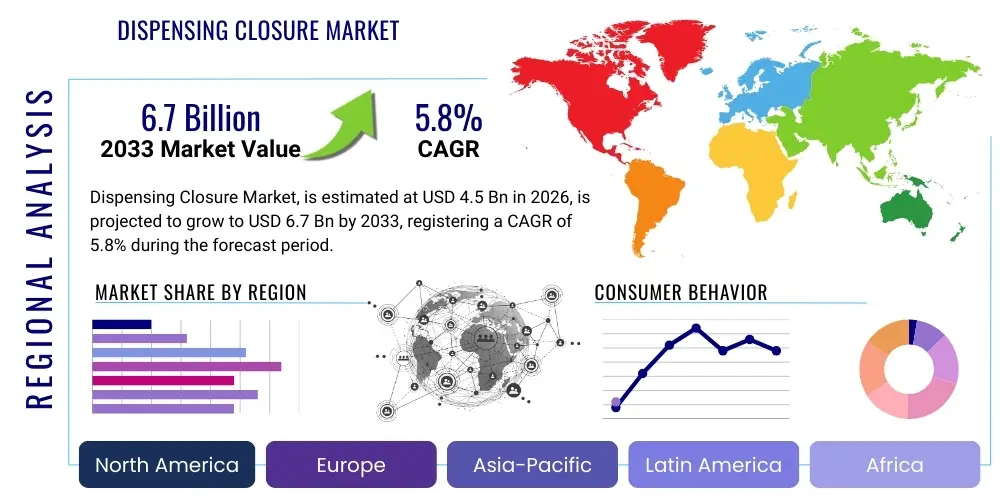

Dispensing Closure Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434623 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Dispensing Closure Market Size

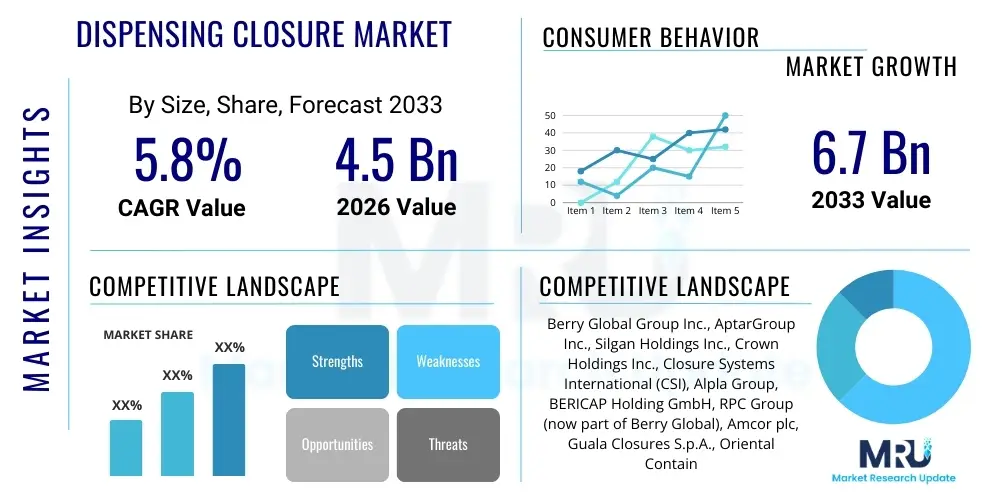

The Dispensing Closure Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the increasing consumer preference for convenient, on-the-go packaging solutions, particularly across the fast-moving consumer goods (FMCG) sectors such as personal care, food and beverage, and household cleaning products. The versatility and functional advantages of dispensing closures, including controlled product release and enhanced user experience, are key determinants driving this valuation increase.

The consistent expansion in end-use applications, coupled with technological advancements leading to improved material efficiency and anti-spillage designs, solidifies the market's positive outlook. Furthermore, emerging economies are witnessing rapid urbanization and growing disposable incomes, which fuels the demand for packaged goods utilizing sophisticated dispensing systems. Manufacturers are increasingly focusing on sustainable and recyclable dispensing closure designs to align with global environmental mandates, thus opening new avenues for innovation and market penetration, ensuring sustained revenue generation throughout the forecast period.

Dispensing Closure Market introduction

The Dispensing Closure Market encompasses a wide array of closure mechanisms designed to control the flow, application, or release of a product from its container, distinct from traditional screw caps which only seal. These products are crucial components of modern packaging, primarily utilized for efficiency, hygiene, and consumer convenience. Key product types include flip-top caps, spout caps, trigger closures, pump dispensers, and dosing closures, fabricated predominantly from polymers like polypropylene (PP) and polyethylene (PE). Major applications span the food and beverage industry (condiments, sauces, bottled water), personal care (shampoos, lotions, sanitizers), and household goods (cleaning agents, detergents), where precise and easy access to the product is paramount for daily use.

The primary benefits of utilizing advanced dispensing closures revolve around enhanced shelf appeal, reduced product waste through controlled dosing, and improved user experience, especially for thick or viscous materials. Driving factors include the accelerating shift towards single-use packaging and smaller, travel-friendly containers, coupled with the rapid growth of e-commerce, which necessitates robust, leak-proof closures for transit integrity. Furthermore, increased focus on hygiene and contactless product access, particularly post-pandemic, has boosted demand for touchless or single-hand operating dispensing systems, cementing their role as essential packaging components across global consumer markets. These factors collectively define a dynamic market environment characterized by continuous innovation in material science and mechanical design to meet evolving consumer expectations.

Dispensing Closure Market Executive Summary

The Dispensing Closure Market exhibits robust growth, primarily propelled by global business trends emphasizing convenience and product differentiation in FMCG sectors. Key business trends include the strong shift towards lightweight and flexible packaging formats which require integrated dispensing solutions, and substantial investment in injection molding technology to produce complex, multi-functional closures efficiently. Companies are strategically engaging in mergers and acquisitions to expand geographic reach and secure advanced proprietary closure designs, ensuring a competitive edge in rapidly evolving segments like liquid detergents and specialty food products. The market's structural evolution is heavily influenced by regulatory pressures in mature markets compelling manufacturers to adopt bio-based and highly recyclable polymers, driving innovation in sustainable closure solutions.

Regionally, Asia Pacific (APAC) stands out as the highest growth region, driven by rapid urbanization, substantial growth in middle-class disposable income, and the burgeoning local cosmetic and food processing industries requiring high-volume dispensing closure solutions. North America and Europe, while mature, remain crucial centers for innovation, particularly in pharmaceutical dosing and sustainable material adoption, maintaining strong demand for sophisticated trigger and pump mechanisms. Segment-wise, the flip-top closure segment dominates due to its cost-effectiveness and versatility across personal care products, while the food and beverage sector continues to be the largest end-user, specifically driven by increased consumption of ready-to-use sauces and dressings requiring precise dispensing. Sustainability and functionality are the overarching segment trends, dictating investment decisions and new product development pipelines globally.

AI Impact Analysis on Dispensing Closure Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Dispensing Closure Market primarily revolve around operational efficiency, customized product development, and predictive maintenance within high-speed manufacturing environments. Users frequently ask how AI can optimize the injection molding process to reduce material waste and cycle times, and whether AI-driven quality inspection systems can eliminate defects in complex closure mechanisms like bi-injection flip-tops. Additionally, there is significant interest in using machine learning algorithms to forecast demand fluctuations for specific closure types across different geographic markets and integrating AI tools into packaging design software to simulate consumer interaction and ergonomics, ensuring closure designs meet optimal performance criteria before physical prototyping, thereby accelerating time-to-market for novel dispensing systems.

The application of AI is fundamentally transforming the manufacturing lifecycle of dispensing closures, moving beyond simple automation toward intelligent, adaptive production systems. In the design phase, generative AI is accelerating the creation of complex geometries for closures that require precise functionality, such as non-drip spout systems or child-resistant mechanisms. Operationally, AI-powered predictive maintenance models monitor the performance of high-precision molds and machinery, minimizing unplanned downtime and maximizing throughput, which is critical for meeting the high-volume demand characteristic of the FMCG supply chain. This infusion of AI elevates product quality standards, drastically reduces manufacturing variability, and supports the rapid scaling required by global packaging conglomerates, leading to more resilient and efficient supply chains for dispensing closure production.

- Optimization of Injection Molding: AI algorithms tune temperature, pressure, and cooling times, maximizing throughput and material utilization (e.g., reducing polymer scrap).

- Predictive Quality Control (QC): Machine vision systems powered by deep learning identify microscopic defects and misalignments in complex closure parts at high speeds.

- Supply Chain Forecasting: Machine learning models analyze historical sales, seasonal trends, and geopolitical factors to accurately predict demand for specific closure types (e.g., lotion pumps vs. beverage caps).

- Generative Design: AI assists engineers in designing novel, ergonomic, and sustainable dispensing geometries that minimize material usage while maintaining structural integrity.

- Automated Tooling Maintenance: AI predicts optimal timing for mold cleaning and repair, reducing manufacturing interruptions and extending the lifespan of expensive tooling assets.

DRO & Impact Forces Of Dispensing Closure Market

The market dynamics of dispensing closures are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces shaping industry strategy and investment. Key drivers include heightened consumer demand for product convenience, necessitating easy-to-use, single-handed closures, particularly prevalent in the personal care and ready-to-eat food sectors. Simultaneously, stringent regulatory requirements, particularly concerning child safety (CRCs) and pharmaceutical dosage accuracy, mandate continuous innovation in closure design. However, market growth is significantly restrained by increasing scrutiny on single-use plastics and the environmental cost associated with complex, multi-material closures that challenge existing recycling infrastructures, pressuring manufacturers to adopt mono-material or recycled content solutions.

Opportunities in the market center around the development of fully sustainable closures, including those made from Post-Consumer Recycled (PCR) content and bio-based polymers, addressing the fundamental restraint of environmental impact while capitalizing on brand sustainability commitments. Furthermore, advancements in smart packaging technologies, such as closures integrated with Near-Field Communication (NFC) or QR codes for consumer engagement and anti-counterfeiting measures, present high-value market penetration possibilities. The confluence of these forces—high demand for convenience (Driver), mandatory sustainability integration (Opportunity), and environmental compliance challenges (Restraint)—necessitates strategic agility, driving investment towards highly efficient manufacturing processes and novel material science to maintain profitability and market relevance in a globally competitive landscape.

The impact forces translate directly into operational and commercial decisions. The imperative to design lighter closures, for instance, driven by sustainability goals and transportation cost reduction, forces material engineering advancements. Market resilience is tested by fluctuating raw material prices (polymers derived from crude oil), which often necessitates long-term procurement contracts and diversification of material sourcing. Ultimately, competitive differentiation is increasingly achieved not just through cost efficiency, but through delivering superior, consumer-centric functionality—such as precision dosing or mess-free application—while simultaneously meeting the highest standards of circular economy principles, establishing a difficult but necessary equilibrium for market participants.

Segmentation Analysis

The Dispensing Closure Market is highly segmented, allowing for precise targeting of diverse end-use applications and operational requirements. Segmentation is primarily based on the closure mechanism Type, the Material composition, the End-Use Industry served, and the geographical region. Analyzing these segments provides a granular understanding of market hot spots and technological specialization. The dominant segment by type, flip-top closures, continues to lead due to its versatility, cost-effectiveness, and pervasive adoption across personal care and household cleaning products, offering a balance of secure sealing and user accessibility. Meanwhile, the material segmentation is seeing rapid shifts, with polypropylene (PP) remaining the primary choice, though demand for recycled and bio-based PE and PP is accelerating in response to corporate sustainability pledges and regulatory mandates across North America and Europe.

In terms of end-use, the food and beverage industry represents the largest consumer segment, driven by the sheer volume of products requiring dispensing, particularly in dairy, sauces, and non-alcoholic beverages, where closures such as spouts and sports caps are fundamental. However, the personal care and cosmetics segment exhibits the highest growth rate, fueled by product premiumization and the increasing use of specialty closures like airless pumps and dosing droppers for high-value serums and creams. Strategic analysis of these segments reveals that future growth will be concentrated in developing regions adopting sophisticated packaging solutions (APAC) and mature markets demanding hyper-customized, sustainable, and high-performance dispensing systems.

- By Type:

- Flip-Top Closures

- Sports Caps (Push-pull, valve caps)

- Spout Closures

- Pump Dispensers (Lotion pumps, foam pumps)

- Trigger Closures

- Droppers and Pipettes

- Dosing Closures

- By Material:

- Polypropylene (PP)

- Polyethylene (PE) (HDPE, LDPE)

- Other Plastics (PET, PVC, etc.)

- Metal (Aluminum)

- By End-Use Industry:

- Food and Beverage

- Personal Care and Cosmetics

- Household Care

- Pharmaceuticals and Healthcare

- Chemicals and Industrial

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Dispensing Closure Market

The Value Chain for the Dispensing Closure Market begins with upstream activities focused on raw material sourcing, primarily petroleum-derived polymer resins (PP and PE) but increasingly including recycled and bio-based feedstocks. Stability in resin pricing and availability significantly impacts manufacturing costs, making strong supplier relationships crucial. The intermediate stage involves the core manufacturing process, dominated by high-precision injection molding, compression molding, and complex assembly operations, where technological efficiency and automation (often leveraging AI) determine quality and throughput. Specialized tool and mold manufacturers form a critical upstream element, providing the foundational equipment necessary for producing intricate closure designs with tight tolerances required for effective sealing and dispensing functionality.

Downstream activities involve logistics, distribution, and integration into the final packaging process. Dispensing closures are typically sold B2B directly to primary packaging manufacturers (bottle/container producers) or large-scale Consumer Packaged Goods (CPG) companies that operate integrated packaging lines. Distribution channels are predominantly direct, facilitating customized product specifications and technical support. However, regional distributors and specialized packaging resellers play a role in serving smaller, local CPG companies. The final stage is the integration onto the filled container and subsequent distribution to retail or e-commerce consumers, where the closure's performance—its sealing integrity, leak prevention, and ease of use—directly affects brand perception and consumer satisfaction, completing the value cycle.

Dispensing Closure Market Potential Customers

The primary consumers and end-users (buyers) of dispensing closures are large-scale manufacturers and contract packagers operating within the fast-moving consumer goods (FMCG) and pharmaceutical industries. These companies require high-volume, reliable, and standardized closure solutions that integrate seamlessly with automated filling lines. Major buyers include global multinational corporations in personal care (e.g., Procter & Gamble, Unilever, L'Oréal), demanding sophisticated pump dispensers and flip-tops for shampoos and lotions, and large food and beverage conglomerates (e.g., Nestlé, Coca-Cola, Kraft Heinz), requiring precise dosing closures for condiments, sauces, and sports drinks.

Furthermore, the pharmaceutical and healthcare sector constitutes a high-value customer base, characterized by stringent requirements for tamper-evident, child-resistant, and metered-dose closures, often procured through specialized packaging partners. The purchasing decisions of these potential customers are driven by factors beyond mere cost, focusing heavily on closure reliability, certification adherence (FDA, CE, etc.), brand alignment with sustainability goals (demanding PCR or mono-material options), and the closure's ability to enhance product differentiation on the retail shelf. Contract packagers represent an expanding customer group, as they handle production for smaller brands and private labels, requiring flexible access to a wide variety of standard and customized closure types.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Berry Global Group Inc., AptarGroup Inc., Silgan Holdings Inc., Crown Holdings Inc., Closure Systems International (CSI), Alpla Group, BERICAP Holding GmbH, RPC Group (now part of Berry Global), Amcor plc, Guala Closures S.p.A., Oriental Containers, Weener Plastics, O.Berk Company, Rieke Packaging Systems, M&H Plastics, Zhejiang Hexing Packaging Co., Ltd., Global Closure Systems, Pouch Cap, AFA Dispensing Group, Coster Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dispensing Closure Market Key Technology Landscape

The technological landscape of the Dispensing Closure Market is defined by advanced manufacturing techniques aimed at precision, efficiency, and material complexity. The core technology remains high-speed, multi-cavity injection molding, which is constantly refined to achieve faster cycle times and tighter dimensional tolerances, crucial for leak-proof performance. A significant technological evolution involves bi-injection and multi-component molding, allowing manufacturers to combine different materials (e.g., hard plastics for the shell and softer elastomers for the sealing liner) within a single production cycle, enabling features like hinges, living hinges, and integrated seals, thereby reducing assembly costs and enhancing functionality, particularly in sports caps and sophisticated flip-top designs.

Furthermore, technology related to sustainability is rapidly gaining prominence. This includes the development of lightweighting technologies to reduce material consumption per closure, often through advanced CAE (Computer-Aided Engineering) simulations. Compression molding is also utilized, primarily for simpler, larger caps, offering advantages in energy efficiency and material density. The integration of advanced dispensing mechanisms, such as non-contact foaming technology for personal care products and anti-suck-back valve systems for beverage closures, represents product innovation driven by specialized technological expertise. The overall trend is moving toward highly automated, quality-controlled production lines capable of mass-producing customized, high-performance closures efficiently, often utilizing smart sensors and real-time monitoring to ensure zero-defect output and process optimization.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by explosive population growth, rapid industrialization, and significant expansion in the food processing, personal care, and pharmaceutical sectors, particularly in China, India, and Southeast Asian nations. The region benefits from increasing urbanization and rising disposable incomes, translating into higher consumption of packaged goods requiring both standard and innovative dispensing mechanisms. Investment in high-speed manufacturing infrastructure by local and international players is accelerating the adoption of sophisticated closures over traditional sealing methods.

- North America: North America represents a mature yet highly innovative market. Growth is sustained by strong consumer demand for high-convenience, premium personal care products and advanced pharmaceutical packaging solutions. The region is a leader in adopting sustainable packaging standards, pushing manufacturers toward closures utilizing PCR content and lightweight designs. Regulatory mandates, especially concerning child safety closures (CRCs) and precise dosing, necessitate continuous R&D investment and technological upgrades among market participants.

- Europe: Europe is characterized by stringent environmental regulations, making sustainability a core market driver. The demand here is primarily focused on mono-material closures that facilitate recycling and closures made from bio-plastics or certified recycled content, aligning with the EU’s Circular Economy Action Plan. Countries like Germany and the UK show high demand for high-performance trigger sprayers and pump systems used in household cleaning products, coupled with a strong emphasis on tamper-evident features across food and beverage packaging.

- Latin America (LATAM): LATAM offers significant growth potential, particularly in countries like Brazil and Mexico, due to improving economic conditions and the expansion of the organized retail sector. The market is currently focused on cost-effective, high-volume closures for food and beverage items, though demand for premium personal care dispensing pumps is rising, reflecting gradual consumer segmentation and urbanization trends.

- Middle East and Africa (MEA): The MEA market is exhibiting steady growth, largely driven by infrastructure development in the pharmaceutical and cosmetic industries in the GCC countries and South Africa. Demand is concentrated in imported technology and high-quality closures that meet international standards, supporting local efforts to reduce reliance on imported packaged goods and establish regional manufacturing hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dispensing Closure Market.- Berry Global Group Inc.

- AptarGroup Inc.

- Silgan Holdings Inc.

- Closure Systems International (CSI)

- Bericap Holding GmbH

- Alpla Group

- Amcor plc

- Guala Closures S.p.A.

- Weener Plastics

- Crown Holdings Inc.

- Global Closure Systems

- RPC Group (now part of Berry Global)

- Rieke Packaging Systems

- Coster Group

- M&H Plastics

- AFA Dispensing Group

- Texan Corp.

- Oriental Containers

- Zhejiang Hexing Packaging Co., Ltd.

- O.Berk Company

Frequently Asked Questions

Analyze common user questions about the Dispensing Closure market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary sustainability challenges facing dispensing closure manufacturers?

The primary challenge lies in the multi-material construction (e.g., plastic closure body, metal spring in a pump, elastomer gaskets) which complicates sorting and recycling. Manufacturers are addressing this by developing mono-material solutions and increasing the incorporation of Post-Consumer Recycled (PCR) resins into closure production to enhance circularity.

Which type of dispensing closure holds the largest market share by revenue?

Flip-top closures currently hold the largest market share due to their broad application across personal care, household, and food products, offering excellent functional versatility, sealing capability, and cost-effectiveness in high-volume production compared to more complex mechanisms like pump dispensers.

How does e-commerce growth influence the demand for dispensing closures?

E-commerce growth significantly boosts demand for high-integrity, leak-proof dispensing closures. Products shipped through parcel networks require closures with superior sealing and tamper-evident features to withstand rigorous transportation and handling, prioritizing safety and preventing product leakage during transit.

What role does the pharmaceutical sector play in the dispensing closure market?

The pharmaceutical sector is crucial, driving demand for specialized, high-precision closures, including child-resistant closures (CRCs), tamper-evident mechanisms, and metered-dose systems. Accuracy, safety certifications, and compliance with global healthcare regulations are the primary drivers for this high-value segment.

What materials are projected to see the highest growth in the closure market?

While Polypropylene (PP) and Polyethylene (PE) remain dominant, the highest growth rates are projected for sustainable alternatives, specifically bio-based polymers derived from renewable sources and PP/PE grades that utilize high levels of certified Post-Consumer Recycled (PCR) content, mandated by brand sustainability goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager