Distributor And Ignition Coil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440045 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Distributor And Ignition Coil Market Size

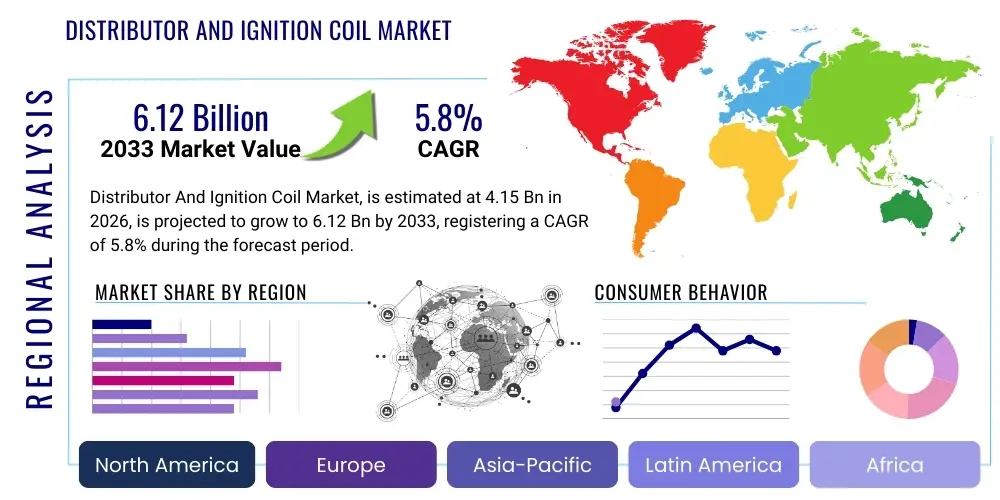

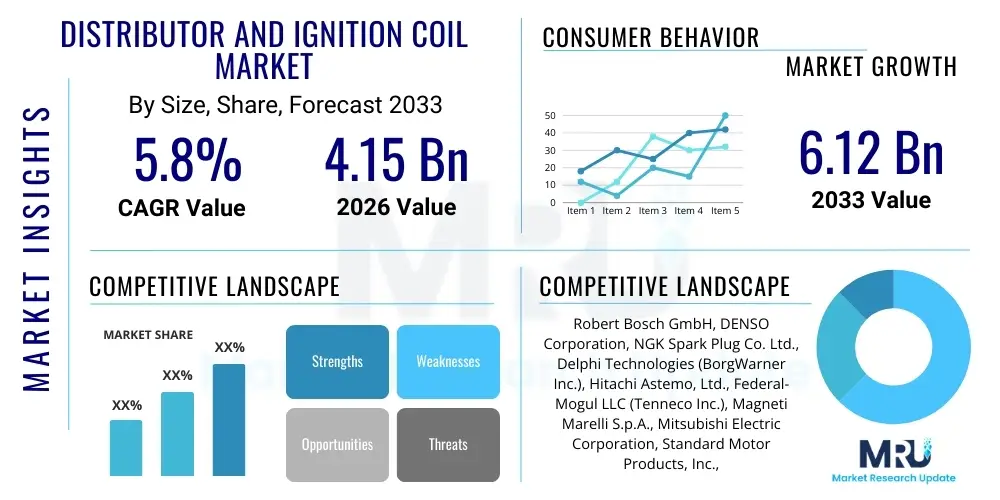

The Distributor And Ignition Coil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.15 Billion in 2026 and is projected to reach USD 6.12 Billion by the end of the forecast period in 2033.

Distributor And Ignition Coil Market introduction

The Distributor and Ignition Coil market encompasses critical components integral to the functioning of internal combustion engines across various vehicle types. Distributors are mechanical devices that precisely regulate the timing and delivery of high-voltage current from the ignition coil to individual spark plugs, ensuring efficient combustion cycles. Ignition coils, conversely, are inductive devices that transform the low voltage (typically 12V) from the vehicle’s battery into the significantly higher voltage (tens of thousands of volts) required to generate an electric spark at the spark plug gap, initiating the air-fuel mixture ignition within the engine cylinders.

These components find major applications across the automotive sector, including passenger vehicles, light and heavy commercial vehicles, and two-wheelers. They serve both the Original Equipment Manufacturer (OEM) segment for new vehicle assembly and the extensive automotive aftermarket for maintenance and repair. Primary benefits include optimized engine performance, enhanced fuel efficiency through precise ignition timing, reduced exhaust emissions by ensuring complete combustion, and reliable vehicle starting under various operating conditions. The continuous evolution of engine technologies, coupled with the enduring presence of conventional gasoline and hybrid vehicles, underscores the persistent importance of these parts.

Key driving factors for the Distributor and Ignition Coil market are multifaceted. Consistent global production of new vehicles, though with a gradual shift towards electrification, creates sustained OEM demand. Furthermore, the increasing average age of the global vehicle fleet necessitates a robust aftermarket for replacement parts, as these components are subject to wear and tear. Stringent global emission regulations push manufacturers to develop more efficient and reliable ignition systems that contribute to cleaner combustion, further stimulating market activity. The inherent demand for reliable, high-performance engine systems in conventional powertrains continues to anchor the market's growth trajectory, despite the long-term prospects of EV adoption.

Distributor And Ignition Coil Market Executive Summary

The Distributor and Ignition Coil Market demonstrates resilient performance, driven by ongoing vehicle production and substantial global aftermarket demand. Business trends indicate a strategic pivot by manufacturers towards advanced ignition coil technologies, such as coil-on-plug systems, while simultaneously maintaining production of traditional distributors for older vehicle models. The market is witnessing consolidation and partnerships aimed at enhancing technological capabilities and expanding geographical reach, particularly in high-growth regions. Supply chain resilience and raw material cost management are prominent business considerations, alongside a focus on product durability and performance to meet evolving consumer expectations.

Regional trends highlight the Asia Pacific (APAC) as a dominant force, fueled by significant automotive manufacturing bases in countries like China, India, and Japan, coupled with a vast and expanding vehicle parc that drives both OEM and aftermarket sales. Europe and North America maintain stable market positions, with growth primarily stemming from the aftermarket segment, driven by an aging vehicle fleet and stringent quality requirements. Emerging markets in Latin America and the Middle East & Africa are showing promising growth trajectories as automotive penetration increases and infrastructure develops, leading to a rising demand for vehicle maintenance components.

Segmentation trends indicate a gradual decline in the market share of traditional distributors as modern engines increasingly adopt distributor-less ignition systems. Conversely, the ignition coil segment, particularly advanced types like coil-on-plug and pencil coils, is experiencing robust expansion due to their superior performance, reliability, and integration capabilities with sophisticated engine control units. The aftermarket segment continues to represent a significant revenue stream, often surpassing the OEM segment in terms of volume, driven by routine replacements and repairs. This executive summary underscores a market characterized by technological transition, regional variances in growth, and a persistent demand for essential engine components.

AI Impact Analysis on Distributor And Ignition Coil Market

The integration of Artificial Intelligence (AI) into the Distributor and Ignition Coil market is poised to revolutionize several aspects, addressing core challenges and unlocking new efficiencies. Common user questions often revolve around how AI can enhance the reliability and lifespan of these critical components, streamline manufacturing processes, and optimize their distribution. Users expect AI to move beyond traditional diagnostics, offering predictive insights that anticipate component failure before it occurs, thereby reducing unexpected breakdowns and costly repairs. This shift from reactive to proactive maintenance is a key theme, driven by the desire for greater vehicle uptime and lower operational costs for fleet managers and individual owners.

A significant area of user concern and expectation pertains to quality control and manufacturing precision. Users anticipate AI-powered vision systems and machine learning algorithms to detect micro-defects during production that are imperceptible to the human eye, ensuring higher product quality and consistency. Furthermore, the optimization of supply chains through AI is highly sought after, with users hoping for more accurate demand forecasting, reduced inventory holding costs, and faster, more efficient delivery of parts to meet dynamic market needs. The potential for AI to personalize product recommendations based on specific vehicle models, driving conditions, and maintenance histories also represents a valuable future application.

Ultimately, users envision AI as a tool to make the entire lifecycle of distributors and ignition coils more intelligent, efficient, and cost-effective. From the design phase, where AI can simulate material performance and thermal stress, to end-of-life recycling recommendations, the overarching expectation is for AI to contribute to more sustainable, high-performance, and reliable ignition systems. The ability of AI to analyze vast datasets from engine performance and field failures will be instrumental in driving continuous improvement and innovation in this established automotive component sector, supporting better diagnostic tools and enhancing product development cycles.

- Enhanced predictive maintenance algorithms for ignition systems, forecasting coil failure rates.

- Optimized manufacturing processes through AI-driven quality inspection and anomaly detection.

- AI-powered supply chain management for superior demand forecasting and inventory optimization.

- Development of smart ignition coils with integrated sensors for real-time performance monitoring.

- Personalized diagnostic recommendations for workshops and end-users based on AI analysis.

- Improved product design and material selection through AI simulations for durability.

- Automated testing and validation procedures for ignition components, enhancing accuracy.

DRO & Impact Forces Of Distributor And Ignition Coil Market

The Distributor and Ignition Coil market operates under the influence of several critical Drivers, Restraints, Opportunities, and broader Impact Forces that collectively define its trajectory. Among the primary drivers is the expansive global vehicle parc, which continues to grow, albeit at a moderated pace. This large existing fleet of gasoline-powered and hybrid vehicles consistently generates significant demand for both original equipment during new vehicle manufacturing and, more substantially, for aftermarket replacement parts as vehicles age and components naturally wear out. Furthermore, increasingly stringent global emission regulations compel manufacturers to innovate and develop more efficient and precise ignition systems that contribute to cleaner combustion and lower pollutant output, thereby stimulating research and development and new product introduction.

Despite these drivers, significant restraints temper the market's growth potential. The most prominent long-term restraint is the accelerating global shift towards electric vehicles (EVs), which do not utilize distributors or ignition coils. This transition poses an existential threat to the OEM segment over time, requiring traditional manufacturers to diversify or adapt. The inherent complexity in manufacturing advanced ignition coils, requiring precise winding techniques and integration of sophisticated electronics, also presents a barrier to entry and challenges for cost efficiency. Moreover, the pervasive issue of counterfeit products in the aftermarket undermines genuine manufacturers' revenues and reputation, while also posing safety and performance risks to consumers.

Opportunities within the market largely stem from technological innovation and geographical expansion. The development of advanced ignition technologies, such as multi-spark ignition systems, direct injection-compatible coils, and integrated smart coils with diagnostic capabilities, presents avenues for growth by offering superior performance and efficiency. Expanding into emerging markets, particularly in Asia Pacific and Latin America, where automotive penetration is still growing, provides significant potential for both OEM and aftermarket sales. The adoption of premium materials for enhanced durability and thermal management in ignition coils further creates opportunities for differentiation and value addition. Broader impact forces, including volatile raw material prices for copper and plastics, evolving consumer preferences for vehicle performance and reliability, and macro-economic factors influencing automotive sales, continuously shape the competitive landscape and strategic decisions of market participants, demanding adaptability and continuous innovation to sustain relevance.

Segmentation Analysis

The Distributor and Ignition Coil market is rigorously segmented to provide a granular understanding of its complex structure and diverse operational dynamics. This systematic classification enables market participants and analysts to dissect market trends, identify lucrative niches, and formulate targeted strategies based on specific product characteristics, vehicle applications, and consumption patterns. The foundational segmentation divides the market by Product Type, distinguishing between traditional distributors—whose market share is steadily diminishing due to technological obsolescence in newer vehicle models—and various advanced ignition coil designs, which represent the growth frontier.

Under the Ignition Coils sub-segment, further differentiation exists, encompassing Pencil Coils, Block Coils, Coil-on-Plug (COP) systems, and Waste Spark Coils, each catering to different engine architectures and performance requirements. Coil-on-Plug systems, for instance, are gaining significant traction due to their enhanced precision and elimination of distributor-related losses. The market is also segmented by Vehicle Type, reflecting the varied demands across Passenger Cars, Commercial Vehicles (further broken down into Light Commercial Vehicles (LCV) and Heavy Commercial Vehicles (HCV)), and Two-Wheelers. Each vehicle category possesses unique operational stresses and lifespan expectations for ignition components, influencing design and material choices.

A crucial segmentation aspect is By End-Use, which delineates between the Original Equipment Manufacturer (OEM) channel and the Aftermarket. The OEM segment comprises sales directly to automotive manufacturers for integration into new vehicles on the assembly line, driven by new vehicle production volumes. Conversely, the Aftermarket segment involves the sale of replacement components for repair and maintenance of the existing vehicle fleet. This segment is characterized by a high volume of transactions, driven by the aging vehicle parc, component wear and tear, and routine servicing needs. Understanding these segmentations is vital for forecasting demand, optimizing production, and tailoring marketing efforts to specific customer groups within the Distributor and Ignition Coil market.

- By Product Type:

- Distributors

- Ignition Coils

- Pencil Coils

- Block Coils

- Coil-on-Plug (COP)

- Waste Spark Coils

- Direct Ignition Systems

- Multi-Spark Ignition Coils

- Others

- By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Two-Wheelers

- Specialty Vehicles

- By End-Use:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Sales Channel:

- Online Retail

- Offline Retail (Automotive Parts Stores, Workshops)

- Distributor Network

Value Chain Analysis For Distributor And Ignition Coil Market

The value chain for the Distributor and Ignition Coil market is a complex, interconnected network of activities that transforms raw materials into finished products and delivers them to the end-user. This chain typically commences with upstream analysis, which focuses on the procurement of essential raw materials. Key inputs include high-grade copper wire for windings, various polymers and resins for housing and insulation, specialized steel for laminations and core materials, and advanced ceramic or epoxy compounds for robust encapsulation. These raw material suppliers form the foundation of the value chain, and their pricing, quality, and supply reliability directly impact the manufacturing costs and final product characteristics of ignition components. Strategic sourcing and long-term supplier relationships are critical at this stage.

Following raw material acquisition, the manufacturing and assembly phase takes precedence. This involves precision engineering processes such as automated coil winding, core assembly, plastic injection molding for housing, and the integration of electronic components for modern ignition coils. Rigorous quality control checks, including electrical testing, thermal cycling, and vibration analysis, are performed at various stages to ensure product reliability and performance, meeting stringent automotive industry standards. Manufacturers often invest heavily in research and development to innovate in materials, design, and production techniques, aiming for enhanced durability, efficiency, and compactness of their products, particularly for advanced ignition coil technologies.

The downstream analysis primarily encompasses the intricate distribution channels responsible for bringing finished distributors and ignition coils to market. These channels can be broadly categorized as direct and indirect. Direct distribution involves manufacturers supplying components directly to Original Equipment Manufacturers (OEMs) for integration into new vehicle assembly lines. This often entails long-term contracts and just-in-time delivery systems. Indirect distribution, which is particularly vital for the aftermarket, relies on a vast network comprising master distributors, regional wholesalers, automotive parts retailers (both brick-and-mortar and online), and independent repair workshops. The efficiency of this extensive network is crucial for ensuring widespread availability, timely replacements, and effective market penetration for both brand-new components and aftermarket solutions. Logistics, inventory management, and channel partner relationships are key drivers of success in this segment of the value chain.

Distributor And Ignition Coil Market Potential Customers

The Distributor and Ignition Coil market caters to a diverse array of potential customers, each driven by distinct purchasing motivations and operational requirements within the broader automotive industry. The foremost customer segment consists of Automotive Original Equipment Manufacturers (OEMs). These are global vehicle manufacturers who integrate distributors and ignition coils into new vehicles during the assembly process. Their demand is highly dependent on new vehicle production volumes, specific engine designs, and compliance with performance and emission standards. OEMs prioritize high-volume supply, consistent quality, reliability, and often seek customized solutions and long-term supply partnerships to ensure seamless integration into their production lines.

Another critically important customer group includes aftermarket parts distributors and wholesalers. These entities procure ignition coils and, to a lesser extent, distributors in bulk from manufacturers to supply a vast network of automotive parts retailers, independent repair shops, franchised workshops, and service centers. Their primary role is to ensure the timely availability of replacement parts for the maintenance and repair of the existing vehicle fleet. This segment often demands a wide range of product compatibility, competitive pricing, and efficient logistics, as their business relies on meeting the varied needs of thousands of repair facilities and end-users with aging vehicles.

Independent garages, authorized service stations, and automotive repair shops also represent significant direct or indirect customers. These professionals purchase ignition components for vehicle servicing, diagnostics, and repairs on behalf of their clientele. Their buying decisions are influenced by product quality, brand reputation, ease of installation, and technical support. Lastly, individual vehicle owners who undertake do-it-yourself (DIY) repairs or wish to upgrade their vehicle's ignition system constitute a substantial segment of end-user buyers. They typically acquire parts through retail automotive parts stores, online marketplaces, or specialty performance shops, often prioritizing a balance between cost-effectiveness, brand trust, and ease of access to compatible components for their personal vehicles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.15 Billion |

| Market Forecast in 2033 | USD 6.12 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, DENSO Corporation, NGK Spark Plug Co. Ltd., Delphi Technologies (BorgWarner Inc.), Hitachi Astemo, Ltd., Federal-Mogul LLC (Tenneco Inc.), Magneti Marelli S.p.A., Mitsubishi Electric Corporation, Standard Motor Products, Inc., Wells Vehicle Electronics, Valeo S.A., ZF Friedrichshafen AG, Hella GmbH & Co. KGaA, BorgWarner Inc., Continental AG, Prestolite Electric, Inc., BBT Automotive Parts GmbH, ACDelco (General Motors Company), Autolite (FRAM Group), Facet S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Distributor And Ignition Coil Market Key Technology Landscape

The Distributor and Ignition Coil market is characterized by a rapidly evolving technological landscape, driven by the continuous imperative to enhance engine performance, improve fuel efficiency, and minimize exhaust emissions in internal combustion and hybrid powertrains. While traditional distributors have largely been superseded by more sophisticated electronic ignition systems in modern vehicle designs, significant innovation continues to define the ignition coil segment. A pivotal technological shift involves the widespread adoption of Coil-on-Plug (COP) systems. In COP configurations, each spark plug is equipped with its own dedicated ignition coil, which eliminates the need for distributor caps, rotor arms, and spark plug wires, thereby reducing potential points of failure and enabling more precise spark timing and energy delivery directly to the combustion chamber. This direct approach translates into superior combustion efficiency and enhanced reliability, becoming a standard in contemporary engine architectures.

Further advancements within the ignition coil domain include the development of Pencil Coils, a compact and slender form of COP coils designed to fit into narrow cylinder head spaces, offering excellent thermal management and precise spark delivery. Multi-spark ignition systems represent another crucial innovation, capable of generating multiple sparks per combustion cycle, particularly at lower RPMs. This technology significantly improves fuel atomization and combustion completeness, leading to better fuel economy, reduced cold-start emissions, and enhanced engine responsiveness. Direct Ignition Systems (DIS), while conceptually similar to COP, refer to integrated ignition modules that control multiple coils, often mounted on the engine, further streamlining the ignition process and reducing electromagnetic interference. These systems exemplify the trend towards miniaturization and integration of electronics within ignition components.

The technological landscape is also shaped by material science breakthroughs and advanced manufacturing techniques. Utilizing premium materials such as high-temperature resistant plastics, advanced magnet wire, and specialized core laminations contributes to lighter, more durable, and thermally efficient coil designs capable of withstanding extreme engine operating conditions. Sophisticated winding techniques ensure optimal inductance and energy storage. Moreover, the integration of advanced electronics and microprocessors within ignition coils allows for real-time monitoring, diagnostics, and communication with the engine control unit (ECU). This enables adaptive ignition timing and energy output based on various engine parameters, optimizing performance, extending component lifespan through predictive analytics, and facilitating advanced diagnostic capabilities. The ongoing convergence of mechanical engineering, electronics, and software is fundamentally transforming the capabilities and roles of ignition components in modern vehicles.

Regional Highlights

- Asia Pacific (APAC): This region stands as the dominant market for Distributor and Ignition Coils, primarily driven by its robust and rapidly expanding automotive manufacturing base, especially in countries such as China, India, Japan, and South Korea. These nations account for a significant portion of global vehicle production, fueling substantial OEM demand. Furthermore, the immense and continuously growing vehicle parc across APAC necessitates a vast and dynamic aftermarket for replacement parts, making it a key consumption hub. The increasing adoption of advanced ignition technologies in new vehicle models also contributes to the region's strong market position and technological advancement.

- Europe: The European market is characterized by stringent emission regulations and a strong emphasis on engineering excellence and premium vehicle segments. While new vehicle production contributes to OEM demand, the aftermarket sector is a significant and stable revenue generator, supported by a mature vehicle parc and a consumer base that prioritizes quality and durability in replacement parts. Innovation in highly efficient and low-emission ignition systems is a consistent trend here, driven by regulatory pressures and technological leadership in automotive engineering.

- North America: North America represents a substantial and stable market, heavily influenced by its large, aging vehicle fleet and a strong culture of vehicle maintenance and repair. The aftermarket for ignition coils and, to a lesser extent, distributors is particularly robust, providing significant opportunities for manufacturers and distributors. While OEM demand is consistent, the replacement market is the primary growth driver. There is a continuous focus on performance upgrades and reliable components, particularly in the premium and heavy-duty vehicle segments.

- Latin America: This region exhibits an emerging automotive manufacturing base and a steadily growing vehicle parc, leading to an increasing demand for ignition components across both OEM and aftermarket segments. The market dynamics are influenced by economic stability, infrastructure development, and consumer purchasing power. As vehicle ownership expands, the need for both initial installations and subsequent replacements for maintenance and repair is on a clear upward trajectory, making it a region of growing strategic importance.

- Middle East and Africa (MEA): The MEA region is witnessing a gradual expansion of its automotive sector, particularly in parts of the Middle East, driven by increasing vehicle sales, urbanization, and infrastructure development projects. This growth translates into a rising demand for ignition coils and distributors, supported by an expanding vehicle fleet and the necessity for durable and reliable engine components capable of performing in diverse and often challenging environmental conditions. Imports play a significant role in meeting local demand, and the aftermarket is steadily developing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distributor And Ignition Coil Market, highlighting their strategic initiatives, product portfolios, and market presence. These companies are at the forefront of innovation, consistently introducing advanced technologies to meet evolving automotive industry demands for efficiency, performance, and emission compliance. Their competitive strategies often involve significant investments in research and development, strategic partnerships, and geographical expansion to capitalize on emerging market opportunities. The market landscape is characterized by a mix of large, diversified automotive suppliers and specialized ignition system manufacturers, all vying for market share through product differentiation and service excellence.

- Robert Bosch GmbH

- DENSO Corporation

- NGK Spark Plug Co. Ltd.

- Delphi Technologies (BorgWarner Inc.)

- Hitachi Astemo, Ltd.

- Federal-Mogul LLC (Tenneco Inc.)

- Magneti Marelli S.p.A.

- Mitsubishi Electric Corporation

- Standard Motor Products, Inc.

- Wells Vehicle Electronics

- Valeo S.A.

- ZF Friedrichshafen AG

- Hella GmbH & Co. KGaA

- BorgWarner Inc.

- Continental AG

- Prestolite Electric, Inc.

- BBT Automotive Parts GmbH

- ACDelco (General Motors Company)

- Autolite (FRAM Group)

- Facet S.p.A.

Frequently Asked Questions

Analyze common user questions about the Distributor And Ignition Coil market and generate a concise list of summarized FAQs reflecting key topics and concerns.

What is the primary function of an ignition coil in a vehicle's engine?

An ignition coil is a fundamental component in internal combustion engines, tasked with converting the low voltage (typically 12 volts) from the vehicle's battery into a significantly higher voltage, ranging from 15,000 to 45,000 volts. This high-voltage current is then discharged across the spark plug gap, creating an electrical spark that ignites the air-fuel mixture within the engine cylinders, initiating the combustion process necessary for engine operation. Its precise function ensures efficient and reliable engine starting and continuous running.

How does a traditional distributor contribute to an automotive ignition system?

In older internal combustion engines, a traditional distributor serves as a vital mechanical and electrical device responsible for two main functions: timing the ignition spark and distributing the high-voltage current from a single ignition coil to the correct spark plug at the precise moment. It achieves this through a rotating rotor arm within a distributor cap, ensuring that each cylinder receives its spark in the proper firing order for synchronized and efficient combustion. While largely replaced by electronic systems, its historical role was critical for engine synchronization.

What are the key advantages of modern coil-on-plug (COP) ignition systems over conventional designs?

Modern coil-on-plug (COP) ignition systems offer several significant advantages over conventional designs that utilize a single coil and distributor. Firstly, COP systems dedicate an individual ignition coil to each spark plug, eliminating the need for a distributor and long spark plug wires, thereby reducing energy loss and electromagnetic interference. This direct approach allows for more precise spark timing, stronger spark delivery, and enhanced reliability. Furthermore, COP systems facilitate more effective engine diagnostics, as individual coil performance can be monitored, leading to improved fuel efficiency, lower emissions, and superior engine performance and responsiveness.

What impact is the global transition towards electric vehicles (EVs) expected to have on the Distributor and Ignition Coil market?

The accelerated global transition towards electric vehicles (EVs) represents a significant long-term restraint for the Distributor and Ignition Coil market. Since EVs operate solely on electric powertrains and do not utilize internal combustion engines, they have no need for these ignition components. Consequently, the OEM segment for distributors and ignition coils is projected to experience a gradual decline as EV production scales up. However, the vast existing global fleet of internal combustion engine and hybrid vehicles will ensure a robust and sustained demand for replacement parts in the aftermarket for several decades, though manufacturers will increasingly need to diversify their product portfolios.

What are the leading technological innovations currently shaping the future of ignition coils?

The future of ignition coils is being shaped by several leading technological innovations focused on enhancing efficiency, performance, and integration. Key advancements include the development of multi-spark ignition systems, which generate multiple sparks per combustion cycle for improved fuel combustion and reduced emissions. There's also a trend towards smart ignition coils with integrated sensors and microelectronics, enabling real-time diagnostics, adaptive spark control, and communication with the engine control unit (ECU). Additionally, innovations in materials science are leading to lighter, more durable, and thermally efficient coil designs, crucial for meeting stringent environmental regulations and optimizing engine operation under diverse conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager