Distributed Peristaltic Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432002 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Distributed Peristaltic Pump Market Size

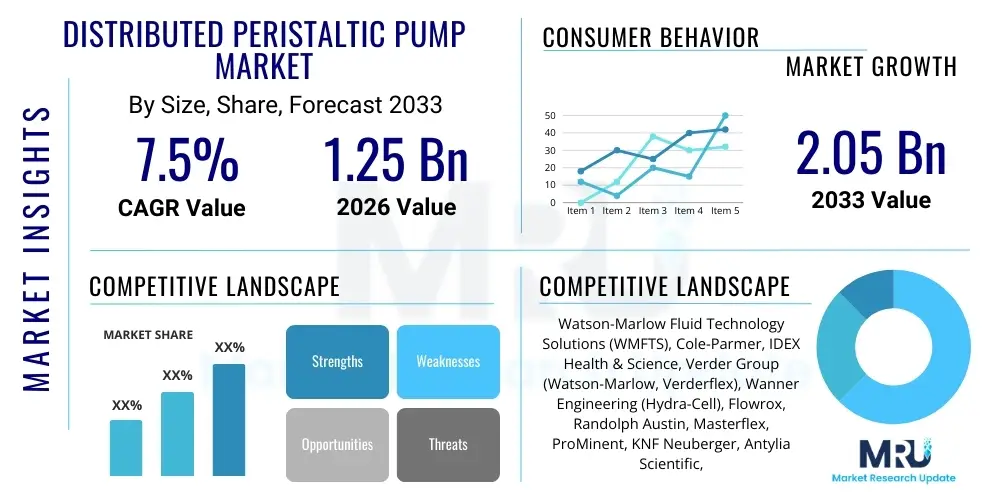

The Distributed Peristaltic Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.05 Billion by the end of the forecast period in 2033.

Distributed Peristaltic Pump Market introduction

The Distributed Peristaltic Pump Market encompasses specialized fluid handling systems where pumping functions are decentralized and integrated directly into complex machinery, laboratory devices, or industrial pipelines, often involving multiple smaller pump heads controlled centrally or via network protocols. These pumps, characterized by their tube-squeezing mechanism, are crucial for applications requiring high precision, sterility, and contamination-free fluid transfer. The core product involves drive mechanisms, tubing materials (such as silicone or Tygon), and advanced control systems enabling precise flow rates and dispensing volumes, crucial in sensitive environments like pharmaceuticals, biotechnology, and food processing. The inherent design of peristaltic pumps ensures that the fluid only contacts the interior of the tubing, making them ideal for handling corrosive, shear-sensitive, or highly viscous materials.

Major applications driving the demand for distributed peristaltic pumps include automated diagnostic equipment in clinical laboratories, bioprocessing systems for fermentation and media transfer, chemical metering, and water treatment facilities. In clinical diagnostics, these pumps facilitate accurate reagent addition and sample preparation, significantly enhancing automation and throughput. In industrial settings, their ability to self-prime and run dry without damage offers substantial operational benefits. Key benefits include superior fluid isolation, elimination of backflow contamination, ease of maintenance due to simple tube replacement, and highly repeatable accuracy, which is essential for regulated industries. The precision and reliability offered by distributed systems, where multiple pumping functions can be finely tuned and monitored across a facility, provide significant advantages over traditional centralized pumping solutions, especially in large-scale biopharmaceutical manufacturing.

The primary driving factors for market expansion are the increasing adoption of automated liquid handling systems in R&D and manufacturing, the stringent regulatory environment demanding high-purity fluid transfer in pharmaceuticals and biotechnology, and the growing trend towards miniaturization and integration of fluidic components. Furthermore, the rising incidence of chronic diseases globally fuels the expansion of clinical diagnostics and personalized medicine, both heavy consumers of highly precise distributed peristaltic pumping technology. Technological advancements in control interfaces, incorporating features like IoT connectivity and predictive maintenance, further enhance the utility and attractiveness of these decentralized pumping solutions, solidifying their role as indispensable components in modern industrial and laboratory automation.

Distributed Peristaltic Pump Market Executive Summary

The Distributed Peristaltic Pump Market is experiencing robust growth fueled by transformative technological adoption across healthcare and industrial automation sectors. Current business trends indicate a strong focus on developing smart pump systems that integrate seamlessly with Laboratory Information Management Systems (LIMS) and Manufacturing Execution Systems (MES). Key industry players are prioritizing modular pump designs, offering scalability and easier integration into complex, multi-functional machinery. Furthermore, strategic partnerships between pump manufacturers and bioprocessing equipment providers are becoming common, aiming to provide end-to-end solutions for sterile and single-use fluid transfer, aligning with the industry's shift towards disposable technologies to minimize cleaning validation risks and downtime. High demand for pumps capable of ultra-low flow rates and high-pressure capabilities in microfluidics is driving significant R&D investment.

Regionally, North America maintains market dominance due to its established biopharmaceutical industry, high expenditure on healthcare R&D, and the presence of major market innovators. Europe follows closely, driven by stringent quality standards in pharmaceutical production and substantial investments in advanced clinical diagnostics infrastructure. The Asia Pacific (APAC) region is projected to register the fastest growth rate, primarily attributed to rapid industrialization, expanding healthcare infrastructure in countries like China and India, and increasing foreign direct investment in local biomanufacturing capabilities. Governments in APAC are actively promoting biotechnology and pharmaceutical self-sufficiency, which mandates the use of high-precision fluidic components, thereby accelerating the deployment of distributed peristaltic systems across laboratories and production facilities.

Segment trends highlight the dominance of low-flow distributed pumps, particularly those used in analytical instrumentation and small-scale dosing applications, due to their ubiquitous use in research and quality control. However, the medium-to-high flow rate segment is showing accelerated growth driven by large-scale commercial bioprocessing activities, such as media preparation and buffer management. In terms of drive type, brushless DC motors integrated with sophisticated microprocessors are increasingly preferred for their extended lifespan, minimal maintenance requirements, and precise digital control. The single-use tubing segment is also gaining traction over multi-use options, especially in biological applications where contamination risk mitigation is paramount, underscoring a critical shift in operational paradigms within the biotechnology segment towards enhanced safety and operational efficiency.

AI Impact Analysis on Distributed Peristaltic Pump Market

Common user questions regarding AI's influence on the Distributed Peristaltic Pump Market center around how AI can enhance operational efficiency, predictive maintenance capabilities, and dispensing accuracy, particularly in large-scale, networked installations. Users frequently inquire about the feasibility of AI-driven anomaly detection in fluidic systems, the use of machine learning algorithms to optimize tube life and prevent catastrophic failures, and how AI can automate calibration processes to maintain stringent regulatory compliance. The consensus expectation is that AI integration will transform reactive maintenance into proactive system management, optimizing energy consumption and maximizing uptime in critical bioprocessing and diagnostic environments. Furthermore, there is significant interest in using advanced analytics to correlate pump performance data with batch quality metrics in real-time, moving beyond simple control systems to holistic process optimization platforms.

- AI enables real-time performance monitoring and predictive failure analysis of tubing life and motor degradation.

- Machine learning algorithms optimize flow rate calibration, ensuring superior volumetric accuracy and repeatability.

- AI systems facilitate advanced anomaly detection, identifying subtle deviations in pump pressure or flow indicative of impending system errors.

- Integration with digital twins allows for simulation-based optimization of complex distributed pump networks.

- Automated decision-making capabilities reduce human intervention during routine adjustments and troubleshooting.

- AI enhances inventory management for disposable components (e.g., tubing sets) based on usage prediction and system demand.

- Improved data correlation between pump parameters and end-product quality, especially critical in personalized medicine manufacturing.

DRO & Impact Forces Of Distributed Peristaltic Pump Market

The Distributed Peristaltic Pump Market is primarily driven by the escalating demand for highly accurate, sterile, and single-use fluid transfer mechanisms in the pharmaceutical and biotechnology industries, necessitating the integration of decentralized pumping units into closed-loop systems. A significant driver is the regulatory mandate for enhanced process control and validation, particularly in aseptic manufacturing, where the pump’s contamination-free mechanism is a vital asset. Restraints include the inherent limitation of peristaltic pumps regarding maximum pressure capability compared to other positive displacement pumps, which can restrict their application in certain high-pressure industrial processes. Furthermore, the finite lifespan and required frequent replacement of the tubing element introduce operational costs and potential maintenance bottlenecks, especially in high-throughput applications, demanding robust scheduling and inventory management protocols.

Opportunities for growth are vast, particularly in the rapidly evolving fields of cell and gene therapy manufacturing, microfluidics, and continuous bioprocessing, all of which require extremely precise, scalable, and customizable fluidic control. The ongoing trend towards process intensification and modular facility design directly supports the adoption of distributed, flexible pumping modules. Moreover, the integration of Industrial Internet of Things (IIoT) sensors and edge computing into these pumps presents a major opportunity to offer sophisticated remote diagnostics, enhanced process control, and streamlined data logging capabilities, positioning these devices as foundational elements of smart factory environments. Developing specialized tubing materials that offer extended operational life and enhanced chemical resistance further opens doors in harsh chemical processing environments.

The impact forces shaping the market are heavily centered on technological innovation and regulatory pressures. The impact of technological advancement is high, driving features like magnetic coupling, advanced stepper motors, and intuitive human-machine interfaces (HMIs) for better control. Regulatory standards, particularly those enforced by bodies like the FDA and EMA concerning sterility and validation, exert immense pressure, favoring pump designs that minimize product contact surfaces and facilitate easy cleaning or single-use deployment. Economic factors, such as the cost-benefit analysis of single-use systems versus traditional stainless steel infrastructure, also play a significant role, pushing manufacturers toward more cost-effective, high-reliability distributed pump solutions that minimize capital expenditure while ensuring compliance and minimizing cross-contamination risks.

Segmentation Analysis

The Distributed Peristaltic Pump Market is highly fragmented and segmented based on crucial attributes such as type, flow rate, drive technology, and primary end-use application, reflecting the diverse requirements across industries ranging from critical care diagnostics to heavy industrial chemical metering. Segmentation allows manufacturers to tailor pump characteristics—such as roller material, casing design, and control interface—to specific operational environments. The increasing demand for automation in analytical instrumentation has made the flow rate segment, particularly the low-flow category (micro-liters to milliliters per minute), critical for research laboratories and point-of-care devices. Conversely, the growth in large-scale biomanufacturing necessitates high-flow pumps capable of handling significant volumes of media and buffer solutions accurately and reliably.

The market analysis reveals that the technology segmentation, focusing on drive mechanisms (e.g., standard DC, stepper, or brushless DC motors), influences precision, durability, and cost. Brushless DC motors are steadily gaining market share in distributed systems due to their longevity and ability to integrate sophisticated digital controls necessary for networking pump modules. Furthermore, end-user segmentation clearly indicates that the biotechnology and pharmaceutical sectors are the dominant revenue contributors, driven by the critical need for contamination control and high precision in drug discovery, clinical trials, and commercial production. These sectors prioritize features such as validation support, cGMP compliance, and specialized chemically inert tubing materials suitable for sensitive biological media.

The market’s continuous evolution is also reflected in the material segmentation, where advanced polymer and elastomer tubing materials are continually being developed to resist cracking, maintain flow stability under pulsation, and withstand aggressive chemicals or sterilization protocols (like gamma irradiation or autoclaving) required for single-use assemblies. Understanding these detailed segments is vital for strategic positioning, enabling market players to identify specific niches, such as distributed dosing systems for food and beverage flavoring or high-accuracy pumps for environmental monitoring stations, thereby facilitating targeted product development and market penetration strategies globally.

- By Type:

- Hose Pumps (High Flow/Pressure)

- Tube Pumps (Low Flow/Precision Dosing)

- By Flow Rate:

- Low Flow (Micro-liter to 100 ml/min)

- Medium Flow (100 ml/min to 10 L/min)

- High Flow (Above 10 L/min)

- By Drive Technology:

- DC Motor Driven

- Stepper Motor Driven

- Brushless DC (BLDC) Motor Driven

- Precision Gear Motor Driven

- By Application/End-Use:

- Pharmaceutical and Biotechnology

- Clinical Diagnostics and Medical Devices

- Food and Beverage Processing

- Water and Wastewater Treatment

- Chemical Processing and Dosing

- Environmental Monitoring and Sampling

- Laboratory and Analytical Instrumentation

- By Tubing Material:

- Silicone

- Tygon

- Marprene

- Viton/Fluorel

- Santoprene

Value Chain Analysis For Distributed Peristaltic Pump Market

The value chain for the Distributed Peristaltic Pump Market commences with upstream activities involving the sourcing of highly specialized raw materials, primarily focusing on advanced polymers and elastomers for tubing, high-precision electronic components (motors, microprocessors, sensors), and robust engineering plastics or metals for casing and roller assemblies. Suppliers in the upstream segment must meet stringent quality standards, particularly for medical-grade and food-contact materials. Key challenges at this stage involve ensuring material compatibility with various chemicals and biological media, managing the volatility of raw material costs, and maintaining a reliable supply of highly specialized stepper and brushless DC motors necessary for achieving precise control in distributed networks. Successful management of the upstream segment directly dictates the final pump’s reliability and compliance profile.

Midstream, the value chain involves the design, manufacturing, and assembly of the distributed pump modules. This stage is characterized by high intellectual property requirements, focusing on optimizing roller geometry, pulsation reduction techniques, and developing proprietary control software tailored for networked environments (e.g., EtherCAT or Modbus integration). Manufacturers often specialize in modular designs that allow end-users to scale their pumping capacity easily. Quality control and rigorous testing, especially calibration and validation services, are central to the manufacturing process, ensuring the pumps meet the high accuracy and repeatability demanded by pharmaceutical and diagnostic end-users. Efficiency in lean manufacturing practices is crucial for maintaining competitive pricing while adhering to high quality benchmarks, especially as production volumes increase due to market automation trends.

Downstream, the distribution channel is primarily bifurcated into direct sales channels for major OEM integration projects (common in diagnostic instrument manufacturing) and indirect channels utilizing specialized technical distributors and authorized resellers for smaller laboratories and general industrial maintenance, repair, and operations (MRO) markets. Indirect channels often provide localized technical support, application engineering assistance, and rapid access to consumable tubing spares. Direct distribution is favored when complex system integration and customized firmware development are required. The final stage involves servicing, maintenance contracts, and the provision of replacement parts, particularly the consumable tubing sets, which represent a recurring revenue stream for distributors and manufacturers. The efficacy of the downstream network significantly impacts market responsiveness and customer satisfaction in mission-critical applications.

Distributed Peristaltic Pump Market Potential Customers

The primary end-users and buyers of distributed peristaltic pumps are large pharmaceutical corporations and biotechnology firms, driven by the critical need for sterile, accurate fluid handling in both upstream (fermentation feed, media transfer) and downstream (purification, formulation, filling) bioprocessing activities. These customers prioritize pumps that offer validation packages, superior chemical resistance, and compatibility with single-use systems (SUS), minimizing cleaning validation costs and contamination risks inherent in multi-product facilities. Clinical diagnostic laboratories, including central labs and point-of-care testing facilities, also represent major buyers, integrating these pumps into sophisticated automated analyzers for reagent dispensing and sample metering, where accuracy in microliter volumes is non-negotiable for reliable test results and throughput.

Beyond the life sciences, critical industrial sectors constitute a significant customer base. Water and wastewater treatment plants utilize distributed peristaltic pumps extensively for precise chemical dosing (e.g., chlorine, flocculants) to ensure regulatory compliance and process efficiency, valuing the pump's robust ability to handle abrasive slurries and corrosive chemicals without damage to internal components. The food and beverage industry employs these pumps for adding flavors, colors, and preservatives with high volumetric precision, particularly valuing the hygienic design and gentle, shear-minimizing transfer mechanism, crucial for handling sensitive liquids like sauces, syrups, and dairy products without altering their viscosity or texture.

Furthermore, Original Equipment Manufacturers (OEMs) specializing in analytical instrumentation, printing technology, and specialized chemical dispensing systems are substantial, though indirect, customers. These OEMs integrate the pump mechanisms directly into their proprietary machinery, requiring high reliability, compact footprints, and easy integration via communication protocols. Research and academic institutions also remain steady buyers, using distributed pumps in benchtop experiments, continuous flow chemistry, and microfluidic studies. The common thread among all these potential customers is the requirement for accurate, repeatable, and non-contaminating fluid transfer capabilities in highly controlled or sensitive operational environments, validating the premium positioning of distributed peristaltic technology in specialized fluidics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.05 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Watson-Marlow Fluid Technology Solutions (WMFTS), Cole-Parmer, IDEX Health & Science, Verder Group (Watson-Marlow, Verderflex), Wanner Engineering (Hydra-Cell), Flowrox, Randolph Austin, Masterflex, ProMinent, KNF Neuberger, Antylia Scientific, TAC Distribution, Graco Inc., Seko S.p.A., Reglo AS, Welco Co., Ltd., Gilson Inc., InnovaQuartz, Zhongke-Chem. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Distributed Peristaltic Pump Market Key Technology Landscape

The technological landscape of the Distributed Peristaltic Pump Market is characterized by continuous advancements aimed at improving accuracy, reducing pulsation, extending tube life, and enhancing connectivity for integration into networked automation systems. A critical technological focus is on precision motor control, particularly the increased adoption of advanced stepper motors and sensor-less brushless DC (BLDC) motors coupled with high-resolution encoders. These technologies allow for micro-stepping capabilities, enabling incredibly fine flow resolution and highly repeatable dispensing profiles, which is essential for microfluidic applications and automated high-throughput screening. Furthermore, manufacturers are employing specialized pump head designs, often featuring multiple rollers (4 to 8 rollers) and optimized occlusive geometry, specifically to minimize the inherent pulsation effects associated with peristaltic action, thereby ensuring smoother flow and superior performance in continuous processes.

Another significant technological driver is the development of Smart Pump functionalities utilizing Industrial Internet of Things (IIoT) connectivity. New distributed pumps are increasingly equipped with Ethernet/IP, Modbus, or PROFINET interfaces, allowing them to communicate seamlessly within a centralized distributed control system (DCS) or PLC environment. This connectivity facilitates remote monitoring, allows for over-the-air firmware updates, and enables the real-time transmission of operational data (such as motor load, accumulated run hours, and error logs) crucial for implementing proactive maintenance schedules. Sensor technology is also being deployed internally to monitor tube wall thickness and integrity, providing alerts before tubing failure, significantly reducing the risk of catastrophic batch loss in critical applications and enhancing operational safety and efficiency across the distributed network.

Material science innovation remains foundational to the market’s technological trajectory. Research is heavily focused on developing single-use, gamma-stable, and chemically compatible tubing materials that offer exceptional flexural fatigue resistance. These newer materials, often custom blends of specialized elastomers and polymers, are designed to withstand millions of compression cycles without compromising structural integrity or leaching contaminants into the fluid stream. The market is also witnessing the emergence of magnetic drive technology in certain pump configurations, eliminating the physical shaft seal entirely, thereby enhancing sterility and reducing maintenance in extremely sensitive processes. The convergence of precise mechanical engineering, sophisticated digital control systems, and specialized material science is defining the next generation of highly reliable and networked distributed peristaltic pumping solutions for advanced manufacturing environments.

Regional Highlights

- North America (USA and Canada)

North America holds the dominant market share, driven primarily by the colossal pharmaceutical and biotechnology industry sectors. The United States, in particular, boasts the highest concentration of leading biopharmaceutical companies, rigorous FDA regulatory standards necessitating high-precision fluid transfer, and substantial investment in life science research and clinical diagnostics. The trend toward personalized medicine and the rapid development of cell and gene therapies inherently require complex, distributed fluidic systems for small-batch, high-value production. Furthermore, the region is a global hub for technological innovation in automated laboratory equipment, with a high rate of adoption of advanced smart pumps equipped with IIoT and AI capabilities, solidifying its leadership position in both value and technological maturity.

The demand is particularly strong for highly validated, single-use tube pump systems integrated into bioreactors and aseptic filling lines. Canada also contributes significantly through its expanding medical device manufacturing and governmental support for fundamental life sciences research. High operational efficiency and minimizing downtime are paramount for North American end-users, pushing manufacturers to offer comprehensive service contracts and high-durability products. The maturity of the regional infrastructure supports the seamless deployment and management of complex distributed pump networks across large manufacturing footprints.

- Europe (Germany, UK, France, Italy, Spain)

Europe represents the second-largest market, characterized by stringent industrial and environmental regulations, particularly within Germany's robust chemical and engineering sectors and the UK's advanced medical research infrastructure. Germany leads the regional market due to its strong manufacturing base and high adoption rate of sophisticated automation solutions in chemical dosing and water treatment plants. The European Medical Agency (EMA) standards mirror the demand for highly precise, traceable, and contamination-free processes in pharmaceutical manufacturing, driving sustained demand for distributed peristaltic solutions.

The region is also at the forefront of implementing Industry 4.0 principles, promoting the integration of connected, smart pumping systems across manufacturing operations. Eastern European countries are demonstrating accelerated growth as multinational pharmaceutical companies expand their manufacturing footprint into these emerging markets. Emphasis is placed on energy-efficient designs and pumps capable of handling high-viscosity fluids common in food processing and cosmetic manufacturing, alongside the critical needs of the flourishing regional biotechnology cluster.

- Asia Pacific (APAC) (China, Japan, India, South Korea)

The Asia Pacific region is projected to exhibit the highest CAGR during the forecast period, primarily due to escalating healthcare expenditure, rapid urbanization, and significant government initiatives promoting indigenous pharmaceutical manufacturing capacity. China and India are the primary growth engines, driven by massive investments in infrastructure development, including expansive water treatment facilities and the establishment of numerous new biotechnology parks. The expanding middle class in these countries is fueling demand for generic and specialty pharmaceuticals, necessitating scale-up in manufacturing capabilities using modern, efficient fluidic systems.

Japan and South Korea are mature markets within APAC, focusing heavily on R&D, advanced clinical diagnostics equipment integration, and the adoption of cutting-edge microfluidic technology where distributed low-flow pumps are essential. While initial adoption was centered on cost-effective solutions, the increasing regulatory awareness and quality mandates are now shifting the market toward high-precision, internationally compliant distributed pump modules. Local manufacturing capacity is also increasing, often through joint ventures or technology transfer agreements, aiming to serve the massive regional consumption base effectively.

- Latin America (LATAM)

The Latin American market is demonstrating steady, moderate growth, primarily driven by investments in water infrastructure upgrades and the modernization of industrial facilities in Brazil and Mexico. The chemical and mining sectors frequently utilize distributed peristaltic pumps for reagent addition and slurry handling, valuing their robustness against abrasive materials. Growth acceleration is dependent on sustained economic stability and increased foreign direct investment into the healthcare and pharmaceutical sectors, promoting the shift away from manual processes toward automated fluid handling.

- Middle East and Africa (MEA)

The MEA market, though smaller, is gaining traction, particularly in the Gulf Cooperation Council (GCC) countries, driven by large-scale desalination and wastewater treatment projects. These projects rely heavily on high-flow and robust hose pumps for precise chemical dosing. Investment in localized pharmaceutical production in countries like Saudi Arabia and the UAE, aimed at reducing import dependency, is introducing the need for high-quality distributed laboratory and production pumps. Challenges include varied operational environments and reliance on imports for advanced technology, but the strategic governmental focus on industrial diversification supports long-term market potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distributed Peristaltic Pump Market.- Watson-Marlow Fluid Technology Solutions (WMFTS)

- Cole-Parmer

- IDEX Health & Science

- Verder Group (Verderflex)

- Wanner Engineering (Hydra-Cell)

- Flowrox

- Randolph Austin

- Masterflex (Antylia Scientific)

- ProMinent GmbH

- KNF Neuberger

- Seko S.p.A.

- Reglo AS

- Welco Co., Ltd.

- Gilson Inc.

- InnovaQuartz

- Tacmina Corporation

- Graco Inc.

- Albin Pump

- Netzsch Pumps & Systems

- Yamada Corporation

Frequently Asked Questions

Analyze common user questions about the Distributed Peristaltic Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using distributed peristaltic pumps in pharmaceutical manufacturing?

The primary advantages include absolute fluid isolation, eliminating contamination risk as the fluid only contacts the sterile tubing, superior volumetric accuracy crucial for dosage, and the ability to integrate seamlessly into single-use, closed bioprocessing systems, minimizing complex cleaning validation protocols.

How does the integration of IIoT technology benefit distributed pump networks?

IIoT integration allows for real-time remote monitoring, centralized control over multiple pump modules, predictive maintenance scheduling based on operational data, and automated data logging for regulatory compliance, significantly enhancing operational efficiency and system uptime.

What is the main restraint affecting the widespread adoption of high-flow peristaltic pumps?

The main restraint is the limited pressure generation capability inherent to peristaltic design compared to conventional diaphragm or piston pumps, restricting their use in high-pressure industrial applications. Additionally, the recurring cost and finite lifespan of the disposable tubing represent a significant operational expense.

Which end-user segment is anticipated to drive the fastest growth for distributed peristaltic pumps?

The Biotechnology and Cell & Gene Therapy segment is anticipated to drive the fastest growth. This is due to the rising demand for highly precise, sterile, small-volume dispensing required for novel therapeutic manufacturing processes and the sector's rapid adoption of advanced single-use fluid handling technologies.

What factors determine the optimal tubing material choice for a distributed peristaltic pump application?

Optimal tubing material choice depends on chemical compatibility with the fluid being pumped, required operational temperature range, mechanical resistance to flexural fatigue (tube life), and regulatory requirements (e.g., FDA or USP Class VI compliance for biomedical applications).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager