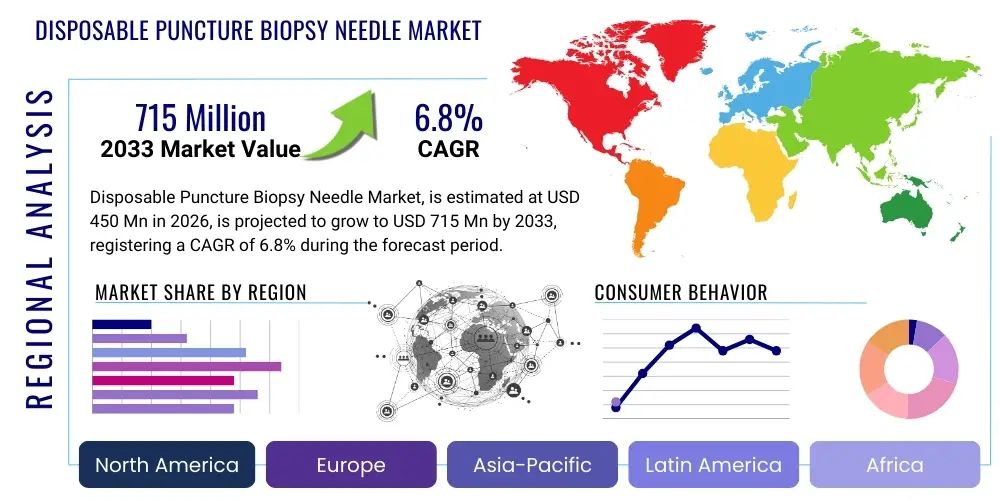

Disposable Puncture Biopsy Needle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437414 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Disposable Puncture Biopsy Needle Market Size

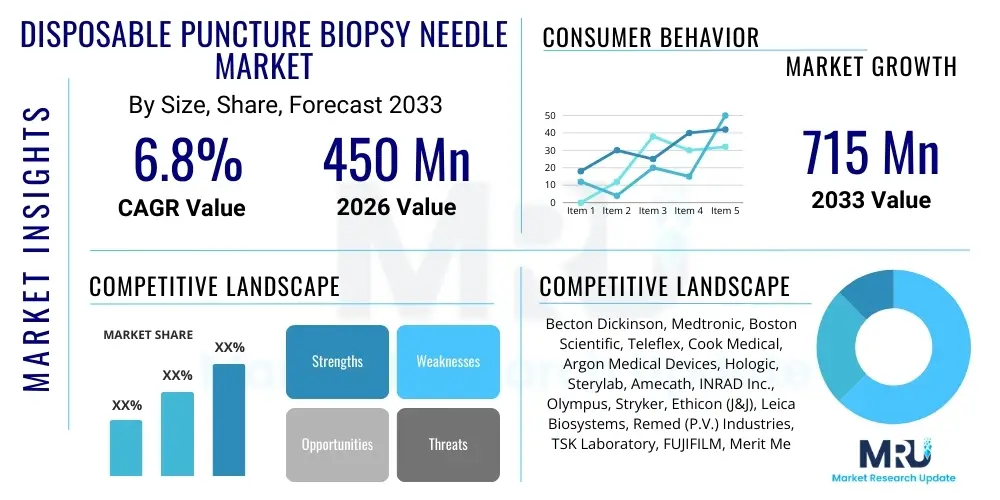

The Disposable Puncture Biopsy Needle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 715 Million by the end of the forecast period in 2033.

Disposable Puncture Biopsy Needle Market introduction

The Disposable Puncture Biopsy Needle Market encompasses the sales and distribution of single-use medical devices essential for extracting tissue samples (biopsies) from internal organs or masses for diagnostic analysis. These needles are critical tools in modern medicine, particularly in oncology and pathology, facilitating the accurate identification and staging of various diseases, primarily cancer. The disposable nature of these needles ensures enhanced patient safety by mitigating the risk of cross-contamination and eliminating the necessity for complex, expensive sterilization procedures required by reusable instruments. Key products include core biopsy needles, fine-needle aspiration systems, and specialized guidance systems, varying based on the mechanism of tissue acquisition—automatic, semi-automatic, or manual.

The major applications of disposable puncture biopsy needles span across critical areas such as breast biopsy, lung biopsy, liver biopsy, and prostate biopsy. The rising global prevalence of chronic diseases, particularly cancer, is the primary accelerator for market demand. These devices offer significant operational benefits, including improved precision, reduced procedural time, and minimization of patient trauma due to advanced ergonomic designs and sharper needle tips. The market is driven by increasing adoption rates of minimally invasive diagnostic procedures, technological advancements in imaging guidance (like ultrasound and CT scans), and growing governmental support for early disease detection programs worldwide.

Further driving the market expansion is the continuous evolution of needle materials, coatings, and gauge sizes, which allows clinicians to tailor the biopsy procedure to specific tissue types and anatomical locations, maximizing sample yield while minimizing complications. Regulatory mandates emphasizing patient safety and stringent reprocessing guidelines for reusable instruments also bolster the preference for disposable alternatives. As healthcare infrastructure improves in emerging economies and awareness regarding early diagnosis heightens, the utility and penetration of disposable biopsy needles are expected to witness sustained growth throughout the forecast period, underpinning their indispensable role in diagnostic imaging centers and hospitals globally.

Disposable Puncture Biopsy Needle Market Executive Summary

The Disposable Puncture Biopsy Needle Market is characterized by robust growth driven by the escalating demand for accurate cancer diagnostics and the global shift towards minimally invasive procedures. Business trends indicate a strong focus on strategic acquisitions and partnerships among key players to enhance geographical reach and integrate advanced imaging technologies, such as MRI and ultrasound compatibility, into biopsy systems. Manufacturers are increasingly prioritizing the development of automated and semi-automatic needle systems that offer superior firing power and sample retrieval consistency, addressing the clinical need for high-quality tissue samples for immunohistochemical and genomic testing. Furthermore, supply chain resilience, coupled with optimizing manufacturing processes for cost-efficiency, remains a crucial competitive differentiator in this specialized medical device sector.

Regionally, North America continues to dominate the market owing to sophisticated healthcare infrastructure, high awareness regarding preventative care, and favorable reimbursement policies for cancer screening and diagnostic procedures. However, the Asia Pacific region is poised to exhibit the fastest growth trajectory, fueled by rapidly improving healthcare access, increasing disposable incomes, and the massive patient pool requiring diagnostic interventions. European markets maintain stable growth, driven by stringent quality standards and widespread adoption of standardized biopsy protocols across major economies. Regional market dynamics are also heavily influenced by regulatory approvals for novel products and the localized prevalence rates of cancers that necessitate tissue diagnosis.

Segment trends highlight the dominance of core needle biopsy (CNB) procedures due to their ability to retrieve larger, more histologically informative tissue samples compared to fine-needle aspiration (FNA). In terms of product type, semi-automatic devices are gaining traction, balancing the precision of automatic systems with user control and cost-effectiveness. The hospital segment remains the largest end-user, though the diagnostic centers segment is showing accelerated growth due to increased outsourcing of specialized imaging and interventional procedures. Innovation in specialty applications, particularly lung and liver biopsies, driven by the increasing incidence of non-small cell lung cancer and non-alcoholic fatty liver disease (NAFLD), is expected to shape future segment performance.

AI Impact Analysis on Disposable Puncture Biopsy Needle Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Disposable Puncture Biopsy Needle Market frequently revolve around how AI can enhance procedural safety, improve diagnostic accuracy post-biopsy, and guide needle placement in real-time. Common concerns include the integration challenges of complex AI algorithms into existing imaging modalities, the cost implications of AI-enabled systems, and the regulatory pathway for these advanced tools. Users express high expectations that AI will revolutionize the planning phase of the biopsy, offering predictive analytics to identify the most critical areas within a lesion for sampling (lesion heterogeneity), thus reducing the need for multiple passes and improving sample quality, which ultimately reduces the utilization rate per patient but increases the precision value of each disposable needle sold.

AI's primary influence is not directly on the physical disposable needle manufacturing, but rather on the entire diagnostic workflow surrounding its use. Specifically, AI algorithms are being developed for advanced image segmentation and fusion, enabling highly accurate tracking of the needle trajectory relative to the target lesion during complex procedures under CT or MRI guidance. This real-time course correction minimizes collateral tissue damage and ensures the sample is representative, thereby maximizing the utility of the single-use biopsy needle. Furthermore, AI-powered pathology systems are crucial downstream, automating the initial analysis of the retrieved tissue sample, providing quicker turnaround times for preliminary diagnosis, and increasing the overall efficiency of the diagnostic pipeline where the disposable needle initiates the process.

This technological synergy means that while the core product remains the mechanical needle, its value proposition is significantly enhanced by digital guidance. For manufacturers, this implies a strategic shift toward developing disposable needles fully compatible with AI-driven navigation platforms, perhaps incorporating subtle features that aid in machine recognition or tracking. For end-users, AI integration promises reduced complication rates (such as pneumothorax in lung biopsies), higher diagnostic yield, and ultimately better patient outcomes, solidifying the professional preference for precision-guided disposable systems over traditional, manually reliant methods.

- AI algorithms enable precise, real-time trajectory guidance during image-guided biopsy procedures, enhancing sampling accuracy.

- Predictive analytics determine optimal biopsy sites within heterogeneous lesions, improving sample yield and quality.

- AI-powered image fusion systems improve visualization, minimizing procedural time and reducing the risk of complications associated with needle placement.

- Automated post-biopsy analysis (digital pathology) accelerates diagnostic turnaround time, increasing the overall efficiency of the workflow initiated by the disposable needle.

- Integration of AI systems drives the demand for specialized disposable needles that are seamlessly traceable and compatible with complex navigation software.

- AI integration supports the training of clinicians by simulating complex biopsy scenarios and evaluating performance, leading to safer device utilization.

DRO & Impact Forces Of Disposable Puncture Biopsy Needle Market

The Disposable Puncture Biopsy Needle Market is fundamentally shaped by a confluence of accelerating drivers, structural restraints, and emerging opportunities that dictate its growth trajectory and competitive landscape. The primary driving force is the global surge in cancer incidence and mortality rates, necessitating highly reliable and repeatable diagnostic tools for early intervention. This is compounded by the increasing preference among healthcare providers and patients for minimally invasive surgical and diagnostic techniques, which reduce recovery time and hospital stays. However, the market faces significant restraints, chiefly concerning the high cost of advanced, automated disposable systems, particularly in cost-sensitive markets, and the persistent challenges related to favorable reimbursement policies across all regions for specialized procedures. These elements create a complex environment where manufacturers must balance innovation with cost-effectiveness.

Opportunities in this sector are vast, driven primarily by technological leaps. The refinement of imaging technologies (such as high-resolution ultrasound and advanced MRI) allows for the precise targeting of smaller and deeper lesions, demanding equally precise, small-gauge disposable needles. Furthermore, the expansion of healthcare access in developing nations presents a substantial untapped market for essential diagnostic tools, provided localized manufacturing or distribution strategies can address affordability concerns. Strategic opportunities also lie in the development of multi-modality needles suitable for various guiding systems and the integration of smart features (like pressure sensors or markers) into disposable devices to enhance user feedback during tissue retrieval. The structural impact forces—such as globalization of supply chains and evolving material science—ensure constant pressure on innovation and price structure.

The overall impact forces are overwhelmingly positive, favoring market expansion. Regulatory scrutiny, while potentially a short-term constraint, acts as a long-term driver by mandating higher safety standards, which naturally favors certified, sterile, disposable products over reusable alternatives. The shift toward outpatient biopsy settings and specialized diagnostic centers, away from large tertiary hospitals for routine procedures, demands portable and user-friendly disposable systems. Continuous investment in research and development aimed at reducing pain, minimizing complications, and maximizing tissue sample integrity ensures that the disposable biopsy needle remains a high-value item in the diagnostic toolbox, cementing its essential role in the clinical workflow.

Segmentation Analysis

The Disposable Puncture Biopsy Needle Market is systematically segmented based on product type, procedure, application, and end-user, reflecting the diverse clinical needs and technological variations inherent in tissue sampling. Analyzing these segments provides a clear map of market demand dynamics. By product type, differentiation occurs based on the mechanism of tissue acquisition—automatic, semi-automatic, or manual—with automatic systems often commanding a higher price point due to their speed and integrated safety features. The procedural segmentation delineates between Fine Needle Aspiration (FNA), primarily used for cytology, and Core Needle Biopsy (CNB), which provides larger, more complex tissue samples necessary for histological grading and molecular testing. CNB typically utilizes thicker-gauge needles and more advanced firing mechanisms.

Application-based segmentation is crucial, as the morphology and location of tumors dictate the specific type of needle required. The prominent applications include biopsies of the breast, lungs, liver, and prostate, each requiring specialized lengths, tip configurations (e.g., blunt or bevelled), and guidance capabilities to maximize diagnostic yield while minimizing procedural risks specific to that organ. For instance, breast biopsy often utilizes vacuum-assisted devices, while lung biopsies require specific needles designed to navigate the lung parenchyma efficiently. End-user segmentation categorizes consumption into Hospitals, Specialty Clinics, and Diagnostic Centers. Hospitals currently represent the largest segment due to the volume of complex procedures performed, but the rising prevalence of dedicated outpatient diagnostic centers is rapidly shifting the market share landscape.

The strategic importance of segmentation lies in targeting specific segments with tailored product offerings. For instance, in developed markets, the focus is on high-precision, automatic CNB systems for complex oncology cases. Conversely, in rapidly growing emerging markets, manual or semi-automatic systems might gain preference due to their lower cost and ease of use in diverse clinical settings. Furthermore, continuous segmentation refinement based on materials (e.g., specific alloys, surface coatings) or guidance systems (e.g., specific MRI or CT compatibility) is key for capturing niche segments focused on optimizing diagnostic performance under stringent conditions. This granular analysis is essential for manufacturers to align production and marketing efforts effectively.

- Product Type:

- Automatic Biopsy Needles

- Semi-automatic Biopsy Needles

- Manual Biopsy Needles

- Procedure:

- Core Needle Biopsy (CNB)

- Fine Needle Aspiration (FNA)

- Application:

- Breast Biopsy

- Lung Biopsy

- Liver Biopsy

- Prostate Biopsy

- Kidney Biopsy

- Other Applications (e.g., Thyroid, Lymph Nodes)

- End-User:

- Hospitals

- Specialty Clinics

- Diagnostic Centers

Value Chain Analysis For Disposable Puncture Biopsy Needle Market

The value chain for the Disposable Puncture Biopsy Needle Market begins with the upstream activities of raw material procurement and highly specialized manufacturing. Upstream suppliers are responsible for providing medical-grade components, primarily stainless steel alloys (such as high-grade 304 or 316 steel for shafts), plastics for hubs and safety mechanisms, and advanced surface coatings designed to reduce friction and improve patient comfort. Quality control and material standardization are paramount in this stage due to the critical nature of the device. Key upstream challenges involve maintaining a stable supply of specialized materials compliant with stringent bio-compatibility and mechanical strength requirements.

The manufacturing stage involves precision engineering, including highly specialized grinding, beveling, and assembly processes, often performed in ISO-certified cleanroom environments. Major market players typically employ high levels of automation to ensure consistency and large-scale production capability. This stage also includes the critical steps of sterilization (often using ethylene oxide or radiation) and packaging. Downstream activities are dominated by distribution logistics. Given that these are sterile, high-value medical devices, the distribution channel is highly controlled and typically involves specialized medical device distributors who manage inventory, warehousing, and transportation to ensure sterile integrity until the point of use. Direct sales models are often employed by major manufacturers for large hospital networks, ensuring closer relationships and faster feedback loops.

The distribution channel is dichotomous: direct sales often target large integrated delivery networks (IDNs) and specialized centers, allowing manufacturers to control pricing and support services more effectively. Indirect channels rely on regional or local distributors to reach smaller clinics and remote diagnostic facilities, requiring strong oversight to maintain cold chain or specific storage condition requirements, although biopsy needles generally require standard temperature storage. Efficient logistics and robust inventory management are crucial, as disposable needles have a finite shelf life and are essential for scheduled procedures. The entire chain culminates with the end-users—hospitals and clinics—where clinical training and product support provided by the manufacturers or distributors are critical factors influencing purchasing decisions and adoption rates.

Disposable Puncture Biopsy Needle Market Potential Customers

The primary customers for the Disposable Puncture Biopsy Needle Market are institutions specializing in diagnostic imaging, interventional radiology, and surgical oncology, where accurate tissue procurement is indispensable for patient management. Hospitals, particularly those with dedicated cancer centers or comprehensive radiology departments, constitute the largest segment of potential customers. These institutions require high volumes of diverse needle types to handle a wide spectrum of inpatient and outpatient biopsies across various organs, driven by institutional guidelines and patient referral rates. Purchasing decisions in this segment are often centralized and influenced by large-scale procurement contracts, requiring manufacturers to demonstrate clinical superiority, supply reliability, and cost-effectiveness over long periods.

Specialty clinics, including dedicated breast health centers, urology clinics, and gastroenterology practices that perform specific organ biopsies, represent a rapidly growing customer base. These facilities often seek specialized, high-precision disposable needles optimized for their narrow range of procedures, such as vacuum-assisted biopsy devices for breast lesions or transrectal biopsy kits for prostate cancer screening. For specialty clinics, ease of use, compatibility with existing ultrasound or CT equipment, and specific technical support are critical purchasing factors. Their procurement cycles are often shorter and more agile compared to large hospital systems, allowing newer, specialized products to penetrate the market more quickly.

Diagnostic Centers, which primarily focus on imaging and outpatient interventional procedures, form the third major customer group. These centers rely heavily on efficiency and rapid patient throughput. They demand standardized, reliable disposable systems that minimize complications and maximize sample viability, as procedural efficiency directly impacts their profitability. Furthermore, pathology laboratories, though not direct users of the needle itself, exert indirect influence by setting the quality standards for the tissue samples they receive, thereby driving the demand for advanced needles capable of retrieving highly intact, uncontaminated specimens suitable for advanced molecular diagnostics. Targeting these diverse segments requires segmented marketing and varied pricing strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 715 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton Dickinson, Medtronic, Boston Scientific, Teleflex, Cook Medical, Argon Medical Devices, Hologic, Sterylab, Amecath, INRAD Inc., Olympus, Stryker, Ethicon (J&J), Leica Biosystems, Remed (P.V.) Industries, TSK Laboratory, FUJIFILM, Merit Medical Systems, Cardinal Health, SAKURA FINETEK JAPAN CO. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Puncture Biopsy Needle Market Key Technology Landscape

The technological landscape of the Disposable Puncture Biopsy Needle Market is defined by innovation centered on enhancing precision, improving sample quality, and ensuring patient safety. A foundational technology involves advanced metallurgy and material science, where needles are constructed using specialized stainless steel alloys or sometimes nitinol, chosen for their superior strength, flexibility, and biocompatibility. Crucially, needle tips are manufactured using micro-machining techniques to achieve extremely sharp, consistent bevels (such as Chiba, Franseen, or Menghini types) and specialized coatings (e.g., silicone or PTFE) to minimize friction as the needle passes through dense tissue, thereby reducing patient discomfort and trauma. The firing mechanism, particularly in automatic and semi-automatic systems, utilizes sophisticated spring-loaded technology to achieve high-speed, controlled throws, ensuring rapid tissue acquisition before the sample can be displaced or fragmented.

A major technological advancement driving the market is the development of vacuum-assisted biopsy (VAB) systems. VAB devices utilize specialized disposable needles integrated with a vacuum mechanism to retrieve multiple, large-volume samples from a lesion through a single skin puncture. This technology significantly improves diagnostic yield, particularly in breast biopsies, by ensuring comprehensive sampling and reducing the number of passes required. Furthermore, technological progress is intensely focused on compatibility with medical imaging modalities. Needles are increasingly designed to be highly visible under ultrasound (echogenic tips and markers) and compatible with powerful magnetic resonance imaging (MRI-compatible materials) and computed tomography (CT) guidance systems, allowing clinicians to visualize the needle's precise location in real-time without artifacts.

The future technology landscape emphasizes connectivity and smart features. This includes the development of disposable needles with integrated fiber optics or electronic markers to enhance tracking accuracy, especially for robotic or AI-assisted procedures. Furthermore, there is growing research into cryobiopsy and radiofrequency-assisted biopsy devices, which combine tissue sampling with immediate therapeutic intervention (ablation) or preservation, utilizing specialized disposable components. Sterilization technology is also continuously scrutinized, with a focus on cold sterilization methods like E-beam and gamma irradiation, ensuring the sterility of the disposable product without compromising the structural integrity or functional performance of the device before it reaches the end-user.

Regional Highlights

- North America: North America, comprising the United States and Canada, stands as the largest and most mature market for disposable puncture biopsy needles, commanding a significant share globally. This dominance is attributable to several factors: highly advanced healthcare infrastructure, high consumer awareness regarding early cancer screening, widespread adoption of premium, automated biopsy systems (especially vacuum-assisted devices), and favorable reimbursement scenarios for complex diagnostic procedures. The U.S. market is characterized by substantial investment in R&D, leading to the rapid uptake of technologically superior devices compatible with AI-driven navigation. The high prevalence of various cancers, coupled with stringent regulatory standards that favor single-use, sterile devices to prevent hospital-acquired infections (HAIs), further solidifies this region's leadership position. Demand here is typically focused on high-throughput, high-quality core biopsy systems.

- Europe: The European market maintains a robust and stable growth rate, driven by aging populations, well-established national healthcare systems (like the NHS in the UK and centralized systems in Germany and France), and standardized clinical guidelines that emphasize early diagnosis through biopsy. Western European countries are early adopters of modern interventional techniques, ensuring consistent demand for high-quality disposable devices. The market here is highly competitive, with a focus on both cost-efficiency and clinical performance. Central and Eastern European countries are demonstrating accelerated growth as their healthcare spending increases and they harmonize their clinical practices with Western standards, leading to a greater transition from reusable to disposable instruments.

- Asia Pacific (APAC): The Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fundamentally driven by massive population density, economic development leading to increased healthcare expenditure, and significant improvements in healthcare access, particularly in countries like China, India, and South Korea. The increasing incidence of lifestyle-related diseases, including specific cancers (e.g., liver cancer in Southeast Asia), fuels the urgent need for diagnostic tools. While pricing sensitivity remains a factor, the massive volume potential and governmental initiatives promoting cancer diagnosis infrastructure make APAC a crucial strategic target for global manufacturers, often leading to the establishment of regional manufacturing hubs and tailored, more affordable product lines.

- Latin America (LATAM): The LATAM market, including Brazil, Mexico, and Argentina, represents an emerging segment with substantial untapped potential. Market growth is primarily hampered by fluctuating economic conditions and variations in healthcare access and infrastructure. However, rising investment in private healthcare facilities and increasing public awareness regarding chronic disease detection are steadily driving the adoption of disposable biopsy needles, particularly in major urban centers. Manufacturers must navigate complex regulatory environments and prioritize systems that offer a good balance between functionality and cost-effectiveness to penetrate this diverse regional market effectively.

- Middle East and Africa (MEA): The MEA market shows heterogeneous growth. The Gulf Cooperation Council (GCC) countries exhibit high demand for premium products, comparable to Western markets, due to significant wealth and investment in high-end medical tourism and state-of-the-art hospitals. Conversely, the African sub-region faces infrastructure and budgetary constraints, leading to lower per capita consumption of disposable medical supplies. Future growth hinges on stabilizing political conditions, improving medical training, and international aid programs focused on establishing basic diagnostic capabilities, gradually shifting demand toward reliable, sterilized, disposable instruments for infectious and chronic disease diagnosis.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Puncture Biopsy Needle Market.- Becton Dickinson and Company (BD)

- Medtronic Plc

- Boston Scientific Corporation

- Teleflex Incorporated

- Cook Medical

- Argon Medical Devices, Inc.

- Hologic, Inc.

- Sterylab S.r.l.

- Amecath Medical Technologies

- INRAD Inc.

- Olympus Corporation

- Stryker Corporation

- Ethicon (Johnson & Johnson)

- Leica Biosystems (Danaher Corporation)

- Remed (P.V.) Industries

- TSK Laboratory

- FUJIFILM Corporation

- Merit Medical Systems, Inc.

- Cardinal Health

- SAKURA FINETEK JAPAN CO., LTD.

Frequently Asked Questions

Analyze common user questions about the Disposable Puncture Biopsy Needle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Disposable Puncture Biopsy Needle Market?

Market growth is predominantly fueled by the surging global incidence of cancer and other chronic diseases necessitating tissue diagnosis. The strong clinical trend favoring minimally invasive diagnostic procedures, coupled with increasing investments in advanced imaging guidance systems (CT, MRI, ultrasound), ensures the consistent demand for high-precision, single-use biopsy needles to achieve optimal sample yield and patient safety. Furthermore, regulatory pressure to reduce hospital-acquired infections accelerates the shift from reusable to sterile disposable instruments.

How do technological advancements influence the segmentation of biopsy needles?

Technological advancements heavily influence segmentation by driving the shift towards automatic and semi-automatic Core Needle Biopsy (CNB) systems, which offer higher firing speed and more consistent tissue retrieval compared to traditional Fine Needle Aspiration (FNA). Key innovations include vacuum-assisted biopsy (VAB) technology for high-volume sampling, specialized echogenic coatings for enhanced ultrasound visibility, and the development of MRI-compatible materials, allowing for tailored product offerings across different application segments like breast, lung, and prostate biopsies.

Which regional market holds the largest share, and which is expected to grow fastest?

North America currently holds the largest market share in the Disposable Puncture Biopsy Needle Market due to its mature healthcare system, high rate of cancer diagnosis, and rapid adoption of premium diagnostic technologies and robust reimbursement mechanisms. Conversely, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by massive population expansion, accelerating healthcare infrastructure development, and growing governmental initiatives focused on improving early disease detection access across populous countries like China and India.

What are the main challenges restraining market expansion?

The primary restraints hindering market expansion include the relatively high cost associated with advanced, fully automatic disposable biopsy systems, which can limit adoption in cost-sensitive healthcare settings, particularly in developing economies. Additionally, navigating complex and inconsistent regulatory approval processes across different countries, as well as managing the technical complexities and training requirements associated with integrating these devices with sophisticated imaging and potential AI navigation platforms, pose significant challenges to widespread market penetration.

What is the role of Artificial Intelligence (AI) in the disposable biopsy needle workflow?

AI significantly impacts the workflow by enhancing procedural planning and real-time guidance, rather than the physical needle itself. AI algorithms assist clinicians by analyzing medical images to predict the optimal, most representative location for tissue sampling, ensuring maximum diagnostic yield from a single pass. During the procedure, AI-driven navigation platforms provide highly accurate trajectory tracking, especially under challenging imaging conditions (CT or MRI), minimizing procedural risk and ensuring the effective utilization of the single-use disposable needle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager