Document Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434970 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Document Management Software Market Size

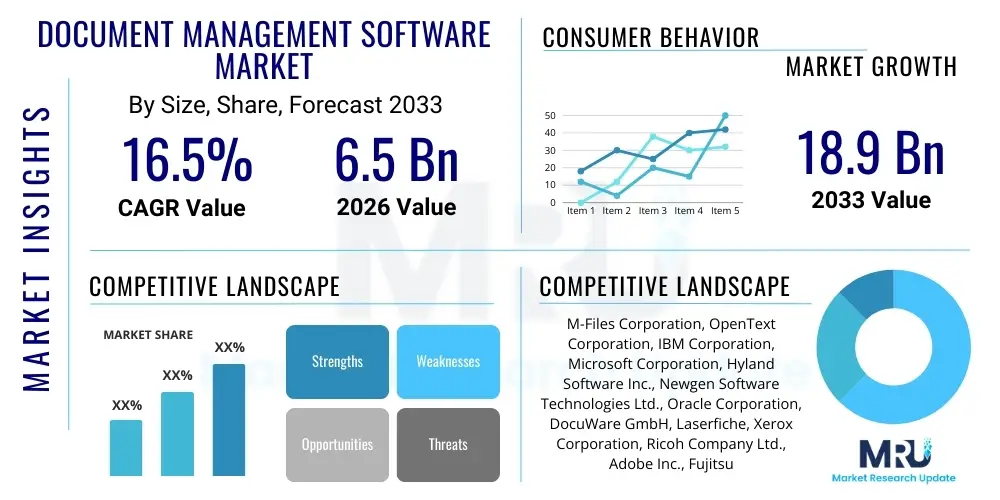

The Document Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 18.9 Billion by the end of the forecast period in 2033.

Document Management Software Market introduction

The Document Management Software (DMS) Market encompasses systems and applications designed to store, manage, and track electronic documents and images. These solutions provide organizations with the capability to centralize document storage, streamline collaboration, enhance security, and ensure regulatory compliance. Key functionalities include document capture, indexing, version control, workflow management, and secure archiving. The core objective of DMS is to transition businesses away from paper-intensive processes, thereby improving operational efficiency, reducing administrative costs, and accelerating information retrieval across various departments, including legal, HR, finance, and operations. The foundational technology relies heavily on robust database management systems and secure cloud infrastructure to handle increasingly large volumes of unstructured data.

Major applications of DMS span across nearly all industry verticals, driven primarily by the global movement toward digital transformation. In the Banking, Financial Services, and Insurance (BFSI) sector, DMS is critical for managing customer onboarding forms, loan applications, and adherence to stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Similarly, the healthcare sector utilizes DMS for managing electronic health records (EHRs), patient consent forms, and maintaining compliance with privacy standards like HIPAA. The benefits of deploying sophisticated DMS solutions are multifaceted, including significant improvements in organizational agility, reduced physical storage overheads, minimized risk of data loss, and enhanced audit readiness. The shift towards remote and hybrid work models has further solidified the necessity of cloud-based, accessible DMS platforms, making them indispensable components of modern enterprise IT infrastructure.

The primary driving factors fueling the expansion of the DMS market include the exponential growth in enterprise data generation, the escalating need for stringent data governance and regulatory compliance (such as GDPR and CCPA), and the continuous push for process automation through integration with artificial intelligence (AI) and machine learning (ML) technologies. Furthermore, the increasing awareness among Small and Medium-sized Enterprises (SMEs) regarding the cost-effectiveness and scalability of cloud-native DMS solutions is opening up new market opportunities. These systems are evolving rapidly, moving beyond simple storage repositories to become intelligent information management hubs that integrate seamlessly with enterprise resource planning (ERP) and customer relationship management (CRM) systems, thereby facilitating end-to-end digital workflows and enhancing decision-making capabilities.

Document Management Software Market Executive Summary

The Document Management Software market is characterized by robust growth, primarily influenced by accelerating global digital transformation initiatives and the critical necessity for improved data security and regulatory adherence. Current business trends indicate a strong pivot towards hyper-automation, integrating advanced technologies like Artificial Intelligence (AI) and Robotic Process Automation (RPA) directly into DMS platforms to automate tasks such as document classification, data extraction, and workflow routing. This integration is transforming DMS from passive repositories into active, intelligent information management systems. Furthermore, the subscription-based Software-as-a-Service (SaaS) model is dominating the market, offering enhanced flexibility, lower upfront costs, and superior scalability, particularly appealing to SMEs navigating rapid growth and fluctuating operational needs. Strategic mergers and acquisitions among established vendors and specialized AI startups are common, aiming to consolidate market share and acquire next-generation technological capabilities, focusing on seamless integration with broader enterprise content management (ECM) suites.

Regionally, North America maintains the largest market share, driven by early technology adoption, the presence of major industry players, and rigorous regulatory frameworks (especially in finance and healthcare) that mandate structured document handling. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion in APAC is attributed to rapid industrialization, burgeoning digitalization efforts in economies like India and China, and increased government investment in modernizing public sector services. Europe also remains a significant market, largely influenced by strict data protection regulations such as the General Data Protection Regulation (GDPR), which compels European organizations to implement sophisticated DMS solutions for compliance and data lifecycle management.

In terms of segmentation trends, the cloud deployment segment is experiencing explosive growth, significantly outpacing on-premise solutions due to superior accessibility and lower infrastructure maintenance requirements. Organizationally, while large enterprises remain the major revenue generators, the Small and Medium-sized Enterprises (SME) segment is emerging as the fastest-growing category, driven by the increasing affordability and accessibility of SaaS-based offerings tailored to their specific budgetary and resource constraints. Application-wise, highly regulated sectors like BFSI and Healthcare continue to be primary adopters, but there is substantial, growing adoption in the manufacturing and retail sectors, utilizing DMS for supply chain documentation, quality control, and contract management. The trend is moving towards vertical-specific DMS solutions that offer highly tailored features and predefined compliance templates, optimizing the time-to-value for specialized industry needs.

AI Impact Analysis on Document Management Software Market

Users frequently inquire about how AI enhances efficiency, specifically asking: "How does AI automate document classification and data entry?", "What security risks does AI introduce into DMS?", and "Can AI handle complex, unstructured documents with high accuracy?" Key themes emerging from these user questions revolve around the promise of hyper-automation—specifically reducing manual labor, improving data extraction accuracy, and ensuring compliance through automated auditing. Users also express concerns regarding data privacy when feeding sensitive documents into AI models and the necessity for robust audit trails within AI-driven workflows. There is a clear expectation that AI should not just organize documents but actively turn them into actionable business intelligence, driving the move toward Intelligent Document Processing (IDP) solutions that integrate seamlessly with existing enterprise systems.

The infusion of Artificial Intelligence, particularly through Natural Language Processing (NLP) and Machine Learning (ML), is fundamentally reshaping the capabilities and value proposition of Document Management Software. AI algorithms enable rapid and highly accurate automatic classification of documents, regardless of their format (e.g., invoices, contracts, correspondence). This eliminates the time-consuming and error-prone process of manual tagging and indexing, dramatically accelerating search and retrieval times. Furthermore, ML models are crucial for performing advanced sentiment analysis or identifying anomalous patterns within vast document repositories, which is critical for fraud detection and risk management within highly regulated industries such as finance and insurance. AI is also integral to enhancing data security by autonomously identifying and redacting sensitive personal information (PII) before documents are shared or archived, ensuring proactive adherence to evolving privacy laws.

The impact extends significantly into workflow automation and decision support. AI-powered DMS platforms utilize predictive analytics to anticipate necessary document actions—for instance, automatically routing a contract based on extracted clauses or prioritizing customer support tickets based on document urgency and content. This transition from passive storage to active, intelligent information governance is key. By continuously learning from user interactions and document processing history, these systems improve their accuracy over time, reducing operational friction and improving overall user experience. This focus on cognitive automation represents the largest technological leap in DMS in the last decade, positioning it as an essential tool for enterprise digital transformation rather than merely a records management system.

- AI-powered Intelligent Document Processing (IDP) automates data extraction from unstructured forms, minimizing manual errors and improving throughput.

- Machine Learning (ML) enables advanced document classification and indexing, allowing for faster and more precise content discovery and retrieval.

- Natural Language Processing (NLP) facilitates sophisticated content analysis, summarizing long documents, and identifying key contractual terms automatically.

- Predictive analytics enhance workflow automation by dynamically routing documents based on content analysis and predicted urgency or compliance requirements.

- AI enhances compliance capabilities through automated PII identification, redaction, and continuous auditing for regulatory adherence (e.g., GDPR, HIPAA).

- Chatbots and conversational interfaces utilize AI to simplify document search and access, providing employees with quick, natural language queries for information retrieval.

- Computer Vision technology allows DMS to process scanned images, handwriting, and complex visual data within documents, broadening the scope of manageable content types.

DRO & Impact Forces Of Document Management Software Market

The Document Management Software market is driven by compelling global mandates for digital transformation, stringent data governance requirements, and the necessity to optimize organizational operational expenditure. Key drivers include the exponential growth of enterprise data, pushing organizations to seek scalable, cloud-based storage and management solutions. Regulatory pressures, exemplified by global standards like GDPR, CCPA, and industry-specific mandates, force companies across all sectors to adopt robust DMS platforms capable of providing full audit trails, ensuring data integrity, and facilitating rapid compliance reporting. Moreover, the increasing adoption of hybrid and remote work models post-2020 has necessitated secure, centralized digital repositories accessible across geographies, accelerating the shift away from traditional, restrictive on-premise systems. These drivers collectively create a compelling business case for immediate DMS investment.

However, the market faces significant restraints that slow adoption in certain segments. The high initial cost associated with migrating massive volumes of legacy data, coupled with the complex process of integrating new DMS solutions with disparate existing enterprise systems (e.g., legacy ERPs), presents a major barrier, particularly for budget-constrained SMEs. Furthermore, concerns surrounding data security and privacy, especially when migrating sensitive information to multi-tenant public cloud environments, require vendors to continuously invest heavily in advanced encryption, access control mechanisms, and zero-trust architectures to build user trust. Another significant restraint is the organizational change management required; employee resistance to adopting new workflows and lack of adequate technical expertise within organizations can impede successful deployment and utilization of sophisticated DMS features.

Opportunities for market growth lie predominantly in the convergence of DMS with intelligent technologies, forming comprehensive Enterprise Content Management (ECM) and Intelligent Information Management (IIM) suites. Significant potential exists in developing highly verticalized solutions—DMS tailored specifically for the niche compliance and operational needs of sectors like pharmaceutical R&D, advanced manufacturing quality assurance, and legal discovery. The ongoing expansion of 5G infrastructure and edge computing also creates opportunities for faster document processing and decentralized management, particularly beneficial in logistics and field operations. Finally, the growing emphasis on environmental, social, and governance (ESG) criteria provides an opportunity for DMS vendors to market their solutions as critical components for sustainability by enabling truly paperless operations. Impact forces like regulatory environment changes and rapid technological obsolescence compel both vendors and users to continuously upgrade their systems, sustaining market momentum.

Segmentation Analysis

The Document Management Software market is meticulously segmented based on Deployment Model, Organization Size, Application, and Industry Vertical. Analyzing these segments provides a nuanced understanding of market dynamics, revealing specific growth pockets and evolving customer preferences. The market structure shows a clear preference for cloud-based solutions across nearly all industries, signaling a fundamental shift in how enterprises approach IT infrastructure management. Furthermore, the increasing complexity of regulatory environments worldwide drives demand for segment-specific solutions, moving away from generic, one-size-fits-all platforms towards highly specialized, compliant offerings. This specialization ensures that businesses can meet their unique operational and legal requirements efficiently and effectively.

The segmentation by organization size highlights the bifurcated nature of demand. Large enterprises typically require sophisticated, integrated ECM suites that can manage petabytes of data and support complex global workflows, often favoring hybrid cloud models for security and control over highly sensitive documents. Conversely, SMEs are heavily reliant on pure SaaS models, valuing quick deployment, minimal IT overhead, and predictable, usage-based subscription costs. This disparity in needs pushes vendors to offer highly scalable and flexible pricing tiers. Application segmentation, such as document archiving, retrieval, and workflow automation, demonstrates the increasing value placed on process optimization, indicating that buyers view DMS as a strategic tool for productivity improvement rather than just a basic storage utility.

Industry vertical segmentation reveals differential adoption rates based on regulatory intensity. Sectors like BFSI and Healthcare, characterized by strict data handling laws, exhibit deep and mature adoption of DMS. In contrast, sectors such as Retail and Manufacturing are experiencing rapid, late-stage adoption, primarily focusing on managing supply chain documents, product specifications, and quality control records. The future growth will be significantly shaped by the convergence of these segments, where vendors deliver customized, integrated cloud solutions to SMEs within regulated verticals, combining the fastest growing deployment model with the most demanding regulatory environment, maximizing market potential.

- Deployment Model:

- On-Premise

- Cloud (Public, Private, Hybrid)

- Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Application:

- Document Storage and Retrieval

- Document Security and Compliance

- Workflow Automation and Management

- Document Capture and Scanning

- Document Indexing and Classification

- Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Pharmaceuticals

- Government and Public Sector

- IT and Telecommunication

- Manufacturing

- Retail and Consumer Goods

- Legal

Value Chain Analysis For Document Management Software Market

The value chain for the Document Management Software market begins with core software development and technology infrastructure provision (Upstream Analysis). This stage involves R&D efforts focused on integrating advanced technologies such as AI, ML, and Blockchain for enhanced security and efficiency. Key upstream activities include developing robust, scalable cloud infrastructure, designing intuitive user interfaces, and ensuring compliance with global data standards. Vendors rely heavily on third-party suppliers for computational resources, specialized AI model development kits, and foundational cloud services (e.g., AWS, Azure, GCP). The intellectual property surrounding indexing algorithms, security protocols, and proprietary workflow engines represents the greatest value capture point at this stage.

The midstream of the value chain focuses on distribution channels and system integration. Distribution occurs primarily through direct sales teams for large enterprise contracts and indirectly via robust channel partner networks, including value-added resellers (VARs), system integrators (SIs), and managed service providers (MSPs). These partners are crucial for localization, providing tailored implementation services, customizing workflows to specific industry needs, and offering ongoing technical support. The effectiveness of the channel strategy dictates market penetration, especially in fragmented global markets. Integration services are vital, as DMS solutions must seamlessly interact with existing enterprise applications like ERP, CRM, and HRIS to deliver end-to-end process automation. The complexity of these integrations often necessitates specialized consulting services.

The downstream analysis covers the end-user deployment, ongoing maintenance, and post-sales support. Direct customers include various departments within an organization (e.g., Finance, Legal, HR), which utilize the DMS daily. Indirect customers are often managed by third-party integrators who oversee system upkeep and optimization. Post-sales support—including technical assistance, user training, and regular software updates incorporating new features and security patches—is a critical differentiator and a significant revenue stream (especially in the SaaS model). High customer satisfaction and retention depend heavily on the quality and responsiveness of these downstream services. Successful vendors focus on providing continuous service improvements and anticipating future regulatory and technological needs to maintain long-term relationships and recurring revenue.

Document Management Software Market Potential Customers

Potential customers for Document Management Software span every sector where regulatory compliance, data security, and efficient handling of unstructured information are critical operational concerns. The primary end-users are decision-makers and IT managers across highly regulated industries, including the Banking, Financial Services, and Insurance (BFSI) sector, which mandates stringent record-keeping for auditability and risk management, especially concerning loan documentation, insurance policies, and customer KYC records. Healthcare organizations represent another major customer segment, driven by the need to securely manage vast volumes of Electronic Health Records (EHRs), patient intake forms, and billing information while adhering strictly to privacy regulations like HIPAA in the US or similar mandates globally. Their buying decisions are often influenced by certified compliance features and secure data encryption capabilities.

Beyond highly regulated industries, the public sector and government agencies constitute substantial customers, using DMS to manage official records, public archives, licensing applications, and inter-departmental communication, aiming to enhance transparency and citizen service delivery. Large corporations across Manufacturing and Retail sectors are increasingly adopting DMS to streamline complex supply chain documentation, manage quality assurance certificates, handle vendor contracts, and automate invoicing processes. For these customers, the primary value proposition centers on reducing operational bottlenecks and ensuring version control integrity across global operations. The sheer volume of technical specifications, patents, and operational manuals makes DMS indispensable for maintaining standardization and efficiency in multi-site manufacturing environments.

Crucially, the fastest-growing customer base comprises Small and Medium-sized Enterprises (SMEs). Historically underserved due to the high cost of traditional on-premise solutions, SMEs are now rapidly adopting affordable, scalable, and easy-to-implement cloud-based DMS platforms. These businesses are often seeking quick solutions to manage basic administrative documents, HR records, and financial invoices efficiently, enabling them to compete effectively with larger counterparts without significant capital investment in IT infrastructure. Vendors targeting this segment must focus on intuitive interfaces, simple integration with common business tools (like Microsoft 365 or Google Workspace), and strong emphasis on affordability and minimal maintenance requirements. The continuous rise of digital startups globally further amplifies the demand from this agile and resource-conscious customer demographic.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 18.9 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | M-Files Corporation, OpenText Corporation, IBM Corporation, Microsoft Corporation, Hyland Software Inc., Newgen Software Technologies Ltd., Oracle Corporation, DocuWare GmbH, Laserfiche, Xerox Corporation, Ricoh Company Ltd., Adobe Inc., Fujitsu Ltd., Box Inc., Dropbox Business, Alfresco Software Inc., SAP SE, Intalio, ELO Digital Office GmbH, VIENNA Advantage. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Document Management Software Market Key Technology Landscape

The technological landscape of the Document Management Software market is undergoing rapid evolution, shifting from traditional archival systems towards intelligent, integrated information platforms. The most impactful technological trend is the widespread adoption of cloud-native architectures, which leverage microservices, containerization (like Docker and Kubernetes), and serverless computing. This approach ensures high scalability, rapid deployment cycles, and superior resilience, allowing DMS vendors to offer robust multi-tenant SaaS solutions. Furthermore, the increasing incorporation of AI and Machine Learning (ML), particularly within Intelligent Document Processing (IDP), is defining competitive advantage. These cognitive technologies are crucial for automated classification, high-accuracy data extraction, and enhanced search capabilities that move beyond simple keyword matching to contextual understanding.

Another crucial element shaping the landscape is the integration of advanced security technologies to address rising cyber threats and complex compliance needs. Zero-Trust Security architectures are becoming standard, ensuring that no user or application is implicitly trusted, regardless of location. Furthermore, the potential application of Distributed Ledger Technology (DLT) or Blockchain is gaining traction, particularly for ensuring the immutability and verifiable provenance of critical documents, such as legal contracts or regulatory filings, significantly enhancing audit trails and reducing forgery risks. The convergence of DMS with technologies like Robotic Process Automation (RPA) allows for end-to-end hyper-automation, where documents not only trigger workflows but the extracted data is automatically entered into back-end systems without human intervention, maximizing efficiency and minimizing error rates across the enterprise.

The focus on seamless interoperability is driving technological investment in API-first strategies. Modern DMS platforms are built with extensive and well-documented APIs to ensure easy integration with the expanding ecosystem of enterprise applications, including Salesforce, SharePoint, and specialized vertical software. This shift supports the move towards composable enterprise architectures, where IT components are flexibly assembled to meet specific business requirements. Mobile accessibility and user experience (UX) design are also key technological differentiators, with vendors investing in intuitive, mobile-optimized interfaces that allow knowledge workers to manage, approve, and retrieve documents securely from any location, catering directly to the needs of the modern remote and hybrid workforce.

Regional Highlights

The global Document Management Software market exhibits significant regional variation in maturity, growth trajectory, and key adoption drivers. North America, encompassing the United States and Canada, remains the dominant market in terms of revenue share. This dominance is attributable to the region's high concentration of established DMS vendors, high rate of technological innovation, and stringent regulatory environments in sectors like BFSI (Sarbanes-Oxley) and Healthcare (HIPAA). Enterprises in North America were early adopters of cloud solutions and are now leading the implementation of AI-driven IDP for large-scale operational efficiencies. The high IT spending capacity and the prevailing need for complex multi-jurisdictional compliance ensure continued stable growth in this region.

Europe holds a substantial market share, primarily driven by the imperative to comply with the General Data Protection Regulation (GDPR). GDPR’s requirements for data protection, data minimization, and the right to erasure have significantly boosted the demand for advanced DMS solutions capable of sophisticated data governance, automated auditing, and secure document lifecycle management. Countries such as Germany, the UK, and France are mature markets, focusing on vertical-specific compliance solutions, particularly in finance and government sectors. The European market shows a strong preference for secure private and hybrid cloud models, reflecting ongoing concerns over data sovereignty and cross-border data transfer limitations, providing unique opportunities for localized solution providers.

Asia Pacific (APAC) is projected to be the fastest-growing regional market, driven by accelerating digital transformation efforts in large economies like China, India, and Southeast Asia. Governments in these regions are heavily investing in digitalization programs to modernize public administration, creating massive demand for DMS solutions. The rapid proliferation of internet infrastructure, coupled with the growth of SMEs actively seeking affordable SaaS tools, fuels this expansion. While data privacy awareness is increasing, the initial focus in APAC is primarily on cost reduction, efficiency improvement, and managing high volumes of structured and semi-structured documents, presenting significant opportunities for vendors offering competitive, scalable cloud services. Economic development in countries like Japan and Australia maintains consistent demand for sophisticated, compliance-focused enterprise systems.

- North America: Market leader; driven by high IT maturity, robust regulatory frameworks (HIPAA, SOX), and early adoption of AI/IDP technologies. High concentration of major vendors and high enterprise IT spending.

- Europe: Strong demand driven by GDPR compliance and data sovereignty requirements. Focus on highly secure hybrid and private cloud deployments, especially in Germany and the UK. Significant adoption in the public sector and BFSI.

- Asia Pacific (APAC): Fastest-growing region; fueled by massive government digitalization projects (e.g., India's Digital India), rapid SME adoption of SaaS, and increasing industrialization in developing economies (China, Southeast Asia).

- Latin America (LATAM): Emerging market characterized by increasing foreign investment and growing regulatory needs. Adoption is rising, focusing on financial services and telecom sectors, often utilizing simplified, cost-effective cloud platforms.

- Middle East and Africa (MEA): Growth driven by ambitious national digitalization visions (e.g., Saudi Arabia Vision 2030, UAE's smart government initiatives) and significant investment in oil & gas and finance sectors requiring standardized documentation and governance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Document Management Software Market.- M-Files Corporation

- OpenText Corporation

- IBM Corporation

- Microsoft Corporation

- Hyland Software Inc.

- Newgen Software Technologies Ltd.

- Oracle Corporation

- DocuWare GmbH

- Laserfiche

- Xerox Corporation

- Ricoh Company Ltd.

- Adobe Inc.

- Fujitsu Ltd.

- Box Inc.

- Dropbox Business

- Alfresco Software Inc.

- SAP SE

- Intalio

- ELO Digital Office GmbH

- VIENNA Advantage

Frequently Asked Questions

Analyze common user questions about the Document Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Intelligent Document Processing (IDP) and how is it used in DMS?

Intelligent Document Processing (IDP) is a crucial evolution of DMS, utilizing AI, Machine Learning, and NLP to automatically capture, categorize, extract, and validate data from both structured and unstructured documents. IDP dramatically reduces manual data entry, enhances accuracy, and accelerates the integration of document data into core business systems like ERPs and CRMs, making workflows faster and more reliable.

How does the cloud deployment model benefit SMEs in adopting Document Management Software?

Cloud deployment (SaaS) significantly benefits SMEs by eliminating the need for substantial upfront capital investment in hardware and IT infrastructure. It offers lower Total Cost of Ownership (TCO), faster implementation, predictable subscription pricing, and inherent scalability, allowing SMEs to easily manage fluctuating data volumes and access enterprise-grade features without dedicated in-house IT expertise.

Which regulatory compliance standards are most critical for Document Management Software vendors to support?

Critical compliance standards include GDPR (General Data Protection Regulation) for global data privacy, HIPAA (Health Insurance Portability and Accountability Act) for protected health information in the US, and various financial regulations like SOX (Sarbanes-Oxley Act). Vendors must provide features such as immutable audit trails, advanced encryption, access control, and automated retention/destruction policies to ensure legal compliance.

What are the primary differences between DMS and Enterprise Content Management (ECM)?

DMS focuses specifically on the management (storage, retrieval, tracking) of documents. ECM is a broader term encompassing DMS, alongside strategies and technologies for the entire lifecycle of all forms of enterprise content (including records, web content, and digital assets). Modern DMS solutions often integrate into wider ECM frameworks, emphasizing intelligent content automation beyond simple document handling.

What impact does integration with ERP and CRM systems have on DMS functionality?

Integration with ERP (Enterprise Resource Planning) and CRM (Customer Relationship Management) systems transforms DMS into a strategic asset. It allows documents (like invoices, contracts, or customer histories) to be directly linked to transactional data and customer records. This ensures data consistency across platforms, automates critical business processes (e.g., invoice processing), and provides knowledge workers with comprehensive, contextual information instantly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Document Management Software Market Size Report By Type (Mobile End, Clouds), By Application (Android, IOS, Windows, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Document Management Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Mobile End, Clouds), By Application (Android, IOS, Windows, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager