Distributed Wind Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432219 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Distributed Wind Market Size

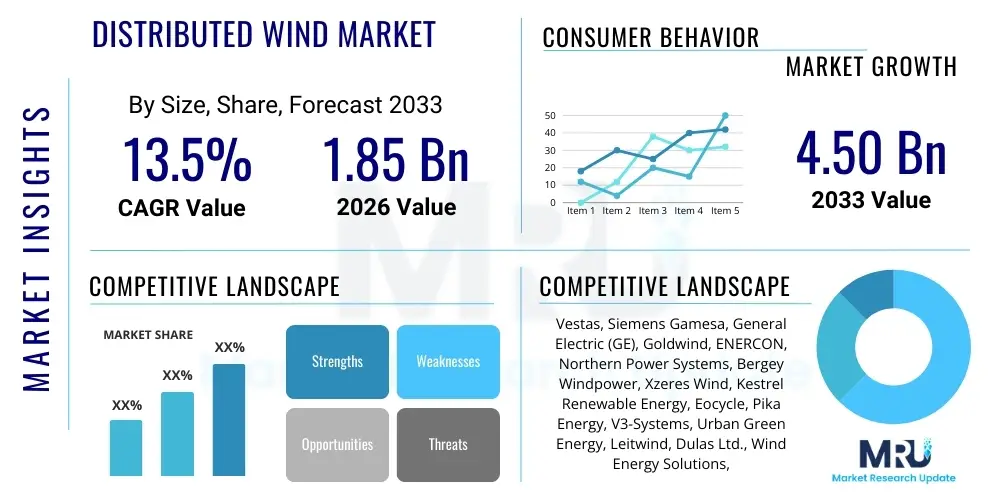

The Distributed Wind Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $4.50 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily attributed to the increasing global focus on decentralized energy generation, advancements in turbine efficiency, and supportive regulatory frameworks such as net metering and feed-in tariffs across key developed and emerging economies. The inherent advantages of distributed wind, including reduced transmission losses, enhanced energy resilience, and the ability to serve remote or localized loads, position it as a critical component in the transition towards a sustainable and resilient global energy infrastructure. Furthermore, the decline in the Levelized Cost of Energy (LCOE) for smaller wind systems, driven by manufacturing scale and improved material science, is broadening the application base, making distributed wind economically viable for commercial, agricultural, and residential users who seek energy independence and hedging against volatile utility costs.

The market expansion is not uniform across all segments; while small-scale (<100 kW) turbines historically dominated, the mid-scale (100 kW to 1 MW) sector is exhibiting accelerated growth, largely fueled by commercial and industrial (C&I) installations seeking to maximize self-consumption and achieve corporate sustainability goals. These mid-sized projects often benefit from economies of scale relative to micro-turbines, balancing localized power needs with efficient resource utilization. Regional policy differences, particularly the implementation of streamlined permitting processes and the availability of direct financial incentives or tax credits, critically influence installation rates. For instance, regions prioritizing energy security and resilience, especially those vulnerable to grid outages or relying on expensive diesel generation, are rapidly adopting distributed wind solutions, further solidifying the market’s projected valuation increase. The integration challenge with existing utility infrastructure, particularly concerning grid synchronization and voltage regulation, remains a technical hurdle, but ongoing innovations in smart inverters and battery storage are progressively mitigating these constraints, paving the way for wider deployment.

Distributed Wind Market introduction

The Distributed Wind Market encompasses the use of wind turbines deployed near the point of electricity consumption, serving residential, commercial, industrial, agricultural, or institutional loads, rather than supplying bulk power to the central grid over long distances. Distributed wind projects range significantly in size, typically from micro-turbines (less than 5 kW) used for residential energy generation up to utility-scale projects (1 MW or more) designed for community power or dedicated commercial facility supply, all characterized by their localized deployment strategy. The primary products within this market are Horizontal Axis Wind Turbines (HAWTs) and Vertical Axis Wind Turbines (VAWTs), categorized further by capacity (small, medium, large). Major applications include powering farms and rural facilities (agricultural), offsetting energy consumption in factories and campuses (industrial/commercial), and providing critical power in remote locations (off-grid power). The key benefits driving adoption are energy cost savings, enhanced grid resilience, reduced reliance on fossil fuels, and achievement of sustainability targets. These factors, combined with technological advancements in blade design, control systems, and power electronics, are propelling the global market forward, supporting the transition toward a decentralized energy paradigm that offers greater consumer control and localized economic benefits.

Distributed Wind Market Executive Summary

The Distributed Wind Market is experiencing a pivotal shift driven by strong global business trends emphasizing corporate Power Purchase Agreements (PPAs) for decentralized renewable sources and governmental commitment to net-zero targets. Business trends highlight increasing mergers and acquisitions (M&A) among turbine manufacturers and energy service companies (ESCOs) to offer integrated solutions encompassing generation, storage, and energy management software. Regionally, North America and Europe remain mature markets characterized by stable policy environments and high technological readiness, while the Asia Pacific (APAC) region, led by China and India, is emerging as the fastest-growing market due to rapid industrialization and escalating energy demand paired with government incentives for rural electrification. Segment-wise, the mid-scale capacity segment (100 kW to 1 MW) is witnessing the highest penetration growth, largely due to its optimal balance of efficiency and local applicability for the robust commercial and industrial sector. Furthermore, the increasing affordability and efficiency of hybrid distributed systems, which couple wind turbines with solar photovoltaic (PV) systems and battery energy storage systems (BESS), are fundamentally altering the competitive landscape, pushing the market towards more reliable and dispatchable localized power solutions.

AI Impact Analysis on Distributed Wind Market

User inquiries regarding AI's influence in the Distributed Wind Market frequently center on predictive maintenance effectiveness, optimization of microgrid operations, and AI's role in site assessment accuracy. Users are concerned about how AI can mitigate the inherent intermittency of wind power and improve the economic viability of smaller, less monitored systems. Key themes highlight expectations for AI to dramatically lower operational expenditures (OPEX) through early fault detection and enhanced forecasting capabilities, which are crucial for distributed assets that lack the continuous, dedicated monitoring of large utility-scale farms. There is significant interest in AI-driven algorithms for optimizing turbine pitch and yaw in real-time based on localized meteorological data, maximizing energy capture even in highly variable distributed environments. Furthermore, users anticipate AI will facilitate seamless grid integration and energy trading within distributed microgrids, allowing asset owners to dynamically respond to pricing signals and local demand, thereby realizing higher revenues and enhancing overall system reliability and security against cyber threats targeting decentralized infrastructure.

- AI-Enhanced Predictive Maintenance: Utilizes machine learning on sensor data (vibration, temperature) to predict component failures in small and medium turbines, reducing downtime and maintenance costs significantly.

- Optimized Site Assessment: AI algorithms process complex geospatial, meteorological, and topographical data faster than traditional methods, identifying optimal, high-yield locations for localized turbine deployment.

- Real-Time Performance Optimization: AI systems dynamically adjust turbine control parameters (pitch, yaw, speed) based on localized wind conditions and immediate energy demands, maximizing Annual Energy Production (AEP).

- Advanced Grid Integration and Forecasting: Machine learning improves short-term wind forecasting accuracy, enabling better scheduling and integration of distributed assets into local distribution networks, minimizing grid instability.

- Automated Energy Trading in Microgrids: AI manages energy flow and transactions within localized microgrids, optimizing buying, selling, and storing energy based on real-time price signals and demand fluctuations.

- Design and Prototyping Acceleration: Generative AI assists engineers in designing more efficient blade profiles and turbine structures optimized for urban or complex terrain environments.

DRO & Impact Forces Of Distributed Wind Market

The Distributed Wind Market is substantially influenced by a convergence of driving forces, inherent limitations, and emergent opportunities, collectively shaping its development trajectory. Key drivers include supportive government policies, such as lucrative tax credits and renewable portfolio standards (RPS) that mandate clean energy adoption, coupled with the rising costs of conventional electricity and the consumer desire for energy independence. Restraints primarily involve high initial capital investment costs for smaller turbines, complex and time-consuming local permitting processes, and the aesthetic/acoustic concerns raised by nearby communities, particularly in densely populated areas. Opportunities lie in the technological convergence with smart grid infrastructure and energy storage solutions (hybrid systems), expanding applications in rural electrification in developing nations, and the emergence of innovative financing models specifically tailored for localized renewable projects. These forces dictate the pace and geographic distribution of market growth, with regulatory environments acting as the most significant external impact force determining project viability and return on investment across different jurisdictions.

The principal impact forces can be dissected into economic, environmental, and technological factors. Economically, achieving grid parity without heavy subsidies remains critical for widespread adoption, making the continuous decline in manufacturing costs a paramount force. Environmentally, the imperative to meet international climate goals and reduce greenhouse gas emissions pushes governments and corporations toward distributed generation, positioning wind as a core compliance mechanism. Technologically, innovations in low-wind-speed turbine designs, noise reduction features, and the successful integration of decentralized assets with modern power electronics are essential for overcoming siting limitations and technical intermittency challenges. Furthermore, the societal force related to public acceptance and community engagement dictates the ease of project development; successful projects often involve local ownership or substantial community benefits. The market's future vitality depends heavily on how efficiently these positive and negative forces are managed, especially concerning regulatory harmonization and technological maturation necessary to deliver reliable and aesthetically acceptable power solutions to diverse end-users.

Segmentation Analysis

The Distributed Wind Market is extensively segmented based on criteria that reflect technological design, power output, and primary end-use application. Understanding these segments is crucial for manufacturers and investors to target specific niches where distributed wind provides the greatest value proposition. Key segmentation is primarily driven by capacity, as this dictates the turbine size, complexity, and target customer profile (e.g., residential vs. industrial). Further segmentation by axis type highlights the trade-offs between efficiency (HAWTs) and suitability for complex, low-wind environments (VAWTs). The application segmentation illustrates the diverse deployment scenarios, ranging from highly regulated on-grid systems in commercial settings to essential off-grid power solutions in remote regions, each requiring specialized product features, permitting processes, and financing structures. This multifaceted analysis allows for precise market sizing and strategic planning tailored to meet the distinct energy needs of various consumer groups worldwide.

- By Type:

- Horizontal Axis Wind Turbine (HAWT)

- Vertical Axis Wind Turbine (VAWT)

- By Capacity:

- Small (<100 kW)

- Medium (100 kW to 1 MW)

- Large (>1 MW, but distributed in nature)

- By Application:

- Residential

- Commercial

- Industrial

- Agricultural

- Off-grid Power Generation

- Community Wind Projects

- By Deployment:

- On-Grid Connected

- Off-Grid Standalone

Value Chain Analysis For Distributed Wind Market

The value chain for the Distributed Wind Market commences with upstream analysis, focusing on the procurement and manufacturing of core components. This stage involves raw material suppliers (steel, fiberglass, composites for blades, rare earth magnets for generators), specialized component manufacturers (gearboxes, towers, generators, power electronics), and the original equipment manufacturers (OEMs) responsible for final turbine assembly. Cost control and quality assurance in this upstream segment are critical, as the small-scale nature of distributed wind often precludes the immense economies of scale enjoyed by utility-scale wind production, necessitating optimized design and supply chain logistics. The complexity introduced by various turbine sizes and specialized applications (e.g., low-wind VAWTs) means manufacturers must maintain flexible production lines and robust sourcing networks to meet diverse consumer needs efficiently.

The midstream phase involves transportation, project development, and system integration. Due to the localized nature of distributed wind, logistics are less complex than those for massive utility-scale components, but site-specific engineering and foundation design become paramount. Project developers, system integrators, and engineering, procurement, and construction (EPC) firms play a crucial role in navigating local regulations, securing permits, and ensuring safe and effective installation tailored to the specific wind resource and energy requirements of the end-user. The distribution channel is often direct-to-consumer or indirect through specialized local dealers, distributors, and certified installers, particularly for residential and small commercial systems. This localized distribution network requires technical training and deep understanding of regional regulations and incentive programs to effectively market and install the technology.

Downstream analysis encompasses the operation, maintenance (O&M), and eventual decommissioning of the distributed wind assets. Given the remote and dispersed nature of these assets, reliable remote monitoring and AI-driven predictive maintenance (as discussed in the AI analysis) are essential for maximizing uptime and financial returns. Service providers offer long-term O&M contracts, ensuring the efficiency and longevity of the investment. Direct channels involve manufacturers selling and installing their products directly to large commercial or agricultural clients, often through performance contracts. Indirect channels utilize certified third-party dealers who manage sales, installation, and often initial servicing for residential and small business customers. The efficiency of the downstream O&M services significantly affects the long-term perceived value and adoption rate of distributed wind technology, especially in highly price-sensitive segments.

Distributed Wind Market Potential Customers

Potential customers for the Distributed Wind Market are highly diverse, spanning both private and public sectors seeking localized, sustainable, and cost-effective electricity generation. The primary end-users or buyers of distributed wind systems include large agricultural operations (farms, ranches) seeking to offset high energy consumption for irrigation and drying processes, where distributed wind offers reliable power independent of fluctuating utility prices. The Commercial and Industrial (C&I) sector, encompassing manufacturing plants, universities, hospitals, and large retail centers, represents a rapidly growing customer base, driven by corporate sustainability mandates and the desire for enhanced energy resilience against grid failures. For these customers, mid-to-large distributed wind turbines (100 kW to 1 MW+) offer a compelling investment, often facilitated through specialized financing mechanisms like Power Purchase Agreements (PPAs) that require minimal upfront capital expenditure. The residential segment, while traditionally dominated by solar PV, remains a viable customer for micro-turbines, especially in windy, rural, or semi-rural areas seeking complete energy self-sufficiency or participation in net metering programs.

Beyond the grid-connected segments, a critical subset of potential customers includes communities and facilities requiring reliable Off-Grid Power Generation. This encompasses remote villages in developing countries, telecommunication towers, monitoring stations, and critical infrastructure located far from centralized grid connectivity. For these users, distributed wind, often deployed in hybrid configurations with solar and battery storage, provides essential, reliable, and non-polluting electricity access. Additionally, government agencies, military bases, and critical municipal services are increasingly investing in distributed wind as a resilience measure, ensuring operational continuity during regional disasters or grid disturbances. The decision-making criteria for these varied customers heavily depend on regional wind resource availability, local permitting ease, the existence of supportive financial incentives, and the specific application's need for either cost reduction (C&I) or critical power reliability (Off-Grid, Government). Market participants must tailor their product offerings—from ultra-quiet VAWTs for residential use to robust HAWTs for agricultural settings—to effectively address the unique demands and regulatory environments faced by each potential customer group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $4.50 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vestas, Siemens Gamesa, General Electric (GE), Goldwind, ENERCON, Northern Power Systems, Bergey Windpower, Xzeres Wind, Kestrel Renewable Energy, Eocycle, Pika Energy, V3-Systems, Urban Green Energy, Leitwind, Dulas Ltd., Wind Energy Solutions, Vergnet, EWT (Emergya Wind Technologies), Endurance Wind Power, Lely Aircon |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Distributed Wind Market Key Technology Landscape

The technology landscape for the Distributed Wind Market is characterized by continuous refinement aimed at enhancing efficiency, reducing noise profiles, and enabling deployment in challenging or low-wind environments. A foundational technology remains the advancement of blade aerodynamics and materials, with modern designs utilizing lighter, more durable composites to maximize energy capture at lower wind speeds, which is crucial for localized, sub-optimal sites. Pitch control systems and direct-drive generators are increasingly common, particularly in the medium-scale segment (100 kW to 1 MW), as they reduce mechanical complexity, improve reliability, and lower maintenance requirements over the operational lifespan. The integration of advanced power electronics, including smart inverters, is a pivotal technological development, facilitating seamless grid synchronization, reactive power support, and bidirectional energy flow management, essential functions for distributed generation assets operating within increasingly complex local grids.

A significant area of focus is the development of Vertical Axis Wind Turbines (VAWTs), which, while historically less efficient than Horizontal Axis Wind Turbines (HAWTs), are undergoing rapid technological improvement. Modern VAWTs are prized for their lower noise output, reduced visual impact, and ability to capture wind effectively from any direction, making them suitable for turbulent urban environments or aesthetically sensitive locations. Technological convergence is another defining trend, with the increasing standardization of Hybrid Distributed Energy Systems. These systems combine wind generation with solar photovoltaic panels and sophisticated Battery Energy Storage Systems (BESS) managed by intelligent Energy Management Systems (EMS). This hybridization mitigates the intermittency of wind, allows for energy shifting and peak shaving, and dramatically increases the resilience and dispatchability of the localized power source, driving significant adoption in both off-grid and critical commercial applications.

Furthermore, digital technologies, particularly the Industrial Internet of Things (IIoT) and cloud-based monitoring platforms, are transforming the O&M landscape. Real-time monitoring of performance metrics, coupled with AI analytics, allows manufacturers and operators to diagnose issues remotely and perform proactive maintenance, drastically improving the cost-effectiveness of distributed assets that are geographically spread out. Nanomaterial coatings designed to reduce icing and increase durability are also emerging technologies that enhance performance in harsh climates. The overall trend is toward highly interconnected, modular, and intelligent systems that can adapt dynamically to local weather patterns, energy demand curves, and utility grid requirements, ensuring distributed wind remains competitive against other decentralized generation options while maintaining a high standard of reliability and operational efficiency across diverse installation sites globally.

Regional Highlights

Regional dynamics play a crucial role in shaping the Distributed Wind Market, driven primarily by variations in wind resources, regulatory frameworks, grid modernization efforts, and economic development levels across different continents. Each region presents a unique set of drivers and challenges, influencing the capacity mix and application focus within its boundaries. North America, particularly the United States, has historically been a strong market, propelled by federal tax incentives (like the Production Tax Credit) and state-level renewable mandates. The market here is characterized by a high concentration of mid-scale installations serving agricultural and C&I customers, emphasizing grid resiliency and energy cost savings. Europe, led by Germany, the UK, and Denmark, focuses heavily on community-owned wind projects and advanced integration technologies, benefiting from long-standing feed-in tariff mechanisms and a mature regulatory environment that supports decentralized energy planning. European technology often leads in low-noise and integrated urban turbine design due to higher population density constraints.

Asia Pacific (APAC) is currently the fastest-growing region, primarily fueled by the enormous energy demand and electrification efforts in countries like China, India, and Australia. China dominates the global small wind turbine manufacturing landscape and is rapidly expanding its domestic deployment, particularly in rural and remote areas. India’s focus on solar-wind hybrid solutions for rural connectivity and energy access is driving adoption of small, robust systems. The growth in APAC is less reliant on net metering and more on direct subsidies and large-scale government procurement programs aimed at achieving mass electrification and reducing reliance on fossil fuels in remote areas. Conversely, Latin America and the Middle East & Africa (MEA) represent emerging markets, with deployment concentrated in off-grid applications for telecommunications, mining, and remote community power. Growth here is constrained by lower levels of grid infrastructure investment and often inconsistent policy support, yet the fundamental need for reliable off-grid power creates substantial long-term market potential for durable and reliable distributed wind solutions.

- North America: High market maturity, strong federal and state incentives (e.g., net metering, tax credits in the U.S.), focus on agricultural and C&I installations (100 kW to 1 MW).

- Europe: Stable regulatory framework, emphasis on community wind projects and urban deployment; technological focus on noise reduction and advanced grid integration.

- Asia Pacific (APAC): Fastest-growing region, driven by rural electrification goals, high manufacturing capacity (China), and increasing adoption of hybrid systems in India and Australia.

- Latin America: Emerging market potential, mainly focused on off-grid applications for rural communities and remote industrial sites; growth constrained by economic instability.

- Middle East and Africa (MEA): Significant potential for off-grid deployment, particularly for remote telecommunication towers and critical infrastructure, utilizing distributed wind for energy access in resource-constrained environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distributed Wind Market.- Vestas

- Siemens Gamesa

- General Electric (GE)

- Goldwind

- ENERCON

- Northern Power Systems

- Bergey Windpower

- Xzeres Wind

- Kestrel Renewable Energy

- Eocycle

- Pika Energy

- V3-Systems

- Urban Green Energy

- Leitwind

- Dulas Ltd.

- Wind Energy Solutions

- Vergnet

- EWT (Emergya Wind Technologies)

- Endurance Wind Power

- Lely Aircon

Frequently Asked Questions

Analyze common user questions about the Distributed Wind market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Distributed Wind and how does it differ from utility-scale wind power?

Distributed wind refers to wind energy generated near the point of consumption, serving localized loads such as homes, farms, or businesses. Unlike utility-scale wind, which feeds bulk power into the central transmission grid, distributed wind minimizes transmission losses and enhances energy resilience by offering local power generation.

What is the typical size range for distributed wind turbines?

Distributed wind turbines vary significantly in size, generally categorized into small (<100 kW), medium (100 kW to 1 MW), and large (>1 MW), with the smaller end serving residential needs and the medium segment being popular for commercial, industrial, and agricultural applications.

What are the primary challenges facing the widespread adoption of distributed wind energy?

Key challenges include the high initial capital investment required for smaller projects, complex and time-consuming local permitting and siting regulations, and mitigating community concerns related to noise and visual impact, particularly in populated areas.

How is AI impacting the operational efficiency of distributed wind assets?

AI significantly enhances operational efficiency through predictive maintenance, using machine learning to analyze turbine health data and predict failures, thereby reducing unplanned downtime, lowering maintenance costs, and optimizing real-time energy capture based on local conditions.

Which geographical region is showing the fastest growth in the Distributed Wind Market?

The Asia Pacific (APAC) region, driven primarily by extensive rural electrification programs and major manufacturing bases in countries like China and India, is currently exhibiting the fastest growth rates in the Distributed Wind Market due to high energy demand and policy support.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager