Document shredding services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431549 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Document shredding services Market Size

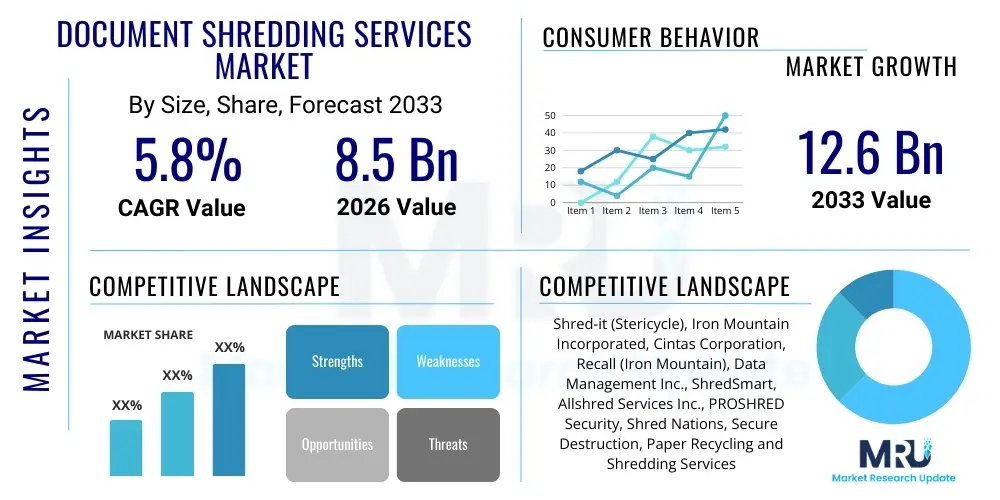

The Document shredding services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Document shredding services Market introduction

The Document Shredding Services Market encompasses the professional destruction of sensitive paper-based records to ensure data security, legal compliance, and prevention of identity theft. This essential service is driven primarily by increasingly stringent global data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States, which mandate secure disposal protocols for confidential information. While digital transformation is reducing the overall volume of physical documents generated, the mandatory nature of secure destruction for legacy records and mandatory retention periods ensures sustained demand across highly regulated industries.

These services typically involve secure collection, transportation, and destruction of documents, often offering on-site (mobile) or off-site (plant-based) shredding options. The product—secure document destruction—is critical for businesses managing Personal Identifiable Information (PII), financial records, proprietary trade secrets, and patient data. Major applications span across the financial services sector, healthcare providers, governmental agencies, and legal firms, where failure to comply with destruction mandates can lead to significant fines and reputational damage. The market is characterized by high trust requirements, emphasizing documented chain of custody and verifiable proof of destruction.

Key benefits derived from utilizing professional shredding services include enhanced security protocols, guaranteed compliance with federal and industry-specific destruction laws, operational efficiency gains by eliminating the need for internal resources dedicated to shredding, and environmental responsibility through certified recycling of shredded paper waste. Driving factors center around the increasing sophistication of corporate espionage and identity fraud, alongside the sheer complexity of navigating diverse global data privacy legislation. The market thrives on providing specialized solutions that standard office equipment cannot match, specifically regarding volume capacity and certified security levels.

Document shredding services Market Executive Summary

Current business trends indicate a strong shift towards flexible and verifiable shredding solutions, heavily favoring on-site mobile shredding services due to the transparency and immediate certification of destruction they offer, which mitigates security risks associated with transporting sensitive documents off-premises. Large enterprises are increasingly consolidating their document destruction needs under single, nationally or internationally certified providers to streamline compliance audits and maintain consistent security standards across all operational sites. Furthermore, the market is witnessing growing pressure to integrate environmental sustainability, pushing service providers to emphasize closed-loop recycling processes and carbon footprint reduction within their operations, appealing to environmentally conscious corporate clients.

Regionally, North America remains the dominant market segment, propelled by rigorous legislation such as HIPAA and the strict regulatory frameworks governing financial institutions. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, attributed to rapid commercialization, increased awareness regarding data privacy (catalyzed by regulations like India’s Digital Personal Data Protection Act and similar initiatives across Southeast Asia), and the burgeoning presence of multinational corporations establishing strict data governance protocols. Europe maintains steady demand, largely dictated by the ongoing enforcement and refinement of GDPR standards, making certified destruction a mandatory requirement for data processors and controllers.

Segment trends highlight the critical divergence between end-user requirements, with the healthcare sector prioritizing secure, frequent, scheduled shredding (recurring services) to manage patient records effectively, while small and medium-sized enterprises (SMEs) often opt for one-time purge services to clear accumulated backlogs of archived documents. Technological innovation, particularly the integration of GPS tracking in collection vehicles and digital certification tools, is elevating the standard of service, addressing client concerns about the security integrity during the collection and destruction chain of custody. Overall, the market remains robust, pivoting on the fundamental necessity of mitigating regulatory and reputational risk through certified data destruction.

AI Impact Analysis on Document shredding services Market

User queries regarding AI's influence often revolve around two key areas: whether AI-powered digital document management systems will eliminate the need for physical shredding entirely, and conversely, how AI can enhance the efficiency and security of existing shredding processes. Key user themes reveal concerns about the long-term volume reduction of paper records due to automated digitization and intelligent document processing (IDP), while simultaneously seeking confirmation that physical destruction security protocols can be modernized. Users are keen to understand how AI tools, particularly those focused on data classification and risk assessment, can accurately identify which physical documents require mandated destruction and when, thereby optimizing purge schedules for businesses and reducing unnecessary storage costs.

While AI adoption accelerates the migration from physical to digital formats, potentially reducing the net volume of newly generated paper, it simultaneously increases the urgency and complexity of securely disposing of the historical paper archives that are digitized. AI-driven record management systems can categorize legacy documents based on their regulatory retention period (e.g., 5 years, 7 years, permanent) and automatically flag them for mandatory physical destruction once the retention cycle expires, leading to more structured and periodic large-scale shredding projects. This shift changes the demand profile from small, daily shredding needs to larger, compliance-driven purge events, ensuring the physical records align legally with their digital counterparts.

Furthermore, AI algorithms can be implemented within the operational framework of shredding service providers themselves. For instance, predictive maintenance for high-capacity industrial shredders, optimized routing for mobile shredding fleets based on real-time traffic and customer density, and enhanced digital audit trails using machine learning to detect anomalies in the chain of custody documentation. These technological integrations primarily improve operational efficiency, minimize downtime, and solidify the verifiable security guarantee that providers offer, thereby maintaining competitive advantage against purely digital solutions.

- AI drives automated retention policies, accurately triggering physical document destruction cycles upon expiry.

- Increased volume of large-scale, compliance-driven purge projects driven by AI-accelerated digitization efforts.

- AI optimizes logistics (routing, scheduling) for mobile shredding services, enhancing operational efficiency and speed.

- Machine learning enhances digital chain of custody tracking, ensuring robust compliance verification and audit readiness.

- Indirectly, AI document classification reduces redundant physical storage, focusing shredding efforts on truly sensitive and expiring materials.

DRO & Impact Forces Of Document shredding services Market

The document shredding services market is strongly influenced by a robust set of driving forces centered on regulatory mandates, which enforce secure destruction, and the rising global emphasis on data privacy and identity protection. Restraints often revolve around the costs associated with certified, audited destruction processes, coupled with the increasing trend towards enterprise-wide digital archiving, which aims to reduce the physical footprint entirely. Opportunities lie in expanding specialized services, such as media destruction (hard drives, tapes) and providing consulting services on information lifecycle management. These factors collectively create impact forces that necessitate high levels of capital investment in secure logistics and robust verification technology.

The primary driving force is mandatory compliance, particularly in highly regulated verticals like finance and healthcare, where non-compliance results in severe financial penalties and criminal liability. This external pressure ensures consistent demand regardless of economic cycles. Conversely, a major restraint is the perceived high cost of secure, certified destruction compared to uncertified internal processes, leading some smaller businesses to use cheaper, less secure methods, thereby capping the market penetration within the SME segment. Moreover, the environmental impact and the logistics required for transporting large volumes of paper in urban centers also present operational challenges that service providers must mitigate through optimized fleet management and high-efficiency shredding equipment.

The most compelling opportunities stem from broadening the definition of ‘document destruction’ to include the secure disposal of non-paper media containing confidential data, addressing the convergence of physical and digital security needs. Additionally, the increasing corporate focus on ESG (Environmental, Social, and Governance) mandates offers an opportunity for service providers to market their closed-loop recycling programs and verifiable waste reduction metrics as a value-added service. The cumulative impact force of these elements dictates that successful market participants must not only offer secure destruction but also provide integrated, compliant, environmentally sound, and digitally verifiable services.

Segmentation Analysis

The Document Shredding Services Market is segmented based on Service Type, End-User Industry, and Frequency, allowing providers to tailor solutions to specific client needs—ranging from high-volume corporate clients demanding on-site transparency to governmental bodies requiring long-term, certified off-site storage and eventual destruction. The Service Type segmentation is critical as it defines the security risk profile and logistical requirements, with on-site services offering immediate peace of mind while off-site services capitalize on economies of scale at centralized processing plants. End-user classification is essential for understanding regulatory drivers, as the security needs of a hospital (HIPAA) differ substantially from those of a bank (GLBA/Basel III), influencing service frequency and audit trail requirements.

- By Service Type:

- On-Site Shredding (Mobile Shredding)

- Off-Site Shredding (Plant-Based Shredding)

- By End-User Industry:

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare (Hospitals, Clinics, Pharmaceutical Companies)

- Legal and Consulting Services

- Government and Public Sector

- Education

- Others (Retail, Manufacturing)

- By Frequency:

- Recurring Scheduled Services

- One-Time/Purge Services

Value Chain Analysis For Document shredding services Market

The value chain for document shredding services begins with the upstream segment involving the secure manufacturing and deployment of specialized equipment, including armored collection vehicles, high-capacity shredders, and secure containers (consoles and bins). The crucial activity within this chain is the core service delivery: secure collection, maintenance of the chain of custody through tracking systems, and the certified destruction process itself. Downstream activities involve the handling and disposition of the shredded material, primarily routing it to certified paper recyclers, thus closing the loop and fulfilling environmental commitments. Effective management of this chain relies heavily on logistics and verified audit trails at every step.

Upstream analysis focuses on suppliers providing secure, proprietary technology—shredding equipment must meet specific particle size standards (e.g., DIN Level P-4 or higher) to ensure irreversibility of data. This stage also includes the provision of IT infrastructure necessary for GPS tracking, digital security auditing, and compliance management software. Suppliers who provide secure transport vehicles and personnel training (security clearance) are critical links, as the collection phase is arguably the highest risk point in the entire destruction process regarding potential data breaches.

Distribution channels in this market are predominantly direct, where service providers interact directly with the end-user (client) through dedicated contracts. However, indirect channels occasionally exist through facilities management or integrated records management companies that bundle shredding services into a broader enterprise solution package. Both channels rely on establishing trust and providing rigorous documentation. The ultimate downstream segment, recycling, is essential; securing reliable, certified paper mills that can process large volumes of shredded material efficiently and guarantee the material's security post-shredding is vital for profitability and sustainability positioning. The integration of high-level recycling guarantees enhances the overall service offering and client retention.

Document shredding services Market Potential Customers

The primary customer base for secure document shredding services includes any organization that routinely handles sensitive, regulated, or proprietary information, making compliance-driven sectors the most lucrative segments. Large corporations, particularly those operating internationally, represent high-volume recurring customers that require rigorous service level agreements (SLAs) and unified destruction standards across multiple geographies. These customers prioritize auditability, demanding detailed, traceable documentation and proof of destruction to satisfy both internal governance requirements and external regulatory bodies.

The financial services sector, comprising banks, insurance companies, and investment firms, is a cornerstone of the market, necessitating continuous secure disposal of customer PII, transaction details, and legal contracts in adherence to strict financial regulations (e.g., Sarbanes-Oxley, Dodd-Frank). Similarly, healthcare providers, encompassing large hospital systems, specialized clinics, and pharmaceutical researchers, require meticulous handling of Protected Health Information (PHI) under mandates like HIPAA, driving demand for secure collection consoles and scheduled, recurring shredding cycles.

While large enterprises drive volume, the vast ecosystem of Small and Medium-sized Enterprises (SMEs), including independent legal practices, accounting firms, and small business consultants, represents a critical growth segment for one-time purge services and smaller, more flexible recurring contracts. These smaller entities often lack the internal resources or specialized equipment to manage secure destruction themselves and rely on third-party experts to minimize their regulatory risk and ensure they are not exposing clients or proprietary information during their document lifecycle management processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shred-it (Stericycle), Iron Mountain Incorporated, Cintas Corporation, Recall (Iron Mountain), Data Management Inc., ShredSmart, Allshred Services Inc., PROSHRED Security, Shred Nations, Secure Destruction, Paper Recycling and Shredding Services, G4S Secure Solutions, Confidential Shredding, DocuVault, Royal Document Destruction, National Document Shredding, Secure Data Destruction, EnviroShred, Total Secure Shredding, Safeguard Document Destruction |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Document shredding services Market Key Technology Landscape

The technology landscape in the document shredding services market is defined by innovation focused on enhancing security, improving operational logistics, and ensuring indisputable compliance documentation. The core mechanical technology involves industrial-grade, cross-cut shredders capable of processing large volumes rapidly while achieving stringent security particle sizes (e.g., DIN 66399 standards). Beyond the shredding mechanism itself, key technological advancements are centered on integrating systems for tracking and verification, crucial elements for maintaining the legally required chain of custody throughout the entire destruction process.

Operational efficiency is significantly augmented by specialized mobile shredding units, which incorporate high-power hydraulic systems and on-board camera surveillance, allowing clients to visually witness the destruction of their documents, thereby maximizing trust and transparency. These vehicles are equipped with advanced GPS and telematics systems, optimizing routes to minimize fuel consumption and increase service density, which is critical for reducing operational costs and improving service timeliness. Furthermore, real-time data feeds from these vehicles allow service providers to proactively manage maintenance schedules, reducing equipment downtime.

The most important technological development for compliance and AEO is the widespread adoption of digital certification and auditing platforms. These cloud-based systems automatically generate timestamped, geolocated Certificates of Destruction immediately upon service completion. This shift moves the industry away from paper-based receipts, offering clients instantaneous, verifiable proof required for regulatory audits. Additionally, secure tracking software utilizing barcode scanning or RFID tags ensures that collection bins and containers are accounted for from the point of collection to final destruction, significantly reducing the risk of loss or tampering and solidifying the security guarantee offered to the end-user.

Regional Highlights

- North America (NA): Represents the most mature and largest market due to early and stringent implementation of privacy laws (HIPAA, GLBA, FACTA). The region displays a high adoption rate of premium on-site shredding services, driven by large corporate clients in the BFSI and healthcare sectors prioritizing security and immediate certification.

- Europe: Growth is primarily sustained by the continuous enforcement of GDPR, which has standardized the secure destruction requirements across the continent. Service providers focus heavily on compliance consulting, ensuring destruction methods meet the specific P-level security standards required for personal data.

- Asia Pacific (APAC): Positioned as the fastest-growing market, fueled by rapidly industrializing economies, increasing regulatory focus on data privacy (e.g., China’s PIPL, Australian Privacy Act), and the expansion of international companies demanding global data security standards. Demand is accelerating in financial hubs like Singapore, Hong Kong, and emerging economies like India.

- Latin America (LATAM): A developing market characterized by high fragmentation but increasing centralization driven by new data protection laws (e.g., Brazil’s LGPD). Market growth is concentrated in major urban centers, with a strong emphasis on off-site, plant-based solutions due to cost constraints.

- Middle East and Africa (MEA): A niche market where growth is concentrated in the Gulf Cooperation Council (GCC) states and South Africa. Demand is tied to government and energy sector requirements for proprietary information protection and the establishment of international business operations that adhere to global regulatory best practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Document shredding services Market.- Shred-it (A Stericycle Solution)

- Iron Mountain Incorporated

- Cintas Corporation

- PROSHRED Security

- Shred Nations

- Confidential Shredding Services

- Vecoplan LLC

- ShredSmart

- Allshred Services Inc.

- Secure Destruction

- Data Management Inc.

- DocuVault

- Royal Document Destruction

- National Document Shredding

- Secure Data Destruction

- EnviroShred

- Total Secure Shredding

- Safeguard Document Destruction

- Mobile Shredding Company

- Access Information Management (AIM)

Frequently Asked Questions

Analyze common user questions about the Document shredding services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Document Shredding Services Market?

The primary driver is mandatory legal compliance, specifically the need to adhere to global data privacy regulations such as GDPR and HIPAA, which impose strict requirements for the certified, secure destruction of confidential documents upon the expiration of their mandated retention period to prevent data breaches and corporate liability.

What is the difference between On-Site and Off-Site shredding services regarding security?

On-Site (mobile) shredding offers immediate, verifiable destruction at the client's location, allowing personnel to witness the process, maximizing security transparency. Off-Site shredding involves transporting documents in secure, tracked containers to a centralized facility, which relies heavily on a robust, auditable chain of custody during transit for security assurance.

How does the Document Shredding Services Market address environmental sustainability?

Professional service providers adhere to closed-loop recycling mandates. After shredding documents to required security particle sizes, the waste paper is baled and transported to certified paper mills for pulping and reuse, guaranteeing that 100% of the destroyed material is recycled, contributing significantly to corporate ESG goals and verifiable sustainability reporting.

How has technology, such as AI, influenced the physical volume of documents needing shredding?

While AI-driven document management accelerates digital migration, reducing the volume of *new* paper generated, it simultaneously creates larger, more predictable purge projects. AI systems precisely flag legacy archives for mandatory destruction when retention limits expire, optimizing and structuring the demand for high-capacity, one-time shredding services.

Which security standard defines the required size of shredded paper particles?

The international standard commonly used is DIN 66399 (or its predecessor, DIN 32757). This standard categorizes security levels (P-1 through P-7), where higher numbers denote smaller particle sizes, ensuring the destroyed information is irrecoverable and guaranteeing compliance for highly sensitive data protection, such as PII and military secrets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager