Disposable Anesthesia Puncture Kit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433034 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Disposable Anesthesia Puncture Kit Market Size

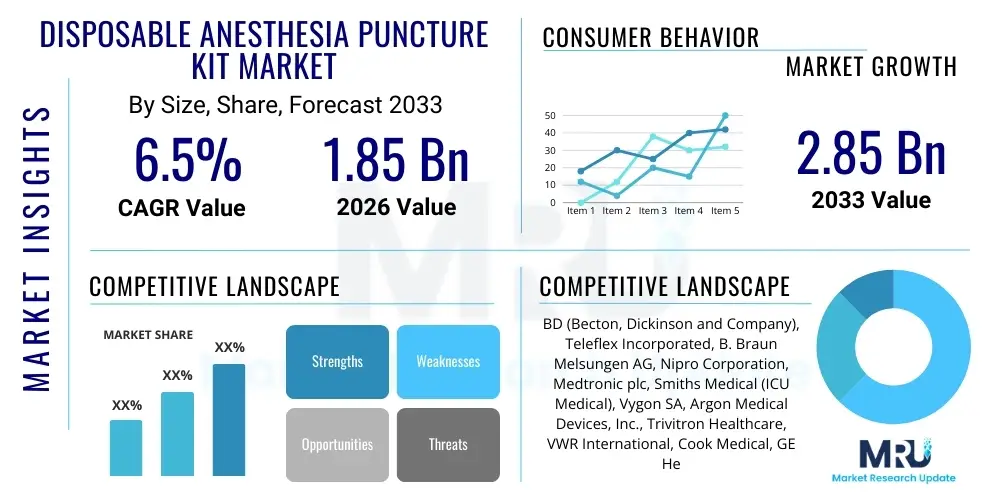

The Disposable Anesthesia Puncture Kit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.85 Billion by the end of the forecast period in 2033.

Disposable Anesthesia Puncture Kit Market introduction

The Disposable Anesthesia Puncture Kit Market encompasses products designed for the administration of regional anesthesia, including epidural and spinal procedures. These kits typically contain all necessary components—such as specialized needles (e.g., Quincke, pencil-point), introducers, syringes, filters, and antiseptic solutions—in a single, sterile package. The primary objective of utilizing disposable kits is to enhance procedural safety, minimize the risk of infection, ensure consistency in supplies, and streamline the workflow for anesthesiologists and surgical staff. These kits are crucial in various surgical settings, pain management clinics, and obstetric care units, where regional blocks are frequently employed as alternatives or adjuncts to general anesthesia.

The core applications of these kits lie in delivering precise, targeted regional pain relief. Major surgical applications include orthopedic surgeries of the lower limbs, complex abdominal procedures, and crucially, labor and delivery (obstetric anesthesia). The kits are engineered for single-use to eliminate cross-contamination risks associated with reprocessing, adhering strictly to modern healthcare infection control standards. Growing awareness among healthcare providers regarding the benefits of regional anesthesia, such as reduced systemic side effects and quicker patient recovery times compared to general anesthesia, is fundamentally driving the demand for high-quality, reliable disposable puncture kits across global markets.

Market benefits are manifold, directly impacting patient outcomes and healthcare operational efficiency. Key driving factors include the escalating volume of surgical procedures worldwide, particularly among the aging population who often benefit from regional anesthesia due to comorbidities, and the continuous technological advancements leading to safer and more ergonomically designed needles and components. Furthermore, stringent regulatory guidelines emphasizing patient safety and sterility in operating theaters necessitate the adoption of pre-packaged, single-use kits, solidifying their indispensable role in modern anesthetic practices.

Disposable Anesthesia Puncture Kit Market Executive Summary

The Disposable Anesthesia Puncture Kit Market is experiencing robust expansion driven by increasing procedural volumes and heightened global focus on infection control protocols. Business trends indicate a strong move toward product innovation, specifically concerning ergonomic needle designs that improve tactile feedback and reduce the risk of dural puncture and post-dural puncture headache (PDPH). Strategic collaborations between medical device manufacturers and pain management specialists are leading to customized kits tailored for specific procedures, such as continuous nerve blocks. Furthermore, the rising adoption of regional anesthesia in ambulatory surgical centers (ASCs) is creating new avenues for market growth, encouraging competitive pricing and broader distribution networks focused on outpatient care settings.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated infrastructure, and rapid adoption of advanced anesthetic techniques. However, the Asia Pacific (APAC) region is poised for the highest growth trajectory, fueled by expanding healthcare access, increasing medical tourism, and rising prevalence of chronic conditions requiring surgical intervention. European markets show stable growth, heavily influenced by centralized procurement policies and strong regulatory bodies ensuring product quality. Emerging segments trends include a pronounced shift toward spinal anesthesia kits over traditional epidural kits in certain elective surgeries, alongside growing demand for kits integrated with ultrasound guidance tools, which improve the accuracy and safety of nerve blocks.

Segment-wise, spinal anesthesia kits and epidural kits remain the largest revenue generators, segmented primarily by type of anesthesia needle and target procedure. By end-user, hospitals continue to be the primary consumer, although the fastest growth is observed within specialty clinics and ambulatory surgical centers (ASCs) due to the shift towards minimally invasive and outpatient surgeries. Competitive strategies center on securing long-term supply contracts with major hospital groups and emphasizing clinical validation data to differentiate products based on safety metrics. The market structure remains moderately consolidated, but regional players are increasing their footprint by focusing on cost-effectiveness and localized supply chains.

AI Impact Analysis on Disposable Anesthesia Puncture Kit Market

User queries regarding the impact of Artificial Intelligence (AI) in the disposable anesthesia kit domain primarily revolve around three key themes: how AI enhances procedural safety, the role of machine learning in logistics and inventory management, and the potential for AI-driven needle guidance systems. Users are keen to understand if AI can predict or mitigate complications associated with nerve blocks, optimize needle placement trajectories in real-time, or automatically analyze patient specific anatomical data derived from imaging. The overarching expectation is that while the disposable physical product (the puncture kit itself) remains essential, AI integration will revolutionize the preparation, execution, and documentation phases of regional anesthesia, leading to improved consistency and reduced reliance on operator expertise alone.

- AI enhances pre-procedural planning by analyzing patient imaging (MRI, ultrasound) to generate optimal nerve block trajectories.

- Machine learning algorithms optimize inventory levels and predict demand for specific kit types based on surgical schedules and historical usage patterns.

- AI-powered augmented reality systems can provide real-time guidance overlays for needle insertion, improving accuracy and reducing procedural time.

- Automated complication prediction models use intraoperative data to alert anesthesiologists to potential adverse events during injection.

- Natural Language Processing (NLP) streamlines the documentation process by automatically capturing procedural details and kit lot numbers for traceability and compliance.

DRO & Impact Forces Of Disposable Anesthesia Puncture Kit Market

The Disposable Anesthesia Puncture Kit Market is subject to significant Drivers, Restraints, and Opportunities (DRO) which collectively define its growth trajectory and competitive landscape. The primary driver is the rising preference for regional anesthesia techniques over general anesthesia, attributed to fewer systemic side effects, reduced recovery times, and suitability for high-risk patients with comorbidities. Furthermore, the global imperative to reduce Healthcare-Associated Infections (HAIs) rigorously mandates the use of single-use, sterile kits, thereby boosting demand. The market is also heavily influenced by demographic trends, specifically the globally aging population, which necessitates frequent surgical procedures like joint replacements, ideal for regional anesthetic management.

However, the market faces notable restraints, chiefly the high cost associated with advanced, specialized disposable kits, particularly in developing economies where budgetary constraints limit procurement. The availability and proper training of skilled anesthesiologists capable of performing complex regional blocks accurately remains a significant barrier in remote or underserved areas. Additionally, although rare, potential risks such as nerve damage or post-dural puncture headache (PDPH) associated with these procedures generate occasional negative press and regulatory scrutiny, necessitating continuous innovation in needle design to minimize these adverse outcomes.

Opportunities for market growth are abundant, particularly through product differentiation by integrating smart technologies, such as kits compatible with ultrasound-guided nerve localization systems or those featuring self-aspirating mechanisms. Geographic expansion into high-growth emerging markets in Asia and Latin America, where healthcare infrastructure is rapidly developing, presents substantial revenue potential. The ongoing shift from inpatient to outpatient surgical settings, specifically the growth of Ambulatory Surgical Centers (ASCs), also creates a sustained opportunity for manufacturers focusing on smaller, standardized, and cost-effective procedure kits tailored for day-case surgeries. Impact forces, driven by regulatory compliance and technological leaps in material science, ensure continuous evolution in product safety and effectiveness.

Segmentation Analysis

The Disposable Anesthesia Puncture Kit Market is comprehensively segmented based on product type, application, and end-user, enabling manufacturers to strategically target specific healthcare needs. Segmentation by product type primarily includes spinal anesthesia kits, epidural kits (including single-shot and continuous), combined spinal-epidural (CSE) kits, and peripheral nerve block (PNB) kits. This segmentation reflects the varied procedural requirements within regional anesthesia. Epidural kits typically dominate the market due to their widespread use in obstetrics and chronic pain management, while PNB kits are experiencing rapid growth driven by orthopedic surgical advances.

Segmentation by application focuses on the major clinical areas utilizing these kits, such as Obstetrics (labor and delivery), Surgery (general, orthopedic, neurosurgery), and Pain Management (acute and chronic relief). The surgical segment holds the largest share due to the sheer volume of procedures requiring anesthetic intervention. Segmentation by end-user differentiates between large healthcare facilities and smaller specialized centers, encompassing Hospitals, Ambulatory Surgical Centers (ASCs), and Specialty Clinics. While hospitals represent the traditional, high-volume consumer base, ASCs are increasingly influential, demanding standardized, bulk procurement of reliable kits optimized for quick turnaround times in outpatient settings.

The continuous refinement of regional anesthesia techniques is perpetually driving the complexity of segmentation, particularly concerning specialized needles (e.g., differentiated by gauge and tip geometry) and the incorporation of specific catheter materials for continuous blocks. Understanding these nuanced segments allows market players to cater to specific clinical demands, for instance, supplying robust, high-precision kits to tertiary care centers undertaking complex surgeries, versus providing more standardized, cost-efficient kits to smaller community hospitals focusing on routine procedures. This granular analysis is essential for accurate forecasting and successful penetration strategies.

- By Product Type:

- Spinal Anesthesia Kits

- Epidural Anesthesia Kits

- Combined Spinal-Epidural (CSE) Kits

- Peripheral Nerve Block (PNB) Kits

- By Application:

- Surgery (Orthopedic, General, Vascular)

- Obstetrics and Gynecology

- Pain Management (Acute and Chronic)

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics and Diagnostic Centers

Value Chain Analysis For Disposable Anesthesia Puncture Kit Market

The value chain for the Disposable Anesthesia Puncture Kit Market begins with upstream activities focused on raw material sourcing and component manufacturing. Key raw materials include high-grade medical plastics (PVC, polypropylene), stainless steel for needles, and specialized polymers for catheters. Upstream efficiency is crucial, as the quality and sterility of these components directly impact the final product's performance and regulatory compliance. Manufacturers often maintain stringent quality control over specialized needle grinding and sterilization processes (e.g., ethylene oxide or irradiation) to ensure maximum safety and precision. Fluctuations in raw material prices, particularly specialized medical-grade metals and plastics, can significantly affect production costs and overall market pricing.

Midstream activities involve the assembly, kitting, packaging, and final sterilization of the complete anesthesia puncture kit. Kitting is a highly specialized logistical process, ensuring all required components are present, correctly oriented, and maintained in a sterile environment until use. Leading manufacturers invest heavily in automated assembly lines to minimize human error and ensure compliance with Good Manufacturing Practices (GMP). This phase adds significant value through packaging design that is intuitive for clinical use and robust sterilization validation procedures, which are critical steps prior to market release.

The downstream segment involves distribution channels, sales, and end-user delivery. Distribution is typically handled through a mix of direct sales forces (for large institutional contracts) and indirect channels utilizing third-party medical distributors. These distributors manage regional logistics, inventory warehousing, and compliance with local healthcare regulations. Direct channels allow for closer relationships with key opinion leaders (KOLs) and detailed product training, while indirect channels provide wider geographic reach, particularly into smaller hospitals and ASCs. Effective downstream management, including just-in-time delivery systems, is paramount given the critical and immediate nature of surgical supplies.

Disposable Anesthesia Puncture Kit Market Potential Customers

The primary potential customers and end-users of the Disposable Anesthesia Puncture Kit Market are institutions where surgical interventions and specialized pain management procedures are performed. Hospitals, encompassing governmental, private, and university-affiliated medical centers, represent the largest and most foundational customer base. They utilize these kits across a wide range of departments including operating theaters, maternity wards for labor analgesia, emergency departments for acute pain management, and specialized procedural units. Hospitals require diverse kits in high volumes and often engage in long-term procurement contracts, placing a high value on supply reliability, standardization, and competitive pricing.

Ambulatory Surgical Centers (ASCs) and outpatient clinics constitute a rapidly expanding customer segment. As healthcare delivery shifts toward minimally invasive and outpatient settings, ASCs are increasing their procedural complexity, necessitating advanced regional anesthesia capabilities. These centers prioritize efficiency, demanding kits that are highly standardized, easy to manage in inventory, and optimally priced for high-volume, quick-turnaround environments. The focus in ASCs is often on peripheral nerve block kits for orthopedic and plastic surgery procedures, reflecting their procedural specialization.

Specialty pain management clinics and chronic pain centers form the third major customer group. These centers utilize disposable kits extensively for diagnostic and therapeutic nerve blocks, epidural steroid injections, and specialized interventional pain procedures. Their requirements often lean towards smaller gauge needles and specialized filter components tailored for precision drug delivery. Furthermore, military hospitals and mobile surgical units also serve as niche but significant customers, emphasizing the need for robust, compact, and highly reliable kits suitable for diverse and challenging operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BD (Becton, Dickinson and Company), Teleflex Incorporated, B. Braun Melsungen AG, Nipro Corporation, Medtronic plc, Smiths Medical (ICU Medical), Vygon SA, Argon Medical Devices, Inc., Trivitron Healthcare, VWR International, Cook Medical, GE Healthcare, Mindray, Avanos Medical, Inc., ConMed Corporation, Halyard Health, Dynarex Corporation, Troge Medical GmbH, PFM Medical AG, Kirwan Surgical Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Anesthesia Puncture Kit Market Key Technology Landscape

The technology landscape for disposable anesthesia puncture kits is characterized by continuous innovation aimed at enhancing needle safety, precision, and minimizing patient trauma. A primary technological focus is on needle tip design, moving beyond traditional Quincke needles to advanced pencil-point and rounded-tip designs. Pencil-point needles are engineered to reduce the risk of dural puncture headache (PDPH) by separating rather than cutting the dural fibers, leading to faster dural healing and improved patient comfort. Manufacturers are also employing specialized coating technologies, such as PTFE or silicone coatings, to reduce friction during insertion and improve the tactile feel, or "loss of resistance" (LOR), crucial for epidural identification.

Another significant technological advancement involves the integration of connectivity and visualization technologies. Ultrasound-guided regional anesthesia has fundamentally shifted the market, making kits compatible with, or optimized for, ultrasound visualization (e.g., echogenic needles). Echogenic technology involves roughening or laser-marking the distal tip of the needle, allowing it to reflect ultrasound waves more effectively, thus providing clearer visualization of the needle tip in relation to nerves and anatomical structures. This drastically improves the success rate and reduces the complexity and risk of peripheral nerve blocks, driving the demand for specialized PNB kits.

Furthermore, the materials science governing catheters and components is continuously evolving. Modern kits feature enhanced catheter flexibility and resistance to kinking, minimizing the potential for drug delivery failure during continuous infusions. Safety mechanisms, such as locking connectors (e.g., Luer-Lok systems) and specialized anti-reflux valves, are standard inclusions to prevent accidental disconnection or backflow. Future technologies are likely to involve bio-absorbable components for temporary nerve blocks and the incorporation of embedded micro-sensors within the kits that can provide real-time pressure or impedance feedback to the clinician, further augmenting safety and precision during complex procedures.

Regional Highlights

- North America: North America, comprising the United States and Canada, holds the dominant share in the Disposable Anesthesia Puncture Kit Market. This leadership is underpinned by exceptionally high per capita healthcare spending, the presence of advanced medical infrastructure, and rapid adoption of innovative surgical and anesthetic techniques. The market here is highly regulated, placing premium importance on disposable, single-use kits to maintain stringent infection control standards. High reimbursement rates and the proliferation of Ambulatory Surgical Centers (ASCs) drive continuous demand for specialized kits, particularly those optimized for orthopedic and outpatient pain management procedures. The U.S. remains the central hub for market development and technological innovation, with major global players maintaining strong sales networks and R&D activities focused on safety-enhancing features like ultrasound compatibility.

- Europe: The European market demonstrates steady and mature growth, characterized by strong governmental emphasis on universal healthcare access and quality standards. Countries like Germany, the United Kingdom, and France are significant contributors, propelled by a substantial elderly population requiring surgical intervention and well-established pain management protocols. Procurement in Europe is often centralized, leading to intense competition among suppliers based on compliance with CE marking and cost-effectiveness over large tenders. The region shows a strong preference for combined spinal-epidural (CSE) kits, particularly in obstetric settings. Regulatory bodies heavily influence product specifications, ensuring high levels of material traceability and consistent sterility across all disposable components.

- Asia Pacific (APAC): The APAC region is forecast to be the fastest-growing market during the projection period. This rapid expansion is primarily driven by substantial improvements in healthcare infrastructure, increasing disposable incomes, and the expansion of medical tourism in countries such as China, India, and South Korea. While historically focused on cost-effective solutions, the increasing affluence and awareness among the urban population are leading to greater demand for premium, specialized kits compliant with international safety standards. Governments in APAC are prioritizing public health investments, leading to increased surgical volumes and a corresponding spike in demand for reliable regional anesthetic supplies. Local manufacturing presence is increasing, posing competitive challenges to international suppliers regarding pricing.

- Latin America (LATAM): The LATAM market, including Brazil and Mexico, is experiencing moderate growth. Growth is constrained by economic volatility and variations in healthcare access and funding across different nations. However, the private healthcare sector in major metropolitan areas is expanding, readily adopting modern anesthetic practices and high-quality disposable kits. Market penetration often relies on strategic partnerships with local distributors who can navigate complex import regulations and tiered pricing structures. The increasing adoption of surgical procedures related to trauma and chronic conditions necessitates stable supply chains for basic and intermediate anesthesia kits.

- Middle East and Africa (MEA): The MEA region exhibits heterogeneous market characteristics. The Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia and UAE) boast significant market potential driven by high per capita healthcare expenditure and state-of-the-art medical facilities. These nations import high-specification kits from global leaders. Conversely, the African market remains nascent, with demand largely focused on essential and cost-optimized kits, driven mainly by international aid organizations and public health initiatives focused on basic surgical capacity building. The overall regional growth is accelerating due to massive government investment in health infrastructure modernization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Anesthesia Puncture Kit Market.- BD (Becton, Dickinson and Company)

- Teleflex Incorporated

- B. Braun Melsungen AG

- Nipro Corporation

- Medtronic plc

- Smiths Medical (ICU Medical)

- Vygon SA

- Argon Medical Devices, Inc.

- Trivitron Healthcare

- VWR International

- Cook Medical

- GE Healthcare

- Mindray

- Avanos Medical, Inc.

- ConMed Corporation

- Halyard Health

- Dynarex Corporation

- Troge Medical GmbH

- PFM Medical AG

- Kirwan Surgical Products

Frequently Asked Questions

Analyze common user questions about the Disposable Anesthesia Puncture Kit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the increased adoption of disposable anesthesia puncture kits globally?

Increased adoption is primarily driven by stringent global infection control protocols requiring single-use sterile products, the growing elderly population necessitating more surgeries, and the clinical benefits of regional anesthesia (faster recovery, fewer side effects) compared to general anesthesia.

How do technological advancements influence the safety profile of these kits?

Technological advancements focus heavily on needle design (e.g., pencil-point tips to reduce PDPH risk), the use of echogenic materials for better ultrasound visualization, and advanced catheter materials to prevent kinking, all significantly enhancing procedural safety and precision.

Which end-user segment is showing the fastest growth rate in the market?

Ambulatory Surgical Centers (ASCs) and specialty clinics are exhibiting the fastest growth rate, fueled by the accelerating shift of procedures from traditional inpatient hospitals to high-efficiency, cost-effective outpatient settings.

What are the primary restraints challenging market expansion?

Major restraints include the high unit cost of specialized kits, particularly those featuring advanced components, and the continuing shortage of highly trained anesthesiologists skilled in complex regional nerve block techniques across various geographies.

Is the Disposable Anesthesia Puncture Kit Market considered consolidated or fragmented?

The market is moderately consolidated, dominated by a few large multinational medical device corporations. However, regional specialization and increasing presence of domestic players focused on cost-efficiency contribute to a growing level of fragmentation in specific emerging markets.

The Disposable Anesthesia Puncture Kit Market presents a robust landscape for investment, driven by the unwavering global commitment to patient safety and the clinical shift toward regional anesthesia practices. Continuous technological refinements in needle geometry and visualization compatibility are expected to sustain high demand, particularly in developed economies. For stakeholders, focusing on innovative, cost-effective product lines tailored for the burgeoning Ambulatory Surgical Center (ASC) segment and securing strong distribution partnerships in high-growth regions like Asia Pacific will be critical for achieving long-term market leadership and capitalizing on the projected CAGR of 6.5%. The market trajectory is intrinsically tied to advancements in surgical practice and evolving regulatory standards demanding single-use, high-precision instruments to mitigate infection risks effectively.

Manufacturers must navigate the dual challenges of reducing production costs to penetrate price-sensitive markets while simultaneously integrating high-value technological features, such as enhanced echogenicity and ergonomic designs, necessary for clinical adoption in premium segments. The emphasis on supply chain resilience is also paramount, ensuring that critical components are available to support high surgical volumes globally. As regional anesthesia protocols become standardized for a wider range of surgical interventions, the market for pre-assembled, reliable puncture kits will continue its upward trend, making this sector highly attractive for strategic expansion and M&A activities focused on niche technology acquisition and geographic expansion.

Future growth will be heavily influenced by regulatory harmonisation and the successful integration of digital health tools, particularly AI-assisted procedural planning, which will further de-risk complex procedures. This integration, while not replacing the physical disposable kit, elevates the overall value proposition of the entire regional anesthesia ecosystem. Ultimately, the market success hinges on delivering products that offer a superior balance of patient safety, clinical efficacy, and operational efficiency for healthcare providers globally, ensuring the kit remains an indispensable tool in modern anesthetic practice. This strategic focus will secure continued market growth towards the USD 2.85 Billion valuation by 2033.

The strong demand emanating from obstetrics, where epidurals remain a standard of care for labor pain management, provides a stable foundational segment. Furthermore, the increasing application of pain management techniques, including facet joint injections and complex spinal procedures, also relies heavily on these disposable kits, diversifying the end-user base beyond purely surgical settings. This diversity shields the market from volatility associated with any single medical specialty, contributing to the overall stability and long-term viability of the disposable puncture kit market landscape.

The market’s resilience is also tested by the need for continuous education and training for clinicians regarding new kit features and procedural techniques, especially as complex peripheral nerve blocks become more common. Companies that invest in robust educational programs alongside product sales are likely to gain competitive advantages by ensuring proper use and optimal outcomes. The shift toward sustainable manufacturing practices, including the use of less environmentally impactful materials where permissible by regulation, is also emerging as a significant long-term trend influencing procurement decisions, particularly in Western European and North American healthcare systems seeking to reduce their environmental footprint without compromising sterility.

Finally, the competitive environment mandates continuous surveillance of intellectual property and regulatory changes. Speed to market with clinically superior, certified products is crucial. Smaller innovators often find success by developing proprietary needle technologies or specialized accessories that enhance compatibility with existing ultrasound or neuraxial monitoring equipment. For the major global players, leverage comes from integrating these disposable components seamlessly into broader acute care and surgical product portfolios, offering comprehensive solutions to large hospital networks globally.

The segmentation by product type is critical for understanding revenue streams; while spinal kits are essential for many single-shot procedures, the growth in chronic pain management relies heavily on continuous epidural and peripheral nerve block kits, which command higher average selling prices due to the inclusion of specialized catheters and larger procedural trays. This high-value, continuous segment is expected to outpace the growth of the single-shot segment in developed markets over the forecast period, reflecting a clinical preference for extended post-operative analgesia achieved through continuous catheter placement. This technological and procedural shift necessitates corresponding investments in R&D for catheter material science.

Additionally, the market is characterized by strict inventory management challenges at the hospital level. Disposable kits have expiration dates and must be stocked in sufficient quantities to meet fluctuating surgical demands, often exacerbated by emergency procedures. Manufacturers offering streamlined logistics, automated inventory tracking systems, and efficient direct-to-hospital delivery models are highly valued by procurement departments, acting as an ancillary service differentiator beyond the physical product itself. The reliability of the supply chain, therefore, is almost as important as the clinical quality of the kit components, particularly in high-volume settings like Level I trauma centers.

The increasing focus on pain management outside the operating theater, including dedicated interventional pain units, creates specialized demand for kits tailored for fluoroscopy or computed tomography (CT) guidance, distinct from the needs of operating room procedures. These specialized procedural kits require unique needle lengths, hub designs, and component arrangements to accommodate advanced imaging techniques. Suppliers who can offer a diverse portfolio covering these highly specific, niche procedural requirements demonstrate greater versatility and capture a broader share of the total accessible market across the pain management spectrum.

In conclusion, the Disposable Anesthesia Puncture Kit Market is defined by a confluence of rising surgical needs, unyielding demands for infection prevention, and continuous clinical innovation. Success depends on marrying precision engineering with robust supply chain management, while strategically targeting high-growth areas like ASCs and emerging APAC markets. The overall market valuation projection to USD 2.85 Billion by 2033 reflects confidence in sustained healthcare investment and the irreplaceable role of these disposable devices in safe and effective regional anesthesia administration.

The market maintains resilience despite economic headwinds due to the non-discretionary nature of surgical care and pain management. Even during periods of fiscal restraint within healthcare systems, the shift away from reusable trays—which present sterilization risks and higher long-term operational costs—to disposable, pre-packaged kits remains an economically and clinically sound decision. This fundamental economic argument strongly supports the positive long-term growth forecast for this indispensable medical device category. Furthermore, the integration of educational resources, such as high-fidelity simulators for training clinicians on needle manipulation using specific kit designs, serves as a powerful market differentiator for leading industry vendors.

A crucial factor in competitive positioning is the ability of manufacturers to secure group purchasing organization (GPO) contracts in North America and similar centralized tenders in Europe. These large-scale agreements provide stable volume commitments but require exceptionally competitive pricing and impeccable quality assurance. Companies must demonstrate not only product superiority but also robust compliance documentation and consistent product availability to maintain these lucrative contracts, which often dictate market share across entire regions or health systems.

Finally, future analysis of this market must account for potential disruptions from non-invasive pain relief technologies or the development of automated robotic systems for regional blocks. While full automation is distant, partial automation and advanced imaging will continually push the demand towards kits designed for integration with these sophisticated technologies, making compatibility a key metric for future product success and market valuation. Companies that proactively invest in digital compatibility will secure a stronger foothold in the evolving anesthetic landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager