Ditcher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434464 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Ditcher Market Size

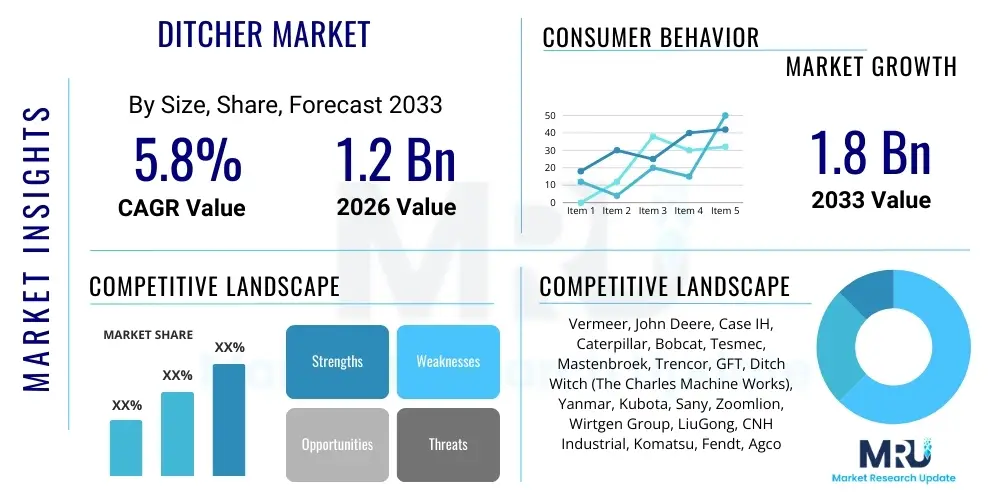

The Ditcher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.8 Billion by the end of the forecast period in 2033. This growth trajectory is significantly influenced by global infrastructure development projects, particularly in rural electrification, water management systems, and the relentless expansion of broadband and 5G network infrastructure worldwide. The increasing adoption of precision agriculture techniques also necessitates efficient subsurface drainage and irrigation ditch creation, further bolstering demand across key agricultural economies.

Ditcher Market introduction

The Ditcher Market encompasses specialized heavy machinery designed for excavating trenches, drainage channels, or irrigation ditches efficiently and precisely. These machines vary widely in type, ranging from highly maneuverable chain ditchers and compact micro-trenchers used primarily for fiber optic installation, to powerful wheel ditchers and rock saws deployed in rugged terrain or large-scale civil engineering projects. Major applications span critical sectors including agriculture, where they are essential for optimizing soil moisture and preventing flooding; construction, facilitating the laying of utility lines (water, sewage, gas, electricity); and increasingly, telecommunications, driven by the immediate need for high-speed fiber deployment globally. The primary benefits of utilizing modern ditching equipment include significant reductions in operational time and labor costs compared to traditional excavation methods, coupled with superior accuracy and minimal environmental disruption, enhancing project efficiency and sustainability.

Ditcher Market Executive Summary

The Ditcher Market is experiencing robust growth driven by foundational global macroeconomic shifts, particularly substantial governmental investments in sustainable infrastructure and smart cities initiatives. Business trends indicate a strong move toward automation and higher horsepower machinery capable of operating in diverse soil conditions, optimizing trench depth and width automatically, thereby maximizing project profitability for contractors. Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid urbanization, extensive agricultural modernization programs, and unprecedented telecommunication infrastructure expansion in countries like India and China. Segment trends reveal the Chain Ditcher segment maintaining market dominance due to its versatility and cost-effectiveness, while the micro-trencher segment is exhibiting the fastest growth due to the global fiber-to-the-home (FTTH) rollout. Key manufacturers are focusing heavily on developing equipment with enhanced telematics, predictive maintenance features, and modular designs to cater to specialized market needs, ensuring operational continuity and adherence to increasingly stringent safety and environmental regulations.

AI Impact Analysis on Ditcher Market

User queries regarding AI in the Ditcher Market primarily revolve around questions concerning operational autonomy, predictive maintenance efficiency, and the integration of advanced machine vision for obstacle avoidance and trench mapping. Users are keen to understand how AI algorithms can optimize digging speeds relative to real-time soil resistance (dynamic load management) and how satellite imagery combined with machine learning can improve pre-trenching route planning and utility location accuracy, minimizing costly strikes and delays. The summarized expectation is that AI will transition ditching operations from human-supervised mechanical tasks to fully autonomous, data-driven processes, thereby dramatically reducing operational variability and increasing the speed and safety of infrastructure deployment, especially in high-risk or remote environments. This integration of AI is expected to significantly enhance the market value proposition by delivering consistent, high-precision results while minimizing wear and tear on expensive equipment.

- AI-Powered Telematics: Optimizing fleet management, scheduling, and fuel consumption based on real-time operational metrics and historical performance data.

- Predictive Maintenance: Utilizing machine learning models to analyze vibration, temperature, and pressure data to forecast component failure, drastically reducing unplanned downtime.

- Autonomous Trenching Systems: Implementing sophisticated control algorithms for automatic depth and slope control, ensuring precise specifications without constant operator intervention.

- Route Optimization and Obstacle Detection: Using AI combined with LiDAR and GPS to map optimal trench paths and instantaneously identify buried utilities or hazardous rocks.

- Soil Condition Adaptation: Dynamic adjustment of cutting speed, engine RPM, and torque based on immediate analysis of soil type and density, maximizing efficiency.

DRO & Impact Forces Of Ditcher Market

The Ditcher Market is fundamentally driven by critical infrastructure needs (Drivers), while facing challenges related to initial investment and environmental concerns (Restraints), opening up vast potential through technology integration and emerging markets (Opportunity), all moderated by stringent governmental policies and economic cycles (Impact Forces). Major drivers include the necessity for extensive water management infrastructure globally, especially in developing regions susceptible to flooding, alongside the aggressive expansion of high-speed internet networks demanding subterranean fiber placement. Restraints primarily involve the high capital expenditure required for acquiring specialized, high-capacity machinery, coupled with increasing regulatory complexity regarding soil disturbance and disposal. However, the opportunity for market expansion lies in precision agriculture adoption, particularly in optimizing subsurface drainage systems, and the growth of micro-trenching technologies tailored for dense urban environments, offering minimal pavement disruption. These forces collectively shape the competitive landscape, dictating investment strategies toward automation and specialized attachments capable of navigating complex project environments efficiently and sustainably.

Segmentation Analysis

The Ditcher Market segmentation provides a granular view of specific product capabilities and their targeted application areas, which is essential for strategic market positioning and product development. Segmentation by Type reveals the technological hierarchy, separating heavy-duty machinery like Wheel Ditchers, designed for continuous, high-volume excavation in clear fields, from sophisticated, smaller-scale Micro-Trenchers, optimized for discreet installation in urban areas. Segmentation by Application highlights the varied demands placed on the equipment; the Agricultural segment prioritizes consistency and depth for drainage, whereas the Telecommunication segment requires high precision and speed over long linear distances. Analyzing the market through these segments allows manufacturers to tailor marketing efforts and R&D towards meeting the distinct performance benchmarks required by different end-user industries globally.

The Power output segmentation is crucial as it directly correlates with the capacity of the machine to handle hard ground or deep trenches; lower horsepower models (Under 100 HP) typically serve agricultural and lighter utility tasks, while higher horsepower units (Above 200 HP) are indispensable in heavy construction, oil and gas pipeline installations, and rock excavation. This distinction dictates procurement decisions based on the anticipated operational environment and project size, influencing both pricing strategies and competitive positioning among manufacturers. Understanding the interplay between Type, Application, and Power segments is key to accurately forecasting demand shifts and capitalizing on emerging niche markets, such as specialized rock trenching equipment for solar farm installations.

Furthermore, geographic segmentation provides insight into regional infrastructure priorities; for example, North America and Europe show a high demand for micro-trenchers due to dense utility networks and high labor costs, while APAC demonstrates substantial demand across all types, driven by large-scale agricultural and utility projects. This comprehensive segmentation analysis serves as the foundation for strategic resource allocation, ensuring that product inventory and distribution networks are optimized to meet localized market requirements and maximize revenue potential across diverse global economies.

- By Type:

- Wheel Ditchers

- Chain Ditchers

- Micro-Trenchers (Mini/Compact Ditchers)

- Rock Saws/Rock Trenchers

- By Application:

- Agriculture (Drainage and Irrigation)

- Construction and Civil Engineering

- Oil and Gas Pipeline Installation

- Telecommunication and Utility (Fiber Optic, Water, Electric Lines)

- By Power:

- Under 100 HP

- 100 HP to 200 HP

- Above 200 HP

Value Chain Analysis For Ditcher Market

The Value Chain for the Ditcher Market begins with upstream activities involving the sourcing of high-grade raw materials, particularly specialized steels, heavy-duty engine components, hydraulic systems, and increasingly, complex electronic control units and sensors. Key upstream suppliers include major engine manufacturers (e.g., Cummins, Caterpillar) and hydraulic system specialists. Efficiency at this stage is critical, as the quality and availability of these components directly impact the durability and performance of the final machine. Manufacturers maintain robust relationships with these suppliers to ensure reliability, reduce lead times, and leverage economies of scale in component procurement, mitigating supply chain vulnerabilities inherent in global heavy equipment production.

Midstream activities focus on core manufacturing, assembly, and integration. This involves sophisticated processes such as precision welding, heat treatment of cutting elements (chain and teeth), engine integration, and the installation of complex electronic control systems and telematics hardware. Manufacturers invest heavily in automated assembly lines and quality control processes to ensure compliance with strict industry standards and safety regulations. Following manufacturing, the distribution channel plays a vital role. Distribution is typically managed through a blend of direct sales (especially for large, high-value contracts with government entities or major infrastructure firms) and indirect distribution via an extensive network of authorized dealers and rental companies who provide local sales, service, and parts support.

Downstream analysis involves the sales, after-sales service, and end-user deployment. Dealers offer essential services such as equipment financing, operator training, and crucial maintenance support, enhancing the overall customer value proposition. The indirect channel through dealers is particularly important in localized markets, providing proximity to agricultural and small to medium construction enterprises. Rental companies also form a significant downstream component, offering flexibility to contractors who wish to avoid large capital investments. The efficiency of the downstream chain, particularly the availability of specialized replacement parts and qualified service technicians, significantly influences customer loyalty and machine lifecycle cost, which are paramount factors in heavy equipment purchasing decisions.

Ditcher Market Potential Customers

The primary segment of potential customers for the Ditcher Market includes large-scale agricultural enterprises and farming cooperatives requiring sophisticated subsurface drainage systems (tiling) and irrigation channels to maximize crop yield and manage water resources effectively. These customers seek machines that offer high-precision GPS integration, consistent depth control, and robust performance across large tracts of land. The adoption of smart agriculture practices, aimed at sustainable land use and efficiency, is consistently driving demand from this key end-user group, particularly in North America, Western Europe, and highly productive agricultural regions in APAC.

The second major customer segment encompasses civil engineering and large construction contractors who undertake substantial infrastructure projects, such as highway construction, airport expansions, and major utility deployments (water mains, sewage systems). These buyers prioritize high-horsepower, durable ditchers and rock saws capable of handling challenging terrains, including rocky or frozen ground. They require equipment that can maintain high productivity rates and adhere to strict project timelines, often favoring manufacturers who provide comprehensive support packages, robust warranty schemes, and rapid parts delivery to minimize any on-site operational delays.

Finally, telecommunication companies and specialized utility installation contractors constitute a rapidly expanding customer base, particularly demanding micro-trenching solutions for installing fiber optic cables in densely populated urban and suburban areas. These customers require compact, maneuverable equipment that minimizes disruption to public areas and street pavement, emphasizing speed and efficiency in shallow trenching applications. Additionally, governmental agencies and municipalities involved in public works and environmental management (e.g., flood control, wetland creation) represent significant, albeit cyclical, buyers who procure or lease ditching equipment for ongoing maintenance and emergency infrastructure projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vermeer, John Deere, Case IH, Caterpillar, Bobcat, Tesmec, Mastenbroek, Trencor, GFT, Ditch Witch (The Charles Machine Works), Yanmar, Kubota, Sany, Zoomlion, Wirtgen Group, LiuGong, CNH Industrial, Komatsu, Fendt, Agco |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ditcher Market Key Technology Landscape

The technological landscape of the Ditcher Market is rapidly evolving, moving far beyond basic mechanical digging towards integrated digital and hydraulic systems designed for high precision and efficiency. A core advancement is the widespread adoption of Global Navigation Satellite System (GNSS) integration, utilizing technologies like RTK (Real-Time Kinematic) GPS to provide centimeter-level accuracy for trench depth and line placement. This precise guidance is crucial for agricultural tiling and telecommunication infrastructure installation, minimizing errors and reducing material waste. Furthermore, manufacturers are implementing advanced hydrostatic transmissions and intelligent hydraulic systems that dynamically manage power distribution based on ground conditions, thereby maximizing fuel efficiency and overall digging performance across varied soil compositions.

Another significant technological shift involves the integration of telematics and Internet of Things (IoT) capabilities into new ditching machinery. These systems enable remote monitoring of operational parameters such as engine load, fuel consumption, machine location, and diagnostic alerts in real time. This data is critical for fleet management, allowing large contractors to optimize asset utilization and schedule preventive maintenance based on actual usage patterns rather than fixed time intervals. The collection and analysis of this operational data also feed into the development of next-generation autonomous and semi-autonomous digging functions, reducing the reliance on highly skilled operators and standardizing trench quality across diverse project sites.

Finally, the focus on sustainable and resilient design has led to innovations in cutting element materials and dust/debris management systems. Advanced carbide-tipped teeth and chains are being developed to withstand extreme abrasion, significantly extending service intervals when working in rock and highly compact soil. Simultaneously, micro-trenching technologies incorporate vacuum excavation and debris collection systems to minimize environmental impact and streamline clean-up in urban areas. These technologies not only improve performance and longevity but also address growing environmental regulations regarding construction site waste and airborne particulate matter, thereby maintaining compliance and community acceptance.

Regional Highlights

The regional analysis of the Ditcher Market reveals distinct growth drivers and technological adoption rates influenced by local economic priorities and infrastructure needs. North America currently holds a significant market share, driven primarily by extensive agricultural operations demanding advanced subsurface drainage and the ongoing rollout of 5G and fiber-to-the-home networks across the US and Canada. The demand here is skewed towards high-horsepower equipment for large farms and specialized micro-trenchers for dense urban fiber deployment. High labor costs in the region accelerate the adoption of automated and GPS-guided ditching solutions to maximize operational efficiency and productivity.

Europe represents a mature yet steady market characterized by stringent environmental regulations and a focus on renewable energy infrastructure (e.g., district heating pipes, smart grid deployment). Western European countries show a strong preference for compact, precise machinery that minimizes public disruption, leading to high demand for micro-trenchers. Eastern Europe, conversely, is experiencing rapid growth in both agriculture modernization and utility construction, driving demand for robust chain and wheel ditchers. Regulatory alignment under the EU framework promotes the adoption of standardized, high-safety machinery across the continent, favoring manufacturers who comply with the latest emissions and noise standards.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, propelled by unparalleled urbanization, government-led infrastructure investment, and the vast scale of agricultural modernization, particularly in China, India, and Southeast Asia. The demand spans the entire range of ditching equipment, from large wheel ditchers for massive irrigation projects to compact models for burgeoning utility line installation in rapidly expanding urban centers. Economic development and increasing accessibility to financing are enabling the adoption of advanced machinery, replacing older, less efficient methods. Latin America and the Middle East & Africa (MEA) offer substantial long-term growth potential, fueled by oil and gas pipeline projects (MEA) and significant government investment in improving connectivity and water management (LATAM and MEA).

- North America (US, Canada): Mature market driven by high-tech agriculture and telecom infrastructure expansion; focuses on high automation and advanced GPS integration.

- Europe (Germany, France, UK): Emphasis on environmental compliance, compact machinery, and sophisticated utility installation for smart grids and district heating; strong regulatory impact.

- Asia Pacific (China, India, Australia): Fastest growth due to massive agricultural modernization, urbanization, and large-scale public infrastructure projects; high volume demand across all machine types.

- Latin America (Brazil, Mexico): Emerging growth driven by investments in water management, resource extraction, and rural connectivity initiatives, seeking cost-effective, durable equipment.

- Middle East & Africa (Saudi Arabia, UAE, South Africa): Growth concentrated in energy infrastructure (pipelines), massive construction projects, and desert agriculture requiring specialized, high-power ditchers and rock trenchers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ditcher Market.- Vermeer

- John Deere

- Case IH

- Caterpillar

- Bobcat (A Doosan Company)

- Tesmec

- Mastenbroek

- Trencor

- GFT (Global Fleet Trailer)

- Ditch Witch (The Charles Machine Works, A Subsidairy of The Toro Company)

- Yanmar

- Kubota

- Sany Heavy Industry

- Zoomlion Heavy Industry Science and Technology

- Wirtgen Group

- LiuGong Machinery Co., Ltd.

- CNH Industrial N.V. (Including Case Construction Equipment)

- Komatsu Ltd.

- Fendt (AGCO Corporation)

- Agco Corporation

Frequently Asked Questions

Analyze common user questions about the Ditcher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Ditcher Market?

The market growth is primarily driven by global infrastructure spending on water management (drainage, irrigation), the rapid worldwide rollout of fiber optic and 5G telecommunication networks, and the increasing adoption of precision agriculture techniques requiring subsurface tiling.

How does the type of ditcher (Wheel vs. Chain) affect project applications?

Wheel ditchers are favored for large, continuous projects in agricultural settings or soft soil where high productivity and consistent depth are needed. Chain ditchers offer greater versatility, handling varied soil conditions and deeper trenches, making them suitable for construction and utility line laying.

Which region currently dominates the Ditcher Market, and why is APAC growing fastest?

North America holds a significant share due to mechanized agriculture and advanced utility infrastructure. APAC is the fastest-growing region, fueled by massive government investments in new infrastructure, rapid urbanization, and extensive agricultural modernization programs in key economies like China and India.

What role does Artificial Intelligence (AI) play in modern ditching equipment?

AI is increasingly used for predictive maintenance, optimizing engine performance based on real-time soil conditions, and integrating autonomous functions such as GPS-guided path following and dynamic depth control, significantly boosting efficiency and reducing operational costs.

What are the main restraints impacting the Ditcher Market?

The major restraints include the high initial capital investment required for purchasing specialized, high-capacity machinery and the rising complexity of regulatory hurdles related to environmental impact, soil disposal, and noise pollution in urban operating areas.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ditcher Market Statistics 2025 Analysis By Application (Agricultural Trenching, Oil and Gas Pipeline Installation, Energy Cables and Fiber Optic Laying, Telecommunication Networks Construction, Sewers and Water Pipelines Installation), By Type (Wheel Ditcher, Chain Ditcher), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Ditcher Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Dynamic Ditchers, Power Ditcher, Cyclone Ditcher), By Application (Agriculture, Construction, Subway), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager