Dog Training Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432022 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Dog Training Services Market Size

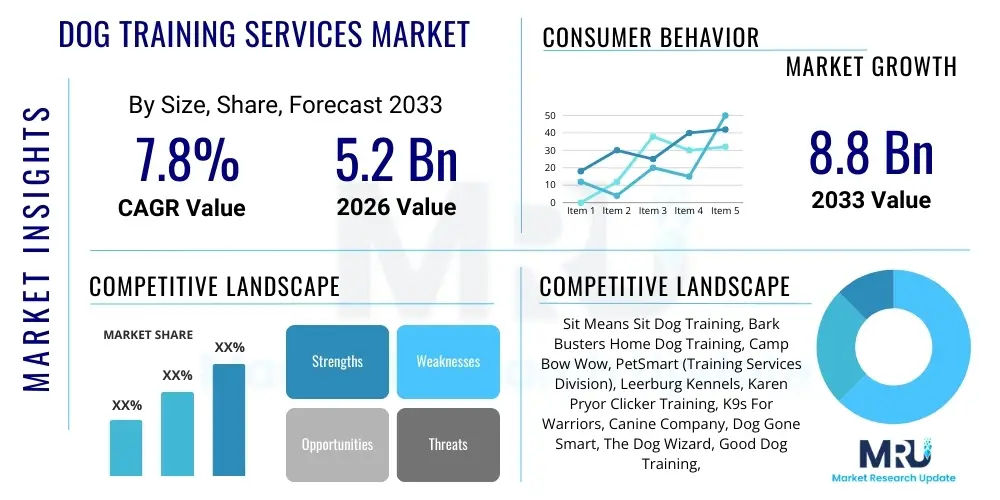

The Dog Training Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.8 Billion by the end of the forecast period in 2033.

Dog Training Services Market introduction

The Dog Training Services Market encompasses professional instruction aimed at modifying canine behavior, enhancing obedience, and strengthening the human-animal bond. These services range from basic obedience classes and specialized behavior modification training to advanced competitive sports preparation and service dog instruction. The fundamental product offering centers on structured curriculum delivered through various formats, including in-person one-on-one sessions, group classes, board-and-train programs, and increasingly, virtual or hybrid models utilizing digital platforms and personalized remote coaching. The increasing trend of pet humanization, where companion animals are viewed as integral family members, serves as the bedrock for sustained market demand, prompting owners to invest significantly in their pets' well-being and behavioral development to ensure harmonious integration into household environments.

Major applications of dog training services span critical life stages and specific behavioral needs. These applications include puppy socialization, essential foundational training for new dog owners, remedial training for addressing severe behavioral issues such as aggression or separation anxiety, and maintenance training to reinforce learned behaviors throughout a dog's life. The scope of the market extends beyond basic household management, catering to niche segments such as therapy dog certification, protection dog training, and specialized scent work or agility courses, which further diversifies revenue streams for service providers. The efficacy of these services is often measured by the reduction of unwanted behaviors and the dog’s ability to respond reliably to commands in diverse settings, thereby improving overall quality of life for both the pet and the owner.

Key driving factors fueling market expansion include rising disposable incomes in developed economies, enabling higher expenditure on premium pet services, and growing awareness regarding the importance of positive reinforcement and force-free training methods, displacing outdated, punitive techniques. Furthermore, stringent regulations in certain urban areas regarding leash laws and public conduct necessitate formal training. The core benefit derived from these services is the reduction of relinquishment rates to shelters, as behavioral problems are a leading cause of pet abandonment. By investing in professional training, pet owners safeguard their investment, ensure public safety, and maximize the longevity and happiness of their canine companions within the family structure, solidifying the necessity of this market segment.

Dog Training Services Market Executive Summary

The Dog Training Services Market is experiencing robust growth characterized by several key business trends, shifts in regional dominance, and evolving segment preferences. Business trends highlight a strong movement towards professionalization and accreditation, with consumers increasingly seeking trainers certified by recognized industry bodies, moving away from informal, unregulated services. The integration of technology, particularly through subscription-based online content, virtual consultations, and specialized training apps, is significantly enhancing scalability and accessibility, transforming traditional service delivery models. Moreover, strategic mergers and acquisitions among large, franchise-based training operations are consolidating the market landscape, allowing these entities to leverage centralized marketing and standardized training protocols across wider geographical footprints, focusing heavily on convenience and measurable outcomes for the modern, busy pet owner.

Regionally, North America and Europe currently dominate the market, largely due to high pet ownership rates coupled with significant discretionary spending allocated to pet enrichment and health services, further augmented by a deeply entrenched culture of pet humanization. However, the Asia Pacific (APAC) region, particularly rapidly developing economies such as China and India, represents the highest growth trajectory. This acceleration is driven by urbanization, changing cultural attitudes toward pet ownership (moving pets indoors), and the rapid expansion of the middle class, which is increasingly adopting Western pet care standards. This shift necessitates localized market strategies focusing on cultural sensitivities regarding animal welfare and behavior management tailored to denser living conditions prevalent in these metropolitan areas, presenting substantial untapped opportunities for market players.

Segmentation trends indicate strong performance in specialized training categories, such as behavior modification services targeting severe issues, which often command premium pricing due to the specialized expertise required. In terms of delivery method, hybrid models combining intensive, short-duration in-person instruction with extensive follow-up virtual support are gaining traction, optimizing both effectiveness and client convenience. The demand for puppy and basic obedience training remains foundational, serving as the entry point for most consumers, but the fastest growing segment pertains to specialized skills (e.g., service, therapy, and sport dog training), reflecting owners' desire for their dogs to perform roles beyond companionship. These trends collectively underscore a market maturing rapidly, prioritizing professional quality, technological integration, and highly specialized service delivery tailored to diverse consumer needs.

AI Impact Analysis on Dog Training Services Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Dog Training Services Market primarily revolve around concerns about job displacement for traditional trainers, the accuracy and ethical implications of AI-driven behavioral diagnostics, and the potential for personalization in remote training. Users frequently ask if AI-powered cameras or wearable devices can replace human observation in identifying subtle behavioral cues, and whether large language models (LLMs) can generate effective, customized training plans without hands-on expertise. The central theme emerging is the perceived tension between the irreplaceable human element—the ability to read nuances in both the dog and the owner—and the efficiency gains promised by algorithmic tools for tracking progress, scheduling, and delivering consistent instructional content, highlighting a strong user expectation for AI to augment, rather than eliminate, the role of the certified professional trainer.

AI is poised to revolutionize the administrative, analytical, and consistency aspects of dog training, fundamentally shifting the business model toward data-driven decision-making. AI-powered behavioral monitoring systems utilize computer vision and motion sensors to track a dog’s stress levels, sleeping patterns, and reactive behaviors in real-time, providing trainers and owners with objective data that traditional subjective observation often misses. This capability allows trainers to refine interventions based on quantifiable results, significantly improving the efficacy of behavior modification protocols. Furthermore, AI assists in the logistical management of large training facilities, optimizing class scheduling, managing client communications, and predicting demand for specific services based on demographic data and seasonal trends, thereby maximizing operational efficiency and reducing overhead costs.

However, the human touch remains irreplaceable, particularly in the critical phases of handler education and complex behavioral rehabilitation. AI tools, such as intelligent virtual assistants or advanced tracking apps, serve best as potent support mechanisms, providing owners with immediate, algorithmically generated feedback on homework compliance and technical execution of commands. By automating data collection and synthesizing vast amounts of canine behavioral data, AI enables trainers to spend less time on administration and more time focusing on the nuanced interactional dynamics—the core of effective training—which require empathy, adaptability, and complex non-verbal communication skills that AI currently cannot replicate. This symbiotic relationship ensures that AI integration elevates the standard of care and professional efficacy rather than diminishing the need for skilled practitioners.

- Enhanced Behavioral Diagnostics: AI uses computer vision to analyze subtle canine body language and behavior patterns, offering objective data previously inaccessible to human trainers alone.

- Personalized Training Plan Generation: Algorithms leverage historical data to suggest highly customized training exercises and progression schedules based on the dog's breed, age, temperament, and past responses.

- Automated Progress Tracking: Smart collars and wearable technology, coupled with AI analytics, monitor training compliance, activity levels, and physiological responses, providing quantifiable success metrics.

- Virtual Consultation Augmentation: AI-powered tools enhance remote sessions by analyzing video input for common errors in owner technique, offering immediate, targeted feedback during live virtual classes.

- Optimized Business Operations: Machine learning models forecast client demand, optimize staff scheduling, and automate administrative tasks like billing and follow-up communications, improving service scalability.

DRO & Impact Forces Of Dog Training Services Market

The dynamics of the Dog Training Services Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. Key drivers include the pervasive trend of pet humanization, leading to increased willingness among owners to invest premium amounts in their pets' quality of life, alongside heightened societal recognition that trained dogs lead happier and safer lives, reducing the risk of euthanasia due to behavioral issues. Restraints primarily involve the lack of standardized global regulation and certification for dog trainers, which can lead to consumer confusion, distrust in quality, and price variance across the market. Furthermore, the time commitment and cost associated with intensive training programs can act as a financial and logistical barrier for lower-income households. Opportunities, however, are abundant, focusing on the expansion into specialized services like therapy animal certification, utilizing telehealth and hybrid training models to reach underserved geographic areas, and developing corporate wellness programs that include dog training subsidies for employees with pets, tapping into preventative behavioral management.

The primary driving force remains demographic and cultural shifts, particularly the global expansion of high-density urban living. As more dogs live in close proximity to humans and other pets in apartments and crowded neighborhoods, the necessity for impeccable manners and controlled behavior becomes non-negotiable for peaceful coexistence and public safety. This environmental pressure organically increases demand for professional training services, particularly those focusing on impulse control and reactivity management in stimulating environments. Additionally, the proliferation of scientific research validating the effectiveness and ethical superiority of positive reinforcement and force-free methodologies is educating consumers, making them more discerning about the training approaches they choose, further professionalizing the industry and rewarding high-quality service providers.

Conversely, a significant restraint is the seasonality and high operational cost inherent in running quality in-person training facilities, particularly board-and-train programs which require extensive staffing, insurance, and facility upkeep. The market is also highly fragmented, characterized by numerous small, independent operators, which makes large-scale marketing and consumer trust difficult to standardize without reliance on local word-of-mouth. However, the future market opportunity is heavily skewed toward technological adaptation; the ability to leverage digital platforms for scalable content delivery and remote coaching, effectively democratizing access to expert knowledge, represents the strongest positive impact force. Trainers who successfully integrate these digital components can drastically lower their marginal cost per client while expanding their reach globally, transforming a traditionally localized service into a globally accessible industry, ensuring robust growth despite existing constraints.

Segmentation Analysis

The Dog Training Services Market is comprehensively segmented based on the type of training service offered, the delivery method utilized, the target application of the training, and the demographic profile of the dog (age group). This segmentation allows market players to tailor their marketing strategies and service offerings precisely to the diverse needs of the pet-owning population, ranging from preventative care for new puppies to complex intervention for adult behavioral problems. The complexity of services, from generalized obedience to specialized task training, significantly impacts pricing and the required expertise, creating distinct sub-markets within the overall industry structure.

Service type segmentation is crucial, distinguishing high-volume, standardized basic obedience classes from lower-volume, higher-value behavior modification consultations. Delivery method segmentation highlights the shift towards flexible consumer options, recognizing that time constraints mandate alternatives to traditional weekly group classes. The dominance of hybrid models and virtual coaching illustrates the market's response to consumer demand for convenience and flexibility. Furthermore, segmenting by dog age—Puppy, Adolescent, and Adult/Senior—is essential as the behavioral challenges and learning capabilities differ substantially across these groups, necessitating age-specific curriculum development and marketing efforts focused on addressing life-stage specific owner pain points, such as housebreaking for puppies or fear-related aggression in adults.

- Service Type:

- Basic Obedience Training (Sit, Stay, Recall)

- Behavior Modification Training (Aggression, Anxiety, Reactivity)

- Specialized Training (Service Dog, Therapy Dog, Protection Dog)

- Advanced/Sport Training (Agility, Dock Diving, Scent Work)

- Delivery Method:

- In-Person Group Classes

- Private One-on-One Training (In-Home or Facility Based)

- Board and Train Programs

- Virtual/Remote Training (Online Courses, Video Consultations)

- Hybrid Models

- Dog Age Group:

- Puppy (0-6 months)

- Adolescent (6-18 months)

- Adult/Senior (18+ months)

- Provider Type:

- Independent Trainers

- Franchise Operations

- Veterinary Clinics & Shelters (Offering Training Services)

- Online Training Platforms

Value Chain Analysis For Dog Training Services Market

The value chain for Dog Training Services is largely focused on intangible skill transfer and highly specialized knowledge delivery, diverging from manufacturing-centric models. Upstream analysis involves the acquisition and development of human capital—the certification, continuing education, and expertise of the trainers themselves, often requiring investments in specialized behavior analysis programs and positive reinforcement workshops. Key upstream inputs also include high-quality training equipment (leashes, harnesses, enrichment toys) and facility infrastructure (training halls, secure outdoor areas for board-and-train services). The integrity of the service quality relies fundamentally on the trainers' adherence to ethical, science-based methodologies, representing the core value proposition derived from professional investment in human resources.

Midstream activities encompass the actual delivery and customization of the training curriculum. This stage involves meticulous client intake and assessment, tailoring generalized protocols to individual dog-owner pairs, and the execution of training sessions, whether conducted in person or virtually. The efficiency of the delivery mechanism—scheduling, communication tools, and the ratio of trainer-to-client support—are critical factors affecting perceived value and client retention. Service providers must manage operational logistics efficiently, ensuring high utilization rates of facilities and staff time, while maintaining high service quality and measurable outcomes, which often involves significant investment in proprietary content and client management software designed specifically for the pet service industry.

Downstream activities center on distribution channels and post-training support. Distribution is segmented into direct channels (trainers marketing directly to consumers through local reputation, social media, and their own websites) and indirect channels (referrals from veterinary offices, pet supply retailers, local shelters, and increasingly, partnerships with pet insurance providers). Crucially, the downstream relationship extends beyond the conclusion of the paid service; ongoing client support, including follow-up emails, maintenance group classes, and loyalty programs, maximizes customer lifetime value and generates robust word-of-mouth referrals, which are the lifeblood of this service-oriented market. Effective management of the distribution channel ensures maximum exposure to target client segments, while high-quality post-service support solidifies the market reputation necessary for sustainable growth.

Dog Training Services Market Potential Customers

The end-users and buyers of dog training services are highly diverse but can be broadly categorized into first-time dog owners, experienced owners facing behavioral crises, individuals seeking specialized dog roles, and institutional clients. First-time owners constitute a critical segment, typically seeking foundational services like puppy socialization and basic manners to ensure successful integration of their new pet into the home environment. These customers are highly susceptible to marketing focused on prevention and ease of use, prioritizing safety and simple solutions for common early-stage problems such as housebreaking and nipping. Their purchasing decisions are often influenced heavily by recommendations from veterinarians or breeders, positioning these referral sources as vital touchpoints for market penetration.

Another major segment includes experienced dog owners who are specifically seeking behavior modification services for complex or severe issues, such as resource guarding, human or dog aggression, or debilitating separation anxiety. These clients represent the high-value segment, as interventions require significant time, specialized expertise (often involving certified applied animal behaviorists), and consequently, higher service fees. These buyers prioritize proven experience, high certification levels, and data-driven protocols, often having exhausted previous, unsuccessful training attempts. The willingness to invest substantial resources stems from the emotional distress and legal liabilities associated with unmanaged severe behavioral problems, making efficacy and trust the paramount drivers of purchase decisions in this segment.

Institutional buyers and specialized end-users form a smaller yet financially significant customer base. This group includes governmental or private organizations requiring working dogs (e.g., police departments, search and rescue organizations, or airport security), hospitals and nursing homes needing therapy or facility dogs, and individuals requiring service dogs for physical or psychological disabilities. These contracts demand rigorous, long-term training protocols and highly specialized skills, often necessitating continuous recertification and maintenance training. Furthermore, ancillary markets like pet resorts and boarding facilities often contract trainers to provide enrichment and behavioral assessment services for their clientele, representing a crucial B2B sales channel focused on risk mitigation and quality assurance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.8 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sit Means Sit Dog Training, Bark Busters Home Dog Training, Camp Bow Wow, PetSmart (Training Services Division), Leerburg Kennels, Karen Pryor Clicker Training, K9s For Warriors, Canine Company, Dog Gone Smart, The Dog Wizard, Good Dog Training, Courteous Canine, McCann Professional Dog Trainers, Starmark Academy, Best Friends Pet Hotel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dog Training Services Market Key Technology Landscape

The technology landscape within the Dog Training Services Market is rapidly evolving, driven primarily by the need for scalability, remote data collection, and enhanced client engagement outside of traditional class settings. Central to this transformation are robust Learning Management Systems (LMS) and custom-built mobile applications that allow trainers to deliver proprietary curricula, track client progress, manage billing, and maintain consistent communication. High-definition video conferencing platforms facilitate effective virtual coaching sessions, extending the geographic reach of expert trainers beyond local catchment areas. Furthermore, the adoption of specialized Customer Relationship Management (CRM) software tailored for pet services is improving client lifecycle management, ensuring timely follow-ups and personalized service recommendations, thereby enhancing client retention and overall operational efficiency within multi-location or franchise operations.

Wearable technology and smart home devices represent the frontier of behavioral analysis and training augmentation. Smart collars, activity trackers, and specialized cameras are now capable of monitoring physiological indicators (like heart rate variability and breathing patterns) and environmental factors that contribute to stress or anxiety in dogs, providing quantitative data that validates behavioral modification efforts. This objective data helps trainers move beyond anecdotal evidence, allowing for highly precise adjustments to training protocols. Integration with other smart pet technology, such as automated feeders or interactive toys that track usage, allows trainers to better assess a dog’s overall environment and adherence to enrichment plans prescribed as part of the behavior treatment, creating a truly holistic and data-informed training ecosystem.

Beyond hardware, the utilization of sophisticated content creation and delivery technologies is paramount. This includes the development of high-quality, pre-recorded video modules and interactive 3D simulations that help owners visualize complex concepts, such as the proper execution of leash handling or the dynamics of canine body language. The investment in tools that support AEO and GEO optimization is also crucial for market visibility, ensuring that training content ranks prominently in answer engines and virtual assistants, capturing the initial consumer query before they seek in-person service. Trainers leveraging technology effectively are those who blend high-touch human interaction with high-tech data insights, leading to superior client outcomes and securing a competitive advantage in a segment increasingly defined by convenience and demonstrable results.

Regional Highlights

The Dog Training Services Market exhibits substantial regional variation in maturity, service demand, and regulatory oversight, influencing growth patterns globally.

- North America (U.S. and Canada): This region commands the largest market share, driven by the highest per-capita spending on pets, a robust culture of pet humanization, and a well-developed network of professional training organizations. The US market is characterized by high demand for specialized services (e.g., service dogs) and rapid adoption of technological delivery methods, particularly hybrid and virtual training models that cater to affluent, time-constrained urban populations. Competition is intense, requiring providers to focus heavily on professional certification and niche specialization for differentiation.

- Europe (Germany, UK, France): Europe represents a mature market with strong growth potential, heavily influenced by stringent national and local animal welfare laws that often mandate basic levels of training or socialization for specific breeds or urban residence. Demand is particularly high in Western Europe for positive reinforcement methods and certified trainers, reflecting a commitment to ethical pet ownership. The UK, in particular, shows strong uptake of advanced behavior consultation services, often linked to veterinary referrals and sometimes supported by pet insurance plans, indicating a deeper integration into the wider pet healthcare ecosystem.

- Asia Pacific (APAC) (China, Japan, Australia): APAC is the fastest-growing region, primarily fueled by soaring pet adoption rates linked to urbanization and rising middle-class disposable incomes. While Australia is a mature market similar to North America, countries like China and India are seeing explosive demand for foundational obedience training as pet ownership shifts indoors and behavioral management becomes critical for dense city living. Market players must navigate diverse regulatory environments and cultural differences regarding pet roles, focusing on localized training materials and effective digital marketing to capture the emerging consumer base.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are nascent markets for professional dog training services, though growth is accelerating, particularly in urban hubs like Brazil, Mexico, and the UAE. Growth is driven by expatriate populations bringing Western pet care standards and local affluence leading to increased discretionary spending on luxury pet services. The market here is fragmented, offering significant opportunities for international franchise operations willing to invest in educating consumers about the long-term benefits of professional training over traditional, often punitive, methods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dog Training Services Market.- Sit Means Sit Dog Training

- Bark Busters Home Dog Training

- Camp Bow Wow

- PetSmart (Training Services Division)

- Leerburg Kennels

- Karen Pryor Clicker Training

- K9s For Warriors

- Canine Company

- Dog Gone Smart

- The Dog Wizard

- Good Dog Training

- Courteous Canine

- McCann Professional Dog Trainers

- Starmark Academy

- Best Friends Pet Hotel

- Cesar's Way

- Dog Training Elite

- Zoom Room Dog Training

- National K9 School for Dog Trainers

- Highland Canine Training, LLC

Frequently Asked Questions

Analyze common user questions about the Dog Training Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Dog Training Services Market?

The Dog Training Services Market is projected to experience a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033, driven by increasing pet humanization and urbanization.

Which delivery methods are most preferred by consumers in the dog training market?

Consumers increasingly prefer hybrid and virtual training models, which combine the effectiveness of short, intensive in-person sessions with the flexibility and convenience of remote follow-up coaching and online content delivery.

How is technology, specifically AI, influencing the future of dog training?

AI is primarily augmenting the training process by providing objective behavioral diagnostics through smart wearables and computer vision, optimizing business operations, and personalizing training plans based on real-time data analysis, thus improving professional efficacy.

What are the primary restraints affecting the Dog Training Services Market growth?

The key restraints include the lack of standardized, global regulation and certification for trainers, leading to service quality inconsistencies, coupled with the high cost and significant time commitment required for complex behavior modification programs.

Which regional market is exhibiting the fastest growth trajectory for dog training services?

The Asia Pacific (APAC) region, particularly emerging economies like China and India, is showing the fastest growth rate, fueled by rapidly rising pet ownership and the increased need for behavioral control in dense urban environments.

The overall market for canine behavioral services is experiencing profound transformation, moving away from purely localized, informal models toward internationally standardized, tech-enabled service provision. The emphasis across all segments, from foundational puppy classes to advanced aggression management, is on science-based, force-free training, which is now the industry standard demanded by well-informed consumers. The shift is not just in methodology but in accessibility, with virtual platforms breaking down geographic barriers. The economic stability of the market is underpinned by its resilience to economic fluctuations, as pet owners consistently prioritize the well-being and behavioral stability of their companion animals, viewing training as a necessary investment rather than a luxury expenditure. This dedication ensures steady demand for certified professionals capable of delivering measurable, positive outcomes. The professionalization trend is also fostering collaborations with veterinarians, leading to integrated pet care approaches where behavioral health is addressed alongside physical health. This interdisciplinary approach further legitimizes dog training as an essential service. The future trajectory of the market relies heavily on the ability of service providers to integrate sophisticated tracking technology, leverage big data to refine training methodologies, and efficiently scale their operations using franchise or partnership models to capture the vast, untapped market potential in developing regions, while maintaining the high ethical and quality standards that define the established Western markets. The global regulatory landscape remains fragmented, yet self-governance through strong professional associations is gradually filling this void, offering consumer confidence and establishing benchmarks for competence and ethical practice across various geographical territories.

The commitment of dog owners to enhancing the cognitive and emotional development of their pets is a significant underlying driver that often goes underestimated in traditional market analyses. Modern pet owners are increasingly aware of the psychological needs of dogs and actively seek training that goes beyond simple obedience commands, focusing instead on enrichment, confidence building, and addressing the root causes of anxiety or frustration. This sophisticated demand profile necessitates trainers possessing skills in applied animal behaviorism and positive reinforcement techniques, moving the industry decisively away from punitive or dominance-based approaches which are rapidly becoming obsolete due to scientific evidence and ethical concerns. Consequently, training programs that incorporate elements of environmental management, canine body language interpretation, and human psychology are gaining preference, commanding higher price points and attracting a clientele deeply invested in long-term behavioral success and mutual understanding with their pets. The growth in specialized certifications for trainers reflects this complex demand, transforming the profession into a highly skilled field.

Market expansion is also heavily influenced by public awareness campaigns and media portrayal of responsible pet ownership. Documentaries, books, and social media influencers focused on positive training methods have dramatically educated the consumer base, creating a highly informed customer who demands transparency, verifiable credentials, and guaranteed ethical treatment of their animals. This external educational pressure forces training providers to constantly update their skills and accreditation status, favoring large, centrally managed organizations or well-established independent trainers with transparent track records. Furthermore, the role of local government and housing associations in mandating proof of training for certain breeds or in multi-unit dwellings acts as a statutory driver, ensuring a baseline level of market activity even among less enthusiastic pet owners. This structural support stabilizes the demand for basic obedience services and puppy socialization, establishing them as non-discretionary pet care expenses akin to veterinary visits.

A notable restraint often overlooked is the consumer perception of value versus cost, particularly for specialized behavior modification which can involve months of consultations and thousands of dollars. While highly effective, the barrier to entry for this essential service remains high for many households, leading some pet owners to resort to quick-fix, ineffective, or harmful techniques found online or recommended by unqualified sources, perpetuating the cycle of behavioral problems. The industry's long-term opportunity lies in bridging this gap through scalable, affordable digital solutions that provide high-quality foundational knowledge, effectively acting as triage before severe issues necessitate expensive, intensive in-person interventions. Developing standardized insurance products that cover accredited behavior modification services could also significantly mitigate the financial barrier, potentially unlocking substantial latent demand within the middle-income demographic.

The competitive landscape is characterized by dual growth strategies: volume expansion via franchising (targeting broad geographic reach and brand recognition for basic services) and specialization (targeting premium pricing through highly niche expertise, such as military working dog training or veterinary behavior consulting). Franchises excel at standardized curricula delivery and scalable marketing, offering consistency that appeals to the general consumer. Independent specialists, conversely, thrive on referral networks built on tackling severe, complex cases that require intensive, customized protocols. The adoption of technology, such as dedicated practice management software that integrates scheduling, client notes, video tutorials, and financial processing, is crucial for both models to maintain efficiency and a professional image, serving as a significant competitive differentiator in an increasingly sophisticated service market.

Technological advancement is also enabling better measurement of service efficacy, a key metric for competitive differentiation. Trainers utilizing specialized apps can track dog and owner adherence to protocols, logging successful repetitions, monitoring latency of response to commands, and providing graphical representations of progress. This data-driven feedback loop not only motivates owners but provides empirical evidence of service value, essential for securing professional referrals from veterinary offices who prioritize quantifiable outcomes. Furthermore, the increasing sophistication of machine learning models allows for predictive analytics regarding potential behavioral issues based on breed, age, and environment, enabling proactive, preventative training interventions—a highly attractive, emerging service category focused on lifetime behavioral wellness management.

The demographic shift towards smaller household sizes and delayed human childbirth in many developed nations has elevated the status of dogs to true family members, profoundly impacting spending habits. This cultural phenomenon, often termed "pet pampering" or "pet parenting," means that expenses for training, especially high-end board-and-train programs promising rapid results and holistic care, are often prioritized over other discretionary household expenditures. This robust emotional investment secures the market against minor economic downturns, ensuring that professional training services retain their classification as non-essential but highly valued necessities for maintaining household harmony and the pet's quality of life. This emotional driver is far stronger than simple utility-based purchasing, granting significant pricing power to established, high-reputation providers in the market.

In terms of upstream sourcing within the value chain, the reliance on scientific publications and academic research in animal behavior (ethology) has never been higher. Leading training academies and professional bodies continuously adapt their curricula based on the latest findings in canine neuroscience and learning theory. This continuous need for professional development constitutes a massive internal knowledge market, driving demand for specialized conferences, workshops, and advanced degree programs for trainers. Consequently, firms that invest heavily in research and development, often collaborating with universities, position themselves as thought leaders, attracting both the highest caliber trainers and the most discerning, educated clientele, thereby reinforcing their market dominance based on intellectual capital and proven scientific methodology.

The downstream distribution channel benefits significantly from digital marketing strategies specifically targeted through search engines and social media platforms. Content optimized for AEO often addresses specific pain points, such as "how to stop puppy biting" or "managing dog reactivity on leash." Successful market entrants utilize detailed, keyword-rich content and instructional videos that demonstrate expertise and establish immediate trust, converting search queries directly into consultation bookings. The increasing importance of localized search results means that maintaining a strong online presence, managing positive Google reviews, and ensuring accurate local business listings are as critical to market success as the quality of the training services themselves themselves. This digitalization of outreach minimizes the reliance on traditional, slow word-of-mouth growth alone, allowing rapid scaling.

The role of franchising in stabilizing market quality is a critical factor for future growth. Large franchise operators provide standardized curricula, mandatory continuing education, centralized marketing support, and robust quality control mechanisms that reassure consumers wary of the fragmented nature of the independent trainer sector. This model allows for rapid geographic expansion while maintaining a predictable level of service quality and brand integrity, features highly valued by corporate partners and pet insurance companies looking to refer clients to reliable national networks. The expansion of these franchise models, particularly into high-growth APAC and LATAM urban centers, will be a defining trend in the market over the forecast period, driving competition among independent trainers to formalize their operations and achieve professional accreditation to compete effectively against these established, recognized brands.

Finally, the ethical dimension of training services is becoming an increasingly powerful market force. Consumers are not only seeking effective results but demanding humane treatment, often defined by adherence to LIMA (Least Intrusive, Minimally Aversive) guidelines. This ethical preference strongly influences buying decisions, pushing out providers who still rely on outdated, aversive tools or methods. Marketing efforts that highlight commitment to animal welfare, coupled with visible certifications from organizations focused on positive reinforcement (e.g., CCPDT, IAABC), provide a powerful ethical competitive advantage, particularly appealing to the younger, socially conscious demographic of pet owners who prioritize animal well-being above all other factors, solidifying the long-term sustainability of force-free methodologies as the prevailing market standard.

The integration of training services into the broader pet ecosystem, specifically through veterinary clinics and boarding facilities, is a key strategic opportunity. Veterinarians are increasingly recognizing the impact of behavioral health on overall canine wellness, leading to higher rates of behavioral referrals. Training companies that establish formal partnership agreements with large veterinary hospital chains or regional pet care conglomerates secure a reliable, high-quality lead source. These partnerships often involve cross-promotion, shared client management systems, and joint educational initiatives aimed at pet owners, presenting a unified front of health and behavioral wellness care. This symbiotic relationship elevates the perceived medical necessity of professional training, moving it from an optional expense to a critical preventative health measure, thereby increasing overall market penetration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager