Disposable Inflation Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435292 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Disposable Inflation Devices Market Size

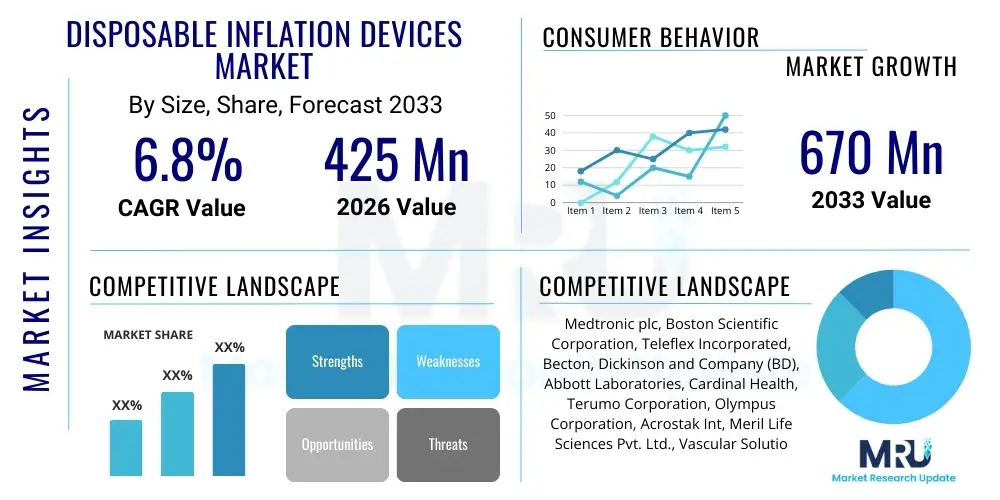

The Disposable Inflation Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $425 Million in 2026 and is projected to reach $670 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global incidence of cardiovascular and peripheral artery diseases, which necessitate complex interventional procedures such as angioplasty and stent placement. Disposable devices offer enhanced infection control and reduced maintenance costs compared to their reusable counterparts, making them increasingly preferred in high-volume catheterization labs and ambulatory surgical centers (ASCs).

The transition towards single-use medical equipment is a significant trend bolstering market expansion. Healthcare facilities are actively seeking ways to mitigate the risks associated with cross-contamination and the complex sterilization protocols required for reusable instruments. Disposable inflation devices, which ensure sterility and consistent performance out of the box, address these critical operational and patient safety concerns. Furthermore, technological advancements leading to devices with improved ergonomics, precise pressure monitoring, and rapid deflation mechanisms are enhancing procedural efficiency and overall physician acceptance, particularly in emergency settings where rapid response is crucial.

Geographically, market expansion is heavily influenced by the adoption rates of advanced interventional cardiology techniques across emerging economies. While North America and Europe currently dominate the market due to established healthcare infrastructure and favorable reimbursement policies, the Asia Pacific region is expected to demonstrate the highest CAGR during the forecast period. This accelerated growth in APAC is driven by rising healthcare expenditure, a rapidly aging population, and the expansion of medical tourism focusing on specialized procedures. The persistent demand for cost-effective, high-quality, and infection-safe tools remains the central pillar sustaining the robust financial outlook for the disposable inflation devices segment through 2033.

Disposable Inflation Devices Market introduction

Disposable inflation devices are specialized medical instruments primarily used in interventional procedures, such as percutaneous transluminal coronary angioplasty (PTCA) and peripheral vascular interventions (PVI), to accurately and safely inflate angioplasty balloons or deploy vascular stents. These devices consist of a syringe barrel, a plunger, a gauge for precise pressure monitoring (usually up to 20-30 atmospheres), and a connector for coupling with the catheter system. The core product function revolves around generating high, controlled hydrostatic pressure to ensure optimal lesion dilatation and stent apposition within a blood vessel.

Major applications of disposable inflation devices are concentrated in cardiology, radiology, and vascular surgery, crucial for treating conditions like coronary artery stenosis, peripheral arterial disease, and venous obstructions. Key benefits driving their adoption include superior infection control due to the single-use nature, elimination of sterilization costs and logistical burdens associated with reusable equipment, and guaranteed performance consistency for every procedure. These factors collectively enhance patient safety and streamline clinical workflows, directly contributing to better surgical outcomes and reduced hospital stay times.

The primary driving forces for this market encompass the escalating prevalence of chronic lifestyle diseases requiring minimally invasive treatment, the increasing global volume of angioplasty and stenting procedures, and regulatory mandates favoring single-use instruments to curb healthcare-associated infections (HAIs). Furthermore, continuous innovation in ergonomic design and the integration of digital pressure sensors capable of highly accurate, real-time pressure management further solidify the essential role of disposable inflation devices in modern catheterization laboratory practice.

Disposable Inflation Devices Market Executive Summary

The Disposable Inflation Devices Market is poised for stable expansion, characterized by a persistent shift from reusable to single-use platforms driven by heightened awareness of infection control and evolving regulatory standards across developed healthcare systems. Key business trends include aggressive mergers and acquisitions among major medical device manufacturers seeking to consolidate market share and expand their cardiovascular product portfolios, coupled with strategic collaborations aimed at integrating advanced pressure sensing technology into standard disposable units. The trend towards optimizing cost-efficiency in hospital settings further favors disposable models, as they eliminate the capital expenditure and operational costs associated with reprocessing. Furthermore, specialized devices designed for high-pressure applications (up to 30 ATM) are gaining traction, reflecting the complexity of modern vascular lesions being treated.

Regionally, North America maintains its dominance due to high procedural volumes, established reimbursement structures for interventional cardiology, and the early adoption of premium, technology-integrated disposable devices. However, the Asia Pacific region is emerging as the fastest-growing market, propelled by infrastructural development in countries like China and India, expanding health insurance coverage, and a burgeoning patient demographic suffering from cardiovascular ailments. European stability is maintained by strong clinical guidelines advocating for single-use devices, while Latin America and MEA show potential fueled by increasing investment in specialized cardiac care facilities. These regional variances necessitate tailored market entry strategies focusing either on premium feature offerings (developed markets) or cost-effective volume solutions (emerging markets).

Segmentation trends indicate that mechanical inflation devices still hold a significant market share due to their reliability and simplicity, but electronic or digitized inflation devices are expected to grow faster, leveraging integrated features like automatic pressure locking and digital readouts for enhanced safety and precision. By application, coronary interventions remain the largest segment, though peripheral interventions are exhibiting rapid growth due to the rising global incidence of peripheral artery disease (PAD) linked to diabetes and obesity. End-user segmentation confirms that hospitals and catheterization laboratories are the primary purchasers, with Ambulatory Surgical Centers (ASCs) representing a promising, high-growth segment driven by the shift towards outpatient settings for less complex procedures.

AI Impact Analysis on Disposable Inflation Devices Market

Common user questions regarding AI's impact on disposable inflation devices center on whether AI can improve procedural outcomes, how it might integrate with existing disposable hardware, and if it will ultimately reduce the need for highly skilled manual operation. Users are primarily concerned with predictive analytics related to optimal inflation pressure, real-time feedback loops to prevent vessel damage, and leveraging AI for better inventory management and procedural planning in catheterization labs. The underlying theme is the expectation that AI should enhance precision and standardization, thereby minimizing complications associated with manual pressure control during critical interventional steps.

The integration of Artificial Intelligence into the ecosystem of disposable inflation devices is not focused on the device’s mechanical function itself but rather on enhancing the data surrounding its use and the procedural context. AI algorithms can process real-time hemodynamic data, angiographic images, and patient-specific vessel characteristics to provide the interventionalist with an optimal inflation pressure profile or duration recommendation before the device is even activated. This level of predictive guidance ensures safer deployment of stents and balloons, reducing the risk of barotrauma or incomplete lesion coverage, transforming the manual operation into an augmented, data-driven process.

Furthermore, AI plays a crucial role in the manufacturing and supply chain efficiency of disposable inflation devices. Machine learning algorithms optimize production schedules, forecast demand based on regional disease prevalence and seasonal procedural trends, and conduct automated quality control checks on the components of the disposable unit, ensuring superior reliability. While the device remains a mechanical single-use component, AI acts as a pervasive intelligence layer that standardizes procedural protocols, minimizes human error, and ensures that the right disposable product is available at the right time for critical interventions, thus increasing overall utilization and lowering operational wastage.

- AI-powered predictive modeling optimizes ideal inflation pressure based on vessel characteristics, enhancing procedural safety.

- Real-time image analysis guided by AI assists in precise balloon positioning, ensuring accurate deployment of the disposable device.

- Machine learning algorithms streamline inventory management for catheterization labs, reducing stockouts of essential disposable inflation units.

- AI enhances manufacturing quality control by detecting microscopic defects in disposable components, improving device reliability.

- Data integration allows AI systems to analyze pressure trends recorded by digital disposable devices for post-procedure outcome assessment and standardization.

DRO & Impact Forces Of Disposable Inflation Devices Market

The Disposable Inflation Devices Market is primarily driven by the globally increasing burden of cardiovascular diseases, which necessitates a high volume of complex interventional procedures requiring precise inflation control. Restraints include the persistent preference for reusable devices in low-resource settings seeking cost containment and the stringent regulatory hurdles faced during new product clearance, especially concerning pressure accuracy and material biocompatibility. Significant opportunities lie in developing devices compatible with advanced imaging modalities (like IVUS/OCT) and expanding market penetration into high-growth segments such as neurovascular interventions. These dynamics create a competitive landscape where technological innovation is crucial, and regulatory compliance acts as a substantial entry barrier, shaping the market's overall trajectory and impacting profitability.

A major driving force is the regulatory pressure, particularly in North America and Western Europe, to adopt single-use devices as a primary measure against Healthcare-Associated Infections (HAIs). This regulatory environment mandates high standards for sterilization and traceability, which reusable devices often struggle to meet cost-effectively, naturally promoting the disposable segment. Additionally, rapid technological evolution, including the miniaturization of pressure sensors and the development of ergonomic, user-friendly designs, improves physician efficiency and patient outcomes, thereby sustaining high demand. The rising incidence of lifestyle diseases (diabetes, hypertension) that lead to arterial blockages further guarantees a steady increase in the procedural volume where these devices are indispensable.

Conversely, significant market restraints include the relatively high per-unit cost of advanced disposable inflation devices compared to older reusable models, creating budgetary pressures, especially in public healthcare systems or developing markets. Furthermore, the reliance on plastics and non-biodegradable materials raises environmental sustainability concerns, prompting manufacturers to invest in new, potentially more expensive, eco-friendly materials, which could temporarily restrain growth due to increased production costs. The market is also heavily influenced by reimbursement policies—any adverse changes in coverage for complex interventional procedures could directly reduce procedural volume and, consequently, the demand for inflation devices.

Segmentation Analysis

The Disposable Inflation Devices Market is extensively segmented based on device type, application, and end-user, reflecting the diverse clinical needs and operational environments utilizing these precision instruments. Segmentation by device type primarily differentiates between mechanical (manual) and digital/electronic inflation devices, with the latter rapidly gaining traction due to superior accuracy and data logging capabilities essential for modern clinical documentation. Mechanical devices, while simpler and more cost-effective, are increasingly being substituted in high-stakes procedures where millimeter-level precision is non-negotiable.

Application segmentation highlights the critical role of these devices in cardiology and peripheral vascular interventions. Coronary angioplasty remains the foundational application, generating the largest revenue due to the high global prevalence of coronary artery disease. However, peripheral vascular applications, addressing diseases in the legs, arms, and neck, are experiencing accelerated growth, driven by an aging and increasingly diabetic population. Furthermore, smaller, niche applications like neurovascular and gastrointestinal interventions represent emerging segments demanding specialized device features, such as lower volume capacity and enhanced tactile feedback.

The end-user segment is dominated by Hospitals and Catheterization Laboratories (Cath Labs), which perform the vast majority of complex cardiovascular procedures. These institutions require high-volume procurement and often favor advanced, digitally integrated models. Ambulatory Surgical Centers (ASCs) are the fastest-growing end-user segment, driven by cost containment strategies encouraging the shift of routine, non-complex interventional procedures to outpatient settings. This structural shift necessitates disposable solutions that minimize reprocessing logistics and maximize turnover efficiency in smaller clinical environments.

- Device Type:

- Mechanical Inflation Devices

- Digital/Electronic Inflation Devices

- Application:

- Coronary Interventions

- Peripheral Interventions

- Neurovascular Interventions

- Gastrointestinal Interventions

- Other Applications

- End-User:

- Hospitals and Catheterization Laboratories

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

Value Chain Analysis For Disposable Inflation Devices Market

The value chain for the Disposable Inflation Devices Market begins with upstream activities focused on sourcing high-grade raw materials, specifically engineering plastics (polycarbonate, ABS) for the housing, specialized medical-grade metals (stainless steel) for internal components, and calibrated pressure gauges. Key upstream processes involve precision molding and sensor manufacturing, where quality control is paramount to ensure pressure accuracy and device integrity. Suppliers in this segment often specialize in highly regulated material production and maintain strict adherence to ISO 13485 standards, forming the foundation of device reliability.

The core midstream phase involves the design, assembly, and sterilization of the disposable inflation devices. Manufacturing complexity arises from integrating precise mechanical components with potentially digital pressure sensors and ensuring airtight sealing for high-pressure operation. Downstream activities involve distribution channels, which are crucial due to the time-sensitive and critical nature of these medical supplies. Direct sales channels are often utilized for large hospital networks and key opinion leaders, providing specialized training and technical support, which helps manufacturers maintain tight control over product performance feedback.

Indirect distribution relies heavily on large medical supply distributors and group purchasing organizations (GPOs), particularly for serving smaller clinics and Ambulatory Surgical Centers (ASCs). GPOs facilitate bulk purchases, offering standardized pricing and efficient logistics. Effective inventory management within these channels is vital, as devices have specific shelf lives and must be immediately accessible for emergency procedures. The profitability throughout the chain is determined by optimizing manufacturing efficiency (reducing material waste) and streamlining distribution logistics to ensure rapid and cost-effective delivery to the point of use.

Disposable Inflation Devices Market Potential Customers

The primary customers and end-users of disposable inflation devices are highly specialized medical institutions that perform catheter-based interventions. The largest segment of buyers comprises major hospitals, particularly those with dedicated, high-volume cardiac and vascular catheterization laboratories (Cath Labs). These facilities prioritize devices offering maximum pressure capacity, superior accuracy, and integrated safety features to manage complex coronary and peripheral lesions. Procurement decisions in large hospitals are typically centralized, driven by clinical consensus and cost-efficiency agreements negotiated through Group Purchasing Organizations (GPOs), often favoring long-term contracts with established medical device suppliers.

A rapidly growing segment of potential customers includes Ambulatory Surgical Centers (ASCs) and specialized outpatient vascular clinics. These centers are increasingly performing less complex, elective interventional procedures, requiring disposable devices that minimize turnaround time and reprocessing burdens. ASCs generally exhibit a strong preference for cost-effective, high-quality disposable units that integrate seamlessly into their efficient, low-overhead operational model. Their buying behavior is heavily influenced by ease of use and the total cost of ownership, making simple, reliable mechanical or basic digital disposable devices highly attractive.

Furthermore, academic medical centers and university teaching hospitals represent key potential customers, not only for their high procedural volumes but also for their role in clinical trials and physician training. These institutions often adopt the newest, most technologically advanced digital inflation devices first, serving as reference sites and providing crucial clinical feedback to manufacturers. The procurement teams at these academic centers focus on both clinical superiority and the ability of the device to integrate with advanced imaging and electronic health record (EHR) systems for research and teaching purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $425 Million |

| Market Forecast in 2033 | $670 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, Boston Scientific Corporation, Teleflex Incorporated, Becton, Dickinson and Company (BD), Abbott Laboratories, Cardinal Health, Terumo Corporation, Olympus Corporation, Acrostak Int, Meril Life Sciences Pvt. Ltd., Vascular Solutions (Teleflex), Cook Medical, MicroVention Inc., Translumina, Minvasys, OptoMedic, Merit Medical Systems, Inc., Penumbra, Inc., Asahi Intecc Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Inflation Devices Market Key Technology Landscape

The technology landscape for disposable inflation devices is defined by continuous innovation focused on precision, safety, and integration. A crucial technological element is the development of highly accurate digital pressure sensing and display mechanisms. Modern devices increasingly incorporate integrated microprocessors and strain gauge sensors that provide real-time, high-resolution pressure readings, significantly improving upon traditional analog gauges which can suffer from parallax error and reduced accuracy at extreme pressures. This digital integration allows for features like automatic pressure locking and warning systems, vital for maintaining precise inflation during complex stenting procedures and minimizing the risk of vessel rupture or incomplete lesion expansion.

Another significant technological advancement centers on the ergonomic design and material science used in the construction of the device body and connection systems. Manufacturers are utilizing advanced, lightweight, and high-strength polymer composites to ensure the devices can withstand extremely high internal pressures (up to 30 ATM) while remaining compact and easy for the physician to manipulate. Innovative quick-release or dual-port connections are also being standardized to ensure rapid attachment and detachment from the catheter system, reducing procedural time and minimizing blood loss during interventions. Furthermore, the push for eco-friendly materials is driving research into bio-absorbable or easily recyclable plastics, though widespread adoption is still constrained by cost and regulatory requirements.

The future technology landscape involves greater integration with complementary diagnostic and imaging tools. Devices are being developed with standardized digital outputs that can interface directly with advanced imaging systems like Intravascular Ultrasound (IVUS) and Optical Coherence Tomography (OCT) systems. This technological linkage enables procedural documentation and optimization, allowing interventionalists to correlate the precise inflation pressure applied with the resulting vessel lumen gain visualized on the screen. This data correlation capability, often supported by integrated battery packs for sustained digital functionality, transforms the disposable inflation device from a simple mechanical tool into a sophisticated, data-generating instrument essential for achieving optimal clinical outcomes and supporting evidence-based practice.

Regional Highlights

North America currently dominates the Disposable Inflation Devices Market, primarily driven by exceptionally high healthcare spending, a robust infrastructure of specialized cardiac centers, and strong reimbursement policies for complex cardiovascular interventions. The U.S. market, in particular, benefits from the swift adoption of premium, digital inflation devices and strict regulatory guidelines from bodies like the FDA, which favor single-use items to mitigate infection risks. High prevalence rates of coronary artery disease and peripheral artery disease, coupled with an aging demographic, ensure sustained demand for high-precision disposable devices. Furthermore, the concentrated presence of major market players and active clinical research contributes significantly to technological penetration and market size in this region.

Europe represents the second-largest market, characterized by stable growth supported by universal healthcare access and well-established clinical protocols for catheter-based procedures across countries such as Germany, the UK, and France. European market growth is bolstered by increasing investment in minimally invasive surgery techniques and a growing public health focus on reducing surgical site infections, accelerating the shift away from reusable instruments. However, pricing pressures and varying economic conditions among Eastern European nations sometimes present challenges, leading to a bifurcated market where Western European countries adopt advanced digital devices, while Eastern regions may prioritize cost-effective mechanical disposable solutions.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is attributed to massive population bases, improving healthcare access, increasing medical tourism, and rising disposable incomes fueling investment in advanced medical technologies, particularly in countries like China, India, and Japan. While procedural volumes are rapidly escalating, regulatory landscapes are evolving, and the key challenge remains balancing the need for high-quality disposable devices with intense price sensitivity. Manufacturers entering this region often focus on establishing local manufacturing hubs and strategic partnerships to navigate distribution complexities and capitalize on the massive untapped patient pool requiring primary interventions.

- North America: Market leader due to high procedural volumes, established reimbursement, and rapid adoption of digital disposable technology in the U.S. and Canada.

- Europe: Stable growth driven by standardized clinical protocols, strong governmental support for cardiovascular care, and stringent infection control mandates.

- Asia Pacific (APAC): Fastest-growing region, fueled by expanding healthcare infrastructure, rising incidence of lifestyle diseases, and increasing patient awareness in China and India.

- Latin America: Emerging market potential driven by improving economic conditions and increased foreign investment in specialized medical facilities.

- Middle East and Africa (MEA): Growth concentrated in Gulf Cooperation Council (GCC) countries due to high medical tourism expenditure and modernization of cardiac care centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Inflation Devices Market.- Medtronic plc

- Boston Scientific Corporation

- Teleflex Incorporated

- Becton, Dickinson and Company (BD)

- Abbott Laboratories

- Cardinal Health

- Terumo Corporation

- Olympus Corporation

- Acrostak Int

- Meril Life Sciences Pvt. Ltd.

- Vascular Solutions (Teleflex)

- Cook Medical

- MicroVention Inc.

- Translumina

- Minvasys

- OptoMedic

- Merit Medical Systems, Inc.

- Penumbra, Inc.

- Asahi Intecc Co., Ltd.

- Advanced Cardiovascular Systems (ACS)

Frequently Asked Questions

Analyze common user questions about the Disposable Inflation Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of disposable inflation devices over reusable devices in interventional cardiology?

The primary advantages are enhanced infection control, guaranteed sterility, elimination of expensive and complex sterilization/reprocessing logistics, and consistent, calibrated performance for every procedure. Disposables significantly reduce the risk of Healthcare-Associated Infections (HAIs) compared to reusable models.

How does the segmentation between mechanical and digital inflation devices affect procedural outcomes?

Digital inflation devices offer superior precision and safety features, including real-time electronic pressure monitoring, automatic pressure holding, and data logging capabilities. While mechanical devices are reliable and cost-effective, digital units provide higher accuracy critical for complex stenting, leading to better lesion expansion and documented standardization of the procedure.

Which geographical region exhibits the fastest growth potential for the disposable inflation devices market?

The Asia Pacific (APAC) region is forecast to show the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by the rapid expansion of healthcare infrastructure, increased governmental investment in cardiovascular care, and the rising prevalence of chronic vascular diseases across major economies like China and India.

What is the current impact of regulatory standards on the adoption of disposable inflation devices?

Regulatory bodies globally, especially the FDA and European authorities, are enforcing increasingly stringent standards regarding sterilization and patient safety. This trend strongly favors disposable devices, as they inherently comply with mandates against cross-contamination and ensure product traceability, acting as a major market driver across developed economies.

Are Ambulatory Surgical Centers (ASCs) a significant growth segment for the disposable inflation devices market?

Yes, ASCs represent a highly significant growth segment. The industry trend toward shifting simpler, cost-efficient interventional procedures from high-cost hospitals to outpatient settings boosts demand for disposable devices in ASCs, minimizing operational complexity and maximizing quick patient turnaround times.

What role do specialized materials play in the manufacturing of high-pressure disposable inflation devices?

Specialized, high-strength engineering plastics and polymers (such as reinforced polycarbonate and ABS blends) are crucial. These materials ensure the device housing and internal components can safely withstand extremely high pressures—up to 30 atmospheres—required for full balloon expansion and stent deployment without structural failure or leakage, thereby guaranteeing patient safety and procedural effectiveness.

How does the value chain manage the distribution of disposable inflation devices to ensure timely availability?

The distribution segment relies on a hybrid model involving direct sales for large hospital systems and extensive use of Group Purchasing Organizations (GPOs) and specialized medical distributors for broader reach. Logistics are managed to ensure efficient inventory turnover, minimizing shelf-life expiration risks and guaranteeing immediate availability of sterile devices required for unplanned or emergency interventional procedures in Cath Labs.

What are the key restraint factors challenging the growth of the disposable inflation devices market?

Major challenges include the higher per-unit manufacturing cost of disposable, advanced devices compared to reusable sets, the budgetary limitations faced by public health systems, and growing environmental concerns related to the large volume of plastic medical waste generated by single-use products, prompting calls for sustainable material innovation.

Beyond cardiology, what are the emerging application areas driving demand for disposable inflation devices?

Emerging demand is significantly driven by complex peripheral interventions, treating conditions like Peripheral Artery Disease (PAD) associated with diabetes. Additionally, specialized neurovascular procedures, often requiring smaller, highly precise devices for intracranial access, and certain gastrointestinal endoscopic interventions are increasingly utilizing dedicated disposable inflation platforms.

In what ways is Artificial Intelligence (AI) expected to enhance the usage of disposable inflation devices?

AI will primarily enhance usage through predictive analytics and decision support. It can analyze patient-specific data and real-time angiography to recommend optimal inflation pressures, standardize procedural protocols, and provide post-procedure analysis on the effectiveness of the inflation process, thereby increasing precision without altering the device's mechanical nature.

How do reimbursement policies influence the market dynamics for advanced digital disposable inflation devices?

Favorable reimbursement policies for complex interventional procedures, particularly those utilizing high-precision techniques, directly encourage hospitals to invest in advanced digital disposable devices. Where procedures are well-reimbursed, the higher unit cost of digital devices is justified by the clinical benefits, procedural efficiency gains, and reduced risk of complications.

What are the main segments within the application category of the disposable inflation devices market?

The primary application segments include Coronary Interventions, which constitute the largest segment, followed by Peripheral Interventions, which is the fastest-growing. Other critical segments include Neurovascular Interventions and specialized Gastrointestinal and Urology procedures requiring precise pressure control for balloon expansion.

Why is the precise calibration of the pressure gauge so important for disposable inflation devices?

Precise calibration is critical because procedural success in angioplasty and stenting relies on applying the exact prescribed pressure to fully expand the balloon or secure the stent without exceeding the vessel's tolerance limit. Inaccurate gauges can lead to under-expansion (stent failure) or over-expansion (vessel injury), making reliability paramount for patient safety and efficacy.

Which specific patient demographic trends are fueling the long-term growth of this market?

Long-term growth is driven by the global aging population, which is more susceptible to vascular diseases, and the rising global incidence of metabolic disorders such as Type 2 diabetes and obesity. These conditions significantly contribute to the prevalence of Coronary Artery Disease (CAD) and Peripheral Artery Disease (PAD), ensuring sustained demand for interventional devices.

How are manufacturers integrating ergonomics and safety features into new disposable inflation device designs?

Manufacturers are focusing on lightweight designs, intuitive plunger mechanisms that require less force, and specialized handles that provide tactile feedback. Safety features include clear, high-contrast digital displays, built-in safety valves to prevent over-pressurization, and secure locking mechanisms to maintain pressure consistency during critical deployment phases.

What role do Group Purchasing Organizations (GPOs) play in the procurement of disposable inflation devices?

GPOs are instrumental in the procurement process by consolidating the purchasing power of multiple hospitals and healthcare networks. They negotiate standardized pricing and long-term supply contracts for disposable devices, ensuring cost savings and streamlined logistics for healthcare providers while guaranteeing high-volume sales for manufacturers.

How do competitive dynamics influence the pricing strategy within the disposable inflation devices market?

The market faces intense competition, particularly in the mechanical device segment, leading to moderate pricing pressures. However, in the high-end digital segment, pricing is maintained by focusing on proprietary technology, superior accuracy, and integration features, allowing manufacturers to command premium prices based on clinical value and brand reputation.

What is the impact of economic downturns on the procurement patterns for disposable inflation devices?

While critical procedures cannot be halted, economic downturns can lead healthcare facilities to shift procurement towards lower-cost, high-quality mechanical disposable devices instead of the latest, most expensive digital models. Furthermore, inventory optimization becomes critical, leading to more conservative purchasing forecasts to minimize operational capital expenditure.

Are there significant market opportunities related to emerging imaging technologies like IVUS and OCT?

Yes, a major opportunity lies in developing disposable inflation devices explicitly designed for interoperability with Intravascular Ultrasound (IVUS) and Optical Coherence Tomography (OCT) guidance. This integration allows physicians to precisely confirm balloon expansion relative to the visualized vessel wall, driving demand for technologically integrated digital devices that enhance procedural accuracy under advanced imaging.

Describe the current trend regarding the maximum pressure capacity of disposable inflation devices.

The current trend shows increasing demand for high-pressure disposable inflation devices, typically rated up to 30 atmospheres (ATM). This trend reflects the need to treat more complex, calcified, and fibrotic vascular lesions that require significantly greater force for successful balloon dilatation and stent preparation, ensuring optimal clinical results.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager