DNS Security Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431359 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

DNS Security Software Market Size

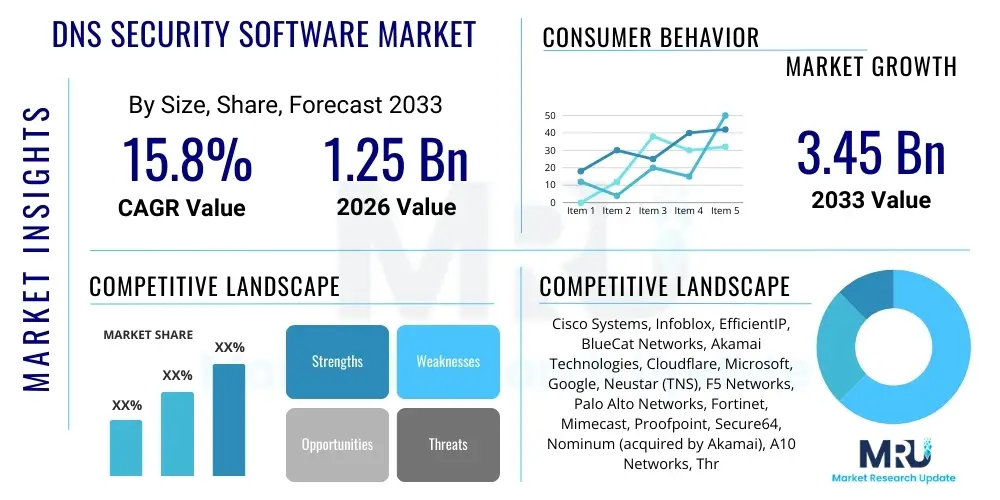

The DNS Security Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $3.45 Billion by the end of the forecast period in 2033.

DNS Security Software Market introduction

The DNS Security Software Market encompasses solutions designed to safeguard the foundational Domain Name System (DNS) infrastructure against various cyber threats, including Distributed Denial of Service (DDoS) attacks, domain generation algorithms (DGAs), DNS tunneling, cache poisoning, and other malware-related exploits that leverage DNS for command and control (C2) communication. These sophisticated security platforms ensure DNS resolution integrity, availability, and confidentiality, which are critical for seamless internet operation and enterprise resource access. The inherent ubiquity of DNS, utilized in almost every network connection, makes it a prime target for attackers seeking to disrupt operations, exfiltrate data, or redirect users to malicious sites, thereby necessitating specialized security layers beyond traditional firewalls and intrusion prevention systems.

DNS security products typically include advanced features such as predictive threat intelligence, behavioral anomaly detection, real-time logging and analytics, and policy enforcement engines tailored specifically for DNS queries and responses. Major applications span across critical infrastructure protection, regulatory compliance (like GDPR and HIPAA), corporate network defense, and managed security services offerings. The software integrates seamlessly into existing network architectures, often deploying solutions either on-premises, as cloud-based services (DNS-as-a-Service), or in hybrid environments. The primary product goal is to provide deep visibility into DNS traffic, filtering out malicious queries before they connect endpoints to compromised resources, effectively acting as an early warning system and prevention layer in the cyber defense strategy.

Driving factors for sustained market growth include the exponential increase in the volume and complexity of multi-vector cyberattacks, where DNS tunneling is frequently employed to bypass security controls. Furthermore, the massive shift towards remote work models and cloud adoption has blurred traditional network perimeters, making centralized, secure DNS resolution vital for maintaining Zero Trust architecture principles. Regulatory pressures mandating robust data protection and continuous monitoring also compel organizations across finance, healthcare, and government sectors to adopt purpose-built DNS security solutions. The benefits derived include reduced operational downtime, immediate detection of covert communication channels, enhanced data loss prevention, and significant improvement in overall security posture maturity.

DNS Security Software Market Executive Summary

The DNS Security Software Market is experiencing robust expansion driven by pervasive digital transformation initiatives and the corresponding rise in targeted, highly evasive cyber threats that exploit DNS vulnerabilities. Business trends indicate a significant shift from on-premises dedicated hardware solutions towards flexible, scalable cloud-native and hybrid DNS security offerings (DNS-as-a-Service), catering particularly to the needs of Small and Medium-sized Enterprises (SMEs) and large organizations managing distributed networks. Key technological advancements center around integrating machine learning (ML) and artificial intelligence (AI) into threat detection mechanisms, allowing security software to identify new domain generation algorithms (DGAs) and subtle tunneling activities with greater precision and reduced false positives. Consolidation in the vendor landscape, marked by strategic acquisitions focusing on specialized threat intelligence capabilities, is also shaping the competitive environment, emphasizing comprehensive, integrated security portfolios.

Regionally, North America maintains its dominance in market share, primarily due to the presence of numerous large enterprises, stringent cybersecurity regulations (such as those from NIST and CISA), and high cybersecurity spending budgets across finance, government, and technology sectors. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid industrialization, increasing internet penetration, and mandatory governmental mandates for securing critical national infrastructure in economies like China, India, and Japan. Europe also represents a mature market, stimulated by GDPR compliance requirements which necessitate robust data flow monitoring and immediate response capabilities against data breaches facilitated through compromised DNS infrastructure. Investment flows are concentrated in developing localized, regional threat intelligence feeds tailored to specific geographical threat actors and attack patterns.

In terms of segmentation, the market is primarily categorized by deployment model (cloud-based versus on-premises), component (solution versus services), organization size (SMEs versus Large Enterprises), and end-user vertical. The solution segment, specifically the Recursive DNS protection sub-segment, is currently the largest contributor, reflecting the widespread need to secure external resolution services. Conversely, the managed services segment is witnessing accelerated adoption, driven by organizations lacking specialized in-house security expertise to manage complex DNS defenses 24/7. Large enterprises currently hold the majority market share due to their extensive network footprints and high regulatory exposure, yet the SME segment is rapidly catching up, supported by accessible and cost-effective cloud-delivered security models.

AI Impact Analysis on DNS Security Software Market

User inquiries frequently center on how AI can automate and enhance the detection of zero-day DNS threats, reduce reliance on static signature databases, and improve the speed of incident response within complex enterprise environments. Users are highly interested in AI’s ability to differentiate legitimate high-volume DNS traffic from malicious covert communication channels, such as sophisticated DNS tunneling techniques often used in advanced persistent threats (APTs). Concerns often revolve around the computational overhead of deploying ML models in real-time DNS resolvers, the potential for adversarial AI to confuse security models, and the need for explainable AI (XAI) to validate automated decision-making processes, ensuring compliance and minimizing business disruption from false positives. Expectations are high regarding predictive analysis capabilities, allowing systems to anticipate domain shifts used by malware families and automatically update blacklists or quarantine affected endpoints before a breach fully materializes. The integration of AI is seen not just as an analytical tool but as a critical component for achieving self-healing security architectures.

- AI-driven behavioral analysis enhances the detection of DNS tunneling and data exfiltration by recognizing subtle deviations from established network baselines.

- Machine Learning models automate the identification and classification of new Domain Generation Algorithms (DGAs) used by rapidly evolving malware variants.

- Predictive threat intelligence utilizes deep learning to forecast future malicious domain registrations, offering proactive blocking capabilities.

- AI significantly reduces response time to DNS-based threats by automatically isolating compromised devices and updating policy enforcement points instantly.

- Generative AI tools may be used by threat actors to create highly realistic phishing domains, necessitating more sophisticated defense mechanisms powered by advanced neural networks.

- Enhanced reporting and visualization through AI simplify complex DNS log data, improving situational awareness for security operations teams.

DRO & Impact Forces Of DNS Security Software Market

The dynamics of the DNS Security Software Market are profoundly shaped by a confluence of powerful drivers, persistent restraints, and significant opportunities, collectively summarized as the DRO (Drivers, Restraints, Opportunities) structure. The primary driver is the exponentially increasing sophistication and volume of cyberattacks, particularly those leveraging DNS as a blind spot for command and control communication, prompting immediate investment in dedicated defense solutions. Regulatory mandates, such as the Network and Information Security (NIS) Directive in Europe and various sector-specific compliance requirements (e.g., PCI DSS, HIPAA), force organizations to implement robust DNS monitoring and protection. Furthermore, the shift to hybrid work environments and multi-cloud strategies necessitates decentralized yet secure DNS resolution for remote users, boosting demand for cloud-delivered security models. These factors exert immense pressure, accelerating market adoption across nearly all industry verticals.

However, market growth faces notable restraints. The most significant challenge is the pervasive lack of awareness among many organizations, particularly SMEs, regarding the critical security role of DNS; many incorrectly assume that traditional perimeter defenses adequately cover DNS traffic. The high initial deployment costs associated with complex on-premises DDI (DNS, DHCP, IP Address Management) solutions, coupled with the ongoing need for specialized IT personnel to manage and maintain these systems, act as financial and operational barriers. Additionally, performance concerns related to implementing deep packet inspection or complex filtering rules directly within the DNS resolution pathway can occasionally introduce latency, which is unacceptable for mission-critical applications, leading to hesitation in large-scale deployment.

The market is rich with opportunities, especially in leveraging emerging technologies and addressing underserved segments. The proliferation of IoT devices and Operational Technology (OT) networks presents a massive opportunity, as these endpoints require secure DNS resolution but often lack robust internal security controls. Development of integrated security platforms combining DDI capabilities with Endpoint Detection and Response (EDR) and Security Information and Event Management (SIEM) solutions offers a competitive edge. Moreover, the growth of Managed Security Service Providers (MSSPs) delivering specialized DNS security services allows smaller organizations to access high-grade protection without the burden of in-house expertise. Successfully navigating the restraints by offering user-friendly, high-performance, and affordable cloud-based solutions will unlock substantial unrealized market potential.

Segmentation Analysis

The DNS Security Software Market is meticulously segmented based on several critical dimensions, allowing vendors to target specific operational needs and deployment preferences of diverse client bases. Key segmentation categories include the component type (solutions vs. services), deployment model (cloud vs. on-premises), organization size (SMEs vs. large enterprises), and the type of security offering (recursive DNS protection, authoritative DNS protection, etc.). This granular approach ensures that solutions are optimized for scalability, cost-effectiveness, and integration requirements, whether the client is a cloud-native startup requiring flexible subscription models or a highly regulated financial institution necessitating strict on-premises control and compliance. Understanding these segment dynamics is crucial for strategic market positioning and for accurately forecasting demand shifts in evolving IT landscapes.

- By Component:

- Solution (Recursive DNS Protection, Authoritative DNS Protection, DNS Firewall, DNS Auditing and Reporting)

- Services (Managed Services, Professional Services, Training and Consultation)

- By Deployment Model:

- On-Premises

- Cloud-Based (DNS-as-a-Service)

- Hybrid

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-User Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecommunications

- Government and Defense

- Healthcare

- Retail and E-commerce

- Manufacturing

- Education and Research

Value Chain Analysis For DNS Security Software Market

The value chain for the DNS Security Software Market begins with the upstream activities of core technology development, focusing on proprietary threat intelligence, sophisticated DGA detection algorithms, and high-performance DNS resolution engines. Core foundational elements involve R&D into cryptographic techniques for DNS security extensions (DNSSEC) and the development of robust, scalable cloud infrastructure necessary for low-latency, global DNS resolution services. Key upstream suppliers include providers of AI/ML frameworks, raw cloud computing infrastructure (AWS, Azure, GCP), and specialized cybersecurity researchers who constantly analyze emerging threat patterns, providing the critical data feeds that power the security intelligence platforms. Competitive advantage at this stage is derived from innovation speed and the exclusivity and breadth of proprietary threat data.

The midstream phase involves the transformation of core technology into deployable software solutions and integrated services. This includes the development of user interfaces, management consoles, seamless integration capabilities with existing enterprise security ecosystems (SIEM, SOAR), and the creation of highly redundant, distributed global networks necessary for cloud-based offerings. Distribution channels play a vital role in reaching the end-customer. Direct sales are common for large enterprise contracts requiring significant customization and integration support. Indirect channels, primarily through Value-Added Resellers (VARs), System Integrators (SIs), and Managed Security Service Providers (MSSPs), are crucial for reaching SMEs and specialized market segments. MSSPs, in particular, often white-label or deeply integrate vendor solutions to offer comprehensive security packages, significantly expanding market reach.

Downstream activities focus on deployment, post-sales support, maintenance, and continuous threat intelligence updates. For cloud-based solutions, this involves constant monitoring of network performance and immediate application of security policy updates. For on-premises installations, specialized professional services are required for deployment and integration into complex internal network architectures. Customer retention hinges heavily on the quality of technical support and the effectiveness of the security platform in thwarting actual attacks. Feedback from end-users and MSSP partners is fed back into the R&D cycle (upstream) to continuously improve product efficacy and adapt to evolving threat landscapes, completing the cyclical nature of the value chain and ensuring sustainable product relevance.

DNS Security Software Market Potential Customers

Potential customers for DNS Security Software span the entire spectrum of organizations that rely on interconnected networks and the internet for critical business operations, ranging from multinational corporations to small businesses and public sector entities. Organizations in the Banking, Financial Services, and Insurance (BFSI) sector are primary consumers due to their high volume of sensitive transactions, stringent regulatory requirements (like compliance with global anti-money laundering regulations and data protection laws), and their status as frequent targets for sophisticated state-sponsored and organized cybercrime groups utilizing DNS for financial fraud and data theft. Similarly, the IT and Telecommunications sector, being the infrastructure backbone of digital commerce, requires the highest levels of DNS integrity and availability to maintain service delivery and protect their vast customer data sets, making them critical buyers of advanced DDI and security solutions.

The Government and Defense sectors represent another major end-user group, driven by the need to secure critical national infrastructure (CNI) and prevent espionage or disruption by foreign adversaries who frequently use DNS hijacking and tunneling for highly covert operations. Their requirements often lean towards robust, highly resilient on-premises or secured private cloud deployments with certified compliance standards. The Healthcare sector, dealing with highly sensitive patient health information (PHI), mandates robust DNS security to comply with regulations such as HIPAA, ensuring that internal systems are protected from ransomware and malware that often utilize compromised DNS queries to propagate or communicate command and control signals. Their vulnerability stems from the widespread use of legacy systems and interconnected medical devices.

Beyond these highly regulated segments, the Retail and E-commerce vertical relies heavily on secure, high-availability DNS for online transaction processing, protecting customer trust, and ensuring continuous website accessibility, making them significant buyers of high-performance recursive DNS protection. Manufacturing and Critical Infrastructure segments (Energy, Utilities) are increasingly adopting these solutions to protect their Operational Technology (OT) environments, where IoT devices and ICS systems interact with standard IP networks. The proliferation of devices in these environments drastically expands the attack surface, necessitating centralized visibility and strict policy enforcement via security-enhanced DNS layers to prevent production downtime and catastrophic physical damage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $3.45 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems, Infoblox, EfficientIP, BlueCat Networks, Akamai Technologies, Cloudflare, Microsoft, Google, Neustar (TNS), F5 Networks, Palo Alto Networks, Fortinet, Mimecast, Proofpoint, Secure64, Nominum (acquired by Akamai), A10 Networks, ThreatSTOP, DNSFilter, DDI-Lifecycle. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DNS Security Software Market Key Technology Landscape

The technology landscape of the DNS Security Software Market is defined by the integration of advanced techniques aimed at preempting and neutralizing threats that operate at the network’s foundation. A core technology is DNS Security Extensions (DNSSEC), which uses digital signatures to authenticate data origin and integrity, preventing cache poisoning and man-in-the-middle attacks, though its complexity hinders universal adoption. Modern solutions increasingly rely on sophisticated behavioral analytics and machine learning algorithms that establish normal traffic baselines. These algorithms are vital for detecting anomalies indicative of DNS tunneling—a technique where attackers encode sensitive data or command-and-control instructions within standard DNS query formats—which signature-based systems routinely miss. Furthermore, secure recursive DNS services provided by vendors offer global networks capable of performing real-time blocking based on continuously updated global threat intelligence feeds, minimizing latency while maximizing protection.

Another pivotal technological area is the convergence of DDI (DNS, DHCP, IPAM) capabilities with dedicated security features. Integrated DDI solutions, provided by market leaders, offer centralized visibility and control over all IP addressing resources, linking security policy enforcement directly to IP address assignments and user identity. This integration streamlines network management while providing a crucial, contextual layer of security intelligence. Furthermore, the rising demand for Zero Trust Network Access (ZTNA) architectures has spurred the adoption of highly granular, policy-based DNS filtering, ensuring that even internal lateral movement is restricted based on trust levels, rather than relying solely on network location. The technical shift towards containerization and microservices also necessitates secure, API-driven DNS infrastructure management.

Cloud-native architectures, particularly DNS-as-a-Service, represent a significant technological shift, offering advantages in scalability, resilience, and immediate deployment of global security updates without requiring customer intervention. These cloud platforms leverage massive data pools to feed their AI models, continuously improving threat detection accuracy far beyond what any single on-premises installation could achieve. Edge computing is also becoming relevant, allowing certain security checks, such as preliminary query filtering, to occur closer to the user, thereby mitigating potential latency issues associated with centralized cloud security. The overall technological thrust is towards making DNS security ubiquitous, invisible to the end-user, and deeply integrated into the broader cybersecurity framework, moving away from siloed security products towards unified, intelligent platforms.

Regional Highlights

- North America: North America remains the leading region in terms of market share and technological innovation adoption, primarily driven by the United States. This dominance is attributable to the high concentration of large enterprises in technology, finance, and defense sectors, coupled with substantial cybersecurity budgets mandated by strict regulatory frameworks like SOX, HIPAA, and various government directives (e.g., CISA guidelines). The region is characterized by early adoption of advanced cloud-based DNS security solutions and a high demand for AI-integrated threat detection platforms. The competitive environment is mature, featuring both established global players and innovative security startups, ensuring continuous product evolution focused on preventing sophisticated APTs and state-sponsored attacks.

- Europe: The European market demonstrates significant growth, largely propelled by the enforcement of the General Data Protection Regulation (GDPR) and the NIS Directive, which impose heavy penalties for data breaches and require robust protective measures for critical infrastructure. Countries like the UK, Germany, and France are primary markets, showing accelerated adoption of hybrid and managed DNS security services to manage complex multi-national operations and diverse regulatory landscapes. Focus areas include ensuring data sovereignty for DNS logs and deploying solutions that integrate easily with existing legacy network infrastructure while providing transparent auditing capabilities.

- Asia Pacific (APAC): APAC is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This explosive growth is fueled by rapid digital transformation, increasing internet penetration, and significant governmental investment in smart city initiatives and critical infrastructure protection, particularly in emerging economies like India and China. While cost sensitivity remains a factor, the escalating geopolitical tensions and corresponding rise in cyber warfare activities drive demand for powerful, localized DNS security solutions tailored to regional threat profiles. Adoption of cloud-based DDI solutions is accelerating due to the rapid establishment of new data centers and decentralized operations.

- Latin America (LATAM): The LATAM region presents a growing opportunity, albeit starting from a smaller base, driven by improving economic stability and increasing awareness of global cyber threats affecting financial institutions and major telecommunication carriers. Market adoption is concentrated in larger economies like Brazil and Mexico. The primary driver here is the need for affordable and easily deployable solutions, making cloud-based DNS-as-a-Service particularly appealing for mitigating localized phishing campaigns and basic malware distribution leveraging compromised DNS. Challenges include fragmented regulatory environments and reliance on international vendors.

- Middle East and Africa (MEA): The MEA market is seeing steady, concentrated growth, largely centralized around the GCC nations (Saudi Arabia, UAE) due to high government spending on cybersecurity and large-scale infrastructural projects like NEOM. High oil and gas sector investments, coupled with national strategies to diversify economies (e.g., Vision 2030), necessitate world-class protection against espionage and operational disruption. The African market, while nascent, shows potential, driven by mobile connectivity expansion and the growing need to secure mobile network operator infrastructure against DNS abuse and fraud.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DNS Security Software Market.- Cisco Systems

- Infoblox

- EfficientIP

- BlueCat Networks

- Akamai Technologies

- Cloudflare

- Microsoft

- Neustar (TNS)

- F5 Networks

- Palo Alto Networks

- Fortinet

- Mimecast

- Proofpoint

- Secure64

- Nominum (acquired by Akamai)

- A10 Networks

- ThreatSTOP

- DNSFilter

- DDI-Lifecycle

Frequently Asked Questions

Analyze common user questions about the DNS Security Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of DNS Security Software?

The primary function of DNS Security Software is to secure the Domain Name System infrastructure by preventing threats like DNS tunneling, cache poisoning, DDoS attacks, and domain generation algorithms (DGAs). It ensures DNS resolution integrity, availability, and acts as an essential filter to block malicious connections before they reach the endpoint, significantly enhancing the overall security posture of the network.

How does DNS security differ from a traditional firewall?

Traditional firewalls primarily focus on inspecting IP packet headers and port information at the perimeter, whereas DNS security software provides deep packet inspection specific to DNS queries (Layer 7). It analyzes the content, context, and behavior of the DNS traffic itself, using threat intelligence and behavioral analytics to detect highly covert threats that firewalls typically overlook, especially those operating over standard ports like UDP 53.

Which deployment models are most prevalent in the DNS Security market?

The market is increasingly transitioning towards Cloud-Based (DNS-as-a-Service) and Hybrid deployment models. Cloud-based solutions offer scalability, global threat intelligence feeds, and reduced maintenance costs, making them popular among SMEs and geographically distributed enterprises. On-premises solutions remain critical for highly regulated sectors (like government and finance) that require maximum control and data sovereignty.

What role does AI play in improving DNS security solutions?

AI, specifically Machine Learning (ML), is crucial for enhancing threat detection by automating the recognition of zero-day threats and new DGA variants that generate malicious domain names randomly. AI models analyze enormous volumes of DNS traffic to establish behavioral baselines, allowing for the immediate identification and blocking of subtle anomalies indicative of command-and-control communication or data exfiltration attempts.

Which industry vertical is projected to drive the highest demand for advanced DNS Security solutions?

The Banking, Financial Services, and Insurance (BFSI) sector is consistently the highest driver of demand due to the critical nature of their data, high regulatory scrutiny (GDPR, PCI DSS), and their constant targeting by advanced persistent threats aiming for financial fraud or high-value data theft. The IT and Telecommunications sector also represents substantial and rapidly growing demand as they secure core network infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager