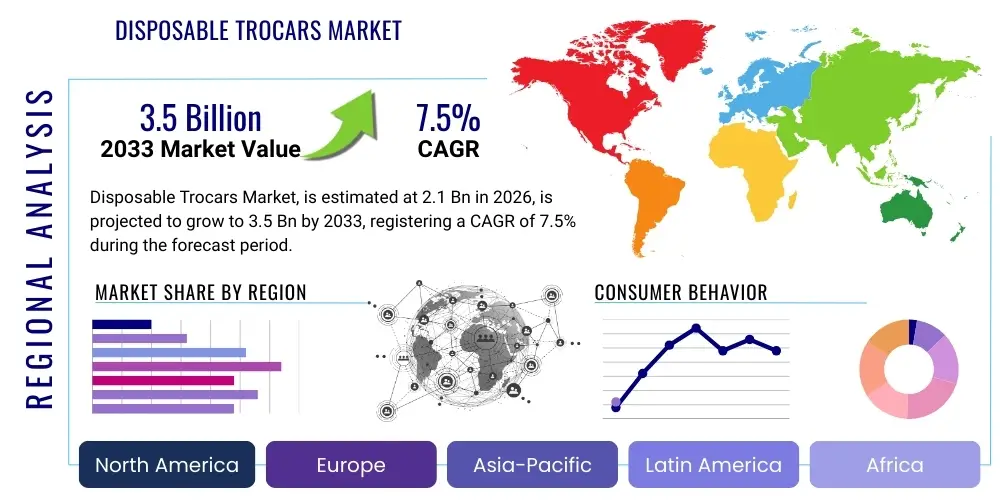

Disposable Trocars Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439622 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Disposable Trocars Market Size

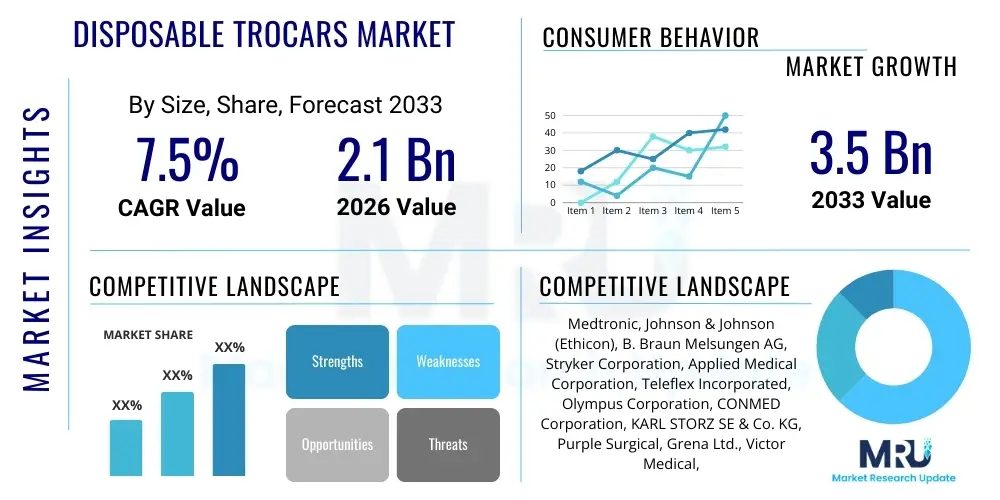

The Disposable Trocars Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033. This significant expansion is driven by the escalating global demand for minimally invasive surgical (MIS) procedures, which are increasingly favored due to their associated benefits such as reduced patient trauma, shorter hospital stays, and faster recovery times. The market's robust growth trajectory reflects ongoing innovations in surgical technology and the increasing adoption of advanced medical devices across diverse healthcare settings worldwide.

Disposable Trocars Market introduction

The Disposable Trocars Market encompasses a range of single-use surgical instruments designed to create and maintain a port of entry into the patient's body cavity during laparoscopic and other minimally invasive procedures. These devices typically consist of an obturator (a pointed or blunt tip) encased within a cannula (a hollow tube), facilitating the insertion of instruments like endoscopes, graspers, and scissors into the surgical field. The primary objective is to provide a safe and effective conduit for surgical tools while minimizing tissue damage and reducing the risk of complications associated with traditional open surgery. The single-use nature of these trocars eliminates the need for sterilization, thereby enhancing patient safety by mitigating the risk of cross-contamination and hospital-acquired infections, a critical concern in modern healthcare environments. This characteristic also contributes to operational efficiency in busy surgical suites by reducing turnaround times.

Major applications for disposable trocars span a wide spectrum of surgical specialties, including general surgery (e.g., cholecystectomy, appendectomy, hernia repair), bariatric surgery, gynecological procedures (e.g., hysterectomy, oophorectomy), urological surgery (e.g., nephrectomy, prostatectomy), and thoracic surgery. The versatility and precision offered by these instruments make them indispensable across these various fields, supporting a shift towards less invasive techniques. The inherent benefits of disposable trocars extend beyond infection control to include consistent performance, as each device is new and untarnished by previous use or sterilization cycles. They also offer ergonomic advantages and a broader range of specialized designs tailored to specific anatomical needs or procedural requirements, enhancing surgeon comfort and procedural outcomes.

Several pivotal driving factors underpin the sustained growth of the disposable trocars market. The global rise in the prevalence of chronic diseases such as obesity, cardiovascular conditions, and various forms of cancer necessitates an increasing number of surgical interventions, many of which can be managed through minimally invasive approaches. Furthermore, the aging global population is more susceptible to these conditions and often benefits from less invasive surgeries due to faster recovery and reduced post-operative complications. Technological advancements, including the development of optical trocars for direct visualization during insertion, bladeless trocars designed to separate tissue rather than cut it, and specialized trocars for robotic-assisted surgery, are continually improving safety and efficacy, further fueling adoption. Enhanced patient awareness and preference for procedures that offer shorter recovery periods and less pain also contribute significantly to the market's expansion.

Disposable Trocars Market Executive Summary

The Disposable Trocars Market is experiencing dynamic shifts driven by evolving business strategies, regional healthcare infrastructure developments, and specific segment-level innovations. Key business trends include an intensified focus on strategic collaborations and mergers and acquisitions among leading medical device manufacturers to consolidate market share, expand product portfolios, and enhance global distribution networks. Companies are increasingly investing in research and development to introduce trocars with enhanced safety features, such as integrated port closure mechanisms, ergonomic designs, and improved visualization capabilities, catering to the nuanced demands of complex minimally invasive surgeries. There is also a growing emphasis on value-based healthcare, prompting manufacturers to demonstrate the clinical and economic benefits of their disposable trocar solutions, often through robust clinical evidence and cost-effectiveness studies. This competitive landscape fosters innovation, pushing companies to differentiate their offerings through superior materials, design, and user experience.

Regional trends reveal a heterogeneous growth pattern. North America and Europe currently dominate the market, largely due to well-established healthcare infrastructures, high adoption rates of advanced surgical technologies, favorable reimbursement policies, and a significant prevalence of lifestyle-related diseases requiring surgical intervention. However, the Asia Pacific region, particularly emerging economies like China, India, and Southeast Asian countries, is projected to exhibit the fastest growth. This surge is attributed to rapidly improving healthcare access, increasing healthcare expenditure, a rising medical tourism industry, and a growing awareness of and preference for minimally invasive surgical techniques. Latin America and the Middle East & Africa also present lucrative opportunities, driven by expanding healthcare investments, modernization of medical facilities, and efforts to reduce healthcare disparities. The regulatory landscape across regions also plays a crucial role, influencing market entry and product commercialization strategies.

Within the segmentation analysis, certain trends stand out. By product type, bladeless and optical trocars are gaining significant traction due to their enhanced safety profiles, reducing the risk of vessel and organ injury during insertion. Optical trocars, which allow for direct visualization of tissue layers, are particularly valued for challenging patient anatomies or revisional surgeries. In terms of application, general surgery continues to hold the largest share, but bariatric and gynecological surgeries are experiencing rapid growth, fueled by the rising global rates of obesity and various women's health issues, respectively. End-user trends highlight the increasing role of Ambulatory Surgical Centers (ASCs) as cost-effective alternatives to traditional hospitals for routine MIS procedures. ASCs benefit from the efficiency and reduced infection risk associated with disposable trocars, contributing to their expanding adoption in these settings. The market is also witnessing the emergence of specialized trocars tailored for robotic-assisted surgery, a burgeoning segment that demands instruments with specific features for robotic compatibility and precision.

AI Impact Analysis on Disposable Trocars Market

Common user questions regarding the impact of AI on the Disposable Trocars Market frequently revolve around how artificial intelligence can enhance surgical safety, improve procedural outcomes, optimize inventory management, and contribute to new product development. Users are keen to understand if AI can predict complications related to trocar insertion, personalize trocar selection based on patient anatomy, or streamline the supply chain for these critical single-use devices. Concerns often include the cost implications of integrating AI, data privacy considerations, and the potential for AI-driven systems to augment rather than replace human surgical expertise. There is also significant interest in how AI might contribute to the design and testing of future trocar generations, potentially leading to more advanced, safer, and more efficient instruments. The overarching theme is the pursuit of greater precision, efficiency, and patient safety through intelligent technological integration.

- AI can optimize inventory management and demand forecasting for disposable trocars, reducing waste and ensuring availability.

- Predictive analytics powered by AI may assist surgeons in assessing patient-specific risks related to trocar placement, enhancing safety.

- AI-driven simulation and training platforms can improve surgeon proficiency in using various trocar types and insertion techniques.

- Computer vision and AI algorithms can provide real-time guidance during trocar insertion, potentially reducing complications.

- AI can analyze vast datasets from surgical procedures to identify optimal trocar designs and materials for different applications.

- Robotic surgery platforms, increasingly integrated with AI, will demand specialized trocars optimized for precision and automated control.

- AI could facilitate personalized medicine by recommending specific trocar types or sizes based on individual patient characteristics.

- Enhanced post-operative analysis through AI can identify correlations between trocar usage and patient outcomes, informing best practices.

DRO & Impact Forces Of Disposable Trocars Market

The Disposable Trocars Market is propelled by a confluence of robust drivers, notably the accelerating global adoption of minimally invasive surgical (MIS) procedures across various medical disciplines. This shift is fundamentally driven by patient preference for less invasive interventions that promise quicker recovery times, reduced post-operative pain, smaller incisions, and shorter hospital stays compared to traditional open surgery. Furthermore, the increasing prevalence of chronic diseases such as obesity, gastrointestinal disorders, and various cancers worldwide directly contributes to a higher volume of surgical procedures amenable to MIS techniques, thereby escalating the demand for disposable trocars. The demographic trend of an aging global population, inherently more susceptible to conditions requiring surgical treatment and often benefiting from less traumatic procedures, further amplifies this demand. Continuous technological advancements, including the development of safer and more specialized trocar designs (e.g., optical, bladeless, radially expanding) and their seamless integration with advanced surgical platforms like robotic systems, significantly enhance their utility and appeal, acting as a powerful market driver. These innovations offer surgeons improved visualization, easier access, and greater control, directly contributing to superior patient outcomes.

Despite significant growth prospects, the market faces several notable restraints. The relatively high cost associated with minimally invasive surgical procedures, which often includes the single-use disposable instruments like trocars, can be a deterrent, particularly in price-sensitive markets or healthcare systems with budget constraints. While disposable trocars offer advantages in infection control and efficiency, the initial capital outlay for the full suite of MIS equipment, coupled with the recurring expense of disposables, can be substantial. Stringent regulatory approval processes, varying significantly across different regions (e.g., FDA in the US, EMA in Europe, NMPA in China), represent a significant barrier to market entry and product innovation, requiring extensive testing and documentation that adds to development costs and timelines. The continued availability and lower upfront cost of reusable trocar alternatives in some healthcare settings, particularly in developing economies, also pose a competitive challenge. Additionally, the requirement for highly skilled and trained surgical professionals to perform MIS procedures proficiently, coupled with a global shortage of such specialists, can limit the wider adoption of these techniques and, consequently, the demand for associated instruments.

Opportunities within the Disposable Trocars Market are abundant and diverse. Emerging economies in Asia Pacific, Latin America, and the Middle East & Africa present significant untapped potential. These regions are witnessing rapid healthcare infrastructure development, increasing healthcare expenditure, and a growing awareness among both patients and clinicians regarding the benefits of MIS. As these regions expand their surgical capabilities, the demand for advanced disposable instruments is expected to surge. Moreover, the ongoing trend towards the development of highly specialized trocars tailored for specific surgical procedures or patient anatomies (e.g., pediatric trocars, bariatric trocars) represents a fertile ground for innovation and market penetration. The increasing integration of disposable trocars with advanced robotic-assisted surgical platforms is another major opportunity, as robotic surgery continues to expand its reach and capabilities, requiring compatible, high-precision access devices. Focus on improving patient safety through innovative features, such as integrated port closure devices, enhanced fixation mechanisms, and advanced optical visualization systems, will continue to drive market differentiation and create new revenue streams. These opportunities, coupled with ongoing research into biocompatible materials and smart trocar technologies, promise sustained market evolution and expansion.

Segmentation Analysis

The Disposable Trocars Market is comprehensively segmented based on various factors including product type, application, and end-user, providing a granular understanding of market dynamics and growth drivers across different niches. This detailed segmentation allows market participants to identify specific high-growth areas, tailor product development strategies, and optimize their marketing and distribution efforts. Each segment reflects unique demand patterns, technological preferences, and competitive landscapes, contributing to the overall market complexity and strategic planning for stakeholders. Understanding these segments is crucial for accurate market forecasting and for companies aiming to capture specific market shares within the broader disposable trocars industry.

- By Product Type

- Bladed Trocars

- Bladeless Trocars

- Optical Trocars

- Hasson Trocars

- Dilating Trocars

- By Application

- General Surgery

- Bariatric Surgery

- Gynecological Surgery

- Urological Surgery

- Cardiac Surgery

- Other Surgeries (e.g., Thoracic, Pediatric)

- By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Disposable Trocars Market

The value chain for the Disposable Trocars Market begins with upstream activities, primarily involving the sourcing of raw materials and the manufacturing of specialized components. This critical phase includes the procurement of high-grade, biocompatible polymers such as medical-grade polycarbonate, ABS, and polypropylene for the cannula and housing, along with stainless steel or other alloys for the obturator and other metallic components. Specialized manufacturers produce precision-molded plastic parts, machined metal components, and intricate seals. Quality control and material certification are paramount at this stage to ensure product safety, regulatory compliance, and consistent performance. Suppliers of advanced coatings and sterilization-compatible packaging materials also form a crucial part of the upstream segment, ensuring that the components meet the exacting standards required for medical devices. Efficiency in raw material procurement and component manufacturing directly impacts the final product's cost-effectiveness and quality.

Further along the value chain, the assembled disposable trocars move through various distribution channels to reach their ultimate end-users. The downstream analysis encompasses the intricate network of distributors, wholesalers, and sales representatives responsible for marketing, sales, and logistics. This phase is characterized by efforts to build strong relationships with hospitals, ambulatory surgical centers (ASCs), and specialty clinics, which are the primary buyers. Effective inventory management, warehousing, and transportation are essential to ensure timely delivery and minimize supply chain disruptions, especially for critical surgical instruments. Post-sales support, including product training for surgical staff and technical assistance, also constitutes a vital part of the downstream activities, enhancing customer satisfaction and product adoption. Regulatory compliance for distribution and sales in different geographical markets adds another layer of complexity to this segment.

The distribution channels for disposable trocars can be broadly categorized into direct and indirect methods. Direct distribution involves manufacturers utilizing their own sales force to engage directly with healthcare institutions, offering personalized service, product demonstrations, and technical support. This approach allows for greater control over brand messaging and customer relationships but requires significant investment in sales infrastructure. Indirect distribution, on the other hand, leverages third-party distributors, wholesalers, and group purchasing organizations (GPOs). These intermediaries provide manufacturers with access to broader markets, particularly in regions where direct presence might be economically unfeasible, and can streamline procurement processes for healthcare providers. Many large manufacturers employ a hybrid strategy, combining direct sales for key accounts and regions with indirect channels to maximize market reach and efficiency. The choice of distribution strategy often depends on market maturity, geographical scope, and the competitive landscape, aiming to optimize both reach and profitability while ensuring product availability for critical surgical procedures.

Disposable Trocars Market Potential Customers

The primary potential customers and end-users of disposable trocars are healthcare institutions that perform a significant volume of minimally invasive surgical procedures. Hospitals represent the largest segment of these customers, encompassing a wide range of facilities from large university-affiliated medical centers to community hospitals. These institutions typically have fully equipped operating theaters, specialized surgical staff, and the infrastructure to support complex laparoscopic, thoracoscopic, and robotic-assisted surgeries across multiple specialties. Hospitals value disposable trocars for their role in reducing hospital-acquired infections, enhancing patient safety, and contributing to efficient surgical workflows, which are critical metrics for hospital performance and patient care quality. Their purchasing decisions are often influenced by clinical efficacy, cost-effectiveness over the long term, and compliance with stringent infection control protocols. The demand from hospitals is consistently high due to the sheer volume and diversity of surgical cases they manage on a daily basis.

Ambulatory Surgical Centers (ASCs) constitute another rapidly growing segment of potential customers. ASCs are freestanding facilities that specialize in outpatient surgical procedures, offering a cost-effective and convenient alternative to traditional hospital settings for less complex surgeries. These centers place a high premium on operational efficiency, rapid patient turnover, and stringent infection control measures, making disposable trocars an ideal choice. The single-use nature of these devices aligns perfectly with the ASC model, minimizing sterilization costs, reducing preparation time, and eliminating the risk of cross-contamination associated with reusable instruments. As healthcare systems increasingly shift towards outpatient care models to reduce costs and improve patient experience, the demand for disposable trocars from ASCs is expected to escalate significantly. Their purchasing decisions are often driven by direct cost savings, ease of use, and compatibility with their streamlined operational processes.

Beyond hospitals and ASCs, specialty clinics, government healthcare facilities, and military hospitals also represent important potential customers. Specialty clinics, such as gynecological or bariatric clinics that perform specific types of minimally invasive procedures, require specialized trocars tailored to their specific needs. Government healthcare facilities and military hospitals, which serve a large and diverse patient population, often prioritize both cost-effectiveness and robust infection control, making disposable trocars an attractive option. Furthermore, the burgeoning medical tourism sector, particularly in emerging economies, contributes to the demand, as international patients seek high-quality, safe surgical options. Manufacturers and distributors often tailor their marketing and sales strategies to address the unique procurement processes, budget constraints, and clinical requirements of each of these diverse customer segments, highlighting the specific value propositions that disposable trocars offer to their particular operating environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Johnson & Johnson (Ethicon), B. Braun Melsungen AG, Stryker Corporation, Applied Medical Corporation, Teleflex Incorporated, Olympus Corporation, CONMED Corporation, KARL STORZ SE & Co. KG, Purple Surgical, Grena Ltd., Victor Medical, SILS™, Laprosurge, LiNA Medical ApS, CooperSurgical, Inc., Millennium Surgical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Trocars Market Key Technology Landscape

The Disposable Trocars Market is characterized by a rapidly evolving technological landscape, driven by continuous innovation aimed at enhancing patient safety, improving surgical outcomes, and increasing procedural efficiency. One significant area of advancement is the development of bladeless trocars, which employ a dilating tip mechanism rather than a sharp blade to separate tissue layers, thereby minimizing the risk of vascular and visceral injuries during insertion. This design philosophy significantly reduces patient trauma and post-operative complications, contributing to faster recovery times. Another crucial innovation includes optical access trocars, which incorporate an integrated optical system allowing surgeons to visualize tissue layers directly during insertion, providing real-time visual feedback and enhancing safety, particularly in challenging anatomical scenarios or revisional surgeries. These technologies address some of the most critical risks associated with abdominal access in laparoscopic procedures, such as blind insertion.

Further technological advancements focus on improving ergonomics and functionality. Radially expanding trocars, for instance, utilize a small initial incision that is then expanded by a radially dilating sleeve, offering a secure and minimally invasive port. There is also ongoing development in trocars with integrated port closure mechanisms, which simplify the process of closing fascial defects after trocar removal, potentially reducing the risk of port-site hernias. Materials science plays a vital role, with manufacturers continually exploring new biocompatible polymers and advanced composites that offer superior strength, flexibility, and reduced friction, enhancing the smooth passage of instruments. Innovations in seal technology are also critical, ensuring airtight ports that maintain pneumoperitoneum throughout the procedure while accommodating a variety of instrument sizes without gas leakage, thus providing stable working conditions for the surgeon.

The emergence of "smart" trocars represents a future frontier in this market. These next-generation devices could integrate sensors for real-time pressure monitoring, tissue impedance detection, or even miniature cameras for enhanced internal visualization. Such smart features could provide surgeons with immediate feedback, further improving precision and safety. The increasing adoption of robotic-assisted surgery also necessitates specialized trocar designs that are compatible with robotic systems, offering secure docking, precise instrument articulation, and stable port placement throughout prolonged and complex procedures. These trocars often feature enhanced fixation mechanisms and robust designs to withstand the forces exerted by robotic arms. The convergence of these technological innovations collectively aims to make minimally invasive surgery even safer, more accessible, and more effective, continually pushing the boundaries of surgical capability and patient care in the disposable trocars market.

Regional Highlights

- North America: Dominates the market due to advanced healthcare infrastructure, high adoption of MIS, significant prevalence of chronic diseases, and favorable reimbursement policies. The presence of major market players and continuous R&D investments also contribute to its leading position.

- Europe: A mature market characterized by robust healthcare systems, an aging population, and a strong emphasis on reducing healthcare-associated infections. Countries like Germany, the UK, and France are significant contributors, with a steady uptake of innovative trocar technologies.

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by improving healthcare access, increasing healthcare expenditure, a large patient pool, rising medical tourism, and growing awareness of MIS benefits in economies like China, India, and Japan.

- Latin America: Exhibits significant growth potential due to increasing investments in healthcare infrastructure, economic development, and a gradual shift towards advanced surgical practices. Brazil and Mexico are key markets in this region.

- Middle East & Africa (MEA): A developing market with growth fueled by increasing healthcare spending, modernization of medical facilities, and efforts to enhance surgical capabilities. The adoption of MIS is steadily rising, particularly in wealthier Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Trocars Market.- Medtronic

- Johnson & Johnson (Ethicon)

- B. Braun Melsungen AG

- Stryker Corporation

- Applied Medical Corporation

- Teleflex Incorporated

- Olympus Corporation

- CONMED Corporation

- KARL STORZ SE & Co. KG

- Purple Surgical

- Grena Ltd.

- Victor Medical

- SILS™ (Single Incision Laparoscopic Surgery)

- Laprosurge

- LiNA Medical ApS

- CooperSurgical, Inc.

- Millennium Surgical Corp.

- Frankenman Medical Equipment Co., Ltd.

- Genicon, Inc.

- Changzhou Ankang Medical Instruments Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Disposable Trocars market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are disposable trocars and why are they used in surgery?

Disposable trocars are single-use surgical instruments that create and maintain a port of entry into a patient's body during minimally invasive procedures like laparoscopy. They consist of an obturator within a cannula. Their single-use nature enhances patient safety by reducing infection risk, ensures consistent performance, and improves surgical efficiency by eliminating sterilization needs.

What are the primary advantages of disposable trocars over reusable ones?

The main advantages include superior infection control due to zero risk of cross-contamination, consistent sharp performance with each new device, reduced sterilization costs and turnaround times for healthcare facilities, and often enhanced safety features like optical visualization or bladeless designs that minimize tissue trauma. They contribute to greater patient safety and operational efficiency.

Which surgical procedures commonly utilize disposable trocars?

Disposable trocars are widely used across various minimally invasive surgical specialties. Common applications include general surgeries such as cholecystectomy (gallbladder removal), appendectomy, and hernia repair. They are also indispensable in bariatric surgery, gynecological procedures (e.g., hysterectomy), urological surgery (e.g., nephrectomy), and increasingly in cardiac and thoracic surgeries.

What factors are driving the growth of the disposable trocars market?

Key drivers include the global increase in minimally invasive surgical procedures due to patient preference for faster recovery, the rising prevalence of chronic diseases requiring surgery, an aging global population, and continuous technological advancements in trocar design that enhance safety and efficacy. Growing healthcare expenditure and improving infrastructure in emerging economies also fuel market expansion.

How does AI impact the disposable trocars market?

AI impacts the disposable trocars market by optimizing inventory and supply chain management, improving surgical planning through predictive analytics for trocar placement, and enhancing surgeon training via AI-driven simulations. AI also aids in designing safer and more efficient trocars by analyzing surgical data and supports robotic-assisted surgery, which often requires specialized AI-compatible trocars, contributing to improved safety and outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager