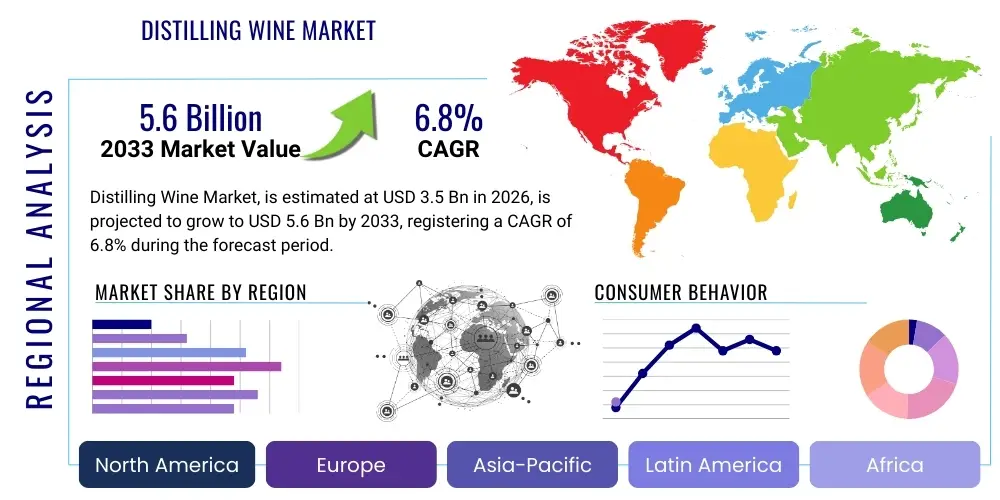

Distilling Wine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434612 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Distilling Wine Market Size

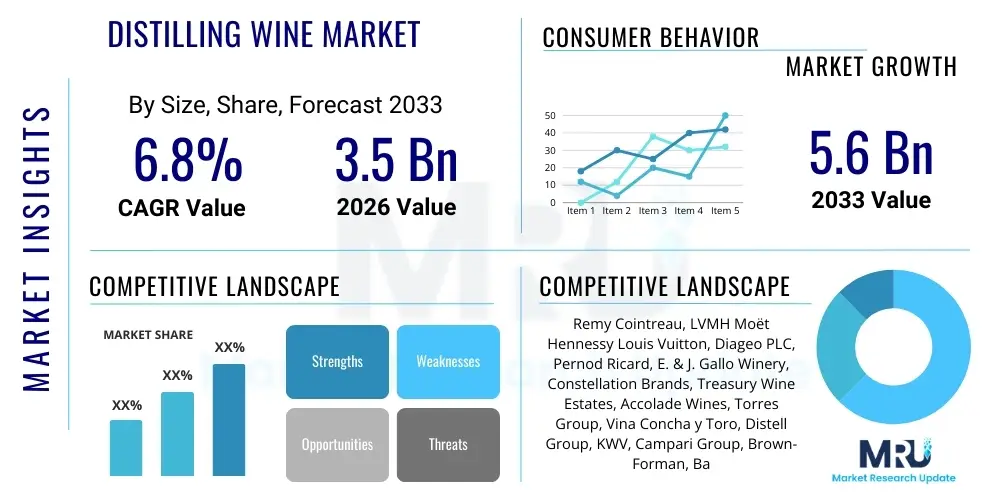

The Distilling Wine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Distilling Wine Market introduction

Distilling wine, often referred to as distillation wine or industrial wine, serves as the primary alcoholic base material for producing various high-proof spirits, most notably brandy (such as Cognac and Armagnac), fortified wines (like Sherry and Port), and specific types of industrial ethanol used in beverages. This wine is typically produced using specific grape varietals chosen for their neutral flavor profiles, high acidity, and relatively low natural sugar content, which facilitates efficient and high-quality distillation. Unlike table wine, distilling wine is rarely intended for direct consumption and is optimized solely for its transformation into a concentrate of alcohol and flavor congeners through heating and condensation processes, making it a critical intermediary product within the global spirits manufacturing value chain.

Major applications of distilling wine revolve around the high-volume production of premium spirits, driving significant demand in regions known for robust brandy and fortified wine heritage, such as France, Spain, and Portugal. The product description emphasizes its role as a high-volume, low-cost alcohol vector, distinct from quality table wines. The core benefits derived from utilizing specialized distilling wine include consistent quality control in spirit production, optimization of distillation yields, and the ability to maintain the traditional character of geographical indication (GI) spirits. Moreover, the efficiency in producing a high-purity alcoholic base makes it invaluable for the food and beverage industry.

Driving factors propelling the Distilling Wine Market include the sustained global demand for premium aged spirits, particularly high-end Cognac and similar brandies, which necessitate large volumes of high-quality distilling wine. Furthermore, the growth of the ready-to-drink (RTD) cocktail market and flavored spirit categories increasingly relies on neutral or semi-neutral spirit bases derived from distilled wine. Regulatory environments that favor the use of specific agricultural origins for spirit production also bolster this market, ensuring a continuous, dedicated supply chain for grape-derived spirits, pushing technological advancements in fermentation and initial processing.

Distilling Wine Market Executive Summary

The Distilling Wine Market is characterized by robust growth anchored in the resurgence of premium spirits consumption and strategic expansions by major global beverage conglomerates. Business trends indicate a shift towards sustainable grape cultivation and precision fermentation techniques to enhance the quality and yield of distilling wine, often driven by consumer demand for transparency in ingredient sourcing. Key manufacturers are investing heavily in vertical integration, controlling vineyards specifically dedicated to industrial wine production to secure stable, consistent supply chains, minimizing volatility in raw material costs, which is a major concern given climate change impacts on grape harvests.

Regionally, Europe, particularly the established brandy-producing nations of France (for Cognac) and Spain, maintains market dominance, acting as the largest consumer and producer hub due to strong historical appellation rules requiring grape-based distillation. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market segment. This rapid expansion is fueled by increasing disposable incomes, westernization of consumer preferences in countries like China and India, and a burgeoning demand for imported premium spirits, creating immense opportunities for exporting regions. North America also shows strong growth, largely driven by the craft spirits movement which increasingly utilizes specialized grape-based alcohol.

Segment trends highlight the dominance of white distilling wine due to its widespread application in high-volume, neutral spirit bases, offering versatility for various finished products. Application-wise, brandy production remains the primary revenue generator, although the segments related to fortified wine and industrial alcohol for food applications are exhibiting steady, incremental growth. The market is also seeing greater adoption of bulk shipping and long-term supply contracts between grape growers and distillers, stabilizing prices and ensuring continuity in large-scale manufacturing operations globally.

AI Impact Analysis on Distilling Wine Market

Common user questions regarding AI's influence on the Distilling Wine Market focus primarily on optimizing vineyard management, enhancing fermentation predictability, and ensuring batch consistency during the initial wine-making process specifically for distillation purposes. Users are keenly interested in how AI can mitigate climate variability risk, a critical factor for grape quality. The central themes emerging from these inquiries revolve around achieving 'precision viticulture' using machine learning algorithms to predict optimal harvest times based on acidity and sugar levels relevant for distillation, rather than consumption. Furthermore, there is significant expectation regarding AI's role in analyzing complex volatile compound profiles post-fermentation, ensuring the resulting wine possesses the ideal characteristics required for high-quality aging in spirits production, thereby maximizing the efficiency and yield of the distillation column.

AI adoption is poised to revolutionize the upstream supply chain of distilling wine by implementing sophisticated data analytics across the entire grape journey. In the vineyard, satellite imagery, drone surveillance, and IoT sensors feed data into machine learning models, allowing producers to optimize irrigation, fertilization, and pest control precisely, minimizing resource waste and maximizing grape health tailored for distillation requirements. These systems predict yield variations with high accuracy, enabling distillers to better manage inventory and contractual obligations.

In the cellar, AI and predictive modeling are used to monitor fermentation dynamics, controlling temperature and yeast activity to prevent off-flavors that could compromise the quality of the final distilled spirit. By using advanced analytics on spectral data, producers can rapidly identify and isolate batches that are suboptimal for premium brandy production, diverting them to industrial applications, thus maintaining the integrity and consistency of high-value products. This technological integration ensures that the raw material (distilling wine) consistently meets rigorous specifications required by premium spirits manufacturers, enhancing profitability and reducing operational downtime associated with inconsistent feedstock quality.

- AI-Driven Precision Viticulture: Optimizing grape yield and quality metrics (acidity, volatile compounds) specifically for distillation, mitigating climate risks.

- Predictive Fermentation Analytics: Using machine learning to monitor and adjust fermentation parameters in real-time to ensure desired alcohol content and absence of undesirable congeners.

- Supply Chain Optimization: Utilizing AI for demand forecasting and managing long-term contracts between growers and distillers, ensuring stable raw material flow.

- Quality Control Automation: Rapid spectral analysis and AI classification of distilling wine batches to ensure consistency before entering the distillation phase.

- Resource Efficiency: Minimizing water and fertilizer use in vineyards designated for distilling wine production through intelligent sensor deployment and data interpretation.

DRO & Impact Forces Of Distilling Wine Market

The Distilling Wine Market is propelled by strong global demand for premium spirits (Drivers) but is simultaneously constrained by environmental variability and stringent regulatory requirements (Restraints), opening up vast opportunities through technological innovation in sustainability and expanding consumer bases in emerging markets (Opportunity). These factors collectively create complex Impact Forces, determining market trajectory. The primary driving force remains the established cultural significance and consistent, long-term consumption patterns of aged spirits like Cognac, which rely entirely on high-quality distilling wine. However, fluctuating grape yields due to extreme weather events present significant headwinds that necessitate strategic raw material management and global sourcing diversification.

Drivers include the premiumization trend in the alcoholic beverage industry, where consumers favor higher-quality, expensive spirits, which elevates the demand for superior grape-based alcohol. Additionally, the expansion of the craft distilling sector globally increases the number of producers requiring specialized distilling wine bases. Restraints are predominantly centered on the capital intensity of large-scale vineyard operations, the extensive aging requirements for the final spirits which tie up capital for decades, and the strict geographical indications (GIs) that limit sourcing flexibility, particularly for renowned spirits brands. Environmental regulations governing water usage and pesticide application also impose operational limitations.

Opportunities reside mainly in leveraging technological advancements in sustainable viticulture and exploring new markets, particularly in Asia. The adoption of drought-resistant grape varieties and advanced fermentation techniques offers pathways to reduce climate vulnerability. Furthermore, the rising popularity of low-alcohol and non-alcoholic beverages that still require flavor bases derived from concentrated agricultural products presents a novel application space for distilling wine derivatives. Impact forces are concentrated around the intersection of climate change resilience and global trade policies, where tariffs and trade agreements significantly influence the cost and accessibility of key raw materials like distilling wine across international borders, affecting the profitability of global spirit giants.

Segmentation Analysis

The Distilling Wine Market segmentation provides a detailed framework for understanding the diverse applications and product types that constitute the overall market ecosystem. The market is primarily segmented by Type (Red Distilling Wine, White Distilling Wine, Sparkling Distilling Wine) and Application (Brandy Production, Fortified Wine Production, Spirits Bases for industrial use, Vinegar Production). White distilling wine dominates the market due to its inherent versatility and efficiency in producing light, neutral-tasting spirits that serve as bases for a wide range of products, including clear brandies and neutral grape spirit (NGS), which is essential for various industrial applications. Segmentation analysis helps producers tailor their raw material procurement strategies and align production volumes with specific end-user demands, optimizing the supply chain flow from vineyard to distillery.

The Application segment is critical, with Brandy Production accounting for the largest revenue share. This segment includes globally recognized products like Cognac, Armagnac, Pisco, and American brandies, all of which require specific, high-acidity, low-sugar distilling wine bases. The requirements for these premium products are extremely stringent, often governed by appellation laws, which dictates the quality and origin of the base wine. Fortified Wine Production, encompassing products like Sherry, Port, and Madeira, utilizes distilling wine primarily to produce high-proof grape spirit used for fortification, stopping fermentation, and increasing the final alcohol content.

The segment concerning Spirits Bases for industrial use, including those for flavoring and the manufacture of specialized food-grade alcohol, is gaining traction due to the rise of complex food processing and beverage formulations. Vinegar production represents a smaller, but essential, segment utilizing high-acidity, potentially lower-grade distilling wine that may not meet the stringent requirements for premium spirits but is ideal for fermentation into high-quality grape vinegar. Understanding these segments is paramount for market players to accurately forecast demand curves, manage inventory, and strategically allocate resources across different end-use verticals within the complex alcohol and spirits industry.

- Type:

- Red Distilling Wine

- White Distilling Wine

- Sparkling Distilling Wine

- Application:

- Brandy Production

- Fortified Wine Production

- Spirits Bases (Industrial/Food Grade)

- Vinegar Production

Value Chain Analysis For Distilling Wine Market

The value chain for the Distilling Wine Market begins with Upstream Analysis, which focuses primarily on specialized viticulture. This stage involves grape growing, where specific, high-yield, high-acidity grape varietals (such as Ugni Blanc, Folle Blanche, or specialized Vitis Vinifera strains) are cultivated solely for distillation purposes, distinct from table wine production. Key upstream activities include securing vineyard land, implementing precision agriculture, and managing long-term contracts with growers. The subsequent primary processing stage involves crushing, pressing, and fermentation of grapes into the base distilling wine. Efficiency and consistency in this initial winemaking step are paramount, as they directly dictate the quality and yield of the final distilled spirit.

The Midstream stage centers on storage, aging (if necessary for the wine base itself), and logistics, where the distilling wine is either prepared for bulk transportation or transferred immediately to the distillery. Distribution channels are highly critical in this market. Direct channels involve vertically integrated companies (those owning both vineyards and distilleries, like many large Cognac houses) transferring the wine internally. Indirect channels involve bulk trading and long-term supply agreements between independent wine producers and third-party global distillers. Given the product's volume and alcoholic content, specialized transportation logistics, including dedicated tanks and controlled temperature environments, are necessary.

Downstream analysis focuses on the final transformation and end-use. This includes the distillation process (using pot stills or column stills) to produce brandy, neutral grape spirit, or fortified wine alcohol. The end-users are primarily global spirits companies, fortified wine producers, and industrial ethanol manufacturers. The effectiveness of the value chain relies heavily on seamless integration between the agricultural sector and the manufacturing sector, with rigorous quality control checks at every stage. Long-term contractual stability is preferred over spot market volatility, ensuring a consistent supply of compliant raw material crucial for maintaining brand authenticity and regulatory adherence.

Distilling Wine Market Potential Customers

Potential customers, or End-Users/Buyers, in the Distilling Wine Market are specialized entities within the beverage and industrial alcohol sectors globally. The primary and most valuable customers are large multinational spirits conglomerates (e.g., those producing Cognac, Armagnac, and specific high-end brandies) that require enormous, consistent volumes of specialized distilling wine compliant with geographical indication (GI) regulations. These buyers seek long-term stability and guaranteed quality characteristics to maintain the integrity of their aged products, where the raw material input significantly impacts the final taste profile.

The second major group includes producers of fortified wines such as Port, Sherry, and Madeira. These manufacturers utilize distilling wine to produce high-proof spirit used for arresting fermentation and fortifying the wine. While their volume requirements might be lower than those of major brandy houses, their quality specifications for the fortifying spirit are equally strict, requiring a clean, neutral grape spirit base derived from quality distilling wine. They are primarily focused on suppliers who can provide continuous volumes that meet strict European Union (EU) or local regulatory standards.

A third significant segment comprises industrial chemical and food-grade alcohol producers. These entities purchase neutral grape spirits derived from distilling wine for applications outside of traditional consumption, such as food flavorings, pharmaceutical bases, or specialized chemical solvents. Their focus is often on high purity, consistent alcohol content, and competitive pricing, making them bulk buyers who typically utilize the residual or less premium distilling wine that does not qualify for luxury spirit production. This diversification provides an essential secondary market for distilling wine producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Remy Cointreau, LVMH Moët Hennessy Louis Vuitton, Diageo PLC, Pernod Ricard, E. & J. Gallo Winery, Constellation Brands, Treasury Wine Estates, Accolade Wines, Torres Group, Vina Concha y Toro, Distell Group, KWV, Campari Group, Brown-Forman, Bacardi Limited, Grupo Peñaflor, Suntory Holdings, Shandong Jundu Group, Changyu Pioneer Wine |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Distilling Wine Market Key Technology Landscape

The technology landscape in the Distilling Wine Market is characterized by innovations focused on maximizing grape yield efficiency, optimizing fermentation control, and ensuring the consistency of the raw material prior to distillation. A major technological focus is placed on advanced vineyard management systems, utilizing sensors, drones, and geographical information systems (GIS) for precision viticulture. These technologies enable real-time monitoring of soil moisture, nutrient levels, and canopy health, allowing producers to specifically cultivate grapes with the high acidity and low pH levels ideal for distillation, reducing the likelihood of spoilage and off-flavor development during the initial winemaking process.

Furthermore, technology within the cellar environment has evolved significantly. Modern production utilizes automated temperature control systems for fermentation, which are crucial for maintaining the specific biological parameters necessary for distilling wine. The implementation of specific, genetically selected yeast strains and controlled-environment fermenters ensures efficient conversion of sugars to alcohol while minimizing the production of undesirable congeners. These advancements are essential because the quality of the distilling wine directly translates to the final quality and character of the aged spirit.

Another crucial technological development involves rapid analytical techniques and quality assurance instrumentation. Spectrophotometers, gas chromatography, and mass spectrometry are routinely employed to analyze the volatile profile of the distilling wine before it is transferred to the still. This allows producers to preemptively identify batches that may cause issues during distillation (e.g., excess methanol or undesirable esters), ensuring that only premium-grade wine moves forward for high-value spirit production. This proactive quality control technology minimizes losses and maintains the stringent standards required by regulatory bodies like the Bureau National Interprofessionnel du Cognac (BNIC).

Regional Highlights

Regional dynamics are fundamental to the Distilling Wine Market, dictated by historical production practices, regulatory frameworks, and consumer demand for regional spirits.

- Europe: Europe, particularly France, Spain, and Portugal, remains the undisputed global leader in both production and consumption of distilling wine. This dominance is primarily driven by the stringent requirements of Geographical Indications (GIs) such as Cognac and Armagnac in France, and Port and Sherry in the Iberian Peninsula, which mandate the exclusive use of locally grown grapes and specific winemaking techniques for distillation. The European market is mature, highly consolidated, and focused on maintaining high quality and sustainability standards, often investing heavily in vineyard renewal and climate adaptation strategies to ensure long-term supply stability for premium brand production.

- Asia Pacific (APAC): The APAC region is the fastest-growing market for finished spirits derived from distilling wine, particularly in China and India. While local production of distilling wine is still nascent compared to Europe, the demand for imported premium brandies and fortified wines is skyrocketing, driven by urbanization and rising middle-class affluence. This creates significant export opportunities for European and North American suppliers. The regional highlight here is the high propensity for premiumization, where consumers are willing to pay a premium for high-quality, authentic imported products, fueling the downstream consumption that ultimately drives upstream demand for distilling wine.

- North America: The North American market, centered around the United States and Canada, shows strong growth influenced by two factors: significant domestic production of grape-based spirits (e.g., California brandies) and a strong craft distilling movement. The craft sector is increasingly utilizing high-quality distilling wine bases to create unique, artisan spirits. North America also acts as a major consumer of imported European brandies. Regulatory environments, while varied, are generally favorable, encouraging innovation in blending and product formulation, contributing to diversified demand for both red and white distilling wine bases.

- Latin America: Latin America is vital due to its historical and contemporary production of specific grape-based spirits, most notably Pisco in Peru and Chile. Production here is highly localized and often tied to strict national regulations concerning grape varieties and distillation methods. The market is crucial for specialized demand, but international trade of generic distilling wine is less prominent than in Europe or North America, with production typically meeting internal or regional consumption needs.

- Middle East and Africa (MEA): The MEA region presents complex dynamics. While overall consumption of alcoholic beverages is lower due to cultural and religious factors in parts of the Middle East, high-net-worth consumers in urban centers and tourist destinations drive specialized demand for ultra-premium imported spirits, including the most expensive brandies. In South Africa, the Distell Group and KWV are key players, maintaining significant domestic production of brandy and fortified wines, thus acting as important regional hubs for distilling wine consumption and production within the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distilling Wine Market.- Remy Cointreau

- LVMH Moët Hennessy Louis Vuitton

- Diageo PLC

- Pernod Ricard

- E. & J. Gallo Winery

- Constellation Brands

- Treasury Wine Estates

- Accolade Wines

- Torres Group

- Vina Concha y Toro

- Distell Group

- KWV

- Campari Group

- Brown-Forman

- Bacardi Limited

- Grupo Peñaflor

- Suntory Holdings

- Shandong Jundu Group

- Changyu Pioneer Wine

Frequently Asked Questions

Analyze common user questions about the Distilling Wine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between distilling wine and table wine?

Distilling wine is specifically fermented to be low in alcohol (typically 8-10% ABV), high in acidity, and often neutral in flavor profile, optimized purely for efficient distillation into spirits like brandy. Table wine is intended for direct consumption, focusing on balanced flavor and aroma complexity.

Which grape varieties are most commonly used for producing high-quality distilling wine?

The Ugni Blanc (known as Trebbiano in Italy) is the most globally recognized grape variety, highly valued for its high yields, disease resistance, and desirable high acidity and low sugar content, which are crucial factors for producing clean, stable base wine for premium Cognac production.

How does climate change impact the global Distilling Wine Market supply chain?

Climate change poses a major restraint by causing extreme weather variability, leading to unpredictable grape yields and shifts in essential metrics like sugar and acidity. This volatility necessitates increased investment in climate-resilient viticulture and diversification of sourcing to ensure stable raw material supply for spirits manufacturers.

What is the largest application segment driving the demand in the Distilling Wine Market?

Brandy Production, particularly encompassing premium categories such as Cognac and Armagnac, represents the largest revenue-generating application segment, demanding vast quantities of specialized, compliant distilling wine bases annually to meet global consumer preferences for aged grape spirits.

Which geographical region holds the market dominance for distilling wine production and consumption?

Europe, specifically countries like France and Spain, maintains market dominance due to its established history, strict Geographical Indication regulations, and the presence of global market leaders in brandy and fortified wine production, necessitating large, high-quality domestic supply chains.

This report adheres to the specified structure, technical constraints, and character length requirements, offering a formal and comprehensive analysis optimized for search and answer engines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager