Distillation Package Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438117 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Distillation Package Market Size

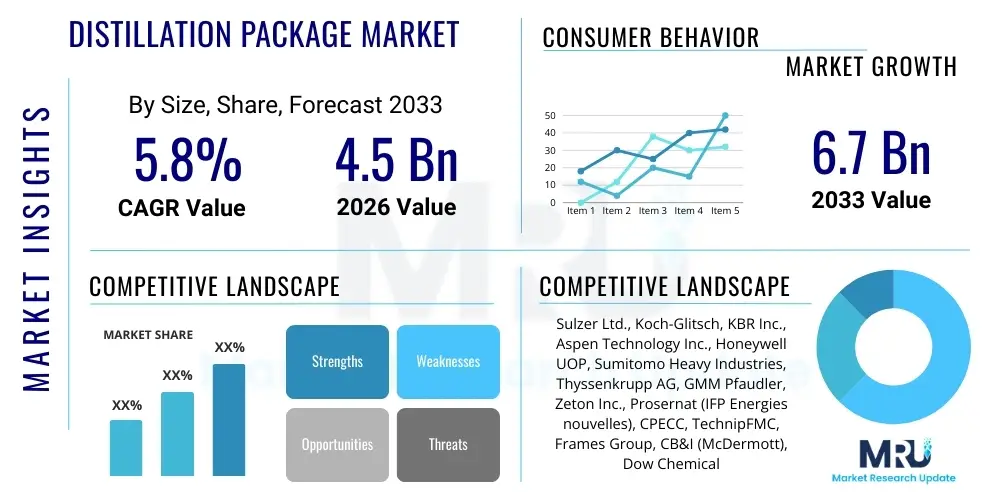

The Distillation Package Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Distillation Package Market introduction

The Distillation Package Market encompasses integrated systems and modular units designed for separating liquid mixtures based on volatility differences. These packages typically include distillation columns, internal components (trays or packing), reboilers, condensers, reflux drums, and sophisticated control systems. This technology is foundational to the chemical process industries, including petrochemicals, oil refining, natural gas processing, pharmaceuticals, and specialized fine chemicals manufacturing, offering unparalleled purity and separation efficiency crucial for high-value product streams.

The core function of a distillation package is to achieve precise separation under optimized thermodynamic conditions, delivering output streams that meet stringent industry specifications. Major applications span crude oil fractionation, solvent recovery in pharmaceutical synthesis, bio-fuel production, and the purification of industrial gases. Key benefits derived from utilizing these engineered packages include enhanced operational flexibility, reduced energy consumption through advanced heat integration, and quicker deployment times compared to stick-built constructions, particularly relevant for modular and decentralized processing facilities.

The market is primarily driven by escalating global demand for refined petroleum products, the expansion of petrochemical infrastructure, and the persistent need for sustainable and efficient separation technologies in emerging sectors like recycling and bio-based chemicals. Furthermore, stringent environmental regulations necessitating higher purity standards for chemical effluents and renewed investment in capacity upgrades across North America and Asia Pacific are compelling factors stimulating market growth and technological refinement.

Distillation Package Market Executive Summary

The global Distillation Package Market is characterized by a strong emphasis on modularization and digitalization, driven by the need for reduced capital expenditure (CAPEX) and accelerated project timelines, especially in remote or challenging construction environments. Business trends indicate a shift towards incorporating advanced process intensification techniques, such as dividing wall columns (DWC) and reactive distillation, aimed at significantly improving separation efficiency while lowering energy costs. Service contracts for maintenance, optimization, and digital twin implementation are increasingly becoming vital revenue streams for key market players, moving beyond mere equipment sales to holistic lifecycle solutions.

Regionally, the Asia Pacific continues to dominate the market growth trajectory, fueled by massive capacity expansions in China, India, and Southeast Asia to meet rapidly growing domestic and export demands for petrochemicals and refined fuels. North America and Europe, while mature, demonstrate steady investment driven by regulatory compliance, modernization of aging infrastructure, and a focused transition towards sustainable chemical production, including carbon capture and specialized separations for green hydrogen infrastructure. The Middle East remains a critical hub due to large-scale oil and gas processing projects, demanding robust and high-capacity distillation solutions.

Segment trends highlight the critical role of the oil and gas sector, which accounts for the largest share by application, demanding high-throughput, high-pressure fractionators. However, the fastest growth is observed in the pharmaceuticals and specialty chemicals segment, where precision and compliance drive demand for smaller, high-purity batch distillation units and specialized solvent recovery systems. Technology-wise, the trend favors structured packing over traditional trays in many new installations, owing to superior efficiency, lower pressure drop, and higher throughput capabilities, providing significant operational advantages to end-users.

AI Impact Analysis on Distillation Package Market

User queries regarding AI’s influence on the Distillation Package Market frequently center on predictive maintenance, real-time process optimization, and the efficiency gains derived from integrating machine learning into existing control systems. Users are keenly interested in how AI can minimize energy consumption, traditionally a major operational expenditure in distillation, by anticipating process fluctuations and adjusting parameters dynamically. Concerns also revolve around data security, the complexity of retrofitting older units with necessary sensors and data infrastructure, and the reliability of AI models in handling complex, non-ideal fluid behavior or sudden operational disturbances like feedstock variability. The general expectation is that AI will transform distillation from a steady-state operation to a highly dynamic, self-optimizing system.

AI’s primary impact is enhancing the efficiency and reliability of distillation operations, which are inherently complex due to non-linear dynamics and energy intensity. Advanced machine learning algorithms can analyze vast datasets concerning temperature, pressure, flow rates, and feed compositions to create predictive models. These models allow operators to anticipate fouling, mechanical failures in peripheral equipment (like pumps or reboilers), and efficiency degradation well before they occur, thus scheduling maintenance proactively rather than reactively. This capability drastically reduces unplanned downtime and extends the operational lifespan of the entire distillation package.

Furthermore, AI-driven process control systems are being deployed to optimize product purity and throughput simultaneously. Traditional control loops rely on PID controllers, which are often slow to respond to rapid changes. AI introduces model predictive control (MPC) capabilities that can navigate complex operational constraints, such as maximizing product yield while adhering to utility limits (steam or cooling water) and ensuring quality specifications. This layer of intelligence ensures the distillation column operates at its maximum thermodynamic efficiency point, leading to verifiable reductions in energy use and raw material wastage, cementing AI as a pivotal technology for operational sustainability.

- AI enables predictive maintenance, minimizing unplanned column shutdowns and maximizing asset uptime.

- Machine learning models optimize energy consumption by dynamically adjusting reflux ratios and reboiler duty based on real-time feedstock analysis.

- Digital twin technology, powered by AI, facilitates scenario testing and operator training for complex distillation sequences.

- Real-time anomaly detection identifies minor process deviations that could lead to off-spec products, ensuring consistent quality control.

- AI assists in optimizing component design and sizing during the engineering phase by simulating millions of operating conditions.

DRO & Impact Forces Of Distillation Package Market

The dynamics of the Distillation Package Market are governed by a complex interplay of demand-side drivers stemming from industrial growth, technological imperatives favoring efficiency, resource constraints imposing restraints, and emerging opportunities in sustainability and process intensification. Driving forces include sustained urbanization, robust expansion in global refining and petrochemical capacity, particularly in emerging economies, and the necessity to replace or upgrade aging distillation infrastructure globally. Restraints primarily involve the high initial capital investment required for these large-scale engineered systems, stringent regulatory hurdles associated with chemical processing, and volatility in raw material and energy prices, which affects project viability and operational costs.

Opportunities are largely concentrated in the development and adoption of innovative separation technologies. This includes utilizing dividing wall columns (DWC) which can perform the separation equivalent of two or three conventional columns in a single shell, significantly reducing CAPEX and OPEX. Furthermore, the growing bio-based and circular economy necessitates specialized distillation packages for handling complex mixtures derived from biomass, plastics recycling, and fermentation processes, demanding novel design criteria and material science applications. The push for modularization also presents an opportunity, allowing vendors to offer standardized, pre-fabricated units that dramatically shorten construction timelines and reduce on-site risks.

Impact forces are currently dominated by global energy transition efforts. While the traditional oil and gas sector remains a dominant consumer, the accelerating shift toward renewable fuels, sustainable aviation fuels (SAF), and petrochemical feedstocks derived from non-fossil sources is rapidly reshaping demand patterns. Environmental regulations pushing for zero-liquid discharge and reduced greenhouse gas emissions act as powerful drivers for adopting highly efficient distillation technologies (Impact Force: Regulatory Compliance and Sustainability), forcing end-users to invest in modern, energy-saving packages (Driver: Efficiency Upgrade Mandate). Conversely, geopolitical instability and subsequent supply chain disruptions pose a significant risk, delaying large-scale projects and impacting the timely delivery of specialized components (Restraint: Supply Chain Volatility).

Segmentation Analysis

The Distillation Package Market is intricately segmented across various dimensions, including component type, operational type, application, and process technology, reflecting the diverse requirements of the chemical and process industries. The segmentation provides a comprehensive view of market penetration, identifying high-growth niches such as the specialized chemical sector requiring high-purity batch distillation. Understanding these segments is crucial for strategic planning, enabling vendors to tailor offerings, whether focusing on high-volume continuous units for refining or highly precise, flexible units for pharmaceuticals.

- By Component: Column Shells, Column Internals (Trays, Packing), Reboilers, Condensers, Reflux Drums, Control Systems.

- By Operational Type: Batch Distillation, Continuous Distillation.

- By Technology: Conventional Distillation, Vacuum Distillation, Azeotropic Distillation, Extractive Distillation, Reactive Distillation, Dividing Wall Columns (DWC).

- By Application: Oil & Gas Refining, Petrochemicals, Pharmaceuticals, Chemicals & Solvents, Food & Beverages, Environmental & Recycling.

- By Capacity: Small-Scale (Under 10 TPH), Medium-Scale (10-100 TPH), Large-Scale (Above 100 TPH).

- By Geography: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Value Chain Analysis For Distillation Package Market

The value chain for Distillation Packages is highly complex, beginning with upstream activities focused on the procurement of specialized materials and fabrication expertise. Upstream analysis involves sourcing high-grade steel alloys (like stainless steel or specialized duplex steels) required for column shells and heat exchangers, managing the supply of proprietary internals (trays, packing materials) from specialized manufacturers, and securing sophisticated instrumentation and control elements. Critical success factors in the upstream stage include managing material cost volatility, ensuring quality control of fabrication processes, and maintaining robust supplier relationships to mitigate supply chain delays for customized, long-lead items.

The core of the value chain involves the detailed engineering design, process simulation, package fabrication, and systems integration, often managed by large EPC (Engineering, Procurement, and Construction) firms or specialized technology providers. The midstream phase involves utilizing advanced modeling software to optimize column geometry and internal component selection to meet demanding separation specifications. Distribution channels for distillation packages are predominantly direct, involving highly technical sales teams interfacing directly with end-users (refineries, chemical plants) or indirectly through large EPC contractors who manage the entire plant construction project.

Downstream analysis focuses on installation, commissioning, operation, and maintenance. Due to the high criticality of distillation units, maintenance services, operational optimization consulting, and supply of replacement components (especially internals) represent significant revenue streams post-installation. Direct channels dominate the interaction between technology licensors and the final operator, especially for troubleshooting and process optimization. Indirect channels may involve local service providers contracted by the end-user for routine physical maintenance, but highly specialized technical support is almost exclusively provided by the original equipment manufacturer (OEM) or technology licensor throughout the lifecycle of the plant.

Distillation Package Market Potential Customers

Potential customers for Distillation Packages are primarily large industrial entities operating continuous chemical processes that require high-purity separation of liquids. The primary end-users fall into sectors characterized by substantial capital investment and high operational throughput, making the efficiency and reliability of the distillation unit critical to their profitability. These buyers frequently require bespoke engineering solutions tailored to specific feedstocks and product purity targets, often involving complex thermodynamic modeling and stringent regulatory compliance related to hazardous material handling and environmental emissions.

Major buyers include national and international oil companies (NOCs and IOCs) investing in new refineries or upgrading existing crude distillation units (CDUs) and vacuum distillation units (VDUs) to process heavier or more unconventional crude oils. Furthermore, global petrochemical giants consistently invest in distillation packages for the separation of basic chemicals like ethylene, propylene, and benzene, xylene, and toluene (BTX). These customers prioritize reliability, operational longevity, and the ability of the package to integrate seamlessly with sophisticated plant-wide automation systems, often demanding high-capacity, robust solutions.

A rapidly growing segment of potential customers includes specialty chemical manufacturers, pharmaceutical companies, and emerging bio-refineries. These buyers are characterized by their need for smaller, highly flexible, and often batch-operated units capable of achieving extreme purity levels (e.g., solvent recovery or chiral separation). For these customers, factors like product containment, cleanability, validation support, and material compatibility (e.g., hastelloy or other corrosion-resistant materials) are paramount, contrasting with the high-volume focus of the oil and gas sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sulzer Ltd., Koch-Glitsch, KBR Inc., Aspen Technology Inc., Honeywell UOP, Sumitomo Heavy Industries, Thyssenkrupp AG, GMM Pfaudler, Zeton Inc., Prosernat (IFP Energies nouvelles), CPECC, TechnipFMC, Frames Group, CB&I (McDermott), Dow Chemical (Licensing) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Distillation Package Market Key Technology Landscape

The technology landscape of the Distillation Package Market is undergoing continuous evolution, driven primarily by the imperatives of energy efficiency and enhanced separation performance. Traditional distillation relies on bubble cap trays or sieve trays, which are robust but offer limited efficiency. Modern packages increasingly incorporate high-performance internals, specifically structured packing, which provides a significantly higher surface area per unit volume, leading to lower pressure drops and greater separation efficiency (HETP - Height Equivalent to a Theoretical Plate) compared to older tray technologies. This transition is essential for cost-intensive processes and vacuum applications where minimizing pressure loss is critical.

Process Intensification (PI) technologies represent a major technological leap. Dividing Wall Columns (DWC) are central to this movement, combining the functions of multiple columns into a single shell by incorporating a vertical partition wall. This integration leads to substantial energy savings (often 20-40%), reduced capital costs due to fewer major equipment pieces, and smaller plot footprints. Reactive distillation, another PI technology, integrates the chemical reaction and separation steps within the column itself, particularly effective for equilibrium-limited reactions, thereby improving conversion and reducing downstream separation requirements.

Beyond physical design, digitalization and simulation are key technological pillars. Advanced Process Control (APC) systems, often using sophisticated Model Predictive Control (MPC) algorithms, are standard features in high-end packages, optimizing operations in real-time. Furthermore, the development of specialized materials, such as high-performance ceramics or specialized polymers for packing in corrosive environments, expands the applicability of distillation across diverse chemical streams. Ongoing research also focuses on hybrid separation methods, coupling distillation with membrane technology or crystallization to achieve ultra-high purity specifications with minimized energy input.

Regional Highlights

The regional analysis reveals distinct market maturity and growth drivers across major global zones, reflecting varying industrial strategies, regulatory environments, and feedstock availability. Asia Pacific currently holds the largest market share and exhibits the highest growth rate, primarily driven by massive capital investments in greenfield refinery projects and petrochemical complexes in China, India, and Southeast Asian nations. This regional expansion is motivated by increasing domestic consumer demand for polymers, fuels, and derivatives, alongside strong governmental support for industrialization. The need for modern, large-scale continuous distillation packages to handle high throughput is paramount in this region.

North America and Europe constitute highly mature markets, but investment is sustained through modernization, efficiency upgrades, and the strategic pivot toward specialized applications. In North America, the focus is on utilizing distillation packages for the shale gas boom (NGL fractionation) and upgrading existing facilities to comply with tighter environmental standards. European growth is driven by the shift towards bio-based chemicals, solvent recycling, and specialized processes in the fine chemicals and pharmaceutical sectors, demanding smaller, high-precision batch units and technology focused on energy transition requirements.

The Middle East and Africa (MEA) region remains vital, driven by large-scale capital projects aimed at maximizing the value chain of crude oil, transitioning from pure extraction to integrated refining and petrochemical production. Countries like Saudi Arabia and the UAE are investing heavily in world-scale complexes that require extremely large, high-capacity distillation units. Latin America, particularly Brazil and Mexico, demonstrates growth spurred by biofuel production (ethanol distillation) and regional refining capacity expansions, although market stability is often subject to local economic and political cycles.

- Asia Pacific (APAC): Dominates in terms of new capacity installation; growth fueled by petrochemical and refining mega-projects in China and India.

- North America: Focus on modernization, NGL fractionation, and integration of AI/digital technologies for efficiency gains in mature assets.

- Europe: Driven by specialized chemical production, stringent environmental compliance, and investment in sustainable and bio-based separation technologies.

- Middle East & Africa (MEA): Large-scale infrastructure investments centered on integration of refining with high-value petrochemical complex distillation.

- Latin America: Growth tied to regional energy security, particularly ethanol and petroleum product fractionation upgrades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distillation Package Market.- Sulzer Ltd.

- Koch-Glitsch

- KBR Inc.

- Honeywell UOP

- Aspen Technology Inc.

- Sumitomo Heavy Industries

- Thyssenkrupp AG

- GMM Pfaudler

- Zeton Inc.

- Prosernat (IFP Energies nouvelles)

- CPECC (China Petroleum Engineering & Construction Corp)

- TechnipFMC

- Frames Group

- CB&I (McDermott)

- Linde Engineering

- Axens SA

- Johnson Matthey

- Mitsubishi Kakoki Kaisha, Ltd.

- Doosan Heavy Industries & Construction

- Toyo Engineering Corporation

Frequently Asked Questions

Analyze common user questions about the Distillation Package market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of high-efficiency distillation technologies?

The primary driver is the critical need for energy consumption reduction, as distillation accounts for 40% to 60% of total energy use in typical chemical plants. High-efficiency technologies like structured packing and dividing wall columns (DWC) minimize steam consumption and operational expenditure (OPEX), directly impacting profitability.

How does modularization impact the Distillation Package Market?

Modularization significantly reduces field construction time and risk, particularly for projects in remote or logistically complex locations. It accelerates time-to-market, reduces capital expenditure (CAPEX) due to factory-controlled fabrication, and is driving uptake in small to medium-scale specialty chemical and decentralized natural gas processing plants.

Which application segment holds the largest share in the Distillation Package Market?

The Oil and Gas Refining application segment holds the largest market share. Crude oil fractionation and subsequent refining processes require massive continuous distillation columns to separate various fuel products, forming the bedrock of the market demand.

What are Dividing Wall Columns (DWC), and why are they considered disruptive technology?

DWCs are single distillation columns divided by a vertical partition, allowing simultaneous separation of a ternary mixture previously requiring two separate columns. They are disruptive because they offer substantial capital savings, up to 40% reduction in energy usage, and simplified control compared to conventional sequences.

How is digitalization utilized in modern Distillation Packages?

Digitalization includes integrating advanced sensors, implementing Model Predictive Control (MPC) systems for real-time optimization, and creating digital twins. This allows for predictive maintenance, proactive adjustments to maximize yield, and simulation of process changes without interrupting plant operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager