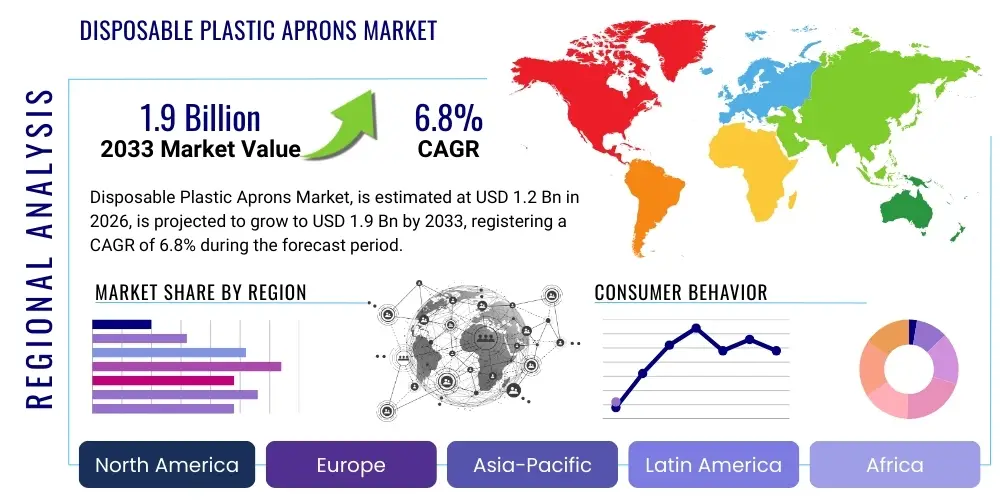

Disposable Plastic Aprons Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434451 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Disposable Plastic Aprons Market Size

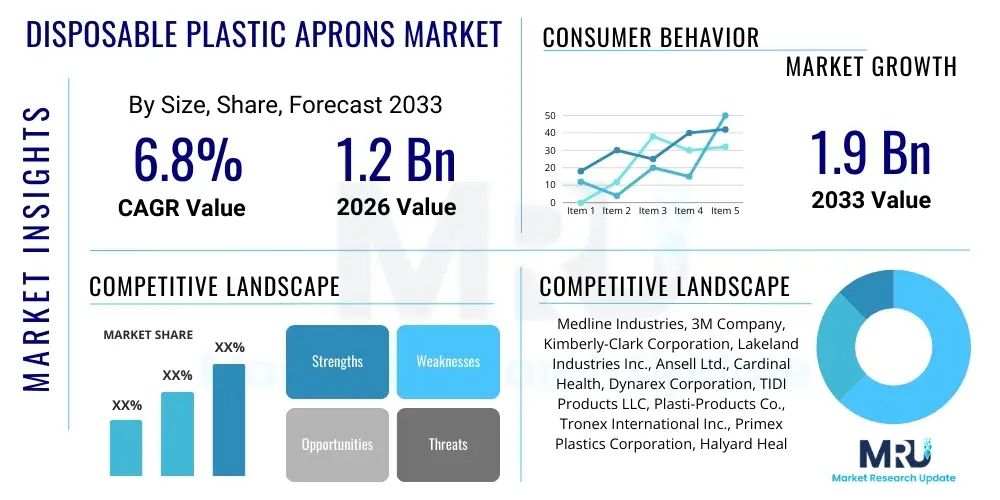

The Disposable Plastic Aprons Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.9 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by escalating demands for stringent infection control measures across vital sectors, particularly healthcare and food service, coupled with increasing global awareness regarding workplace hygiene and cross-contamination prevention protocols. The high volume consumption nature of single-use protective equipment ensures sustained market momentum throughout the forecast period.

Disposable Plastic Aprons Market introduction

The Disposable Plastic Aprons Market encompasses the production and distribution of single-use protective garments designed primarily to safeguard users and clothing from liquid splashes, chemical exposure, and particulate contamination. These products are typically manufactured from lightweight polymers, predominantly Polyethylene (PE) or Polypropylene (PP), offering an effective barrier while ensuring user comfort and ease of disposal. The essential function of these aprons is to uphold hygiene standards, minimize the risk of pathogen transmission, and comply with occupational health and safety regulations in contamination-sensitive environments.

Major applications of disposable plastic aprons span across critical industries, including patient care and surgery preparation in healthcare settings, food handling and processing to prevent contamination, chemical mixing and laboratory work, and general cleaning operations. The inherent benefits of these products—such as low cost, waterproof construction, and the elimination of laundering needs—make them indispensable components of personal protective equipment (PPE) suites globally. The transition towards standardized safety practices, particularly in developing economies, further solidifies their market position.

Driving factors propelling market expansion include the sustained and expanding global healthcare infrastructure, heightened regulatory enforcement regarding workplace safety and food hygiene, and the recurrent threat of infectious disease outbreaks, which necessitates vast stockpiling and immediate availability of protective consumables. Furthermore, efficiency gains in manufacturing processes have made these products increasingly accessible and affordable, encouraging higher rates of adoption across diverse professional environments, ranging from veterinary services to industrial cleaning operations.

Disposable Plastic Aprons Market Executive Summary

The Disposable Plastic Aprons Market is characterized by robust growth underpinned by non-discretionary demand from critical infrastructure sectors. Key business trends indicate a strong move toward product diversification, focusing on biodegradable polymer alternatives and reinforced heavy-duty options for specialized industrial applications, responding directly to evolving environmental mandates and sector-specific protection needs. Manufacturers are also heavily investing in automation to meet high-volume demands swiftly, capitalizing on economies of scale to maintain competitive pricing. Supply chain resilience, following recent global disruptions, has become a core strategic priority, leading to regional manufacturing localization efforts in high-consumption areas like North America and Europe, mitigating over-reliance on single geographic sourcing.

Regional trends highlight that the Asia Pacific (APAC) region dominates manufacturing output due to lower raw material costs and established polymer processing capabilities, simultaneously emerging as the fastest-growing consumption hub owing to rapidly improving healthcare accessibility and modernization of food processing sectors. North America and Europe maintain leading positions in terms of market value, driven by strict regulatory frameworks governing healthcare safety (e.g., OSHA, EU Directives) and high per capita expenditure on medical consumables. These developed markets show a particular preference for higher-quality, often medium-weight aprons that balance protection with economic viability, while also piloting sustainable options.

Segmentation trends reveal that the Healthcare/Medical segment remains the largest end-user, accounting for the majority of the market share, driven by intensive use in operating theaters, isolation wards, and general examination rooms. In terms of material, Polyethylene (PE) dominates due to its superior cost-effectiveness and water resistance, although Polypropylene (PP) variants are gaining traction in situations requiring greater breathability or specific chemical resistance. The medium-weight thickness category is expected to witness the highest demand growth, balancing durability required for daily tasks with minimized material usage, optimizing cost-efficiency for large institutional buyers.

AI Impact Analysis on Disposable Plastic Aprons Market

Common user questions regarding AI's impact on the disposable plastic aprons market generally revolve around supply chain optimization, demand forecasting accuracy, and enhancement of manufacturing quality control processes. Users frequently inquire if AI can predict regional stock shortages, whether machine learning algorithms can detect subtle manufacturing defects in large batches of plastic film, and how AI might streamline complex procurement processes in large hospital systems. These concerns highlight a user desire for greater efficiency, improved quality assurance, and enhanced resilience against sudden surges in demand, such as those experienced during public health crises.

The core influence of Artificial Intelligence (AI) and Machine Learning (ML) in this sector is primarily infrastructural, focusing on optimizing the entire value chain rather than directly modifying the end product. AI-powered predictive analytics tools are fundamentally transforming demand forecasting, allowing major distributors and manufacturers to anticipate consumption spikes in specific geographical areas or institutional segments based on epidemiological data, public health advisories, or seasonal trends. This capability significantly reduces risks associated with overstocking or critical shortages, ensuring efficient allocation of essential protective equipment precisely when and where it is needed most, particularly vital for managing pandemic preparedness supplies.

Furthermore, AI is increasingly integrated into the high-speed manufacturing phase. Computer vision systems utilizing ML algorithms are deployed on production lines to perform continuous, real-time quality checks of the plastic film and finished apron integrity. These systems can instantly identify minor imperfections, thickness variations, or seal failures that human operators or traditional sensors might miss, thereby drastically improving the overall quality consistency of the protective barrier provided by the aprons. This advanced quality assurance, driven by AI, guarantees that the disposable product meets stringent international standards, reinforcing user trust and reducing waste associated with defective items.

- AI-driven predictive analytics enhances demand forecasting accuracy for institutional buyers and governments, optimizing inventory levels.

- Machine learning algorithms enable real-time quality control checks in manufacturing, detecting material defects and ensuring barrier integrity.

- AI optimizes complex global supply chains, identifying efficient logistics routes and mitigating delays in raw material procurement.

- Robotics and AI-controlled automation increase production line speed and throughput, facilitating rapid scalability during crisis events.

- Natural Language Processing (NLP) tools analyze regulatory changes across different regions, ensuring rapid product compliance adaptation.

- AI assists in dynamic pricing models for large tenders and contracts, maximizing profitability based on supply availability and current demand volatility.

DRO & Impact Forces Of Disposable Plastic Aprons Market

The market dynamics are governed by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the competitive landscape and impact forces. Principal drivers include the irreversible trend towards standardized hygiene practices in professional settings, the expansion of global healthcare services necessitating constant supply of single-use protective wear, and continuous investments in worker safety mandates. Conversely, the market faces significant restraints primarily related to environmental sustainability concerns, the substantial volume of plastic waste generated by disposable products, and increasing regulatory pressure to shift towards sustainable or biodegradable alternatives, which often carry higher production costs. Opportunities are vast, focused mainly on technological advancements in bioplastics and polymer engineering, expansion into emerging markets with underdeveloped infection control protocols, and strategic stockpiling by governmental agencies for future health emergencies. These elements exert a powerful, fluctuating force on market pricing and product development strategies.

The drivers are particularly potent in the healthcare sector, where regulatory bodies strictly enforce the use of protective barriers to prevent healthcare-associated infections (HAIs). The aging global population and the resulting increase in surgical procedures and chronic care facilities mean that the baseline demand for basic PPE like aprons is inherently inelastic and constantly rising. Furthermore, the pervasive adoption of stringent HACCP (Hazard Analysis Critical Control Point) principles in the food industry mandates specific protective clothing, reinforcing demand for liquid-resistant, food-safe plastic aprons. This convergence of health and safety standards acts as a continuous upward pressure on consumption volumes.

However, the environmental backlash against single-use plastics poses a serious and growing challenge. Public awareness of ocean plastic pollution and landfill overuse has spurred legislative action in many regions, imposing taxes or bans on certain plastic products. This has forced manufacturers to expend significant resources researching and developing alternatives such as starch-based polymers or compostable plastics. The success of the market during the forecast period will heavily depend on the industry's ability to innovate sustainable solutions that retain the functional integrity and cost-effectiveness of traditional PE aprons. Overcoming this sustainability constraint presents the largest opportunity for competitive differentiation and market leadership.

Segmentation Analysis

The Disposable Plastic Aprons Market is fundamentally segmented based on factors crucial for end-user applicability, regulatory compliance, and cost structure, including material type, thickness, end-user industry, and distribution channel. Understanding these segments is paramount for manufacturers tailoring product lines to meet specific sector needs, such as the high-volume, low-cost requirements of the food processing industry versus the highly specialized, high-barrier needs of pharmaceutical manufacturing cleanrooms. The segmentation analysis provides a granular view of market dynamics, revealing where investment in material science (e.g., enhanced barrier properties or biodegradability) yields the highest return, and where logistical efficiencies (e.g., optimizing distribution channels) can maximize profit margins for standard PE products.

Segmentation by material—Polyethylene (PE) being dominant—highlights the importance of cost-efficiency, as PE offers an excellent moisture barrier at a minimal production expense, making it the preferred choice for general use. In contrast, Polypropylene (PP) is utilized in scenarios where the apron needs to be more breathable or where limited chemical splash protection is required, often found in certain lab settings or non-wet areas. The differentiation by thickness (lightweight, medium weight, heavy duty) directly correlates to application; lightweight options are used for short-duration, low-risk tasks (e.g., catering), while heavy-duty aprons are reserved for intensive industrial or surgical procedures where puncture resistance is essential, driving premium pricing and lower volume.

The End-User segmentation remains the most critical determinant of market demand, with the Healthcare/Medical segment generating the highest revenue due to strict institutional protocols and massive patient throughput. The Food & Beverage sector, encompassing processing, handling, and service, constitutes the second largest segment, prioritizing food-grade compliance and high turnover rates. Furthermore, the segmentation by Distribution Channel elucidates market access, with offline channels (wholesalers, GPOs, distributors) historically dominating procurement for large institutions, though online sales are rapidly gaining ground, especially for smaller businesses and localized retail environments due to convenience and direct manufacturer-to-consumer links.

- Material Type

- Polyethylene (PE)

- Polypropylene (PP)

- Other Materials (e.g., Bioplastics, HDPE)

- Thickness

- Lightweight (Under 15 Microns)

- Medium Weight (15 to 25 Microns)

- Heavy Duty (Above 25 Microns)

- End-User

- Healthcare/Medical (Hospitals, Clinics, Laboratories)

- Food & Beverage (Processing, Catering, Service)

- Industrial/Manufacturing

- Pharmaceutical and Biotechnology

- Chemical/Hazardous Material Handling

- Distribution Channel

- Online Sales (E-commerce, Company Websites)

- Offline Sales (Wholesalers, Distributors, Retail Pharmacies, Group Purchasing Organizations (GPOs))

Value Chain Analysis For Disposable Plastic Aprons Market

The value chain for the Disposable Plastic Aprons Market begins with the upstream segment, which involves the sourcing and production of base polymeric raw materials, primarily petrochemical derivatives such as crude oil and natural gas, converted into Polyethylene or Polypropylene resins. This upstream phase is highly capital-intensive and susceptible to global commodity price volatility, directly impacting the manufacturing costs of the final apron. Key activities here include polymerization, compounding, and pelletizing the resins. Manufacturers often seek long-term contracts with major chemical producers to secure stable supply and mitigate price risk, ensuring a predictable cost structure for high-volume production operations.

The midstream phase constitutes the core manufacturing process. This involves extrusion, where plastic pellets are melted and processed into thin films, followed by conversion processes such as cutting, sealing, and packaging the finished aprons. Efficiency in this stage is critical; high-speed automated machinery is essential to achieve the necessary throughput and maintain competitive pricing. Strict quality control measures, sometimes integrated with computer vision technology, are applied to ensure the plastic film meets specified thickness, tensile strength, and barrier performance criteria. This stage also includes labeling and compliance verification to meet various regional health and safety standards (e.g., CE marking, FDA approval).

The downstream analysis focuses on distribution and end-user consumption. Products move through a complex network including large-scale wholesalers, specialized medical and industrial distributors, Group Purchasing Organizations (GPOs) that service large hospital networks, and increasingly, direct e-commerce platforms. GPOs play a pivotal role in the healthcare segment, leveraging bulk purchasing power to negotiate favorable, long-term contracts, influencing the market share of major suppliers. The final step involves consumption by end-users—hospitals, food processors, and laboratories—where safe disposal methods become the final, critical element of the product's life cycle. Effective logistics and inventory management within the distribution channel are crucial to ensuring timely delivery, particularly during emergency situations.

Disposable Plastic Aprons Market Potential Customers

The primary customer base for disposable plastic aprons is dominated by institutional buyers across sectors where contamination control, hygiene adherence, and liquid barrier protection are mandatory operational requirements. Hospitals and healthcare facilities represent the largest single segment, utilizing aprons in diverse environments including operating theaters, emergency rooms, isolation wards, outpatient clinics, and nursing homes. These professional end-users require aprons as a fundamental component of barrier protection protocols to shield staff and patients from bodily fluids, minimize cross-contamination between examination rooms, and maintain sterile environments essential for patient safety.

The Food & Beverage industry constitutes another massive consumer segment, ranging from large-scale meat and poultry processing plants to commercial catering services and retail food outlets. In this sector, the usage is governed by rigorous food safety standards intended to prevent microbial contamination of edible products. Aprons must be food-grade, often blue or yellow for easy visibility and regulatory compliance, and are used extensively by personnel handling raw ingredients, preparing cooked meals, and cleaning processing equipment, ensuring product integrity from preparation through packaging.

Beyond these two major sectors, significant demand originates from pharmaceutical and biotechnology companies for use in cleanrooms and non-sterile compounding areas, industrial manufacturing facilities handling chemicals or requiring splash protection (e.g., painting, assembly), and academic or industrial research laboratories. Furthermore, the retail cleaning and janitorial services industry relies heavily on these disposable garments for protection against harsh cleaning agents and general refuse, emphasizing the broad and diversified end-user base that underscores the market's stability and consistent demand profile across multiple economic cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medline Industries, 3M Company, Kimberly-Clark Corporation, Lakeland Industries Inc., Ansell Ltd., Cardinal Health, Dynarex Corporation, TIDI Products LLC, Plasti-Products Co., Tronex International Inc., Primex Plastics Corporation, Halyard Health Inc. (now part of Owens & Minor), Alpha Pro Tech, Ammex Corporation, Harco Corporation, SARC, Debmed Inc., Guangzhou R&F Protective Products Co. Ltd., Shield Scientific, and Kwalitex Healthcare. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Plastic Aprons Market Key Technology Landscape

The technological landscape in the Disposable Plastic Aprons Market is characterized less by revolutionary product inventions and more by continuous optimization of manufacturing efficiency, material science enhancements, and quality assurance mechanisms. A key technological focus remains on advanced polymer processing, particularly the refinement of film extrusion techniques. Modern extrusion lines incorporate sophisticated temperature and pressure controls to ensure uniform thickness and consistent barrier properties across large film rolls, which is essential for maximizing yield and minimizing weak spots, especially critical for aprons designated for high-risk clinical use or heavy industrial applications.

A significant area of technological investment centers on the development and scaling of sustainable polymer technologies. Research efforts are intensely focused on producing cost-effective, high-performance bioplastics and compostable materials, such as Polylactic Acid (PLA) blends or specialized polyethylene derivatives that break down more rapidly. The challenge lies in maintaining the requisite liquid barrier protection and tensile strength of traditional plastics while meeting biodegradability standards. Successful implementation of these sustainable polymers will require adapting existing machinery to handle new material properties without compromising the ultra-high-speed nature of disposable manufacturing.

Furthermore, technology is playing a crucial role in enhancing the usability and tracking of these ubiquitous products. Automated packaging systems now integrate features such as easy-dispense packaging, minimizing contact and improving hygienic presentation in high-traffic areas like hospital corridors. Supply chain technology, including RFID tagging and IoT sensor integration, is increasingly being adopted by major institutional buyers. This technology allows for real-time tracking of apron inventories, automated reordering triggered by low stock thresholds, and precise consumption auditing, drastically improving logistical efficiency and ensuring constant availability of protective equipment during periods of fluctuating demand.

Regional Highlights

- North America: North America, encompassing the United States and Canada, currently holds the largest share in terms of market value for disposable plastic aprons. This dominance is attributed to a highly mature healthcare infrastructure, robust regulatory mandates enforced by bodies like OSHA and the FDA which drive continuous consumption of certified PPE, and high awareness regarding occupational safety standards. The region exhibits high purchasing power, leading to a preference for medium to heavy-duty, high-quality aprons that comply with strict performance specifications. The established presence of large Group Purchasing Organizations (GPOs) facilitates massive, centralized procurement contracts, creating substantial market stability for major manufacturers and distributors. Future growth will be spurred by the modernization of food processing facilities and the increasing focus on pandemic preparedness stockpiling within federal and state agencies.

- Europe: The European market is characterized by a high degree of sensitivity toward environmental concerns, driving innovation in sustainable plastic alternatives, including biodegradable and bio-based aprons. Countries like Germany, the UK, and France maintain strong demand, fueled by universal healthcare systems and rigorous EU directives concerning worker protection and food hygiene (e.g., HACCP implementation). While consumption volume is high, market growth is increasingly linked to legislative shifts toward green procurement policies. Manufacturers operating in Europe are under intense pressure to demonstrate the ecological responsibility of their products, making material science research a major investment area. The region’s focus on ethical sourcing and high-quality medical device standards ensures a premium market segment for certified protective wear.

- Asia Pacific (APAC): The APAC region stands out as the fastest-growing market, serving as both the global manufacturing powerhouse and a rapidly expanding consumer base. China, India, and Southeast Asian nations benefit from vast polymer production capabilities, offering cost advantages that underpin global supply. Simultaneously, rapid urbanization, significant investments in public and private healthcare infrastructure, and rising adoption of Western hygiene standards in food service drive domestic demand. The market here is segmented, with high-volume, cost-effective aprons dominating the industrial and mass-market segments, while premium, high-barrier products see increased use in advanced medical centers and export-focused manufacturing zones. The massive population base ensures that even small increases in per capita consumption translate into significant market volume growth.

- Latin America (LATAM): The LATAM market, including Brazil and Mexico, presents substantial opportunities driven by expanding public health coverage and increasing industrialization, particularly in the food and beverage processing sectors which are major exporters. However, market adoption faces challenges related to economic volatility and varied enforcement of occupational health standards. Demand is typically price-sensitive, favoring cost-effective PE aprons, often imported from APAC. Improving regulatory environments and foreign direct investment in healthcare modernization are expected to accelerate steady consumption growth throughout the forecast period, emphasizing localized distribution networks to bypass complex logistical challenges.

- Middle East and Africa (MEA): The MEA region is characterized by heterogeneous market development. Gulf Cooperation Council (GCC) countries exhibit high per capita expenditure on advanced medical supplies due to substantial oil wealth and state-of-the-art healthcare systems, driving demand for high-quality protective equipment. Conversely, many African nations focus on essential, low-cost aprons for public health initiatives and basic clinic use. The market is highly reliant on international aid and global supply chains. Growth is tied to diversification efforts away from oil economies, which include expanding tourism, hospitality, and healthcare sectors, increasing the need for standardized hygiene supplies compliant with global norms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Plastic Aprons Market.- Medline Industries LP

- 3M Company

- Kimberly-Clark Corporation

- Lakeland Industries Inc.

- Ansell Ltd.

- Cardinal Health

- Dynarex Corporation

- TIDI Products LLC

- Plasti-Products Co.

- Tronex International Inc.

- Primex Plastics Corporation

- Halyard Health Inc. (now part of Owens & Minor)

- Alpha Pro Tech

- Ammex Corporation

- Harco Corporation

- SARC

- Debmed Inc.

- Guangzhou R&F Protective Products Co. Ltd.

- Shield Scientific

- Kwalitex Healthcare

Frequently Asked Questions

Analyze common user questions about the Disposable Plastic Aprons market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary materials are used in disposable plastic aprons and which offers the best barrier protection?

The primary materials are Polyethylene (PE) and Polypropylene (PP). PE is the most common due to its superior liquid impermeability and cost-effectiveness, making it the preferred choice for tasks requiring a strong fluid barrier in healthcare and food service environments.

How significant are environmental concerns impacting the future market growth of disposable plastic aprons?

Environmental concerns are highly significant. Regulatory pressure and public demand are driving market focus toward sustainable alternatives, such as biodegradable bioplastics (PLA). While current plastic use dominates due to cost, long-term growth hinges on the industry's successful transition to functional, environmentally friendly materials.

Which end-user segment contributes the most revenue to the Disposable Plastic Aprons Market?

The Healthcare and Medical segment is the largest revenue contributor. This is driven by mandatory infection control protocols, high patient turnover, and consistent, non-discretionary use in hospitals, clinics, and long-term care facilities globally to mitigate cross-contamination risks.

How does the thickness of the plastic apron relate to its specific application?

Apron thickness determines durability and intended use. Lightweight aprons (thin micron count) are suited for short-term catering or general service. Medium-weight aprons offer a balance for daily hospital tasks. Heavy-duty aprons (thickest) provide superior tear and puncture resistance for complex industrial or high-exposure medical procedures.

What is the projected Compound Annual Growth Rate (CAGR) for the Disposable Plastic Aprons Market between 2026 and 2033?

The Disposable Plastic Aprons Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven largely by sustained global demand for hygiene consumables and preparedness initiatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager