Dispensing Shielded Cell Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435028 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Dispensing Shielded Cell Market Size

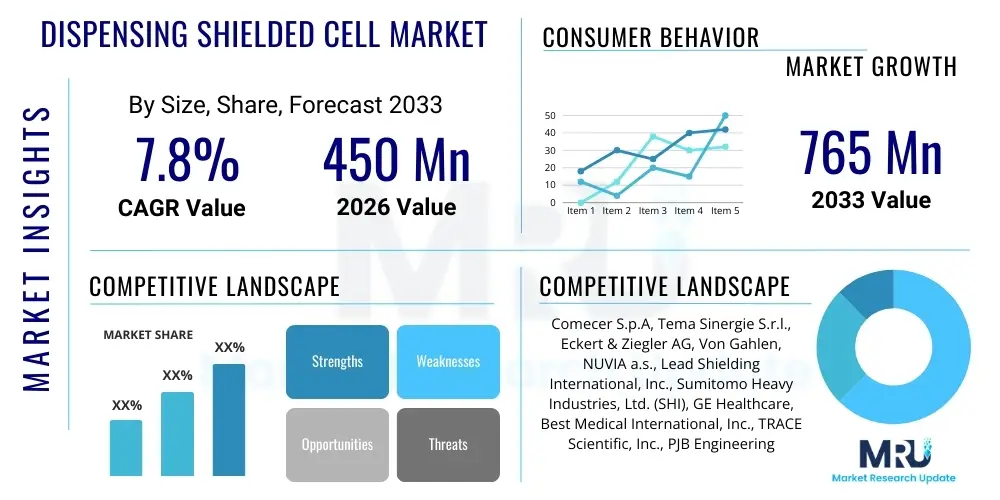

The Dispensing Shielded Cell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 765 Million by the end of the forecast period in 2033.

Dispensing Shielded Cell Market introduction

The Dispensing Shielded Cell Market encompasses specialized equipment designed for the safe and efficient handling, manipulation, and dispensing of high-energy radioactive materials, particularly radiopharmaceuticals used in nuclear medicine. These cells, often referred to as hot cells or mini-cells, provide essential protection for operators and maintain sterile conditions necessary for compounding injectable drugs. They are crucial for minimizing radiation exposure (ALARA principle) while ensuring product quality meets stringent regulatory standards, such as Good Manufacturing Practices (GMP). The primary function is the automated or semi-automated fractionation and dispensing of unit doses of radioisotopes for diagnostic procedures like Positron Emission Tomography (PET) and Single-Photon Emission Computed Tomography (SPECT), as well as for emerging therapeutic applications (theranostics).

The design of modern dispensing shielded cells incorporates advanced shielding materials, including lead, tungsten, and specialized glass, to effectively attenuate gamma radiation and other emitted particles. Critical features include integrated manipulators or robotic systems for remote handling, rapid transfer ports for material introduction and removal, and sophisticated ventilation systems to maintain negative pressure and prevent the release of airborne contaminants. These features collectively enable the precise preparation and quality control testing of time-sensitive radiopharmaceuticals, which often have extremely short half-lives, demanding high efficiency and throughput in the dispensing process. Technological advancements are continuously focused on enhancing automation levels, thereby reducing human intervention and associated radiation exposure risks.

Major applications driving the demand include the increasing global adoption of PET scans for oncology, cardiology, and neurology, coupled with the exponential growth in therapeutic radioisotopes, such as Lutetium-177 and Actinium-225, utilized in targeted alpha and beta therapies. Key benefits derived from utilizing dispensing shielded cells include vastly improved operator safety, enhanced precision in dose measurement, minimized risk of microbial contamination (aseptic environment), and overall compliance with increasingly rigorous pharmaceutical production and radiation safety regulations worldwide. Market growth is fundamentally driven by the rising prevalence of chronic diseases, particularly cancer, and significant investments by pharmaceutical companies in developing novel radiopharmaceutical agents.

Dispensing Shielded Cell Market Executive Summary

The Dispensing Shielded Cell Market is characterized by a strong trend towards modular and highly automated solutions, reflecting the increasing centralization of radiopharmaceutical production in specialized radiopharmacies and cyclotrons centers. Business trends show a preference for customized units that integrate seamlessly with existing Quality Control (QC) and dose calibration equipment, facilitating rapid turnaround times crucial for short-lived isotopes. Vendors are focusing heavily on developing compact, lead-shielded mini-cells suitable for hospital-based pharmacies with limited space, contrasting with larger hot cells tailored for high-volume centralized production facilities. Furthermore, sustainability in design, incorporating systems that simplify decontamination and maintenance, is becoming a pivotal competitive factor, driven by end-user demand for minimizing facility downtime and operational expenditure.

Regionally, North America maintains its dominance due to a highly established nuclear medicine infrastructure, robust regulatory framework encouraging safe practices, and high reimbursement rates for advanced imaging procedures, fostering continuous investment in state-of-the-art shielded dispensing technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by substantial governmental investments in healthcare infrastructure, the burgeoning middle class demanding access to advanced diagnostic imaging, and the rapid expansion of domestic radiopharmaceutical manufacturing capabilities in countries like China, India, and South Korea. Europe remains a mature market, guided by the stringent European Pharmacopoeia standards and supported by established nuclear reactor sites and commercial isotope production facilities, focusing primarily on replacing aging infrastructure with modern, automated systems.

In terms of segment trends, the automated dispensing shielded cells segment is rapidly outpacing manual systems, driven by the imperative to minimize human error, increase throughput, and adhere strictly to ALARA principles regarding radiation exposure. Among end-users, centralized commercial radiopharmacies represent the largest consumer segment, benefiting from economies of scale achieved through high-throughput automated dispensing lines capable of serving multiple hospital systems. Technology adoption also shows a significant shift toward specialized cells optimized specifically for therapeutic radioisotopes (theranostics), which often require thicker shielding and more complex handling procedures compared to traditional diagnostic tracers, indicating a lucrative, high-growth niche within the overall market structure.

AI Impact Analysis on Dispensing Shielded Cell Market

User queries regarding the impact of Artificial Intelligence (AI) on the Dispensing Shielded Cell Market frequently revolve around three core themes: the potential for AI-driven precision dosing, the use of computer vision and machine learning (ML) for enhanced quality control within shielded environments, and the implementation of predictive maintenance for complex robotic systems. Users seek assurance that AI can reduce variability in dose preparation, a critical factor in personalized medicine, and mitigate potential human errors that are amplified in high-radiation, remote-handling scenarios. Concerns also focus on data integration challenges, cybersecurity risks associated with networked, smart hot cells, and the validation process required to prove AI algorithms meet regulatory standards for pharmaceutical manufacturing environments, particularly in aseptic dispensing.

The integration of AI technologies promises a paradigm shift in how radiopharmaceutical dispensing is managed, moving from largely automated (pre-programmed) processes to intelligent, adaptive systems. For instance, ML algorithms can analyze real-time data from dose calibrators, manipulators, and radiation sensors to dynamically adjust dispensing parameters based on specific patient protocols, half-life decay calculations, and environmental variables, leading to optimized efficiency and maximized utilization of expensive radioactive materials. This level of optimization is particularly valuable in facilities handling bespoke patient-specific therapies where customization and extreme precision are paramount. The ability of AI to model complex chemical and radiological processes within the cell environment also opens doors for improved reaction yield prediction and impurity detection.

Furthermore, AI significantly enhances the operational reliability and compliance aspects of shielded cell infrastructure. Through advanced pattern recognition applied to visual inspections and sensor telemetry, AI can autonomously detect subtle defects in sterile packaging or mechanical anomalies in robotic arms, far surpassing human detection capabilities in confined, restricted-access zones. The integration of AI-powered predictive maintenance scheduling, based on operational wear and stress analysis, minimizes unexpected downtimes, which are particularly costly in facilities dealing with short-lived radioisotopes. This robust automation and decision support system accelerates the release process of finished doses, thereby increasing overall facility throughput and reinforcing compliance with rigorous GMP standards necessary for patient safety.

- AI-powered precision dosimetry and adaptive dispensing protocols optimize unit dose accuracy, minimizing waste of expensive radioisotopes.

- Machine Learning (ML) enhances automated quality control (AQC) by analyzing visual and sensor data for contamination or mechanical faults in real-time.

- Predictive maintenance algorithms reduce unexpected hot cell downtime by forecasting component failure in remote handling systems.

- AI aids in complex route planning for robotic manipulators, optimizing movement within the confined shielded space to enhance throughput and speed.

- Data integration platforms, supported by AI, streamline regulatory reporting by automatically aggregating batch records, QC data, and radiation exposure logs.

DRO & Impact Forces Of Dispensing Shielded Cell Market

The Dispensing Shielded Cell Market dynamics are dictated by a powerful combination of increasing demand for nuclear medicine, stringent safety regulations, and the high investment required for sophisticated infrastructure. The primary drivers revolve around the global surge in cancer cases and the subsequent demand for highly targeted diagnostic and therapeutic radiopharmaceuticals (theranostics). Restraints largely center on the prohibitive capital expenditure needed to establish hot cell facilities, the complexity of compliance with global GMP guidelines, and the critical shortage of skilled personnel (radiochemists and nuclear medicine technologists) required to operate and maintain these high-technology environments. Opportunities are significant, driven by the rapid commercialization of novel therapeutic radioisotopes and expansion into untapped emerging markets, particularly across Asia and Latin America. Impact forces, such as accelerating technological advancement in automation and evolving global radiation safety standards, continually reshape the competitive landscape, pushing manufacturers toward more efficient, safer, and compact designs.

A key market driver is the shift from conventional treatment modalities to personalized nuclear medicine, which necessitates local, quick access to custom-prepared doses. This requirement directly fuels the demand for decentralized, modular dispensing shielded cells capable of rapid synthesis and dispensing near patient centers. However, overcoming restraints is critical; the initial cost of a fully equipped, compliant hot cell facility can run into millions of dollars, creating a significant barrier to entry for smaller hospitals or nascent pharmaceutical operations. Furthermore, the global supply chain vulnerabilities concerning key reactor-produced isotopes necessitate resilient and adaptable dispensing infrastructure that can handle varied input materials and rapid shifts in production schedules, adding another layer of operational complexity that often acts as a restraint.

Conversely, the burgeoning market for alpha- and beta-emitting therapeutic radioisotopes presents a massive opportunity, requiring specialized high-density shielding cells capable of accommodating more complex synthetic processes and handling higher levels of radioactivity compared to typical diagnostic dispensing. These systems represent a higher value per unit sale and demand more integrated automation, driving technological innovation. The pervasive impact force of tightening global regulatory scrutiny—exemplified by organizations such as the FDA and EMA demanding rigorous quality assurance—mandates continuous upgrades and validation of dispensing systems, ensuring that only the most reliable and technologically advanced solutions remain viable in the long term, thereby favoring established, compliant market players capable of supporting comprehensive validation packages.

Segmentation Analysis

The Dispensing Shielded Cell Market is broadly segmented based on Cell Type, Application, and End-User. The segmentation by Cell Type primarily differentiates between high-throughput automated Hot Cells, typically employed in centralized radiopharmacies for mass production and synthesis, and compact Mini Cells, which are optimized for dispensing activities in decentralized, hospital-based nuclear medicine departments where space and budget constraints are tighter. Application segmentation reflects the core utility of the isotopes handled, separating systems dedicated to high-volume Diagnostic isotopes (PET, SPECT) from those designed for the more radio-intensive and complex handling required by Therapeutic isotopes (Theranostics), each demanding distinct shielding and manipulation capabilities. Finally, end-user categorization highlights the differing needs of Commercial Radiopharmacies (highest volume), Hospital-based Pharmacies (decentralized dispensing), and Research Institutions (prototyping and low-volume clinical trials).

- By Cell Type:

- Automated Hot Cells (High Capacity Synthesis and Dispensing)

- Compact/Mini Cells (Decentralized Dispensing and QC)

- By Application:

- Diagnostic Radiopharmaceuticals (e.g., FDG, Tc-99m)

- Therapeutic Radiopharmaceuticals (e.g., Lu-177, Ac-225)

- By End-User:

- Commercial Radiopharmacies and Cyclotron Centers

- Hospital-Based Nuclear Medicine Departments

- Research and Academic Institutions

- By Technology:

- Manual Dispensing Cells

- Semi-Automated Dispensing Cells

- Fully Automated/Robotic Dispensing Cells

Value Chain Analysis For Dispensing Shielded Cell Market

The value chain for Dispensing Shielded Cells begins with upstream activities involving the sourcing of specialized raw materials, primarily high-purity lead, lead glass, tungsten alloys, stainless steel for structure, and critical electronic components necessary for robotics and control systems. Suppliers of these high-specification materials are crucial, as shielding integrity and material traceability are non-negotiable regulatory requirements. Midstream activities involve the core competencies of design, specialized manufacturing, assembly, and rigorous testing of the complex integrated systems, requiring expertise in nuclear engineering, robotics, and cleanroom technologies. Distribution channels typically involve direct sales by the manufacturer or through highly specialized, technically trained regional distributors who can provide necessary installation, validation (IQ/OQ/PQ), and long-term maintenance support, given the specialized nature of the equipment and its critical role in pharmaceutical production. Downstream, the key activities include the continuous operation, periodic calibration, and maintenance undertaken by the end-users—radiopharmacies and hospitals—to ensure continuous compliance and operational safety.

Dispensing Shielding Cell Market Potential Customers

The primary consumers and buyers of dispensing shielded cells are entities directly involved in the synthesis, quality control, and preparation of ready-to-administer radiopharmaceuticals. Centralized Commercial Radiopharmacies represent the largest segment of potential customers, as they require high-throughput, fully automated dispensing solutions capable of preparing hundreds of patient doses daily for widespread distribution across regional hospital networks. These customers prioritize reliability, speed, and seamless integration with Enterprise Resource Planning (ERP) and tracking systems. Secondary crucial buyers are Hospital-based Nuclear Medicine Departments, especially those integrated with major medical centers or regional cancer treatment facilities, who purchase smaller, modular units for preparing immediate or bespoke doses, requiring cells optimized for spatial efficiency and localized aseptic conditions. Finally, academic and pharmaceutical research institutions involved in the development and preclinical or early-phase clinical testing of novel radio-tracers and therapeutic agents form a smaller but vital customer base, needing flexible, easily reconfigurable systems for R&D purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 765 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Comecer S.p.A, Tema Sinergie S.r.l., Eckert & Ziegler AG, Von Gahlen, NUVIA a.s., Lead Shielding International, Inc., Sumitomo Heavy Industries, Ltd. (SHI), GE Healthcare, Best Medical International, Inc., TRACE Scientific, Inc., PJB Engineering, Cyclomedica, AB Scientific, Elysia-Raytest GmbH, Isotope Technologies Garching GmbH (ITG), Nuclear Shields, Ray-Ran Test Equipment Ltd., Veenstra Instruments, JFE Engineering Corporation, Shielding Integrity Services. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dispensing Shielded Cell Market Key Technology Landscape

The technological landscape of the Dispensing Shielded Cell Market is defined by the continual drive toward enhanced automation, minimized operator exposure, and improved aseptic conditions. Key technological advancements include the widespread adoption of integrated robotic arms and remote manipulators designed specifically for hot cell environments. These robotic systems offer high precision, repeatability, and the ability to perform complex tasks, such as vial uncapping, aliquot measurement, and final product packaging, completely remotely. Coupled with specialized lead-shielded transfer mechanisms (e.g., L-blocks and transfer pots), these technologies ensure that radioactive source materials are contained safely throughout the entire dispensing process, adhering to the highest standards of radiation protection while maximizing operational throughput. The continuous development of specialized shielding materials, particularly composite materials combining lead, tungsten, and high-density polyethene, allows for the production of thinner, lighter, yet equally effective shielded enclosures, facilitating installation in existing, space-constrained hospital facilities.

Another crucial technological development involves integrated dosimetry and quality control systems. Modern shielded cells are equipped with highly accurate dose calibrators and Multi-Channel Analyzers (MCAs) that communicate directly with the control software, enabling real-time verification of dispensed activity and isotopic purity. This real-time quality assurance is vital for radiopharmaceuticals with short half-lives, where delays in QC testing can render the product unusable. Furthermore, advanced Human-Machine Interface (HMI) systems are increasingly deployed, offering intuitive touch-screen controls and sophisticated graphical visualizations of the internal cell environment, allowing operators to monitor complex processes and troubleshoot remotely without breaching containment or incurring unnecessary radiation doses. The synergy between these software and hardware components defines the current state-of-the-art in shielded dispensing.

The future technology trajectory points toward complete integration with external laboratory systems, facilitating end-to-end digital tracking of the drug production lifecycle, crucial for compliance with Pharmaceutical Inspection Co-operation Scheme (PIC/S) and FDA regulations. Aseptic processing technology remains paramount; therefore, incorporating advanced Vapour Hydrogen Peroxide (VHP) decontamination systems and stringent air flow management (laminar flow or turbulent flow) within the cell is standard. These advanced sterilization systems, often integrated into the cell design, minimize the risk of microbial contamination, ensuring that the dispensed injectable products meet sterile drug requirements. The emphasis on modular design also facilitates future upgrades and ensures scalability for facilities expanding their radiopharmaceutical portfolio, particularly into the high-growth area of theranostics.

Regional Highlights

- North America: This region holds the largest market share, driven by a mature nuclear medicine infrastructure, high expenditure on healthcare technology, and the presence of major pharmaceutical companies and specialized cyclotron operators. The strong regulatory environment enforced by the FDA encourages continuous investment in high-quality, validated automated dispensing shielded cells to meet strict GMP guidelines. The high prevalence of cancer and widespread acceptance of PET/CT imaging further solidify its market position, especially concerning early adoption of therapeutic radioisotopes like those based on Lu-177 and Ac-225, necessitating specialized dispensing equipment.

- Europe: Europe represents a significant market, characterized by established nuclear research centers and well-defined safety standards (e.g., Euratom directives). Market growth is steady, focusing on replacing older, manual hot cells with modern, highly automated, and modular systems to enhance efficiency and comply with updated European Pharmacopoeia standards for pharmaceutical production. Western European countries, particularly Germany, France, and the UK, are key contributors due to active research and large centralized public health systems supporting nuclear medicine usage.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region. This explosive growth is fueled by massive infrastructure development in emerging economies like China and India, increasing governmental healthcare spending, and rising awareness regarding the benefits of nuclear medicine diagnostics. Local manufacturing capabilities for cyclotrons and radiopharmaceuticals are expanding rapidly, necessitating the installation of certified dispensing shielded cells to serve the burgeoning urban population and meet the growing demand for cancer diagnostics and treatment, often supported by international joint ventures.

- Latin America (LATAM): The LATAM market is emerging, driven primarily by investments in major centers in Brazil and Mexico. Market penetration is gradually increasing as hospitals seek to establish local radiopharmacy capabilities to reduce reliance on imported radiopharmaceuticals. Growth is currently bottlenecked by economic instability and regulatory harmonization challenges but presents long-term opportunity as healthcare access expands.

- Middle East and Africa (MEA): This region shows selective growth focused primarily on high-income Gulf Cooperation Council (GCC) countries, such as Saudi Arabia and the UAE, where significant capital is being invested in establishing world-class specialty hospitals and cancer treatment centers. The demand here is for cutting-edge, fully automated systems that meet global standards, often procured through international tenders and partnerships with global vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dispensing Shielded Cell Market.- Comecer S.p.A.

- Tema Sinergie S.r.l.

- Eckert & Ziegler AG

- Von Gahlen

- NUVIA a.s.

- Lead Shielding International, Inc.

- Sumitomo Heavy Industries, Ltd. (SHI)

- GE Healthcare

- Best Medical International, Inc.

- TRACE Scientific, Inc.

- PJB Engineering

- Cyclomedica

- AB Scientific

- Elysia-Raytest GmbH

- Isotope Technologies Garching GmbH (ITG)

- Nuclear Shields

- Ray-Ran Test Equipment Ltd.

- Veenstra Instruments

- JFE Engineering Corporation

- Shielding Integrity Services

Frequently Asked Questions

Analyze common user questions about the Dispensing Shielded Cell market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between Automated Hot Cells and Compact Mini Cells?

Automated Hot Cells are large, centralized systems designed for high-volume synthesis and dispensing of radiopharmaceuticals, offering higher throughput and advanced robotics. Compact Mini Cells are smaller, modular units primarily used in decentralized hospital settings for dose dispensing, prioritizing space efficiency and lower capital costs over maximum volume.

How does the growth of theranostics influence the design requirements for dispensing shielded cells?

The rise of therapeutic radioisotopes (theranostics) necessitates enhanced shielding due to higher energy emissions (alpha/beta emitters) and increased activity levels. Modern dispensing cells must incorporate thicker lead or tungsten shielding and specialized remote handling tools capable of safely manipulating more potent radioactive materials during preparation.

What role does regulatory compliance play in the purchasing decision for shielded cells?

Regulatory compliance is paramount. Shielded cells must meet stringent international standards for radiation safety (ALARA) and pharmaceutical manufacturing (GMP/cGMP). Buyers prioritize systems accompanied by comprehensive validation packages (IQ/OQ/PQ) and integrated aseptic processing capabilities to ensure rapid regulatory approval and product sterility.

Which geographical region exhibits the fastest growth potential in this market?

The Asia Pacific (APAC) region, driven by countries like China and India, is projected to show the highest Compound Annual Growth Rate (CAGR). This acceleration is due to significant governmental investment in advanced healthcare infrastructure and the rapid expansion of domestic radiopharmaceutical production capabilities across the continent.

How is Artificial Intelligence (AI) expected to impact the operational efficiency of hot cells?

AI integration is expected to drastically improve operational efficiency by enabling predictive maintenance for robotic systems, optimizing complex dispensing routes, and enhancing quality control through real-time, automated defect detection (computer vision), thereby minimizing downtime and maximizing dose accuracy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager