, requires Ultra-High Purity (UHP) Disilane, typically 7N (99.99999%) or higher. This ultra-pure grade is necessary to eliminate metallic and particulate impurities that can cause crystalline defects, significantly reducing wafer yield and compromising the electrical performance of nanoscale devices.

How do global semiconductor capacity expansion plans affect the Disilane market growth?

Global plans, such as the construction of new fabs in the US, Europe, and Asia (often fueled by government incentives like the CHIPS Acts), directly translate into long-term robust demand for Disilane. Each new fabrication facility, especially those focusing on advanced memory and logic, increases the structural volume consumption required for ALD/CVD processes, ensuring the market's projected growth trajectory throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hexachlorodisilane (HCDS) Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Thin Film Precursors Market Statistics 2025 Analysis By Application (Semiconductors, Fiber Optics, Aerospace Industry, Solar Energy, Others), By Type (Silicon, Tetramethylsilane (4MS), Trimethysilane (3MS), Bis(diethylamino)silane (BDEAS), Trisilylamine (TSA), Hexachlorodisilane (HCDS), Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Hexachlorodisilane (HCDS) Market Statistics 2025 Analysis By Application (Semiconductors, Fiber Optics, Aerospace Industry, Solar Energy), By Type (Low Purity Type, High Purity Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager