Disposable Pulp Urinals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433532 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Disposable Pulp Urinals Market Size

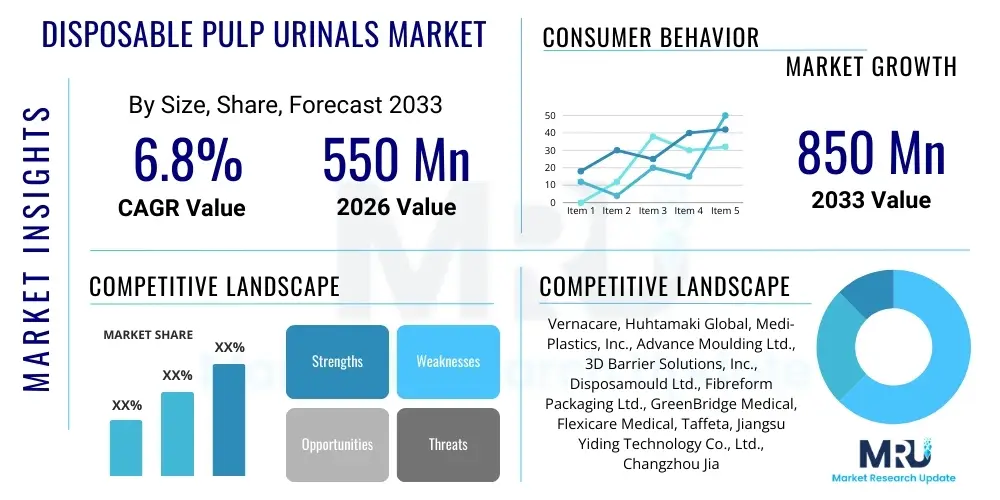

The Disposable Pulp Urinals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $850 Million by the end of the forecast period in 2033.

Disposable Pulp Urinals Market introduction

The Disposable Pulp Urinals Market encompasses the production, distribution, and consumption of single-use urine receptacles manufactured primarily from recycled paper or virgin pulp materials. These products are designed to offer a hygienic, convenient, and environmentally sustainable alternative to traditional reusable plastic or ceramic urinals, particularly within healthcare and emergency settings. The core function of these pulp products is the containment of biological waste, often featuring a waterproof lining or additive to enhance fluid integrity before disposal via maceration or standard waste streams. The increasing focus on infection control and reducing cross-contamination in medical environments globally serves as the primary impetus for market expansion, driving institutional adoption across developed and developing economies.

Disposable pulp urinals are crucial components in modern patient care protocols, significantly contributing to streamlined waste management processes. Their major applications span acute care hospitals, specialized surgical centers, geriatric care facilities, home health services, and temporary field hospitals or disaster relief operations where sanitation infrastructure is limited. Key benefits include the inherent biodegradability of the materials, which aligns with growing global sustainability mandates, coupled with the elimination of the need for rigorous cleaning and sterilization required by reusable alternatives. This disposability minimizes labor costs and reduces the risk of Hospital-Acquired Infections (HAIs), making them a cost-effective and safety-conscious choice for healthcare administrators.

The market is predominantly driven by regulatory pressures emphasizing stringent hygiene standards, coupled with the demographic shift toward an aging population requiring extensive long-term care services. Furthermore, advancements in pulp molding technology have led to the production of stronger, more ergonomic, and leak-resistant products, enhancing user comfort and caregiver confidence. The commitment of governments and private healthcare providers to adopt environmentally responsible procurement policies is accelerating the transition from plastic bedpans and urinals to compostable pulp alternatives, positioning the market for sustained, robust growth over the forecast period.

Disposable Pulp Urinals Market Executive Summary

The Disposable Pulp Urinals Market is characterized by steady growth, underpinned by significant global shifts in healthcare infrastructure and environmental mandates. Business trends indicate a strong move towards vertically integrated supply chains, where manufacturers are increasingly investing in proprietary pulp formulation technologies to enhance product absorbency, rigidity, and rapid disintegration during maceration. Key market players are focusing on strategic partnerships with large hospital networks and Group Purchasing Organizations (GPOs) to secure long-term supply contracts. Regional trends show North America and Europe leading in market share due to established healthcare spending and rigorous infection control standards, while the Asia Pacific region is demonstrating the highest growth potential, fueled by rapid expansion of private healthcare facilities and improved access to basic sanitation products in densely populated areas. Innovation is centered on incorporating bio-based polymer coatings to replace traditional fossil fuel-derived barrier layers, catering to the growing demand for 100% compostable solutions.

Segment trends reveal that the institutional end-use category, primarily large hospitals and specialized surgical units, maintains dominance owing to high patient turnover and mandatory waste disposal protocols. However, the Home Care segment is projected to experience accelerated growth, driven by the increasing prevalence of aging-in-place initiatives and the demand for comfortable, discreet, and easy-to-use patient care products outside clinical settings. In terms of material segmentation, the preference for products derived from Recycled Paper pulp remains high due to cost efficiency and immediate availability, although Virgin Pulp is gaining traction in specialized applications requiring superior strength and consistent quality control. Capacity segmentation highlights that standard-sized urinals (Up to 700ml) form the bulk of consumption, suitable for general ward use, while larger capacity units are utilized in specialized geriatric or bariatric care where high volume containment is necessary.

Overall market dynamics suggest that the transition from reusable medical waste containment systems to single-use, biodegradable options is irreversible, establishing a resilient market ecosystem. Competition is intensifying among manufacturers who are attempting to differentiate their offerings through superior ergonomic design, advanced leak-proof features, and verifiable environmental certifications. Successful penetration into emerging markets requires strategic investments in local manufacturing capabilities to mitigate complex logistics and tariff issues. The core takeaway for stakeholders is the sustained demand driven by non-discretionary healthcare needs, coupled with the critical requirement to adhere to increasingly strict regulatory frameworks concerning sustainability and infection prevention, solidifying the market’s positive trajectory.

AI Impact Analysis on Disposable Pulp Urinals Market

User inquiries regarding AI's influence on the Disposable Pulp Urinals Market typically focus on supply chain optimization, predictive inventory management, and enhancing manufacturing efficiency. Common questions revolve around whether AI algorithms can optimize raw material sourcing (pulp), predict peak demand periods in healthcare systems (especially during epidemic surges), and streamline the complex logistics of delivering bulky, low-cost disposable items. The central theme emerging from user concerns is the application of AI to reduce manufacturing waste, ensure highly efficient production cycles (e.g., optimizing mold pressing and drying times for pulp products), and implement automated quality control mechanisms (visual inspection for leaks or defects). Users expect AI to stabilize pricing and improve reliability in procurement by providing real-time demand forecasting for large hospital systems, thereby preventing stockouts of critical hygiene supplies.

- AI-driven Predictive Maintenance: Utilizing machine learning to monitor pulp molding machinery, forecasting equipment failure, and reducing downtime, thereby maintaining high-volume production output.

- Demand Forecasting Optimization: Employing advanced algorithms to analyze healthcare census data, seasonal illness patterns, and demographic shifts, providing precise demand predictions for inventory management across global distribution networks.

- Quality Control Automation: Implementing AI-powered vision systems for continuous, high-speed inspection of finished products, ensuring consistency in structural integrity, waterproofing, and dimensions.

- Sustainable Sourcing Optimization: AI analysis of sustainable pulp source availability, pricing volatility, and logistical pathways to minimize environmental footprint and procurement costs.

- Supply Chain Resilience: Using AI to simulate disruption scenarios (e.g., pandemic surges, transportation delays) and automatically re-route logistics or adjust manufacturing schedules to maintain product availability in critical care settings.

- Warehouse and Logistics Efficiency: Optimizing palletization, storage density, and route planning for bulky disposable goods, significantly reducing freight costs and delivery times.

DRO & Impact Forces Of Disposable Pulp Urinals Market

The Disposable Pulp Urinals Market is shaped by a robust set of Drivers, Restraints, and Opportunities that define its growth trajectory and competitive landscape. The primary Drivers revolve around the imperative for heightened infection control in clinical settings, accelerated by global events emphasizing hygiene standards, alongside the regulatory push for sustainable healthcare products that reduce plastic waste. Restraints largely center on the relatively bulky nature of the product, which increases storage and transportation costs compared to compact reusable alternatives, and the occasional perception that pulp products lack the rigidity of traditional plastic bedpans. Opportunities are substantial, focused mainly on expanding into emerging economies where healthcare infrastructure is rapidly developing, and innovating product design to incorporate enhanced ergonomic features and certified compostable barrier coatings to attract eco-conscious institutions.

Impact forces in the market are primarily driven by technological advancements in fiber processing and molding techniques. The adoption of advanced hot-press and vacuum-forming methods allows manufacturers to produce urinals with superior surface finish, increased wall thickness consistency, and enhanced resistance to fluid penetration over extended periods. Economic impact forces are evident in the cost efficiency provided by large-scale production runs, which makes pulp products competitive despite rising raw material (pulp) costs. Social impact forces are dominated by the increasing environmental consciousness among consumers and institutional purchasers, pushing buyers toward certified biodegradable and compostable options, penalizing manufacturers reliant on traditional non-degradable coatings.

Political and regulatory impact forces are highly influential, with government policies supporting sustainable procurement in public health systems in regions like the European Union and specific states in North America. These policies often mandate the reduction of single-use plastics in medical settings, creating a captive and expanding market for molded fiber alternatives. Furthermore, stringent healthcare regulations regarding the proper disposal and maceration of patient waste directly support the use of disposable pulp products that are designed for safe and rapid breakdown. Managing these impact forces effectively requires market players to continuously invest in R&D to improve product sustainability metrics while maintaining strict adherence to medical device manufacturing quality standards (ISO certification), ensuring both market compliance and consumer trust.

Segmentation Analysis

The Disposable Pulp Urinals Market is systematically segmented based on material type, capacity, and end-use application, providing a granular view of consumption patterns and market potential across various sectors. The analysis of these segments is critical for manufacturers to tailor their production capabilities and marketing strategies to specific purchaser needs, such as the rigid requirements of acute care hospitals versus the cost sensitivity of home care providers. Material segmentation determines the product's environmental footprint and cost structure, while capacity segmentation addresses varying patient needs and clinical protocols for fluid monitoring and containment. End-use segmentation dictates distribution strategies and regulatory compliance priorities, as clinical environments have stricter mandates than community settings.

Segmentation allows stakeholders to identify high-growth areas. For instance, the transition from traditional high-density polyethylene (HDPE) plastic items to pulp-based products is most pronounced in segments driven by environmental mandates, such as large municipal hospital systems. Conversely, segments prioritizing extreme robustness and low unit cost, such as disaster relief agencies, might favor certain material blends that offer the best balance of strength and affordability. The complexity of waste disposal, particularly the availability of maceration equipment, also significantly influences segment choice; facilities with macerators overwhelmingly prefer pulp products due to the ease of disposal and reduced biohazard risks, creating a distinct segmentation opportunity within the End-Use category.

Understanding the interplay between these segments is vital for strategic pricing and product development. Manufacturers are increasingly developing specialized product lines, such as anti-microbial pulp surfaces or enhanced ergonomic designs tailored specifically for geriatric patients (a key demographic driving the Home Care segment). This targeted approach, guided by sophisticated segmentation analysis, ensures that product innovation directly addresses unmet needs in the clinical landscape, optimizing market penetration and securing competitive advantage against generic commodity producers.

- Material Type:

- Recycled Paper Pulp

- Virgin Pulp (Wood Fiber/Bamboo)

- Capacity:

- Up to 700 ml (Standard Use)

- 701 ml to 1000 ml (High Capacity)

- Above 1000 ml (Bariatric/Specialized Use)

- End-Use:

- Hospitals (Acute Care, Surgical Units)

- Clinics and Ambulatory Surgical Centers

- Home Care Settings

- Geriatric Care Facilities and Nursing Homes

- Emergency Medical Services (EMS) and Disaster Relief

- Distribution Channel:

- Direct Sales (GPOs, Bulk Contracts)

- Distributors and Wholesalers

- E-commerce and Retail Pharmacies

Value Chain Analysis For Disposable Pulp Urinals Market

The value chain for Disposable Pulp Urinals begins with the upstream sourcing of raw materials, primarily virgin cellulose fibers or high-grade recycled paper stock. This phase is critical as the quality and consistency of the pulp directly determine the final product's strength, water resistance, and biodegradability. Manufacturers must establish reliable relationships with paper mills and recycling facilities, often negotiating bulk purchase agreements to secure sustainable and cost-effective material supply. Energy consumption during the molding and drying phases is a significant cost component in the upstream process; therefore, companies prioritize access to energy-efficient manufacturing technologies and potentially renewable energy sources to maintain competitive pricing and adhere to carbon reduction goals. This foundational stage dictates the structural integrity and environmental compliance of the finished urinal product.

Midstream activities involve the highly specialized process of pulp molding, which includes slurry preparation, vacuum forming over specialized molds, compression, and subsequent high-temperature drying. This stage is followed by the application of necessary barrier coatings, which must be leak-proof yet ideally biodegradable or compostable. Quality control measures, now frequently augmented by AI-powered visual inspection systems, are applied rigorously during manufacturing to ensure dimensional accuracy and zero tolerance for leaks. Downstream activities focus on packaging, sterilization (if required by the end-user), and efficient distribution. Given the low-density and bulky nature of the finished goods, optimizing packaging for maximum freight utilization is essential to control logistics costs and maintain profitability across long-haul supply routes to institutional customers globally.

The distribution channel analysis reveals two primary routes: Direct and Indirect sales. Direct sales typically involve large-volume contracts established through competitive bidding processes with major hospital networks, national healthcare systems, or Group Purchasing Organizations (GPOs). This channel offers high predictability and stable volume but requires extensive sales support and administrative resources. Indirect distribution relies on specialized medical supply distributors and wholesalers who manage inventory, warehousing, and just-in-time delivery to smaller clinics, nursing homes, and retail pharmacies catering to home care segments. The success of the downstream operation is heavily reliant on streamlined logistics management, ensuring that essential patient hygiene products are delivered promptly and economically, bridging the manufacturer to the point of care efficiently.

Disposable Pulp Urinals Market Potential Customers

Potential customers for Disposable Pulp Urinals are predominantly institutions within the formal healthcare ecosystem that prioritize high standards of hygiene, efficiency in waste management, and sustainability. The primary customer base comprises large acute care hospitals, which utilize these products in high volumes across general wards, post-operative recovery areas, and intensive care units, driven by continuous patient turnover and the need to mitigate cross-contamination risk. Specialized geriatric and long-term care facilities represent another major customer segment, as the ergonomic design of pulp urinals provides comfort and dignity to patients with mobility limitations, reducing caregiver workload associated with cleaning reusable implements. These institutional customers seek products certified for use with clinical macerators, ensuring compliance with biohazard disposal regulations and operational streamlining.

Beyond traditional hospital settings, emerging potential customers include the burgeoning segment of Home Health Services and independent Home Care providers. As healthcare shifts towards community-based and in-home recovery models, there is increasing demand for convenient, discreet, and easily disposable patient care items that simplify household waste management. This customer group often procures products through retail pharmacies, specialized online medical supply retailers, or via government-subsidized care packages. Furthermore, governmental and non-governmental organizations involved in disaster relief, humanitarian aid, and military field operations represent highly valuable, albeit intermittent, customers. These agencies require robust, stackable, lightweight, and single-use sanitary solutions for temporary settings lacking fixed sanitation infrastructure.

In summary, the purchasing decisions of these diverse customer groups are driven by varying factors: hospitals prioritize infection control, volume discounts, and macerator compatibility; geriatric facilities focus on patient comfort and ease of use; and home care providers value convenience, discretion, and retail accessibility. Manufacturers must tailor product specifications and pricing tiers to meet the highly specific procurement criteria of each end-user segment. Successful market penetration hinges on demonstrating verifiable cost savings related to reduced cleaning labor and lower infection rates, alongside providing clear evidence of product sustainability and environmental compliance, especially to institutional buyers facing public scrutiny regarding waste output.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $850 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vernacare, Huhtamaki Global, Medi-Plastics, Inc., Advance Moulding Ltd., 3D Barrier Solutions, Inc., Disposamould Ltd., Fibreform Packaging Ltd., GreenBridge Medical, Flexicare Medical, Taffeta, Jiangsu Yiding Technology Co., Ltd., Changzhou Jianle Equipment Co., Ltd., Elite Moulded Fibre Products, Medline Industries, LP, Cardinal Health, Stryker Corporation, Becton, Dickinson and Company (BD), Dynarex Corporation, Hogy Medical Co., Ltd., Kimberly-Clark Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Pulp Urinals Market Key Technology Landscape

The manufacturing process for Disposable Pulp Urinals is primarily defined by advanced molded fiber technology, which has evolved significantly to address the critical requirements of clinical use, specifically strength and fluid resistance. Key technological advancements center around optimizing the vacuum forming process and the subsequent high-temperature drying phases to achieve a product with uniform wall thickness and superior compressive strength, minimizing the risk of collapse or spillage when in use. Modern production lines utilize precision tooling and closed-loop control systems to manage slurry concentration and mold temperature, ensuring rapid cycle times and high repeatability. Furthermore, innovations in mold materials and surface treatments reduce adherence and facilitate easier release, thereby enhancing production efficiency and reducing defects, directly lowering the overall manufacturing cost per unit and making pulp products more commercially viable against plastic alternatives.

Crucially, technology related to fluid barrier properties is driving market differentiation. Traditional pulp products often relied on paraffin wax or non-biodegradable plastics (like polyethylene) for waterproofing, contradicting the sustainability goals of the product. The modern technological landscape is dominated by the development and implementation of bio-based and compostable barrier coatings. These advanced coatings, often derived from starches, natural polymers, or polylactic acid (PLA) derivatives, are applied post-molding, creating a robust, leak-proof interior surface that adheres strictly to compostability standards (e.g., EN 13432). This technological shift allows manufacturers to market "zero plastic" or "100% biodegradable" urinals, significantly appealing to environmentally conscious institutional buyers and securing premium segment contracts.

A third area of critical technology involves the design for end-of-life disposal, specifically compatibility with clinical maceration systems. Manufacturers employ fiber length optimization and specific pulp processing techniques to ensure the urinals disintegrate rapidly and thoroughly when subjected to maceration, avoiding blockages in hospital plumbing systems. Additionally, advancements in ergonomic design—utilizing Computer-Aided Design (CAD) and simulation tools—allow for the development of anatomically contoured shapes that maximize patient comfort and minimize spillage risk, particularly for immobile or geriatric patients. These technologies collectively elevate the disposable pulp urinal from a commodity product to a highly engineered medical accessory, meeting stringent performance and sustainability metrics demanded by modern healthcare environments.

Regional Highlights

- North America (United States, Canada): North America maintains a dominant position in the Disposable Pulp Urinals Market, driven by high per capita healthcare spending, the widespread adoption of stringent infection control protocols (particularly following increased scrutiny on HAIs), and the mature market presence of clinical macerator systems in hospitals. The U.S. market is highly competitive, characterized by robust government procurement programs and significant influence from Group Purchasing Organizations (GPOs). The growing focus on reducing single-use plastic waste in healthcare, particularly in states like California and New York, provides a strong impetus for the ongoing conversion from reusable bedpans to eco-friendly disposable pulp alternatives, ensuring sustained market leadership and continuous demand for advanced, certified biodegradable products.

- Europe (Germany, UK, France, Italy): Europe represents the second largest market, underpinned by regulatory frameworks such as the EU directives aimed at minimizing plastic pollution and promoting sustainable healthcare practices. The UK, historically a leader in pulp product adoption (driven largely by companies like Vernacare), continues to be a major consumer. Germany and France show robust growth, supported by national healthcare systems that prioritize hygiene and efficiency. The European market focuses heavily on product certifications guaranteeing biodegradability and compatibility with existing waste disposal infrastructure, leading to a strong competitive landscape focused on high-quality virgin pulp products and innovative, starch-based barrier technologies that fully meet EU environmental standards.

- Asia Pacific (APAC) (China, India, Japan, South Korea): The Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid expansion and modernization of healthcare infrastructure, increased public and private sector investment in hospital capacity, and rising awareness regarding basic patient hygiene and infection prevention. While cost sensitivity remains a factor in developing nations like India and China, the burgeoning middle class and expanding medical tourism sectors in countries like South Korea and Japan are driving demand for premium, high-quality disposable medical consumables. Local manufacturers are emerging, focusing on domestic production to serve the massive population base, often utilizing locally sourced pulp materials, positioning APAC as the critical growth engine for the next decade.

- Latin America (Brazil, Mexico, Argentina): The Latin American market is currently moderate but shows consistent upward trajectory, spurred by increasing government investment in public health systems and improvements in patient care standards across major economies like Brazil and Mexico. Market adoption is segmented; private hospitals readily adopt pulp urinals for advanced infection control, while public sector uptake is often driven by cost-effectiveness and volume procurement. Logistical challenges and fluctuating exchange rates can pose restraints, necessitating localized manufacturing or strong distributor partnerships to ensure reliable supply chains and competitive pricing within the region.

- Middle East and Africa (MEA): The MEA region is characterized by steady, infrastructure-led growth, primarily centered in the GCC countries (Saudi Arabia, UAE) due to high investment in state-of-the-art medical cities and specialized healthcare facilities targeting medical tourism. These facilities exhibit a strong preference for high-standard disposable products sourced from European or North American manufacturers. In the African continent, adoption is growing slowly, concentrated in urban centers and NGO-supported medical initiatives, with primary demand focused on essential, cost-effective hygiene solutions for temporary and emergency clinical settings, often sourced via global aid procurement channels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Pulp Urinals Market.- Vernacare

- Huhtamaki Global

- Medi-Plastics, Inc.

- Advance Moulding Ltd.

- 3D Barrier Solutions, Inc.

- Disposamould Ltd.

- Fibreform Packaging Ltd.

- GreenBridge Medical

- Flexicare Medical

- Taffeta

- Jiangsu Yiding Technology Co., Ltd.

- Changzhou Jianle Equipment Co., Ltd.

- Elite Moulded Fibre Products

- Medline Industries, LP

- Cardinal Health

- Stryker Corporation

- Becton, Dickinson and Company (BD)

- Dynarex Corporation

- Hogy Medical Co., Ltd.

- Kimberly-Clark Corporation

Frequently Asked Questions

Analyze common user questions about the Disposable Pulp Urinals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Disposable Pulp Urinals Market?

The primary driver is the global imperative for enhanced infection control in healthcare settings. Disposable pulp urinals significantly reduce the risk of cross-contamination and Hospital-Acquired Infections (HAIs) compared to reusable plastic alternatives by eliminating the need for cleaning and sterilization processes, thereby improving patient safety and operational efficiency.

Are disposable pulp urinals environmentally friendly and what are they made of?

Yes, they are considered environmentally friendly. They are typically made from recycled paper pulp or virgin cellulose fibers, making them biodegradable. Modern iterations increasingly feature bio-based or compostable barrier coatings instead of traditional polyethylene to ensure full environmental compliance and compatibility with composting or clinical maceration systems.

How do pulp urinals compare in cost and rigidity to traditional plastic bedpans?

While the initial unit cost of a reusable plastic bedpan is higher, disposable pulp urinals offer substantial overall cost savings by eliminating the labor, water, and energy expenses associated with cleaning, sterilizing, and maintaining reusable items. Modern pulp molding techniques have significantly improved rigidity and leak resistance, making them structurally sound for single-use clinical requirements.

Which geographical region holds the largest market share for disposable pulp urinals?

North America currently holds the largest market share, predominantly due to well-established, high-standard healthcare infrastructure, strong regulatory enforcement of hygiene protocols, and the extensive adoption of specialized waste management equipment like clinical macerators within hospital networks.

What role does advanced technology play in improving the quality of disposable pulp products?

Advanced technology, specifically precision vacuum-forming and high-speed drying, ensures uniform wall thickness and structural strength. Furthermore, innovation in compostable polymer barrier coatings provides essential leak resistance without compromising the product’s biodegradability, meeting stringent clinical performance standards and sustainability goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager