Docetaxel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431452 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Docetaxel Market Size

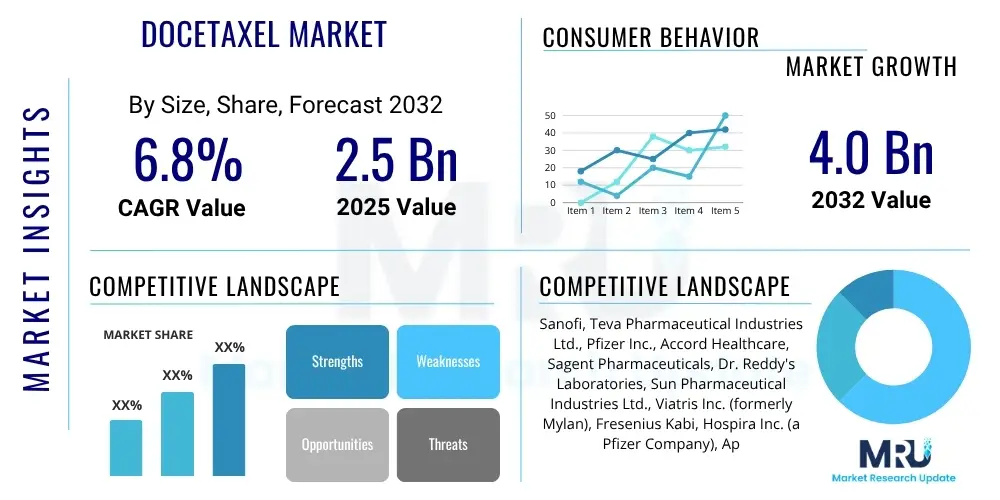

The Docetaxel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 2.85 Billion by the end of the forecast period in 2033.

Docetaxel Market introduction

Docetaxel, chemically known as (2R,3S)-N-carboxy-3-phenylisoserine N-tert-butyl ester 13-ester with 5b,20-epoxy-1,2a,4,7b,10b,13a-hexahydroxytax-11-en-9-one 4-acetate 2a-benzoate, is a crucial agent in the chemotherapy armamentarium, originally synthesized semi-synthetically from precursors found in the European yew tree (Taxus baccata). Its mechanism of action involves the highly targeted disruption of the cellular mitotic process. Specifically, Docetaxel stabilizes microtubules, preventing their depolymerization. This stabilization inhibits the normal dynamic reorganization required for cell division, leading to the accumulation of microtubule bundles and subsequent induction of apoptosis in actively dividing cancer cells. This highly efficient cytotoxic activity is why Docetaxel remains a preferred agent for treating advanced and metastatic stages of solid tumors, even decades after its initial launch. The clinical guidelines across major oncology societies, including ASCO and ESMO, consistently recommend Docetaxel, either as a monotherapy or in sophisticated combination regimens, underscoring its indispensable role in standard care protocols worldwide. This enduring relevance, despite the emergence of biological and targeted therapies, provides a robust foundation for the sustained market value. The market is characterized by widespread generic availability following the expiration of the original patent for Taxotere.

The product landscape primarily consists of concentrated solutions for intravenous infusion, although technological innovation has introduced ready-to-use formulations to simplify preparation in clinical settings and reduce administration errors. Major applications for Docetaxel span a broad spectrum of aggressive cancers. It is considered a gold standard in the treatment of metastatic hormone-refractory prostate cancer, offering significant survival benefits when used alongside corticosteroids. In breast cancer, Docetaxel is widely utilized in both adjuvant settings (following primary surgery) to reduce recurrence risk and in the treatment of metastatic disease. Furthermore, it is a key component in regimes for non-small cell lung cancer, gastric cancer, and head and neck cancer. The core benefits derived from Docetaxel therapy include improved progression-free survival (PFS) and overall survival (OS) in responsive tumor types. Its established clinical profile, supported by extensive long-term safety and efficacy data, ensures its continued position as a foundational chemotherapeutic agent, despite the challenges posed by its known toxicity profile, which manufacturers are actively trying to mitigate through formulation enhancements.

Driving factors for sustained market demand include the undeniable increase in the global cancer burden, particularly in aging populations across developed and developing nations, which necessitates high volumes of effective systemic therapies. Furthermore, enhanced public health awareness and advances in early detection technologies lead to more patients being diagnosed at stages where systemic chemotherapy is indicated. The availability of low-cost, high-quality generic Docetaxel has significantly improved access in emerging economies, contributing substantially to volume growth. Conversely, the market faces constraints from inherent product limitations, primarily the risk of severe adverse events such as febrile neutropenia, fluid retention, and peripheral neuropathy, which sometimes necessitates treatment discontinuation or dose reduction. Strategic manufacturers are investing in better formulations and supportive care agents to manage these toxicities, aiming to maximize the therapeutic index. The overall market trajectory remains positive, underpinned by high clinical demand, robust generic supply chains, and continuous exploration of new combination therapies that pair Docetaxel with novel anti-cancer agents to overcome drug resistance.

Docetaxel Market Executive Summary

The Docetaxel market, despite its maturity and intense generic competition, is poised for modest growth, driven primarily by volume expansion in emerging regional markets and sustained clinical utility in established indications. Business trends emphasize operational efficiency, with generic manufacturers focusing heavily on achieving economies of scale and securing high-volume tender contracts through competitive pricing. Key strategic shifts involve vertical integration or robust control over the API supply chain to ensure quality and cost advantages. Manufacturers are increasingly differentiating their offerings not merely through price, but through superior formulation stability, ready-to-use presentation formats, and comprehensive logistical support for high-stakes oncology products. Furthermore, strategic alliances are forming between Western generic giants and APAC-based API suppliers to stabilize global inventory and mitigate geopolitical supply risks, solidifying the global supply network structure that underpins this essential medicine.

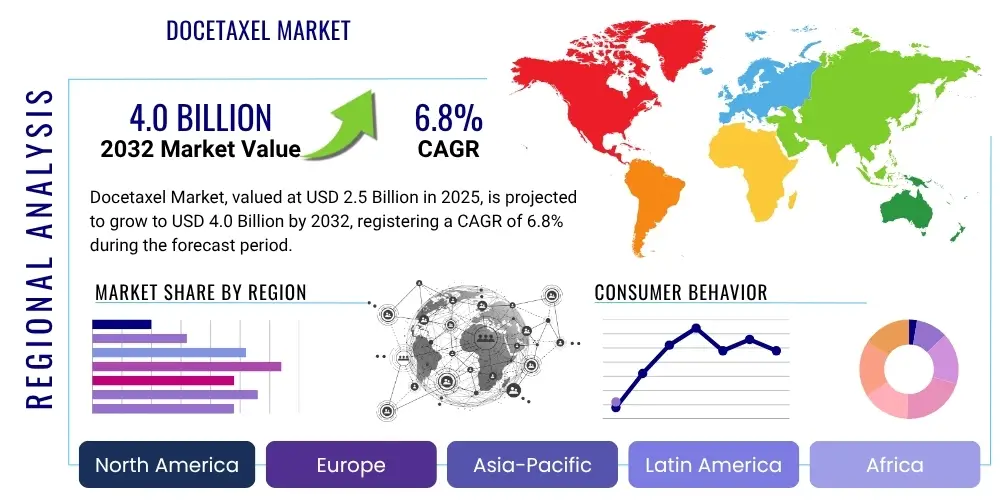

Regional dynamics reveal a clear bifurcation in growth profiles. Mature markets like North America and Western Europe exhibit stable, high-value consumption, characterized by comprehensive regulatory oversight and robust reimbursement structures that support high-quality generic procurement. However, significant market growth momentum is shifting towards the Asia Pacific (APAC), particularly in China, India, and Southeast Asian nations. This rapid regional expansion is propelled by rapid increases in healthcare spending, aggressive governmental initiatives to modernize oncology infrastructure, and a burgeoning patient pool gaining access to standard-of-care treatments for the first time. Latin America and the Middle East & Africa (MEA) represent high-potential, yet fragmented, growth zones, where market access is often contingent upon successful navigation of complex, tender-based procurement systems established by national health agencies. Success in these high-growth regions requires localized regulatory expertise and flexible distribution models adapted to varying infrastructural capabilities.

Segmentation trends confirm the sustained dominance of the application segment encompassing breast cancer, non-small cell lung cancer (NSCLC), and prostate cancer, collectively representing the majority of therapeutic usage. The formulation segment shows marginal but important growth in ready-to-use solutions, reflecting the increasing clinical preference for reduced complexity and enhanced patient safety during drug preparation. Standard injectable concentrates, however, remain the volumetric backbone of the market due to their established position and manufacturing simplicity. In the end-user category, hospitals and large, specialized oncology clinics maintain overwhelming dominance as the primary points of administration. There is a discernible trend towards increased utilization within dedicated Ambulatory Surgical Centers (ASCs) for outpatient chemotherapy infusions, driven by cost containment efforts and enhanced patient comfort, which slightly diversifies the end-user base but keeps purchasing power concentrated among institutional buyers.

AI Impact Analysis on Docetaxel Market

User inquiries frequently explore how Artificial Intelligence (AI) and Machine Learning (ML) can refine the clinical application of a conventional chemotherapy agent like Docetaxel. The focus is on leveraging AI for personalized medicine—specifically, identifying which patients, based on complex genomic, transcriptomic, and proteomic data, will derive the maximum benefit from Docetaxel while avoiding severe toxicities. Users are keen to understand if AI can move beyond simple diagnostics to integrate pharmacokinetic and pharmacodynamic models to predict individual patient response curves and side effect profiles, allowing oncologists to tailor dosage and scheduling with unprecedented precision. A parallel theme revolves around AI's role in the manufacturing and supply chain, optimizing batch yields and quality control in complex semisynthetic processes, thereby enhancing the overall operational efficiency of Docetaxel production and distribution, ensuring high standards in a highly competitive generic environment. This strategic integration of AI is not seen as a threat to the drug itself, but rather as a tool to significantly improve its therapeutic window.

- AI optimizes manufacturing processes, improving yield and purity of Docetaxel active pharmaceutical ingredients (APIs) by real-time process monitoring and adjustment.

- Predictive analytics determines optimal patient selection for Docetaxel therapy based on complex multi-omics data and clinical history, significantly enhancing treatment efficacy rates.

- AI-driven clinical trial design accelerates testing of Docetaxel combination therapies and novel formulations by identifying optimal patient cohorts and endpoints.

- Machine learning algorithms enhance pharmacovigilance by rapidly identifying and analyzing adverse drug reaction patterns across vast electronic health record (EHR) databases globally.

- AI tools assist oncologists in personalized dosing recommendations, adjusting Docetaxel concentration based on real-time toxicity markers and patient metabolic profiles, minimizing severe adverse events.

- Automated image analysis (radiomics) predicts treatment response to Docetaxel in solid tumors more accurately than manual assessment, supporting timely treatment escalation or de-escalation decisions.

- AI models forecast regional demand fluctuations, improving inventory management and logistics for manufacturers and ensuring consistent global supply of this critical chemotherapy agent.

DRO & Impact Forces Of Docetaxel Market

The strategic dynamics of the Docetaxel Market are governed by the interplay of persistent Drivers, substantial Restraints, and latent Opportunities (DRO), which collectively shape the competitive and commercial landscape. Key drivers include the overwhelming global incidence of major cancers—particularly breast, lung, and prostate—where Docetaxel remains a cornerstone treatment, guaranteeing continuous baseline demand. Furthermore, its status as a mature, genericized product ensures cost-effectiveness, making it highly attractive for centralized procurement bodies and public healthcare systems worldwide, especially compared to newer, high-cost biological treatments. Opportunities primarily stem from formulation innovation, such as developing specialized drug delivery systems that mitigate severe side effects, and strategically repositioning Docetaxel in combination therapies with novel targeted agents or immunotherapies to address treatment resistance and expand its therapeutic window into new clinical niches, thereby revitalizing a mature compound.

However, the market faces significant restraints. The most prominent restraint is the intense, multi-source generic competition, which has relentlessly driven down pricing, severely compressing profit margins for all participants and shifting the competitive basis entirely towards supply chain efficiency and volume. Furthermore, the inherent severe side effect profile of traditional Docetaxel formulations, including dose-limiting toxicities such as myelosuppression and neuropathy, compels clinicians and patients to constantly seek less toxic alternatives, threatening its long-term market share. The substantial threat of substitution comes from the rapid proliferation of targeted small molecules, advanced biologics, and transformative immunotherapies (e.g., PD-1/PD-L1 inhibitors) which offer potentially superior safety and efficacy profiles in specific indications, although Docetaxel often finds a role in subsequent lines of therapy when these novel agents fail. These powerful substitution forces mandate continuous innovation to maintain relevance.

The market is heavily influenced by powerful external forces consistent with Porter's Five Forces analysis. Competitive rivalry is exceptionally high due to the large number of generic players operating globally, leading to aggressive bidding wars, particularly in government tender markets. Buyer bargaining power, driven by major hospital networks, GPOs, and national health authorities, is substantial because of the high volumes required and the commoditized nature of generic Docetaxel. Regulatory stringency also acts as a profound force; while generic entry is facilitated by patent expiry, maintaining regulatory compliance (cGMP) for oncology injectables is costly and non-negotiable, acting as a barrier to smaller, less established entrants. Lastly, supplier bargaining power for critical intermediates and the specialized API is moderate but subject to geopolitical risk, necessitating dual sourcing strategies among manufacturers to ensure supply security and mitigate unforeseen disruptions, solidifying the importance of a robust, compliant global supply network to sustain market operations effectively.

Segmentation Analysis

The Docetaxel market structure is defined by three primary layers of segmentation: therapeutic application, physical formulation characteristics, and the institutional end-user base. Analysis of application segments clearly reveals the clinical priority areas, showing where the highest patient volume is concentrated and thus where procurement demand is highest. Formulation segmentation highlights technological progression, differentiating standard, high-solvent formulations from potentially safer, contemporary ready-to-use versions. The end-user analysis provides insight into the procurement pathways, confirming that highly structured institutional environments remain the primary purchasing and administering centers for this critical, high-risk medication, necessitating specialized distribution and handling protocols across the globe for safety and efficacy maintenance.

- Application:

- Breast Cancer (Primary usage segment, including adjuvant and metastatic settings)

- Non-Small Cell Lung Cancer (NSCLC) (Key application, particularly in combination regimens)

- Prostate Cancer (Essential for metastatic hormone-refractory disease)

- Gastric Cancer (Used in advanced disease settings)

- Head and Neck Cancer (Part of multimodal therapy protocols)

- Others (Ovarian Cancer, Esophageal Cancer, etc.)

- Formulation:

- Standard Injectable Concentrate (Requires dilution, typically polysorbate 80-based)

- Ready-to-Use Solutions (Pre-diluted, often designed to reduce solvent toxicity risks and preparation complexity)

- Novel Drug Delivery Systems (e.g., Liposomal Formulations, designed for enhanced targeting and reduced systemic toxicity)

- End-User:

- Hospitals (Largest consumers, including inpatient and outpatient settings)

- Oncology Clinics and Centers (Specialized facilities for ambulatory chemotherapy)

- Ambulatory Surgical Centers (ASCs) (Growing segment focusing on outpatient infusion services)

Value Chain Analysis For Docetaxel Market

The Docetaxel value chain commences with the highly specialized and technically demanding upstream segment involving the sourcing of raw materials, which are often semi-synthetic precursors derived from biomass or obtained through complex intermediate synthesis. The crucial factor at this stage is the consistent procurement of high-purity starting materials (e.g., 10-DAB III) required for the subsequent multi-step synthesis of the Docetaxel API. Manufacturers must adhere to rigorous international sourcing standards to ensure the stability and quality of the supply, mitigating the risk of contaminants that could compromise the final oncology product. Vertical integration, where companies control both the precursor production and the final API synthesis, provides a significant competitive advantage in terms of cost control, quality assurance, and reducing dependence on external, potentially volatile, third-party suppliers, which is paramount in the generic drug market where margin control is crucial.

Midstream activities focus intensely on the chemical synthesis, purification, and aseptic manufacturing of the finished drug product. Given Docetaxel's cytotoxic nature, this requires specialized, isolated manufacturing facilities operating under the strictest cGMP protocols, often involving containment technologies to protect personnel and prevent cross-contamination. The shift from concentrated formulations to ready-to-use formats introduces new complexity in formulation technology, packaging, and stability testing, demanding advanced analytical capabilities to verify shelf-life and drug integrity. Distribution forms the critical next layer, segmented into direct and indirect channels. Direct channels involve large-scale supply contracts with centralized national health services or major hospital group purchasing organizations (GPOs), facilitating streamlined logistics and deeper relationship management. Indirect channels rely on established specialty pharmaceutical wholesalers and third-party logistics (3PL) providers capable of handling controlled substances and maintaining cold-chain integrity, particularly for sensitive injectable preparations, ensuring broad market reach.

Downstream activities center on market access, competitive pricing, and final delivery to the end-users. In a generic market, competitive tendering and formulary inclusion processes are pivotal, demanding aggressive pricing strategies and impeccable supply reliability. Marketing focuses on reinforcing brand trust, particularly for generic manufacturers needing to convince clinicians of product parity with the originator. Reimbursement policies significantly influence downstream demand, with favorable coverage ensuring high patient access and continued clinical usage volume. Ultimately, the successful execution of the Docetaxel value chain is dependent on regulatory compliance at every juncture, from the sourcing of initial precursors to the final administration in oncology centers. This regulatory burden enforces rigorous process controls, inventory tracking, and risk management throughout the product lifecycle, underpinning the stability and safety of the entire supply ecosystem.

Docetaxel Market Potential Customers

The primary customers for Docetaxel are specialized institutional healthcare providers that administer systemic chemotherapy on a large scale. This encompasses general acute-care hospitals, which typically house large oncology wards and infusion centers, and specialized cancer treatment centers, including both standalone private and large academic medical institutions. These institutions are characterized by their bulk procurement requirements, necessitating reliable, high-volume supply chains capable of delivering cytotoxic agents under stringent quality controls. Procurement decisions in these settings are often centralized, managed by Pharmacy and Therapeutics (P&T) committees, driven by factors including generic price competition, demonstrated product quality, and manufacturer reliability, which ensures uninterrupted patient care delivery.

A secondary, yet rapidly expanding, customer segment includes specialized oncology clinics and Ambulatory Surgical Centers (ASCs). As healthcare systems strive to shift chemotherapy administration from costly inpatient settings to more efficient outpatient facilities, ASCs are becoming increasingly vital purchasers. These smaller facilities often rely heavily on specialty distributors for inventory management and just-in-time delivery. Furthermore, government health ministries and centralized public procurement agencies, particularly in regions like Europe, Latin America, and emerging APAC countries, represent massive potential customers as they manage national formularies and execute large-scale tenders aimed at securing cost-effective essential medicines, including Docetaxel, for universal access programs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 2.85 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sanofi S.A., Teva Pharmaceutical Industries Ltd., Hospira Inc. (Pfizer Inc.), Sandoz International GmbH (Novartis AG), Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Actavis plc (Teva), Mylan N.V. (Viatris Inc.), Accord Healthcare (Intas Pharmaceuticals), Jiangsu Hengrui Medicine Co., Ltd., Fresenius Kabi AG, Cipla Ltd., Zydus Cadila, Hikma Pharmaceuticals PLC, Aurobindo Pharma Ltd., Gland Pharma Limited, Baxter International Inc., Emcure Pharmaceuticals Ltd., Strides Pharma Science Limited, Reliance Life Sciences. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Docetaxel Market Key Technology Landscape

The Docetaxel market relies heavily on sophisticated chemical engineering and aseptic manufacturing technologies. The semi-synthetic nature of Docetaxel necessitates advanced organic chemistry techniques for the modification of precursor molecules, which are often complex taxane diterpenoids. The core technological challenge lies in achieving high enantiomeric purity and minimizing synthesis by-products, as trace impurities can significantly enhance toxicity, demanding strict adherence to ICH quality guidelines. Critical synthesis technologies include highly optimized reaction processes, specialized chromatography for high-purity separation, and robust crystallization methods to ensure the stability and polymorphic control of the Docetaxel API. Manufacturers continuously invest in process optimization to improve reaction yields, reduce solvent consumption, and lower the overall cost of goods sold, which is essential for competitiveness in the generic oncology sector. Furthermore, sterile filtration and lyophilization technologies are critical for ensuring the microbiological safety and long-term stability of the final injectable product, particularly in multi-dose vials.

A major area of technological innovation centers on drug formulation designed to overcome the inherent low aqueous solubility of Docetaxel, historically addressed using polysorbate 80, which is associated with hypersensitivity reactions and solvent-related toxicities. The introduction of polysorbate-free formulations represents a significant technological leap. These newer formulations often utilize alternative solubilizers, micelles, or nanoparticle technologies, such as liposomes or albumin-bound particles, designed to improve drug stability, enhance systemic delivery, and reduce the frequency and severity of infusion reactions. The development of ready-to-use (RTU) solutions, which require no complex dilution or mixing steps prior to administration, is another pivotal technological advancement focused on reducing preparation time, minimizing medication errors in busy clinical settings, and improving overall workflow efficiency for oncology nurses and pharmacy staff. These RTU technologies demand specialized packaging and long-term container-closure integrity studies to guarantee product efficacy throughout its shelf life.

Beyond formulation, quality control and analytical technology underpin market reliability. Companies utilize advanced analytical platforms, including high-resolution mass spectrometry (HRMS) and Nuclear Magnetic Resonance (NMR), to provide in-depth structural characterization and quantification of impurities, crucial for regulatory filings, particularly Abbreviated New Drug Applications (ANDAs) requiring bioequivalence demonstration. Furthermore, advanced packaging technologies, such as pre-filled syringes and complex vial configurations, are being adopted to enhance safety and reduce product waste. The integration of advanced manufacturing techniques, including Continuous Manufacturing (CM), is being explored by leading players to improve production flexibility, reduce batch variation, and respond rapidly to global supply needs while adhering to the highest standards of regulatory oversight. This continuous technological refinement across synthesis, formulation, and analysis is essential for maintaining Docetaxel's clinical relevance and commercial viability in the face of ongoing pharmaceutical evolution.

Regional Highlights

- North America: This region, dominated by the United States, holds the largest market value primarily due to high healthcare expenditure, sophisticated infrastructure, and comprehensive insurance coverage supporting established chemotherapy protocols. Generic utilization is widespread, leading to intense competition among suppliers. Market maturity means volume growth is steady but slower than in APAC, with focus shifting towards specialized logistics and the use of newer, less toxic formulations to differentiate products. The U.S. FDA's rigorous standards significantly influence manufacturing practices globally.

- Europe: Characterized by centralized governmental health systems and strict tendering processes (e.g., in Germany, France, and the UK). The market is highly price-sensitive, with generic manufacturers dominating supply. Market stability is ensured by the high prevalence of target cancers and reliable reimbursement. Key growth drivers include the integration of Docetaxel into evolving clinical pathways and harmonization of drug procurement across the European Union, favoring reliable, large-scale generic providers.

- Asia Pacific (APAC): Positioned as the fastest-growing region globally, driven by escalating cancer incidence, increasing public and private healthcare investments, and growing access to essential medicines. China and India are pivotal, serving both as massive consumer markets and major global manufacturing and API export hubs. Market entry success requires navigating complex, localized regulatory environments, but the immense untapped patient population presents unparalleled volume potential.

- Latin America: This region presents moderate growth, highly dependent on macroeconomic stability and governmental procurement cycles. Brazil, Mexico, and Argentina lead the regional market, focusing on purchasing cost-effective generic Docetaxel through public tenders to broaden patient access. Challenges include inconsistent regulatory timelines and distribution complexity across varied geographical terrains.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) nations due to significant investments in oncology infrastructure and high patient affordability. In sub-Saharan Africa, market access is severely limited, though non-governmental organizations and philanthropic efforts are crucial for distributing affordable generic Docetaxel, primarily through managed donation and tender programs aimed at essential medicines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Docetaxel Market.- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Hospira Inc. (A Pfizer Company)

- Sandoz International GmbH (A Novartis Division)

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Mylan N.V. (Viatris Inc.)

- Accord Healthcare (Intas Pharmaceuticals)

- Fresenius Kabi AG

- Cipla Ltd.

- Jiangsu Hengrui Medicine Co., Ltd.

- Zydus Cadila

- Hikma Pharmaceuticals PLC

- Aurobindo Pharma Ltd.

- Gland Pharma Limited

- Baxter International Inc.

- Emcure Pharmaceuticals Ltd.

- Strides Pharma Science Limited

- Reliance Life Sciences

- Bristol-Myers Squibb Company

Frequently Asked Questions

Analyze common user questions about the Docetaxel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the Docetaxel Market size and anticipated growth rate?

The Docetaxel Market size is projected to reach USD 2.85 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.5% during the forecast period (2026-2033), driven by sustained demand for generic oncology treatments and rising global cancer incidence.

Which application segment accounts for the highest usage of Docetaxel?

The Breast Cancer application segment currently holds the dominant share in the Docetaxel market, followed closely by Non-Small Cell Lung Cancer (NSCLC) and Prostate Cancer, reflecting established clinical guidelines for these major oncological indications.

How is generic competition impacting the Docetaxel market dynamics?

Intense generic competition, following the patent expiration of the originator drug Taxotere, has led to significant price erosion across all regions, making Docetaxel highly accessible but challenging profitability for manufacturers, emphasizing volume over value growth.

What technological advancements are influencing Docetaxel formulation?

Technological advancements focus on developing improved drug delivery systems, such as liposomal and nanoparticle formulations, and ready-to-use solutions, primarily aimed at reducing dependence on toxic solubilizers like polysorbate 80 and mitigating severe side effects.

Which region is expected to lead the growth in the Docetaxel market?

The Asia Pacific (APAC) region is projected to experience the fastest growth due to expanding healthcare infrastructure, increasing treatment accessibility, and rising cancer prevalence in densely populated countries such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager