Disodium Cocoyl Glutamate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437381 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Disodium Cocoyl Glutamate Market Size

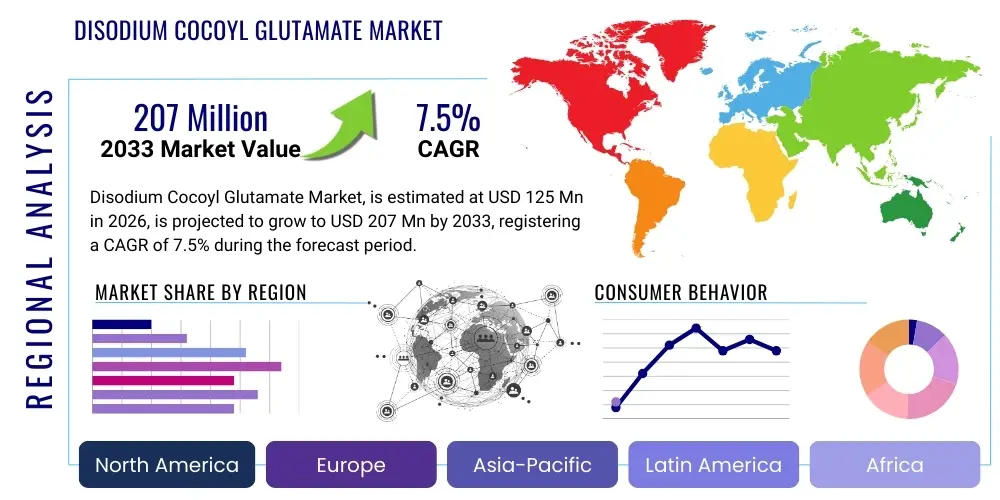

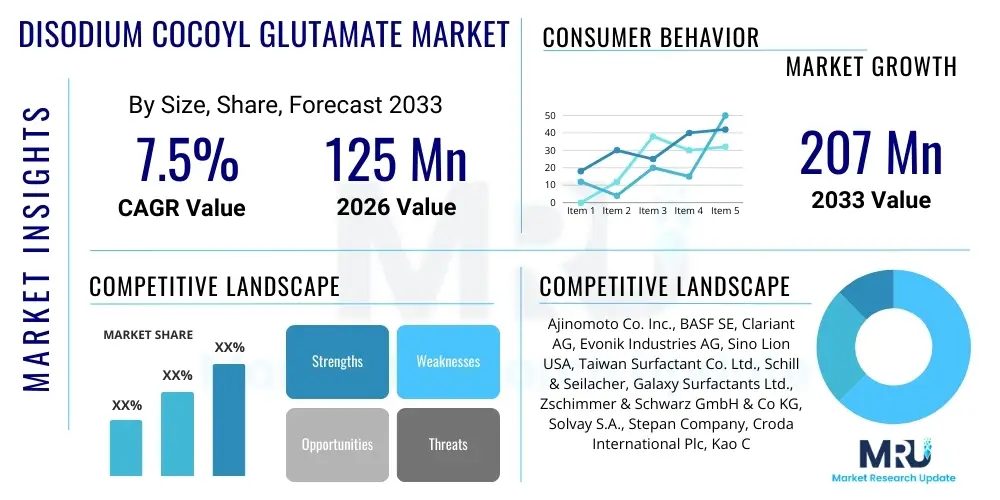

The Disodium Cocoyl Glutamate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 125 million in 2026 and is projected to reach USD 207 million by the end of the forecast period in 2033.

Disodium Cocoyl Glutamate Market introduction

The Disodium Cocoyl Glutamate (DSCG) market encompasses the production, distribution, and application of this mild anionic surfactant derived from coconut oil and glutamic acid. DSCG is highly valued in the personal care industry, primarily due to its exceptional mildness, excellent foaming properties, and its natural, biodegradable profile. As consumers increasingly prioritize clean label ingredients and sustainable sourcing, DSCG has emerged as a preferred alternative to harsher, traditional sulfate-based surfactants like Sodium Lauryl Sulfate (SLS) and Sodium Laureth Sulfate (SLES). This shift is particularly pronounced in sensitive skin, baby care, and high-end cosmetic formulations, driving sustained demand globally. The inherent compatibility of DSCG with the human skin's natural pH and lipid layer makes it indispensable for formulators aiming to create non-irritating, high-performance cleansing products that cater to the expansive demographic seeking dermatologically validated ingredients. Furthermore, its contribution to stable and luxurious foam texture, even in challenging water conditions, provides a premium user experience that justifies its inclusion in specialized and luxury product lines across hair and skin cleansing categories. This fundamental shift away from petrochemical-derived ingredients towards natural amino acid derivatives is a defining characteristic of the contemporary cosmetic ingredient landscape, positioning DSCG as a critical growth engine.

Disodium Cocoyl Glutamate is synthesized through the acylation of glutamic acid, an amino acid, with fatty acids derived from coconut oil, resulting in a gentle, amino acid-based surfactant with low critical micelle concentration, contributing to its mildness. Its primary applications span across various personal hygiene products, including facial cleansers, body washes, shampoos, and specialized mild detergents. Unlike many conventional surfactants, DSCG maintains skin barrier integrity, minimizes irritation potential, and exhibits effective performance even in hard water conditions. The multifunctional nature of DSCG—acting as a cleansing agent, foam booster, and conditioning agent—enhances formulation stability and user experience, solidifying its position as a cornerstone ingredient in modern green chemistry. The production process itself is increasingly scrutinized for sustainability, prompting manufacturers to invest in bio-fermentation methods for glutamic acid production, further cementing DSCG's environmental credentials compared to older, synthetic alternatives. The high solid content versions of DSCG are also revolutionizing the logistics of cosmetic manufacturing, allowing for greater concentration and reduced transportation costs for bulk ingredient buyers.

Key drivers propelling the expansion of the DSCG market include stringent regulatory requirements in regions like the European Union favoring biodegradable and safe cosmetic ingredients, coupled with rising consumer awareness regarding the potential health risks associated with synthetic chemicals. This regulatory push, particularly concerning environmental persistence and aquatic toxicity, favors natural, readily degradable molecules like DSCG. Furthermore, innovation in manufacturing processes leading to cost-effective production methods for amino acid surfactants is making DSCG more accessible to mass-market brands, gradually eroding the cost disparity with traditional surfactants. The growing focus on dermatologically tested, hypoallergenic products, especially in rapidly urbanizing economies across Asia, further stimulates the adoption of DSCG, underscoring its pivotal role in the future of sustainable personal care. The shift towards solid formats (e.g., shampoo bars, concentrated tablets) also utilizes DSCG for its superior performance and stability in highly concentrated formulations, addressing the critical consumer and industry need to minimize plastic packaging and water usage, thereby linking product innovation directly to environmental sustainability objectives. The market is also benefiting from increasing investment in R&D aimed at creating specialized DSCG derivatives optimized for specific temperature and pH ranges, enhancing its versatility across diverse product categories, including high-end therapeutic applications.

Disodium Cocoyl Glutamate Market Executive Summary

The Disodium Cocoyl Glutamate (DSCG) market is defined by robust growth driven primarily by a global pivot toward sustainability, clean beauty, and profound skin health consciousness, making ingredient choice a defining competitive edge. Business trends indicate a strong move toward vertical integration among key manufacturers, seeking to secure raw material supply (coconut oil derivatives and glutamic acid) and optimize supply chain efficiency against commodity price fluctuations. This strategic integration mitigates risk and ensures a consistent supply of high-purity material, essential for premium brand partners. There is also a notable increase in strategic collaborations between specialized ingredient producers and major multinational cosmetic corporations, aiming to accelerate product development and market penetration for premium, natural formulations. Furthermore, technological advancements are focused on improving the purity, consistency, and yield of DSCG production through biocatalysis and advanced fermentation techniques, ensuring the high-quality standards demanded by formulators in the fast-paced beauty sector. The adoption of digital supply chain management tools is enhancing transparency regarding the source and ethical credentials of the raw materials, a critical element for AEO and meeting consumer scrutiny.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely fueled by rising disposable incomes, increasing awareness of amino acid surfactants in densely populated countries like China and India, and a deeply entrenched culture of natural and traditional medicinal ingredients integrating into modern cosmetics, particularly the influential J-Beauty and K-Beauty formulation philosophies. North America and Europe, while mature, exhibit high per capita consumption and are key innovation hubs where the clean beauty movement originated, setting the benchmark for ingredient scrutiny, safety, and ethical sourcing practices. These regions display high demand for certified organic and certified natural DSCG variants, emphasizing transparency, carbon footprint reduction, and environmental impact mitigation. Regulatory changes, such as the EU Green Deal initiatives, continue to reinforce Europe's position as a market demanding continuous ingredient innovation towards absolute environmental compatibility. The competitive advantage in these regions often lies not just in product performance but in the comprehensive sustainability story behind the ingredient, which DSCG, as a bio-derived material, uniquely fulfills.

Segmentation trends highlight the dominance of the Liquid Form segment due to its ease of incorporation into standard formulations and lower initial complexity for smaller manufacturers. However, the Powder Form is rapidly gaining significant traction, particularly in specialized solid cosmetic formats (shampoo and conditioner bars, powdered facial cleansers) and high-concentration industrial uses where stability, longer shelf life, and substantially reduced shipping weight are paramount for achieving sustainability goals. Application-wise, Hair Care and Facial Cleansing remain the largest segments, benefiting from DSCG’s non-irritating yet effective cleansing action. Specialized applications like oral care (as a mild foaming and plaque-reducing agent in high-end toothpastes) and baby care products (requiring the highest level of proven mildness) are expanding aggressively. The market demonstrates structural resilience, benefiting from the non-discretionary nature of personal hygiene and self-care products, ensuring a stable, upward growth trajectory throughout the forecast period, irrespective of minor short-term economic headwinds. Strategic market players are increasingly utilizing predictive analytics to forecast demand shifts between liquid and powder formats, ensuring optimized inventory and responsiveness to formulator needs.

AI Impact Analysis on Disodium Cocoyl Glutamate Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Disodium Cocoyl Glutamate market frequently center on optimizing synthesis routes, predicting raw material fluctuations, and enabling granular personalization of cosmetic formulations. Users are keen to understand how AI can enhance the efficiency and sustainability of glutamic acid and coconut oil sourcing, minimizing waste, and ensuring stable, ethically compliant supply chains. Specifically, common questions address how machine learning can forecast the yield variations based on agricultural cycles or fermentation batch quality. Furthermore, there is significant interest in AI-driven formulation platforms that can predict the compatibility, efficacy, and sensory profile (e.g., foam quality, skin feel) of DSCG when combined with complex mixtures of natural ingredients, thereby drastically reducing R&D timeline and costs associated with traditional trial-and-error methods. Concerns often revolve around data privacy related to consumer personalization models and the high initial capital expenditure required for implementing sophisticated predictive analytics and large-scale automation systems in chemical manufacturing environments, especially regarding integration with existing legacy systems.

AI's influence is fundamentally transforming R&D within the DSCG sector by enabling high-throughput screening of various precursor combinations and reaction parameters, leading to more efficient, higher-purity DSCG synthesis methods. Machine learning algorithms are being rigorously deployed to model complex chemical kinetics, identifying optimal catalytic systems, precise temperature profiles, and mixing regimens, which translates directly into superior product consistency, reduced energy consumption per unit of output, and subsequently, higher yields. Predictive maintenance powered by advanced AI algorithms minimizes catastrophic equipment failure and prolonged downtime in large-scale production facilities, ensuring continuous and reliable supply of this essential ingredient to global formulators. This technological adoption enhances profitability margins for manufacturers and significantly speeds up the introduction of specialized DSCG derivatives tailored for unique formulation challenges, such as those requiring exceptional stability in acidic or basic environments, a technological differentiator in a competitive market.

In consumer-facing segments, AI facilitates hyper-personalization of finished cosmetic products containing DSCG. By analyzing vast datasets encompassing consumer purchasing history, environmental exposures, diagnosed skin conditions, regional climate data, and ingredient sensitivities, AI platforms can recommend precise, customized formulations, often utilizing DSCG as the primary mild surfactant base. This personalized, data-driven approach not only drives unprecedented consumer loyalty and engagement but also provides rapid, valuable feedback loops to manufacturers regarding real-time ingredient performance under various dynamic, real-world conditions. Furthermore, AI is crucial in automating regulatory compliance checks for new DSCG-containing products across multiple jurisdictions, drastically reducing time-to-market. Ultimately, AI serves as an indispensable tool for enhancing operational excellence, accelerating sustainable ingredient innovation, deepening comprehensive market understanding, and streamlining the complex compliance requirements inherent to the Disodium Cocoyl Glutamate market.

- AI-driven optimization of DSCG synthesis, leading to higher purity, reduced energy consumption, and minimized manufacturing waste.

- Machine learning models predict commodity price volatility (coconut oil, glutamic acid) for optimized, cost-effective procurement strategies and inventory management.

- Hyper-personalized cosmetic formulation using AI to determine optimal DSCG concentration and adjunct ingredient ratios based on individual skin microbiomes and environmental factors.

- Enhanced supply chain transparency and traceability using AI and blockchain integration, ensuring ethical sourcing validation for glutamic acid and coconut derivatives.

- Automated quality control systems and real-time spectrophotometric monitoring of surfactant production parameters, guaranteeing superior batch-to-batch consistency and regulatory adherence.

- Accelerated R&D cycles by simulating complex ingredient interactions, stability profiles, and sensory characteristics (e.g., foam density, rinse feel) before costly laboratory bench trials.

DRO & Impact Forces Of Disodium Cocoyl Glutamate Market

The Disodium Cocoyl Glutamate market is primarily driven by the escalating consumer demand for natural, sulfate-free, and fundamentally skin-friendly personal care products, strongly supported by global clean beauty trends, which emphasizes ingredient simplicity and functionality. Restraints include the relatively higher production cost of amino acid-based surfactants compared to traditional petroleum-derived alternatives, leading to increased final product prices that can limit adoption in extremely price-sensitive mass-market segments, particularly in developing economies where cost remains the dominant purchasing factor. Opportunities abound in expanding application scope into specialized areas like professional aesthetics, mild industrial cleaners requiring low environmental impact, and premium pet care products, coupled with ongoing, industry-wide efforts by manufacturers to optimize green synthesis techniques, particularly through advanced bioprocessing, to significantly lower production costs and improve the overall sustainability profile. These intertwined forces collectively shape the competitive and innovation-driven market landscape, pushing continuous research towards more sustainable, high-performance, and cost-effective mild cleansing solutions.

Drivers: The pervasive consumer push for 'free-from' labeling (SLS-free, SLES-free, paraben-free) is the foremost driver, aligning perfectly with DSCG’s inherent mildness and clean profile. Regulatory tightening, particularly across Western and increasingly Asian jurisdictions, necessitates the use of readily biodegradable and low-toxicity ingredients to meet evolving environmental standards, positioning DSCG as an ideal compliance choice that often exceeds minimum requirements. Furthermore, the robust dermatological benefits of DSCG, such as its proven ability to cleanse effectively while preserving the skin barrier function and natural lipid layers, make it highly sought after for sensitive skin, hypoallergenic formulations, and the rapidly growing baby care lines. This powerful confluence of stringent regulatory compliance, evolving sophisticated consumer preferences for health and nature, and demonstrated functional superiority ensures continuous and robust market acceleration throughout the forecast horizon, securing its indispensable status in high-quality formulation design.

Restraints and Opportunities: The key restraint lies in the complexity and associated significant capital expenditure required for producing high-purity glutamic acid derivatives at the large, commercial scale needed by global cosmetic brands, thereby impacting the final product pricing compared to ubiquitous commodity surfactants. This inherent price pressure can, however, be strategically mitigated through process engineering innovations, such as utilizing advanced, high-efficiency fermentation-based glutamic acid sources or optimizing continuous flow chemistry during the acylation phase. Key opportunities include the increasing market penetration in emerging Asian and Latin American markets, where traditional cleansing rituals are rapidly evolving toward premium, gentle products as disposable incomes rise. Moreover, aggressively developing solid, concentrated, anhydrous forms of DSCG allows for product differentiation, addresses critical environmental concerns related to water usage and single-use plastic packaging, and dramatically lowers logistics costs, offering a strong, multi-faceted pathway for substantial market expansion and competitive advantage.

Impact Forces: The bargaining power of buyers (major cosmetic conglomerates) is considered high, primarily driven by the increasing availability of alternative high-performance mild surfactants (e.g., Sodium Methyl Cocoyl Taurate, Sodium Lauroyl Sarcosinate). However, the unique, superior mildness profile and excellent environmental credentials of DSCG provide differentiation, somewhat offsetting this intense buyer pressure. The threat of substitutes is categorized as moderate, mitigated by the long lead time required for regulatory approval, safety testing, and widespread consumer acceptance of entirely new surfactant classes. Supplier power is moderate, significantly influenced by the stability of global coconut oil and L-glutamic acid supply chains, which are inherently susceptible to climatic volatility, agricultural harvest cycles, and global trade dynamics. Competitive rivalry is consistently intensifying as more established global chemical companies and specialty ingredient houses invest heavily in R&D and scaling up amino acid surfactant technology, leading to rapid product innovation and fierce price competition within the high-volume segments of the market.

- Drivers: Strong consumer demand for clean label and sulfate-free products; growing focus on documented mildness and dermatological safety; highly favorable global regulatory environment promoting readily biodegradable ingredients.

- Restraints: Higher complexity and increased initial capital expenditure for manufacturing compared to conventional surfactants; inherent price sensitivity in certain mass-market applications; vulnerability to supply chain shocks related to agricultural commodities (coconut oil).

- Opportunities: Significant market expansion into developing Asian and Latin American markets; rapid technological advancements in bioprocessing to dramatically lower long-term production costs; increasing adoption in disruptive solid cosmetic formats and specialized industrial cleaning applications.

- Impact Forces: High buyer bargaining power due to the existence of effective clean beauty alternatives; moderate threat of new substitutes requiring significant R&D; intensifying competitive rivalry among major specialty chemical suppliers focusing on capacity expansion.

Segmentation Analysis

The Disodium Cocoyl Glutamate market is comprehensively segmented based on its physical Form, the critical Purity Grade of the ingredient, and its diverse Applications across the expansive personal care and specialized cleaning industries. Understanding these detailed segments is fundamentally crucial for manufacturers and investors to tailor their production capabilities, optimize distribution networks, and refine their marketing strategies effectively, addressing the highly specific and differentiated requirements of high-end, niche cosmetic brands versus the high-volume, cost-conscious demands of mass-market hygiene product producers. The segmentation profoundly reflects the varied functional properties and commercial standards DSCG must uphold, ranging from highly concentrated, ultra-purified grades used in professional, clinical skincare to standard liquid formulations preferred for their operational simplicity and ease of handling in large-scale continuous manufacturing processes.

The segmentation by Form (Liquid vs. Powder/Granular) is strategically significant, reflecting critical trade-offs between processing ease and supply chain optimization. Liquid DSCG is widely used due to its simple integration into existing water-based manufacturing infrastructure, minimizing formulation adjustments, while the Powder form provides substantially higher active matter content, drastically reduces shipping volume and cost, and is essential for dry or concentrated products, such as innovative solid shampoo bars or powdered facial cleansers. These solid formats are experiencing rapid growth driven by consumer preference for sustainability and reduced plastic use. The segmentation by Grade (Cosmetic Grade and Pharmaceutical Grade) ensures compliance with increasingly strict global quality and safety standards. Pharmaceutical-grade DSCG targets highly sensitive, clinically demanding applications like opthalmic solutions or medical skin barrier treatments, requiring the utmost purity and minimal impurity profiles, thereby commanding a significant price premium over standard cosmetic grades.

Application analysis confirms that the Personal Care industry fundamentally dominates the market, specifically within Hair Care (premium, sulfate-free shampoos and conditioners) and Skin Care (mild facial washes, gentle body cleansers). The signature functional characteristics of DSCG—mild yet powerful cleansing, stable foaming, and excellent skin feel—are perfectly suited for these core sectors. Furthermore, segmentation by Purity allows for sophisticated differentiation in pricing and targeted marketing, where luxury brands focusing on absolute transparency and validated high efficacy are willing to pay a premium for certified high-purity material backed by extensive clinical data. This granular, detailed segmentation strategy allows incumbent market players and new entrants to accurately identify untapped niches, particularly in specialized industrial cleaning that requires eco-friendly ingredients and the rapidly expanding oral care segment, where a mild, non-toxic, yet effective foaming and plaque-dispersion agent is increasingly prioritized for overall dental health and user acceptance.

- By Form:

- Liquid (High volume, easy incorporation into aqueous formulations)

- Powder/Granular (High active matter, crucial for solid formats, reduced logistics costs)

- By Grade:

- Cosmetic Grade (Standard purity for mainstream personal care)

- Pharmaceutical Grade (Highest purity, minimal impurities, targeted for medical/therapeutic uses)

- By Application:

- Hair Care (Sulfate-free shampoos, gentle cleansing systems, co-washes)

- Skin Care (Mild facial cleansers, sensitive body washes, micellar waters)

- Baby Care Products (Tear-free formulations, extremely mild infant washes)

- Oral Care (Mild foaming agents in premium, natural toothpastes)

- Other Applications (Specialized Industrial/Institutional Cleaners requiring biodegradability)

- By End-User Industry:

- Cosmetics and Personal Care (Largest segment)

- Pharmaceuticals (High-grade topical and clinical applications)

- Household and Institutional Cleaning (Driven by green cleaning mandates)

Value Chain Analysis For Disodium Cocoyl Glutamate Market

The value chain for Disodium Cocoyl Glutamate commences with the rigorous upstream sourcing and refinement of two crucial natural raw materials: L-Glutamic Acid, which is predominantly manufactured through large-scale, environmentally controlled bio-fermentation processes, and high-purity fatty acids, primarily Lauric Acid, extracted from sustainably sourced coconut oil or palm kernel oil. Upstream commodity suppliers, particularly those providing certified sustainable palm derivatives or high-volume fermented glutamic acid, maintain moderate leverage, as the availability, price stability, and ethical certification of these agricultural commodities directly and substantially influence the final production cost and market image of the synthesized surfactant. The quality, sustainability certifications (e.g., Fair Trade, RSPO, non-GMO status) at this foundational initial stage are critically vital, as they cascade and must be verifiable throughout the entire chain, significantly influencing the premium pricing and overall marketability of the final cosmetic ingredient to brand owners who prioritize transparency.

The central manufacturing stage involves highly specialized chemical producers and ingredient houses who perform the complex synthesis of DSCG through a specialized acylation reaction. This pivotal stage demands profound chemical engineering expertise, investment in robust, specialized reactor infrastructure, and strict adherence to advanced purification and multi-stage quality control protocols (e.g., ISO 9001, GMP standards, ICH guidelines for pharmaceutical derivatives). Manufacturers continuously invest heavily in focused process R&D to optimize reaction yield, minimize processing time and energy consumption, and ensure the resulting product batch consistently meets highly specific cosmetic or pharmaceutical grade parameters, particularly concerning residual solvent levels and salt content. Direct distribution is common from these leading manufacturers to the largest multinational cosmetic corporations (a B2B model), especially those requiring high-volume, long-term supply agreements and tailored specification sheets.

Downstream analysis focuses on the formulating entities, which includes private label specialists, contract manufacturers, and the final cosmetic brand owners who integrate the DSCG raw material into their complex final consumer product matrices (shampoos, washes, cleansers). Distribution channels for the final raw ingredient are highly varied: large cosmetic companies often operate integrated, direct procurement models, whereas small-to-medium enterprises (SMEs) and niche clean beauty brands typically rely heavily on specialized chemical distributors. These distributors provide essential technical support, smaller batch sizes, and manage complex regulatory paperwork across regions. The final link is the sprawling retail channel, encompassing large international supermarket chains, specialized beauty stores (both physical and online), and e-commerce platforms. E-commerce platforms, characterized by high transparency, detailed ingredient listings, and powerful consumer review systems, profoundly influence purchasing decisions, strongly favoring products that prominently feature and clearly articulate the benefits of mild, natural, and sustainable ingredients like Disodium Cocoyl Glutamate.

Disodium Cocoyl Glutamate Market Potential Customers

The primary and largest cohort of customers for Disodium Cocoyl Glutamate consists of global, large-scale cosmetic and personal care manufacturers specializing in premium, natural, and dermatologically certified sensitive product lines. These key customers, including universally recognized multinational brands, strategically prioritize the superior functional and marketing benefits of DSCG, such as its exceptional mildness, robust foaming performance, and high biodegradability, which are mandatory to meet their stringent corporate sustainability mandates and address the elevated consumer expectations for clean labels. They require secure, high-volume supply contracts, guaranteed batch-to-batch consistent quality, and comprehensive technical documentation, including full toxicological and clinical safety data, supporting efficacy claims. The demand from this segment is structurally volume-driven, highly responsive to technological improvements in synthesis, and extremely sensitive to impending global regulatory shifts favoring bio-derived chemistry.

Another critically significant customer segment comprises specialized formulators, dedicated contract manufacturers, and private label producers focused on highly lucrative niche markets, such as high-end baby care, professional aesthetic spa treatments, specific sensitive skin therapeutic ranges, and specialized organic certifications. These buyers typically procure DSCG through specialized chemical distributors or regional agents in smaller, more flexible quantities, focusing on quick turnaround and formulation support. Their purchasing decisions are less influenced by the absolute unit cost and far more by the ingredient's ability to seamlessly support sophisticated and legally defensible marketing claims, such as "hypoallergenic," "paediatrician-tested," "tear-free," or "Ecocert/COSMOS certified." This segment is a critical driver for the market's continuous demand for highly purified and highly specialized pharmaceutical grades of DSCG, necessitating rigorous quality assurance.

Emerging and expanding customer groups include institutional and household cleaning product manufacturers who are rapidly transitioning toward verified environmentally friendly and non-toxic alternatives for consumer safety and environmental stewardship. This shift is particularly evident in high-regulatory-scrutiny markets such as the European Union and parts of North America. While DSCG is intrinsically more expensive than standard industrial surfactants, its highly valued mildness profile, excellent dermal safety, and superior eco-friendly credentials make it increasingly attractive for high-value applications, including specialized delicate garment washes, baby laundry detergents, and mild, sensitive surface cleaners. Furthermore, compounding pharmacies, clinical dermatological product manufacturers, and select nutraceutical companies exploring advanced transdermal delivery systems may also represent a substantial, rapidly growing, albeit specialized, customer base requiring small volumes of the highest controlled, pharmaceutical-grade DSCG material for clinical research and therapeutic applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125 Million |

| Market Forecast in 2033 | USD 207 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ajinomoto Co. Inc., BASF SE, Clariant AG, Evonik Industries AG, Sino Lion USA, Taiwan Surfactant Co. Ltd., Schill & Seilacher, Galaxy Surfactants Ltd., Zschimmer & Schwarz GmbH & Co KG, Solvay S.A., Stepan Company, Croda International Plc, Kao Corporation, Innospec Inc., Spec-Chem Industry Inc., Shanghai Greentech Co., Berg + Schmidt GmbH & Co. KG, Miyoshi Oil & Fat Co., Ltd., Delivering Chemical Solutions (DCS), Kyowa Hakko Bio Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disodium Cocoyl Glutamate Market Key Technology Landscape

The manufacturing process for Disodium Cocoyl Glutamate is deeply reliant on sophisticated amino acid chemistry, specialized purification methods, and advanced acylation technologies. The core synthesis involves the robust reaction between fatty acid derivatives, typically high-purity Cocoyl Chloride derived from coconut oil, and L-Glutamic acid or its corresponding alkaline salts. Paramount technological focus is placed on optimizing the complex reaction conditions—including precise temperature control, defined pressure parameters, and meticulous catalyst selection—to achieve maximal product purity and yield, while simultaneously minimizing the formation of undesirable byproducts, which is absolutely critical for obtaining the stringent cosmetic and pharmaceutical grade certifications. The contemporary mandate for Green Chemistry principles dictates the rapid adoption of solvent-free or highly mild solvent reaction systems to significantly enhance environmental compatibility and reduce waste output, propelling manufacturers towards bio-based catalysts and enzymatic reaction processes for superior efficiency and lower carbon intensity.

A significant, commercially driven technological focus is placed intensely on the downstream processing phases, specifically involving advanced techniques for filtration, high-efficiency purification, and rapid drying, which are essential for producing the stable, high-concentration powder and granular forms of DSCG, a segment showing explosive growth. Advanced techniques such as precision spray drying, controlled vacuum drying, and sophisticated granulation technologies are undergoing continuous refinement to produce consistent, stable, free-flowing powder with optimal particle size distribution and verified high active matter content. This technical capability is indispensable for manufacturers supplying the solid cosmetic formulation sector and for achieving maximal transportation efficiency. Furthermore, the deployment of highly advanced analytical instrumentation, including Ultra-High-Performance Liquid Chromatography (UHPLC), sophisticated Mass Spectrometry (MS), and Nuclear Magnetic Resonance (NMR) spectroscopy, is crucial for rigorous and non-stop quality control, ensuring consistent batch-to-batch compliance with highly fragmented global regulatory standards concerning impurity profiles and heavy metal trace analysis.

Looking towards the mid-term forecast period, the technology landscape is being profoundly shaped by continuous breakthroughs in industrial biotechnology and advanced fermentation engineering. Utilizing highly specialized microbial fermentation for the sustainable, scalable, and cost-effective production of the L-Glutamic acid precursor is gaining substantial commercial prominence. Research scientists are actively exploring the optimization of non-GMO or advanced fermentation strains to significantly improve the volumetric yield and purity of the glutamic acid precursor, which offers a direct and powerful lever for potentially lowering the overall raw material input cost for DSCG production. Furthermore, innovative material science technologies, particularly micro-encapsulation and advanced stabilization methods, are being vigorously developed to integrate DSCG effectively into highly complex formulations, especially those involving challenging extremes of pH or high ionic strength environments, thereby substantially expanding its functional versatility and applicability across the entire breadth of the personal care and therapeutic market spectrum.

Regional Highlights

The global Disodium Cocoyl Glutamate market exhibits significant regional diversity and asynchronous growth patterns, heavily influenced by varying local regulatory landscapes, consumer purchasing power parity, and deeply entrenched cultural preferences towards natural and traditional ingredients. Asia Pacific (APAC) stands definitively as the primary consumption epicenter and is robustly projected to maintain the highest Compound Annual Growth Rate over the forecast period. This exponential market expansion in APAC is structurally underpinned by the sheer scale of the population bases in massive consumer markets like China, Japan, and South Korea, coupled with rapidly and consistently improving standards of living and a potent consumer affinity for high-quality, gentle skincare products, particularly the internationally influential K-Beauty and J-Beauty formulation philosophies which intrinsically favor mild, amino acid-based surfactants. Local manufacturing capabilities across South-East Asia are also rapidly scaling and modernizing their facilities to efficiently meet this burgeoning domestic and highly interconnected regional demand.

Europe represents a mature yet exceptionally high-value and quality-sensitive market, internationally setting rigorous standards for ingredient safety, efficacy, and verifiable environmental impact. The stringent and continuously evolving regulatory framework, most notably the EU Cosmetics Regulation and associated Circular Economy initiatives, strongly mandates and encourages the wholesale shift towards readily biodegradable, low-toxicity, and sustainably sourced ingredients, positioning DSCG as a superior, highly compliant, and strategically preferred option over legacy synthetic alternatives. Key Western European nations, including Germany, France, and the United Kingdom, consistently exhibit extremely high per capita spending on premium, rigorously certified natural, and organic personal care products, thereby sustaining a robust and steady demand for high-purity, environmentally transparent DSCG variants. European manufacturers are often recognized as global leaders in innovation concerning sustainable sourcing methodologies and advanced green synthesis techniques, proactively influencing and establishing global best practices for the entire specialty chemical industry.

North America is characterized by high adoption rates and dynamic market growth, primarily driven by the globally influential clean beauty and wellness movement that originated in the United States, profoundly altering consumer expectations. The American consumer base is increasingly educated, actively scrutinizes ingredient labels, and vocally seeks out certified sulfate-free, non-toxic, and clean label alternatives across all personal care categories. Demand for DSCG is heavily concentrated in the premium, specialized, and prestige segments of the personal care market, where price elasticity is lower, and ingredient transparency is paramount. Latin America and the Middle East & Africa (MEA) currently hold smaller, yet strategically important market shares but offer compelling future growth potential driven by socio-economic factors. LATAM benefits from increasing modernization and premiumization of personal care routines and a heightened awareness of ingredient safety, while MEA shows significant promise due to rapid urbanization, expanding organized retail presence, and the increasing market entry of multinational cosmetic brands promoting premium, gentle, and specialized hygiene formulations in burgeoning economic hubs like the GCC countries and South Africa.

- Asia Pacific (APAC): Market leader by volume and fastest-growing region; sustained expansion driven by K-Beauty/J-Beauty formulation trends, significant urbanization, and consistently rising disposable incomes; key high-growth markets include China, Japan, South Korea, and India.

- Europe: Highly mature and high-value market focused intensely on stringent regulatory compliance, documented safety, and superior sustainability performance; robust demand for certified natural and organic cosmetic grades; market dynamics incentivize continuous innovation in low-waste, green manufacturing processes.

- North America: Strong consumer demand fueled by the established and powerful clean beauty movement; high ingredient penetration primarily within the luxury, specialized, and professional personal care segments; the U.S. remains the single largest regional consumption market, setting innovation trends.

- Latin America (LATAM): Emerging and dynamic market characterized by increasing adoption rates; growth is stimulated by an expanding middle class and a clear preference for high-quality, imported, and locally manufactured gentle formulations.

- Middle East & Africa (MEA): Nascent market displaying high potential growth directly linked to expanding retail and e-commerce infrastructure, rapid demographic shifts, and the growing localized presence of international personal care brands emphasizing premium and gentle hygiene products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disodium Cocoyl Glutamate Market, focusing on manufacturers driving innovation and market capacity expansion.- Ajinomoto Co. Inc.

- BASF SE

- Clariant AG

- Evonik Industries AG

- Sino Lion USA

- Taiwan Surfactant Co. Ltd.

- Schill & Seilacher

- Galaxy Surfactants Ltd.

- Zschimmer & Schwarz GmbH & Co KG

- Solvay S.A.

- Stepan Company

- Croda International Plc

- Kao Corporation

- Innospec Inc.

- Spec-Chem Industry Inc.

- Shanghai Greentech Co.

- Berg + Schmidt GmbH & Co. KG

- Miyoshi Oil & Fat Co., Ltd.

- Delivering Chemical Solutions (DCS)

- Kyowa Hakko Bio Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Disodium Cocoyl Glutamate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Disodium Cocoyl Glutamate (DSCG) and how is it used in high-end cosmetics?

DSCG is a premium, highly mild anionic surfactant derived synthetically from coconut fatty acids and L-Glutamic acid. It is primarily used in premium personal care products as an essential gentle cleansing agent, effective foam booster, and reliable emulsifier in sulfate-free shampoos, sophisticated facial cleansers, and hypoallergenic baby care products due to its exceptional skin compatibility, pH balance maintenance, and superior environmental biodegradability.

Why are multinational manufacturers increasingly replacing traditional sulfates (SLS/SLES) with DSCG in their formulations?

The transition is mandated by escalating consumer demand for clean label transparency, documented ingredient safety, and rigorous regulatory pressure favoring eco-friendly materials. DSCG provides dramatically superior mildness, actively maintaining the skin's natural moisture barrier and physiological pH, minimizing irritation potential, unlike traditional sulfate surfactants. Its natural origin and rapid biodegradability position it as the environmentally and dermatologically preferred premium substitute.

What is the primary factor limiting the widespread, mass-market adoption of Disodium Cocoyl Glutamate?

The primary constraint on widespread adoption is the inherent, relatively higher manufacturing complexity and significantly increased production cost associated with synthesizing amino acid-based surfactants compared to traditional, high-volume petroleum-derived options. This cost disparity results in higher final ingredient pricing, strategically limiting its penetration and price competitiveness in the extremely price-sensitive mass-market and commodity segments.

Which key geographic region currently dominates the Disodium Cocoyl Glutamate market in terms of production capacity and consumption?

The Asia Pacific (APAC) region currently dominates the global market, both in terms of high production capacity and overall consumption volume. This leadership position is strongly driven by highly sophisticated and mature cosmetic markets like Japan and South Korea (J-Beauty/K-Beauty), which possess a long-standing preference for mild amino acid surfactants, coupled with rapidly expanding domestic demand and manufacturing scale in China.

How do technological advancements in fermentation impact the future supply and cost of DSCG?

Technological advancements in industrial fermentation, specifically optimizing microbial strains for L-Glutamic acid production, promise significant future impact. These innovations are expected to increase yield purity, reduce overall raw material costs, enhance sustainability, and provide a more stable, less agriculturally volatile supply of the key amino acid precursor, fundamentally improving the commercial viability of DSCG.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager