Disposable Washcloth Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431649 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Disposable Washcloth Market Size

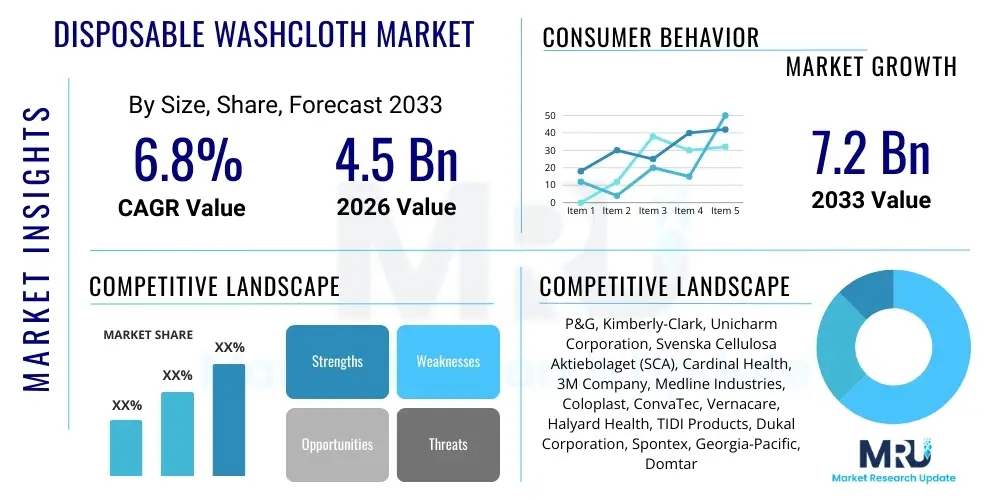

The Disposable Washcloth Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Disposable Washcloth Market introduction

The Disposable Washcloth Market encompasses a diverse range of non-woven fabric products designed for single-use cleansing and hygiene purposes across various sectors, including healthcare, personal care, and hospitality. These products are engineered for convenience, superior absorption, and reduced risk of cross-contamination compared to traditional reusable textiles. Typically constructed from materials such as spunlace non-woven fabrics, airlaid pulp, or blends of polyester and rayon, disposable washcloths offer a gentle yet effective solution for bathing, perineal care, and general skin cleaning, particularly in clinical and geriatric settings where hygiene protocols are paramount. The design focus is often on material softness, pre-moisturization (in the case of wet wipes), and biodegradability to meet evolving consumer and regulatory preferences regarding environmental impact.

The primary driving forces behind the market expansion include the rapidly aging global population, which necessitates specialized care products for incontinence and hygiene management; the rising incidence of Hospital-Acquired Infections (HAIs), compelling healthcare facilities to adopt stringent single-use protocols; and increased consumer awareness regarding personal hygiene, catalyzed by recent global health crises. Disposable washcloths are extensively used in hospitals, nursing homes, assisted living facilities, and increasingly in homes for infant care and adult care. The inherent benefits, such as convenience, ease of disposal, and guaranteed sterility (in medical-grade varieties), position them as essential components of modern hygiene practices.

Furthermore, product innovation, focusing on enhanced material texture, incorporation of skin-nourishing ingredients (like Aloe Vera or Vitamin E), and sustainable material sourcing (e.g., bamboo or plant-based fibers), continues to spur market demand. The adaptability of these products across various applications—from patient bathing and surface disinfection to baby care and household cleaning—underscores their market resilience and growth potential. Manufacturers are investing heavily in optimizing production processes, particularly in spunlace technology, to improve tensile strength and absorbency while maintaining cost efficiency, ensuring that disposable washcloths remain a cost-effective and highly functional hygiene solution.

Disposable Washcloth Market Executive Summary

The Disposable Washcloth Market is characterized by robust growth driven primarily by demographic shifts, escalating hygiene standards, and advancements in non-woven material science. Key business trends indicate a strong focus on sustainable product lines, where manufacturers are increasingly replacing synthetic materials with biodegradable and compostable alternatives to appeal to environmentally conscious consumers and comply with emerging regional waste regulations. Furthermore, strategic partnerships and mergers and acquisitions are prevalent, aimed at expanding geographic reach, securing raw material supplies, and integrating specialized manufacturing technologies, particularly in the highly competitive North American and European markets. The healthcare segment remains the largest end-user, but rapid penetration into the retail consumer segment, fueled by the convenience factor of pre-moistened wipes for travel and daily self-care, is accelerating non-medical application growth.

Regionally, North America and Europe hold substantial market share due to well-established healthcare infrastructure, high healthcare spending, and stringent regulatory frameworks mandating high levels of hygiene in institutional settings. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate during the forecast period. This rapid expansion is attributed to improving healthcare access, increasing disposable income, large population bases requiring geriatric and infant care, and rising awareness of infection prevention methods in countries like China and India. Local manufacturers in APAC are focusing on scaling up production capabilities and adapting product formulations to regional consumer preferences, particularly concerning skin sensitivity and fragrance preferences, leading to localized product differentiation and market segmentation based on economic viability and premium attributes.

Segment trends reveal that the wet/pre-moistened washcloths segment dominates the market due to their superior convenience and efficacy in cleaning without the need for additional water or soap, making them ideal for bedridden patients and quick consumer use. In terms of material, non-woven fabrics, specifically spunlace technology, maintain their lead due to optimal texture, strength, and fluid handling capabilities. The end-user analysis confirms that hospitals and nursing homes constitute the core demand driver, emphasizing products with antimicrobial properties and high tensile strength. However, the retail and household segment, driven by pandemic-induced hygiene focus and product diversification into specialized categories like makeup removal and pet cleaning, is expected to narrow the gap with the institutional sector over the forecast horizon, necessitating diverse packaging and marketing strategies.

AI Impact Analysis on Disposable Washcloth Market

User queries regarding AI's influence on the Disposable Washcloth Market typically revolve around operational efficiency, supply chain predictability, quality control, and personalized product development. Users seek to understand how AI-driven analytics can optimize production schedules and reduce waste in the complex non-woven manufacturing process, characterized by high-speed production and stringent quality checks. Key concerns focus on integrating machine learning for defect detection on fast-moving production lines to ensure product uniformity and safety, particularly for medical-grade products. Furthermore, expectations include the use of AI algorithms to forecast demand accurately based on localized disease outbreaks or demographic shifts, thereby optimizing inventory levels and mitigating supply chain disruptions for critical hygiene supplies.

- AI-driven optimization of manufacturing lines reduces material waste and energy consumption in spunlace non-woven production.

- Machine learning algorithms enhance quality control by identifying and classifying micro-defects in washcloth materials at high speeds.

- Predictive analytics forecasts demand fluctuations in healthcare and retail sectors, optimizing inventory and supply chain resilience.

- AI facilitates personalized product development by analyzing consumer feedback and demographic data to tailor washcloth formulations (e.g., pH balance, ingredient inclusion).

- Automation of warehousing and logistics using AI-powered robotics streamlines distribution channels for fast-moving consumer goods (FMCG) hygiene products.

- Implementation of Computer Vision systems for automated packaging inspection ensures compliance with sterility and labeling standards.

DRO & Impact Forces Of Disposable Washcloth Market

The Disposable Washcloth Market is heavily influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate market direction and growth velocity. The dominant drivers stem from heightened institutional hygiene mandates and favorable demographic trends, particularly the expansion of the geriatric population requiring assisted bathing and incontinence care. However, the market faces significant restraints, primarily related to environmental concerns over non-biodegradable synthetic materials, which necessitate substantial R&D investment into sustainable alternatives. Opportunities exist in emerging markets, technological breakthroughs in biodegradable polymers, and the diversification of product applications into specialized markets like veterinary care or industrial cleaning, allowing for sustained penetration and market expansion beyond traditional hospital settings.

Key drivers include the global prioritization of infection control, which has permanently altered hygiene consumption patterns, favoring single-use items in clinical settings to prevent cross-contamination, particularly in high-risk environments such as intensive care units (ICUs) and neonatal units. Moreover, the inherent convenience and portability of disposable wet wipes appeal strongly to modern consumer lifestyles, driving adoption in personal care and travel hygiene categories. Conversely, the primary restraints center on the high volume of waste generated by disposable products, leading to regulatory pressure and consumer backlash against plastic-based non-wovens, potentially increasing the cost of goods as manufacturers transition to more expensive, certified compostable materials like cellulose or bamboo fiber blends. Addressing these environmental concerns is paramount for long-term market acceptance and regulatory compliance.

The strategic opportunities lie in the commercialization of certified bio-based and flushable washcloths, tapping into the premium sustainability segment and facilitating easier disposal in home-care settings. Furthermore, market participants can capitalize on technological advancements in smart packaging that communicates product expiry or usage instructions. The impact forces show that while cost pressures remain a constant factor, driven by volatile raw material prices for petroleum-based components, the imperative for improved hygiene and the pursuit of sustainability are powerful, overriding forces. Success will depend on the capacity of manufacturers to innovate material science while simultaneously achieving economies of scale in sustainable production methods, balancing environmental stewardship with profitability in a highly regulated global hygiene landscape.

Segmentation Analysis

The Disposable Washcloth Market is strategically segmented based on factors such as product type, material, end-user, distribution channel, and geography, enabling manufacturers to tailor offerings to specific consumer and institutional needs. Understanding these segmentations is critical for market penetration and strategic resource allocation. Product segmentation primarily differentiates between dry and wet (pre-moistened) washcloths, where wet washcloths dominate due to their ready-to-use convenience and integrated cleaning solutions. Material analysis focuses on the non-woven fabric used, with spunlace being the industry standard for strength and softness, though airlaid and carded non-wovens also hold specialized positions in the market depending on required absorbency and cost parameters.

End-user segmentation clearly distinguishes between institutional settings (hospitals, nursing homes, clinics) and the retail/household sector. The institutional segment demands medical-grade, often antimicrobial products with stringent quality controls, whereas the retail segment focuses more on aesthetic appeal, fragrance, and convenience packaging for daily use, baby care, and travel. Distribution channels are equally split between direct institutional sales (tenders, large volume contracts) and retail sales via pharmacies, supermarkets, and increasingly, e-commerce platforms, which offer vast geographical reach and direct-to-consumer capabilities, especially for niche or specialized care products.

- By Product Type:

- Dry Disposable Washcloths (Used with water or cleaning agents)

- Wet Disposable Washcloths (Pre-moistened, Ready-to-use)

- Specialized Medicated Washcloths (e.g., CHG impregnated wipes)

- By Material:

- Spunlace Non-woven

- Airlaid Pulp

- Carded Non-woven

- Blends (Polyester, Rayon, Polypropylene)

- Natural/Sustainable Fibers (Bamboo, Cotton, Viscose)

- By End-User:

- Hospitals and Clinics

- Nursing Homes and Long-Term Care Facilities (LTCF)

- Assisted Living Facilities

- Home Care Settings

- Retail/Household Consumers (Baby Care, Personal Hygiene)

- By Distribution Channel:

- Institutional Sales (Direct Procurement, Distributors)

- Retail Sales (Supermarkets, Hypermarkets, Pharmacies)

- E-commerce

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Disposable Washcloth Market

The value chain for the Disposable Washcloth Market begins with upstream activities focused on raw material sourcing and conversion, primarily involving petrochemical derivatives for synthetic fibers (polypropylene, polyester) and forestry products for natural fibers (pulp, cellulose, rayon). Key challenges in the upstream sector include volatile commodity pricing and the increasing demand for certified sustainable raw materials, putting pressure on suppliers to demonstrate ethical sourcing and environmentally friendly conversion processes. Major chemical and fiber producers form the bedrock of this stage, providing the non-woven materials (like hydroentangled spunlace) that define the final product's texture and performance attributes. Efficiency in this stage dictates the overall cost structure and the sustainability profile of the final washcloth product.

The midstream involves the core manufacturing process, where raw non-woven fabric rolls are treated, cut, folded, impregnated with cleaning solutions (for wet wipes), and packaged. This stage is highly capital-intensive, relying on sophisticated high-speed machinery for spinning, treating, and converting materials while maintaining cleanroom standards, especially for medical applications. Companies specialize in formulations for wet wipes, balancing factors like pH, preservative efficacy, and skin compatibility. Quality control is paramount here, focusing on microbial safety and material integrity. The downstream activities involve distribution and sales, which are bifurcated into institutional and retail channels, utilizing specialized distributors who manage logistics for bulk institutional contracts (hospitals) and consumer packaged goods logistics for retail outlets and e-commerce fulfillment centers. Direct sales are common in the institutional segment for customized bulk orders.

Distribution channels are critical determinants of market reach and profitability. Direct sales to major healthcare systems ensure streamlined inventory management and stronger contractual relationships, often bypassing intermediate distribution margins for high-volume orders. However, reliance on indirect distribution (wholesalers, healthcare distributors, retail chains) provides necessary geographical market penetration, especially in fragmented consumer markets. E-commerce platforms are increasingly transforming the downstream, offering manufacturers a direct link to the end-user, facilitating customized bundling, and enabling detailed collection of consumer purchase data, which in turn feeds back into product development cycles for agile market response, enhancing the overall responsiveness and efficiency of the value chain.

Disposable Washcloth Market Potential Customers

Potential customers for disposable washcloths span a broad spectrum, ranging from large-scale institutional buyers to individual consumers seeking convenient hygiene solutions. The primary end-users, which represent the largest procurement volume, are institutional entities such as public and private hospitals, specialized surgical centers, and long-term care facilities, including nursing homes and rehabilitation centers. These organizations prioritize clinical efficacy, cross-contamination prevention capabilities (e.g., single-patient packs), and adherence to strict budgetary guidelines, often procuring products through complex tender processes or group purchasing organizations (GPOs). The specific need here is often for high-quality, durable washcloths, sometimes impregnated with disinfectants like Chlorhexidine Gluconate (CHG), suitable for pre-operative cleansing and patient bathing protocols.

The secondary, yet rapidly growing, customer segment is the home care market, encompassing individuals managing chronic illnesses, elderly populations receiving in-home care, and families utilizing washcloths for infant and child hygiene. These consumers value convenience, skin gentleness, and ease of disposal, with purchasing decisions often influenced by recommendations from healthcare providers or caregivers. The demand here is highly sensitive to product attributes like hypoallergenic properties, fragrance, and environmentally friendly packaging. Retail outlets and e-commerce platforms serve as the main purchasing points for this consumer base, which is characterized by repeat purchases driven by the necessity of ongoing care, making brand loyalty and accessibility crucial factors for market success.

Beyond traditional patient care, specialized industrial sectors and travel industries also represent significant potential customers. For instance, cleaning companies and manufacturing facilities utilize heavy-duty disposable wipes for equipment maintenance and surface sanitization, demanding high chemical resistance and durability. Furthermore, the travel and hospitality sectors, including airlines, hotels, and cruise lines, procure high volumes of individually packaged washcloths for guest comfort and sanitation, particularly after increased post-pandemic hygiene awareness. Manufacturers targeting these diverse end-users must tailor their offerings—whether through specialized chemical impregnation, material strength variations, or bulk versus individual packaging—to meet the distinct functional and volume requirements of each customer group effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | P&G, Kimberly-Clark, Unicharm Corporation, Svenska Cellulosa Aktiebolaget (SCA), Cardinal Health, 3M Company, Medline Industries, Coloplast, ConvaTec, Vernacare, Halyard Health, TIDI Products, Dukal Corporation, Spontex, Georgia-Pacific, Domtar Corporation, First Quality Enterprises, Rockline Industries, Meridian Industries, Dürasol GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Disposable Washcloth Market Key Technology Landscape

The Disposable Washcloth Market is heavily reliant on advanced non-woven manufacturing processes, with hydroentangling (spunlace) technology dominating the production of high-quality, durable, and soft washcloths. Spunlace technology uses high-pressure water jets to entangle fibers, creating a fabric structure without the use of chemical binders, resulting in superior textile-like feel, excellent absorption, and high wet and dry strength, which are essential attributes for clinical and personal cleansing applications. Recent technological advancements in spunlace focus on optimizing fiber blending ratios, integrating natural fibers like wood pulp and bamboo, and refining the hydroentangling process to reduce energy consumption and improve material integrity, allowing for thinner yet stronger washcloths, thus minimizing material usage and disposal volume.

Another critical technological area is the chemical formulation and impregnation systems for wet washcloths. Manufacturers utilize sophisticated compounding and saturation machinery to ensure uniform distribution of cleansing agents, moisturizers, and antimicrobial components (such as parabens, phenoxyethanol, or alternative preservative systems) while maintaining microbial safety. Key innovation in this space involves developing mild, pH-neutral, and hypoallergenic formulations suitable for sensitive skin (e.g., geriatric and neonatal care), often leveraging proprietary emulsion technologies to stabilize ingredients and prolong shelf life without compromising skin integrity. Advanced packaging technology, including multi-layer films and resealable dispensers, is also crucial to prevent moisture loss and maintain the sterility of wet wipe products over extended periods.

Finally, the growing environmental imperative drives technological investment into sustainable material science and end-of-life solutions. This includes the development and scaling of technologies for manufacturing flushable and compostable non-wovens, which often involves using specialized short-cut cellulose fibers or bio-based polymers (like polylactic acid or PLA) that rapidly disperse in water or degrade in composting environments. Testing and certification technologies, such as those adhering to INDA/EDANA flushability guidelines, are vital for ensuring product claims and securing consumer trust. The successful commercialization of these environmentally friendly technologies is contingent upon reducing production costs to achieve parity with traditional synthetic materials, which represents a significant ongoing challenge for R&D departments across the industry.

Regional Highlights

- North America: North America, particularly the United States, represents a mature and dominant market for disposable washcloths, driven by high healthcare spending, a well-established infrastructure of long-term care facilities, and strict regulatory adherence to infection control protocols. The region sees high adoption of premium and specialized products, including pre-impregnated CHG washcloths for patient pre-operative preparation. Market growth is sustained by the increasing prevalence of chronic diseases and a demographic shift toward an aging population requiring extensive care. Consumers here exhibit strong demand for convenience and are increasingly willing to pay a premium for certified sustainable and dermatologically tested products, stimulating innovation in eco-friendly material usage.

- Europe: Europe is a highly competitive market characterized by diverse national regulatory landscapes and a strong emphasis on sustainability, particularly in Western European countries like Germany and the UK. High institutional demand, similar to North America, is complemented by significant consumer interest in baby care and personal hygiene wet wipes. The European Union’s policies on plastic waste and single-use plastics are profoundly shaping market trajectory, compelling manufacturers to rapidly transition toward biodegradable, certified compostable, and plastic-free materials. Scandinavian countries often lead in adopting innovative, resource-efficient non-woven manufacturing techniques, setting a benchmark for environmental performance.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by demographic factors, including massive populations in China and India, rapidly increasing disposable income, and the expansion and modernization of healthcare facilities. The market is highly price-sensitive but shows increasing segmentation, with urban centers driving demand for premium, imported, or locally manufactured high-quality wet wipes (for baby and adult care), while institutional growth is driven by government initiatives to improve sanitation and reduce infectious diseases. Local players dominate the low-to-mid-range segment, focusing on high-volume, cost-effective production, while multinational corporations target the premium and medical-grade segments.

- Latin America (LATAM): The LATAM market exhibits moderate but steady growth, largely driven by improving access to healthcare and an increasing elderly population in countries like Brazil and Mexico. Economic volatility and varying regulatory standards across the region pose challenges, yet the consumer market for hygiene products remains robust. There is strong demand for cost-effective, multi-purpose disposable washcloths, especially in the home care and infant care categories. Infrastructure investment in healthcare systems is gradually boosting institutional procurement volumes, although the distribution logistics remain complex due to diverse geographical and infrastructural conditions.

- Middle East and Africa (MEA): The MEA region is emerging, with growth concentrated in the Gulf Cooperation Council (GCC) countries, supported by high healthcare expenditure and modernization projects. Demand in this region is influenced by cultural preferences, high birth rates driving infant care demand, and increasing health tourism requiring high hygiene standards in clinics and hospitals. The reliance on imports for advanced non-woven materials and finished products, particularly for medical applications, dictates market dynamics, although local manufacturing capacity is slowly developing to address regional cost structures and specific climatic requirements (e.g., product stability in high heat).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Disposable Washcloth Market.- The Procter & Gamble Company (P&G)

- Kimberly-Clark Corporation

- Unicharm Corporation

- Svenska Cellulosa Aktiebolaget (SCA)

- Cardinal Health, Inc.

- 3M Company

- Medline Industries, LP

- Coloplast A/S

- ConvaTec Group PLC

- Vernacare (a part of J&J)

- Halyard Health (now part of Owens & Minor)

- TIDI Products LLC

- Dukal Corporation

- Spontex (a part of Newell Brands)

- Georgia-Pacific LLC

- Domtar Corporation

- First Quality Enterprises, Inc.

- Rockline Industries

- Meridian Industries, Inc.

- Dürasol GmbH

Frequently Asked Questions

Analyze common user questions about the Disposable Washcloth market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Disposable Washcloth Market?

Market growth is primarily driven by the globally increasing geriatric population, the rising focus on preventing Hospital-Acquired Infections (HAIs) through single-use hygiene protocols, and the enhanced consumer preference for convenient, ready-to-use hygiene products in both clinical and home care settings.

Which segment holds the largest share in the Disposable Washcloth Market?

The wet or pre-moistened disposable washcloth segment holds the largest market share due to its superior convenience, integration of cleansing agents, and widespread application in patient bedside bathing, incontinence care, and general consumer hygiene without requiring additional water.

What are the key materials used in manufacturing disposable washcloths?

The primary materials are non-woven fabrics, predominantly spunlace (hydroentangled) blends of synthetic fibers (polyester, polypropylene) and natural fibers (rayon, wood pulp, cellulose). There is a rapid shift towards sustainable materials like bamboo and plant-based biopolymers.

What are the main environmental concerns associated with the market?

The main environmental concern is the waste volume generated by disposable products, particularly those made from non-biodegradable synthetic plastics. This concern is prompting manufacturers to invest heavily in developing certified flushable, compostable, and plastic-free alternatives to meet regulatory demands and consumer expectations.

How is technological advancement influencing disposable washcloth production?

Technology is driving innovation in spunlace manufacturing for enhanced material performance and energy efficiency, advanced chemical formulation for skin-safe wet wipes, and the development of new bio-based materials to improve biodegradability and flushability characteristics of the product lines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager