Dispensing Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437774 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Dispensing Valves Market Size

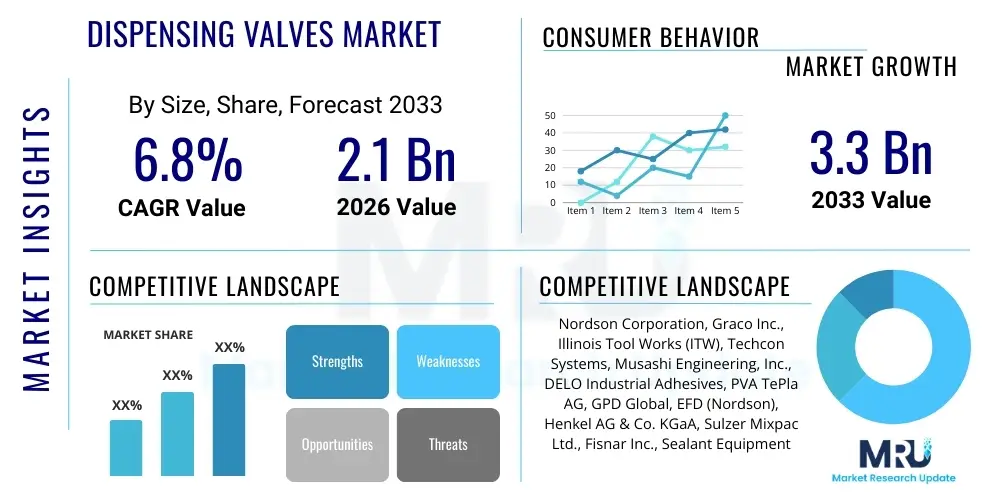

The Dispensing Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.3 Billion by the end of the forecast period in 2033.

Dispensing Valves Market introduction

Dispensing valves are critical components within automated fluid management systems, designed to precisely control the application of various liquids, pastes, adhesives, and sealants in manufacturing processes. These devices ensure highly accurate volumetric deposition, repeatability, and consistency, which are essential for maintaining quality and efficiency in high-volume production environments. The core function of a dispensing valve is to act as a gate, allowing a controlled amount of fluid to flow and then shutting off cleanly to prevent stringing or dripping, thereby optimizing material usage and minimizing defects in the final product. Their versatility allows them to handle a wide range of fluid viscosities, from ultra-thin solvents to thick epoxies.

Major applications of dispensing valves span across electronics manufacturing, automotive assembly, medical device production, and consumer goods packaging. In the electronics sector, they are indispensable for tasks such as conformal coating, bonding surface-mount devices (SMDs), and encapsulating sensitive components. The automotive industry relies heavily on these valves for applying sealants, gaskets, and lubricants with high precision on assembly lines. Benefits derived from utilizing advanced dispensing valve technology include enhanced production speed, reduced material waste, improved product reliability due to consistent application, and increased automation capabilities, leading to lower labor costs and higher throughput.

The market is predominantly driven by the accelerating demand for miniaturization in electronics and the corresponding requirement for micro-dispensing solutions. Furthermore, the global push towards industrial automation (Industry 4.0) mandates the integration of highly precise, reliable, and network-enabled dispensing equipment. The increasing adoption of advanced manufacturing materials, particularly complex adhesives and thermal interface materials (TIMs), necessitates sophisticated valve technologies capable of handling their specific flow characteristics. Regulatory demands for quality assurance and traceability in sectors like medical devices and aerospace also contribute significantly to the sustained growth of the dispensing valves market.

Dispensing Valves Market Executive Summary

The Dispensing Valves Market is experiencing robust expansion, driven primarily by evolving manufacturing standards that demand superior precision and automation, particularly within the Asia Pacific region. Key business trends indicate a strong shift towards piezoelectric and jetting valve technologies, which offer ultra-fast dispensing speeds and non-contact application, crucial for micro-assembly tasks in semiconductor and display manufacturing. Market participants are focusing on developing integrated dispensing solutions that incorporate vision systems and sophisticated software control interfaces to enhance system calibration and real-time monitoring. Strategic alliances and mergers are common as companies seek to expand their technological portfolios and geographic reach, particularly in high-growth emerging economies where automation investments are surging.

Regionally, Asia Pacific maintains its dominance, spurred by massive investments in electric vehicle (EV) battery production, 5G infrastructure deployment, and large-scale consumer electronics fabrication facilities located in countries like China, South Korea, and Taiwan. North America and Europe, while mature, exhibit high adoption rates for advanced, specialized valves in medical and aerospace applications, driven by stringent quality requirements and high labor costs necessitating full automation. The increasing penetration of smart factories globally ensures sustained demand across all regions, emphasizing integration ease and modular design in new valve systems.

Segment trends highlight the dominance of automated valves over manual systems, reflecting the necessity for high throughput and repeatability. By product type, diaphragm valves and pinch valves remain essential for lower-viscosity fluids, whereas specialized positive displacement and spool valves dominate the application of high-viscosity materials and critical sealing tasks. End-user segmentation shows that the electronics sector is the largest consumer, utilizing valves for intricate assembly and protection processes. However, the automotive industry, particularly the e-mobility segment requiring structural bonding and thermal management materials (TIMs) for battery packs, represents the fastest-growing application area, propelling demand for robust, high-pressure dispensing solutions.

AI Impact Analysis on Dispensing Valves Market

Common user questions regarding AI’s impact on dispensing valves center around how machine learning can enhance precision beyond current mechanical limits, whether AI can predict and prevent dispensing errors, and how integration complexity changes with AI-driven control systems. Users are keen to understand the shift from fixed programming to adaptive processes where parameters adjust in real-time based on environmental factors or material variability. Key concerns also revolve around the cost justification of AI integration, the necessary data infrastructure, and the skills required to manage these advanced systems. There is high expectation that AI will unlock new levels of efficiency, particularly in handling highly complex, multi-stage dispensing tasks and optimizing material consumption by minimizing rework.

The core themes emerging from this analysis suggest that the future of dispensing involves 'smart dispensing,' where AI algorithms analyze data streams from embedded sensors (temperature, pressure, flow rate, component orientation) to autonomously fine-tune valve operation. This capability moves dispensing from a reactive process to a predictive one, where maintenance schedules are optimized, and quality drift is corrected before defects occur. Expectations are high for AI-powered vision systems to instantaneously verify dispensed bead geometry and volume, ensuring 100% quality inspection without slowing the production line. This shift promises significant improvements in yield rates, particularly in zero-tolerance industries like semiconductor manufacturing and medical device assembly.

Furthermore, AI is crucial for optimizing the setup and programming phases. Complex dispensing patterns, such as those required for advanced packaging (e.g., flip-chip bonding or 3D stacking), currently require extensive manual calibration and fine-tuning by skilled technicians. AI tools can simulate and optimize these processes virtually, dramatically reducing setup time, minimizing material waste during trials, and allowing less experienced operators to achieve expert-level quality. The data generated by these smart dispensing systems also provides valuable insights for upstream material formulation and downstream process optimization, creating a highly integrated manufacturing ecosystem.

- Enhanced Predictive Maintenance (PPM) through anomaly detection in valve operation data.

- Real-time, closed-loop adjustment of dispensing parameters (pressure, temperature, stroke) based on sensor feedback.

- Optimization of complex dispensing paths and fluid flow models using machine learning algorithms.

- AI-driven vision inspection systems for instantaneous defect detection and geometric validation.

- Automated material degradation analysis, adjusting dispensing speed or pressure to compensate for changes in viscosity over time.

- Reduced programming and setup time for new dispensing tasks through intelligent simulation and calibration.

DRO & Impact Forces Of Dispensing Valves Market

The Dispensing Valves Market dynamics are shaped by a confluence of accelerating drivers (D) related to precision manufacturing, significant restraints (R) linked to technological barriers and cost, and abundant opportunities (O) arising from emerging industry shifts. The principal drivers include the pervasive trend of miniaturization across consumer electronics and medical devices, necessitating micro-dispensing capabilities; the rapid expansion of the electric vehicle market requiring high volumes of thermal interface materials and structural adhesives; and the global mandate for industrial automation (Industry 4.0). These factors are creating consistent demand for advanced, high-speed, and high-precision dispensing solutions that outperform conventional pneumatic systems.

However, the market faces notable restraints, primarily stemming from the high initial capital investment required for advanced automated dispensing systems, particularly those incorporating sophisticated jetting and volumetric technologies. Furthermore, the complexity involved in integrating these precise systems into existing manufacturing lines, coupled with the necessity for highly skilled personnel for programming and maintenance, acts as a barrier to entry for smaller manufacturers. Variability in fluid properties—viscosity changes due to temperature or material batch differences—poses ongoing operational challenges that require constant calibration, which can limit efficiency if not managed by advanced control systems.

Opportunities for market growth are significant and include the increasing adoption of 3D printing and additive manufacturing techniques, which utilize precise material deposition methods. There is a growing niche for specialized valves designed to handle highly abrasive, high-temperature, or exotic materials used in advanced semiconductor packaging and aerospace applications. Moreover, the shift towards sustainable manufacturing practices is creating opportunities for valves optimized for bio-based or recycled adhesives and sealants. These impact forces—the push for automation, the cost of precision, and the need for material specialization—collectively dictate the competitive landscape and technological trajectory of the dispensing valve industry.

Segmentation Analysis

The Dispensing Valves Market is segmented comprehensively based on technology, product type, automation level, end-user industry, and geography, providing granular insights into market dynamics. The segmentation reflects the diverse applications and material requirements across various manufacturing environments. Technological segmentation distinguishes between traditional contact dispensing (like needle and spool valves) and advanced non-contact methods (jetting/piezoelectric valves), which is crucial for high-speed, micro-dot applications. Product type differentiation is essential as specific materials require specialized valve mechanics, such as positive displacement valves for high-viscosity fluids or diaphragm valves for volatile solvents.

Segmentation by end-user industry clearly illustrates the varied demand patterns, with electronics currently holding the largest market share due to complex bonding, sealing, and encapsulation requirements. However, the automotive industry, fueled by the accelerating production of electric vehicle batteries and components, is witnessing the highest growth rate. Analyzing the market by automation level (manual, semi-automatic, fully automatic) provides insight into the maturity and investment capabilities of different regional markets, with fully automated systems dominating developed economies and high-volume sectors.

This structured segmentation allows market players to tailor their product development and marketing strategies towards specific high-growth niches. For example, companies focusing on Asia Pacific prioritize high-speed, robust valves for mass electronics assembly, while those targeting the European market often concentrate on specialized volumetric valves meeting stringent quality controls for aerospace and high-end medical device manufacturing. Understanding these distinct segment requirements is pivotal for accurate forecasting and competitive positioning within the global dispensing valves ecosystem.

- By Technology:

- Contact Dispensing Valves

- Non-Contact Dispensing Valves (Jetting Valves)

- By Product Type:

- Spool Valves

- Diaphragm Valves

- Pinch Valves

- Jetting Valves (Piezoelectric, Solenoid)

- Volumetric Valves (Screw/Auger Valves, Piston Valves)

- Spray Valves

- By Automation Level:

- Manual Dispensing Systems

- Semi-Automatic Dispensing Systems

- Fully Automated Integrated Systems

- By Application/End-User Industry:

- Electronics (Semiconductors, PCBs, Display Assembly)

- Automotive (EV Battery Assembly, Structural Bonding, Gasketing)

- Medical Devices (Diagnostics, Catheters, Microfluidics)

- Aerospace & Defense

- General Industrial Assembly

- Packaging & Consumer Goods

- By Region:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, Japan, South Korea, Taiwan)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Dispensing Valves Market

The value chain of the Dispensing Valves Market begins with upstream material suppliers providing precision-machined components, specialized alloys, polymers, and electronic control elements like sensors and microprocessors. Quality control at this stage is paramount, as the integrity and durability of valve components directly influence dispensing accuracy and longevity. Key upstream activities involve advanced material research and precision engineering to ensure component compatibility with aggressive chemical fluids and high operational pressures. Manufacturers often engage in long-term relationships with specialized component providers to ensure supply chain stability and compliance with strict quality standards required for complex valve assemblies.

The core manufacturing and assembly stage involves the design, fabrication, and integration of the valve head, fluid reservoir interfaces, and sophisticated electronic controllers. Valve manufacturers focus heavily on R&D to develop proprietary actuation methods (e.g., piezoelectric drives for jetting) and modular designs that allow easy integration with robotic arms and existing automation platforms. Downstream analysis reveals a reliance on a dual distribution channel: direct sales for large OEMs requiring customized, complex integrated solutions and indirect sales through specialized distributors and system integrators for standardized products and localized support, particularly for small-to-medium enterprises (SMEs).

System integrators play a crucial role downstream, often bundling dispensing valves with pumps, temperature controllers, vision systems, and robotic platforms to deliver a complete, turnkey automation solution tailored to the end-user’s specific production line needs. Post-sale services, including maintenance, calibration, spare parts supply, and technical training, are essential value-added services that contribute significantly to the total cost of ownership and customer loyalty. The increasing complexity of fluid materials and micro-dispensing tasks elevates the importance of knowledgeable system integrators and robust direct technical support from the original equipment manufacturer (OEM).

Dispensing Valves Market Potential Customers

Potential customers for the Dispensing Valves Market are predominantly large-scale, precision-driven manufacturing entities that require accurate, repeatable, and high-speed material deposition as a core part of their assembly process. The primary end-users or buyers of these products include global Original Equipment Manufacturers (OEMs) operating in highly automated industries. These customers prioritize equipment reliability, integration capability (compatibility with various robotics and controllers), and technical specifications like minimum dispense volume and maximum cycle rate. The decision-making unit typically involves manufacturing engineers, automation specialists, and procurement departments focused on optimizing production throughput and minimizing rework costs associated with inconsistent fluid application.

A significant customer segment comprises contract manufacturers (CMs) and electronics manufacturing services (EMS) providers who handle assembly tasks for multiple clients across various industries. These buyers require versatile dispensing systems capable of rapidly switching between different fluids (e.g., solders, underfills, adhesives) and complex patterns without extensive downtime. Their procurement strategy often favors modular, flexible valve systems that can be quickly repurposed for different projects, maximizing asset utilization. As manufacturing processes become increasingly complex, particularly in advanced semiconductor packaging, the demand shifts toward specialized customers who require non-contact jetting technologies for micro-scale dot placement and high-frequency operation.

The fastest-growing segment of potential customers includes electric vehicle (EV) battery manufacturers and tier-one automotive suppliers investing heavily in new production lines for thermal management, cell-to-cell bonding, and battery pack sealing. These customers require robust positive displacement valves capable of handling highly abrasive or high-viscosity structural adhesives and gap fillers under high pressure, often operating in harsh environments. Additionally, specialized medical device manufacturers, particularly those involved in microfluidics and implant assembly, represent high-value customers who demand absolute precision and validation protocols, often preferring customized volumetric dispensing solutions adhering to strict regulatory compliance standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson Corporation, Graco Inc., Illinois Tool Works (ITW), Techcon Systems, Musashi Engineering, Inc., DELO Industrial Adhesives, PVA TePla AG, GPD Global, EFD (Nordson), Henkel AG & Co. KGaA, Sulzer Mixpac Ltd., Fisnar Inc., Sealant Equipment & Engineering, TTP Ventus Ltd., Valco Melton, Mycronic AB, Dispensing Dynamics, Loctite Corporation (Henkel), ViscoTec Pumpen- u. Dosiertechnik GmbH, Dymax Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dispensing Valves Market Key Technology Landscape

The technological landscape of the Dispensing Valves Market is rapidly evolving, moving away from simple pneumatic piston actuation toward sophisticated electronic and mechanical methods that prioritize speed, precision, and volumetric control. The most impactful shift is the proliferation of non-contact jetting valve technology, primarily driven by piezoelectric actuation. Piezoelectric jetting allows for the deposition of fluid dots at extremely high frequencies (up to 1,000 dots per second) without touching the substrate, making it indispensable for advanced semiconductor packaging, micro-LED assembly, and fine-pitch electronic applications where physical contact is prohibited or cycle time is critical. This technology handles ultra-low viscosity fluids with unprecedented accuracy and repeatability, defining the cutting edge of micro-dispensing.

Another crucial technological development involves positive displacement (PD) valves, specifically screw (auger) and piston variants. These systems offer superior volumetric control, ensuring that the exact same volume of material is dispensed regardless of variations in fluid viscosity, line pressure, or temperature. PD technology is crucial for applications involving expensive, high-viscosity materials like thermal interface materials (TIMs) and thick structural adhesives in automotive and aerospace manufacturing, where consistent bead width and volume are non-negotiable for structural integrity and heat dissipation. Modern PD valves often incorporate servo motors and highly accurate encoders to provide real-time feedback and closed-loop control, further minimizing process variation.

Furthermore, the integration of smart sensors and advanced control software (leveraging IoT and AI principles) is fundamentally altering the operational capability of dispensing valves. Newer systems feature integrated temperature monitoring, ultrasonic flow meters, and vision systems that enable instantaneous process verification and automatic parameter correction. This digital integration facilitates seamless communication with higher-level manufacturing execution systems (MES) and robotic platforms, enhancing overall factory automation. The focus remains on modularity, enabling quick changeovers between different valve heads and fluid materials, thus maximizing flexibility in high-mix, low-volume manufacturing environments prevalent in specialized industries.

Regional Highlights

- Asia Pacific (APAC): Dominance and High Growth Center

- APAC commands the largest market share globally, driven by its unparalleled concentration of electronics manufacturing, including semiconductor fabrication, PCB assembly, and display production (OLED, Micro-LED).

- Countries like China, South Korea, Japan, and Taiwan are major centers for automated assembly, investing heavily in high-speed jetting and micro-dispensing technologies to meet the demand for miniaturized consumer electronics and advanced packaging solutions.

- The region is also rapidly expanding its EV manufacturing capacity, leading to explosive demand for robust dispensing systems utilized for battery module assembly, thermal management, and structural bonding applications.

- Government initiatives promoting industrial automation and smart factory implementation further solidify APAC's position as the primary growth engine for the dispensing valves market.

- North America: Focus on High-Value and Specialized Applications

- North America is characterized by mature industrial sectors with high technological adoption rates, particularly in aerospace, medical devices, and advanced research facilities.

- Demand is concentrated in specialized, high-precision applications requiring strict regulatory compliance (e.g., FDA-approved medical device bonding), driving the adoption of high-accuracy volumetric valves and validated dispensing processes.

- The presence of major automotive research and development centers and growing domestic EV production contributes significantly to demand for advanced adhesive and sealant dispensing systems, emphasizing closed-loop process control and traceability.

- Europe: Leading in Automation and Customized Solutions

- The European market is marked by high labor costs and stringent quality standards, driving continuous investment in fully automated dispensing systems and Industry 4.0 integration.

- Germany, specifically, leads in automotive manufacturing and industrial machinery, driving demand for heavy-duty, reliable dispensing valves for structural applications.

- The focus is often on customized dispensing solutions for niche markets like high-performance adhesives, special sealants, and precision assembly of complex machinery, requiring robust support and engineering expertise from valve manufacturers.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging Markets

- These regions represent developing markets where the adoption of automated dispensing is growing, primarily driven by investments in infrastructure, packaging, and localized consumer goods manufacturing.

- Demand is often concentrated in mid-range pneumatic and volumetric systems, focused on increasing production efficiency and reducing manual application variability.

- Growth is highly dependent on foreign direct investment into establishing local manufacturing hubs, particularly in sectors like automotive assembly (Mexico, Brazil) and construction materials (MEA).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dispensing Valves Market.- Nordson Corporation

- Graco Inc.

- Illinois Tool Works (ITW)

- Techcon Systems

- Musashi Engineering, Inc.

- DELO Industrial Adhesives

- PVA TePla AG

- GPD Global

- EFD (Nordson)

- Henkel AG & Co. KGaA

- Sulzer Mixpac Ltd.

- Fisnar Inc.

- Sealant Equipment & Engineering

- TTP Ventus Ltd.

- Valco Melton

- Mycronic AB

- Dispensing Dynamics

- Loctite Corporation (Henkel)

- ViscoTec Pumpen- u. Dosiertechnik GmbH

- Dymax Corporation

- Innovative Polymers Pvt Ltd

- ASG Dispensing Technology

- Dopag Dosiertechnik und Mischtechnik AG

- Metcal Inc.

- Tech International Corporation

- Dispense Works Inc.

- Exact Dispensing Systems

- Mikron Automation

- Pro-Tec Industries

- Shenzhen Focuseal Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Dispensing Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for non-contact jetting dispensing valves?

The primary factor is the demand for miniaturization in electronics and semiconductor packaging, requiring extremely high-speed, non-contact deposition of micro-dots (picoliters) without risking damage to sensitive substrates or slowing down high-volume production lines.

How do positive displacement (PD) valves differ from time/pressure valves in terms of application reliability?

PD valves, particularly screw and piston types, deliver a precise, consistent volume of material regardless of viscosity fluctuations or inlet pressure changes, ensuring superior volumetric accuracy and reliability, especially crucial for high-viscosity structural adhesives and thermal interface materials (TIMs).

Which end-user industry is currently showing the fastest growth rate for dispensing valve adoption?

The automotive industry, specifically the electric vehicle (EV) sector, is exhibiting the fastest growth due to the critical need for precision dispensing of high-performance structural adhesives, sealants, and thermal gap fillers required for robust EV battery assembly and thermal management systems.

What role does AI play in optimizing the performance of modern dispensing systems?

AI facilitates real-time, closed-loop process control by analyzing sensor data to adjust dispensing parameters automatically, predicting and preventing quality defects, and optimizing complex dispensing paths to reduce setup time and material waste in highly automated environments.

What are the key technological challenges currently facing the dispensing valves market?

Key challenges include handling highly abrasive and difficult-to-process materials (like metal-filled thermal pastes), managing material variability across batches, and reducing the high capital cost and complexity associated with integrating ultra-precision micro-dispensing systems into existing factory infrastructure.

The continuous innovation within the Dispensing Valves Market is intrinsically linked to global manufacturing trends, particularly the increasing reliance on automation and the demand for products with higher integration density. As devices become smaller and more functional, the tolerance for error in material deposition shrinks, making the capabilities of dispensing valves paramount to manufacturing success. The shift towards sustainable and lighter materials in automotive and aerospace applications further pressures valve manufacturers to develop robust solutions capable of handling innovative, often abrasive or reactive, chemical compounds. The adoption curve for advanced dispensing systems is steep in emerging economies, driven by government incentives aimed at modernizing industrial sectors and attracting foreign direct investment in high-tech manufacturing. Furthermore, the convergence of dispensing technology with robotics and machine vision systems creates synergistic effects, allowing manufacturers to achieve previously unattainable levels of precision and throughput. This technological interplay is vital for maintaining competitive advantage in sectors where cycle time and material efficiency are critical performance indicators. Companies that successfully integrate AI-driven quality checks and predictive maintenance into their dispensing platforms are poised to capture significant market share by offering superior reliability and lower total cost of ownership to end-users. The complexity of fluid dynamics within micro-channels and high-pressure environments necessitates ongoing research into nozzle design and valve actuation mechanisms. Piezoelectric technology, while established, is still undergoing refinements to increase longevity and chemical compatibility, pushing the boundaries of non-contact dispensing capability to handle higher viscosity materials. Volumetric dispensing, particularly auger valves, benefits from advanced servo control, enabling minute adjustments in rotational speed and reversal to prevent stringing and ensure perfect shutoff. The drive towards zero-defect manufacturing mandates that dispensing valves become more intelligent, offering full data logging and traceability for every dispensed dot or bead, satisfying the stringent regulatory requirements of medical and aerospace clients. Investment in smart factory infrastructure is intrinsically tied to the demand for these integrated dispensing solutions. The ability of a dispensing valve system to communicate real-time performance metrics (temperature, pressure stability, flow rate deviation) directly to a centralized MES or cloud-based analytics platform is now a key purchasing criterion. This connectivity supports large-scale optimization efforts, allowing manufacturers to identify bottlenecks and process inefficiencies globally. The market's future growth is therefore heavily dependent on the continued fusion of mechanical engineering excellence with cutting-edge digital control and data science methodologies, ensuring dispensing remains a reliable cornerstone of high-precision automated assembly worldwide. The Dispensing Valves market segmentation by product type is complex due to the specialization required for different fluid rheologies. Diaphragm valves are often preferred for low-to-medium viscosity fluids, offering inert fluid paths suitable for reactive chemistries, commonly used in biotechnology and pharmaceutical production. In contrast, spool valves are favored for medium-to-high viscosity applications, providing excellent flow control through precise mechanical action, essential for general industrial bonding. The emergence of micro-dispensing requires highly refined control systems that minimize pulsation and startup inertia, challenging engineers to produce lighter, faster-acting components without compromising durability. The competitive landscape reflects an intense focus on intellectual property related to fluid heating and conditioning systems, which are integral to stabilizing material viscosity just prior to dispensing, particularly critical for reactive chemistries like two-part epoxies and urethanes. The necessity of precision is further amplified by the complexity of substrates, ranging from flexible electronic films to large, rigid metallic components, each demanding tailored dispensing strategies to ensure optimal adhesion and material coverage. The development of proprietary coating materials for valve wetted parts to resist aggressive solvents and abrasive fillers is a continuous area of R&D investment, crucial for extending equipment lifespan in demanding environments. This comprehensive approach to material science and mechanical precision ensures the ongoing evolution and sustained growth of the dispensing valve market globally. The necessity for highly accurate metering in demanding applications, such as the encapsulation of sensitive microchips or the application of protective conformal coatings on PCBs, drives continuous improvement in sensor feedback loops and nozzle tip geometry. The industry also sees increasing consolidation, with larger players acquiring specialized smaller companies to integrate niche technologies like advanced volumetric mixing and dispensing solutions for two-component materials. This strategic consolidation aims to offer end-users complete, end-to-end fluid management solutions from material preparation right through to final cure monitoring, enhancing the overall value proposition. The future trajectory emphasizes modularity and ease of maintenance, recognizing that downtime is the most significant cost factor in high-throughput manufacturing settings. Therefore, designs that allow for rapid nozzle and cartridge replacement without requiring extensive recalibration are gaining substantial traction across all major industrial segments, particularly in the APAC region's high-volume consumer electronics production facilities where uptime is critical. The push towards sustainable manufacturing also encourages the development of valve systems that minimize material waste and facilitate the precise use of environmentally friendly, bio-based adhesives and sealants. This combination of technical refinement and market responsiveness defines the competitive edge in the global dispensing valves sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager