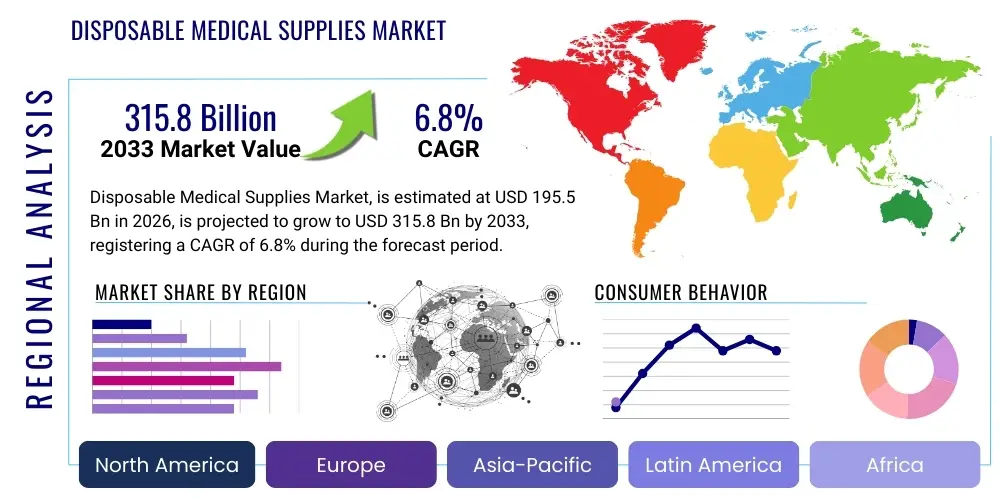

Disposable Medical Supplies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435622 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Disposable Medical Supplies Market Size

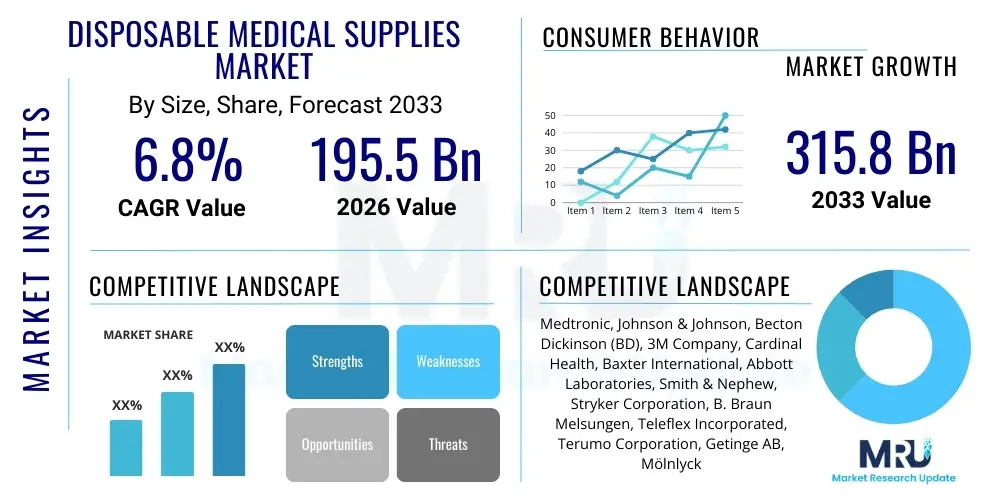

The Disposable Medical Supplies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 195.5 Billion in 2026 and is projected to reach USD 315.8 Billion by the end of the forecast period in 2033.

Disposable Medical Supplies Market introduction

The Disposable Medical Supplies Market encompasses a vast array of products designed for single use in clinical, surgical, and therapeutic settings to prevent cross-contamination and ensure patient safety. These essential supplies include items such as surgical gloves, syringes, catheters, wound dressings, face masks, protective apparel, and diagnostic disposables. The fundamental characteristic of these products is their intended destruction or disposal immediately following a single instance of use, which is critical in maintaining stringent hygiene standards mandated by global healthcare regulatory bodies. The continuous rise in infectious disease outbreaks, coupled with the increasing volume of complex surgical procedures performed worldwide, substantially drives demand for high-quality, sterile disposable goods. Moreover, the aging global population requiring long-term care and the expansion of home healthcare services contribute significantly to the market's robust trajectory.

Major applications of disposable medical supplies span the entire healthcare continuum, from acute care hospitals and specialized surgical centers to diagnostic laboratories and ambulatory care settings. In hospital environments, disposables are fundamental to infection control protocols, underpinning daily operations across operating rooms, intensive care units, and general patient wards. Specific product types, such as disposable needles and syringes, are integral to large-scale vaccination programs and diabetes management, highlighting their role in both primary care and chronic disease management. The convenience and proven efficacy in mitigating Hospital-Acquired Infections (HAIs) make these products indispensable tools for clinicians globally. Furthermore, the advent of sophisticated disposable supplies, such as advanced wound care materials and specialized procedural kits, improves procedural efficiency and patient outcomes.

The primary benefit of utilizing disposable medical supplies is the significant reduction in infection risks, which translates directly into lower healthcare costs associated with treating HAIs and improved patient morbidity rates. Driving factors for market expansion include escalating healthcare expenditure across emerging economies, technological advancements leading to safer and biocompatible materials, and stricter regulatory frameworks globally enforcing single-use policies for invasive and contamination-prone procedures. The push towards minimally invasive surgery, which often utilizes specialized disposable instruments, also accelerates market growth. Conversely, challenges such as sustainable waste management and fluctuating raw material costs occasionally restrain the pace of market development, compelling manufacturers to invest in biodegradable or recyclable product designs to address growing environmental concerns.

Disposable Medical Supplies Market Executive Summary

The Disposable Medical Supplies Market is characterized by resilient growth driven primarily by demographic shifts, expanding healthcare access, and stringent infection control mandates. Key business trends indicate a strong focus on supply chain resilience, post-pandemic operational optimization, and vertical integration among major players to secure critical raw materials and distribution channels. Manufacturers are increasingly emphasizing product innovation, particularly in areas like smart disposables integrated with sensors for real-time monitoring, and sustainable packaging solutions to appeal to environmentally conscious healthcare providers. Mergers and acquisitions remain a prevalent strategy, allowing large corporations to consolidate market share, acquire specialized technological capabilities, and quickly enter high-growth regional markets, particularly in Asia Pacific where infrastructure development is accelerating.

Regionally, the market exhibits mature stability in North America and Europe, supported by established healthcare systems and high per capita expenditure, where the focus remains on premium, high-value disposables and advanced procedural kits. However, the most explosive growth is anticipated in the Asia Pacific (APAC) region, fueled by massive government investments in expanding hospital capacity, increasing insurance penetration, and a burgeoning medical tourism sector. Latin America and the Middle East & Africa (MEA) present significant opportunities, primarily through public-private partnerships aimed at modernizing healthcare infrastructure and addressing large, underserved patient populations. Regulatory harmonization efforts, particularly within the European Union and across key U.S. markets, influence standardization and facilitate cross-border trade of approved disposable products, ensuring consistency in quality and safety standards globally.

Segment trends demonstrate notable shifts toward specialized product categories, moving beyond generic supplies. The protective apparel and PPE segment, while stabilizing from the pandemic peak, is retaining significantly higher demand levels due to heightened public and professional awareness regarding respiratory and contact pathogen transmission. Furthermore, the segmentation by end-user reveals robust growth in Ambulatory Surgical Centers (ASCs) and physician offices, reflecting the broader movement of non-critical procedures out of expensive inpatient hospital settings. Material science is a crucial trend within segmentation, with increasing demand for latex-free, biodegradable polymers and antimicrobial coatings applied to disposables like catheters and wound care products, aiming to further minimize patient adverse reactions and microbial colonization, thereby driving the premium segment of the market.

AI Impact Analysis on Disposable Medical Supplies Market

Common user questions regarding AI's impact on disposable medical supplies typically revolve around efficiency improvements, supply chain prediction accuracy, and quality control mechanisms. Users frequently inquire about how Artificial Intelligence can forecast demand surges, especially for critical items like PPE or specific surgical kits, thereby preventing stockouts and ensuring timely procurement. There is also significant curiosity concerning AI's role in optimizing manufacturing processes, specifically utilizing machine vision and deep learning algorithms for defect detection during high-volume production of items such as syringes or specialized tubing. Furthermore, healthcare professionals often ask how AI can integrate disposable usage data with Electronic Health Records (EHRs) to recommend the most appropriate, cost-effective disposable items for specific patient procedures, thereby enhancing utilization management and reducing medical waste.

The primary themes emerging from these inquiries highlight the expectation that AI will transition disposable supplies from a reactive inventory management challenge to a proactively optimized system. Concerns often center on the initial investment required for AI infrastructure, data privacy issues concerning integrated usage tracking, and the need for skilled personnel to manage and interpret complex AI-driven predictive models. Users anticipate that AI will significantly enhance the security and integrity of the supply chain, particularly through the use of blockchain integrated with AI for tracking the origin and movement of high-value disposable medical devices, ensuring anti-counterfeiting measures are robust. The integration of AI with logistics platforms is expected to create highly dynamic warehousing systems capable of adjusting stocking levels based on real-time disease prevalence, seasonal fluctuations, and hospital procedure schedules.

Ultimately, the consensus suggests that AI's influence will not change the fundamental nature of the disposable product itself (its single-use characteristic), but rather revolutionize its life cycle management, from sourcing and manufacturing to utilization and disposal. Expectations are high that AI-driven quality assurance will lead to near-zero defect rates in mass-produced items, raising the global standard for safety and performance. Moreover, the use of AI in R&D is accelerating the identification of novel, cost-effective, and sustainable materials suitable for medical disposables, addressing both environmental mandates and cost containment pressures faced by healthcare systems worldwide. This technological infusion positions the market for increased operational efficiency and a stronger adherence to customized clinical needs based on predictive data analytics.

- AI-powered demand forecasting optimizing inventory levels for seasonal and pandemic planning.

- Implementation of Machine Vision in manufacturing for high-speed, automated defect detection and quality control.

- Predictive maintenance analytics for disposable manufacturing equipment, minimizing downtime and increasing yield.

- Integration of AI and blockchain for enhanced supply chain traceability and anti-counterfeiting measures for critical disposables.

- AI-driven utilization management systems integrating patient data to optimize procedural kit contents and reduce waste.

- Development of smart disposables (e.g., connected packaging) providing real-time usage data back to inventory systems.

- Natural Language Processing (NLP) utilized to analyze regulatory updates, ensuring disposable product compliance globally.

DRO & Impact Forces Of Disposable Medical Supplies Market

The Disposable Medical Supplies Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all subject to significant Impact Forces originating from technology, regulation, and socioeconomic trends. The primary driver is the pervasive emphasis on infection control, particularly the mandates surrounding the prevention of Hospital-Acquired Infections (HAIs), which globally enforce the adoption of single-use, sterile equipment in clinical settings. This driver is powerfully augmented by the continuous expansion of the elderly demographic, a population segment that necessitates more frequent healthcare interventions, chronic disease management, and higher utilization rates of medical consumables. Furthermore, technological progress in material science, leading to the creation of advanced, safer, and more specialized disposables for minimally invasive procedures, acts as a crucial propellant, expanding the scope and value proposition of the market.

Restraints primarily revolve around escalating environmental concerns and the massive volume of medical waste generated by disposable products, which necessitates substantial investment in waste management infrastructure and sustainable material R&D, adding to operational costs. Volatility in the pricing and availability of key raw materials, especially polymers derived from petrochemicals, poses a recurrent supply chain challenge, impacting manufacturing margins and potentially leading to price increases for end-users. Additionally, intense price competition, particularly for commodity disposables in emerging markets, often pressures manufacturers to reduce costs, sometimes compromising investment in advanced technologies or sustainable practices. Regulatory hurdles, while necessary for safety, can also slow down the introduction of innovative products, particularly in markets with complex approval processes.

Opportunities in the market are abundant, centered around the rapid expansion of healthcare infrastructure in emerging economies, notably in Asia Pacific and Latin America, creating vast untapped consumer bases. The shift toward home healthcare and remote patient monitoring significantly increases the demand for user-friendly, specialized disposable supplies compatible with home-use devices. Furthermore, the development and commercialization of bio-based, biodegradable, and recycled polymer disposables represent a critical opportunity for market players to gain a competitive edge by aligning with global sustainability goals. The strategic implementation of automation and AI in manufacturing and logistics offers potential for significant cost optimization and enhanced supply chain predictability. Impact forces, such as government policies favoring domestic manufacturing, trade tariffs affecting global supply chains, and evolving public health crises, exert continuous pressure, dictating regional market dynamics and investment priorities, making supply chain agility a non-negotiable strategic imperative.

Segmentation Analysis

The Disposable Medical Supplies Market is highly fragmented and analyzed across several critical dimensions, including product type, application, material, and end-user. This multidimensional segmentation allows for precise targeting of market strategies and accurate assessment of growth potential within specialized niches. Products range from high-volume, low-cost commodity items like general-purpose gloves and cotton products to highly specialized, high-value items such as advanced wound management products, specialized surgical kits, and sophisticated interventional disposables. Understanding the differential growth rates across these segments is essential, as segments linked to chronic disease management and complex surgical procedures often exhibit higher CAGR due to increasing prevalence and procedural volumes worldwide.

- Product Type:

- Wound Management Products (Bandages, Dressings, Tapes)

- Infection Control Supplies (Surgical Gloves, Face Masks, Gowns, Drapes)

- Injection and Infusion Products (Syringes, Needles, IV Sets, Catheters)

- Dialysis Disposables (Dialyzers, Bloodlines, Fistula Needles)

- Non-Woven Disposables (Caps, Shoe Covers, Bed Linen)

- Respiratory Disposables (Oxygen Masks, Nebulizer Kits)

- Blood Collection Supplies

- Other Specialized Supplies (Surgical Kits, Ostomy Products)

- Material:

- Plastics & Polymers (Polypropylene, Polyethylene, PVC)

- Non-Woven Fabric

- Rubber & Latex

- Paper & Paperboard

- Application:

- Infection Prevention

- Wound Care

- Drug Delivery

- Dialysis

- Radiology & Imaging

- End-User:

- Hospitals and Clinics (Acute Care Settings)

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Laboratories

- Home Healthcare Settings

Value Chain Analysis For Disposable Medical Supplies Market

The value chain for disposable medical supplies begins with upstream activities focused on raw material sourcing and primary manufacturing. Key raw materials, including specialized medical-grade polymers (such as polypropylene and polyethylene), natural and synthetic rubber for gloves, and non-woven fabrics for gowns and masks, are highly scrutinized for quality and consistency. Manufacturers often engage in global sourcing to optimize costs, but this exposes the supply chain to geopolitical risks and commodity price volatility. Upstream processing involves polymerization, spinning, and molding operations, where adherence to biocompatibility standards (ISO 10993) is paramount. Strategic partnerships with specialized chemical suppliers who can guarantee sterile and medical-grade feedstock are crucial for maintaining product integrity and regulatory compliance, particularly for sterile-barrier systems and items that come into direct contact with bodily fluids.

The core manufacturing and assembly stage involves high-volume, automated processes, including injection molding, ultrasonic welding, sterilization (typically using Ethylene Oxide, gamma radiation, or E-beam), and packaging in controlled environments (cleanrooms). Downstream activities primarily involve distribution channels and end-user consumption. Distribution is complex due to the requirement for specific storage conditions (especially for temperature-sensitive sterile products) and the need for rapid replenishment in high-demand hospital settings. Direct distribution channels, where large manufacturers sell directly to major hospital networks or government procurement agencies, ensure better inventory control and margin preservation. This method is preferred for high-value, specialized disposable kits.

Indirect distribution relies heavily on medical device distributors, wholesalers, and specialized logistics providers who manage inventory and delivery to smaller clinics, physician offices, and retail pharmacies. The efficiency of the distribution network is a significant competitive differentiator, particularly in emerging markets where infrastructure can be challenging. The final consumption stage involves the integration of these supplies into clinical workflows, followed by disposal. As regulatory scrutiny increases, the waste management segment becomes a critical, integrated part of the value chain, driving demand for reverse logistics and specialized medical waste handling services, often managed through outsourced contracts. Overall, the value chain is highly regulated, necessitating continuous quality management across all nodes to ensure patient safety and product effectiveness throughout the supply network.

Disposable Medical Supplies Market Potential Customers

The primary end-users, and thus the largest potential customers, for disposable medical supplies are hospitals and specialized acute care clinics. These institutions constitute the largest purchasing segment due to the sheer volume of surgical procedures, diagnostics, inpatient stays, and emergency services they handle, all of which necessitate continuous, high-volume consumption of infection control supplies, surgical instruments, and general wound care products. Procurement strategies in this segment are highly centralized and often involve long-term contracts based on cost-efficiency, reliability, and the ability of suppliers to handle large-scale logistical requirements. The increasing complexity of hospital networks, often managed by large Group Purchasing Organizations (GPOs), means that securing contracts with GPOs is a critical pathway for market access and volume sales.

Another rapidly expanding potential customer segment includes Ambulatory Surgical Centers (ASCs) and physician offices. The movement toward performing less complex, elective procedures in outpatient settings—driven by lower costs and improved patient convenience—has dramatically increased the utilization rates of disposable supplies in ASCs. These customers typically require standardized, procedure-specific kits that minimize preparation time and streamline workflow. Unlike large hospitals, ASCs often prioritize ease of use, smaller bulk purchasing options, and rapid delivery turnaround. Furthermore, long-term care facilities and nursing homes represent significant customers, requiring substantial volumes of basic disposables, including incontinence products, personal protective equipment for staff, and routine wound care supplies, driven primarily by the sustained care needs of the geriatric population.

Finally, the burgeoning Home Healthcare sector and independent diagnostic laboratories form a distinct, high-growth customer base. Home healthcare patients require a consistent supply of disposables for chronic condition management, such as syringes, infusion sets, and specialized wound dressings, often procured through retail pharmacies or specialized home medical equipment (HME) providers. Diagnostic laboratories, meanwhile, are high-volume consumers of disposable laboratory consumables, including pipettes, petri dishes, collection tubes, and specimen cups, directly correlating to the increasing volume of routine and specialized diagnostic testing performed globally. These customers prioritize laboratory-grade sterile disposables that ensure sample integrity and minimize the risk of contamination during analysis, demanding rigorous quality assurance from their suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.5 Billion |

| Market Forecast in 2033 | USD 315.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Johnson & Johnson, Becton Dickinson (BD), 3M Company, Cardinal Health, Baxter International, Abbott Laboratories, Smith & Nephew, Stryker Corporation, B. Braun Melsungen, Teleflex Incorporated, Terumo Corporation, Getinge AB, Mölnlycke Health Care, Ansell Limited, Paul Hartmann AG, Kimberly-Clark Corporation, Halyard Health (now part of Owens & Minor), Convatec Group Plc, Domtar Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Medical Supplies Market Key Technology Landscape

The technological landscape for disposable medical supplies is heavily influenced by advancements in polymer science, sterilization techniques, and manufacturing automation, all aimed at enhancing safety, functionality, and cost-efficiency. A significant trend involves the development of specialized antimicrobial coatings applied to high-risk disposables, such as urinary and vascular catheters, designed to reduce microbial biofilm formation and prevent device-related infections, a critical concern in acute care. Furthermore, the industry is witnessing a shift towards the integration of sophisticated materials that offer superior barrier protection without compromising tactile sensitivity or breathability, crucial for surgical gowns and examination gloves. The adoption of advanced non-woven technologies allows for the creation of stronger, lighter, and more absorbent materials for surgical drapes and complex wound dressings, improving patient comfort and procedural efficacy.

Manufacturing technologies are increasingly leveraging Industry 4.0 principles, including high-speed robotics and automated assembly lines, essential for producing the enormous volumes of required disposables while maintaining rigorous quality control standards. Precision micro-molding techniques are vital for creating highly complex, small-scale components found in infusion pumps, specialized syringes, and minimally invasive surgical tools, ensuring exact tolerances and optimal performance during clinical use. Sterilization technology is also evolving, with continuous research into novel low-temperature sterilization methods (e.g., vaporized hydrogen peroxide) to accommodate the increasing use of heat-sensitive materials in modern medical devices, ensuring product integrity and reducing cycle times compared to traditional methods like Ethylene Oxide, which carries environmental and health risks.

The future technology landscape is centered on sustainability and connectivity. Research into bio-absorbable and biodegradable polymers derived from renewable resources is gaining momentum, addressing the environmental impact of medical waste. This includes polymers that break down safely after disposal, offering a green alternative to conventional plastics. Concurrently, the rise of "smart" disposables incorporates passive technologies like RFID tags or simple sensors into packaging or the device itself. These technologies enable automated inventory tracking, monitor adherence to expiration dates, and provide usage data back to the healthcare provider’s system. This connectivity facilitates efficient just-in-time inventory management and enhances patient safety by ensuring the use of authentic, in-date supplies, thus integrating the disposable product into the broader digital health ecosystem.

Regional Highlights

- North America: This region holds a dominant market share, primarily driven by high healthcare expenditure, established reimbursement policies, and the presence of major global healthcare companies. The U.S. enforces extremely stringent infection control regulations, propelling continuous demand for premium, specialized disposable supplies and procedural kits. Technological innovation, especially in advanced wound care and interventional cardiology disposables, is robust.

- Europe: Characterized by highly developed public healthcare systems and strong regulatory oversight (via the EU MDR), Europe maintains a large market size. Growth is underpinned by an aging population and high standards of aseptic techniques. There is a strong regional focus on adopting sustainable practices, increasing the demand for eco-friendly and biodegradable disposable alternatives.

- Asia Pacific (APAC): Expected to be the fastest-growing region during the forecast period due to rapid expansion of healthcare infrastructure, increasing disposable incomes, and rising awareness regarding hygiene and infection prevention. Countries like China and India are experiencing massive government investment in expanding hospital beds and primary care facilities, translating to surging demand for both commodity and specialized disposables.

- China: Represents the largest national market in APAC, driven by mass population health programs and significant domestic manufacturing capabilities. The market is shifting from low-cost general supplies to high-quality, advanced interventional disposables, often supported by favorable government policies aimed at self-sufficiency in medical technology.

- Japan: A mature market characterized by the world's oldest population demographic, driving consistent demand for chronic care and geriatric disposables. The market prioritizes advanced material science and high-quality, specialized products for complex procedures.

- Latin America (LATAM): Growth is primarily fueled by increasing access to universal healthcare schemes and medical tourism, particularly in countries like Brazil and Mexico. The market often favors cost-effective commodity disposables, but private sector investment is slowly increasing the uptake of premium surgical kits.

- Middle East and Africa (MEA): This region is witnessing substantial market modernization, particularly in Gulf Cooperation Council (GCC) countries, driven by oil wealth investment into high-tech healthcare cities. Demand is high for imported, specialized disposables to support complex surgical capabilities and managing infectious diseases. South Africa leads the sub-Saharan market in terms of infrastructure and utilization rates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Medical Supplies Market.- Medtronic Plc

- Johnson & Johnson (Ethicon)

- Becton, Dickinson and Company (BD)

- 3M Company

- Cardinal Health Inc.

- Baxter International Inc.

- Abbott Laboratories

- Smith & Nephew Plc

- Stryker Corporation

- B. Braun Melsungen AG

- Teleflex Incorporated

- Terumo Corporation

- Getinge AB

- Mölnlycke Health Care AB

- Ansell Limited

- Paul Hartmann AG

- Kimberly-Clark Corporation

- Owens & Minor Inc. (Halyard Health)

- Convatec Group Plc

- Domtar Corporation

- ICU Medical, Inc.

- Semperit AG Holding

Frequently Asked Questions

Analyze common user questions about the Disposable Medical Supplies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Disposable Medical Supplies Market?

The Disposable Medical Supplies Market growth is primarily driven by three critical factors: the global necessity for stringent infection prevention protocols to minimize Hospital-Acquired Infections (HAIs), the significant demographic shift toward an aging population requiring more frequent and prolonged medical care, and continuous advancements in surgical techniques, particularly the expansion of high-volume, minimally invasive procedures, which rely heavily on specialized, single-use instruments and kits.

How does the increasing focus on sustainability impact the manufacturing of disposable medical supplies?

The increasing focus on sustainability is fundamentally reshaping manufacturing by driving investment into bio-based, recyclable, and biodegradable polymers. Manufacturers are prioritizing product redesign to reduce the overall material footprint and improve end-of-life management. This technological pivot aims to mitigate the massive volume of medical waste generated annually, balancing essential hygiene requirements with environmental responsibility.

Which segment of the Disposable Medical Supplies Market is exhibiting the fastest growth rate?

The Infection Control Supplies segment, encompassing high-demand items such as specialized surgical masks, advanced protective gowns, and sterile gloves, is expected to maintain a robust growth trajectory. Furthermore, the specialized procedural kits and advanced wound care products segment, driven by complexity of procedures and chronic wound prevalence, also demonstrates above-average growth rates, particularly in Asia Pacific where healthcare infrastructure is rapidly expanding.

What role does the adoption of AI and automation play in the future of the disposable supplies supply chain?

AI and automation are crucial for future supply chain optimization, primarily through AI-driven demand forecasting, which minimizes stockouts and obsolescence by predicting consumption patterns based on real-time epidemiological and procedural data. Automation enhances manufacturing efficiency and quality control, ensuring high-volume production meets stringent medical standards while lowering operational costs and improving logistical resilience across global distribution networks.

What challenges do manufacturers face in maintaining product quality and standardization across different regions?

Manufacturers face significant challenges in navigating disparate and evolving regulatory frameworks, such as the EU's Medical Device Regulation (MDR) versus FDA requirements. Maintaining quality and standardization across global facilities requires consistent implementation of ISO certifications, rigorous supplier auditing, and centralized quality management systems to ensure all products, regardless of manufacturing location, meet the highest safety and performance benchmarks required by different national procurement bodies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Disposable Medical Supplies Market Size Report By Type (Injection and Infusion, Wound Care, Blood and Dialysis, Medical Implanting Material, Disposable Clothing, Incontinence Supplies, Surgical Supplies), By Application (Home Healthcare & Nursing Home, Hospitals & Other Medical Institutions, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Disposable Medical Supplies Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Diagnostic Supplies, Dialysis Consumables, Radiology Consumables, Infusion Products, Intubation & Ventilation Supplies, Hypodermic Products, Sterilization Consumables, Nonwoven Medical Supplies, Wound Care Consumables, Others), By Application (Cardiovascular, Cerebrovascular, Ophthalmology, Gynecology, Urology, Orthopedics, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager