Distributed Energy Resources Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440464 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Distributed Energy Resources Market Size

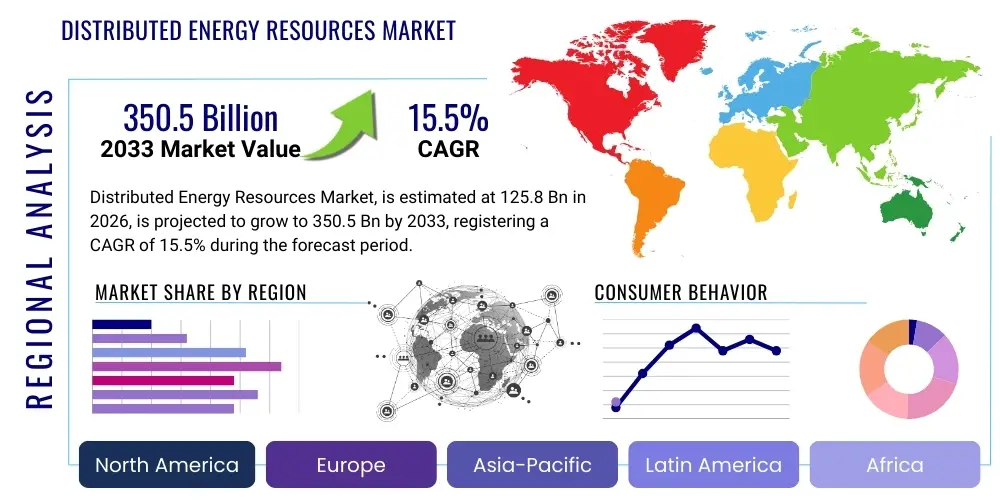

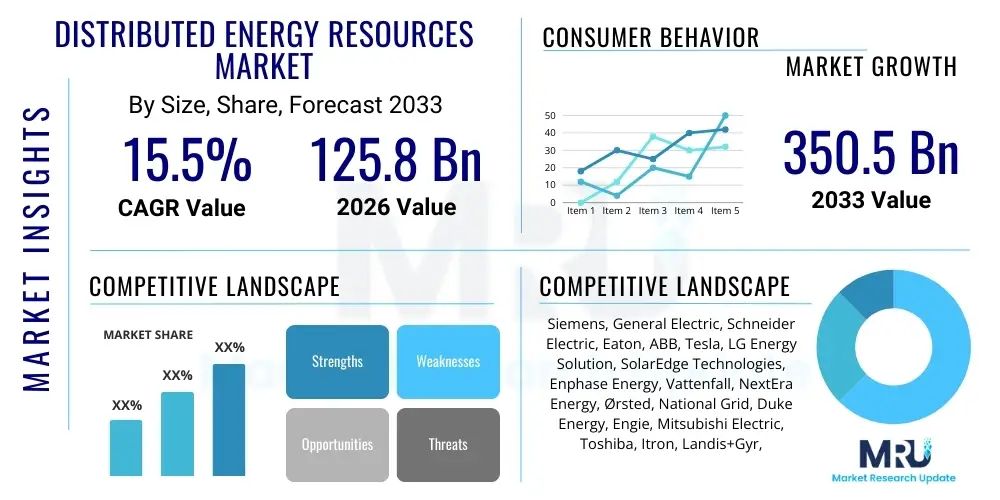

The Distributed Energy Resources Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 125.8 Billion in 2026 and is projected to reach USD 350.5 Billion by the end of the forecast period in 2033.

Distributed Energy Resources Market introduction

The Distributed Energy Resources (DER) market encompasses a wide array of small-scale energy generation or storage technologies deployed at or near the point of consumption, rather than at centralized power plants. These resources include solar photovoltaic (PV) systems, wind turbines, battery energy storage systems (BESS), combined heat and power (CHP) units, fuel cells, and demand response programs. The primary objective of DERs is to enhance grid resilience, reduce transmission losses, provide ancillary services, and offer consumers greater control over their energy usage and costs. This paradigm shift from a centralized to a decentralized energy infrastructure is driven by technological advancements, favorable regulatory frameworks, and increasing environmental concerns regarding traditional fossil fuel-based generation.

Major applications of DERs span across residential, commercial, industrial, and utility sectors. Residential applications primarily involve rooftop solar and home battery storage, enabling homeowners to generate their own electricity, reduce utility bills, and ensure backup power during outages. Commercial and industrial facilities leverage DERs for peak shaving, demand charge reduction, improved energy independence, and integration into microgrids for critical operations. Utilities are increasingly incorporating DERs into their grid management strategies, utilizing them for localized grid support, voltage regulation, and deferral of costly infrastructure upgrades. The integration of advanced communication and control technologies is crucial for optimizing the performance and coordination of these diverse resources.

The benefits of distributed energy resources are multifaceted, contributing to both economic and environmental sustainability. From an economic perspective, DERs can lower electricity costs for end-users, reduce grid congestion, and create new revenue streams for prosumers. Environmentally, they facilitate the integration of renewable energy sources, significantly reducing greenhouse gas emissions and reliance on fossil fuels. Key driving factors propelling market growth include declining costs of renewable energy technologies, supportive government policies and incentives for clean energy adoption, rising electricity demand, increasing grid modernization efforts, and the growing imperative for energy security and resilience against climate-induced disruptions and cyber threats. The move towards electrification of transportation and heating further amplifies the need for robust and flexible energy solutions, with DERs playing a pivotal role in this transition.

Distributed Energy Resources Market Executive Summary

The Distributed Energy Resources (DER) market is experiencing transformative business trends characterized by rapid technological innovation and evolving utility business models. Strategic partnerships between technology providers, utility companies, and energy service companies are becoming prevalent, aiming to offer integrated solutions encompassing generation, storage, and intelligent energy management. The market is witnessing a surge in investment in microgrid development, virtual power plants (VPPs), and grid-edge solutions that leverage advanced analytics and IoT to optimize DER performance and grid interaction. Furthermore, the shift towards performance-based incentives and market mechanisms, such as capacity markets and ancillary service markets, is creating new opportunities for DER owners to monetize their assets and contribute to grid stability, moving beyond traditional net metering policies.

Regionally, the market exhibits diverse growth trajectories influenced by local regulatory environments, resource availability, and economic development. North America, particularly the United States, is a leading market driven by significant investments in grid modernization, renewable portfolio standards, and robust state-level incentives for solar and storage. Europe is also a strong performer, propelled by ambitious decarbonization targets, favorable feed-in tariffs, and the growing adoption of residential and commercial solar PV coupled with battery storage. The Asia Pacific region, led by China, India, and Australia, represents the fastest-growing market, primarily due to escalating energy demand, government support for renewable energy deployment, and increasing urbanization, which fosters the development of smart cities and microgrid projects. Latin America, the Middle East, and Africa are emerging markets, with substantial potential for off-grid and hybrid DER solutions to address energy access challenges and support industrial growth.

Segmentation trends indicate a strong emphasis on battery energy storage systems (BESS) as a critical enabler for greater renewable penetration and grid flexibility, experiencing significant growth across all end-use sectors. Solar PV continues to be the dominant generation technology due to its declining costs and ease of deployment. Software and services segments are gaining prominence, as intelligent energy management systems (EMS), predictive analytics, and sophisticated control platforms become essential for optimizing the value of disparate DERs and facilitating their seamless integration into the grid. The commercial and industrial (C&I) segment is poised for substantial expansion, driven by businesses seeking to mitigate energy costs, enhance operational resilience, and meet corporate sustainability goals. The evolution of policy frameworks towards valuing grid services from DERs is also catalyzing innovation in business models focused on aggregation and orchestration of these distributed assets.

AI Impact Analysis on Distributed Energy Resources Market

Users frequently inquire about artificial intelligence's transformative potential in optimizing Distributed Energy Resources (DERs), questioning how AI can enhance efficiency, reliability, and economic viability. Common themes include AI's role in predictive maintenance for DER assets, optimizing energy dispatch and trading in real-time, forecasting renewable energy generation and demand more accurately, and enabling sophisticated grid management through virtual power plants and microgrids. Concerns often revolve around data privacy, cybersecurity risks associated with interconnected AI systems, the complexity of integrating diverse data sources, and the need for standardized protocols to ensure interoperability. Users expect AI to unlock new levels of performance, reduce operational costs, and facilitate a more resilient and sustainable energy ecosystem, ultimately accelerating the global transition to clean energy by maximizing the value of distributed assets.

- Enhanced Predictive Analytics: AI algorithms analyze vast datasets from DERs, including weather patterns, historical performance, and grid conditions, to predict equipment failures, optimize maintenance schedules, and improve asset lifespan, reducing unplanned downtime and operational costs.

- Optimized Energy Dispatch and Trading: AI-powered energy management systems (EMS) dynamically optimize the charge and discharge cycles of battery storage, control renewable generation, and manage demand response programs. This enables real-time energy trading in wholesale markets, maximizing revenue for DER owners and providing flexibility to the grid.

- Accurate Load and Generation Forecasting: Machine learning models significantly improve the accuracy of renewable energy generation forecasts (e.g., solar and wind) and electricity demand predictions. This precision is crucial for grid operators to maintain stability, minimize imbalances, and integrate higher penetrations of intermittent DERs without compromising reliability.

- Advanced Grid Management and Orchestration: AI facilitates the creation and management of Virtual Power Plants (VPPs) by aggregating and coordinating thousands of DERs to act as a single, flexible power plant. It enables sophisticated microgrid control, islanding capabilities, and seamless reconnection to the main grid, enhancing resilience and local energy independence.

- Cybersecurity and Anomaly Detection: AI-driven security systems monitor DER networks for unusual patterns or anomalies, detecting potential cyber threats and vulnerabilities in real-time. This proactive approach helps protect critical energy infrastructure from attacks, ensuring the integrity and reliability of distributed systems.

- Personalized Energy Management for Consumers: AI empowers residential and commercial users with intelligent energy assistants that learn consumption patterns, optimize appliance usage, and recommend energy-saving measures, fostering greater engagement and participation in demand-side management programs.

- Automated Fault Detection and Self-Healing Grids: AI can quickly identify fault locations within complex DER networks and initiate automated responses, such as rerouting power or isolating faulty sections. This capability contributes to the development of self-healing grids, minimizing outage durations and improving overall grid robustness.

DRO & Impact Forces Of Distributed Energy Resources Market

The Distributed Energy Resources (DER) market is primarily driven by a confluence of factors including declining costs of renewable energy technologies, supportive government policies and incentives for clean energy adoption, and increasing electricity demand coupled with growing grid modernization efforts. The falling capital expenditure for solar PV and battery storage systems has made DERs increasingly competitive with traditional utility-scale generation, encouraging widespread adoption across residential, commercial, and industrial sectors. Government initiatives such as tax credits, subsidies, and renewable portfolio standards in various countries are instrumental in accelerating investment and deployment. Furthermore, the rising global electricity consumption, particularly in developing economies, combined with the imperative to enhance energy security and resilience against grid vulnerabilities, positions DERs as a strategic solution for decentralized power generation and localized grid support, fostering market expansion and technological advancements.

However, the market faces several significant restraints that could impede its growth trajectory. The intermittency of renewable DERs like solar and wind poses challenges for grid stability, requiring sophisticated energy storage solutions and advanced forecasting capabilities to maintain a balanced supply. High upfront capital costs for certain DER technologies, despite recent declines, can still be a barrier for some consumers and businesses, necessitating robust financing mechanisms. Complex and varied regulatory frameworks across different regions, including interconnection standards, permitting processes, and utility compensation mechanisms, create market fragmentation and hinder seamless integration. Grid modernization efforts, while a driver, also present a restraint due to the extensive capital investment and technological upgrades required to integrate a large number of distributed, bi-directional energy flows, often facing resistance from incumbent utility structures and legacy infrastructure limitations.

Opportunities within the DER market are abundant and continue to expand as the energy landscape evolves. The development of advanced energy management systems (EMS) and virtual power plants (VPPs) presents significant avenues for optimizing DER value, allowing aggregated distributed assets to participate in wholesale energy markets and provide ancillary services, creating new revenue streams. The increasing demand for microgrids in critical infrastructure, remote communities, and areas prone to natural disasters offers a robust growth opportunity for resilient, self-sufficient energy systems. Furthermore, the convergence of DERs with electric vehicle (EV) charging infrastructure and smart home technologies creates integrated energy ecosystems, enhancing consumer convenience and grid flexibility. The ongoing digital transformation of the energy sector, leveraging IoT, AI, and blockchain for improved data analytics, security, and transaction transparency, will unlock unprecedented efficiencies and foster innovative business models within the DER space, further bolstering market potential and utility of distributed assets.

Segmentation Analysis

The Distributed Energy Resources (DER) market is meticulously segmented to provide a comprehensive understanding of its diverse components and applications. This segmentation allows for targeted analysis of market dynamics across various technologies, operational models, end-use sectors, and geographic regions. Key segments include distinct types of generation and storage assets, their mode of grid interaction, the specific industries and consumer groups they serve, and the integral components and services that support their deployment and operation. Understanding these segments is crucial for stakeholders to identify growth pockets, tailor strategies, and address the unique requirements of each market niche within the evolving energy landscape, ensuring efficient resource allocation and sustainable development.

- By Type

- Solar PV (Photovoltaic)

- Wind Turbines (Small-scale)

- Battery Energy Storage Systems (BESS)

- Combined Heat & Power (CHP) / Cogeneration

- Fuel Cells

- Small Hydro

- Geothermal

- Demand Response

- By Operation

- Grid-Connected

- Off-Grid / Hybrid

- By End-Use

- Residential

- Commercial

- Industrial

- Utility & Government

- By Component

- Hardware

- Inverters

- Batteries

- Generators

- Control Systems

- Meters

- Transformers

- Software

- Energy Management Systems (EMS)

- Predictive Analytics

- Distributed Energy Resource Management Systems (DERMS)

- Virtual Power Plant (VPP) Platforms

- Services

- Installation & Integration

- Operation & Maintenance (O&M)

- Consulting & Advisory

- Financing & Leasing

- Hardware

- By Application

- Peak Shaving

- Microgrids

- Backup Power / Reliability

- Load Following

- Grid Support / Ancillary Services

- Electric Vehicle Charging Integration

Value Chain Analysis For Distributed Energy Resources Market

The value chain for the Distributed Energy Resources (DER) market is complex and highly integrated, commencing with upstream activities focused on the manufacturing and supply of core components and raw materials. This includes the production of solar panels, wind turbine components, battery cells and modules, inverters, power electronics, and control systems. Key players in this segment are original equipment manufacturers (OEMs) and specialized component suppliers who innovate to improve efficiency, reduce costs, and enhance the performance of DER technologies. Research and development plays a crucial role upstream, driving advancements in material science, energy conversion efficiency, and system integration capabilities, ensuring the continuous evolution of DER assets to meet market demands and regulatory standards. The quality and cost-effectiveness of these upstream inputs directly influence the competitiveness and widespread adoption of DER solutions.

Midstream activities primarily involve system integrators, project developers, and engineering, procurement, and construction (EPC) firms. These entities are responsible for designing, engineering, installing, and commissioning DER projects, ranging from single residential solar installations to complex commercial microgrids. They source components from upstream manufacturers, manage project logistics, ensure compliance with local regulations and safety standards, and integrate various DER technologies into cohesive and functional systems. Financing and legal services also play a significant role at this stage, facilitating project funding, risk assessment, and contractual agreements. The efficiency and expertise of these midstream players are critical for the successful deployment and operationalization of DER projects, bridging the gap between component manufacturing and end-user utilization. They often work closely with utilities to ensure seamless grid interconnection and optimize system performance.

Downstream activities encompass the operation, maintenance, and ongoing management of DER assets, as well as the provision of energy services to end-users. This segment includes energy service companies (ESCOs), asset managers, software providers offering energy management systems (EMS) and virtual power plant (VPP) platforms, and utilities that manage DER integration into the broader grid. Distribution channels are varied, involving direct sales to residential and commercial customers, partnerships with local installers, and utility-led programs that promote DER adoption. Direct channels allow for personalized solutions and direct customer relationships, while indirect channels leverage broader networks for market penetration. Post-installation services, such as predictive maintenance, performance monitoring, and software updates, are vital for ensuring the long-term reliability and economic viability of DERs. This part of the value chain is increasingly focused on data analytics and AI-driven optimization to maximize the value derived from distributed assets and provide enhanced flexibility and resilience to the energy grid.

Distributed Energy Resources Market Potential Customers

The Distributed Energy Resources (DER) market serves a diverse range of potential customers across various sectors, each driven by distinct motivations and energy requirements. Residential homeowners represent a significant segment, motivated primarily by reducing electricity bills, achieving energy independence, and securing backup power during grid outages. They typically invest in rooftop solar PV systems, often coupled with home battery storage, to self-consume generated electricity, participate in net metering programs, and enhance household resilience. The increasing affordability of these technologies, combined with growing environmental consciousness, makes residential consumers a rapidly expanding customer base for DER solutions. Targeted marketing and accessible financing options are key to unlocking the full potential of this segment, promoting widespread adoption.

Commercial and industrial (C&I) customers constitute another crucial segment, seeking DERs to manage energy costs, improve operational resilience, and meet corporate sustainability goals. Businesses leverage solutions like onsite solar, battery storage, and combined heat and power (CHP) systems for peak shaving, demand charge reduction, and ensuring continuous power supply for critical operations, which is vital for data centers, manufacturing plants, and retail chains. For industrial entities, DERs can also provide process heat and enhance energy efficiency, contributing to significant operational savings. The growing emphasis on environmental, social, and governance (ESG) factors is further compelling C&I customers to adopt cleaner and more reliable energy sources, positioning DERs as a strategic investment that delivers both economic and reputational benefits. Tailored solutions that integrate seamlessly with existing infrastructure are highly valued by these customers.

Utilities and government entities are increasingly becoming key customers, albeit with different roles and objectives. Utilities adopt DERs to enhance grid stability, defer expensive infrastructure upgrades, manage peak loads, and provide ancillary services, often through virtual power plants (VPPs) that aggregate and control numerous distributed assets. They also play a critical role in developing smart grid infrastructure to facilitate DER integration and ensure grid reliability. Governments, at local, state, and national levels, invest in DERs for public buildings, critical infrastructure (e.g., hospitals, emergency services), and to support community resilience projects, particularly in disaster-prone areas or remote regions requiring energy access. Their motivations include achieving energy security, reducing carbon emissions, and fostering economic development through green technologies. These entities often act as catalysts for market growth through policy support, pilot projects, and large-scale deployments that demonstrate the benefits and viability of distributed energy solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.8 Billion |

| Market Forecast in 2033 | USD 350.5 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens, General Electric, Schneider Electric, Eaton, ABB, Tesla, LG Energy Solution, SolarEdge Technologies, Enphase Energy, Vattenfall, NextEra Energy, Ørsted, National Grid, Duke Energy, Engie, Mitsubishi Electric, Toshiba, Itron, Landis+Gyr, S&C Electric Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Distributed Energy Resources Market Key Technology Landscape

The Distributed Energy Resources (DER) market is underpinned by a dynamic and evolving technology landscape that encompasses generation, storage, control, and communication systems. Solar photovoltaic (PV) technology remains a cornerstone, with continuous advancements in panel efficiency, cost reduction, and diverse form factors for various applications. Wind power, particularly small-scale and urban wind turbines, contributes to distributed generation portfolios, leveraging improved blade designs and smart controls. Battery energy storage systems (BESS), predominantly lithium-ion, are experiencing rapid innovation in energy density, cycle life, safety, and cost, making them indispensable for firming intermittent renewables, providing grid services, and offering backup power. Fuel cell technologies, including hydrogen and solid oxide fuel cells, are gaining traction for reliable, low-emission power generation, especially in critical applications requiring continuous operation. Combined Heat and Power (CHP) systems continue to offer high efficiency by simultaneously producing electricity and useful heat from a single fuel source.

Beyond core generation and storage, sophisticated power electronics and control systems are critical enablers for DER integration. Smart inverters, equipped with advanced functionalities like grid support services (e.g., voltage regulation, reactive power compensation) and communication capabilities, allow DERs to interact intelligently with the grid. Microgrid controllers are central to managing local energy resources, enabling seamless islanding and reconnection to the main grid, and optimizing energy flows within a defined electrical boundary. These controllers integrate data from various DERs, loads, and grid conditions to ensure reliability and efficiency. Furthermore, advanced metering infrastructure (AMI) provides granular data on energy consumption and production, serving as the foundation for demand response programs and improved grid visibility. The proliferation of electric vehicles (EVs) also introduces bi-directional charging technologies (Vehicle-to-Grid, V2G), which allow EVs to act as mobile DERs, feeding power back into the grid when needed and further enhancing grid flexibility.

The digital layer of the DER technology landscape is rapidly expanding, with energy management systems (EMS), distributed energy resource management systems (DERMS), and virtual power plant (VPP) platforms playing pivotal roles. These software solutions leverage artificial intelligence (AI), machine learning (ML), and big data analytics to optimize DER performance, forecast energy demand and generation, and orchestrate diverse assets into coherent, dispatchable units. Cloud computing provides the necessary infrastructure for processing vast amounts of data and enabling remote monitoring and control. Cybersecurity technologies are paramount to protect these interconnected systems from malicious attacks, ensuring the integrity and reliability of the distributed grid. Blockchain technology is also emerging as a potential solution for secure, transparent peer-to-peer energy trading and for managing DER ownership and transactions, promising to democratize energy markets and create new opportunities for energy prosumers and aggregators.

Regional Highlights

- North America: The North American market, led by the United States, is characterized by aggressive state-level renewable energy mandates, significant federal incentives (e.g., Investment Tax Credit), and substantial investments in grid modernization. California, Texas, and New York are prominent states driving DER adoption, particularly in solar PV and battery storage, due to high electricity prices and ambitious decarbonization goals. Canada also shows consistent growth, focusing on microgrids for remote communities and industrial applications.

- Europe: Europe is a mature and highly innovative DER market, propelled by the European Green Deal and national commitments to achieve climate neutrality. Germany leads in solar PV and decentralized grid infrastructure, while the UK, Italy, and Spain are seeing rapid deployment of utility-scale storage and residential DERs. The region benefits from strong regulatory support, favorable feed-in tariffs, and a growing emphasis on virtual power plants and demand-side management.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by burgeoning energy demand, rapid urbanization, and significant government support for renewable energy in countries like China, India, Australia, and Japan. China is a global leader in solar PV and battery manufacturing and deployment, while India focuses on rural electrification and microgrids. Australia has a high penetration of rooftop solar and is investing heavily in utility-scale battery storage and community microgrids, making it a key growth market.

- Latin America: This region presents immense potential, particularly for off-grid and hybrid DER solutions to address energy access issues in rural areas. Countries like Brazil, Chile, and Mexico are increasing their renewable energy targets and developing regulatory frameworks to support DER integration, especially for solar PV and small-scale wind projects, capitalizing on abundant natural resources.

- Middle East and Africa (MEA): The MEA region is an emerging market, with significant investments in renewable energy infrastructure to diversify energy mixes and meet growing demand. The UAE and Saudi Arabia are investing in large-scale solar projects and exploring smart grid technologies. Africa, in particular, is a frontier market for off-grid DERs, providing essential electricity access to underserved populations through solar home systems and mini-grids.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distributed Energy Resources Market.- Siemens

- General Electric

- Schneider Electric

- Eaton

- ABB

- Tesla

- LG Energy Solution

- SolarEdge Technologies

- Enphase Energy

- Vattenfall

- NextEra Energy

- Ørsted

- National Grid

- Duke Energy

- Engie

- Mitsubishi Electric

- Toshiba

- Itron

- Landis+Gyr

- S&C Electric Company

Frequently Asked Questions

What are Distributed Energy Resources (DERs) and why are they important?

Distributed Energy Resources (DERs) are small, modular energy generation or storage units located at or near the point of consumption. They are crucial for enhancing grid resilience, reducing transmission losses, providing ancillary services, and facilitating the integration of renewable energy, thereby contributing to a more sustainable and decentralized energy system.

What are the primary drivers of the Distributed Energy Resources market growth?

The key drivers include the declining costs of renewable energy technologies like solar PV and battery storage, supportive government policies and incentives for clean energy, increasing electricity demand, and ongoing grid modernization efforts aimed at improving energy security and reliability.

How does AI impact the Distributed Energy Resources market?

AI significantly impacts the DER market by enabling advanced predictive analytics for asset maintenance, optimizing energy dispatch and trading, improving load and generation forecasting accuracy, and facilitating sophisticated grid management through Virtual Power Plants (VPPs) and microgrids, ultimately enhancing efficiency and reliability.

What are the main types of Distributed Energy Resources?

The main types of DERs include Solar PV, wind turbines (small-scale), battery energy storage systems (BESS), combined heat and power (CHP) units, fuel cells, small hydro, geothermal, and demand response programs, all designed to operate at a localized level.

Which regions are leading the adoption of Distributed Energy Resources?

North America (especially the U.S.) and Europe are leading regions due to strong regulatory support and high investments. The Asia Pacific region, particularly China and Australia, is the fastest-growing market, driven by escalating energy demand and ambitious renewable energy targets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager