Diving and Survival Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431761 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Diving and Survival Equipment Market Size

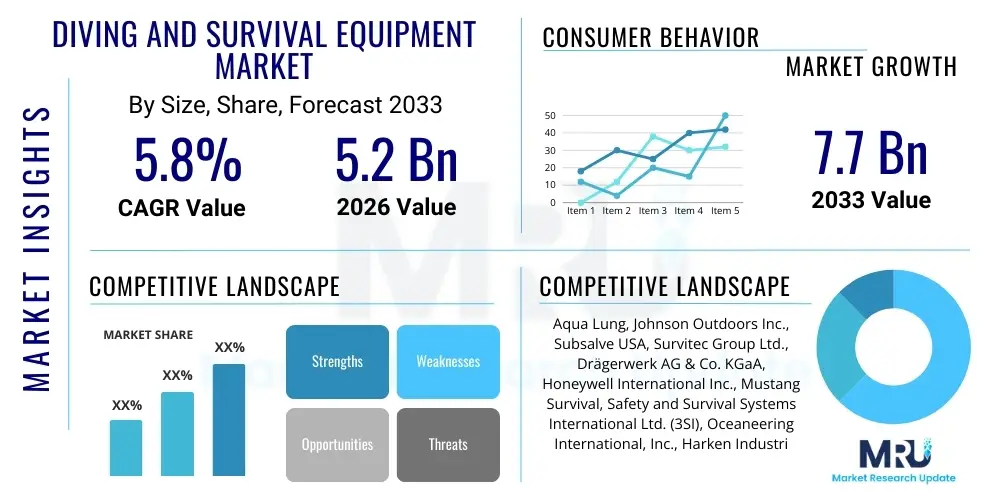

The Diving and Survival Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Diving and Survival Equipment Market introduction

The Diving and Survival Equipment Market encompasses a broad range of specialized gear designed to ensure safety, functionality, and endurance in underwater and hazardous marine environments. This includes sophisticated life support systems, buoyancy control devices (BCDs), regulators, rebreathers, underwater communication tools, protective suits (wetsuits and dry suits), and essential survival equipment such as life rafts, emergency beacons, and personal flotation devices (PFDs). The primary applications span across military and defense operations, rapidly expanding recreational diving, commercial activities like offshore oil and gas exploration, and search and rescue (SAR) missions. The inherent risks associated with deep-sea operations and maritime travel necessitate the use of highly reliable and certified equipment, driving consistent demand across professional and leisure segments.

The core benefit of modern diving and survival gear lies in mitigating high-risk scenarios, enhancing operational efficiency, and ensuring compliance with stringent international marine safety standards (such as SOLAS regulations). Advancements in material science have led to lighter, more durable, and thermally efficient suits, while digital integration is transforming equipment management and underwater navigation. Key driving factors include the resurgence of global marine tourism and recreational scuba diving, increased geopolitical tensions necessitating advanced military diving capabilities, and mandatory safety regulations imposed by governing bodies on commercial shipping and offshore industries. Furthermore, the rising awareness regarding ocean exploration and scientific research contributes significantly to the demand for high-end, specialized equipment capable of operating in extreme depths and harsh conditions.

Diving and Survival Equipment Market Executive Summary

The Diving and Survival Equipment Market is characterized by robust growth, primarily fueled by regulatory mandates and significant technological investment aimed at miniaturization, digitalization, and enhanced material performance. Business trends highlight a strong focus on integration—combining navigation, communication, and life support into unified smart systems. Key market leaders are prioritizing mergers and acquisitions to capture specialized technology providers, particularly those focusing on underwater drone technology and advanced rebreathers which offer extended dive times and superior efficiency compared to traditional open-circuit systems. Sustainability is also emerging as a critical trend, with manufacturers increasingly utilizing eco-friendly materials for wetsuits and packaging, responding to consumer demand for environmentally responsible products in the recreational segment. This push toward innovation ensures equipment meets the dual requirements of performance and compliance.

Regionally, North America and Europe remain mature markets characterized by high penetration rates in military and commercial sectors, alongside a well-established recreational diving infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, driven by burgeoning coastal tourism, rapid development of naval capabilities in countries like China and India, and increasing offshore exploration activities, particularly in Southeast Asia. Segment trends show that the Survival Equipment segment, particularly personal protective equipment (PPE) and emergency response systems, maintains a stable demand driven purely by regulatory requirements, while the Diving Equipment segment sees dynamic growth led by recreational BCDs and advanced technical diving gear (rebreathers). The commercial application sector, particularly in offshore energy, remains sensitive to commodity price volatility but requires continuous replacement and maintenance of high-specification equipment.

AI Impact Analysis on Diving and Survival Equipment Market

Common user questions regarding AI’s impact on the Diving and Survival Equipment Market frequently center on how machine learning can enhance mission safety, predict equipment failure, and automate complex underwater tasks. Users are concerned about the integration costs, reliability of AI algorithms in challenging high-pressure environments, and the potential displacement of human divers in routine commercial tasks. There is significant expectation that AI will primarily revolutionize autonomous underwater vehicles (AUVs) used for inspection and mapping, thereby reducing the risk to human divers. Key themes emerging from these inquiries include the demand for AI-driven predictive maintenance systems to minimize downtime and prevent catastrophic failure of life support apparatus, the use of AI in optimizing underwater acoustic communication pathways, and developing smarter, context-aware emergency distress systems that can automatically initiate complex survival protocols based on real-time environmental data.

- Predictive Maintenance: AI algorithms analyze sensor data from regulators, BCDs, and rebreathers to predict component failure, significantly improving equipment reliability and reducing operational risk in high-stakes environments.

- Autonomous Underwater Systems (AUVs/ROVs): AI enhances the navigation, data processing, and decision-making capabilities of unmanned underwater vehicles, often replacing human divers for high-risk inspection, maintenance, and repair (IMR) tasks, particularly in deep water.

- Optimized Life Support: Machine learning models optimize gas mixing ratios in rebreathers based on real-time physiological data and depth, ensuring maximum efficiency and safety for technical divers.

- Enhanced Training Simulations: AI-driven simulations offer realistic and adaptive training scenarios for military and commercial divers, assessing performance and adjusting difficulties dynamically.

- Smart Survival Gear: Integration of AI into emergency beacons and survival suits to analyze environmental factors (water temperature, currents, location) and automatically prioritize distress signals or deploy countermeasures based on assessed severity and location.

- Underwater Vision and Mapping: AI improves the clarity and interpretation of sonar and underwater camera imagery, automating the identification of hazards, targets, or structural defects, thereby streamlining search and rescue operations and infrastructure inspections.

DRO & Impact Forces Of Diving and Survival Equipment Market

The dynamics of the Diving and Survival Equipment Market are shaped by powerful Drivers stemming from global safety mandates and leisure demand, balanced against critical Restraints primarily related to high procurement costs and environmental volatility. Opportunities are concentrated in technological breakthroughs, such as advanced material science and digital integration, particularly in emerging geographical markets. The market operates under the strong influence of key impact forces, notably the implementation of strict international maritime regulations (e.g., IMO, SOLAS), which exert mandatory demand across the commercial sector. Simultaneously, the burgeoning middle-class consumer base in developing economies fuels the discretionary recreational diving segment, while geopolitical stability and defense spending directly influence military procurement cycles for specialized tactical equipment.

Drivers include the rapid expansion of adventure tourism and recreational diving certification globally, necessitating a continuous influx of consumer-grade equipment. Furthermore, the increasing complexity of offshore installations, encompassing renewable energy infrastructure and deep-sea mineral mining, mandates the deployment of certified, high-end professional diving gear. However, the market faces significant restraints. The initial high investment cost required for professional-grade rebreathers, deep-sea habitats, and advanced survival systems often acts as a barrier to entry, particularly for smaller commercial operators. Additionally, reliance on the volatile offshore oil and gas exploration sector introduces market instability, as demand for saturation diving systems fluctuates severely with global commodity prices.

Opportunities are substantial in leveraging IoT and sensor technology to create integrated, real-time health monitoring systems for divers, a crucial advancement in safety. The focus on developing lightweight, thermally superior, and chemically resistant materials offers potential for competitive advantage. The rise of niche technical diving and specialized scientific exploration also creates demand for ultra-premium, customized equipment. The competitive intensity is moderate to high, driven by the need for regulatory compliance and high-quality certification, which favors established players. The bargaining power of buyers remains significant in the recreational segment due to numerous brands, but it is low in the specialized commercial and military segments where reliability and certification outweigh pricing considerations.

Segmentation Analysis

The Diving and Survival Equipment Market is comprehensively segmented based on the type of product, the intended application, and the distribution channel utilized. This segmentation allows for precise targeting of manufacturing strategies, aligning product specifications with the stringent requirements of specific end-user environments, ranging from highly regulated military operations to high-volume recreational use. The product type segmentation distinctly separates complex life support and maneuverability gear (Diving Equipment) from mandatory emergency response and protection items (Survival Equipment). Application analysis reveals varying demands for ruggedness, depth capability, and communication needs across commercial, military, and leisure sectors, with commercial diving requiring the most robust and certified heavy-duty gear.

The growth dynamics within these segments are disparate. The Diving Equipment segment, particularly high-performance technical gear and rebreathers, is projected to register a higher CAGR due to continuous technological upgrades and increased interest in deep-sea exploration and scientific endeavors. Conversely, the Survival Equipment segment, while stable, experiences growth tied predominantly to regulatory cycles and fleet expansion in maritime transport. Within the distribution channels, the Online segment is growing rapidly, driven by informed recreational divers seeking detailed reviews and competitive pricing, although professional and military buyers still largely rely on specialized, audited Offline distribution channels that offer mandatory equipment servicing and certification verification.

- By Product Type:

- Diving Equipment

- Regulators and Octopuses

- Buoyancy Control Devices (BCDs)

- Cylinders and Valves

- Diving Masks and Fins

- Diving Suits (Wetsuits, Dry Suits)

- Dive Computers and Gauges

- Underwater Communication Devices

- Rebreathers (Closed-Circuit and Semi-Closed Circuit)

- Survival Equipment

- Life Jackets/Personal Flotation Devices (PFDs)

- Life Rafts and Rescue Boats

- Emergency Locator Transmitters (ELTs) and EPIRBs (Emergency Position-Indicating Radio Beacons)

- Immersion Suits and Anti-Exposure Suits

- Thermal Protective Aids (TPAs)

- Flares and Signalling Devices

- Safety Harnesses and Ropes

- Diving Equipment

- By Application:

- Commercial Diving (Offshore Oil & Gas, Construction, Salvage)

- Military and Defense (Naval Operations, Special Forces)

- Recreational Diving (Scuba, Snorkeling)

- Search and Rescue (SAR)

- Scientific and Research

- By Distribution Channel:

- Offline (Specialty Stores, Direct Sales, Audited Suppliers)

- Online (E-commerce Platforms, Brand Websites)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Diving and Survival Equipment Market

The value chain for the Diving and Survival Equipment Market is characterized by highly specialized manufacturing processes, extensive regulatory oversight, and complex distribution pathways tailored to different end-user segments. Upstream activities involve sourcing specialized materials, such as high-grade marine alloys (for regulators and cylinders), technical fabrics (neoprene, vulcanized rubber for suits), and advanced sensor components. Manufacturers must maintain rigorous quality control during design and production to meet international certification standards (e.g., CE, USCG, SOLAS). The middle stage involves assembly and testing, often conducted in highly controlled environments due to the critical nature of the life support functions.

Downstream activities are dominated by highly specialized distribution channels. Direct sales models are prevalent for military and high-value commercial clients, enabling bespoke customization, training, and long-term maintenance contracts. Indirect channels utilize certified dealers and retailers, crucial for the recreational market, often serving as critical points for equipment servicing and training certification (e.g., PADI, SSI centers). The distribution model must accommodate the complexity of the products; for instance, life rafts require periodic re-inspection and packing by certified service centers, which is a significant component of the service and aftermarket segment. Effective inventory management and global logistics are essential, as safety regulations mandate timely replacement of dated or expired survival gear.

Diving and Survival Equipment Market Potential Customers

Potential customers for Diving and Survival Equipment are diverse, ranging from governmental defense agencies requiring highly advanced tactical gear to individual consumers purchasing basic snorkeling equipment. Key end-users include major international shipping companies and cruise lines that are mandated by SOLAS to carry substantial quantities of certified survival gear, alongside continuous replacement of personal safety equipment. The offshore energy sector—including oil and gas exploration firms, wind farm developers, and subsea infrastructure maintenance companies—represents a critical buyer segment for professional-grade diving suits, saturation systems, and hyperbaric chambers.

Furthermore, military and naval forces across all major global regions are persistent buyers of highly specialized and covert diving equipment (especially closed-circuit rebreathers and advanced communication systems) for special operations and submarine rescue missions. On the recreational front, dive centers, resorts, and professional dive instructors constitute a substantial market for bulk purchase of standard scuba equipment and training gear. The increasing focus on marine science and oceanographic research means universities, environmental organizations, and deep-sea exploration foundations also serve as important customers for high-tolerance research-grade equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aqua Lung, Johnson Outdoors Inc., Subsalve USA, Survitec Group Ltd., Drägerwerk AG & Co. KGaA, Honeywell International Inc., Mustang Survival, Safety and Survival Systems International Ltd. (3SI), Oceaneering International, Inc., Harken Industrial, Northern Diver (International) Ltd., Halcyon Manufacturing, Manta Industries, Inc., Shearwater Research Inc., Trelleborg AB, Viking Life-Saving Equipment A/S, Bauer Kompressoren GmbH, Coltri Compressors, Genesis Scuba. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Diving and Survival Equipment Market Key Technology Landscape

The technology landscape in the Diving and Survival Equipment Market is rapidly evolving, driven by the imperative for enhanced safety, extended operational endurance, and improved data collection capabilities. A core technological focus is on rebreather technology, moving from traditional open-circuit systems to sophisticated closed-circuit rebreathers (CCRs). CCRs recycle exhaled gas, conserving helium/oxygen mixtures and significantly extending dive duration while reducing bubble signature, making them essential for military and advanced technical diving. Modern CCRs incorporate sophisticated electronic control systems, including redundant oxygen sensors and computerized solenoid valves, managed by proprietary diving algorithms to ensure precise partial pressure control and mitigate CNS oxygen toxicity risks.

Another crucial technological advancement involves smart equipment integration utilizing the Internet of Things (IoT) and high-density sensors. Dive computers are transitioning into comprehensive digital dashboards that communicate wirelessly with surface support and provide real-time physiological monitoring (heart rate, decompression status) and environmental data (temperature, visibility). Furthermore, material science plays a vital role. The development of advanced, lightweight composite materials for air cylinders and housing components reduces overall diver load without compromising structural integrity or pressure ratings. Survival equipment is also benefiting from technology, with the introduction of high-efficiency, small-footprint water purification systems integrated into life rafts and the proliferation of compact, high-power distress beacons utilizing advanced satellite communications (e.g., Inmarsat, Cospas-Sarsat) for faster location detection.

A significant area of R&D investment is dedicated to underwater communication. Traditional acoustic systems are being supplemented by through-water wireless data transfer methods, allowing divers to send complex data packets, high-resolution imagery, and voice communications seamlessly to surface crews or other divers. Lastly, advancements in battery technology, focusing on non-lithium alternatives for high-pressure environments, are critical for powering underwater propulsion vehicles (DPVs) and integrated lighting/camera systems, ensuring long-term subsea operation capability and maximizing safety margins during extended missions in deep or challenging waters.

Regional Highlights

The geographical distribution of the Diving and Survival Equipment Market reflects varying levels of regulatory enforcement, defense spending, and dependence on marine industries.

- North America: This region maintains a leadership position, characterized by highly stringent commercial diving standards (OSHA, USCG) and substantial defense procurement budgets, driving demand for premium, certified equipment. The US hosts a robust recreational diving industry, supplemented by significant offshore oil and gas activities in the Gulf of Mexico, ensuring consistent high-volume demand for both diving and regulatory-mandated survival gear.

- Europe: Europe is a mature market heavily influenced by IMO and EU maritime safety directives, particularly SOLAS, which mandate high standards for survival equipment on commercial vessels. Countries like Norway and the UK, with extensive North Sea offshore operations, are primary users of advanced saturation diving systems and cold-water survival suits. Germany and the Netherlands are key hubs for manufacturing innovative diving technology, including Drägerwerk’s life support systems.

- Asia Pacific (APAC): APAC is the fastest-growing market segment, primarily driven by expanding coastal tourism (especially in Thailand, Indonesia, and the Philippines), rapid naval modernization programs (China, India, South Korea), and increasing infrastructural development (ports, bridges). The vast maritime jurisdiction of APAC nations necessitates rapid acquisition of SAR equipment and basic recreational gear, offering significant future growth opportunities for manufacturers.

- Latin America: Growth in this region is tied to offshore oil exploration (Brazil, Mexico) and a developing tourism sector. While the market is smaller, it shows steady growth, constrained by economic volatility but supported by mandatory safety legislation in key commercial maritime zones.

- Middle East and Africa (MEA): Demand in MEA is almost entirely concentrated around oil and gas exploration in the Arabian Gulf and Western Africa. The harsh environmental conditions necessitate robust, high-temperature tolerant equipment, driving localized demand for specialized professional diving and maintenance gear required for critical subsea infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Diving and Survival Equipment Market.- Aqua Lung

- Johnson Outdoors Inc.

- Subsalve USA

- Survitec Group Ltd.

- Drägerwerk AG & Co. KGaA

- Honeywell International Inc.

- Mustang Survival

- Safety and Survival Systems International Ltd. (3SI)

- Oceaneering International, Inc.

- Harken Industrial

- Northern Diver (International) Ltd.

- Halcyon Manufacturing

- Manta Industries, Inc.

- Shearwater Research Inc.

- Trelleborg AB

- Viking Life-Saving Equipment A/S

- Bauer Kompressoren GmbH

- Coltri Compressors

- Genesis Scuba

- Hollis Gear

Frequently Asked Questions

Analyze common user questions about the Diving and Survival Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary regulations govern the commercial Diving and Survival Equipment Market?

The commercial market is primarily governed by international maritime safety standards, including the International Maritime Organization’s (IMO) Safety of Life at Sea (SOLAS) Convention, along with national regulations such as the US Coast Guard (USCG) and the European Union’s Marine Equipment Directive (MED), all of which mandate specific certification and performance criteria for life-saving appliances.

How is technological advancement influencing the safety of deep-sea diving?

Technological advancement is enhancing safety through sophisticated closed-circuit rebreathers (CCRs) that minimize decompression sickness risks, advanced dive computers offering real-time physiological monitoring, and AI-driven predictive maintenance systems that detect potential equipment failures before catastrophic incidents occur.

Which application segment holds the largest market share for diving equipment?

The Recreational Diving segment currently accounts for the largest volume of equipment sales, driven by global tourism growth and increasing participation in scuba diving. However, the Commercial and Military segments command the highest revenue share due to the significantly higher unit cost and specialized nature of professional-grade systems like saturation diving gear.

What are the main growth constraints affecting the adoption of new diving technology?

The main constraints include the extremely high upfront procurement cost of advanced systems (like deep-sea rebreathers and hyperbaric chambers), the need for extensive, often proprietary, specialized training for operation and maintenance, and inherent market volatility linked to fluctuating global offshore oil and gas exploration budgets.

How does the Asia Pacific region contribute to market growth?

The Asia Pacific (APAC) region contributes significantly to market growth due to rapidly increasing naval defense spending, a massive expansion in coastal and marine tourism, and large-scale government investment in maritime infrastructure, driving high demand for both military-grade equipment and consumer-level scuba gear.

What is the role of composite materials in modern diving cylinders?

Composite materials, such as carbon fiber wraps over aluminum liners, are crucial for modern diving cylinders as they offer a significant reduction in weight (up to 50%) compared to traditional steel, improving diver mobility, minimizing fatigue, and increasing the overall safety and logistical efficiency of diving operations, particularly for technical and remote area diving.

Explain the function of a Buoyancy Control Device (BCD) in diving.

A Buoyancy Control Device (BCD) is fundamental to diving safety, serving as an inflatable vest that allows the diver to precisely adjust buoyancy underwater. It enables neutral buoyancy (hovering effortlessly), controlled ascent and descent, and ensures positive buoyancy at the surface, which is critical for resting or managing emergency situations.

How does the distribution channel structure differ between recreational and commercial equipment?

Recreational equipment heavily utilizes online e-commerce platforms and retail dive shops (indirect sales), capitalizing on consumer ease and competitive pricing. Commercial and military equipment relies almost exclusively on certified, audited direct sales channels and specialized distributors to ensure mandatory compliance, custom logistics, rigorous servicing, and detailed technical support.

What distinguishes an immersion suit from a standard dry suit?

An immersion suit is classified as specialized survival equipment designed solely for cold-water emergency scenarios, providing total body thermal protection and flotation for victims awaiting rescue, usually without permitting active movement or diving. A dry suit, conversely, is diving equipment designed for continuous, active underwater work, keeping the diver dry through seals at the neck and wrists.

What role does digitalization play in emergency locator transmitters (ELTs) and EPIRBs?

Digitalization allows modern ELTs and Emergency Position-Indicating Radio Beacons (EPIRBs) to transmit highly accurate GPS coordinates via satellite networks (like Cospas-Sarsat) instantaneously. This integration significantly reduces search and rescue (SAR) response times, improving the probability of survival by providing precise, continuous location tracking and detailed vessel identification information to rescue coordination centers.

Why are rebreathers critical for military applications?

Rebreathers are critical for military special forces because they employ closed-circuit technology, which eliminates the visible stream of exhaust bubbles characteristic of open-circuit scuba gear. This feature allows for covert underwater infiltration, minimizing the risk of detection by surface forces and extending the operational endurance for specialized missions.

What impact do rising fuel costs have on the demand for commercial diving equipment?

Rising global fuel costs directly impact the profitability of offshore oil and gas exploration, often leading to scaled-back or delayed projects. Since commercial diving equipment demand is highly correlated with offshore activity, this volatility can cause temporary but significant restraints in sales volume for specialized, high-cost diving systems like saturation spreads and hyperbaric chambers.

How is the market addressing environmental concerns in manufacturing?

The market is addressing environmental concerns by developing wetsuits and buoyancy control devices using sustainable and recycled materials, minimizing the use of environmentally harmful neoprene alternatives, and reducing the environmental footprint of packaging and end-of-life disposal protocols, particularly driven by consumer pressure in the recreational segment.

What is the primary competitive advantage for leading companies in this market?

The primary competitive advantage for leading companies lies in their long-standing track record of reliability, their comprehensive portfolio of necessary regulatory certifications (e.g., CE, SOLAS, ISO standards), and their established global service networks essential for maintenance, auditing, and specialized training required by high-value military and commercial clients.

How do dive computers enhance diver safety and efficiency?

Dive computers are essential safety tools that track depth, bottom time, and ascent rates, continuously calculating the required decompression status based on complex algorithms. This real-time analysis prevents decompression sickness (DCS), extends no-decompression limits, and improves overall dive efficiency far beyond traditional tables, offering personalized gas consumption monitoring and alarms.

What are the key components of a saturation diving system?

A saturation diving system, critical for deep, long-duration commercial dives, consists of a deck decompression chamber (DDC), a transfer lock, and a submersible diving bell. This system maintains divers under constant high pressure in a helium-oxygen mixture, preventing daily decompression, which is crucial for extensive underwater construction and maintenance projects.

Why is certified training important for the growth of the recreational segment?

Certified training, provided by organizations like PADI and SSI, is fundamental to the recreational segment’s growth as it ensures safety standards, builds consumer confidence, and mandates the purchase of necessary entry-level equipment, directly driving sales volume for masks, fins, BCDs, and regulators globally.

What are the challenges in underwater communication technology?

Challenges in underwater communication mainly stem from the rapid attenuation and distortion of electromagnetic waves in water. Current acoustic communication methods are slow and limited in data transfer capacity, prompting research into advanced technologies like optical (blue-green light) communication for high-speed, short-range data links, though reliability across varied water conditions remains a technical hurdle.

How does geopolitical instability influence the market?

Geopolitical instability directly influences the market by escalating defense budgets globally. This leads to increased demand and rapid procurement cycles for highly specialized, advanced tactical diving gear, submersibles, and covert communication systems used by naval and special operations forces worldwide.

What is the difference between a life jacket and an immersion suit in terms of protection?

A life jacket primarily provides buoyancy to keep the wearer's head above water, preventing drowning. An immersion suit provides both buoyancy and significant thermal insulation (hypothermia protection) by forming a waterproof shell around the entire body, essential for survival in cold-water maritime emergencies.

In what way does the search and rescue (SAR) application drive innovation?

The SAR application drives innovation by necessitating the development of lightweight, highly portable, and rapidly deployable equipment. This includes enhanced sonar systems, robust underwater drones (ROVs) for rapid search missions, and highly effective thermal protective aids (TPAs) designed for quick deployment in various emergency climates.

What is the significance of the CE mark for European diving equipment?

The CE mark signifies that diving equipment sold within the European Economic Area (EEA) complies with essential health and safety requirements outlined in the relevant European directives (often related to Personal Protective Equipment). It is a mandatory certification that guarantees the equipment meets necessary performance and quality standards for safety.

How are manufacturers ensuring equipment reliability under extreme pressure?

Manufacturers ensure reliability under extreme pressure through rigorous hydrostatic testing, utilization of high-tensile marine-grade alloys (e.g., brass, stainless steel, titanium) for critical components, and employing redundant safety mechanisms in life support systems like regulators and rebreathers to guarantee structural integrity and functional performance at maximum operational depths.

What challenges are associated with maintaining complex rebreather systems?

Maintaining complex rebreather systems involves challenges such as the mandatory replacement of costly oxygen sensors, strict adherence to specialized manufacturer-certified servicing schedules, the need for precise calibration of electronic components, and meticulous management of absorbent material (scrubber) to eliminate carbon dioxide, all of which require highly trained technicians.

How is the scientific research sector impacting demand for specific equipment?

The scientific research sector drives demand for highly specialized, often customized, research-grade equipment, including deep-rated cameras, precise sampling tools, specialized lighting, and long-endurance autonomous underwater vehicles (AUVs) capable of operating reliably in extreme oceanographic conditions far exceeding standard commercial depths.

What are the limitations of open-circuit diving systems compared to closed-circuit?

Open-circuit systems are limited by high gas consumption, as all exhaled gas is expelled into the water, resulting in shorter dive times and greater logistical complexity for deep or long dives. They also produce a visible bubble stream, which is a tactical disadvantage, unlike the silent, gas-recycling operation of closed-circuit systems.

Discuss the market role of ancillary survival gear like flares and signaling devices.

Flares, signaling mirrors, and rescue strobes are vital ancillary survival gear, mandatory on commercial vessels and widely used by recreational boaters and divers. Their market role is driven purely by regulatory compliance and the fundamental requirement for visual and auditory distress signaling, serving as the last line of communication in an emergency.

How is the growth of offshore wind energy influencing the demand for diving equipment?

The rapid global expansion of offshore wind energy necessitates substantial subsea installation, inspection, and maintenance of foundations and cabling. This drives significant, stable demand for professional commercial diving services, requiring highly durable, certified equipment capable of operating in strong currents and temperate waters typical of wind farm locations.

What trends are emerging in the design of diving masks?

Emerging trends in diving mask design focus on enhancing peripheral visibility through frameless designs and improved lens shapes, integrating high-definition heads-up displays (HUDs) for real-time dive data, and improving purge valves for easier water clearing, appealing to both recreational and professional segments seeking optimized situational awareness.

Explain the concept of thermal protective aids (TPAs) in survival kits.

Thermal Protective Aids (TPAs) are lightweight, insulating bags or sheets made of low-emissivity material, designed to minimize heat loss from a person rescued from cold water or in a life raft. They are mandatory SOLAS components, crucial for preventing or slowing hypothermia by reflecting body heat back to the survivor.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager