Disposable Laparoscopic Instruments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436062 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Disposable Laparoscopic Instruments Market Size

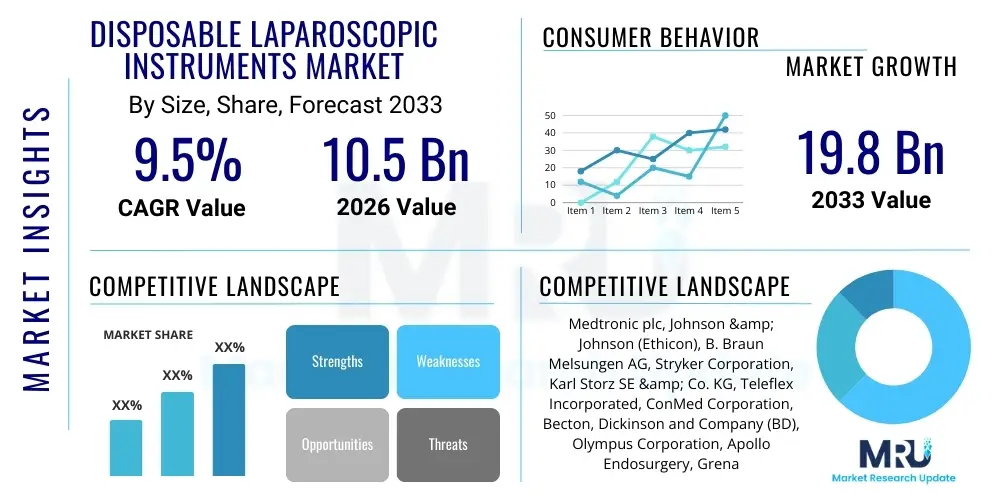

The Disposable Laparoscopic Instruments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 19.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the rising global prevalence of chronic diseases requiring surgical intervention and the increasing adoption of minimally invasive surgical procedures (MIS) across diverse medical specialties, notably gynecology, urology, and general surgery. The preference for disposable instruments stems from stringent sterilization requirements and the imperative to minimize cross-contamination risks in clinical settings, thereby accelerating product consumption globally.

Disposable Laparoscopic Instruments Market introduction

The Disposable Laparoscopic Instruments Market encompasses a diverse range of single-use surgical tools designed for application in minimally invasive surgery (MIS), particularly laparoscopic procedures. These instruments, which include trocars, graspers, scissors, dissectors, suction/irrigation systems, and specialized staplers, are crucial components that enable surgeons to perform complex operations through small incisions, offering significant advantages over traditional open surgery. The core functionality of these disposable devices revolves around ensuring precision, maintaining sterility, and eliminating the time and cost associated with reprocessing reusable surgical equipment. The market's foundational growth is intricately linked to the overall shift towards procedures that reduce patient trauma, decrease hospital stays, and accelerate recovery times.

Product descriptions within this segment highlight lightweight, ergonomic designs coupled with high-quality materials (typically medical-grade plastics and metals) that ensure optimal performance during a single procedure. Major applications span across almost all surgical disciplines employing laparoscopy, including cholecystectomy, appendectomy, hernia repair, various bariatric procedures, and advanced gynecological surgeries such as hysterectomy and oophorectomy. The inherent benefits of utilizing disposable instruments include guaranteed sterility for every procedure, reduced risk of instrument fatigue or failure, and simplified logistical management within the operating theater. This reliability is highly valued in high-volume surgical centers where procedural efficiency is paramount.

The primary driving factors sustaining market momentum are the escalating elderly population susceptible to surgical conditions, technological advancements leading to specialized and safer disposable instruments (e.g., smart instruments with integrated sensors), and increasing healthcare expenditure in emerging economies focused on modernizing surgical infrastructure. Furthermore, heightened concerns regarding hospital-acquired infections (HAIs) and the associated regulatory push for single-use systems in many developed nations provide a strong underlying catalyst. These regulatory mandates reinforce the economic and clinical justification for shifting from reusable to disposable inventory, thereby solidifying the market trajectory for the foreseeable future.

Disposable Laparoscopic Instruments Market Executive Summary

The Disposable Laparoscopic Instruments Market is characterized by robust business trends emphasizing supply chain resilience and strategic integration of smart technologies. Key manufacturers are focusing on mergers, acquisitions, and strategic partnerships to enhance their product portfolios, especially in specialized areas like energy devices and advanced fixation systems. A significant trend involves the development of eco-friendly disposable instruments using biodegradable materials to address rising environmental concerns associated with single-use medical waste. Furthermore, the focus on cost-efficiency and value-based healthcare models compels companies to optimize manufacturing processes to offer competitive pricing without compromising the critical quality and sterility requirements essential for patient safety.

Regionally, North America remains the dominant market owing to high surgical volumes, sophisticated healthcare infrastructure, and favorable reimbursement policies supporting MIS procedures. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by improving access to advanced healthcare, rapidly expanding medical tourism, and substantial investments in private and public hospitals, particularly in countries like China and India. European growth is stable, driven by strict regulatory standards favoring single-use instruments and the demographic burden of an aging population requiring frequent surgical intervention. Market strategies are increasingly tailored to address the disparate regulatory landscapes and purchasing power across these major geographic segments.

Segment trends indicate that Energy Systems/Sealers and Retrieval Bags segments are experiencing above-average growth, reflecting the complexity and safety requirements of modern laparoscopic procedures. Based on application, general surgery holds the largest market share due to the sheer volume of procedures performed globally, while gynecological and urological applications are demonstrating strong incremental growth due to the development of highly specialized disposable instruments tailored for these fields. The End-User segment shows hospitals maintaining the largest adoption rate, yet Ambulatory Surgical Centers (ASCs) are emerging as critical growth drivers due to their focus on cost-effective, high-turnover outpatient surgical services, heavily relying on disposable kits to maintain efficiency and infection control standards.

AI Impact Analysis on Disposable Laparoscopic Instruments Market

User questions regarding the impact of Artificial Intelligence (AI) frequently center on how AI-driven surgical robots influence the design and necessity of disposable instruments, particularly concerning precision and data integration. Users often query whether AI will mandate 'smarter' disposables, potentially embedding sensors or tracking mechanisms, and how predictive analytics might optimize inventory management for these single-use items in hospitals. The primary themes emerging are the integration of AI for enhanced procedural guidance (where instruments act as data inputs), the optimization of supply chains (reducing waste and excess inventory), and the long-term potential for AI-assisted robotic surgery to increase demand for specialized, highly complex disposable robotic accessories, thereby potentially boosting the overall disposable instruments market value while fundamentally changing product specifications.

- AI integration necessitates advanced material handling and precision requirements for robotic-compatible disposable tips.

- Predictive analytics driven by AI optimizes hospital inventory levels, reducing spoilage and overstocking of high-cost disposable kits.

- Machine learning algorithms enhance quality control in the manufacturing process of disposable instruments, ensuring stringent sterilization and defect detection.

- AI-driven surgical planning uses real-time data from laparoscopic sensors, potentially leading to the development of instruments with integrated data capturing capabilities.

- Robotic-assisted surgery, heavily reliant on expensive, disposable instrument end-effectors, is a key growth area directly influenced by AI surgical guidance systems.

DRO & Impact Forces Of Disposable Laparoscopic Instruments Market

The market dynamics for disposable laparoscopic instruments are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the demonstrable clinical efficacy and patient preference for Minimally Invasive Surgery (MIS), which directly mandates the use of specialized laparoscopic tools. Coupled with this is the global tightening of regulatory standards concerning infection control, making disposable instruments an almost indispensable choice for maintaining zero-risk sterility profiles. However, these drivers are counterbalanced by significant restraints, chiefly the high initial cost per unit compared to reusable counterparts, which poses a barrier to adoption in budget-constrained public healthcare systems and developing economies. The environmental concern associated with the significant volume of medical plastic waste generated by single-use items is also a growing restraint demanding sustainable product innovation.

Opportunities within the market largely revolve around technological innovation and geographic expansion. The development of advanced bio-absorbable or partially biodegradable disposable instruments offers a pathway to mitigate environmental concerns and create premium product categories. Furthermore, the increasing procedural complexity in fields like neuro-laparoscopy and pediatric surgery creates niches for highly specialized, high-margin disposable devices. Strategic investment in emerging markets, particularly within Latin America and Southeast Asia, provides vast untapped potential, contingent upon successful navigation of diverse regulatory approval processes and adaptation to local pricing pressures. These opportunities necessitate agility in research and development (R&D) and robust market access strategies.

The impact forces driving market evolution are predominantly macroeconomic and technological. The steady rise in global healthcare spending and insurance coverage acts as a strong positive impact force, ensuring procurement budgets accommodate high-quality disposable supplies. Conversely, global economic instabilities and fluctuations in raw material prices (plastics and specialized metals) exert a limiting force on manufacturer profitability. The most critical technological impact force is the accelerating adoption of robotic surgery platforms, which inherently rely on specialized disposable instruments for their advanced articulation and functionality, ensuring sustained high demand in the premium segment of the market.

Segmentation Analysis

The Disposable Laparoscopic Instruments Market is comprehensively segmented based on product type, application, and end-user, enabling granular analysis of market demand patterns and competitive positioning. Segmentation by product type highlights the critical role played by Trocars and Cannulas, which represent the initial access points, followed closely by Energy Devices (harmonic scalpels, electrosurgical instruments) essential for cutting and sealing tissue. The continuous innovation within these product categories, driven by the need for enhanced safety features like visual access confirmation and ergonomic handling, dictates growth trends. Understanding these segments is vital for suppliers to align their production capabilities with the specific requirements of high-volume procedures like bariatric and general abdominal surgeries.

Analyzing the market based on application reveals general surgery maintaining its historical dominance, primarily due to the high incidence and necessary intervention rates for conditions such as appendicitis, gallbladder removal, and hernia repair. However, the specialized applications of gynecology and urology are demonstrating accelerated CAGR, fueled by increased awareness regarding minimally invasive options for conditions like endometriosis, uterine fibroids, and prostatectomies. This growth is directly linked to the development of application-specific disposable devices, such as specialized morcellators and advanced needle drivers, which improve procedural outcomes and reduce complication rates, thereby reinforcing the viability of these specialized segments.

The End-User segmentation distinguishes between Hospitals, Ambulatory Surgical Centers (ASCs), and Specialty Clinics. While hospitals traditionally represent the largest revenue contributor due to infrastructure capabilities and handling complex cases, ASCs are becoming increasingly crucial growth engines. ASCs prioritize efficiency and rapid turnaround times for elective surgeries, making the logistical advantages and guaranteed sterility of disposable instruments highly attractive. This trend reflects a broader shift in healthcare delivery towards outpatient settings, placing increasing importance on single-use kits and standardized disposable systems to maintain streamlined operations and control costs associated with reprocessing.

- By Product Type:

- Trocars and Cannulas

- Energy Systems and Accessories (Electrosurgical, Harmonic)

- Graspers and Dissectors

- Suction/Irrigation Systems

- Needle Holders and Sutures

- Laparoscopic Scissors

- Specimen Retrieval Bags

- Stapling Devices and Endoscopic Clips

- By Application:

- General Surgery (Cholecystectomy, Appendectomy, Hernia Repair)

- Gynecology (Hysterectomy, Oophorectomy)

- Urology (Nephrectomy, Prostatectomy)

- Bariatric Surgery

- Colorectal Surgery

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics and Research Institutes

Value Chain Analysis For Disposable Laparoscopic Instruments Market

The value chain for the Disposable Laparoscopic Instruments Market is multi-layered, beginning with upstream activities focused on raw material procurement, encompassing specialized medical-grade plastics (like polycarbonate and ABS), high-grade stainless steel, and specialized electronic components for energy devices. Upstream analysis highlights dependence on chemical and metal industries, where quality control and stable sourcing are crucial for maintaining instrument integrity and regulatory compliance. Manufacturers invest heavily in R&D and proprietary molding/assembly technologies to ensure high-volume, cost-effective production that adheres to stringent biocompatibility and sterility standards. Supplier relationships are critical, often involving long-term contracts to ensure stability and quality traceability across the entire production cycle, minimizing defects in high-stakes clinical products.

The midstream of the value chain involves the complex manufacturing and sterilization processes. Given the disposable nature of these instruments, manufacturing scales must be immense, focusing on automation and cleanroom environments. Sterilization, primarily through Ethylene Oxide (EtO) or Gamma irradiation, is a non-negotiable step, heavily regulated by bodies such as the FDA and EMA. Operational efficiency in this stage is key to maintaining competitive pricing. Following manufacturing, instruments are packaged, labeled, and prepared for distribution, requiring specialized logistics to maintain sterility and prevent physical damage during transit, ensuring product readiness upon reaching the end-user.

Downstream activities involve the distribution channel, which is typically bifurcated into direct sales and indirect sales through authorized distributors and wholesalers. Direct channels are preferred by major multinational players for high-value strategic accounts (large hospital networks and GPOs), ensuring maximum control over pricing and customer service. Indirect distribution leverages regional expertise and established supply networks to reach smaller hospitals, ASCs, and specialty clinics efficiently, especially in geographically dispersed or emerging markets. Selection of the distribution channel hinges on geographical coverage, complexity of the product, and the need for localized clinical training and support, which is often crucial for specialized disposable instruments.

Disposable Laparoscopic Instruments Market Potential Customers

The primary end-users and buyers of disposable laparoscopic instruments are large acute-care hospitals, which represent the traditional cornerstone of demand due to their capacity to handle a wide spectrum of complex surgical procedures, including emergency interventions and multi-specialty cases. These institutions rely on high-volume procurement contracts for standardized disposable kits and utilize premium, specialized instruments for intricate operations. Procurement decisions in large hospitals are typically centralized and heavily influenced by Group Purchasing Organizations (GPOs), focusing on bulk discounts, inventory management support, and long-term supply agreements that guarantee product availability and adherence to institutional sterility protocols.

Ambulatory Surgical Centers (ASCs) constitute a rapidly growing segment of potential customers, characterized by a preference for standardized, ready-to-use disposable instrument trays tailored for specific, high-frequency outpatient procedures (e.g., orthopedic scopes, simple cholecystectomies). ASCs prioritize minimizing turnaround time and overhead costs associated with sterilization, making disposable instruments highly cost-effective and operationally efficient for their business model. Their purchasing criteria often emphasize ease of integration into existing surgical workflows, competitive unit pricing, and minimal training requirements for staff, driving demand for intuitive and reliable single-use solutions that ensure rapid patient discharge.

Other significant potential customers include specialized surgical clinics focused on niche areas such as bariatric, urological, or gynecological procedures, along with academic and research institutions requiring precision tools for clinical trials and training simulations. Specialty clinics often demand cutting-edge disposable technology, such as specialized energy devices or advanced suction systems, willing to pay a premium for instruments that offer superior clinical outcomes for their specific patient cohort. Furthermore, military and humanitarian surgical units represent intermittent but crucial customer segments, valuing the guaranteed sterility, portability, and zero reprocessing requirement inherent in disposable laparoscopic kits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 19.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, Johnson & Johnson (Ethicon), B. Braun Melsungen AG, Stryker Corporation, Karl Storz SE & Co. KG, Teleflex Incorporated, ConMed Corporation, Becton, Dickinson and Company (BD), Olympus Corporation, Apollo Endosurgery, Grena Ltd., Ackermann Instrumente GmbH, Richard Wolf GmbH, Microline Surgical, Inc., Intuitive Surgical (Specific robotic accessories), CooperSurgical, Inc., Purple Surgical, OptiScan Group, Silex Medical Inc., Peters Surgical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Laparoscopic Instruments Market Key Technology Landscape

The technology landscape of the Disposable Laparoscopic Instruments Market is constantly evolving, driven by the need for enhanced surgical visualization, better tissue manipulation, and improved patient safety. Key technological advancements center around advanced material science, particularly the development of high-strength, lightweight polymers that maintain instrument rigidity while facilitating easier disposal and potentially offering better biodegradability profiles. Furthermore, the integration of specialized coatings (anti-fog, non-reflective) on viewing elements and the use of sophisticated insulation techniques for electrosurgical devices are crucial to prevent unintended thermal damage and ensure clear surgical fields throughout lengthy procedures. The technological focus is moving beyond simple mechanical function towards devices that offer augmented performance and safety features.

A significant technological shift is the miniaturization and integration of smart components. Modern disposable trocars now feature safety shields with spring-loaded mechanisms and visual entry indicators to minimize accidental puncture injuries (fascial closure risk), demonstrating enhanced engineering ingenuity. In the energy devices segment, technology includes advanced vessel sealing systems that utilize sophisticated feedback mechanisms to deliver precise energy (ultrasonic or bipolar radiofrequency), ensuring efficient hemostasis while protecting surrounding healthy tissue. These advanced, single-use energy instruments require highly complex manufacturing tolerances, differentiating them significantly from basic reusable counterparts and commanding premium pricing based on clinical performance metrics and safety data.

The future technology outlook is heavily weighted towards robotic surgical accessories and data integration capabilities. Companies are developing specialized disposable end-effectors for robotic systems (e.g., da Vinci systems) that incorporate multi-articulating joints and fine force-feedback sensors, dramatically expanding the surgical dexterity achievable in MIS. Furthermore, there is ongoing R&D into embedding RFID chips or other tracking technologies within disposable instruments. This not only aids in automated inventory management and traceability but also contributes to the operating room’s digital ecosystem, allowing hospitals to accurately track instrument usage per patient and integrate this data into electronic health records and quality improvement initiatives, thus aligning technology with modern healthcare management demands.

Regional Highlights

The regional analysis of the Disposable Laparoscopic Instruments Market reveals distinct growth patterns influenced by economic development, healthcare policies, and surgical procedural volumes across various geographies. North America, encompassing the United States and Canada, holds the dominant market share due to its well-established healthcare infrastructure, high prevalence of robotic surgeries requiring disposable accessories, and strong enforcement of single-use policies to mitigate infection risks. The high disposable income and favorable reimbursement landscape in the US further catalyze the adoption of premium disposable instruments, making it a critical revenue center.

Europe represents a mature market characterized by stringent EU medical device regulations, which indirectly favor standardized, reliable disposable systems. Countries like Germany, France, and the UK contribute significantly, driven by an aging population necessitating frequent MIS procedures and government focus on efficiency in hospital management. While growth rates are steady, the emphasis here is often on quality, safety, and adherence to sustainability goals, pushing manufacturers toward developing more environmentally conscious disposable products.

Asia Pacific (APAC) is the region projected for the highest growth, driven by rapid urbanization, significant improvements in healthcare access, and the burgeoning medical tourism sector, particularly in economies such as China, India, Japan, and South Korea. Government initiatives aimed at modernizing surgical facilities and the increasing affordability of laparoscopic procedures are expanding the patient base. Although cost sensitivity remains a factor, the demand for single-use instruments is soaring, primarily driven by the need for effective infection control in expanding hospital environments.

Latin America and the Middle East & Africa (MEA) markets are considered emerging frontiers. Growth in Latin America is uneven but picking up momentum, particularly in Brazil and Mexico, fueled by increasing private sector investment in specialized surgical centers. The MEA region, notably the GCC countries, shows substantial potential due to high healthcare expenditure, modernization efforts, and the expatriate population demanding Western standards of care, including guaranteed sterile, disposable surgical supplies. However, these regions face challenges related to logistics and localized regulatory complexity.

- North America (US & Canada): Dominant market share; highest adoption of robotic surgery; strict infection control mandates; robust R&D funding for advanced disposable features.

- Europe (Germany, UK, France): Stable growth; high regulatory compliance favoring disposables; significant demand driven by aging demographics; focus on sustainability in device design.

- Asia Pacific (China, India, Japan): Fastest growth rate; driven by expanding healthcare infrastructure and medical tourism; increasing awareness and affordability of MIS; strategic target for major manufacturers.

- Latin America (Brazil, Mexico): Emerging market; growth tied to rising private investment in healthcare; high price sensitivity necessitating locally competitive manufacturing and distribution models.

- Middle East & Africa (GCC Countries, South Africa): Moderate but accelerated growth; supported by high government healthcare spending; focus on high-quality sterile supplies mirroring international standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Laparoscopic Instruments Market.- Medtronic plc

- Johnson & Johnson (Ethicon)

- B. Braun Melsungen AG

- Stryker Corporation

- Karl Storz SE & Co. KG

- Teleflex Incorporated

- ConMed Corporation

- Becton, Dickinson and Company (BD)

- Olympus Corporation

- Apollo Endosurgery

- Grena Ltd.

- Ackermann Instrumente GmbH

- Richard Wolf GmbH

- Microline Surgical, Inc.

- Intuitive Surgical (Specific robotic accessories)

- CooperSurgical, Inc.

- Purple Surgical

- OptiScan Group

- Silex Medical Inc.

- Peters Surgical

Frequently Asked Questions

Analyze common user questions about the Disposable Laparoscopic Instruments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from reusable to disposable laparoscopic instruments?

The primary driver is the necessity for guaranteed sterility to prevent Hospital-Acquired Infections (HAIs). Disposable instruments eliminate the risks and high costs associated with manual cleaning, complex sterilization cycles, and potential failure or contamination of reusable instruments, enhancing patient safety and operational efficiency.

Which product segment holds the highest growth potential in the disposable instruments market?

The Energy Systems and Accessories segment, including advanced ultrasonic and bipolar sealing devices, demonstrates the highest growth potential. This is driven by the increasing complexity of laparoscopic procedures requiring precision tissue dissection and highly reliable hemostasis, which these high-technology disposable tools reliably provide.

How is environmental sustainability impacting the manufacturing of disposable laparoscopic instruments?

Environmental concerns are driving manufacturers to invest heavily in R&D for biodegradable or partially recyclable medical-grade polymers. This effort aims to mitigate the large volume of non-recyclable plastic waste generated by single-use items, addressing regulatory pressure and corporate social responsibility mandates.

Which geographic region is expected to show the fastest market expansion?

The Asia Pacific (APAC) region is projected to exhibit the fastest market expansion. This is fueled by rapid expansion of healthcare infrastructure, increasing surgical volumes driven by population growth, and rising government investment in modernizing surgical standards and promoting minimally invasive techniques.

How do Ambulatory Surgical Centers (ASCs) influence the demand for disposable laparoscopic instruments?

ASCs significantly boost demand because their focus on rapid patient turnover and outpatient efficiency relies heavily on pre-packaged, single-use instrument kits. Disposables simplify logistics, reduce costs associated with sterile processing staff, and minimize the risk of procedural delays linked to reusable instrument availability.

The Disposable Laparoscopic Instruments Market is at an inflection point, transitioning towards smarter, more integrated, and environmentally conscious product designs while maintaining its core mission of maximizing surgical efficiency and patient safety. Manufacturers are strategically positioning themselves to capitalize on the sustained global growth of MIS, particularly through innovations that support robotic platforms and enhance procedural outcomes in complex surgeries. The robust regulatory environment, coupled with compelling economic arguments regarding infection control, assures the continued strong performance and expansion of the disposable instruments sector throughout the forecast period. Competitive strategies emphasize differentiating through specialized product offerings, robust clinical data, and optimizing supply chain logistics to meet the divergent needs of mature and emerging markets efficiently. The integration of advanced materials and digital technologies is set to redefine what constitutes a disposable instrument, making them indispensable components of the modern operating room ecosystem.

Market participants face the ongoing challenge of balancing cost control—critical for hospital procurement budgets—against the high R&D investment required for new, advanced disposables. Successfully navigating this trade-off requires economies of scale in manufacturing and effective communication of the long-term cost benefits derived from reduced infection rates and streamlined surgical workflow. The future success of stakeholders in this market will be determined by their ability to innovate responsibly, creating products that are not only clinically superior but also align with global sustainability trends and evolving healthcare reimbursement models. This necessitates strong collaboration with surgeons, hospital administrators, and regulatory bodies worldwide to ensure products meet both clinical efficacy demands and logistical requirements of high-volume surgical settings.

Further analysis reveals that procurement cycles within large hospital networks are increasingly focused on total cost of ownership (TCO) rather than just unit price. While reusable instruments have a lower initial unit cost, the associated TCO including labor for reprocessing, capital equipment for sterilization, and the often-overlooked cost of instrument repair and replacement, frequently outweighs the higher upfront cost of disposables. This TCO calculation is accelerating the acceptance of disposable instruments, particularly in institutions where labor costs and sterilization complexity are significant operational burdens. This strategic financial perspective reinforces the market's stability and growth trajectory, ensuring long-term confidence for investors and market entrants focused on quality and volume production.

The technological evolution extends to packaging and delivery systems, aiming for optimal sterile presentation and minimized waste volume. Innovations include compact, procedure-specific packaging designed to reduce the physical footprint in operating rooms and optimize sterile handling by surgical staff. Advanced inventory tracking systems, often leveraging cloud-based platforms, are being deployed by leading vendors to manage the complex logistics of disposable supplies, predicting demand based on surgical scheduling and historical consumption patterns. This level of logistical sophistication is essential for maintaining supply chain reliability across global markets, especially given the vulnerability exposed by recent geopolitical and public health crises. The integration of these digital logistics solutions is a key factor enabling the scaling up of disposable instrument utilization globally.

Moreover, the regulatory landscape globally continues to tighten, imposing stricter requirements on material traceability, biocompatibility testing, and post-market surveillance for all medical devices, including single-use surgical instruments. Compliance with these evolving regulations—such as the EU Medical Device Regulation (MDR)—demands significant investment from manufacturers in quality management systems and clinical data generation. While this increases the barrier to entry, it inherently favors established market leaders who possess the necessary resources and infrastructure to meet rigorous safety and performance standards. Smaller innovative companies often seek partnerships or acquisitions with larger firms to leverage their compliance expertise and global distribution networks, thereby further consolidating the market's competitive structure around high-quality, fully compliant disposable products.

The demographic factor of aging populations worldwide, particularly in developed economies, remains a fundamental market driver. As the incidence of age-related conditions requiring laparoscopic intervention (such as certain cancers, gastrointestinal disorders, and orthopedic conditions) increases, so does the demand for instruments that facilitate rapid, safe, and minimally disruptive surgical treatment. This sustained demographic pressure ensures that the requirement for high-volume, sterile, and reliable surgical tools remains perpetually high, insulating the disposable laparoscopic instruments market from short-term economic fluctuations and guaranteeing long-term volume stability across core product lines like trocars, graspers, and stapling systems. The focus is shifting towards instruments that minimize operative time and reduce post-operative recovery periods.

Educational initiatives are playing an increasingly crucial role in market penetration, especially in emerging regions. Manufacturers are actively collaborating with medical universities and surgical societies to provide training and simulation opportunities focused on the optimal use of advanced disposable instruments. Effective training ensures that surgeons and operating room staff are proficient in using the latest technologies, thereby enhancing procedural safety and driving wider acceptance of new disposable product innovations. This investment in professional education is vital for transitioning healthcare systems away from entrenched reliance on older, reusable equipment and demonstrates a commitment by key players to fostering best practices in minimally invasive surgery globally.

Finally, strategic price point positioning and bundled offerings are prevalent competitive tactics. Recognizing the budget pressures faced by hospitals, major companies often offer integrated disposable kits tailored for specific procedures, providing efficiency and convenience while offering competitive volume pricing through Group Purchasing Organizations (GPOs). These bundling strategies simplify the hospital's procurement process, reduce administrative overhead, and ensure that all necessary, sterile disposable components are available in a single package, further cementing the logistical superiority of single-use systems over assembling disparate reusable components. This market efficiency is a defining characteristic of the mature disposable instruments sector.

Innovation in disposable instrumentation also involves developing advanced visualization aids that are seamlessly integrated into the surgical workflow. This includes single-use optical systems, high-definition disposable scopes, and illumination fibers designed to provide superior clarity without the reprocessing concerns associated with reusable optics. These visual components are particularly crucial in complex procedures where clear, sustained visualization is non-negotiable for safety and precision. The disposable nature of these visualization tools guarantees peak optical performance for every case, addressing the degradation issues often encountered with frequently sterilized reusable systems. This focus on disposable visualization technology represents a premium segment with high value proposition driven by improved clinical outcomes and reduced maintenance burden for hospital bio-medical departments.

The competitive dynamics are highly concentrated, with a few multinational corporations holding significant market share, primarily due to their established distribution networks, extensive R&D pipelines, and ability to meet rigorous regulatory compliance across multiple jurisdictions. These market leaders often set the standards for product quality and safety, driving smaller competitors to specialize in niche products or regional distribution. Consolidation via strategic mergers and acquisitions remains a persistent trend, allowing large players to quickly integrate new, specialized technologies—such as unique fixation devices or novel energy sources—into their existing broad portfolios of disposable laparoscopic instruments. This ensures that innovation is rapidly commercialized and deployed globally through established channels, maintaining a dynamic yet concentrated market structure.

Furthermore, the emergence of value-based healthcare models compels manufacturers to demonstrate the economic benefits of their disposable instruments beyond simple procedural cost savings. This involves generating robust clinical evidence that showcases how specific disposable tools lead to shorter operating times, reduced post-operative complications, and ultimately, lower total episode-of-care costs. Marketing and sales strategies are increasingly data-driven, leveraging real-world evidence to justify the pricing premium associated with high-performance disposable products, especially when compared against cheaper, less technologically advanced options. This shift necessitates deep engagement with health economists and healthcare policymakers to articulate the holistic value proposition of advanced disposable technology within complex health systems.

The supply chain resilience has become a major strategic priority following global disruptions. Manufacturers are investing in geographically diversified manufacturing sites and multi-sourcing strategies for critical raw materials to mitigate risks associated with regional lockdowns or trade restrictions. For disposable medical products, any interruption in the supply of components or sterilization capacity can directly jeopardize hospital operations. Consequently, long-term contracts and risk-sharing agreements with key suppliers are becoming standard practice, ensuring a reliable and continuous flow of sterile, high-quality disposable laparoscopic instruments to high-demand surgical centers globally, reinforcing the security of healthcare provision.

Finally, cybersecurity implications are also becoming relevant, particularly for 'smart' disposable instruments that incorporate sensors or connectivity features. Ensuring the data collected by these instruments—used for patient monitoring, surgical guidance, or inventory tracking—is securely transmitted and stored, is paramount. Manufacturers must design these advanced disposable devices with embedded security protocols that comply with stringent healthcare data protection regulations (like HIPAA in the US and GDPR in Europe). This intersection of hardware design, software functionality, and data integrity adds a new layer of complexity to the R&D and regulatory approval process for next-generation disposable laparoscopic instruments, necessitating specialized expertise in medical device informatics and security engineering to maintain user trust and regulatory adherence across all applicable jurisdictions where the products are sold or utilized in clinical settings globally and ensuring patient data remains protected.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Disposable Laparoscopic Instruments Market Size Report By Type (Laparoscopic Scissors, Laparoscopic Hooks, Grasping Forceps & Dissectors, Trocars, Laparoscopic Suction / Irrigation Devices, Others), By Application (General Surgery Procedure, Gynecology Procedure, Urology Procedure, Other, By End-User, Hospitals, Ambulatory Surgical Centres, Specialty Clinics), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Disposable Laparoscopic Instruments Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Laparoscopic Scissors, Laparoscopic Hooks, Grasping Forceps & Dissectors, Trocars, Laparoscopic Suction / Irrigation Devices, Others), By Application (General Surgery, Bariatric Surgery, Colorectal Surgery, Urology Surgery, Gynecologic Surgeries, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager