Disposable Coaxial Biopsy Needle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431908 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Disposable Coaxial Biopsy Needle Market Size

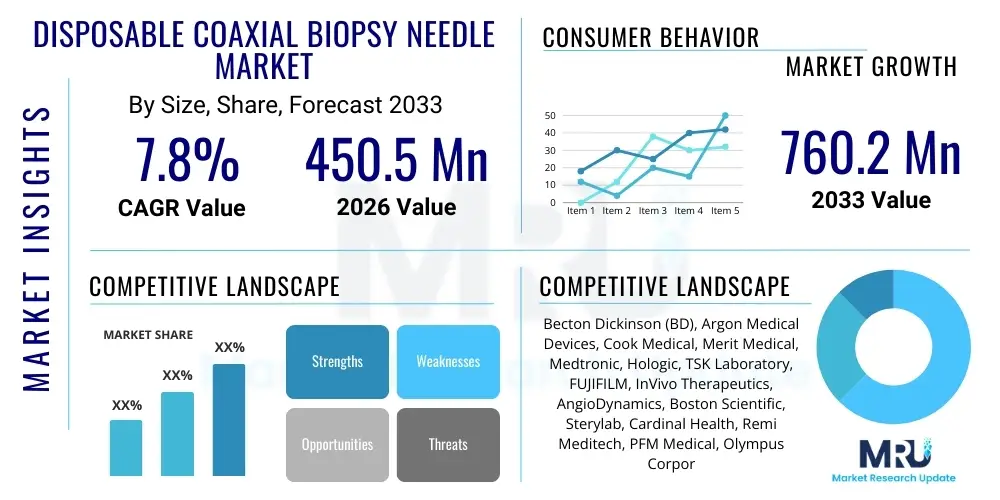

The Disposable Coaxial Biopsy Needle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 760.2 Million by the end of the forecast period in 2033.

Disposable Coaxial Biopsy Needle Market introduction

The Disposable Coaxial Biopsy Needle Market encompasses specialized medical instruments designed for the percutaneous collection of tissue samples (biopsies) from various organs, primarily for cancer diagnosis and disease staging. These needles facilitate minimally invasive procedures by using a coaxial system where an outer introducer needle guides the inner biopsy device, allowing multiple core samples to be collected through a single skin puncture site, thereby reducing trauma and increasing patient comfort. The primary product segments include automatic, semi-automatic, and manual systems, differentiated by their firing mechanism and the level of control provided to the clinician. Major applications span oncology and diagnostics, focusing heavily on breast, lung, liver, kidney, and prostate biopsies.

The core benefit of disposable coaxial biopsy needles lies in their sterile, single-use nature, which significantly mitigates the risk of cross-contamination and ensures optimal sharpness for precise tissue extraction. Furthermore, the coaxial design improves procedural efficiency, especially in complex or highly vascularized areas, by protecting surrounding healthy tissue and enabling rapid re-sampling. This efficiency is critical in high-volume settings like large hospital radiology departments and specialized oncology centers. The inherent safety profile and accuracy of these disposable systems are pivotal in driving their adoption globally, replacing older, more invasive surgical biopsy methods.

The market growth is fundamentally driven by the rising global prevalence of chronic diseases, particularly various forms of cancer, which necessitate early and accurate diagnostic procedures. Increased awareness regarding the advantages of minimally invasive procedures (shorter recovery times, lower complication rates), coupled with technological advancements leading to improved needle tip designs and compatibility with advanced imaging modalities (CT, MRI, Ultrasound), further stimulate demand. Additionally, expanding healthcare infrastructure and rising investments in diagnostic facilities across emerging economies are crucial factors bolstering the market trajectory over the forecast period.

Disposable Coaxial Biopsy Needle Market Executive Summary

The Disposable Coaxial Biopsy Needle Market is characterized by robust growth, propelled by the persistent increase in cancer incidence worldwide and the widespread adoption of minimally invasive diagnostic techniques. Business trends highlight intense competition centered on product innovation, focusing on features such as echogenic tips for enhanced ultrasound visibility, lighter ergonomic handles, and increased compatibility with advanced robotic guidance systems. Key market players are strategically engaging in mergers, acquisitions, and collaborations to expand their geographical footprint and diversify their product portfolios, particularly targeting specialty areas like targeted liver and renal biopsies. Furthermore, the market is seeing a push towards standardization of gauge sizes to simplify procurement processes for major hospital networks, alongside rising demand for automatic, high-speed firing mechanisms that yield higher quality core samples.

Regional trends indicate North America currently holds the dominant market share, attributed to established advanced healthcare systems, favorable reimbursement policies for minimally invasive procedures, and high consumer awareness regarding early disease diagnosis. However, the Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This accelerated growth in APAC is fueled by expanding healthcare accessibility, rapid urbanization, increasing governmental focus on improving diagnostic capabilities, and a large, aging patient pool susceptible to various cancers. Europe remains a significant market, primarily driven by strict regulatory standards ensuring high product quality and the early adoption of advanced diagnostic technologies in countries like Germany and the UK.

Segmentation trends reveal that the Automatic Coaxial Biopsy Needle segment is expected to maintain its leadership position due to its ease of use, speed, and ability to obtain consistent, high-quality tissue cores essential for molecular pathology. By application, the Breast Biopsy segment is a primary revenue driver, given the high volume of screening procedures. However, the Lung Biopsy segment is anticipated to witness significant growth, driven by the increasing incidence of lung cancer and the shift toward image-guided procedures. End-user analysis underscores Hospitals and Diagnostic Centers as the dominant consumers, though Ambulatory Surgical Centers (ASCs) are quickly gaining traction due to their cost-effectiveness and increasing procedural capability.

AI Impact Analysis on Disposable Coaxial Biopsy Needle Market

Users frequently inquire about how Artificial Intelligence (AI) will enhance the safety, efficiency, and diagnostic accuracy associated with disposable coaxial biopsy needles. Common questions center on AI's role in optimizing needle trajectory planning, automating real-time image guidance during the procedure (e.g., distinguishing malignant from benign tissue boundaries on ultrasound/CT scans), and ensuring the extracted tissue sample is representative and adequate for downstream analysis. The key theme emerging from user expectations is the demand for AI to reduce procedural variability, minimize the number of passes required to obtain a viable sample, and ultimately decrease both patient discomfort and diagnostic turnaround time. The consensus is that while AI will not replace the needle itself, it will dramatically refine the pre-procedural planning and intra-procedural execution stages, leading to a new generation of AI-integrated biopsy systems that elevate diagnostic precision and streamline clinical workflows.

- AI-Enhanced Image Interpretation: Algorithms automate the identification of target lesions and critical structures (nerves, vessels), improving the safety margin during needle insertion.

- Optimized Trajectory Planning: AI tools calculate the shortest, safest, and least invasive path for the coaxial needle to reach the lesion, especially in complex anatomical locations.

- Real-Time Guidance and Tracking: AI assists in compensating for organ movement (e.g., during lung biopsy due to respiration), maintaining optimal needle positioning throughout the firing sequence.

- Sample Adequacy Assessment: Computer vision algorithms analyze captured imaging data immediately after tissue retrieval to confirm whether the sample size and representation are sufficient for pathology, reducing the need for repeat procedures.

- Workflow Automation: Integration of AI into Electronic Health Records (EHR) and Picture Archiving and Communication Systems (PACS) automates documentation and quality assurance metrics related to the biopsy procedure.

DRO & Impact Forces Of Disposable Coaxial Biopsy Needle Market

The Disposable Coaxial Biopsy Needle Market is shaped by a strong combination of clinical imperatives and technological innovations, resulting in significant growth drivers (D) while confronting critical cost and regulatory hurdles (R). Opportunities (O) for expansion are emerging from geographic market penetration and technology convergence. The primary driver is the exponentially increasing global burden of cancer, necessitating early and precise tissue diagnosis. Furthermore, the paradigm shift from open surgery to minimally invasive, image-guided biopsy procedures significantly reduces patient morbidity and hospital stay duration, making these disposable devices the standard of care. Conversely, the high upfront cost associated with premium, technologically advanced needles, coupled with restrictive reimbursement policies in certain regions for newer technologies, acts as a significant restraint, especially in resource-limited settings. The constant need for specialized training for clinicians to perform complex image-guided biopsies also poses a barrier to wider adoption in community clinics.

Key opportunities exist in developing coaxial needles specifically optimized for emerging diagnostic techniques, such as liquid biopsy integration systems or needles designed for use with proprietary robotic systems that require unique compatibility features. Geographical expansion into underserved markets, particularly in rapidly developing regions of Southeast Asia and Africa where diagnostic infrastructure is improving, presents substantial revenue potential. The impact forces influencing the market are high, driven primarily by the stringent regulatory environment governing medical devices, which mandates rigorous clinical trials and quality assurance, thereby controlling market entry and accelerating product maturation cycles. Pricing pressure from Group Purchasing Organizations (GPOs) and major hospital networks also exerts considerable force on manufacturers' profit margins, compelling companies to achieve economies of scale and optimize their supply chains.

Technological impact forces are constantly at play, with ongoing research focusing on improved materials science, resulting in needles with sharper tips, greater rigidity, and reduced deflection during insertion, crucial for deep lesion targeting. Furthermore, the push for eco-friendly or biodegradable components in disposable instruments, responding to broader sustainability demands in healthcare, represents a medium-term impact force that manufacturers must address. The collective influence of these drivers, restraints, and opportunities ensures that the market remains dynamic, characterized by continuous innovation aimed at enhancing diagnostic yield while minimizing procedural risk. Successfully navigating the complex interplay of regulatory requirements and healthcare cost containment strategies will define the competitive success of market participants.

Segmentation Analysis

The Disposable Coaxial Biopsy Needle Market is comprehensively segmented based on product type, gauge size, application, and end-user, reflecting the diverse clinical requirements across various medical disciplines. This detailed segmentation allows manufacturers to tailor their product offerings to specific diagnostic needs, optimizing needle characteristics such as firing mechanism, tip geometry, and compatibility with imaging modalities. The analysis of these segments is crucial for strategic planning, revealing which product types are gaining traction (e.g., automatic systems for faster throughput) and which applications (e.g., lung and liver) are experiencing the most rapid growth due to changes in disease incidence and therapeutic approaches. Understanding the end-user landscape helps determine optimal distribution channels, focusing resources on high-volume centers like large academic hospitals versus specialized, outpatient clinics.

Product segmentation into automatic and semi-automatic categories is fundamental. Automatic needles, which feature high-speed, spring-loaded mechanisms, provide superior sample quality and are preferred for soft tissue biopsies where speed is critical to minimize movement artifact. Semi-automatic devices offer clinicians greater manual control over the penetration depth and sample retrieval, often favored in highly critical or superficial areas requiring meticulous manipulation. Gauge size segmentation is directly tied to the target organ and lesion size; smaller gauges (20G+) are typically used for fine-needle aspiration (FNA) or smaller lesions, while larger gauges (14G, 16G) are standard for core biopsies demanding larger tissue volumes for comprehensive histological analysis. The increasing sophistication in molecular pathology requires larger, intact core samples, favoring the growth of the 14G and 16G segments.

Application segmentation remains dominated by breast biopsy, driven by established screening programs and high prevalence rates. However, the fastest growth is anticipated in organs such as the lung and liver, where the diagnosis of metastatic and primary cancers increasingly relies on image-guided percutaneous techniques enabled by coaxial disposable systems. End-user analysis confirms that hospitals, especially those with comprehensive cancer centers, remain the largest purchasers due to their procedural volume and complex diagnostic needs. The growth of specialized clinics and Ambulatory Surgical Centers (ASCs) is creating a decentralized demand stream, driven by the desire for cost-effective, high-quality outpatient procedures, influencing distribution strategies toward smaller, specialized inventory management systems.

- By Type:

- Automatic Coaxial Biopsy Needles

- Semi-Automatic Coaxial Biopsy Needles

- Manual Coaxial Biopsy Needles

- By Gauge Size:

- 14G and 16G

- 18G and 20G

- Others (20G+)

- By Application:

- Breast Biopsy

- Lung Biopsy

- Liver Biopsy

- Kidney Biopsy

- Prostate Biopsy

- Other Applications (Soft Tissue, Bone Marrow)

- By End-User:

- Hospitals and Diagnostic Centers

- Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

Value Chain Analysis For Disposable Coaxial Biopsy Needle Market

The value chain for the Disposable Coaxial Biopsy Needle Market begins with the upstream sourcing of specialized raw materials, primarily high-grade stainless steel (often medical grade 304 or 316) for the needle cannula, and precision plastics (such as polycarbonate or ABS) for the firing mechanism and handle components. Upstream analysis involves rigorous quality control over material suppliers, as the sharpness, rigidity, and biocompatibility of the final product depend entirely on material integrity. Manufacturing processes involve highly specialized precision machining, laser cutting, grinding, and assembly under strict ISO 13485 standards and cleanroom conditions, essential for ensuring the consistency and sterility of disposable devices. Companies invest heavily in automation here to manage the complexity of assembling the inner stylet, outer cannula, and firing mechanism, aiming for high volume production while maintaining zero defect rates, which is critical for patient safety.

The midstream process focuses on sterilization (typically EtO or Gamma irradiation), packaging, and inventory management. Distribution channels form the critical link to the downstream market. The channel structure is typically bifurcated into direct sales teams, targeting large hospital networks and academic medical centers for high-volume contracts, and indirect distribution through specialized medical device distributors or agents who handle sales and logistics for smaller clinics, ASCs, and international markets. The choice between direct and indirect distribution depends on the manufacturer's scale, regional presence, and the existing regulatory landscape, which dictates licensing and market access requirements in different countries. Effective logistics management is paramount due to the high-value, sensitive nature of the product, requiring controlled environments and timely delivery to maintain product integrity and meet surgical scheduling demands.

Downstream analysis centers on the relationship between manufacturers and the end-users: hospitals, diagnostic centers, and clinics. Sales and marketing efforts are heavily focused on demonstrating clinical efficacy, procedural efficiency, and economic value compared to reusable systems. Post-sales activities, while limited for disposable products, include technical support related to imaging system compatibility and clinician training programs on optimal usage techniques. Direct distribution allows manufacturers better control over pricing and access to crucial feedback regarding product performance and emerging clinical needs, driving the next cycle of product innovation. The involvement of centralized purchasing groups (GPOs) significantly impacts downstream pricing power, forcing manufacturers to justify the clinical superiority of their products to secure preferred vendor status and long-term supply contracts.

Disposable Coaxial Biopsy Needle Market Potential Customers

The primary customers and end-users of Disposable Coaxial Biopsy Needles are specialized medical institutions and healthcare providers dedicated to diagnostics and oncology. Hospitals, particularly those with comprehensive radiology and interventional oncology departments, constitute the largest customer base. These institutions manage high volumes of diagnostic imaging procedures, including CT, MRI, and ultrasound-guided biopsies, requiring a constant and reliable supply of sterile, high-performance disposable systems across multiple gauge sizes and design types. Academic medical centers are also critical customers, often adopting the newest technologies first for complex cases and clinical trials, thereby setting procurement trends for the wider market.

Specialty Clinics and Independent Diagnostic Centers represent a rapidly expanding customer segment. These facilities focus specifically on high-volume outpatient procedures, such as breast and prostate biopsies, valuing efficiency, cost containment, and rapid patient throughput. Their purchasing decisions are often highly sensitive to the overall cost-per-procedure and the ease of integration with their existing imaging equipment. The rise of Ambulatory Surgical Centers (ASCs) is also increasing the demand for these devices, as more previously hospital-exclusive procedures migrate to outpatient settings, driven by reduced healthcare costs and shorter patient stays, positioning ASCs as increasingly valuable targets for manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 760.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton Dickinson (BD), Argon Medical Devices, Cook Medical, Merit Medical, Medtronic, Hologic, TSK Laboratory, FUJIFILM, InVivo Therapeutics, AngioDynamics, Boston Scientific, Sterylab, Cardinal Health, Remi Meditech, PFM Medical, Olympus Corporation, Kirwan Surgical Products, Stryker Corporation, Terumo Corporation, Vygon. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Coaxial Biopsy Needle Market Key Technology Landscape

The Disposable Coaxial Biopsy Needle market is highly dependent on continuous technological advancements, focusing primarily on enhancing precision, visibility under imaging, and optimizing the sample collection mechanism. A critical area of innovation is in needle material science and design, involving the use of specialized alloys and surface treatments to improve cannula rigidity, minimizing deflection as the needle traverses soft tissue to reach deep-seated lesions. Manufacturers are integrating advanced tip designs, such as bevel tips or trocar points, which require less force for insertion, resulting in reduced patient trauma and improved procedural control. Furthermore, the development of echogenic coatings and patterns on the needle tip and shaft is paramount for enhancing ultrasound visibility, ensuring the clinician can accurately track the needle in real-time, a key requirement for image-guided procedures.

Another significant technological focus involves optimizing the firing mechanisms, particularly in automatic systems. Newer generations of automatic needles feature lighter components, reduced recoil, and multi-speed firing capabilities, allowing customization based on tissue density and target location. This refinement leads to a more controlled, rapid firing sequence, crucial for obtaining larger, less fragmented core samples required for advanced molecular diagnostics and genomic testing. Integration with real-time navigation and guidance systems, including specialized interfaces compatible with CT fluoroscopy and MRI systems, represents a major technological trajectory. This ensures the coaxial system functions seamlessly within complex imaging suites, improving diagnostic yield and reducing exposure time for both the patient and the operator.

The rise of micro-miniaturization and connectivity is also impacting the landscape, paving the way for disposable needles with integrated sensing capabilities. Although nascent, research is focusing on smart needles equipped with minimal sensors to provide real-time feedback on tissue impedance or temperature, potentially helping to confirm needle tip location within the lesion before sample collection. Given the disposable nature of the product, balancing performance requirements with manufacturing cost efficiency is a perpetual technological challenge. Companies are therefore investing in highly automated, high-precision assembly lines to maintain competitive pricing while incorporating complex mechanical components and advanced surface technologies required by today’s sophisticated diagnostic procedures.

Regional Highlights

- North America (Dominant Market Share): The region, led by the United States, commands the largest share due to the early adoption of advanced medical technologies, high prevalence of cancer, exceptionally well-established screening programs, and robust reimbursement frameworks covering minimally invasive procedures. The presence of major market leaders and significant investment in clinical R&D further solidify its market position.

- Europe (Mature and Stable Growth): Europe maintains strong market revenue, driven by stringent regulatory requirements ensuring product quality and safety, high levels of healthcare expenditure in Western European countries (Germany, France, UK), and a proactive approach to adopting image-guided diagnostic techniques. Growth is stable, focusing heavily on procedural efficiency and ergonomic design.

- Asia Pacific (APAC) (Fastest Growth Trajectory): APAC is anticipated to exhibit the highest CAGR, primarily fueled by the rapid expansion of healthcare infrastructure, increasing disposable incomes leading to greater access to advanced diagnostics, and a massive, growing patient demographic. Countries like China, India, and Japan are heavily investing in upgrading diagnostic capabilities and combating rising cancer incidence rates, creating immense untapped market potential.

- Latin America (Emerging Potential): This region is characterized by improving healthcare access and government initiatives aimed at modernizing medical facilities. While infrastructure challenges persist, increasing awareness of early cancer detection and growing partnerships between international manufacturers and local distributors are driving moderate but accelerating market penetration.

- Middle East and Africa (MEA) (Strategic Niche Growth): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, benefiting from substantial government spending on healthcare modernization and medical tourism. The market is highly reliant on imported finished goods and is focused on establishing centralized specialty centers capable of advanced diagnostic procedures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Coaxial Biopsy Needle Market.- Becton Dickinson (BD)

- Argon Medical Devices

- Cook Medical

- Merit Medical Systems

- Medtronic plc

- Hologic, Inc.

- TSK Laboratory

- FUJIFILM Holdings Corporation

- InVivo Therapeutics Holdings Corp.

- AngioDynamics

- Boston Scientific Corporation

- Sterylab S.r.l.

- Cardinal Health

- Remi Meditech Pvt. Ltd.

- PFM Medical AG

- Olympus Corporation

- Stryker Corporation

- Terumo Corporation

- Vygon SA

- Biomedical s.r.l.

Frequently Asked Questions

Analyze common user questions about the Disposable Coaxial Biopsy Needle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a disposable coaxial biopsy needle and how does it improve procedure safety?

A disposable coaxial biopsy needle system uses an outer introducer cannula to access the target lesion, allowing multiple passes with the inner biopsy needle through a single skin puncture. This design minimizes tissue trauma, reduces procedure time, and ensures high sterility, significantly improving patient safety and comfort compared to traditional methods.

Which types of biopsies primarily use disposable coaxial needles?

Disposable coaxial needles are predominantly utilized in image-guided core needle biopsies for various organs, with the primary applications being breast biopsy, lung biopsy, liver biopsy, and renal (kidney) biopsy. They are crucial for obtaining accurate, adequate tissue samples needed for modern histological and genomic testing.

How does the automatic biopsy needle segment differ from the semi-automatic segment?

Automatic needles feature a spring-loaded, rapid-fire mechanism optimized for speed and consistency, generally preferred for deep, hard-to-reach lesions or when minimal firing time is critical. Semi-automatic needles provide the clinician with independent control over the stylet advancement and cannula cut, offering greater maneuverability and precise depth control, often favored in superficial or critical anatomical areas.

What technological trends are currently shaping the disposable biopsy needle market?

Key technological trends include enhanced echogenic markings for superior visibility under ultrasound, the development of specialized alloys for reduced needle deflection and increased rigidity, and advanced ergonomic handles. Future trends involve AI integration for optimized trajectory planning and real-time guidance during complex procedures.

Which geographic region presents the highest growth potential for this market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by expanding healthcare infrastructure investment, a large population base with increasing cancer incidence, and growing adoption of minimally invasive diagnostic standards across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager