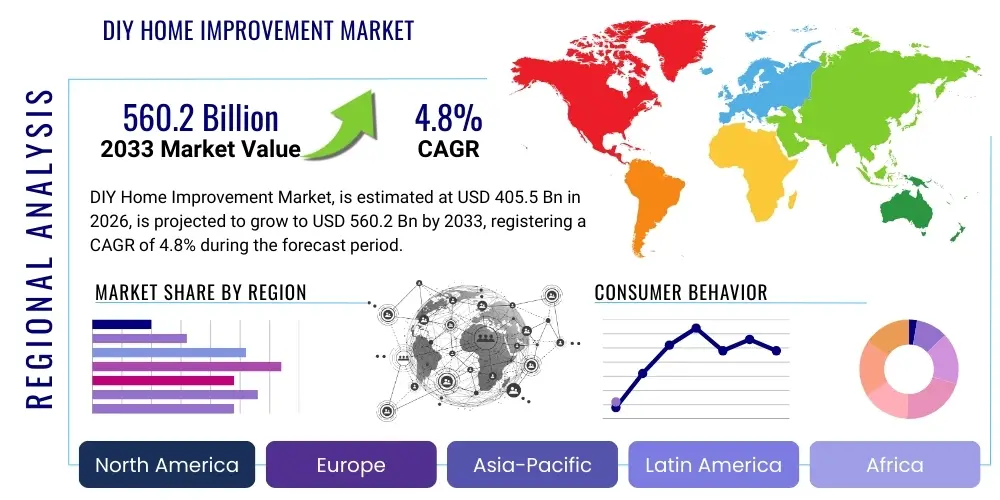

DIY Home Improvement Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437021 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

DIY Home Improvement Market Size

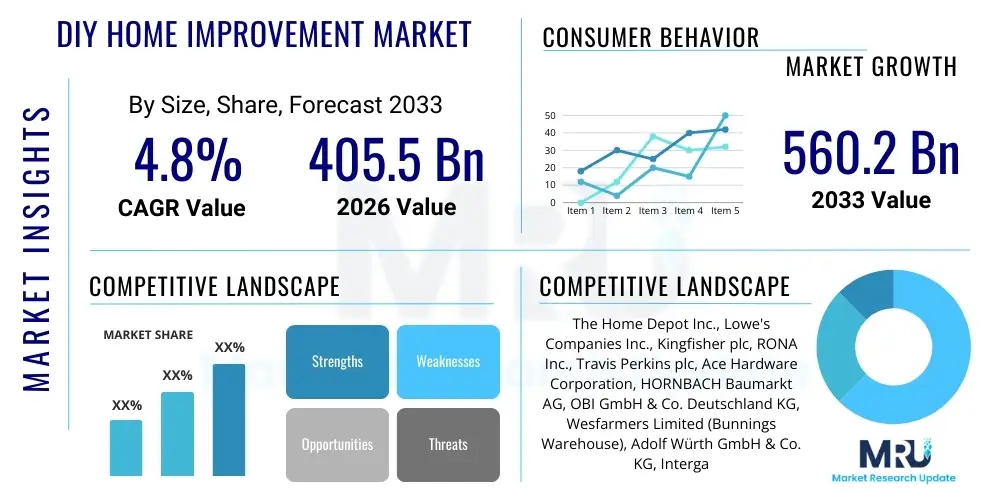

The DIY Home Improvement Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $405.5 billion in 2026 and is projected to reach $560.2 billion by the end of the forecast period in 2033.

DIY Home Improvement Market introduction

The DIY Home Improvement Market encompasses the retail sale of tools, materials, equipment, and services used by non-professional consumers for repairing, remodeling, maintaining, or enhancing their residential properties. This expansive sector covers a broad range of activities, from minor repairs and decorative changes, such as painting and flooring installation, to major structural projects, including kitchen and bathroom renovations. The core product offering spans traditional building materials like lumber and aggregates, modern smart home technologies, specialized hand and power tools, and various home decor items aimed at aesthetic improvement and functional enhancement. The intrinsic benefit of DIY projects lies in cost savings, personal satisfaction, and increased control over the quality and customization of home upgrades, driving consistent consumer engagement across diverse socio-economic groups.

Major applications of DIY products include interior remodeling, exterior maintenance, garden upkeep, and the implementation of energy-efficient solutions. The market saw a significant acceleration globally, particularly following periods of increased time spent at home, which prompted homeowners to invest heavily in creating more functional and comfortable living spaces. This trend cemented the necessity for a robust supply chain capable of delivering both essential and specialized materials directly to consumers through highly accessible distribution channels, including large format home centers and dedicated e-commerce platforms. The perception of DIY has shifted from merely a cost-saving necessity to a lifestyle choice and a recreational activity, further expanding the market's reach.

Key driving factors fueling market expansion include sustained growth in residential real estate values, which incentivizes homeowners to maximize their property investment through targeted upgrades. Furthermore, the rising proliferation of online tutorials, instructional videos, and digital planning tools has significantly lowered the entry barrier for complex projects, encouraging novice users to attempt tasks previously reserved for professionals. Demographic trends, such as an aging housing stock requiring continuous maintenance and the millennial generation purchasing fixer-upper homes, also contribute substantially to the sustained demand for DIY supplies and knowledge.

DIY Home Improvement Market Executive Summary

The DIY Home Improvement Market is characterized by robust resilience and significant technological integration, shifting from a primarily hardware-focused industry to a service- and experience-centric ecosystem. Business trends indicate a powerful move toward omnichannel retailing, where seamless integration between physical stores—which offer necessary tactile experiences and expert consultation—and highly efficient online platforms—which provide convenience and extensive product ranges—is paramount for retaining competitive advantage. Major players are strategically investing in supply chain digitalization to mitigate volatility in material costs and ensure timely delivery, particularly for high-volume, standard products. Sustainable building materials and energy-efficient products are emerging as critical differentiators, aligning with global regulatory pressures and growing consumer environmental consciousness, thereby shaping future product development pipelines.

Regionally, North America and Europe currently dominate the market, largely due to high rates of home ownership, established DIY culture, and disposable income levels conducive to renovation expenditures. However, the Asia Pacific region, specifically emerging economies like China and India, is registering the fastest growth rate, fueled by rapid urbanization, expanding middle-class populations, and the rising accessibility of international home improvement retail chains. Regional trends also show a localized preference for materials; for instance, European consumers prioritize energy efficiency and aesthetic minimalism, while North American consumers often focus on spacious additions and technological integration like smart home systems.

Segment trends highlight the critical role of the Tools & Hardware category, which acts as a foundational segment, benefiting from both professional and amateur usage. More importantly, the E-commerce distribution channel is experiencing explosive growth, particularly within the Paint & Wallpaper and Décor & Flooring segments, as these items are easier to visualize and purchase online. The shift towards small, frequent, and aesthetically motivated projects (such as decorative enhancements or smart device integration) over large, infrequent structural renovations is shaping inventory management and marketing strategies across all segments, emphasizing ease of use, modular design, and simplified installation instructions.

AI Impact Analysis on DIY Home Improvement Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the DIY Home Improvement Market revolve primarily around personalized project guidance, simplified design visualization, and optimized inventory management. Users frequently inquire about how AI can help diagnose home repair issues using visual recognition, generate customized material lists based on room specifications uploaded via smartphone, or provide step-by-step augmented reality (AR) instructions overlaid onto the physical workspace. Concerns often center on the accuracy of AI recommendations for complex tasks, the privacy implications of using visual data of their homes, and whether AI tools might eventually replace the need for skilled tradespeople for certain tasks. Overall expectations are high, anticipating AI to democratize complex home renovation and maintenance by making professional-grade planning and execution accessible to the average homeowner, significantly reducing errors and waste.

The integration of AI is transforming the customer experience both online and in-store. Retailers are deploying sophisticated recommendation engines that analyze purchase history, browsing patterns, and project complexity to suggest the right tools and accessories, thereby boosting average transaction value. On the home design front, AI-powered design tools allow users to digitally remodel spaces, visualize various material choices, and instantly calculate material quantities, streamlining the planning phase which is often the biggest hurdle in DIY projects. Furthermore, AI contributes substantially to optimizing logistical operations, including demand forecasting for seasonal items like outdoor furniture and materials, and optimizing last-mile delivery routes for bulky items, ensuring higher customer satisfaction through improved service reliability.

For the supply side, AI assists manufacturers in predictive maintenance of machinery, reducing downtime, and ensuring the quality control of standardized products like lumber, paint, and hardware. The ability of AI to rapidly process vast datasets on consumer preferences, regional climate impacts, and regulatory changes enables companies to quickly adapt their product offerings and inventory levels, ensuring that specialized tools or sustainable materials are available precisely where and when demand peaks. This analytical capability moves the industry toward a truly demand-driven model, minimizing overstock and obsolescence, thereby creating a more efficient and responsive market structure.

- AI provides personalized product recommendations based on project scope and user skill level, enhancing conversion rates.

- Generative AI and AR tools enable sophisticated 3D visualization of renovation results before purchase, reducing returns due to poor fit or aesthetic dissatisfaction.

- AI optimizes supply chain logistics, predicting demand spikes for seasonal and specialty materials, improving inventory accuracy.

- Smart diagnostics using machine vision help homeowners identify and troubleshoot maintenance issues like leaks or structural damage, offering specific DIY solutions.

- Chatbots and conversational interfaces offer real-time, step-by-step guidance during project execution, acting as digital assistants for complex tasks.

- Data analytics derived from AI track popular project types and material trends, informing product innovation and marketing strategies for retailers.

DRO & Impact Forces Of DIY Home Improvement Market

The dynamics of the DIY Home Improvement Market are shaped by a complex interplay of drivers, restraints, and opportunities, culminating in significant impact forces. A primary driver is the global trend of aging housing stock, particularly in mature economies, necessitating frequent repairs and replacements that homeowners often choose to undertake themselves to manage costs. Simultaneously, the proliferation of digital resources, including detailed instructional videos and accessible online marketplaces, significantly lowers the skill barrier, broadening the base of individuals confident enough to tackle DIY projects. This digital empowerment, coupled with the economic advantage of self-execution over hiring expensive professional labor, provides powerful momentum to market growth, especially in segments focused on small-scale aesthetic improvements and energy efficiency upgrades.

However, the market faces notable restraints, most acutely the persistent volatility and high cost of raw materials, such as lumber, steel, and certain chemicals used in paints and polymers. These fluctuating input costs often squeeze retailer margins or are passed directly to the consumer, potentially discouraging large-scale, cost-sensitive projects. Furthermore, the increasing complexity of modern home systems—including smart wiring, sophisticated plumbing, and HVAC—often exceeds the competency of the average DIY enthusiast, making professional intervention unavoidable for critical installations. Time constraint for working professionals also acts as a restraint, leading some consumers to prefer the expediency of hiring contractors despite the higher cost, particularly for time-sensitive repairs.

Opportunities abound, primarily centered on sustainability and digital penetration. The push for green building practices and energy conservation presents a massive opportunity for specialized DIY products, such as high-efficiency insulation, smart thermostats, and rainwater harvesting systems. Retailers can capitalize by focusing product lines around these environmentally conscious segments. Moreover, the enhancement of e-commerce platforms, particularly leveraging AR and virtual consultation services, provides an opportunity to capture a larger share of the market by offering unparalleled convenience and personalized service. These forces—cost sensitivity, digital enablement, material volatility, and the shift towards sustainability—collectively exert a strong impact on market development, pushing innovation towards easier-to-install, modular, and eco-friendly solutions.

Segmentation Analysis

The DIY Home Improvement Market is segmented to provide a detailed view of consumer behavior, product preference, and distribution dynamics, allowing stakeholders to tailor strategies effectively. Key segmentation variables include the type of product purchased, the end-user demographic or purpose, and the channel through which products are distributed. The product segmentation is crucial, as demand for items like basic tools often remains steady, while demand for decor and specialized materials fluctuates heavily with housing market cycles and seasonal trends. Analyzing these segments helps retailers manage inventory optimally and focus marketing efforts on high-growth areas such as smart home hardware and sustainable materials, which command higher price points and offer greater value addition.

From an end-user perspective, while the market is defined by non-professional consumers, there is an important overlapping segment of handymen or very small contractors who purchase products through DIY channels due to convenience or volume flexibility. Understanding this end-user duality helps retailers calibrate their product assortment, ensuring the availability of both entry-level and commercial-grade tools. Distribution channel segmentation is perhaps the most rapidly evolving area; the traditional dominance of physical home centers is being actively challenged by the meteoric rise of online platforms, which offer logistical ease for standard materials and a broader selection of niche products. This shift necessitates significant investment in logistics and digital interfaces to maintain market share.

Overall, segmentation analysis underscores the need for a balanced approach. Retailers cannot ignore the steady revenue generated by core materials and tools (product segment), nor can they overlook the increasing preference for online purchasing convenience (distribution segment). The future success in the DIY market hinges on providing a cohesive, segmented experience that recognizes the difference between a homeowner performing a quick repair and one undertaking a full-scale renovation, ensuring relevant product and service access regardless of the chosen purchasing path.

- Product Type:

- Lumber and Building Materials

- Décor and Flooring

- Tools and Hardware

- Plumbing and Electrical

- Paint and Wallpaper

- Garden and Outdoor

- End-User:

- Retail Consumers (Homeowners/Renters)

- Professional Contractors/Handymen (Small-Scale)

- Distribution Channel:

- Offline (Home Centers, Specialty Stores, Hardware Stores)

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

Value Chain Analysis For DIY Home Improvement Market

The value chain for the DIY Home Improvement Market begins with upstream activities involving raw material extraction and primary manufacturing. This phase is dominated by suppliers of critical inputs such as wood processing plants, chemical manufacturers (for paint and adhesives), metal producers (for tools and hardware), and specialized component makers. Efficiency and cost control at this stage are vital, as they directly influence the final retail price and subsequent consumer DIY engagement. Strong relationships with diversified raw material suppliers are crucial for retailers to mitigate supply chain risks inherent in volatile commodity markets. Ethical sourcing and sustainability certifications are increasingly important upstream components, driven by consumer scrutiny.

Mid-stream activities involve the aggregation, branding, and distribution of finished goods. Manufacturers transform raw materials into consumer-ready products, focusing on modularity, ease of use, and compatibility with standard home designs. The distribution channel acts as the central hub, integrating large multinational retail giants (the downstream actors) with the numerous suppliers. This segment is characterized by massive logistics operations, inventory management systems, and centralized warehousing designed to handle the wide variety of large, bulky, and small, specialized DIY products. Direct channels are increasingly being adopted by specialized tool manufacturers to bypass traditional retail markups and gain direct customer feedback, impacting the traditional retail relationship.

Downstream activities center on consumer interaction, sales, and post-purchase support. Major retail chains, through both physical stores and e-commerce platforms, manage merchandising, customer consultation, and final sales. Direct channels facilitate sales directly from manufacturers to consumers, often for specialized or high-tech items. The value is added through expert advice, project planning services, localized inventory relevant to regional building codes, and robust return policies. The effectiveness of the value chain is ultimately measured by its ability to deliver the right product, at a competitive price, coupled with high-quality educational resources and support necessary for successful DIY project completion.

DIY Home Improvement Market Potential Customers

Potential customers in the DIY Home Improvement Market primarily comprise residential homeowners, who represent the largest and most frequent buyers, driven by the inherent need for property maintenance, aesthetic upgrades, and value appreciation. This segment is further diversified by age and economic status; older homeowners often focus on necessary repairs and accessibility improvements, while younger demographics, particularly millennials, engage in smaller, frequent, and technologically driven projects, often motivated by personalized aesthetics and sustainability. Renters also constitute a growing potential customer base, particularly for non-permanent, decorative, or modular upgrades that can be taken when moving, driving demand for products like peel-and-stick wallpaper and temporary shelving solutions.

A secondary, yet highly important, customer group includes small-scale professional contractors, handymen, and property management companies who often utilize DIY retail channels for sourcing materials for minor jobs or immediate, on-site repairs. These buyers prioritize product availability, consistency, bulk pricing options, and the convenience of rapid in-store pickup or job-site delivery. Retailers must cater to the slightly different demands of this "Pro" segment by offering dedicated services, specialized loyalty programs, and higher-grade material options that meet industry standards, thereby increasing their potential market penetration beyond the pure consumer base.

The future potential customer base is increasingly defined by technological proficiency. Individuals seeking smart home solutions, energy independence (solar panel installation kits), and complex garden automation systems represent high-value targets. Effective market engagement requires providing these tech-savvy users with not only the product but also comprehensive digital integration guides, virtual reality troubleshooting tools, and readily available technical support, ensuring their complex DIY projects are feasible and successful.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $405.5 Billion |

| Market Forecast in 2033 | $560.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Home Depot Inc., Lowe's Companies Inc., Kingfisher plc, RONA Inc., Travis Perkins plc, Ace Hardware Corporation, HORNBACH Baumarkt AG, OBI GmbH & Co. Deutschland KG, Wesfarmers Limited (Bunnings Warehouse), Adolf Würth GmbH & Co. KG, Intergamma BV, Menard Inc., True Value Company, Screwfix, Toolstation, Ganahl Lumber Company, Sika AG, Sherwin-Williams Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DIY Home Improvement Market Key Technology Landscape

The technology landscape for the DIY Home Improvement Market is rapidly evolving beyond traditional power tools to embrace digital integration and smart automation. Key technologies are centered on enhancing both the planning phase and the execution phase of projects. Augmented Reality (AR) applications are highly transformative, allowing consumers to digitally place furniture, visualize paint colors, or plan electrical layouts in their actual physical space using only a smartphone or tablet. This technology drastically minimizes buyer remorse and accelerates the decision-making process for aesthetic purchases. Furthermore, the use of 3D printing and advanced Computer-Aided Design (CAD) software allows for the customization and rapid prototyping of small, specialized components or architectural details, moving personalized creation closer to the consumer.

In terms of execution, the adoption of smart tools equipped with integrated sensors, Bluetooth connectivity, and microprocessors is growing significantly. Examples include laser measuring devices that feed dimensions directly into project planning apps, or power tools that automatically adjust torque based on the material being worked, enhancing precision and reducing user error. These digital aids are crucial for the DIY demographic which often lacks professional training. On the retail side, sophisticated point-of-sale systems and AI-driven inventory management ensure that the complex assortment of products—from bulky lumber to tiny screws—is managed efficiently, reducing stock-outs and improving supply chain resilience against fluctuating demand.

Digital platforms and connectivity form the backbone of modern DIY engagement. E-commerce platforms leverage machine learning for personalized marketing and dynamic pricing strategies. Beyond purchasing, consumer reliance on detailed video tutorials and remote expert consultation services (tele-advising) is intensifying. This reliance mandates that retailers invest heavily in high-quality digital content and robust bandwidth to support video-based technical assistance. Ultimately, the successful deployment of these technologies aims to make every DIY project simpler, faster, and more foolproof, thereby sustaining market growth by attracting and retaining novice users.

Regional Highlights

North America maintains its position as a dominant force in the DIY Home Improvement Market, driven primarily by the strong homeownership culture in the United States and Canada, coupled with high average disposable income. The region is characterized by large, established retail chains that act as one-stop shops, integrating extensive product catalogs with supplementary services like tool rental and installation consultation. The market here is highly mature, with steady demand stemming from the necessity to maintain aging housing infrastructure and the continuous trend of homeowners engaging in high-value projects like kitchen and bathroom remodels. Adoption of smart home technology, energy-efficient building materials, and outdoor living space enhancements are strong growth vectors within this established market.

Europe represents another vital market segment, characterized by regional variations in consumer preference and retail structure. Western Europe, particularly the UK, Germany, and France, exhibits a robust DIY culture, though the projects tend to be smaller in scale, often focusing on interior decor and spatial optimization due to generally smaller residential footprints compared to North America. Sustainability mandates and energy performance regulations are significantly more stringent in Europe, driving demand for specialized insulation, certified wood products, and advanced heating solutions. The European distribution landscape is fragmented, featuring both large international chains and powerful local specialty retailers, necessitating customized market entry strategies.

The Asia Pacific (APAC) region is projected to experience the highest growth rate during the forecast period. This rapid expansion is fundamentally linked to accelerated urbanization, rising standards of living, and an explosive growth in new residential construction across countries like China, India, and Southeast Asia. While the professional contracting segment traditionally dominates home improvements, increasing exposure to Western DIY concepts through digital media and the proliferation of international retail brands are stimulating consumer interest in self-executed projects, particularly for smaller, aesthetic enhancements. Future growth in APAC will be heavily influenced by infrastructural investment and the successful penetration of localized e-commerce solutions that address logistical challenges associated with dense urban environments.

- North America: Dominates due to high homeownership, large living spaces, substantial disposable income, and a strong preference for high-value renovations and smart home integration.

- Europe: Characterized by a strong DIY tradition, focus on energy efficiency and compact living solutions, and adherence to strict sustainable building regulations, driving demand for specialized materials.

- Asia Pacific (APAC): Fastest-growing region, fueled by urbanization, expanding middle class, increasing exposure to DIY culture, and rising new construction activities requiring initial fit-outs and personalization.

- Latin America (LATAM): Growth driven by economic stability in key nations like Brazil and Mexico, leading to increased discretionary spending on essential home repairs and minor structural improvements.

- Middle East and Africa (MEA): Market growth tied to significant real estate development, particularly in the GCC countries, focusing on luxury, high-end materials, though often reliant on contractor execution rather than pure DIY.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DIY Home Improvement Market.- The Home Depot Inc.

- Lowe's Companies Inc.

- Kingfisher plc

- RONA Inc.

- Travis Perkins plc

- Ace Hardware Corporation

- HORNBACH Baumarkt AG

- OBI GmbH & Co. Deutschland KG

- Wesfarmers Limited (Bunnings Warehouse)

- Adolf Würth GmbH & Co. KG

- Intergamma BV

- Menard Inc.

- True Value Company

- Screwfix (Kingfisher subsidiary)

- Toolstation (Travis Perkins subsidiary)

- Ganahl Lumber Company

- Sika AG

- Sherwin-Williams Company

Frequently Asked Questions

Analyze common user questions about the DIY Home Improvement market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the DIY Home Improvement Market currently?

The market growth is primarily driven by three factors: the aging residential housing stock requiring constant maintenance, the enhanced accessibility of digital resources (tutorials and AR planning tools) which lowers the entry barrier for complex projects, and sustained inflation in labor costs which incentivizes homeowners to perform tasks themselves for cost savings.

How is E-commerce impacting the purchase of DIY materials?

E-commerce is revolutionizing the distribution channel by offering unparalleled convenience, extended product catalogs (especially for specialized tools and aesthetic items), and personalized delivery options for bulky goods. Online sales are rapidly growing, forcing traditional retailers to adopt omnichannel strategies that seamlessly merge physical presence with digital services.

Which segments are expected to show the highest growth rate?

The segments focusing on smart home technology integration, energy efficiency products (like advanced insulation and smart thermostats), and decorative materials (Décor and Flooring) are anticipated to exhibit the highest growth rates, reflecting shifting consumer priorities toward sustainability and personalized living spaces.

What is the primary constraint facing DIY enthusiasts and the overall market?

The main constraint is the increasing volatility and cost of core raw materials such as lumber, metals, and petrochemical derivatives, which drives up product prices. Additionally, the growing technical complexity of modern home systems often acts as a skill barrier, compelling consumers to rely on costly professional services for critical installations.

How is Artificial Intelligence (AI) being utilized in DIY retailing?

AI is employed by retailers to enhance customer experience through personalized product recommendations, real-time inventory optimization across the supply chain, and providing sophisticated visual planning tools (AR/VR) that enable homeowners to accurately preview project outcomes, thereby reducing returns and improving purchasing confidence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager