Disposable Laparoscopic Trocars Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435779 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Disposable Laparoscopic Trocars Market Size

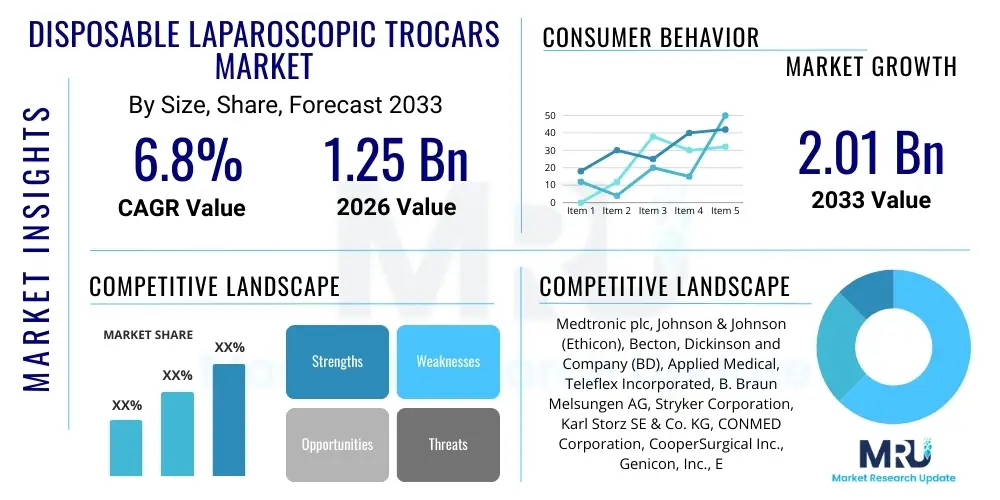

The Disposable Laparoscopic Trocars Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.01 Billion by the end of the forecast period in 2033.

Disposable Laparoscopic Trocars Market introduction

The Disposable Laparoscopic Trocars Market encompasses instruments used to establish a port of entry into the abdomen during minimally invasive surgical procedures, primarily laparoscopy. These single-use devices offer enhanced patient safety and reduce the risk of cross-contamination and surgical site infections compared to their reusable counterparts. The principal products include bladed, bladeless, and optical access trocars, designed to accommodate various surgical needs and minimize fascial trauma. Major applications span general surgery (such as cholecystectomy and appendectomy), gynecological procedures, urology, and increasingly, bariatric and colorectal surgeries. The inherent benefits, such as sterility assurance, consistent performance, and elimination of reprocessing costs and risks, are critical drivers propelling their adoption globally.

The core functionality of a laparoscopic trocar involves creating and maintaining a stable access channel for instruments and cameras into the operative cavity. Modern disposable trocars feature advanced retention mechanisms, integrated seals, and sometimes optical viewing capabilities, ensuring secure access and preventing gas leakage (pneumoperitoneum loss) during complex procedures. The rising global prevalence of chronic diseases requiring surgical intervention, combined with the increasing preference among both surgeons and patients for less invasive operative techniques, positions disposable trocars as essential components in the evolving surgical landscape. Furthermore, strict regulatory scrutiny regarding surgical instrument sterilization in developed economies significantly favors the use of sterile, single-use products, cementing the market's trajectory toward sustained expansion.

Disposable Laparoscopic Trocars Market Executive Summary

The Disposable Laparoscopic Trocars Market exhibits robust growth driven by favorable business trends centered around technological innovation and cost-efficiency in the long term. Business dynamics are characterized by intense competition among major multinational corporations focusing on developing specialized trocars, particularly those with enhanced fascial closure assistance and superior fixation systems to prevent slippage. The trend towards greater standardization in surgical kits, often incorporating pre-packaged disposable trocars, is optimizing hospital inventory management and reducing operating room turnover times. Investment in R&D is heavily concentrated on optical access technology and ergonomic designs, responding directly to surgeons' demand for safer entry techniques, particularly in cases involving adhesion risk.

Regional trends indicate North America currently holds the dominant market share due to high healthcare expenditure, established reimbursement frameworks for minimally invasive procedures, and high adoption rates of advanced surgical technologies. However, the Asia Pacific region is projected to register the highest growth rate, fueled by improving healthcare infrastructure, increasing medical tourism, and a rapidly expanding patient pool requiring surgeries like bariatric procedures. Segment trends show a clear shift toward Bladeless and Optical Trocars, largely superseding traditional bladed designs due to enhanced safety profiles and reduced risk of visceral injury upon entry. Furthermore, the End-User segment reflects growing procurement volumes from Ambulatory Surgical Centers (ASCs), which prioritize efficiency and minimal infection risk, directly benefiting the single-use instrument market.

AI Impact Analysis on Disposable Laparoscopic Trocars Market

User inquiries regarding AI's impact on disposable trocars primarily revolve around how artificial intelligence can enhance surgical planning, improve trocar placement accuracy, and automate certain aspects of the laparoscopic setup. Users are concerned with whether AI-driven robotic systems will integrate disposable components more seamlessly, thereby increasing consumption. Key themes emphasize safety improvements, predictive analytics for complication reduction, and the potential for AI algorithms to guide surgeons toward the optimal size and insertion angle of trocars based on real-time anatomical data. There is also significant interest in AI supporting the training and simulation phase for new surgeons, where precision in entry technique is paramount. Ultimately, users expect AI to validate and standardize minimally invasive surgery workflows, further reinforcing the necessity and safety of specialized disposable devices.

- AI algorithms assist in pre-operative planning, optimizing port placement to ensure minimal tissue damage and efficient instrument triangulation during complex laparoscopic procedures.

- Integration of real-time image analysis via AI enhances the safety of trocar insertion, particularly optical trocars, by providing augmented reality guidance to identify potential vascular or visceral risks immediately beneath the entry site.

- AI-powered robotic surgery systems increasingly utilize disposable instruments, including specialized robotic trocars, driving higher per-procedure disposable volume.

- Predictive maintenance models for OR equipment, often AI-managed, streamline the supply chain for disposable consumables, ensuring high-demand items like trocars are always available.

- AI contributes to training platforms (simulators), grading and improving trainee performance in achieving precise, minimally invasive entry using disposable trocars, thereby standardizing surgical skills.

DRO & Impact Forces Of Disposable Laparoscopic Trocars Market

The market growth is primarily driven by the undeniable increase in surgical volumes globally, stemming from the aging population and the escalating incidence of lifestyle-related chronic conditions requiring surgical intervention. The intrinsic safety profile of disposable trocars, which effectively mitigates the risk of nosocomial infections and ensures maximum sterility for every patient, serves as a major commercial catalyst. Conversely, the market faces constraints primarily related to the higher upfront cost of disposable products compared to long-term reusable systems, a factor that particularly impacts procurement decisions in cost-sensitive healthcare environments and developing nations. However, substantial opportunities lie in untapped emerging markets and the continued integration of advanced technologies, such as seal-less systems and energy-absorbing materials, into new trocar designs.

The overarching impact forces shaping the competitive environment include stringent global regulatory standards favoring single-use instruments and the sustained shift toward value-based healthcare models that emphasize procedural safety and reduced complication rates. While high initial investment acts as a restraint, the opportunity presented by technological miniaturization and the development of specialized trocars for niche procedures, such as pediatric or single-incision laparoscopy, provides substantial growth avenues. The collective pressure from surgeons demanding instruments that enhance visibility and control, alongside hospital administrators prioritizing infection control, creates a powerful dynamic that continually pushes the adoption curve upwards for premium disposable products.

Segmentation Analysis

The Disposable Laparoscopic Trocars Market is meticulously segmented based on product type, application, and end-user, offering diverse avenues for market expansion and competitive differentiation. Segmentation by type—Bladeless, Bladed, and Optical—reveals a clear technological preference shift, with Bladeless and Optical trocars capturing increasing market share due to their superior safety profiles and ability to minimize port site complications. The Bladeless category, often featuring blunt dilating tips, is favored for minimizing traumatic entry, while Optical trocars provide visual confirmation of abdominal wall penetration, drastically reducing the risk of blind insertion injuries. Analyzing the market through the lens of application highlights the dominance of General Surgery, although specialized fields like Bariatric Surgery and Urology are demonstrating accelerated adoption rates due to the increasing complexity and volume of procedures performed minimally invasively.

Further analysis of the End-User segment underscores the significance of Hospitals, which remain the largest consumers due to the high volume of complex inpatient surgeries requiring multiple ports. However, the fastest growth is observed within Ambulatory Surgical Centers (ASCs), driven by the migration of less complex laparoscopic procedures to outpatient settings. ASCs value the convenience, guaranteed sterility, and lack of reprocessing requirements associated with disposable products, making them ideal targets for market vendors. Understanding these segmented dynamics is crucial for manufacturers to tailor their marketing and distribution strategies, focusing on customized trocar lengths, diameters, and access mechanisms suitable for specific procedural demands across different healthcare settings.

- By Type:

- Bladeless Trocars

- Bladed Trocars

- Optical Trocars

- Others (e.g., Dilating Tip Trocars)

- By Application:

- General Surgery (Gastrointestinal, Colorectal)

- Gynecological Surgery (Hysterectomy, Oophorectomy)

- Urological Surgery (Nephrectomy, Prostatectomy)

- Bariatric Surgery (Gastric Bypass, Sleeve Gastrectomy)

- Other Applications

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Disposable Laparoscopic Trocars Market

The value chain for the Disposable Laparoscopic Trocars Market begins with upstream activities involving the sourcing of high-grade raw materials, primarily medical-grade plastics (such as polycarbonate and ABS) and specialized alloys for the instrument shafts and tips. Component manufacturing, including precision molding of cannulas, seals, and specialized valves, is critical. Key upstream challenges include maintaining consistent quality of polymers and managing volatile commodity prices, which directly impact manufacturing costs. The integration of advanced polymer sciences is crucial for developing trocars with superior sealing capabilities and minimal friction. Successful upstream management ensures the final product meets the rigorous sterility and mechanical performance standards required for surgical use.

Midstream activities encompass the core manufacturing, assembly, sterilization (typically Ethylene Oxide or Gamma Irradiation), and stringent quality control processes. This stage is dominated by large, integrated medical device manufacturers who leverage proprietary technology to enhance trocar features, such as stability threads and advanced valve systems designed to maintain pneumoperitoneum despite frequent instrument exchange. The downstream segment involves distribution, which is predominantly executed through a network of specialized medical device distributors who handle logistics, inventory management, and direct sales to end-users (Hospitals and ASCs). Direct sales channels are often employed by major players for large hospital networks, ensuring better contract management and educational support for surgeons. Indirect channels via distributors are crucial for reaching smaller clinics and geographically dispersed markets.

Effective management of the downstream distribution channel, characterized by efficient logistics and strong rapport with procurement managers, determines market penetration speed. Direct engagement with key opinion leaders (KOLs) and surgeons through sales representatives is essential for demonstrating product efficacy and converting reusable trocar users to disposable systems. The final stage involves post-sales services, which, although minimal for disposable products, include inventory replenishment agreements and providing clinical support and training on optimal trocar usage and port closure techniques. The shift toward group purchasing organizations (GPOs) significantly influences procurement decisions, consolidating purchasing power and driving competition on both price and feature set.

Disposable Laparoscopic Trocars Market Potential Customers

The primary potential customers and end-users of disposable laparoscopic trocars are institutions that regularly perform minimally invasive surgical procedures. These predominantly include large tertiary care Hospitals, which maintain high surgical procedure volumes across all specialties, including emergency and elective cases. Hospitals value disposable trocars for their guaranteed sterility, which supports rigorous infection control protocols, a paramount concern in complex surgical environments. The procurement cycle in hospitals is often structured and driven by value analysis committees that assess the total cost of ownership, frequently concluding that the mitigated risks and reprocessing savings associated with disposable instruments justify the unit cost premium.

Ambulatory Surgical Centers (ASCs) represent the fastest-growing customer segment, increasingly specializing in high-volume, minimally invasive outpatient procedures such as general laparoscopic and gynecological interventions. ASCs highly prioritize operational efficiency and quick turnaround times, which are significantly facilitated by single-use, standardized kits containing disposable trocars. For ASCs, eliminating the need for complex, time-consuming sterilization infrastructure and associated staffing overhead provides a clear economic advantage, positioning them as essential high-growth targets for market manufacturers. Furthermore, independent Specialty Clinics focusing on bariatric or fertility procedures also constitute a niche but crucial customer base, relying on high-quality, dependable disposable instruments to maintain procedure safety and reputation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.01 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, Johnson & Johnson (Ethicon), Becton, Dickinson and Company (BD), Applied Medical, Teleflex Incorporated, B. Braun Melsungen AG, Stryker Corporation, Karl Storz SE & Co. KG, CONMED Corporation, CooperSurgical Inc., Genicon, Inc., EndoVision LLC, Purple Surgical, Grena Ltd., Lihua Medical Instrument Co., Ltd., OptiMed, Inc., LaproSurge, Microline Surgical, Surtex Instruments Ltd., Sklar Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Laparoscopic Trocars Market Key Technology Landscape

The technological landscape of the Disposable Laparoscopic Trocars Market is constantly evolving, focusing primarily on enhancing patient safety, improving ease of insertion, and ensuring optimal insufflation maintenance. A major technological trend involves the widespread adoption of bladeless trocars, which utilize a radially expanding or blunt dilating tip mechanism to separate tissue fibers rather than cutting them. This technique significantly reduces the risk of major vessel and visceral injuries associated with traditional bladed trocars. Furthermore, many modern disposable trocars incorporate advanced thread designs on the cannula shaft to improve fixation within the abdominal wall, preventing slippage during instrument manipulation and ensuring a stable surgical platform throughout the procedure. The development of low-insertion force technologies is another critical innovation aimed at improving surgeon comfort and control.

Optical access technology represents another cornerstone of the current landscape. Optical trocars are designed to allow the surgeon to visualize the tissue layers being traversed in real-time using an endoscope placed inside the trocar sheath during insertion. This visualization capability transforms the process from a blind technique into a visually guided procedure, drastically lowering the incidence of catastrophic entry-related complications. Innovations are also focused on improved seal technology. Dual-seal and magnetic sealing systems are being developed to minimize gas leakage (pneumoperitoneum) even during rapid or angled instrument exchanges, which is crucial for maintaining optimal visibility and operative field stability. Finally, integration with smart surgical systems, leveraging embedded sensors for pressure monitoring or haptic feedback, hints at the future direction of disposable trocar evolution, aligning them with digital surgery platforms.

Regional Highlights

- North America: Dominates the global market due to established infrastructure, high penetration of advanced minimally invasive techniques, favorable reimbursement policies for laparoscopic procedures, and significant presence of leading medical device manufacturers. The United States specifically drives innovation and high volume consumption.

- Europe: Represents a mature market characterized by stringent regulatory environments and high acceptance rates of disposable products driven by strong infection control mandates. Germany, the UK, and France are key contributors, focusing on optimizing surgical efficiency and reducing healthcare-associated infections (HAIs).

- Asia Pacific (APAC): Expected to be the fastest-growing region, fueled by rapidly expanding healthcare expenditure, increasing surgical capacity, rising awareness about the benefits of laparoscopy, and growing medical tourism. Key countries like China and India are investing heavily in modern surgical infrastructure, offering lucrative opportunities for disposable device adoption.

- Latin America (LATAM): Exhibits steady growth, primarily in economically stable countries such as Brazil and Mexico, driven by increasing insurance coverage and the slow but steady shift from open surgery to minimally invasive methods, though pricing sensitivity remains a factor.

- Middle East and Africa (MEA): Growth is localized in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) due to high per capita income and investment in specialized hospitals. However, the rest of Africa lags due to infrastructural limitations and low medical device spending.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Laparoscopic Trocars Market.- Medtronic plc

- Johnson & Johnson (Ethicon)

- Becton, Dickinson and Company (BD)

- Applied Medical

- Teleflex Incorporated

- B. Braun Melsungen AG

- Stryker Corporation

- Karl Storz SE & Co. KG

- CONMED Corporation

- CooperSurgical Inc.

- Genicon, Inc.

- EndoVision LLC

- Purple Surgical

- Grena Ltd.

- Lihua Medical Instrument Co., Ltd.

- OptiMed, Inc.

- LaproSurge

- Microline Surgical

- Surtex Instruments Ltd.

- Sklar Instruments

Frequently Asked Questions

Analyze common user questions about the Disposable Laparoscopic Trocars market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for disposable laparoscopic trocars?

The foremost driver is the rising global adoption of minimally invasive surgical procedures coupled with the critical need for enhanced infection control. Disposable trocars guarantee sterility, eliminating the risk of cross-contamination and reducing healthcare-associated infections (HAIs), a core priority for hospitals globally.

How do optical trocars enhance safety compared to traditional bladed trocars?

Optical trocars allow surgeons to visualize the abdominal wall layers during insertion using an endoscope, providing real-time confirmation of tissue separation. This visual guidance minimizes the risk of blind entry injuries, particularly damage to underlying viscera or major blood vessels, thereby significantly improving patient safety.

Which product segment is experiencing the fastest growth in the market?

The Bladeless Trocars segment, followed closely by Optical Trocars, is experiencing the fastest growth. This trend is driven by clinical preference for blunt or dilating entry methods that reduce fascial trauma and the incidence of port site hernias compared to sharp, bladed alternatives.

What major restraint impacts the expansion of the disposable trocar market?

The primary restraint is the higher unit cost of disposable trocars compared to reusable instruments. While disposables offer long-term savings by eliminating reprocessing labor and capital equipment, budget-conscious healthcare providers, especially in developing nations, often face pressure to minimize immediate supply chain expenditures.

Which geographical region is projected to be the fastest-growing for disposable trocars?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly modernizing healthcare systems, increasing government investment in surgical facilities, and a growing patient base seeking high-quality minimally invasive surgical care.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager