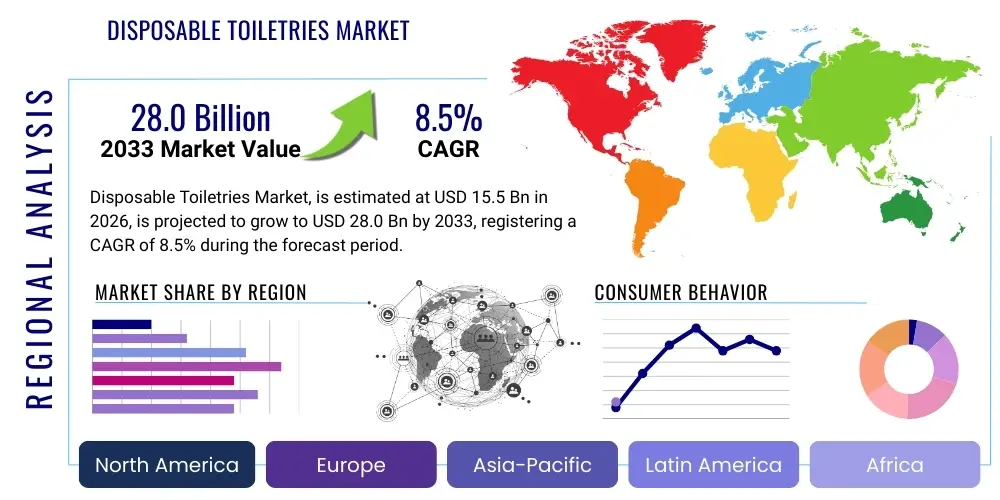

Disposable Toiletries Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437146 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Disposable Toiletries Market Size

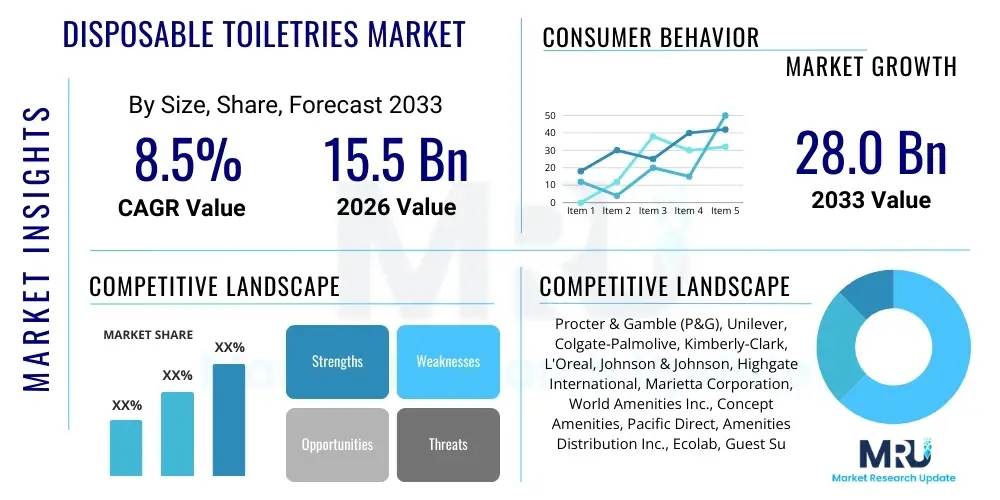

The Disposable Toiletries Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 28.0 Billion by the end of the forecast period in 2033.

Disposable Toiletries Market introduction

The Disposable Toiletries Market encompasses a broad range of personal care and hygiene products designed for single use or short-term, temporary application, typically consumed rapidly and discarded. These products include miniature soaps, shampoos, conditioners, body lotions, toothbrushes, shaving kits, and wet wipes, predominantly utilized in travel, hospitality, healthcare, and institutional settings. The core function of these disposable items is to provide convenience, ensure hygiene standards, and eliminate the need for carrying large, reusable personal care items. This market is fundamentally driven by global tourism growth, stringent hygiene protocols in medical facilities, and the rising consumer preference for convenience, especially among frequent travelers and time-conscious individuals seeking minimal baggage.

Product standardization and packaging innovation are critical facets of this market. Disposable toiletries are often packaged in small, environmentally friendly containers or sachets, offering measured quantities suitable for a few days' use. Major applications are concentrated within the hotel industry, where providing high-quality amenities is crucial for guest satisfaction and brand reputation. Furthermore, air travel, cruise lines, and various public transit sectors utilize these products extensively to offer comfort and essential hygiene services to passengers. The benefits of disposable toiletries extend beyond convenience; they significantly reduce cross-contamination risks compared to shared dispensers or bulk items, making them vital in germ-sensitive environments.

Key driving factors include increasing urbanization and subsequent changes in lifestyle that prioritize portability and ready-to-use solutions. The expansion of the global travel and tourism industry, particularly in developing economies, acts as a primary catalyst for market growth. Additionally, heightened awareness regarding personal hygiene, catalyzed by global health events, has permanently accelerated demand for sealed, individually packaged hygiene products, reinforcing the necessity of disposable options across various commercial and institutional end-users.

Disposable Toiletries Market Executive Summary

The Disposable Toiletries Market demonstrates robust growth, primarily fueled by strong business trends involving strategic partnerships between hospitality chains and major consumer goods manufacturers, focusing intensely on sustainable packaging solutions. Regional expansion is notably pronounced in the Asia Pacific (APAC) region, driven by burgeoning middle-class consumption, increased domestic and international tourism, and rapid expansion of healthcare infrastructure requiring single-use hygiene kits. Simultaneously, North American and European markets are maturing, emphasizing premiumization, organic ingredients, and circular economy principles, leading to higher average selling prices for sophisticated, eco-certified disposable product lines. Manufacturers are optimizing supply chains to handle high-volume, low-margin products efficiently while simultaneously investing in biodegradable plastics and plant-based materials to address growing environmental concerns from both regulatory bodies and consumers.

Segment trends reveal that the institutional segment, encompassing hospitals, corporate restrooms, and fitness centers, is experiencing the fastest growth rate, surpassing traditional hospitality segments due to elevated post-pandemic hygiene standards. Within product types, disposable wet wipes and specialty hygiene kits (e.g., dental or shaving kits) are showing high uptake. Furthermore, the distribution channel is increasingly shifting towards e-commerce platforms and specialized B2B procurement portals, streamlining the supply chain for bulk purchasers. Ingredient trends highlight a consumer preference shift toward natural, chemical-free, and cruelty-free formulations, pushing manufacturers to reformulate their core disposable lines, often at a higher cost base, which is subsequently passed on to premium end-users like luxury hotels and high-end retreats.

Overall market dynamics are characterized by a delicate balance between cost-effectiveness, mandated hygiene standards, and environmental responsibility. Companies that successfully integrate sustainable practices—such as using recycled ocean plastic or offering refillable-disposable hybrid solutions—while maintaining competitive pricing are positioned for long-term dominance. Investment in automated manufacturing processes is key to mitigating rising labor costs and ensuring scalability to meet global spikes in travel and institutional demand. The market remains competitive, necessitating continuous innovation in product design, specifically miniaturization and enhanced functionality within single-use formats.

AI Impact Analysis on Disposable Toiletries Market

Common user questions regarding the impact of AI on the Disposable Toiletries Market often revolve around operational efficiency, personalization capabilities, and sustainability metrics. Users frequently inquire about how AI can optimize inventory management for highly dispersed, low-value inventory items typical of disposable products, predicting demand fluctuations caused by travel trends or local events. There is significant interest in how AI algorithms can drive personalized amenity selection based on guest profiles (e.g., loyalty status, previous purchases, stated preferences) within the hospitality sector, moving beyond standardized offerings. Furthermore, users are keen to understand if AI-driven supply chain transparency can verify sustainable sourcing and waste management processes for disposable items, addressing environmental accountability concerns effectively. The key themes summarized are optimization of logistics, enhanced consumer personalization, and the application of machine learning for sustainability reporting and compliance in manufacturing processes.

- AI-driven Demand Forecasting: Machine learning models analyze seasonal travel patterns, local event calendars, and booking data to accurately predict demand spikes for specific disposable items (e.g., predicting a higher need for dental kits versus shaving kits based on demographic data).

- Optimized Inventory Management: AI systems manage decentralized warehouse stocks, minimizing waste from expiration or overstocking, crucial for the high volume, low margin nature of disposable goods.

- Personalized Guest Experience: AI algorithms categorize hotel guests and suggest optimal amenity packages, allowing hotels to stock only the toiletries likely to be used, reducing cost and environmental footprint from unused products.

- Automated Quality Control (AQC): Computer vision systems monitor production lines for packaging defects, ensuring the integrity and sterility of individual disposable units at high speeds, critical for maintaining hygiene standards.

- Supply Chain Transparency: Blockchain integrated with AI monitors the sourcing of sustainable materials (e.g., biodegradable plastics, RSPO-certified palm oil derivatives), providing immutable records for regulatory compliance and consumer trust.

- Dynamic Pricing Strategy: AI analyzes competitor pricing, raw material costs, and seasonal demand to dynamically adjust wholesale pricing for B2B contracts, maximizing profit margins.

- Robot-Assisted Packaging and Sorting: Robotics deployed in tertiary packaging processes (assembling kits, placing items in boxes) improve throughput and reduce human error, optimizing labor utilization in high-volume production.

DRO & Impact Forces Of Disposable Toiletries Market

The Disposable Toiletries Market is primarily driven by the escalating demand from the global travel and tourism sector, which mandates continuous provision of fresh, hygienically packaged amenities. The stringent regulatory push for elevated sanitation standards in the healthcare and institutional sectors further reinforces the need for sterile, single-use products, particularly following global public health crises. However, the market faces a significant restraint in the form of mounting environmental opposition and governmental bans on single-use plastics, forcing manufacturers to incur higher costs for sourcing biodegradable or compostable alternatives. This pressure necessitates substantial investment in R&D for material science, creating a cost-benefit dilemma for mass-market producers. The inherent volume and logistical complexity of shipping small, low-value products across global supply chains also pose operational hurdles that restrain profitability.

Opportunities for growth are concentrated in the rapid innovation of packaging to achieve "zero waste" credentials and in penetrating high-growth emerging markets, especially within APAC and Latin America, where organized hospitality sectors are rapidly expanding. Developing functional disposable toiletries utilizing natural, organic, or ethically sourced ingredients presents a premiumization pathway, allowing companies to capture affluent consumer segments willing to pay more for sustainable luxury. Furthermore, expanding product lines beyond basic hotel amenities to specialized kits for gyms, corporate travel, or disaster relief efforts offers diversification and new revenue streams that are less susceptible to seasonal tourism fluctuations.

The impact forces within this market are substantial and multi-directional. Consumer behavior acts as a powerful force, shifting demand toward transparency and sustainability, often bypassing brands that rely solely on conventional plastic packaging. Simultaneously, technological advancements, particularly in high-speed, flexible packaging machinery, serve as an internal force enabling cost reduction and faster product turnaround. Competitive intensity is high due to the presence of large multinational CPG companies and smaller, agile, eco-focused startups, keeping pricing under constant scrutiny. Legislative mandates, particularly those limiting plastic waste, serve as the most critical external impact force, fundamentally reshaping the materials and design parameters permissible within the disposable toiletries ecosystem globally.

Segmentation Analysis

The Disposable Toiletries Market is critically segmented based on Product Type, Application (End-Use), and Distribution Channel to provide granular market insights tailored to different operational needs and consumer touchpoints. This segmentation allows stakeholders to target specific niches, such as the lucrative airline and cruise line segment, or the highly standardized hospital segment. Product Type segmentation is crucial for understanding manufacturing requirements, ranging from liquid formulations (shampoo, soap) to solid items (toothbrushes, razors), each requiring specialized production lines and packaging. Analysis by End-Use reveals where the primary consumption occurs, quantifying the relative importance of B2B relationships with the massive hospitality sector versus direct-to-consumer sales of travel kits. Furthermore, distribution channel analysis helps in optimizing logistics, identifying key leverage points within the supply chain, whether through direct procurement, third-party distributors, or modern retail channels.

- By Product Type:

- Disposable Shampoo and Conditioner

- Disposable Soap and Body Wash

- Disposable Lotions and Moisturizers

- Disposable Dental Kits (Toothbrush, Paste)

- Disposable Shaving Kits (Razor, Cream)

- Disposable Wet Wipes and Tissues

- Disposable Feminine Hygiene Products (Specific to Institutional Use)

- Other Specialty Kits (Slippers, Shower Caps)

- By Application (End-Use):

- Hospitality (Hotels, Resorts, Motels, Service Apartments)

- Institutional (Hospitals, Clinics, Rehabilitation Centers)

- Travel and Transportation (Airlines, Cruise Ships, Trains)

- Corporate and Commercial (Offices, Gyms, Spas)

- Others (Disaster Relief, Military)

- By Distribution Channel:

- B2B Direct Sales

- Wholesalers and Distributors

- E-commerce Platforms

- Retail Stores (Supermarkets, Hypermarkets)

Value Chain Analysis For Disposable Toiletries Market

The value chain for the Disposable Toiletries Market is complex, beginning with the highly specialized procurement of raw materials and extending through sophisticated B2B distribution networks. Upstream activities involve the sourcing of cosmetic ingredients (surfactants, fragrances, active compounds), packaging materials (bottles, tubes, sachets, increasingly biodegradable options), and primary raw materials like pulp for wet wipes or plastic resins. This stage is dominated by chemical suppliers and packaging material producers, where costs are highly sensitive to petroleum price volatility and compliance with international sustainability certifications. Manufacturers prioritize securing reliable, cost-effective sources for both formulation components and sustainable packaging alternatives to maintain competitive pricing in the downstream market. Strategic alliances with specialty chemical providers capable of rapidly adapting to clean-label ingredient trends are vital.

Midstream processing focuses on manufacturing, blending, filling, and high-speed packaging, where automation is paramount due to the high-volume nature of disposable products. This includes formulation testing, quality control, and the creation of customized kits specific to client specifications (e.g., a five-star hotel brand requiring a signature scent). The efficiency of this stage directly impacts the final unit cost. Downstream activities are heavily weighted towards distribution and market penetration, dominated by logistics providers, specialized B2B wholesalers, and third-party fulfillment services that manage complex contractual agreements with large hotel chains, hospital purchasing groups, and corporate buyers. Direct sales often form the backbone of major manufacturer distribution, ensuring consistent branding and streamlined bulk delivery.

Distribution channels are delineated into direct and indirect routes. Direct sales involve manufacturers shipping products straight to large corporate accounts, such as major international hotel groups or national healthcare providers, ensuring favorable pricing and customized service levels. Indirect channels utilize wholesalers, distributors, and e-commerce platforms (which are increasingly important for small-to-medium institutional clients and niche specialty purchases) to achieve broader geographic reach and manage smaller, frequent orders. The effectiveness of the value chain is measured by its ability to deliver high-quality, hygienically sealed products rapidly and consistently, while simultaneously mitigating the environmental footprint associated with single-use items, demanding significant transparency and cooperation among all intermediaries.

Disposable Toiletries Market Potential Customers

The primary customers and buyers of disposable toiletries are categorized into institutional entities that purchase these goods in bulk as a core operational requirement, rather than individual end-consumers making retail purchases. The most significant segment is the Hospitality industry, which includes hotels, resorts, cruise lines, and serviced apartments, viewing disposable amenities as an integral part of their service offering and brand standard. Procurement managers in these organizations focus heavily on quality, aesthetics, scent, and, increasingly, the eco-friendliness of the packaging, balancing guest expectation with cost management. The buyer often negotiates long-term, high-volume contracts directly with manufacturers or major distributors to ensure uninterrupted supply and consistent brand identity across properties.

The second largest potential customer group comprises the Healthcare and Institutional sector, including hospitals, surgical centers, nursing homes, and rehabilitation facilities. For these buyers, the primary purchasing criteria shift entirely toward hygiene, sterility, and regulatory compliance, with minimal focus on luxury branding. Disposable products in this segment are essential tools for infection control, including sterile wipes, specialized cleansing solutions, and single-use personal care kits provided to patients. Purchasing decisions are typically handled by central procurement departments or Group Purchasing Organizations (GPOs), which prioritize robust supply chains and cost containment for mission-critical supplies, often requiring specific certification levels for microbial safety and material composition.

Other key buyers include corporate facilities, gyms, and travel providers (airlines and rail services). Corporate clients and fitness centers often provide basic, functional disposable items (soaps, body wash, tissues) as a standard employee or member benefit, focusing on value and basic hygiene. Conversely, airlines and premium transportation services prioritize compact, lightweight, and often branded miniature kits that enhance the passenger experience during long-haul travel. Market vendors must tailor their product offerings—from formulation to packaging size—to meet the specific functional, regulatory, and aesthetic demands of each distinct potential customer segment to maximize market penetration and secure long-term contracts in this highly competitive B2B landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 28.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Procter & Gamble (P&G), Unilever, Colgate-Palmolive, Kimberly-Clark, L'Oreal, Johnson & Johnson, Highgate International, Marietta Corporation, World Amenities Inc., Concept Amenities, Pacific Direct, Amenities Distribution Inc., Ecolab, Guest Supply, Lion Corporation, Kao Corporation, Beiersdorf AG, ITC Limited, The Clorox Company, Diversey. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Toiletries Market Key Technology Landscape

The core technological advancements in the Disposable Toiletries Market are centered around material science innovation, high-speed automated packaging, and sustainable manufacturing processes designed to minimize environmental impact while maximizing operational efficiency. A critical area of focus is the development and commercialization of new bioplastics, such as Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), and other compostable polymers derived from renewable sources, replacing conventional fossil-fuel-based plastics. Manufacturers are investing heavily in technologies that allow for the efficient mass production of miniature, leak-proof packaging using these novel sustainable materials, ensuring they meet the durability and shelf-life requirements expected in commercial environments. This transition necessitates updated injection molding and film extrusion technologies capable of handling materials with different processing temperatures and flow characteristics than traditional polyethylene (PE) or polyethylene terephthalate (PET).

Automation and robotics play a pivotal role in maintaining cost competitiveness and stringent hygiene standards. Modern manufacturing plants utilize advanced fill-and-seal machinery capable of extremely high throughput for liquid sachets and small bottles, minimizing product contact and contamination risk. Furthermore, computer vision systems are integrated into production lines for real-time quality inspection, verifying seal integrity, fill volumes, and accurate labeling of millions of units daily. These technologies are crucial for managing the complex process of assembling various items into cohesive, application-specific kits (e.g., dental kits or amenity boxes), reducing reliance on manual labor and enhancing consistency across large production runs, which is essential for global supply contracts.

Furthermore, technology related to formulation and ingredient delivery is evolving. Microencapsulation technology is being explored to enhance the efficacy and shelf stability of active ingredients, particularly in highly perishable items like disposable wet wipes or specialized topical treatments found in institutional kits. Digital technologies, specifically the integration of IoT sensors and advanced enterprise resource planning (ERP) systems, are being employed across the supply chain to provide end-to-end traceability. This allows buyers, especially large hotel groups, to verify the ethical sourcing and manufacturing compliance of their disposable amenities, ensuring adherence to global labor standards and environmental best practices, which is becoming a non-negotiable requirement in B2B procurement agreements.

Regional Highlights

Regional dynamics are highly heterogeneous, reflecting variances in tourism activity, regulatory environments concerning plastic waste, and disposable income levels. Asia Pacific (APAC) stands out as the highest-growth region, driven by the rapid expansion of hospitality chains in countries like China, India, and Southeast Asian nations, catering to both booming domestic and international tourist volumes. The large, concentrated population bases and improving economic stability translate directly into higher consumption of disposable toiletries across all segments, including institutional and travel applications. The market here is cost-sensitive but is rapidly adopting international sustainability standards under pressure from major global hotel operators establishing presence in the region.

North America and Europe represent mature markets characterized by high penetration rates and consumer preference for premium, sustainable, and organic disposable options. In Europe, strict EU directives regarding single-use plastics are fundamentally reshaping the market, driving mandatory transitions toward certified biodegradable and paper-based packaging solutions. This regulatory environment is pushing innovation but simultaneously increasing operational costs. North America focuses heavily on convenience and branding; while sustainability is crucial, consumers and corporate buyers are often willing to pay a premium for recognized, high-quality brands that offer travel-sized convenience and environmentally conscious attributes, making premiumization a key regional trend.

The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) states, show significant market potential linked to massive investments in luxury tourism, major global events (like expos and sports tournaments), and state-of-the-art healthcare cities. Disposable amenity usage is extremely high in the luxury hospitality sector across the UAE and Saudi Arabia. Latin America presents a mixed picture; Brazil and Mexico show steady growth fueled by internal tourism and infrastructural improvements, but economic volatility and lower average consumer spending necessitate a strong focus on cost-effective, value-oriented disposable product lines, although sustainability concerns are gaining traction, driven by local environmental advocacy groups.

- Asia Pacific (APAC): Dominates growth due to expanding middle class, massive tourism infrastructure development, and high utilization in newly built hospital and institutional facilities. Key focus on balancing cost-effectiveness with emerging sustainable mandates.

- North America: Market characterized by high disposable income, strong brand loyalty, and significant demand from corporate and premium travel segments. Pioneers in adopting sophisticated, certified clean-label and cruelty-free disposable formulations.

- Europe: Regulatory landscape is the primary market driver, necessitating radical shifts toward non-plastic, biodegradable packaging solutions. High penetration of organic and natural product lines across hospitality.

- Middle East and Africa (MEA): Growth centered around luxury hospitality projects and state-driven tourism initiatives (e.g., UAE, KSA), emphasizing high-end, aesthetically pleasing, and customized amenity packaging.

- Latin America (LATAM): Market expansion driven by domestic travel recovery; strong demand for functional, affordable disposable toiletries across smaller hotels and budget accommodations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Toiletries Market.- Procter & Gamble (P&G)

- Unilever

- Colgate-Palmolive

- Kimberly-Clark

- L'Oreal

- Johnson & Johnson

- Highgate International

- Marietta Corporation

- World Amenities Inc.

- Concept Amenities

- Pacific Direct

- Amenities Distribution Inc.

- Ecolab

- Guest Supply

- Lion Corporation

- Kao Corporation

- Beiersdorf AG

- ITC Limited

- The Clorox Company

- Diversey

Frequently Asked Questions

Analyze common user questions about the Disposable Toiletries market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Disposable Toiletries Market?

The exponential growth in the global travel and tourism sector, particularly the expansion of hotel chains and institutional hospitality services, is the main driver. This sector mandates the consistent provision of hygienic, single-use amenities for guest satisfaction and compliance.

How are environmental regulations impacting the material selection for disposable toiletries?

Environmental regulations, particularly anti-single-use plastic mandates in Europe and North America, are forcing a critical shift towards biodegradable polymers, paper-based packaging, and certified compostable materials. This necessitates increased R&D investment and higher procurement costs for manufacturers.

Which segment holds the largest market share in the Disposable Toiletries Market by Application?

The Hospitality segment (hotels, resorts, serviced apartments) currently holds the largest market share due to the massive volume of amenities purchased and distributed daily to global travelers. However, the Institutional segment is experiencing the fastest growth rate.

How is AI being used to optimize the supply chain for disposable amenities?

AI is deployed for highly accurate demand forecasting, analyzing transient data such as booking rates and event schedules to minimize inventory waste and prevent stockouts. It also enhances automated quality control (AQC) during high-speed packaging processes.

What are the key technological advancements expected to shape the future of this market?

Future growth will be shaped by advancements in biopolymer science (PHA, PLA) for packaging, coupled with greater automation (robotics and computer vision) in manufacturing and kit assembly to reduce operational costs while maintaining stringent hygiene and sustainability certifications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager