DNA & RNA Sample Preparation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432338 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

DNA & RNA Sample Preparation Market Size

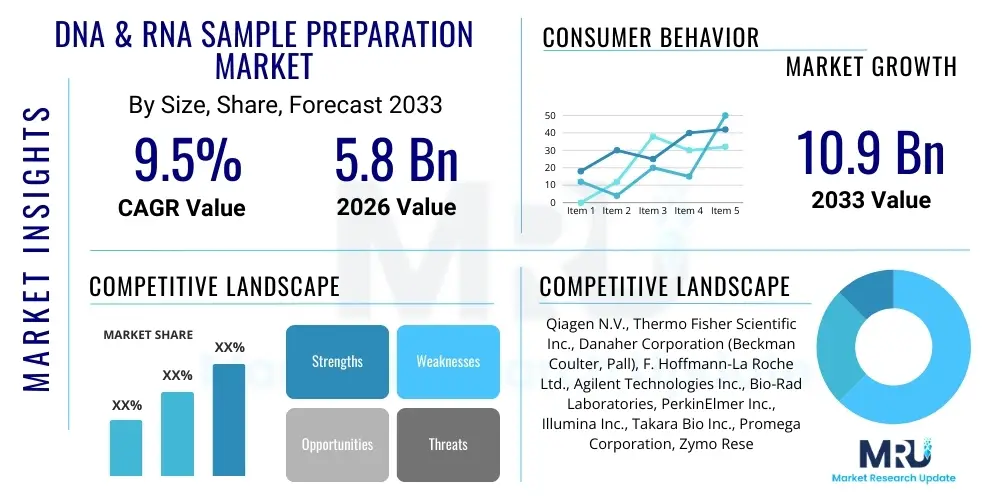

The DNA & RNA Sample Preparation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $10.9 Billion by the end of the forecast period in 2033.

DNA & RNA Sample Preparation Market introduction

The DNA & RNA Sample Preparation Market encompasses the technologies, consumables, and instruments required to isolate, purify, and concentrate nucleic acids from diverse biological sources (blood, tissue, cells, environmental samples) for downstream molecular analysis. These preparatory steps are foundational to all modern genomic, transcriptomic, and proteomic research and diagnostic applications. The core products include specialized kits and reagents utilizing methods such as solid-phase extraction, magnetic bead separation, and column-based filtration, alongside automated instruments designed to handle high-throughput processing. Effective sample preparation is critical to ensuring the quality, quantity, and integrity of nucleic acids, which directly influences the accuracy and reliability of assays like quantitative PCR (qPCR), next-generation sequencing (NGS), and microarrays, driving its indispensability across life science sectors.

Major applications of DNA and RNA sample preparation are centered on clinical diagnostics, particularly in oncology, prenatal screening, and infectious disease detection, where rapid and accurate isolation of pathogen nucleic acids or circulating tumor DNA (ctDNA) is essential. Furthermore, the market is heavily supported by academic and pharmaceutical research, facilitating drug discovery pipelines, biomarker identification, and complex genomic studies. The inherent benefits derived from advanced sample preparation methodologies include reduced manual labor, minimized risk of cross-contamination, and enhanced sensitivity for samples with low nucleic acid yield, particularly relevant in liquid biopsy applications.

Key driving factors accelerating market expansion include the exponential growth in demand for personalized medicine initiatives, the global increase in funding for genomics and proteomics research, and the continuous technological evolution leading to fully automated, high-throughput systems. The persistent threat of infectious diseases, as highlighted by recent global pandemics, has also mandated faster, more efficient nucleic acid extraction methods for rapid epidemiological surveillance and diagnostic scaling, providing a significant sustained impetus to market growth. As sequencing costs continue to fall, the bottleneck shifts increasingly toward reliable sample preparation, making high-quality extraction technologies a key investment priority across healthcare and research institutions.

DNA & RNA Sample Preparation Market Executive Summary

The DNA & RNA Sample Preparation Market is characterized by robust growth, primarily fueled by the expanding adoption of NGS technologies and the rising prevalence of chronic and infectious diseases globally. Current business trends indicate a strong shift towards automated and integrated solutions capable of handling diverse sample matrices while maintaining consistency and scalability. Leading manufacturers are focusing on miniaturization and improved efficiency of magnetic bead-based separation techniques, which offer superior yields and purity compared to traditional methods. Furthermore, strategic partnerships and mergers among technology providers and diagnostic companies are consolidating expertise and creating end-to-end workflow solutions, simplifying the path from sample collection to data analysis for clinical laboratories.

Regional trends reveal that North America holds the largest market share, driven by substantial R&D investments, the presence of major pharmaceutical and biotechnology hubs, and favorable regulatory frameworks supporting genomic medicine. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to improving healthcare infrastructure, increasing awareness of genetic disorders, and significant governmental initiatives aimed at promoting precision medicine, particularly in countries like China, India, and Japan. Europe maintains a strong position, supported by established academic research centers and strong regulatory emphasis on standardized clinical diagnostic procedures, pushing the demand for validated sample preparation kits.

Segment trends highlight that the Kits & Reagents segment dominates the market due to the consumable nature of these products and the continuous development of specialized extraction chemistries optimized for specific sample types (e.g., cell-free DNA, formalin-fixed, paraffin-embedded tissues). The Instruments segment, particularly automated liquid handling systems dedicated to nucleic acid isolation, is experiencing rapid growth, driven by the increasing need for high-throughput screening in clinical diagnostics and large-scale biobanking operations. Among applications, molecular diagnostics remains the most rapidly expanding area, leveraging purified nucleic acids for early disease detection, prognostic assessments, and therapeutic monitoring in personalized healthcare.

AI Impact Analysis on DNA & RNA Sample Preparation Market

Common user questions regarding AI's impact on DNA & RNA Sample Preparation often revolve around how artificial intelligence can minimize human error, optimize protocol parameters for highly complex or limited samples, and streamline the integration of sample quality control with downstream computational genomics. Users are keenly interested in predictive maintenance for robotic systems, AI-driven troubleshooting for failed extraction runs, and the utilization of machine learning algorithms to identify optimal reagent concentrations or incubation times based on historical success data and specific sample characteristics (e.g., input volume, cellularity). The overarching expectation is that AI will transform sample preparation from a critical but labor-intensive bottleneck into a highly consistent, self-optimizing, and fully integrated component of the laboratory workflow, significantly boosting the reliability of sensitive genomic assays.

The direct application of AI in the sample preparation domain centers on enhancing the performance and efficiency of automated extraction platforms. Machine learning models can analyze real-time sensor data from robotic instruments to preemptively detect mechanical failures or anomalies in liquid handling, ensuring maximum uptime and reliability. More profoundly, AI algorithms can be trained on vast datasets of successful and failed extraction protocols across various sample types and purity metrics. This allows the system to intelligently adjust parameters—such as mixing speed, bead volume, or wash steps—mid-protocol, customizing the extraction process dynamically for each sample to maximize yield and purity, a capability far exceeding static, predefined protocols.

Furthermore, AI plays a crucial role in the initial quality assessment and subsequent integration of preparation data with analytical results. By employing computer vision and machine learning on input samples (e.g., histological images or plasma characteristics), AI can predict the likely success rate of extraction and flag samples requiring specialized attention. Post-extraction, AI systems can correlate QC metrics (like 260/280 ratio or fragment size analysis) with downstream assay performance (e.g., sequencing coverage or variant calling accuracy). This holistic data integration provides closed-loop feedback, allowing continuous refinement of preparation protocols and establishing best practices across multiple laboratory sites, thereby standardizing quality across the entire genomic workflow.

- AI-driven optimization of automated liquid handling parameters for maximized nucleic acid yield and purity.

- Predictive quality control (QC) assessment of input samples to anticipate and mitigate extraction difficulties.

- Enhanced troubleshooting and anomaly detection in robotic systems using real-time sensor data analysis.

- Machine learning correlation of preparation metrics with downstream sequencing or PCR performance for continuous protocol refinement.

- Development of smart, adaptive extraction protocols that adjust automatically based on individual sample variability.

DRO & Impact Forces Of DNA & RNA Sample Preparation Market

The market dynamics are significantly influenced by powerful Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces shaping the industry's trajectory. Key drivers include the global genomics revolution, characterized by decreasing sequencing costs and the resultant surge in genomic data generation, necessitating reliable, high-purity inputs. The substantial increase in cancer research and molecular diagnostics, particularly the maturation of liquid biopsy techniques requiring highly sensitive cell-free nucleic acid (cfNA) extraction, also exerts immense pressure for technological advancement. However, restraints such as the high initial investment cost associated with high-throughput automated instruments, especially in developing economies, and the inherent complexity and variability in processing diverse sample matrices (e.g., highly degraded or trace samples) slightly impede uniform market expansion. Opportunities are abundant in developing novel point-of-care (PoC) sample preparation devices, integrating microfluidics for minimal sample volume processing, and expanding applications into non-invasive prenatal testing (NIPT) and advanced microbial surveillance.

Impact forces specifically relate to the confluence of technological innovation and market necessity. The push for precision medicine mandates preparation methods that can reliably isolate nucleic acids from challenging samples like formalin-fixed, paraffin-embedded (FFPE) tissues, which are often degraded. The need for faster turnaround times, especially in critical clinical settings like infectious disease outbreaks, is driving the adoption of rapid, single-step preparation kits that bypass lengthy centrifugation or complex washing steps. The competitive landscape is intensely focused on intellectual property surrounding magnetic bead surface chemistry and robotic arm precision, as these areas determine the cost-effectiveness and performance benchmarks of commercial offerings. Regulatory harmonization in diagnostics is also a substantial force, pushing manufacturers to standardize their products for clinical use, demanding greater quality assurance in the preparation stage.

The continuous development of highly stabilized and user-friendly collection devices designed to preserve nucleic acid integrity post-sampling also acts as a critical external force impacting the preparation market. If collection methods are poor, even the most advanced extraction technology cannot recover high-quality material, thus driving integration across the entire pre-analytical workflow. Conversely, ethical and privacy concerns surrounding large-scale biobanking and genomic data sharing indirectly pressure the market to develop highly secure and trackable sample processing solutions. Overall, the market remains highly responsive to technological breakthroughs that promise higher throughput, lower costs per sample, and superior nucleic acid purity essential for the increasingly sensitive downstream analytical platforms.

Segmentation Analysis

The DNA & RNA Sample Preparation Market is intricately segmented based on Product, Technology, Application, and End-User, reflecting the diverse needs across research and clinical laboratories. The Product segment differentiation between Kits & Reagents and Instruments is critical; Kits, being consumables, account for the largest revenue share and drive volume growth, while Instruments, especially automated platforms, dictate throughput and standardization capabilities crucial for clinical environments. Technology segmentation highlights the shift from conventional solvent-based methods to highly efficient solid-phase extraction techniques like magnetic bead-based systems, which are preferred for their automation compatibility and ability to handle large batches consistently. Application segmentation shows molecular diagnostics as the fastest-growing area, benefiting from the immediate clinical necessity for high-quality genomic information in patient care, while fundamental research provides a stable base demand.

Focusing on the end-users reveals significant growth potential in Pharmaceutical & Biotechnology Companies, which utilize sample preparation extensively in drug discovery, clinical trials, and toxicological studies, demanding ultra-high throughput capabilities. Academic & Research Institutes form the bedrock of the market, purchasing diverse kits for fundamental research in genomics and transcriptomics, often prioritizing flexibility and protocol customization. The rise in decentralized testing and the establishment of large regional diagnostic chains amplify demand from Hospitals & Diagnostic Centers, which seek robust, certified systems compliant with regulatory standards for routine diagnostic workflows.

Understanding these segments allows market participants to tailor their offerings effectively. For instance, manufacturers targeting the diagnostic segment must prioritize regulatory approval (e.g., FDA or CE-IVD marking) and integration with common laboratory information management systems (LIMS), whereas those focused on academic research might emphasize protocols optimized for novel or extremely challenging sample sources. The interdependence of these segments is evident, as advancements in automation (Instrument segment) are directly leveraged to scale diagnostic testing (Application segment) within clinical laboratories (End-User segment), driving the overall market growth trajectory.

- Product

- Kits & Reagents (Lysis Buffers, Purification Columns, Magnetic Beads)

- Instruments (Automated Nucleic Acid Extractors, High-Throughput Workstations, Manual Systems)

- Consumables & Accessories (Plates, Tubes, Tips)

- Technology

- Solid-Phase Extraction (SPE)

- Magnetic Bead-Based Separation

- Spin Column-Based Methods

- Liquid-Liquid Extraction (LLE)

- Microfluidics-Based Isolation

- Application

- Molecular Diagnostics (Infectious Disease Testing, Oncology, Genetic Testing)

- Research Applications (Genomics, Transcriptomics, Proteomics, Drug Discovery)

- Biobanking

- End-User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Hospitals & Diagnostic Centers

- Contract Research Organizations (CROs)

Value Chain Analysis For DNA & RNA Sample Preparation Market

The value chain for the DNA & RNA Sample Preparation Market begins with upstream analysis, focusing heavily on the raw material suppliers, including manufacturers of high-purity chemicals, specialized magnetic particles, and molded plastics for consumables (spin columns, plate wells). Quality control and sourcing reliability at this initial stage are paramount, as the chemical purity of reagents directly impacts the yield and integrity of the extracted nucleic acids. Key upstream activities involve the synthesis of proprietary binding chemistries and the precision engineering of robotic components necessary for automated instrumentation. Manufacturers often maintain tight control over the synthesis of their specialized magnetic beads, which are a core competitive differentiator in the market, allowing for optimized binding and elution efficiencies across various sample types.

Midstream activities involve the primary market players who assemble and package the final products—extraction kits, specialized reagents, and automated instruments. This stage includes complex R&D dedicated to protocol optimization, automation scripting, and securing regulatory approvals (especially for diagnostic-grade kits). Distribution channel analysis reveals a mix of direct sales channels, particularly for high-value instruments and strategic pharmaceutical accounts, and indirect channels relying on specialized regional distributors who possess established relationships with academic and diagnostic laboratories. Direct distribution provides manufacturers with greater control over pricing and technical support, whereas indirect channels are crucial for penetrating geographically diverse and smaller markets efficiently, ensuring widespread product availability.

Downstream analysis centers on the deployment and utilization of the preparation products by end-users. Academic and research laboratories constitute a significant downstream segment, utilizing samples for basic scientific discovery. However, the rapidly expanding clinical diagnostics sector demands extensive post-sales support, application training, and seamless integration with downstream analytical platforms (e.g., NGS sequencers or PCR machines). Customer feedback at this stage is critical for iterative product development. The shift toward decentralized testing is favoring technologies that require less technical expertise and offer rapid, robust results, thereby influencing the innovation roadmap for both direct sales teams supporting large installations and third-party vendors facilitating point-of-care implementation.

DNA & RNA Sample Preparation Market Potential Customers

The primary consumers and end-users of DNA & RNA sample preparation products are institutions engaged in high-stakes biological research, clinical diagnostics, and the development of biopharmaceuticals. Pharmaceutical and Biotechnology companies represent a highly lucrative segment, purchasing high volumes of automated systems and bulk reagents necessary for preclinical studies, high-throughput screening of drug candidates, and the execution of clinical trials where genetic testing or monitoring of biomarkers is required. These customers prioritize scalability, robust performance across complex matrices, and validated compliance with Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) standards. Their demand is consistently focused on high-speed, reliable automation that integrates smoothly into robotic lab workflows.

Hospitals and Diagnostic Centers form another critical customer base, driven primarily by the need for accurate and timely patient results. They are the key buyers of CE-IVD or FDA-cleared diagnostic kits used for routine infectious disease testing, oncology mutation analysis, and genetic screening. Their purchasing decisions are heavily influenced by the ease of use, regulatory approval status, and the ability of the system to manage small, sensitive clinical samples consistently. Furthermore, major academic institutions and government-funded research bodies are continuous, stable customers, focusing on versatility and cost-effectiveness to support diverse fundamental research projects in fields such as microbial genomics, personalized medicine studies, and biobanking activities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $10.9 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qiagen N.V., Thermo Fisher Scientific Inc., Danaher Corporation (Beckman Coulter, Pall), F. Hoffmann-La Roche Ltd., Agilent Technologies Inc., Bio-Rad Laboratories, PerkinElmer Inc., Illumina Inc., Takara Bio Inc., Promega Corporation, Zymo Research Corp., Norgen Biotek Corp., Bioneer Corporation, Tecan Group Ltd., Hamilton Company, Macherey-Nagel GmbH & Co. KG, Analytik Jena GmbH, bioMérieux SA, GenDx B.V., New England Biolabs. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DNA & RNA Sample Preparation Market Key Technology Landscape

The technology landscape of the DNA & RNA Sample Preparation Market is dominated by two primary methodologies: Solid-Phase Extraction (SPE) and Magnetic Bead-Based Separation, with emerging techniques like microfluidics rapidly gaining traction. SPE, often implemented through spin columns, remains widely utilized, particularly in research settings where cost-effectiveness and relatively high purity are required. However, the complexity of SPE methods limits their scalability for high-throughput clinical applications. The major technological shift is toward Magnetic Bead-Based Separation, where paramagnetic particles coated with specific chemistries (silica, carboxyl) bind nucleic acids reversibly. This technology is highly compatible with automated liquid handling systems, minimizes sheer stress on delicate RNA molecules, and provides superior recovery rates, making it the gold standard for clinical diagnostics and biobanking operations requiring high throughput and standardization.

Innovations are concentrated on enhancing the selectivity and efficiency of these separation techniques. Manufacturers are developing proprietary bead coatings optimized for isolating challenging targets, such as cell-free DNA (cfDNA) from plasma or nucleic acids from highly inhibiting environmental samples. Furthermore, there is intense competition in instrument design, focusing on creating fully enclosed, cartridge-based systems that minimize manual intervention and risk of contamination—a critical requirement for sensitive applications like pathogen detection and forensic analysis. These integrated systems often incorporate built-in quality control checks and barcode tracking features, ensuring sample traceability throughout the preparation workflow.

Looking forward, microfluidics technology is poised to revolutionize the market, particularly for point-of-care (PoC) testing and applications involving extremely low sample volumes. Microfluidic chips integrate sample lysis, nucleic acid binding, washing, and elution onto a single, disposable platform, drastically reducing reagent consumption and processing time. While still maturing, microfluidics offers unparalleled portability and the potential for fully automated, sample-to-answer solutions. The synergistic development of advanced robotics, specialized magnetic chemistries, and microfluidic integration defines the current technology roadmap, aiming toward decentralized, rapid, and ultra-high-sensitivity nucleic acid purification necessary for the next generation of genomic medicine.

Regional Highlights

The market for DNA & RNA Sample Preparation exhibits distinct regional characteristics influenced by healthcare spending, R&D intensity, and regulatory environments.

- North America (U.S. and Canada): This region is the undisputed market leader, driven by significant governmental and private funding for genomics research, the robust presence of leading biotechnology and pharmaceutical companies, and the early and extensive adoption of next-generation sequencing in clinical diagnostics. The U.S. spearheads innovation in liquid biopsy and personalized medicine, creating sustained high demand for sophisticated, high-throughput automated extraction systems. Regulatory pathways, although stringent, are well-defined for IVD products, encouraging manufacturers to launch cutting-edge clinical preparation kits.

- Europe (Germany, UK, France): Europe holds the second-largest market share, supported by well-established public healthcare systems, strong academic research collaborations, and large national biobanking initiatives. Countries like Germany and the UK are crucial hubs for pharmaceutical R&D, necessitating large volumes of nucleic acid extraction for drug development and clinical trials. The focus here is balanced between high-quality research products and CE-IVD certified kits for standardized clinical pathology labs.

- Asia Pacific (APAC) (China, Japan, India): APAC is projected to be the fastest-growing region, characterized by rapidly developing healthcare infrastructure, increasing prevalence of genetic and infectious diseases, and growing governmental investments in R&D and precision medicine. China, in particular, is witnessing explosive growth due to massive domestic genomics projects and rising diagnostic capabilities. Japan remains a strong market for premium, automated instruments, while India offers significant growth opportunities driven by the expanding network of diagnostic labs and rising medical tourism.

- Latin America (Brazil, Mexico): This region represents an emerging market with increasing adoption of molecular diagnostics, particularly for infectious disease surveillance and oncology. Market growth is gradually accelerating, constrained slightly by budget limitations but driven by the need for cost-effective, high-reliability solutions for regional public health challenges.

- Middle East and Africa (MEA): Growth in the MEA region is localized, primarily concentrated in high-income Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia, UAE) which are investing heavily in establishing advanced healthcare facilities and genomic sequencing centers. Challenges include fragmented distribution channels and the necessity for culturally appropriate and cost-sensitive technological solutions in broader Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DNA & RNA Sample Preparation Market.- Qiagen N.V.

- Thermo Fisher Scientific Inc.

- Danaher Corporation (Beckman Coulter, Pall Corporation)

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- PerkinElmer Inc.

- Illumina Inc.

- Takara Bio Inc.

- Promega Corporation

- Zymo Research Corp.

- Norgen Biotek Corp.

- Bioneer Corporation

- Tecan Group Ltd.

- Hamilton Company

- Macherey-Nagel GmbH & Co. KG

- Analytik Jena GmbH

- bioMérieux SA

- GenDx B.V.

- New England Biolabs (NEB)

Frequently Asked Questions

Analyze common user questions about the DNA & RNA Sample Preparation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the DNA & RNA Sample Preparation Market?

The market is primarily driven by the exponential expansion of Next-Generation Sequencing (NGS) applications, the increasing global prevalence of chronic diseases requiring molecular diagnostics (e.g., oncology), and the critical need for rapid, high-throughput nucleic acid extraction systems in personalized medicine and infectious disease research. Falling sequencing costs necessitate better sample quality, sustaining demand for advanced preparation technologies.

Which technology segment holds the largest share in the sample preparation market?

The Magnetic Bead-Based Separation technology currently dominates the market share. This method is highly favored due to its compatibility with full automation, scalability for high-throughput clinical workflows, superior consistency, and ability to efficiently process diverse and challenging sample types, including plasma for liquid biopsy applications, ensuring high nucleic acid yield and purity.

How is the rise of liquid biopsy impacting the demand for DNA & RNA sample preparation products?

Liquid biopsy, which relies on isolating trace amounts of circulating tumor DNA (ctDNA) or cell-free RNA (cfRNA) from blood, significantly boosts demand for ultra-sensitive extraction kits. These methods require highly specialized preparation technologies capable of concentrating minute quantities of nucleic acids with high efficiency and minimal inhibitor contamination, driving innovation in magnetic bead chemistries and automated systems optimized for low-concentration targets.

What is the key difference between automated and manual sample preparation instruments?

Automated instruments offer high throughput, standardization, and reduced hands-on time, minimizing human error and cross-contamination, making them ideal for high-volume clinical and pharma labs. Manual systems, primarily utilizing spin columns or organic extraction, are cost-effective and flexible for smaller batch sizes or specialized research protocols but suffer from variability, low throughput, and increased labor requirements.

Which region offers the highest growth potential for the DNA & RNA Sample Preparation Market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly improving healthcare infrastructure, substantial government investments in genomics projects, increasing patient awareness regarding molecular diagnostics, and the large patient populations in economies such as China, India, and South Korea, driving the establishment of new diagnostic and research facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager