Dithiocarbamate Fungicide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432805 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Dithiocarbamate Fungicide Market Size

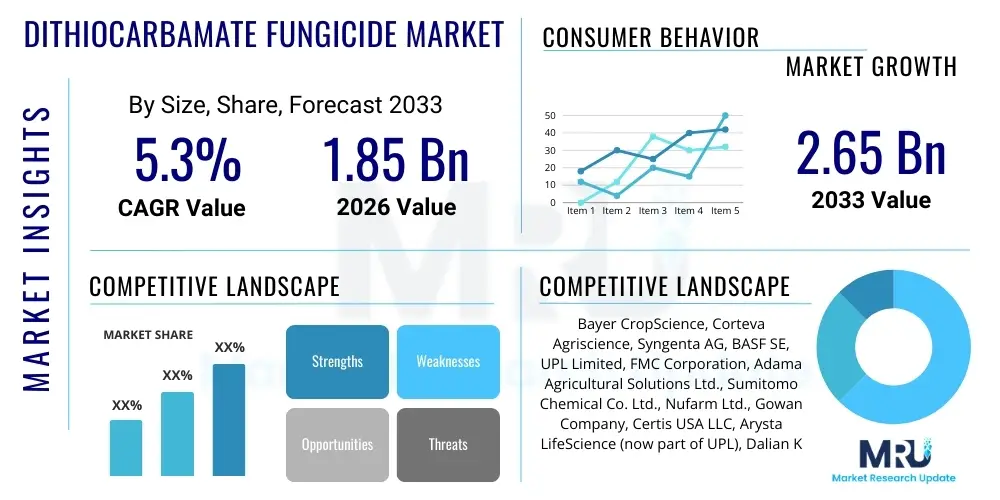

The Dithiocarbamate Fungicide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.3% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.65 Billion by the end of the forecast period in 2033.

Dithiocarbamate Fungicide Market introduction

Dithiocarbamate fungicides represent a crucial class of broad-spectrum, contact-activity agricultural chemicals widely utilized globally for managing fungal diseases across various crops. These compounds, derived from dithiocarbamic acid, are known for their multi-site mode of action, making them highly effective in preventing resistance development, a key concern with single-site systemic fungicides. The primary product in this category is Mancozeb, renowned for its efficacy against early and late blight, rusts, and downy mildew, particularly in high-value crops like potatoes, tomatoes, grapes, and citrus fruits. The inherent stability and relatively low cost of dithiocarbamates contribute significantly to their sustained demand, especially in developing economies where crop protection budgets necessitate cost-effective solutions.

The market landscape is defined by the critical need for enhanced food security amid increasing global population and the concurrent rise in disease pressure due to climate variability. Dithiocarbamate fungicides serve as fundamental tools in integrated pest management (IPM) strategies, offering foundational protection during critical growth stages. Their application extends beyond basic agriculture to horticulture, seed treatment, and non-agricultural turf management, broadening the scope of their utility. Despite regulatory scrutiny concerning residues and environmental impact, particularly in stringent markets like the European Union, the continued reliance on multi-site fungicides as rotational partners ensures a stable market foundation.

Key driving factors include the expansion of commercial agriculture, particularly in the Asia Pacific region, where crop yields are a priority, and the increasing incidence of fungal pathogens that have developed resistance to newer chemical classes. Furthermore, the robust investment in research and development focuses not on discovering entirely new dithiocarbamates, but rather on developing advanced, low-dust, and highly dispersible formulations (such as Water Dispersible Granules or Suspension Concentrates) that improve application safety, handling, and environmental profile, thereby ensuring their relevance and compliance with modern agricultural practices.

Dithiocarbamate Fungicide Market Executive Summary

The Dithiocarbamate Fungicide Market is characterized by steady, moderate growth, propelled primarily by rising global demand for resilient crop protection solutions and the necessity of managing fungicide resistance. Business trends indicate a strategic focus among major agrochemical producers on optimizing existing product portfolios, particularly through enhanced formulation technologies (e.g., advanced WDG and SC formulations) that address applicator safety and environmental exposure, thereby stabilizing regulatory risks. Mergers and acquisitions remain pivotal, allowing key players to consolidate market share, streamline distribution networks, and leverage regional manufacturing advantages, predominantly in Asian markets. The market structure is shifting towards a greater adoption of integrated pest management practices where dithiocarbamates are valued for their role as foundational, low-resistance-risk components.

Regionally, Asia Pacific (APAC) stands out as the primary engine of growth, driven by extensive agricultural land, increasing mechanization, and high incidence of fungal diseases in staple crops such as rice, fruits, and vegetables. North America and Europe, while being mature markets with rigorous regulatory environments, maintain significant demand, largely due to the necessity of resistance management protocols, ensuring that multi-site protectants like Mancozeb remain essential rotational tools. Latin America, particularly Brazil and Argentina, represents robust growth potential, fueled by large-scale commercial farming of soybeans and corn, requiring substantial protective fungicide application throughout the growing season. Regulatory dynamics, such as the phased withdrawal or re-evaluation of specific dithiocarbamates in the EU, introduce volatility but simultaneously create opportunities for reformulated and next-generation products meeting higher safety standards.

Segmentation analysis reveals that the Mancozeb segment dominates the market due to its broad-spectrum efficacy, cost-effectiveness, and established track record across diverse geographies and crops. The Fruits & Vegetables application segment exhibits the fastest growth trajectory, necessitated by the high-value nature of these crops and their susceptibility to a wide range of fungal infections, requiring intensive prophylactic treatment. Furthermore, the Formulation segment sees a pronounced shift away from traditional Wettable Powders (WP) toward cleaner, safer, and more efficient Water Dispersible Granules (WDG) and Suspension Concentrates (SC), reflecting the industry's commitment to improved product handling and reduced drift potential in modern agricultural settings.

AI Impact Analysis on Dithiocarbamate Fungicide Market

Users frequently inquire about how AI and machine learning can optimize the application of traditional, high-volume products like dithiocarbamates, focusing on precision agriculture, minimizing environmental impact, and predicting disease outbreaks. Key concerns revolve around whether AI can help farmers use less fungicide while maintaining efficacy, thereby addressing regulatory pressures related to maximum residue limits (MRLs). The themes consistently highlight the integration of AI-driven disease prediction models with variable rate technology (VRT) for spot application, the use of remote sensing and drone imagery to identify early signs of fungal stress before broad-spectrum intervention is necessary, and the application of machine learning algorithms to optimize mixing ratios and timing for maximum protective effect under diverse climatic conditions. Users expect AI to transform dithiocarbamates from blanket-applied protectants into precisely targeted treatments, extending their commercial viability in an era prioritizing sustainability.

- AI optimizes disease forecasting models, predicting the exact onset and severity of fungal infections, enabling timely and targeted application.

- Integration of AI with precision spraying equipment facilitates variable rate technology (VRT), reducing overall fungicide volume used and lowering input costs.

- Machine learning processes satellite and drone imagery to identify subtle symptoms (spectral signatures) of pathogen presence, allowing for early, localized intervention.

- AI assists in formulating digital advisory tools, recommending the optimal dithiocarbamate product rotation based on historical field data, weather patterns, and resistance risk.

- Enhanced supply chain logistics and inventory management using AI minimize waste and ensure product availability during peak disease pressure windows.

- AI-driven automated reporting systems streamline compliance and documentation required by stringent regulatory bodies regarding application records and MRLs.

DRO & Impact Forces Of Dithiocarbamate Fungicide Market

The Dithiocarbamate Fungicide Market is fundamentally driven by global imperatives for food security and the inherent need for robust fungicide resistance management, contrasting sharply with persistent regulatory challenges and environmental scrutiny. Drivers include the rising incidence of fungicide-resistant strains, particularly in high-value specialty crops, which necessitates the continued use of multi-site compounds like dithiocarbamates as rotational partners to prolong the efficacy of newer, single-site fungicides. Furthermore, the steady growth of commercial agriculture in APAC and Latin America, coupled with climate change increasing disease vector viability, solidifies the demand base. However, the market faces significant restraints, primarily stemming from stringent governmental regulations, particularly in the EU, citing potential health and environmental risks associated with specific compounds (like ethylene thiourea, a metabolite of mancozeb and related products). These regulatory hurdles force manufacturers into costly reformulation or product withdrawal, limiting overall market expansion.

Opportunities for growth are concentrated in the development of innovative, safer formulations that minimize dust exposure and environmental runoff, thus addressing regulatory concerns while maintaining efficacy. The expansion of certified organic and sustainable agriculture programs also presents an adjacent opportunity, as research into bio-based dithiocarbamate derivatives or synergistic blends with biologicals could unlock new market segments seeking reduced chemical loads. The impact forces compelling change include substitution threats from highly effective biological control agents and newer synthetic chemistry, necessitating that dithiocarbamate producers focus heavily on cost leadership and superior efficacy against a broad spectrum of pathogens. The bargaining power of buyers (large distribution channels and farmer cooperatives) remains high, pressuring profitability, while the threat of new entrants is low due to the high regulatory and capital investment required in the agrochemical sector. Supplier power is moderate, influenced by the specialized nature of raw material sourcing, though price fluctuations are generally manageable given the established manufacturing processes.

Ultimately, the market trajectory is dictated by a careful balancing act between maximizing agricultural productivity globally and meeting increasingly rigorous standards for environmental and human safety. The inherent value proposition of dithiocarbamates—multi-site action, broad spectrum, and cost-effectiveness—provides a strong defensive force against displacement, but future success hinges on the industry's ability to innovate formulations and provide sophisticated data supporting their safe, targeted use in modern farming systems. Regulatory outcomes, especially in influential jurisdictions, remain the single most potent impact force shaping the market structure over the forecast period.

Segmentation Analysis

The Dithiocarbamate Fungicide Market is extensively segmented based on the chemical Type, the end-user Application, and the product Formulation utilized. This segmentation offers a granular view of market dynamics, highlighting how different crop systems and regional regulatory frameworks influence product preferences. The Type segment is critical, showcasing the dominance of Mancozeb due to its widespread approval and excellent performance profile against a vast array of pathogens, overshadowing smaller segments like Zineb and Thiram. Segmentation by Application reveals intensive usage in high-value, disease-susceptible sectors such as Fruits & Vegetables, which mandate robust protective measures throughout the growing season to ensure marketable quality and yield preservation. Formulation preferences are increasingly shifting towards advanced, safer dry forms like Water Dispersible Granules (WDG) or flowable liquid forms (SC), optimizing handling safety and field performance for modern spray equipment.

- By Type:

- Mancozeb

- Zineb

- Maneb

- Thiram

- Propineb

- Others (Metiram, Ferbam)

- By Application:

- Cereals & Grains (Wheat, Barley, Rice, Oats)

- Fruits & Vegetables (Potatoes, Tomatoes, Grapes, Citrus, Pome Fruits)

- Oilseeds & Pulses (Soybean, Peanut, Cotton)

- Turf & Ornamentals

- Others (Seed Treatment, Specialty Crops)

- By Formulation:

- Wettable Powder (WP)

- Water Dispersible Granules (WDG)

- Suspension Concentrates (SC)

- Others (Dusts, Emulsifiable Concentrates)

Value Chain Analysis For Dithiocarbamate Fungicide Market

The value chain for dithiocarbamate fungicides begins with the upstream sourcing and production of key chemical intermediates, notably carbon disulfide, amines (like ethylenediamine for Mancozeb), and metal salts (zinc and manganese). This raw material acquisition phase is capital-intensive and subject to global petrochemical price volatility, which influences the final cost structure of the fungicides. Specialized chemical manufacturers process these raw materials into the technical grade active ingredients (TGAI), adhering to strict quality control and environmental standards. The transition from TGAI production to formulation and blending is crucial; this mid-stream segment involves converting the raw material into commercially usable forms (WDG, WP, SC) that enhance stability, dispersibility, and safety for the end-user, often involving proprietary encapsulation or milling technologies developed by the primary market players.

Downstream activities center on distribution, sales, and end-user application. The distribution network typically involves a multilayered approach, encompassing large multinational distributors, regional wholesalers, and local agricultural retailers. Direct distribution channels are often maintained by major producers for large commercial farming operations, ensuring technical support and bulk delivery. Indirect channels leverage established local dealerships that provide personalized advice and product bundling to small and mid-sized farmers. Technical support and farmer education—focusing on safe handling, correct dosage, and resistance management protocols—are integral components of the downstream segment, critical for maximizing product efficacy and ensuring regulatory compliance at the application level.

The overall structure is characterized by significant vertical integration among top-tier manufacturers who control the TGAI production, formulation technology, and extensive global distribution pipelines. This integration allows for robust control over quality and pricing. The shift toward specialized formulations necessitates strong collaboration between manufacturers and formulation experts to meet evolving demands for reduced environmental impact and higher applicator safety. Success in the market heavily relies on efficient logistics and a deep understanding of regional crop cycles and prevailing disease pressures, ensuring that the right product is available precisely when prophylactic treatment is required by the end-user.

Dithiocarbamate Fungicide Market Potential Customers

The primary customers for dithiocarbamate fungicides are large-scale commercial agricultural producers and farm cooperatives specializing in crops highly susceptible to foliar fungal pathogens. These high-volume users, particularly those cultivating potatoes, tomatoes, grapes, and major row crops like soybeans, utilize dithiocarbamates as foundational protective agents due to their broad spectrum activity and essential role in anti-resistance rotation programs. Demand from these segments is driven by the need to maximize marketable yield and quality, making high-efficacy, cost-effective inputs indispensable. Secondary customer groups include specialty crop growers, such as those managing perennial orchards and nuts, where persistent, contact protection is vital during prolonged wet seasons or critical blooming stages.

A growing segment of potential customers includes integrated pest management (IPM) consultants and service providers who recommend product usage to smaller, diversified farming operations. These advisors prioritize compounds that offer multi-site action and favorable ecological profiles compared to certain systemic alternatives, aligning with increasingly sustainability-focused farming policies. Furthermore, customers in the turf and ornamental sector, including professional golf course managers, public park maintenance teams, and commercial nurseries, represent a steady demand base for specialized dithiocarbamate formulations to control cosmetic diseases without disrupting plant growth or public use schedules. The essential characteristic linking all potential customers is the need for reliable, cost-effective disease control that minimizes the risk of pathogen resistance over repeated application seasons.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.65 Billion |

| Growth Rate | 5.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer CropScience, Corteva Agriscience, Syngenta AG, BASF SE, UPL Limited, FMC Corporation, Adama Agricultural Solutions Ltd., Sumitomo Chemical Co. Ltd., Nufarm Ltd., Gowan Company, Certis USA LLC, Arysta LifeScience (now part of UPL), Dalian Kaifeng Chemical Co., Hebei Veyong Bio-Chemical Co. Ltd., Jiangsu Yangnong Chemical Group Co., Sino-Agri Leading Bioscience Co., Indofil Industries Limited, Kenvos Biotech Co., Limin Chemical Co., Rallis India Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dithiocarbamate Fungicide Market Key Technology Landscape

The Dithiocarbamate Fungicide Market, while relying on well-established active ingredients, is continually evolving through critical technological advancements focused predominantly on formulation science and precision application. Key technological drivers involve enhancing the physical properties of the products to improve handling safety, effectiveness, and environmental profile. Modern production utilizes advanced particle micronization and dispersion technologies to create superior Water Dispersible Granules (WDG) and Suspension Concentrates (SC). WDG technology, for instance, focuses on producing dust-free, highly concentrated granules that rapidly disintegrate in water, providing better spray tank stability and reducing applicator inhalation exposure compared to traditional Wettable Powders (WP). SC formulations involve complex suspension agents to keep fine dithiocarbamate particles evenly distributed in a liquid carrier, preventing settling and ensuring homogenous application across the field.

A second significant technological area is the development of encapsulated or controlled-release formulations. Although less prevalent than in systemic fungicides, research is ongoing to embed dithiocarbamates within polymer matrices or protective coatings. This encapsulation aims to prolong the effective residual activity on the leaf surface, minimizing wash-off from rainfall and potentially allowing for fewer applications over a growing season. Such technological breakthroughs are crucial for mitigating regulatory scrutiny related to environmental fate and ensuring the longevity of these contact protectants. Furthermore, advancements in analytical chemistry, particularly high-performance liquid chromatography (HPLC) coupled with mass spectrometry, are vital for monitoring residues in harvested crops and the environment, supporting manufacturers' efforts to provide comprehensive safety data for re-registration processes globally.

Finally, the convergence of digital agriculture technologies with dithiocarbamate use is rapidly defining the future application landscape. This includes the integration of remote sensing (drones and satellites) and sophisticated GIS mapping tools to facilitate site-specific application. These tools allow farmers to monitor disease pressure variability within a field and utilize Variable Rate Application (VRA) sprayers. By linking disease models and spectral imagery to application equipment, the fungicide is only applied where and when it is absolutely needed, optimizing resource use, drastically reducing the total chemical load per hectare, and enhancing the overall sustainability profile of these vital crop protection agents. This precision approach is fundamental to securing the market position of dithiocarbamates against competing lower-risk biological alternatives.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by intensive cultivation of staple crops (rice, fruit, vegetables) and high humidity, which fosters persistent fungal disease pressure. Countries like China, India, and Southeast Asian nations are increasing their consumption due to expanding agricultural land and growing focus on maximizing yield per hectare. Regulatory frameworks, while intensifying, are often less restrictive than in Europe, favoring the cost-effectiveness and broad utility of dithiocarbamates like Mancozeb.

- North America: A mature market characterized by sophisticated farming practices and high adoption of integrated pest management (IPM). Demand is primarily focused on rotational use to manage resistance in high-value specialty crops (potatoes, citrus, grapes) and corn. The market requires premium, advanced formulations (WDG/SC) that align with stringent worker safety standards and environmental stewardship requirements prevalent in the United States and Canada.

- Europe: The most challenging market due to strict regulations, particularly the withdrawal of key dithiocarbamates like Mancozeb in the European Union, driven by concerns over metabolites (ETU) and endocrine disruption potential. The market contraction necessitates manufacturers to focus on countries outside the EU or on non-agricultural uses, while remaining European demand focuses on approved alternatives or highly specified niche applications requiring rotational efficacy against resistant strains.

- Latin America: This region exhibits robust growth potential, primarily driven by massive commercial farming operations focused on export crops such as soybeans, corn, and coffee in Brazil and Argentina. High disease pressure due to tropical and subtropical climates necessitates heavy prophylactic fungicide usage, making dithiocarbamates crucial for protective programs, particularly against rusts and leaf spots. Market success relies on effective logistics and competitive pricing.

- Middle East and Africa (MEA): A nascent but emerging market where growth is spurred by government initiatives to enhance local food production and agricultural modernization efforts. While overall consumption remains lower than in other regions, there is a steady demand in key agricultural economies (e.g., Turkey, South Africa) for affordable, broad-spectrum disease control solutions suitable for diverse climates and resource constraints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dithiocarbamate Fungicide Market.- Bayer CropScience

- Corteva Agriscience

- Syngenta AG

- BASF SE

- UPL Limited

- FMC Corporation

- Adama Agricultural Solutions Ltd.

- Sumitomo Chemical Co. Ltd.

- Nufarm Ltd.

- Gowan Company

- Certis USA LLC

- Arysta LifeScience (now part of UPL)

- Dalian Kaifeng Chemical Co.

- Hebei Veyong Bio-Chemical Co. Ltd.

- Jiangsu Yangnong Chemical Group Co.

- Sino-Agri Leading Bioscience Co.

- Indofil Industries Limited

- Kenvos Biotech Co.

- Limin Chemical Co.

- Rallis India Limited

Frequently Asked Questions

Analyze common user questions about the Dithiocarbamate Fungicide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the continued use of dithiocarbamate fungicides despite regulatory pressures?

The primary driver is the multi-site mode of action exhibited by dithiocarbamates, which makes them highly effective as foundational tools in fungicide resistance management programs, prolonging the viability of newer, single-site chemistry, particularly in high-value crops.

Which dithiocarbamate compound holds the largest market share, and why?

Mancozeb holds the largest market share due to its established broad-spectrum efficacy against common fungal diseases (like blight and rusts), its relatively low cost of production, and its extensive global registration for use across numerous vital crops, including potatoes and grapes.

How is the market addressing environmental concerns and stricter residue limits?

Manufacturers are addressing concerns by investing heavily in advanced formulation technologies, shifting away from dusty powders (WP) toward safer, low-drift Water Dispersible Granules (WDG) and Suspension Concentrates (SC), and promoting targeted application via precision agriculture technologies.

Which geographic region is expected to demonstrate the highest growth rate?

Asia Pacific (APAC) is projected to show the highest growth rate, fueled by the region's vast agricultural expansion, the need for enhanced food security, and persistent high disease pressure in staple crops like rice and vegetables, necessitating consistent protective fungicide use.

How do dithiocarbamates fit into modern Integrated Pest Management (IPM) strategies?

In IPM strategies, dithiocarbamates function as indispensable contact protectants, applied preventatively or in rotation, serving as the first line of defense against fungal pathogens and crucial partners for managing cross-resistance issues inherent to single-site systemic fungicides.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager