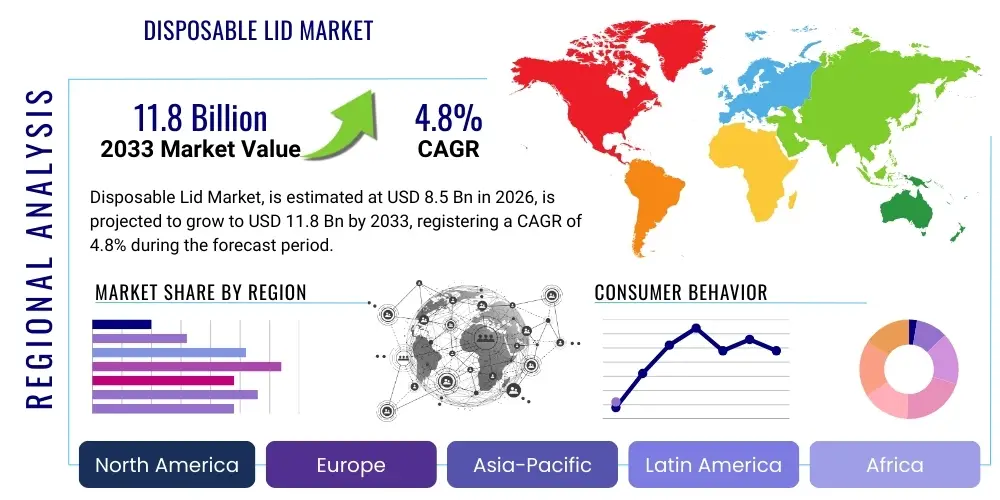

Disposable Lid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438905 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Disposable Lid Market Size

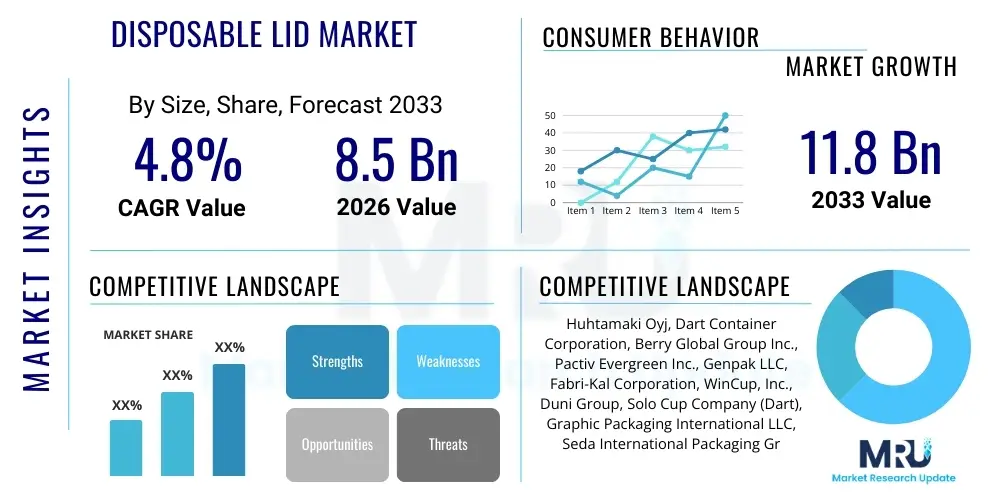

The Disposable Lid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $11.8 Billion by the end of the forecast period in 2033.

Disposable Lid Market introduction

The Disposable Lid Market encompasses the manufacturing, distribution, and sale of single-use covers primarily designed for cups, containers, and other food and beverage packaging. These lids serve critical functions including preventing spills, maintaining temperature (insulation), ensuring hygiene, and facilitating convenient consumption on-the-go. Historically dominated by plastic polymers like Polystyrene (PS), Polypropylene (PP), and Polyethylene Terephthalate (PET), the market is rapidly transitioning toward sustainable alternatives such as molded fiber, PLA (Polylactic Acid), and compostable paperboard to comply with global single-use plastic restrictions and meet evolving consumer demand for environmentally responsible packaging.

Major applications span the entire foodservice industry, encompassing quick-service restaurants (QSRs), coffee shops, institutional catering, airline services, and packaged food manufacturers. Key benefits driving sustained demand include enhanced portability, crucial hygiene protection—especially post-pandemic—and operational efficiency for foodservice providers managing high-volume, takeaway orders. Significant driving factors include the continuous expansion of the global coffee culture, the increasing reliance on online food delivery services (ghost kitchens and third-party delivery platforms), and relentless innovation in sustainable material science aimed at providing functional, cost-effective, and regulatory-compliant lid solutions.

However, the market faces intense regulatory scrutiny regarding plastic waste, particularly in regions like the European Union and specific states within North America. This pressure necessitates substantial investment in biodegradable and compostable packaging infrastructure and forces manufacturers to overhaul existing production lines. Despite these challenges, the functional requirement of disposable lids—particularly for safety and convenience in the booming on-the-go consumption culture—ensures robust market growth, prioritizing materials that offer both performance parity and verifiable end-of-life solutions.

Disposable Lid Market Executive Summary

The Disposable Lid Market is characterized by a high degree of maturity juxtaposed with dynamic innovation driven almost entirely by global sustainability mandates and the rise of the circular economy principles. Business trends prominently feature fierce competition in lightweighting technology and the aggressive adoption of fiber-based and bio-plastic solutions (PLA, PHA) to mitigate the regulatory risks associated with traditional petroleum-based polymers. Strategic mergers and acquisitions are observed as major packaging conglomerates seek to integrate specialized sustainable technology providers and secure raw material supply chains for novel materials, ensuring vertical integration and cost control in an inflationary environment.

Regional trends reveal a clear bifurcation: Developed markets like Europe and North America are defined by stringent regulatory environments leading to premium pricing for certified compostable products, strong consumer preference for plant-based materials, and significant investments in recycling and composting infrastructure development. Conversely, the Asia Pacific (APAC) region acts as the primary volume growth engine, driven by massive urbanization, burgeoning middle-class consumption patterns, and the rapid expansion of QSR chains, although the pace of sustainable transition varies significantly across key economies like China, India, and Southeast Asia, influenced largely by localized regulatory clarity and infrastructure availability.

Segmentation trends indicate a pronounced shift away from Polystyrene (PS) and, increasingly, standard PET, toward Fiber/Paper and Polylactic Acid (PLA) lids, particularly in the hot beverage and cold beverage segments, respectively. The food container lid segment, still heavily reliant on PP due to its superior heat resistance and resealability characteristics, is actively exploring high-barrier, bio-based alternatives. This material substitution trend is the single most important factor shaping market investments, demanding manufacturers prioritize research into materials that maintain critical functional properties—such as leak resistance and stacking ability—while achieving certified compostability or enhanced recyclability, thus ensuring compliance and brand loyalty in environmentally conscious markets.

AI Impact Analysis on Disposable Lid Market

Common user questions regarding AI's impact on the Disposable Lid Market revolve around optimizing manufacturing efficiency, reducing material waste, predicting demand shifts related to sustainability trends, and enhancing quality control. Users are keen to understand how AI can help navigate complex supply chain volatility concerning new bio-based materials and how machine learning algorithms can accelerate the R&D process for novel lid designs that meet both functional and environmental specifications. The key themes emerging from user inquiries center on achieving "Smart Manufacturing" through AI-driven predictive maintenance, automating defect detection in high-speed production lines, and using data analytics to forecast regional regulatory impacts on material procurement and pricing strategy, ensuring agility in a rapidly changing legislative landscape.

The deployment of AI and machine learning models fundamentally alters traditional operational paradigms within the disposable lid manufacturing sector, moving beyond simple automation to predictive optimization. AI algorithms analyze real-time data from production sensors—including temperature, pressure, and material flow rates—to predict equipment failures before they occur, drastically reducing unplanned downtime which is exceptionally costly in high-volume, low-margin packaging operations. Furthermore, AI-driven quality assurance systems use computer vision to inspect every unit instantaneously, identifying microscopic defects (such as weak hinges, uneven seals, or material inconsistencies in molded fiber) far more accurately and consistently than human inspectors, ensuring superior product quality and minimizing customer complaints related to leaks or improper fits.

Beyond the factory floor, AI provides crucial strategic advantages in supply chain resilience and demand forecasting. Machine learning models integrate external variables such as climate data, regulatory updates (e.g., implementation dates for single-use plastic bans), commodity price fluctuations (pulp, resins, bio-feedstocks), and geopolitical instability to create highly accurate demand predictions tailored to specific regional markets and product types (hot vs. cold). This predictive capability enables manufacturers to optimize inventory levels, strategically source sustainable raw materials ahead of supply shortages, and dynamically adjust production schedules, thereby improving capital efficiency and ensuring the timely delivery of specialized, compliant products necessary for large QSR contracts.

- AI-Driven Quality Control: Enhanced defect detection using computer vision on high-speed production lines, ensuring precise sealing and fitment tolerances.

- Predictive Maintenance: Minimizing operational downtime in molding and forming machinery by forecasting component failures based on sensor data analysis.

- Supply Chain Optimization: ML algorithms predicting fluctuations in bio-material pricing (e.g., PLA resin costs) and optimizing global logistics routes.

- Demand Forecasting: Analyzing complex inputs (regulatory changes, weather patterns, competitor strategies) to accurately predict regional shifts from plastic to fiber-based lids.

- Material Science Acceleration: AI simulation aiding in the design and testing of novel sustainable materials, accelerating the development of functional, high-barrier compostable lids.

- Waste Reduction: Optimizing material usage (lightweighting) through simulation and real-time process adjustments driven by AI analytics, minimizing scrap rate.

DRO & Impact Forces Of Disposable Lid Market

The market dynamics of disposable lids are defined by a powerful interplay between regulatory push, consumer pull for sustainability, and technological limitations inherent in functional replacement materials. Major drivers include the global expansion of the ready-to-eat and on-the-go food and beverage culture, accelerated by digital delivery platforms and QSR proliferation. Simultaneously, the relentless pursuit of robust, cost-effective sustainable packaging solutions acts as a primary market opportunity, rewarding companies that can successfully scale certified compostable or truly recyclable alternatives. Restraints primarily center on the significantly higher cost and sometimes inferior performance (e.g., heat stability, barrier protection) of alternative materials compared to traditional plastics, coupled with the lack of standardized, widespread industrial composting infrastructure required for these products to fulfill their environmental promise, creating a structural barrier to full adoption.

These forces exert profound impact on market investment and strategic planning. Regulatory drivers, such as the EU Single-Use Plastics Directive and similar bans across North America, are the most immediate impact force, compelling rapid portfolio transformation. Manufacturers must absorb the substantial costs associated with retooling production lines from plastic injection molding to specialized fiber molding or bio-plastic thermoforming, often resulting in temporary margin compression. Furthermore, the volatility of raw material prices—ranging from petroleum derivatives to pulp—places intense pressure on procurement strategies, requiring sophisticated hedging and long-term contracts for sustainable feedstocks to ensure price stability for end-users like large coffee chains.

The opportunity landscape is dominated by innovations in materials that offer "drop-in" functionality, meaning they can perform equivalently to plastic lids without requiring significant change in consumer handling or infrastructure. This includes developing high-moisture resistant coatings for molded fiber lids and improving the heat tolerance of PLA and similar polymers. Companies successfully addressing these performance gaps will gain substantial market share. However, external impact forces such as stringent labeling requirements (e.g., 'Not suitable for home composting') and persistent public scrutiny regarding 'greenwashing' demand absolute transparency and third-party certification (e.g., BPI, TÜV Austria), making compliance and clear communication essential operational mandates.

Segmentation Analysis

The Disposable Lid Market is broadly segmented based on Material, Application, and Distribution Channel, each facing unique pressure points related to sustainability and performance requirements. The fundamental material split between traditional plastics and sustainable alternatives (fiber/bioplastics) dictates cost structure and regulatory compliance. Material innovation is the most active area, driven by the need to find alternatives that maintain the cost efficiency of PP while offering the end-of-life benefits of compostable pulp or PLA. Applications segmentation highlights performance needs: Hot beverage lids require superior heat resistance and tight seals, while cold beverage lids focus on dome designs and straw compatibility. Distribution remains dominated by the B2B channel, servicing the massive procurement needs of the foodservice industry.

The most significant shift within segmentation is visible in the Material category. Polystyrene (PS), once prevalent, is rapidly being phased out due globally recognized environmental issues. Polypropylene (PP) maintains its dominance in food containers due to its barrier properties and microwave safety, but its presence in beverage lids is being challenged by regulatory measures. Fiber and molded pulp are experiencing explosive growth, particularly for hot drinks, where consumers tolerate a slightly different texture in exchange for environmental benefits. Bioplastics, especially PLA, are emerging as the preferred replacement for clear, cold beverage lids, though they still face challenges regarding industrial composting accessibility and processing heat limits. This fragmentation necessitates complex production strategies tailored to regional material preference and specific end-user needs, such as custom logo printing or unique venting designs.

- By Material:

- Plastic (Polypropylene (PP), Polyethylene Terephthalate (PET), Polystyrene (PS), Polyethylene (PE))

- Paper and Fiber (Molded Pulp, Paperboard)

- Bioplastics (Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA))

- By Application:

- Hot Beverages (Coffee, Tea, Soup Cups)

- Cold Beverages (Soda, Smoothies, Iced Coffee)

- Food Containers (Deli Containers, Takeout Boxes, Bowls)

- By Size and Design:

- Flat Lids

- Dome Lids

- Sip-Through Lids

- Vented Lids

- By Distribution Channel:

- Business-to-Business (B2B) (Foodservice Distributors, Direct Sales to QSRs)

- Retail (Grocery Stores, Bulk Retailers)

Value Chain Analysis For Disposable Lid Market

The value chain for the Disposable Lid Market begins with upstream material suppliers, who provide petrochemical resins (PP, PET) or sustainable feedstocks (pulp, sugar cane bagasse, corn starch for PLA). This upstream segment faces critical price volatility and supply concentration risk, especially concerning certified bio-materials where processing capacity is still limited globally. Manufacturers rely heavily on securing stable, ethically sourced material inputs. Midstream, the manufacturing process involves complex technologies like injection molding, thermoforming, and specialized fiber pressing. Efficiency here is paramount, as competition drives down unit costs, requiring heavy investment in automation and lightweighting technologies to optimize material usage and reduce energy consumption per unit.

Downstream analysis focuses on distribution and the end-user. Direct distribution channels, where major manufacturers supply large Quick Service Restaurant (QSR) chains or institutional clients (hospitals, corporate campuses), demand highly customized products, stringent quality control, and just-in-time delivery capabilities. Indirect channels, involving foodservice distributors (e.g., Sysco, US Foods), provide broader market reach to smaller independent establishments. The critical factor in the downstream market is the ability to communicate regulatory compliance and sustainability certifications effectively to end-users, as buyers increasingly prioritize suppliers whose products align with their corporate environmental targets, making sustainability credentials a non-negotiable component of procurement decisions.

The interdependence across the value chain is intensifying, driven by the shift to circular models. Recyclers and composters, traditionally external, are now integral, influencing product design by demanding monomaterial construction and clear labeling. Collaboration between packaging manufacturers and waste management entities is essential to close the loop, particularly in markets mandating high recycled content. This necessity creates opportunities for vertically integrated companies that control material sourcing, manufacturing, and even post-consumer material recovery, allowing them to offer guaranteed sustainable solutions at a competitive price point while ensuring compliance with increasingly complex global and regional regulations, making the chain highly resilient and transparent.

Disposable Lid Market Potential Customers

The disposable lid market's primary potential customers are those segments of the economy characterized by high-volume, single-use food and beverage service, where speed, hygiene, and portability are non-negotiable operational requirements. The largest segment remains the Quick Service Restaurant (QSR) industry, including global chains specializing in coffee, burgers, and fast casual dining, which rely on secure lids for their vast takeaway and drive-thru operations. These customers demand extremely high quality consistency, standardized sizing, and increasingly, verifiable compostable or recyclable certifications to meet their global brand commitments. The shift toward sustainable sourcing is now a critical criterion in their vendor selection process.

Another major segment includes institutional food services and large-scale caterers, such as airlines, hospitals, corporate cafeterias, and educational facilities. These entities prioritize hygiene, durability, and bulk purchasing efficiency. While historically cost-sensitive, institutional buyers are facing growing internal pressures (e.g., employee and patient demands for sustainability) and external mandates (government contracts requiring green procurement), pushing them toward adopting fiber and bioplastic alternatives. The rapid growth of third-party food delivery aggregators (e.g., DoorDash, Uber Eats) has also indirectly created a massive demand pool, as every delivered meal or beverage requires secure, leak-proof packaging designed to withstand transportation stresses.

Furthermore, packaged food and beverage manufacturers that pre-package items for retail sale (e.g., cold deli salads, ready-to-drink beverages) constitute a significant customer base. Their need is focused on barrier properties and tamper evidence, ensuring product integrity and shelf life. The evolution of this segment is tied to materials innovation that can provide clear, aesthetically pleasing, and protective lids that meet strict food safety standards while still being highly sustainable. Successfully targeting these diverse end-users requires manufacturers to maintain expansive product portfolios tailored to specific application temperatures, container diameters, and regulatory requirements across different geographic locations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $11.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huhtamaki Oyj, Dart Container Corporation, Berry Global Group Inc., Pactiv Evergreen Inc., Genpak LLC, Fabri-Kal Corporation, WinCup, Inc., Duni Group, Solo Cup Company (Dart), Graphic Packaging International LLC, Seda International Packaging Group, BillerudKorsnäs AB, Transco Plastic Industries, Novolex Holdings, International Paper Company, Reynolds Consumer Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Lid Market Key Technology Landscape

The technology landscape of the Disposable Lid Market is undergoing a fundamental transformation, shifting investment focus from optimizing high-speed traditional plastic molding towards perfecting techniques for sustainable materials. The most critical technological advancements are centered around precision thermoforming of bioplastics (PLA), which demands exact temperature control to maintain the material's structural integrity, and advanced pulp molding. Traditional pulp molding often results in rough, porous products, but modern high-pressure, precision-molding techniques—sometimes referred to as 'wet-press' or 'smooth-press' fiber molding—are achieving the smooth surfaces and tight tolerances necessary for leak-proof cup sealing, parity previously only attainable with plastic lids. These innovations are crucial for creating fiber-based lids that are aesthetically pleasing and functionally reliable for both hot and cold applications.

Material science innovation also plays a central role, specifically the development of high-barrier coatings for fiber products and the improvement of heat resistance in PLA. Fiber lids, while sustainable, naturally absorb moisture and lack the barrier properties of plastic, leading to performance issues over time. Manufacturers are employing proprietary, non-fluorinated chemical coatings (PFAS-free) derived from natural polymers or mineral fillers to enhance liquid and grease resistance. Simultaneously, researchers are working on blending PLA with other bio-based polymers (like PBS or PHA) or using nucleating agents to increase its crystallization rate, improving the thermal stability of clear bioplastic lids, allowing them to better handle moderately hot beverages or microwaveable food containers without warping or degrading, thus expanding their application scope significantly.

Furthermore, automation and digitization in the manufacturing process are key technological drivers of efficiency and cost reduction. Modern production facilities integrate sophisticated robotics for high-speed stacking and packaging, minimizing contamination and labor costs. Digital twinning and simulation software are increasingly utilized to model the performance of new lid designs under various stress conditions (e.g., thermal shock, pressure changes during transport) before committing to physical tooling. This digitalization streamlines the R&D cycle and minimizes the risk associated with tooling investment for complex, sustainable designs, ensuring that new products are market-ready faster and meet stringent performance standards required by major foodservice clients globally.

Regional Highlights

Regional dynamics within the Disposable Lid Market are highly heterogeneous, primarily dictated by local regulatory frameworks, the maturity of waste infrastructure, and cultural preferences regarding takeaway consumption. North America (NA), driven largely by the massive scale of the QSR and fast-casual sectors, represents a dominant market volume. The US, in particular, exhibits a complex regulatory patchwork, with states and cities implementing varying degrees of single-use plastic bans, creating a strong impetus for manufacturers to develop versatile, compliant sustainable solutions suitable for national distribution. Demand is strongest for fiber and bioplastic lids, necessitating significant investment in localized production capacity for these alternatives.

Europe stands out as the global leader in sustainability mandates, spearheaded by the EU Single-Use Plastics Directive (SUPD). This legislation has fundamentally reshaped the market, accelerating the phase-out of traditional plastic lids and mandating tethered cap designs for bottles, which influences associated lid technology. The European market places a high value on certified compostable packaging (EN 13432), leading to a premium price structure for innovative bioplastics and molded fiber products. The maturity of composting facilities in countries like Germany and the Netherlands supports this transition, while manufacturers focus intensely on verifiable environmental claims and lifecycle assessments to satisfy strict consumer scrutiny.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by rapid urbanization, substantial growth in disposable income, and the expansion of foodservice chains into emerging markets like India and Southeast Asia. While the overall volume is immense and traditional plastics (PP) remain prevalent due to cost considerations, major economies like China and South Korea are rapidly implementing comprehensive plastic reduction policies. This creates a dual market: a high-volume, cost-sensitive traditional plastic segment, alongside a burgeoning, premium sustainable segment catering to international brands and environmentally aware domestic consumers, making strategic localized partnerships essential for market penetration.

Latin America (LATAM) and the Middle East and Africa (MEA) represent emerging opportunity zones. LATAM is characterized by fragmented but increasingly environmentally conscious regulatory environments, particularly in large urban centers in Brazil and Mexico, leading to sporadic but growing demand for sustainable lids. MEA shows strong demand correlated with tourism and hospitality expansion, especially in the UAE and Saudi Arabia, where international standards often drive packaging choices. In both regions, market penetration relies on establishing efficient, reliable supply chains capable of delivering high-quality products at a competitive price point, often sourced through global manufacturing hubs due to limited local production capacity.

- North America: Focus on lightweighting PP and rapid transition to fiber/PLA driven by state-level bans (e.g., California, New York). High demand from QSR drive-thru operations.

- Europe: Market dictated by EU SUPD, strong preference for certified compostable (EN 13432) materials, and tethered lid innovations for consistency across the continent.

- Asia Pacific (APAC): Highest volume growth, with China and India adopting sustainability measures for premium segments; continued reliance on cost-effective traditional plastics in volume segments.

- Latin America (LATAM): Emerging market potential driven by urbanization and selective city-level regulations; challenges in distribution logistics and consistent infrastructure.

- Middle East and Africa (MEA): Growth linked to tourism, hospitality, and international franchising; emphasis on high-quality, durable packaging meeting international QSR standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Lid Market.- Huhtamaki Oyj

- Dart Container Corporation

- Berry Global Group Inc.

- Pactiv Evergreen Inc.

- Genpak LLC

- Fabri-Kal Corporation

- WinCup, Inc.

- Duni Group

- Solo Cup Company (Dart)

- Graphic Packaging International LLC

- Seda International Packaging Group

- BillerudKorsnäs AB

- Transco Plastic Industries

- Novolex Holdings

- International Paper Company

- Reynolds Consumer Products

- WestRock Company

- Sonoco Products Company

- Anchor Packaging, Inc.

- DS Smith Plc

Frequently Asked Questions

Analyze common user questions about the Disposable Lid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Disposable Lid Market?

The primary driver is the accelerating consumer preference for convenience and on-the-go consumption, significantly bolstered by the rapid expansion of global quick-service restaurants (QSRs) and high-volume food delivery services, which mandate secure, single-use packaging for portability and hygiene. This functional demand is coupled with the critical need for manufacturers to replace traditional plastics with sustainable alternatives like molded fiber and PLA to meet regulatory requirements.

How is the EU Single-Use Plastics Directive (SUPD) impacting the market?

The SUPD is creating profound market disruption in Europe, mandating the phase-out of certain single-use plastic lids and accelerating the adoption of tethered caps for beverage containers. This requires manufacturers to invest heavily in specialized tooling for bio-based and fiber materials, thereby elevating the average cost of compliant lids but simultaneously driving technological innovation in sustainable high-performance packaging solutions globally.

What are the main performance challenges associated with sustainable disposable lids?

Sustainable alternatives, particularly molded fiber and PLA, face key performance challenges including inferior moisture resistance (leading to 'soggy' fiber), lower heat resistance (PLA deformation), and difficulties in achieving the consistently tight tolerances and clarity offered by traditional plastics. Manufacturers are addressing this through non-PFAS barrier coatings and advanced precision molding techniques to achieve functional parity.

Which material segment is expected to see the fastest growth?

The Paper and Fiber segment, specifically molded pulp and paperboard, is projected to see the fastest growth rate. This acceleration is due to its favorable environmental profile, growing public acceptance, and increasing regulatory pressure targeting plastic alternatives in high-volume applications like hot beverage service. Continuous technological advancements are improving fiber lid functionality to match or exceed consumer expectations.

How does AI contribute to manufacturing efficiency in the lid market?

AI significantly contributes by enabling 'Smart Manufacturing,' utilizing machine learning for predictive maintenance to prevent costly equipment failures, optimizing material usage (lightweighting) through real-time process control, and employing computer vision systems for instantaneous, highly accurate quality control, ensuring zero-defect products meet the demanding specifications of large commercial buyers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager