District Heating Pipe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432572 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

District Heating Pipe Market Size

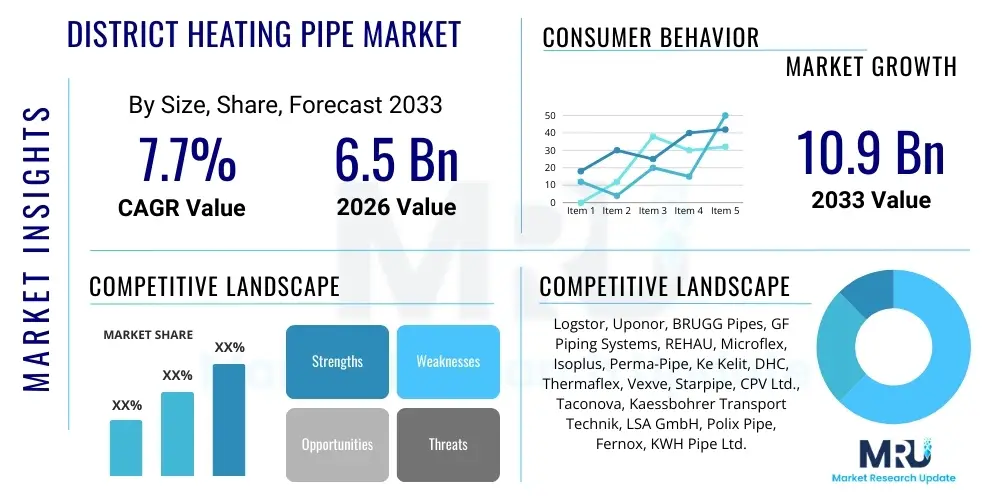

The District Heating Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.7% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.9 Billion by the end of the forecast period in 2033.

District Heating Pipe Market introduction

The District Heating Pipe Market is central to modern sustainable urban infrastructure, providing reliable and efficient transmission of heat (and increasingly cooling) from centralized sources, such as combined heat and power (CHP) plants, geothermal sources, or waste heat recovery systems, to residential, commercial, and industrial consumers. These specialized pipe systems are engineered to minimize heat loss during transmission, often featuring highly efficient pre-insulated structures utilizing materials like polyurethane (PUR) foam or mineral wool, encased in protective outer jackets, typically made of high-density polyethylene (HDPE). The primary function is optimizing energy efficiency and reducing dependence on localized, carbon-intensive heating solutions.

The key applications of district heating pipe networks include heating large-scale residential complexes, supplying process heat for industrial zones, and supporting commercial buildings like hospitals and universities. Benefits of these systems are manifold, encompassing significant reductions in carbon emissions, improved air quality in urban centers, and enhanced energy security through fuel flexibility. Furthermore, district heating minimizes local boiler maintenance and replacements for individual users, offering long-term economic stability and operational simplicity. These networks are crucial infrastructure assets in countries committed to aggressive decarbonization targets.

Driving factors for this market expansion are predominantly governmental mandates and supportive regulatory frameworks promoting sustainable energy transitions, particularly in Europe and parts of Asia. The adoption of 4th Generation District Heating (4GDH) systems, which operate at lower temperatures and demand flexible, high-performance pipe materials, further fuels innovation. Urbanization trends, coupled with the necessity of replacing aging infrastructure built during the mid-20th century, create sustained demand for advanced, corrosion-resistant, and low-loss piping solutions capable of a 50-year service life.

District Heating Pipe Market Executive Summary

The District Heating Pipe Market demonstrates robust growth driven primarily by structural investments in green infrastructure across mature European markets and rapid urbanization in Asia Pacific. Business trends indicate a strong shift towards flexible, polymer-based pre-insulated pipes, which offer easier installation and lower total cost of ownership compared to traditional steel piping, particularly favored in tertiary networks. Strategic acquisitions and vertical integration among key players are evident, aiming to control the supply chain of insulation materials and advanced polymer casings. Furthermore, suppliers are increasingly focusing on offering complete system solutions, including sophisticated monitoring and leak detection technologies, moving beyond mere component supply to comprehensive infrastructure partnerships, reflecting the complexity of modern network management.

Regionally, Europe maintains market dominance, propelled by the European Green Deal and significant funding allocated through recovery programs designed to upgrade existing district heating infrastructure to 4GDH standards. Asia Pacific, particularly China and South Korea, exhibits the highest growth rate, fueled by aggressive expansion of large-scale coal-to-gas conversion programs and mandatory central heating provision in northern urban areas. North America, while having a smaller existing footprint, is seeing renewed interest driven by campus-scale energy systems and decarbonization efforts in major metropolitan areas, leading to specialized demand for durable, large-diameter pipes suitable for high-pressure industrial applications.

Segment trends highlight the pre-insulated pipe segment as the dominant market category due to its mandated use for heat loss prevention in high-efficiency systems. Within insulation, polyurethane (PUR) remains the material of choice for optimal thermal performance, although vacuum insulation technology is emerging for niche applications requiring extremely low heat loss over long distances. Application-wise, the residential segment accounts for the largest share, constantly expanding through new construction mandates and retrofit programs, while the industrial segment demands pipes designed for higher temperature and pressure tolerances. The ongoing technological evolution emphasizes integrated monitoring systems and smart materials for predictive maintenance.

AI Impact Analysis on District Heating Pipe Market

Common user questions regarding AI's impact on the District Heating Pipe Market frequently revolve around optimizing network efficiency, predicting maintenance failures, and automating complex system control. Users are keen to understand how AI algorithms can analyze vast datasets—including temperature readings, flow rates, pressure fluctuations, and external environmental factors—to preemptively identify leakages or component degradation in underground networks, a historically expensive and time-consuming task. Key themes emerging are the feasibility and cost-effectiveness of implementing AI-powered predictive maintenance models, the integration of smart sensors into traditional pipe structures, and the potential for AI to optimize heat generation and distribution based on real-time consumer demand forecasting, minimizing energy waste and lowering operational costs (OPEX) for network operators. The market expects AI to transition network management from reactive repairs to highly proactive, data-driven optimization.

- AI enables highly accurate predictive maintenance by analyzing sensor data for anomalies, reducing costly unplanned shutdowns.

- Optimized pump scheduling and flow control using machine learning algorithms significantly lower electricity consumption within the network.

- AI-driven demand forecasting improves generation efficiency by precisely matching heat production to anticipated consumer needs.

- Integration of smart sensors into new pipe installations facilitates continuous, real-time health monitoring of insulation integrity and fluid dynamics.

- Generative AI supports infrastructure planning by simulating optimal pipe routing and sizing for new district heating expansions.

DRO & Impact Forces Of District Heating Pipe Market

The District Heating Pipe Market is significantly influenced by a confluence of accelerating governmental support and inherent infrastructure challenges. Key drivers include stringent decarbonization goals, especially in the European Union, mandating shifts towards centralized, low-carbon heating sources, necessitating widespread network expansion and rehabilitation. Furthermore, the inherent longevity and energy efficiency benefits of pre-insulated pipe systems offer compelling operational savings over decentralized methods. However, major restraints hinder rapid growth, notably the exceptionally high capital expenditure (CAPEX) required for initial network installation and expansion, coupled with lengthy and complex regulatory approval processes required for trenching and urban deployment. The market is also heavily impacted by volatility in raw material prices, particularly steel and polyurethane components, which directly influence product cost and project profitability.

Opportunities abound in developing next-generation district heating systems, specifically 4GDH and 5GDH networks, which utilize lower temperatures and non-fossil fuel sources, requiring advanced, flexible polymer pipes suitable for both heating and cooling applications. Retrofitting existing networks with smart monitoring technologies provides a substantial addressable market, improving network integrity and reducing non-revenue heat loss. Furthermore, geographic expansion into emerging markets in Eastern Europe and Central Asia, which lack extensive modern heating infrastructure but possess strong urbanization rates, presents significant long-term growth avenues for manufacturers specializing in cost-effective, durable piping solutions designed for harsh climates.

The primary impact forces shaping the market are regulatory pressure and the technological shift towards low-temperature operation. Regulatory forces, such as carbon pricing mechanisms and mandated renewable energy quotas, exert constant upward pressure on demand for efficient distribution networks. Simultaneously, the imperative to maintain competitive heat prices for end-users necessitates a focus on low-loss materials and optimized network design. These forces compel manufacturers to continuously innovate in material science, focusing on enhanced thermal performance (reducing lambda values) and pipe durability to meet the 50-year service life expectation while keeping installation time and costs minimal.

Segmentation Analysis

The District Heating Pipe Market is comprehensively segmented based on Type, focusing on material and insulation configuration; Insulation Material, assessing thermal efficiency and cost; Application, reflecting the end-user environment; and Network Type, detailing the specific function within the heat distribution grid. This detailed segmentation allows stakeholders to analyze market dynamics driven by differing technical specifications and regulatory requirements across regions. For instance, high-temperature, steel-based pipes dominate primary network segments connected to CHP plants, while flexible, polymer-based, pre-insulated pipes are increasingly utilized in the secondary and tertiary connections serving individual residential buildings due to their installation speed and resistance to corrosion, particularly relevant for lower operating temperatures associated with modern networks.

The dominance of pre-insulated pipes (P-I) is indisputable, characterized by a carrier pipe, insulation layer, and outer jacket. These systems are further diversified into flexible P-I pipes, which offer easier handling and installation for smaller diameters, and rigid P-I pipes, preferred for large-diameter primary trunk lines requiring superior structural integrity. The choice of insulation material—predominantly polyurethane foam due to its low thermal conductivity—is critical to overall system efficiency. Ongoing innovation focuses on improving the thermal aging characteristics and water absorption resistance of these materials to ensure long-term performance integrity in challenging underground environments.

- Type: Pre-insulated Pipe, Steel Pipe, Polymer Pipe, Flexible Pipe, Single Pipe, Twin Pipe

- Insulation Material: Polyurethane Foam (PUR), Mineral Wool, Foam Glass, Vacuum Insulation Panel (VIP)

- Application: Residential, Commercial (Office Buildings, Hospitals, Educational Institutions), Industrial (Process Heating)

- Network Type: Primary Network (Main Transmission Lines), Secondary Network (Distribution Lines), Tertiary Network (Service Lines)

- Diameter: Small Bore (DN 20 - DN 100), Medium Bore (DN 125 - DN 300), Large Bore (Above DN 300)

Value Chain Analysis For District Heating Pipe Market

The value chain for the District Heating Pipe Market begins with upstream activities focused on raw material sourcing and preparation. This phase involves acquiring high-grade materials: steel (carbon steel or stainless steel) for the carrier pipes, high-density polyethylene (HDPE) or other polymers for the protective jacket and flexible pipes, and specialized chemicals (polyols and isocyanates) for the polyurethane foam insulation. Volatility in the commodity markets for these materials, particularly steel and petrochemical derivatives, significantly impacts the profitability and stability of the middle-stream manufacturing segment. Manufacturers are heavily invested in optimizing the foaming process and ensuring precise concentricity between the inner pipe and outer casing to meet stringent heat loss standards.

The distribution channel is multifaceted, relying heavily on specialized third-party logistics providers due to the size and weight of the pipe sections, often delivered directly to construction sites. Direct sales channels are common for large, strategic infrastructure projects where manufacturers engage directly with municipal operators or engineering, procurement, and construction (EPC) firms, offering tailored solutions, technical consultancy, and installation supervision. Indirect channels, involving regional distributors and wholesalers, cater primarily to smaller-scale residential connections and maintenance projects, ensuring local stock availability and faster response times for minor infrastructure repairs and extensions. The technical complexity of installation often requires certified installers, making training and certification a crucial part of the distribution service offering.

Downstream activities involve the EPC firms responsible for the trenching, laying, welding, and jointing of the pipe networks, culminating in commissioning and long-term operation by municipal utilities or private energy service companies (ESCOs). The integrity of the downstream installation is paramount, as failure points, often located at joints or bends, lead to significant heat loss and costly remediation. Therefore, sophisticated jointing technology, combined with integrated leak detection wires, constitutes a crucial component of the end product. The efficiency of the entire network is ultimately reliant on the precise execution of the installation phase, cementing the vital link between manufacturing quality and site execution standards.

District Heating Pipe Market Potential Customers

The primary end-users and buyers in the District Heating Pipe Market are diverse organizations with a vested interest in efficient and reliable heat distribution infrastructure. These include municipal utility companies, both public and private, which own and operate the vast majority of existing district heating networks and are responsible for maintenance, modernization, and expansion projects. Large-scale residential property developers and real estate conglomerates form another critical customer base, particularly in regions where new building codes mandate connectivity to district heating systems or require highly efficient, centralized energy solutions for dense urban housing projects.

Industrial users, especially those in the food and beverage, chemical, and automotive sectors, represent a specialized customer segment requiring pipes capable of handling specific high-pressure or high-temperature steam or process water. Universities, hospitals, and military bases—often referred to as campus-style entities—also constitute significant buyers, typically managing their own localized, large-scale district energy systems that require robust and highly reliable piping infrastructure to maintain continuous operations. These customers prioritize long lifespan, minimal maintenance requirements, and proven reliability over the lowest initial cost, reflecting the high costs associated with system downtime.

Furthermore, EPC (Engineering, Procurement, and Construction) firms act as indirect buyers, making procurement decisions on behalf of the ultimate network owner (the utility or municipality). The purchasing decisions are highly technical, driven by compliance with European standards (such as EN 253 for pre-insulated bonded pipe systems) and local regulatory requirements concerning pressure ratings and material specifications. Therefore, manufacturers must maintain strong relationships with specification engineers and consultants within these firms to ensure their products are included in tender documents and project designs for new and refurbishment projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Growth Rate | 7.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Logstor, Uponor, BRUGG Pipes, GF Piping Systems, REHAU, Microflex, Isoplus, Perma-Pipe, Ke Kelit, DHC, Thermaflex, Vexve, Starpipe, CPV Ltd., Taconova, Kaessbohrer Transport Technik, LSA GmbH, Polix Pipe, Fernox, KWH Pipe Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

District Heating Pipe Market Key Technology Landscape

The technology landscape of the District Heating Pipe Market is rapidly evolving, driven by the shift towards lower operating temperatures and the necessity of minimizing energy losses across expansive networks. The core technology remains the pre-insulated pipe system, but advancements focus heavily on material science. Current innovations include the development of enhanced vacuum insulation panel (VIP) technology for specialized high-performance applications where space is limited or extremely low heat loss is critical. Furthermore, the use of advanced polymers, such as high-performance cross-linked polyethylene (PEX-a) or polybutylene (PB), is becoming standard for flexible piping, offering increased temperature resistance and significantly easier handling during urban installations compared to rigid steel pipes.

A crucial technological development is the integration of smart network monitoring systems. Modern pipes often come equipped with integrated leak detection wires (alarm wires) embedded within the insulation layer, capable of continuously monitoring the moisture content and insulation integrity. When coupled with advanced control systems and AI analytics, this allows utilities to pinpoint potential failure points with high precision, dramatically reducing detection time and repair costs. Furthermore, the push for 4th Generation District Heating (4GDH) requires piping designed for operating temperatures often below 70°C, which necessitates excellent corrosion resistance and flexibility, encouraging the adoption of non-metallic carrier pipes and high-quality, closed-cell PUR foams with improved insulation factors (lower lambda values).

Future technological advancements are focused on creating multi-functional pipe systems. This includes twin-pipe systems that house both flow and return lines within a single jacket, simplifying trenching and installation logistics. Research is also concentrating on developing standardized, easily connectable joints and fittings that can be installed rapidly and reliably without compromising the system's thermal envelope or structural integrity. Furthermore, techniques such as trenchless installation (directional drilling) are gaining traction, demanding pipe systems that are mechanically robust yet flexible enough to be pulled through existing conduits, thereby minimizing disruption in densely populated urban environments and reducing project timelines significantly.

Regional Highlights

The geographic analysis of the District Heating Pipe Market reveals distinct development patterns and varying technological preferences driven by regional climate, regulatory environment, and historical infrastructure development.

- Europe: Dominated by historical reliance on district heating, particularly in the Nordic countries (Sweden, Denmark, Finland) and Central/Eastern Europe. The market here is highly mature and characterized by stringent energy efficiency standards (EN 253), driving demand for high-performance, rigid, pre-insulated steel pipes for primary networks and flexible polymer pipes for secondary connections. The EU's decarbonization goals ensure sustained growth through mandatory network upgrades (4GDH transition) and expansion into new urban areas.

- Asia Pacific (APAC): Represents the fastest-growing region, led by massive infrastructure projects in China and South Korea, aiming to replace individual coal boilers with centralized heating systems to combat air pollution. Demand is high for medium-to-large bore pipes. While costs are a major consideration, the push for large-scale, centrally planned networks is driving the adoption of high-volume manufacturing techniques.

- North America: The market is smaller but highly specialized, focused primarily on campus energy systems (universities, hospitals) and central business districts (CBDs). High thermal performance and durability are critical due to stringent regulatory demands and high labor costs for repairs. There is growing interest in utilizing waste heat and geothermal sources, increasing demand for customized, robust pipe solutions.

- Middle East & Africa (MEA): Emerging market for district cooling (DC) pipes, particularly in the Gulf Cooperation Council (GCC) countries. Pipes must be highly corrosion-resistant and engineered to handle the transmission of chilled water (district cooling) efficiently, demanding specialized insulation materials and protective coatings suitable for underground deployment in high ambient temperature and aggressive soil environments.

- Latin America: The smallest regional market, showing fragmented growth in specific urban centers or industrial clusters where localized heating or cooling requirements exist. Market development is slow, heavily reliant on national governmental prioritization of energy infrastructure funding and foreign investment in energy efficiency projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the District Heating Pipe Market.- Logstor (Kingspan Group)

- Uponor Corporation

- BRUGG Pipes System

- GF Piping Systems (Georg Fischer)

- REHAU AG + Co

- Microflex B.V.

- Isoplus Fernwärmetechnik GmbH

- Perma-Pipe International Holdings, Inc.

- Ke Kelit Kunststoffwerk GmbH

- DHC (District Heating Company)

- Thermaflex (Nitto Denko)

- Vexve Oy

- Starpipe A/S

- CPV Ltd.

- Taconova Group AG

- Kaessbohrer Transport Technik

- LSA GmbH

- Polix Pipe Systems

- Fernox (MacDermid Enthone Industrial Solutions)

- KWH Pipe Ltd.

Frequently Asked Questions

Analyze common user questions about the District Heating Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of flexible district heating pipes?

Flexible district heating pipes, typically made of high-performance polymers, are primarily driven by ease and speed of installation, especially in dense urban areas or small-diameter secondary/tertiary networks. Their coiled delivery minimizes the number of required joints and reduces labor costs significantly, lowering the overall capital expenditure for network expansion.

How do 4th Generation District Heating (4GDH) systems impact pipe technology requirements?

4GDH systems operate at significantly lower temperatures (below 70°C) to facilitate integration with renewable heat sources and reduce heat loss. This shift demands highly flexible, corrosion-resistant pipe materials (often non-metallic like PEX or PB) and superior insulation (PUR foam) to maintain efficiency at lower temperature differentials, while also supporting potential district cooling applications.

What is the average expected lifespan for pre-insulated district heating pipes?

High-quality pre-insulated pipe systems conforming to European standards (like EN 253) are engineered and tested to have a minimum service life of 30 to 50 years when installed correctly. Longevity depends critically on the quality of the insulation bond, the integrity of the outer casing, and the use of effective monitoring systems to prevent corrosion or moisture ingress.

What are the key differences between primary and secondary district heating networks regarding pipe material?

Primary networks (main transmission lines from the source) typically use rigid, large-diameter pre-insulated steel pipes due to their superior ability to handle high pressure, high flow rates, and high temperatures (often over 90°C). Secondary networks (distribution to consumer blocks) increasingly utilize flexible, medium-to-small bore polymer pipes because they are easier to maneuver and install, and operate at lower temperature parameters.

How does the volatility of raw material costs affect the District Heating Pipe market?

The cost structure of district heating pipes is highly sensitive to the price volatility of key raw materials, including steel (for carrier pipes) and petrochemical derivatives (for the HDPE casing and PUR insulation foam). Fluctuations in these commodity prices directly impact manufacturing costs, leading to pressure on margins and complexity in long-term project budgeting for utilities and EPC firms.

Which insulation material offers the best thermal performance for district heating pipes?

Polyurethane (PUR) foam remains the industry standard, offering excellent thermal insulation properties (low lambda value) combined with cost-effectiveness and good mechanical strength. For specialized, high-demand applications, Vacuum Insulation Panels (VIPs) offer superior, ultra-low heat loss performance, though at a significantly higher cost and with different installation requirements.

What role does integrated leak detection play in modern district heating networks?

Integrated leak detection systems, utilizing alarm wires embedded within the pipe insulation, are crucial for asset integrity management. They continuously monitor the moisture level, allowing operators to detect insulation damage or water ingress immediately. This reduces heat loss, prevents costly secondary damage, and enables rapid repair, shifting maintenance from reactive to proactive.

Is the market moving towards district cooling applications, and how does this affect pipe specifications?

Yes, especially in warmer climates and urban centers requiring centralized air conditioning (District Cooling or DC). DC pipes must handle chilled water (typically 5°C to 12°C) efficiently. This requires piping and insulation that prevent condensation (dew point risk) and subsequent corrosion, often demanding specialized vapor barriers and slightly different insulation densities compared to traditional heating pipes.

What is the competitive landscape like for the District Heating Pipe Market?

The market is moderately consolidated, dominated by established European players with strong technological expertise (e.g., Logstor, Uponor, Isoplus). Competition centers on technical performance (thermal efficiency), durability, compliance with European standards (EN 253), and the ability to offer comprehensive system solutions, including sophisticated fittings and monitoring technology.

How important are sustainable manufacturing practices in the procurement decisions for district heating pipes?

Sustainability is increasingly critical. Procurement decisions, particularly in EU member states and by ESG-focused utilities, prioritize manufacturers who demonstrate low-carbon production processes, utilize recycled materials, and offer products with verified low life-cycle environmental impacts, aligning with broader climate neutrality goals.

What are the primary restraints hindering rapid market growth outside of established European markets?

The primary restraints include the extremely high upfront capital investment required for laying extensive underground networks, a lack of supportive regulatory frameworks mandating district heating connection, and competition from well-established, decentralized heating technologies like gas boilers and heat pumps in regions like North America and parts of Asia.

Which segment, rigid steel or flexible polymer, is expected to grow faster?

While rigid steel pipes maintain dominance in large-bore primary networks, the flexible polymer pipe segment is projected to exhibit faster growth. This acceleration is driven by the rapid expansion of 4GDH networks (which favor lower temperatures and flexible materials), and the polymer pipes’ cost-efficiency and speed advantages for secondary and tertiary connections.

How is urbanization influencing the demand for district heating pipe infrastructure?

Rapid urbanization increases population density, which makes centralized energy systems like district heating economically viable and environmentally necessary. Dense urban environments provide the high heat density required to justify the massive CAPEX, thus directly stimulating demand for new pipe infrastructure and system upgrades.

What technological challenge does jointing and fitting present in pre-insulated pipe installation?

The major challenge is creating a joint that maintains the mechanical strength, pressure integrity, and thermal efficiency (insulation continuity) of the main pipe sections. Joint failures are common points of heat loss or ingress, necessitating continuous innovation in shrink-sleeve technology, pre-fabricated joint casings, and reliable field foaming methods.

What role does government policy play in driving the District Heating Pipe Market?

Government policy is the single most critical driver. Mandates supporting renewable energy targets, financial subsidies for network modernization (e.g., EU funding), carbon taxes on fossil fuels, and regulatory requirements for energy efficiency compel utilities and developers to invest heavily in expanding and upgrading efficient district heating networks.

How are manufacturers addressing the high cost of trenching and installation in urban areas?

Manufacturers are addressing installation costs through innovation in product design, focusing on light-weight, flexible pipes (polymer) that reduce material handling complexity, and twin-pipe designs that halve the trenching requirements. Furthermore, supporting trenchless installation methods (directional drilling) by providing suitable pipe materials minimizes disruption and labor expenses.

What is the difference between bonded and unbonded pre-insulated pipe systems?

In bonded systems, the PUR insulation foam is chemically adhered to both the inner carrier pipe and the outer casing, forming a monolithic structure that transmits expansion stresses. Unbonded systems feature insulation that allows the carrier pipe to move freely inside the casing, often utilized for high-temperature applications requiring substantial thermal expansion compensation.

Why is the replacement of aging infrastructure a key market opportunity?

Much of the existing district heating infrastructure in Central and Eastern Europe is several decades old, suffering from high heat losses (often exceeding 20%) and frequent failures. The need to modernize these networks with modern, high-efficiency, low-loss pre-insulated pipes represents a massive and non-discretionary replacement market opportunity for manufacturers.

How is the industrial application segment distinct in its piping requirements?

The industrial segment requires pipe systems capable of handling significantly higher pressures and temperatures, often involving steam or superheated water. This necessitates specialized materials, typically robust steel alloys, and high-performance mineral wool or foam glass insulation, along with advanced welding and stress compensation engineering.

What potential impact could bio-based insulation materials have on the market?

The introduction of bio-based polyols for polyurethane foam insulation offers a path to reducing the carbon footprint associated with pipe manufacturing. While currently niche, if performance parity and cost-effectiveness are achieved, bio-based insulation could become a major differentiator, aligning with the sustainability mandates driving the entire district heating sector.

What are the most common failure points in a district heating pipe network?

The most common failure points are located at joints, bends, and transition sections (where materials change), often due to inadequate insulation coverage, poor welding, or insufficient sealing against moisture. Mechanical damage during installation or external corrosion of the outer casing over time can also lead to insulation failure and eventual pipe damage.

How do external market forces, such as volatile natural gas prices, influence pipe demand?

High and volatile natural gas prices increase the operational cost of decentralized heating systems. This economic pressure strengthens the business case for high-efficiency district heating networks, accelerating investment in pipe infrastructure expansion as a long-term strategy for energy security and stable heat pricing.

What is the significance of the "lambda value" in district heating pipes?

The lambda value (thermal conductivity coefficient) measures the heat-insulating capability of the material. A lower lambda value signifies better insulation performance. Manufacturers continuously strive to achieve the lowest possible lambda values in their PUR foam to ensure minimal heat loss during transmission, which is crucial for overall network efficiency and regulatory compliance.

How does the adoption of geothermal energy sources affect pipe material selection?

Geothermal sources typically involve high mineralization and varying pressures. Pipes used in these applications must demonstrate exceptional chemical resistance and durability. While standard steel pipes are often used, specialized coatings or corrosion-resistant materials may be required to handle the aggressive nature of the geothermal fluid over a long operational lifespan.

What considerations are important when designing pipes for high-pressure, long-distance transmission?

For long-distance, high-pressure transmission lines (often primary networks), considerations include high-grade carbon steel pipe material, comprehensive stress analysis for thermal expansion, robust anchors and guides, and mineral wool or highly dense PUR insulation suitable for sustained high temperatures and pressures to ensure structural integrity and safety.

Why is the quality of the HDPE outer jacket essential for pipe longevity?

The High-Density Polyethylene (HDPE) outer jacket serves as the primary protection against external environmental factors. Its quality—including thickness, UV resistance (prior to burial), and resistance to mechanical impact and groundwater ingress—is paramount. Any breach in the jacket compromises the insulation, leading to system failure and costly repairs, thus determining the overall service life.

What role do consulting engineers play in the procurement process?

Consulting engineers are critical influencers who define project specifications, select approved materials, and ensure adherence to local and international standards (like EN 253). Manufacturers must engage with these consultants early in the project cycle to position their products effectively and provide necessary technical documentation and compliance certification.

How is digitalization impacting the District Heating Pipe manufacturing process?

Digitalization impacts manufacturing through enhanced quality control (e.g., automated concentricity checking during foaming), optimizing inventory and scheduling (Supply Chain 4.0), and integrating sensors directly into the pipes during production. This ensures higher product quality, traceability, and readiness for smart network integration once installed.

What are the key differences in pipe requirements between urban and rural district heating networks?

Urban networks demand high pressure and large diameter capacity due to density, focusing on rigid steel pipes for trunk lines, and prioritizing fast installation methods. Rural networks, characterized by longer distances and lower heat density, prioritize exceptional insulation (to minimize heat loss over distance) and often utilize flexible pipes for easier trenching across varied topography.

Which region currently represents the largest market share in terms of value?

Europe holds the largest market share in the District Heating Pipe Market value. This dominance is attributed to the presence of large, mature networks in Nordic countries, Germany, and Eastern Europe, supported by consistent government investment and regulatory pressure to maintain high-efficiency standards.

Why is PEX (Cross-linked polyethylene) commonly used for flexible pipes?

PEX is favored for flexible pipes due to its excellent combination of high temperature resistance, flexibility, and exceptional resistance to corrosion and scaling. Its memory characteristics allow the pipes to be coiled for transport and installation while maintaining structural integrity, making it ideal for small-to-medium bore network segments.

What regulations specifically govern the quality and performance of district heating pipes in Europe?

The primary governing regulation is EN 253 (for pre-insulated bonded pipe systems for district heating), which sets rigorous standards for thermal performance, mechanical strength, material quality (carrier pipe, foam, casing), and testing protocols, ensuring uniformity and reliability across the European market.

How do manufacturers ensure the thermal efficiency of joints matches the pipe sections?

Manufacturers utilize standardized jointing kits, often involving pre-fabricated casings and high-quality polyurethane field-foaming systems. Strict installation protocols, sometimes involving specialized heating or pressure injection methods, are employed to ensure the insulation fills the joint cavity uniformly and bonds effectively, minimizing thermal bridges at connection points.

What is the concept of a 'Twin Pipe' system and its advantage?

A Twin Pipe system integrates both the supply and return carrier pipes within a single outer protective jacket. The primary advantage is efficiency in installation: it reduces excavation and trenching costs by nearly half compared to laying two separate single pipes, streamlining logistics and reducing urban disruption, particularly valuable for smaller diameters.

How is the move towards renewable energy sources (e.g., large-scale heat pumps) impacting pipe design?

Renewable sources typically supply heat at lower temperatures than traditional CHP plants. This strengthens the need for flexible polymer pipes and ultra-low-loss insulation (low lambda values) to maintain economically viable efficiency, as lower operating temperatures require a greater focus on minimizing minor heat losses over the entire network length.

What are the challenges associated with using mineral wool insulation in district heating pipes?

Mineral wool (used in high-temperature steel pipes) challenges include its susceptibility to moisture absorption if the outer casing is breached, which severely degrades its thermal performance. It also requires more complex installation procedures and is generally utilized only when temperature requirements exceed the operational limits of polyurethane foam.

How important is localization and supply chain management for pipe manufacturers?

Localization is crucial due to the immense size and logistical difficulty of transporting large-bore pipe segments across borders. Manufacturers often establish regional production facilities closer to major project sites to reduce transport costs, minimize lead times, and optimize supply chain resilience against geopolitical and material disruptions.

What is the function of the diffusion barrier in some flexible district heating pipes?

The diffusion barrier, typically an EVOH (ethylene vinyl alcohol) layer, is incorporated in polymer pipes to prevent the ingress of oxygen into the heating water. Oxygen ingress can lead to corrosion within the overall system components, such as boilers, pumps, and metal fittings, thereby extending the lifespan and reducing maintenance requirements of the entire network.

In which regions is District Cooling pipe technology seeing the most significant expansion?

District Cooling pipe technology is experiencing the most significant expansion in the Middle East (GCC nations, particularly UAE and Saudi Arabia), where high ambient temperatures necessitate large-scale, centralized cooling infrastructure for commercial and residential developments in metropolitan centers like Dubai and Doha.

How does the total cost of ownership (TCO) influence purchasing decisions for DH pipes?

TCO is more critical than initial purchase price. Utilities prioritize pipes with a low TCO, factoring in the high CAPEX of installation, but heavily weighting low lifetime operational expenditure (OPEX) driven by minimal heat loss, low maintenance requirements, and proven 50-year longevity, making high-quality, efficient pipes the preferred investment.

What is the role of digital twins in the future maintenance of district heating pipe networks?

Digital twins—virtual replicas of the physical network—will integrate sensor data, flow models, and AI predictive analytics. They enable operators to simulate the impact of operational changes, identify system inefficiencies in real-time, and accurately schedule maintenance or expansion work without physical inspection, maximizing system uptime and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager