Doctor Blades Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439510 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Doctor Blades Market Size

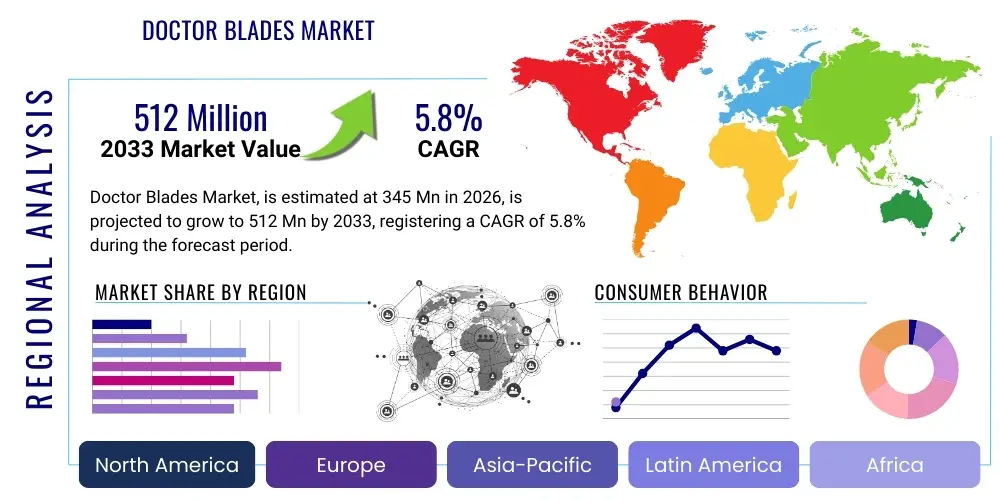

The Doctor Blades Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 345 million in 2026 and is projected to reach USD 512 million by the end of the forecast period in 2033.

Doctor Blades Market introduction

The Doctor Blades Market encompasses the global manufacturing and distribution of precision components essential for various industrial processes, primarily in printing, coating, and paper manufacturing. Doctor blades are critical tools designed to remove excess ink or coating material from a printing cylinder or roller, ensuring a clean and consistent application onto the substrate. This market's trajectory is closely tied to the expansion of packaging, printing, and industrial sectors globally, which demand increasingly higher quality and efficiency in their operations. The market landscape is characterized by continuous innovation in materials and manufacturing techniques, aiming to enhance blade performance, longevity, and print quality.

Doctor blades are thin, flexible strips typically made from steel, ceramic, plastic, or composite materials, distinguished by their precision-ground edges. Their fundamental purpose is to precisely wipe ink from gravure or flexographic printing cylinders, ensuring only the ink within the etched cells is transferred to the substrate. Beyond traditional printing, these blades are integral in various industrial coating applications, such as adhesive coating, label production, and specialty film manufacturing, where uniform layer thickness is paramount. The efficacy of a doctor blade directly impacts production speed, material waste, and the overall quality of the final product, making them a crucial investment for industries reliant on precise fluid application.

The primary applications for doctor blades span the entire spectrum of high-volume printing and coating, including flexible packaging, corrugated packaging, labels, newspapers, magazines, and various industrial coating lines. Their benefits include significantly improved print consistency, reduced material consumption due to optimized wiping, extended print run lengths, and minimized downtime from blade changes. Key driving factors propelling market growth include the robust expansion of the global packaging industry, surging demand for high-quality graphics and specialized coatings, the increasing adoption of automated printing and coating machinery, and continuous technological advancements in blade materials and designs that promise enhanced durability and performance.

Doctor Blades Market Executive Summary

The Doctor Blades market is experiencing dynamic shifts, driven by evolving business trends towards greater operational efficiency and sustainability, alongside robust growth in key industrial segments. Manufacturers are increasingly focused on developing advanced materials, such as specialized steels, ceramics, and composites, which offer superior wear resistance, extended lifespan, and improved performance characteristics, thereby addressing the demanding requirements of high-speed printing and coating applications. This push for innovation is also influencing manufacturing processes, with an emphasis on precision grinding and surface treatments to deliver blades that minimize striation and maximize print quality. Furthermore, consolidation among key players and strategic partnerships are shaping the competitive landscape, aiming to broaden product portfolios and expand geographical reach to cater to diverse end-user needs globally.

Regionally, the Asia Pacific (APAC) continues to dominate the Doctor Blades market, fueled by rapid industrialization, the proliferation of manufacturing hubs, and the explosive growth of the packaging and printing industries in countries like China, India, and Southeast Asian nations. This region benefits from a large consumer base and increasing disposable incomes, leading to higher demand for packaged goods and printed materials. North America and Europe, while mature markets, exhibit stable demand driven by the continuous need for high-quality, specialized printing and coating, along with a strong focus on advanced manufacturing technologies and sustainable practices. Emerging economies in Latin America and the Middle East & Africa are also demonstrating significant growth potential as industrial infrastructure develops and local manufacturing capabilities expand, leading to increased adoption of modern printing and coating equipment.

Segmentation trends reveal a sustained demand for steel doctor blades due to their cost-effectiveness and versatility, although advanced materials like ceramic and composite blades are gaining traction, particularly in applications requiring superior longevity and resistance to abrasive inks. The flexography and gravure printing segments remain major contributors, propelled by their widespread use in packaging and publication industries. However, there is a noticeable rise in specialized industrial coating applications, including those for electronics, medical devices, and automotive components, which require highly precise and defect-free coating. This shift encourages the development of custom blade profiles and materials tailored to specific coating chemistries and substrate types, pointing towards a future market characterized by increasing specialization and technological sophistication across all segments.

AI Impact Analysis on Doctor Blades Market

The market's analysis reveals common inquiries regarding the integration of Artificial Intelligence (AI) into the Doctor Blades market, primarily centered around its potential to revolutionize operational efficiency, predictive maintenance, and quality control. Users are keen to understand how AI can move beyond traditional maintenance schedules to anticipate blade wear and replacement needs, thereby minimizing downtime and maximizing productivity in printing and coating operations. Concerns often revolve around the initial investment costs, the complexity of data integration from various sensors, and the need for specialized expertise to implement and manage AI-driven systems. However, expectations are high for AI to deliver significant improvements in consistency, reduce material waste, and optimize overall equipment effectiveness (OEE), ultimately leading to higher profitability and competitive advantage for end-users.

Anticipated impacts also include AI's role in refining material selection and design processes for doctor blades. By analyzing vast datasets related to material properties, wear patterns under different operational conditions, and performance feedback, AI algorithms can identify optimal material compositions and blade geometries for specific applications. This data-driven approach promises faster innovation cycles and the development of next-generation doctor blades that offer unparalleled durability and precision. Furthermore, AI's ability to simulate performance under various stress factors can significantly reduce the need for extensive physical prototyping, accelerating product development and reducing time-to-market for new blade technologies, providing a strategic edge in a competitive market.

Another significant area of interest is AI's contribution to real-time quality assurance and process optimization within printing and coating lines. By continuously monitoring parameters such as ink viscosity, roller speed, temperature, and blade pressure, AI systems can detect subtle deviations that might lead to print defects or inconsistent coating. Such systems can then either alert operators for immediate intervention or automatically adjust machine settings to maintain optimal conditions. This level of intelligent control minimizes human error, reduces scrap rates, and ensures consistently high-quality output, which is crucial for industries where precision is paramount. The integration of AI therefore transforms the doctoring process from a reactive task to a proactive, intelligently managed operation, pushing boundaries in efficiency and product quality.

- Predictive Maintenance: AI algorithms analyze sensor data from printing presses to predict doctor blade wear, enabling proactive replacement schedules and minimizing unexpected downtime, significantly boosting operational efficiency and reducing maintenance costs.

- Optimized Production Parameters: AI systems monitor and adjust critical printing and coating parameters in real-time, such as blade pressure, angle, and machine speed, to maintain consistent performance, ensuring uniform ink transfer or coating thickness and reducing defects.

- Enhanced Quality Control: AI-powered vision systems can detect subtle imperfections on printed substrates or coated surfaces caused by doctor blade issues, providing immediate feedback for adjustments and maintaining stringent quality standards without human intervention.

- Material and Design Optimization: AI facilitates the analysis of vast material performance data, guiding the development of new doctor blade materials and geometries that offer improved wear resistance, reduced friction, and longer operational lifespans for specific applications.

- Supply Chain and Inventory Management: AI can forecast demand for various doctor blade types and materials based on production schedules and historical usage, optimizing inventory levels for manufacturers and distributors, leading to more efficient logistics and reduced carrying costs.

DRO & Impact Forces Of Doctor Blades Market

The Doctor Blades Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively shaping its growth trajectory and competitive landscape. A primary driver is the relentless expansion of the global packaging industry, fueled by e-commerce growth, rising disposable incomes, and changing consumer lifestyles that demand convenient and attractively packaged goods. This, in turn, escalates the demand for high-quality flexographic and gravure printing, where doctor blades are indispensable for achieving precise and consistent print results. Additionally, the increasing focus on industrial automation across various manufacturing sectors mandates the use of reliable and high-performance components, including advanced doctor blades, to ensure uninterrupted and efficient production processes, further stimulating market expansion.

Conversely, the market faces significant restraints, notably the volatile prices of raw materials such as steel, ceramics, and polymers. Fluctuations in commodity markets can directly impact production costs, squeezing profit margins for manufacturers and potentially leading to price increases for end-users, which can dampen demand. Stringent environmental regulations, particularly regarding material disposal and manufacturing processes, also pose challenges, requiring companies to invest in more sustainable practices and materials, which can be costly. Furthermore, intense competition among numerous domestic and international players, coupled with the availability of substitute technologies or lower-cost alternatives, can exert downward pressure on pricing and limit revenue growth for market participants, compelling continuous innovation to maintain market share.

Despite these challenges, substantial opportunities exist for market participants. The rapid industrialization and economic development in emerging markets across Asia Pacific, Latin America, and Africa present untapped potential for market expansion, as these regions adopt modern printing and coating technologies. Furthermore, continuous advancements in material science, leading to the development of highly durable and specialized doctor blades with enhanced performance characteristics (e.g., improved wear resistance, non-stick properties), create new avenues for growth in niche applications. The growing demand for specialized coatings in industries like electronics, automotive, and medical devices, where extreme precision and reliability are critical, also opens up lucrative opportunities for manufacturers capable of producing custom-engineered doctor blades that meet stringent performance specifications.

Segmentation Analysis

The Doctor Blades market is meticulously segmented to provide a granular understanding of its diverse landscape, reflecting variations in material composition, blade design, application, and end-use industries. This segmentation is critical for market players to tailor their product offerings, sales strategies, and R&D efforts to specific customer needs and market dynamics. The primary segmentations consider the foundational characteristics of the blades themselves, distinguishing between the materials they are made from, which directly impacts their performance attributes and suitability for different tasks, and their precise mechanical design, which dictates their functionality within the printing or coating unit. Understanding these intrinsic properties allows for a clearer analysis of competitive advantages and market positioning.

Further segmentation delves into the functional aspects, categorizing doctor blades by their specific applications across various printing techniques and industrial coating processes. This application-based segmentation highlights the versatility of doctor blades, ranging from high-speed flexography and gravure printing for packaging to highly specialized coating operations for electronics or textiles. Each application often demands unique blade properties, such as specific edge geometries, hardness levels, or chemical resistance, illustrating the specialized nature of demand in different industrial verticals. Analyzing these application areas provides insight into where technological advancements are most needed and where market growth is most pronounced, guiding strategic investment decisions.

Finally, the market is segmented by the diverse end-use industries that rely on doctor blades, encompassing sectors such as packaging, printing & publishing, paper & pulp, and textile manufacturing, among others. This segmentation underscores the broad industrial relevance of doctor blades as indispensable components in manufacturing processes that require precise fluid application. Each end-use industry has distinct requirements regarding print quality, production volume, material compatibility, and cost-efficiency, influencing their choice of doctor blade type and supplier. A comprehensive understanding of these industrial segments helps manufacturers identify key customer groups, assess market penetration opportunities, and develop targeted marketing and sales strategies to capture maximum value from each vertical.

- By Material

- Steel (Carbon Steel, Stainless Steel, Tool Steel)

- Ceramic (Zirconia, Alumina)

- Plastic (UHMW-PE, Polyester, Acetate, Nylon)

- Fiberglass

- Composite Materials

- By Blade Type

- Lamella Blades

- Bevel Blades

- Rounded Tip Blades

- Special Profile Blades (e.g., stepped, combination)

- By Application

- Flexography

- Gravure Printing

- Offset Printing (Coating Units)

- Industrial Coating (Adhesives, Lacquers, Varnishes)

- Paper & Pulp Industry

- Textile Printing

- Others (e.g., Medical, Electronics)

- By End-Use Industry

- Packaging (Flexible Packaging, Corrugated, Labels)

- Printing & Publishing (Magazines, Newspapers, Commercial Print)

- Paper & Pulp

- Textile

- Decorative Laminates

- Food & Beverage

- Pharmaceuticals

- Automotive

- Electronics

- Others

Value Chain Analysis For Doctor Blades Market

The value chain for the Doctor Blades market commences with the upstream analysis, which primarily involves the sourcing and processing of raw materials. This initial stage is critical as the performance and durability of doctor blades are heavily dependent on the quality of their constituent materials. Key raw material suppliers include manufacturers of high-grade steel alloys (such as carbon steel, stainless steel, and specialized tool steels), ceramic powder producers (e.g., zirconia, alumina), and polymer resin manufacturers for plastic and composite blades. These suppliers provide the foundational inputs, often requiring specialized metallurgical or chemical processing to meet the stringent specifications for doctor blade manufacturing. The efficiency and cost-effectiveness of this upstream segment directly influence the overall production costs and market competitiveness of finished doctor blades, making robust supplier relationships and material quality control paramount for manufacturers in this market.

Moving further along the value chain, the core manufacturing process involves precision engineering, cutting, grinding, and often specialized surface treatments (e.g., plasma coating, laser etching) to achieve the exact blade profile and edge finish required for optimal performance. Manufacturers in this segment leverage advanced machinery and expertise to produce blades with consistent thickness, flatness, and edge sharpness, which are crucial for effective doctoring in high-speed printing and coating applications. This stage also includes quality control measures and packaging of the final products. Following manufacturing, the distribution channel plays a vital role in reaching the diverse end-users. This involves both direct sales, where large printing houses or industrial manufacturers purchase directly from blade producers, and indirect channels, utilizing a network of distributors, agents, and local suppliers who often provide technical support and faster delivery to smaller or geographically dispersed customers.

The downstream analysis focuses on the end-users and the consumption of doctor blades within their specific applications. This segment includes a broad spectrum of industries such as packaging manufacturers, commercial printers, paper mills, textile producers, and various industrial coating operations. These end-users integrate doctor blades into their printing presses (flexographic, gravure) or coating machines, where the blades perform their critical function of precise ink or coating removal. The effectiveness of the doctor blade directly impacts the end-user's product quality, operational efficiency, and overall profitability. Post-purchase, considerations such as technical support, product longevity, and responsible disposal or recycling of used blades also form part of the downstream value. Understanding these downstream needs and feedback loops is essential for upstream manufacturers to innovate and refine their products, ensuring alignment with evolving customer demands and technological advancements in the printing and coating industries.

Doctor Blades Market Potential Customers

Potential customers for doctor blades represent a broad spectrum of industries that rely on precision fluid application and surface wiping in their manufacturing processes. Primarily, the market targets entities within the printing and packaging sectors, including large-scale commercial printing houses, flexible packaging manufacturers, corrugated board producers, and label printing companies. These businesses utilize doctor blades extensively in their flexographic and gravure printing presses to ensure consistent ink transfer, sharp image reproduction, and minimized print defects across a variety of substrates such as plastic films, paper, cardboard, and foils. Their demand is driven by the need for high-quality, high-volume output and operational efficiency, making doctor blades an indispensable consumable for their core operations.

Beyond traditional printing, a significant segment of potential customers includes industrial manufacturers involved in specialized coating applications. This encompasses companies producing decorative laminates, specialty papers, technical films, and electronic components, where uniform layer thickness and defect-free surfaces are paramount. For instance, manufacturers of solar panels, medical devices, or automotive components might use doctor blades in their precise coating processes for functional layers. These customers often require custom-engineered blades made from specific materials (e.g., ceramics or composites) with unique profiles to handle specialized coating chemistries, viscosities, and substrate materials, highlighting a growing niche for advanced doctor blade solutions.

Furthermore, the paper and pulp industry stands as a substantial end-user. Paper mills utilize doctor blades not only in their printing operations but also in various stages of paper manufacturing, such as calendering and creping, to ensure smooth surfaces and proper drying. Textile printers, particularly those using rotogravure or rotary screen printing methods for fabric decoration, also represent a viable customer base. The demand from these diverse sectors is influenced by production volumes, the types of inks or coatings used, and the desire for extended operational lifespans and reduced machine downtime. Doctor blade suppliers must therefore adopt a customer-centric approach, offering technical expertise and tailored solutions to meet the specific and often stringent requirements of each industry segment, building long-term partnerships through consistent product quality and reliable service.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 345 million |

| Market Forecast in 2033 | USD 512 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kadant Inc., Fuji Ceramic Corporation, Daetwyler Graphics AG, BTG (Voith Group), ESA (Erich Schweizer AG), TKM GmbH, Swemco, Pamarco, Alltec GmbH, Böttcher Systems GmbH, Anilox Roll Solutions (ARC International), Harris & Bruno International, Max Daetwyler Corporation, Flexo Concepts, D.P.R. S.r.l., Printparts GmbH, Wikoff Color Corporation, Apex International, Flint Group, Zecher GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Doctor Blades Market Key Technology Landscape

The Doctor Blades market is continually shaped by advancements in materials science and manufacturing processes, which are critical for enhancing blade performance, durability, and cost-efficiency. A significant technological focus is on developing advanced steel alloys, including specialized carbon and stainless steels, often combined with sophisticated heat treatments to achieve optimal hardness, flexibility, and wear resistance. Beyond traditional steel, the landscape includes increasing adoption of ceramic materials like zirconia and alumina, known for their extreme hardness and corrosion resistance, particularly suited for abrasive inks and long print runs. Furthermore, the development of composite materials, blending various polymers with reinforcing fibers or particles, offers tailored properties such as improved chemical resistance, non-stick surfaces, and lightweight characteristics, addressing specific application challenges in diverse industries and extending blade lifespan in demanding environments.

Another pivotal aspect of the technology landscape involves precision manufacturing techniques crucial for producing doctor blades with ultra-fine and consistent edge geometries. Laser etching and advanced grinding technologies are employed to create exact bevels, lamella tips, and specialized blade profiles that ensure precise wiping and eliminate common printing defects such as streaks or hazing. Surface coating technologies are also gaining prominence; methods like plasma coating, chrome plating, or ceramic coatings are applied to blade edges to further enhance wear resistance, reduce friction, and improve resistance to aggressive ink chemistries. These surface enhancements are instrumental in extending blade life and maintaining consistent print quality, directly impacting the operational efficiency and profitability of printing and coating operations, aligning with the industry's demand for longer run times and reduced waste.

Moreover, the integration of smart manufacturing principles, including the Internet of Things (IoT) and sensor technologies, is emerging as a key trend in the doctor blades market. While not directly embedded within the blades themselves, these technologies enable real-time monitoring of blade performance, wear rates, and environmental conditions within the printing press. Data collected through these sensors can be fed into analytical systems, potentially leveraging AI, to provide predictive maintenance insights, optimize blade replacement schedules, and fine-tune operational parameters for maximum efficiency. This transition towards a more data-driven and interconnected manufacturing ecosystem allows for proactive decision-making, significantly reducing downtime and improving overall equipment effectiveness. Such technological integrations are driving the market towards more intelligent and adaptive doctoring solutions, offering substantial value to end-users seeking to maximize their production output and quality.

Regional Highlights

- Asia Pacific (APAC): Dominates the global Doctor Blades market, driven by rapid industrialization, the booming e-commerce sector, and significant growth in the packaging and printing industries in countries such as China, India, Japan, and Southeast Asian nations. The region's large manufacturing base and increasing disposable incomes contribute to high demand for packaged goods and, consequently, high-quality printing.

- Europe: Represents a mature yet stable market, characterized by a strong emphasis on advanced printing technologies, high-quality standards, and increasing demand for sustainable and environmentally friendly doctor blade solutions. Countries like Germany, Italy, and the UK are key contributors, focusing on innovative materials and precision engineering to meet specialized industrial coating and printing needs.

- North America: Shows consistent demand, fueled by the well-established printing and packaging industry and a steady adoption of new technologies. The market is driven by the need for efficiency, reduced waste, and adherence to stringent quality controls, particularly in high-speed flexographic and gravure applications within the United States and Canada.

- Latin America: Emerging as a high-growth region due to developing industrial infrastructure, increasing foreign investments, and the expansion of the consumer goods and food & beverage packaging sectors. Countries like Brazil and Mexico are witnessing a rising adoption of modern printing technologies, creating new opportunities for doctor blade manufacturers.

- Middle East & Africa (MEA): Presents significant growth potential as countries in the region invest in diversifying their economies and developing manufacturing capabilities. The expanding packaging and construction industries, along with a growing population, are driving demand for printed materials and coatings, although market penetration is still relatively nascent compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Doctor Blades Market.- Kadant Inc.

- Fuji Ceramic Corporation

- Daetwyler Graphics AG

- BTG (Voith Group)

- ESA (Erich Schweizer AG)

- TKM GmbH

- Swemco

- Pamarco

- Alltec GmbH

- Böttcher Systems GmbH

- Anilox Roll Solutions (ARC International)

- Harris & Bruno International

- Max Daetwyler Corporation

- Flexo Concepts

- D.P.R. S.r.l.

- Printparts GmbH

- Wikoff Color Corporation

- Apex International

- Flint Group

- Zecher GmbH

Frequently Asked Questions

What are doctor blades and what is their primary function?

Doctor blades are precision-engineered components, typically thin strips of steel, ceramic, plastic, or composite material, used primarily in flexographic and gravure printing processes, as well as various industrial coating applications. Their fundamental role is to wipe excess ink or coating material from the surface of an anilox roll or gravure cylinder, ensuring that only the desired amount of fluid remains in the engraved cells or on the roller surface for transfer to the substrate. This critical function ensures consistent print quality, uniform coating thickness, and prevents smudging or undesirable marks, making them indispensable for high-quality output and efficient production.

What materials are commonly used for doctor blades and why?

Doctor blades are manufactured from a range of materials, each selected for specific performance characteristics required by different applications. Steel, including carbon steel, stainless steel, and tool steel, is widely used due to its cost-effectiveness, flexibility, and good wear resistance, making it suitable for general-purpose printing. Ceramic blades, typically made from zirconia or alumina, offer exceptional hardness, superior wear resistance, and chemical inertness, making them ideal for abrasive inks or long print runs where blade longevity is critical. Plastic blades (e.g., UHMW-PE, polyester) are preferred for less abrasive applications, fine lines, or where safety is a concern, as they are less likely to damage expensive anilox rolls. Composite materials combine the benefits of different materials to achieve tailored properties, such as enhanced flexibility, reduced friction, or improved chemical resistance, addressing niche and specialized coating requirements.

What are the key applications driving the demand for doctor blades?

The demand for doctor blades is predominantly driven by the robust growth of the packaging industry, encompassing flexible packaging, corrugated packaging, and labels, which extensively utilize flexographic and gravure printing technologies. These blades are also critical in the broader printing and publishing sector for magazines, newspapers, and commercial prints. Beyond traditional printing, doctor blades find significant application in industrial coating processes, including the production of specialty films, decorative laminates, and various surface treatments where precise application of adhesives, lacquers, or varnishes is required. The paper and pulp industry also relies on them for creping and other surface finishing processes. The overarching need for high-quality, consistent, and efficient production across these sectors continuously fuels the market for advanced doctor blade solutions.

How do technological advancements influence the Doctor Blades market?

Technological advancements are profoundly influencing the Doctor Blades market by driving innovation in materials, manufacturing precision, and operational integration. The development of new steel alloys, advanced ceramics, and composite materials with enhanced wear resistance, improved flexibility, and specific chemical resistance properties directly extends blade lifespan and performance. Precision manufacturing techniques, such as laser etching and advanced grinding, enable the creation of highly consistent and accurate blade edge profiles, crucial for defect-free printing. Furthermore, the burgeoning trend of smart manufacturing and the integration of IoT and AI are enabling predictive maintenance, real-time performance monitoring, and automated adjustments in printing and coating lines, leading to optimized blade usage, reduced downtime, and improved overall equipment effectiveness. These innovations collectively push the boundaries of quality, efficiency, and sustainability in the industries relying on doctor blades.

What is the market outlook for doctor blades over the forecast period?

The Doctor Blades market is projected to experience steady growth over the forecast period, driven by the sustained expansion of the global packaging industry, increasing demand for high-quality printing, and the ongoing trend towards industrial automation. Asia Pacific is expected to remain the dominant region, propelled by rapid industrialization and consumer demand in emerging economies. While raw material price volatility and intense competition pose challenges, opportunities abound in specialized coating applications and the continuous development of advanced, high-performance materials and blade designs. The market is moving towards more intelligent, durable, and application-specific solutions, with a strong emphasis on improving operational efficiency and reducing waste across various end-use industries. Overall, the outlook remains positive, underscored by the indispensable role doctor blades play in precision fluid application processes worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Doctor Blades Market Statistics 2025 Analysis By Application (Flexographic Printing, Intaglio Printing, Offset Printing), By Type (Metal Blades, Plastic Blades), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Doctor Blades Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Plastic Doctor Blade, Metal Blades, Others), By Application (Gravure, Screen Printing, Flexo, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager