Domain Name Registrar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437583 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Domain Name Registrar Market Size

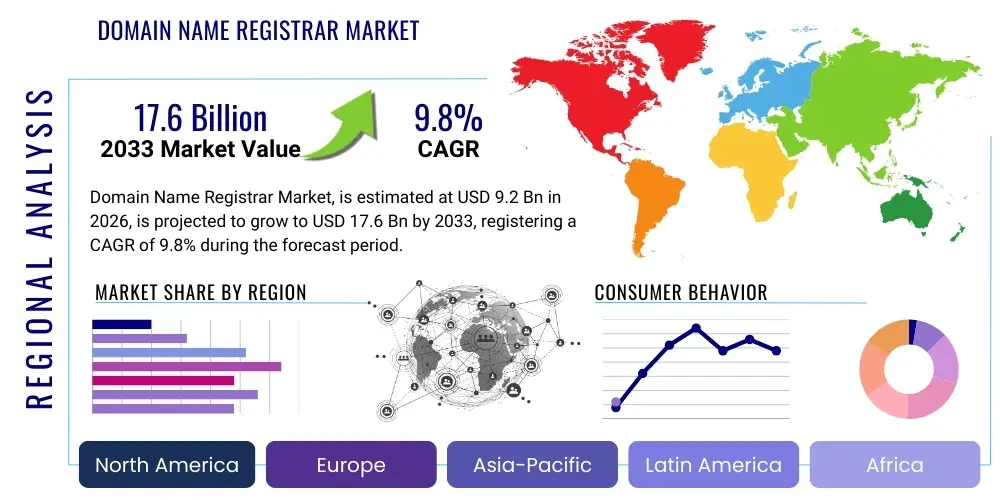

The Domain Name Registrar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 9.2 Billion in 2026 and is projected to reach USD 17.6 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the accelerating global digital transformation, the proliferation of Small and Medium-sized Enterprises (SMEs) establishing an online presence, and the continuous innovation in new Generic Top-Level Domains (gTLDs).

Market valuation reflects the increasing necessity for businesses and individuals to secure unique digital identities across various internet protocols. The market encompasses the processes of registration, renewal, and transfer of domain names, crucial components of the global internet infrastructure overseen by organizations like the Internet Corporation for Assigned Names and Numbers (ICANN). Demand remains resilient, driven by the expansion of e-commerce platforms, the rise of content creators, and the shift towards remote work models globally, all requiring authoritative and memorable domain names.

Domain Name Registrar Market introduction

The Domain Name Registrar Market serves as the cornerstone of internet accessibility, providing services for reserving and managing domain names—the human-readable addresses (like marketresearchupdate.com) that correspond to Internet Protocol (IP) addresses. Registrars act as authorized intermediaries between the public and the domain name registry operators, ensuring compliance with ICANN policies and facilitating the integration of domains into the global Domain Name System (DNS). The core product involves the secure registration and subsequent management services, including DNS hosting, security features like Domain Name System Security Extensions (DNSSEC), and privacy features such as WHOIS masking.

Major applications of registrar services span across corporate branding, e-commerce operations, professional blogging, and digital marketing campaigns. Businesses utilize domain names to establish credibility, drive web traffic, and secure intellectual property rights online. Key benefits derived from robust registrar services include enhanced brand protection, reliable website accessibility, centralized digital asset management, and crucial regulatory compliance. The services often extend beyond mere registration to bundled offerings like web hosting, email services, and SSL certificate provisioning, creating comprehensive digital presence solutions.

Driving factors for market growth are intrinsically linked to global digitization trends. The massive shift towards cloud computing, the necessity for strong digital sovereignty among nations, and the explosive growth of independent online businesses globally are primary drivers. Furthermore, the continuous release and adoption of new gTLDs (e.g., .tech, .shop, .online) broaden the competitive landscape and offer users more choice, stimulating registration volume. Regulatory stability, coupled with increasing consumer confidence in digital security, further supports sustained market expansion and investment in premium domain assets.

Domain Name Registrar Market Executive Summary

The Domain Name Registrar Market is characterized by intense competition, driven primarily by technological advancements in security and user experience, and evolving regulatory landscapes, particularly concerning data privacy and intellectual property rights. Current business trends indicate a strong move towards integration, where registrars are bundling services such as Website Builders, Managed WordPress hosting, and advanced cybersecurity tools, transforming from singular registration providers into comprehensive digital identity platforms. The strategic focus is shifting towards customer lifecycle management, prioritizing renewals and upselling value-added services over purely transactional new registrations.

Regionally, North America maintains the largest market share due to the high density of technological enterprises and early adoption of digital marketing strategies. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid internet penetration, burgeoning e-commerce markets in countries like China and India, and supportive government initiatives promoting digitalization among SMEs. Europe follows a steady growth path, emphasizing compliance with stringent data protection regulations like GDPR, which significantly impacts registrar service offerings, particularly concerning WHOIS data management.

Segment trends highlight the dominance of gTLDs, although specialized ccTLDs (Country Code Top-Level Domains) are seeing strong growth, driven by localized businesses seeking geographical authority and search engine optimization benefits. The SME segment remains the primary revenue contributor, reflecting the global trend of small businesses migrating operations online. Furthermore, the increasing complexity of cybersecurity threats is driving demand for premium services like advanced DNS security, highlighting a trend towards quality and reliability over mere cost optimization in domain management.

AI Impact Analysis on Domain Name Registrar Market

Users frequently inquire about how Artificial Intelligence (AI) will transform domain name selection, management, and security, often focusing on the displacement of traditional search methods and the emergence of automated brand protection. Key user concerns revolve around the ethical use of AI in predicting premium domain values, the potential for AI-driven squatting or domain frontrunning, and the efficiency gains from automating complex DNS configuration and cybersecurity monitoring. Users expect AI to streamline the tedious process of finding the perfect, available domain name that aligns with specific branding and SEO criteria, moving beyond simple keyword matching to contextual relevance and market trend analysis.

The implementation of sophisticated AI and Machine Learning (ML) algorithms is set to revolutionize the Domain Name Registrar market by enhancing operational efficiency and customer engagement. AI tools are increasingly deployed for predictive analysis of domain name popularity and potential brand infringements, allowing registrars to offer proactive defense services. Furthermore, AI-powered domain suggestion engines utilize natural language processing (NLP) to generate highly relevant, marketable, and available domain names based on user input, industry context, and real-time market trends, thereby significantly improving the conversion rate for new registrations and reducing the friction in the initial setup process for new digital ventures.

Beyond customer-facing applications, AI is critical for improving backend infrastructure stability and security. ML models are highly effective at detecting sophisticated phishing attempts, identifying patterns associated with domain generating algorithms (DGAs), and mitigating Distributed Denial of Service (DDoS) attacks targeting DNS servers. This shift ensures higher uptime and better resilience against cyber threats, offering premium security assurances that are becoming standard competitive differentiators in the market. The integration of AI also aids in automating compliance checks and managing the vast, complex data sets associated with global domain registration policies and enforcement.

- AI-driven domain suggestion engines enhance discovery and relevance.

- Machine Learning models improve DNS security and anomaly detection.

- Automated brand monitoring systems proactively identify infringement risks.

- AI optimization of pricing and premium domain valuation.

- Chatbots and conversational interfaces streamline customer support for technical issues.

DRO & Impact Forces Of Domain Name Registrar Market

The Domain Name Registrar Market is primarily driven by the exponential increase in global internet users and the mandate for digital transformation across all industry verticals, compelling even traditional brick-and-mortar businesses to secure an online footprint. Restraints include complex regulatory environments, particularly concerning cross-border data management and stringent ICANN policies, alongside intense price competition that compresses profit margins on basic registration services. Opportunities emerge from the growth of niche markets, such as blockchain-based domain solutions and specialized domains catering to emerging technologies (e.g., augmented reality platforms). These forces collectively shape the market's trajectory, requiring continuous adaptation to technological shifts and regulatory demands to maintain relevance and competitive advantage.

Drivers: Global digital maturity and the rise of e-commerce are significant accelerators. Every new business, organization, and independent professional entering the digital sphere requires at least one domain name, directly linking global economic growth and entrepreneurial activity to registrar revenue. Furthermore, the increased sophistication of internet use, including the deployment of microservices and multiple sub-brands, necessitates multiple domain registrations per enterprise, boosting registration volume. The convenience and speed of modern registration platforms, often integrating instantly with hosting and email services, lower the barrier to entry for digital newcomers, thereby expanding the potential customer base significantly.

Restraints: The market faces considerable challenges from continuous threats of cyberattacks, including DNS hijacking and domain squatting, which erode user trust and necessitate heavy investment in security infrastructure. Furthermore, regulatory fragmentation across different regions poses compliance burdens, especially for global registrars managing both gTLDs and ccTLDs, each governed by unique local policies. Pricing pressure remains a constraint; while premium domains command high prices, the commodity nature of standard domain registration often forces registrars into intense price wars, making differentiation difficult outside of bundled services.

Opportunities: Significant growth potential lies in the development and adoption of new technological frameworks. The rise of decentralized web technologies (Web3) and blockchain domains offers a novel, albeit nascent, revenue stream that circumvents traditional ICANN governance. The proliferation of IoT devices also creates potential for specialized, machine-to-machine communication domains. Geographically, untapped emerging markets in Africa and Southeast Asia, characterized by rapidly increasing mobile internet access, represent substantial areas for future customer acquisition and domain name penetration, particularly for region-specific TLDs.

Segmentation Analysis

The Domain Name Registrar Market is rigorously segmented based on Registration Type, Domain Type, End-User, and Deployment Model, providing a granular view of market dynamics and consumer preferences. Understanding these segments is crucial for strategic planning, enabling registrars to tailor their product offerings, pricing structures, and marketing efforts to specific user groups. The overall segmentation reflects the duality of the market: the mass-market, high-volume transactions driven by individuals and SMEs, and the high-value, high-security transactions required by large enterprises.

The segmentation by Domain Type, covering gTLDs, ccTLDs, and New gTLDs, reveals shifts in consumer choice. While traditional gTLDs like .com maintain dominance due to established branding and trust, the adoption rate of New gTLDs is rapidly increasing as companies seek memorable and specific branding that was unavailable in the saturated primary market. Similarly, the End-User segmentation highlights the critical importance of the SME segment, which is highly sensitive to bundled services and ease of use, contrasting sharply with large enterprises that prioritize advanced security, dedicated account management, and bulk transfer capabilities.

- By Registration Type:

- New Registration

- Renewal

- Transfer

- By Domain Type:

- Generic Top-Level Domains (gTLDs)

- Country Code Top-Level Domains (ccTLDs)

- New Generic Top-Level Domains (New gTLDs)

- By End-User:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Individual Users/Bloggers

- By Deployment Model:

- On-Premise

- Cloud-Based/SaaS

Value Chain Analysis For Domain Name Registrar Market

The Domain Name Registrar market operates through a complex, multi-tiered value chain regulated by ICANN. This chain begins upstream with the Internet Assigned Numbers Authority (IANA) allocating IP addresses and delegating TLD management to Registry Operators (such as Verisign for .com or PIR for .org). Registry Operators maintain the master database for all domains under their TLD. Upstream analysis focuses on the contractual agreements between Registrars and Registries, including the accreditation process and the negotiation of bulk domain pricing. The efficiency of the upstream process is critical, as it dictates the cost basis and the technical reliability of the domain registration itself, influencing the final retail price and service delivery timelines.

The midstream segment is occupied by the Registrars themselves, who compete on price, service bundling, user interface design, and security features. Registrars manage the customer relationship, providing the storefront, payment processing, technical support, and critical DNS management services. The competitive advantage at this stage hinges on effective marketing, robust technological infrastructure, and successful integration with other digital services like hosting and website builders. The ability of registrars to offer comprehensive, integrated solutions determines their market success.

Downstream analysis involves the distribution channel and the end-users. Direct distribution is common, where the registrar sells directly to the end-user (SMEs or individuals) through their website. Indirect distribution involves reselling or white-label partnerships, where smaller hosting companies, web developers, or specialized agents offer domain services powered by a major registrar. This reseller network expands the geographic reach and targets specific local markets or vertical industries, ensuring maximum market penetration. The final delivery point is the end-user who utilizes the domain to establish a functioning website, email service, or digital identity, completing the value exchange.

Domain Name Registrar Market Potential Customers

The primary customer base for the Domain Name Registrar Market is highly diversified, encompassing any entity or individual seeking a sustainable, unique online identity. The most substantial segment consists of Small and Medium-sized Enterprises (SMEs) globally, which are rapidly transitioning their operations to digital platforms to access broader markets and enhance operational efficiency. These businesses require simple, cost-effective, and bundled solutions, prioritizing ease of use, integrated website building tools, and immediate setup capabilities, often relying on registrar recommendations for hosting and security add-ons.

Another crucial customer segment involves Large Enterprises and Corporations. These entities require sophisticated domain portfolio management, often dealing with hundreds or thousands of domain names globally for brand protection, product launches, and geographical market targeting. Their purchasing decisions are heavily weighted towards specialized corporate registrar services that offer advanced features like bulk registration discounts, dedicated account management, stringent compliance tools, and high-level DNS security and anti-hijacking measures, viewing domain management as a critical component of their overall cybersecurity and intellectual property strategy.

Finally, individual users, including professional bloggers, content creators, freelancers, and personal hobbyists, form the third major customer group. This segment is highly sensitive to pricing and seeks simplicity and reliability. They often utilize registration services as an entry point for establishing a professional online presence, frequently purchasing domain names bundled with basic email services or inexpensive shared hosting plans. Their needs drive innovation in user experience and the introduction of simple, one-click solutions for domain deployment and content management system integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.2 Billion |

| Market Forecast in 2033 | USD 17.6 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GoDaddy Inc., Namecheap Inc., Squarespace (Google Domains), Cloudflare Inc., Tucows Inc. (OpenSRS), Public Interest Registry (PIR), Web.com Group Inc., Enom Inc., Key-Systems GmbH, Alibaba Cloud, IONOS, Wix.com Ltd., GMO Internet Group, Register.com, Dynadot, InternetX, HostGator, Bluehost, 1&1, Name.com |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Domain Name Registrar Market Key Technology Landscape

The technological infrastructure supporting the Domain Name Registrar market is centered on robustness, scalability, and security, utilizing advanced DNS management systems, cloud infrastructure, and proprietary domain governance platforms. Critical technologies include EPP (Extensible Provisioning Protocol), which is the standard mechanism used for communication between registrars and registries to perform registration, transfer, and modification commands reliably. Furthermore, sophisticated billing and customer relationship management (CRM) systems are integrated to handle the massive volume of recurring renewals and manage multi-year contracts effectively, ensuring high operational efficiency and minimizing revenue leakage.

Security technologies represent a crucial pillar of the registrar landscape. The widespread implementation of DNSSEC (Domain Name System Security Extensions) provides cryptographic authentication of data, protecting users from forged DNS data like cache poisoning, which is vital for maintaining trust. Similarly, advanced Transport Layer Security (TLS) and Secure Sockets Layer (SSL) certificates are often sold alongside domain names, utilizing cryptographic protocols to secure communications between the user's browser and the website server. The continuous adoption of multi-factor authentication and anti-phishing technologies ensures both the registrar's and the end-user's accounts are protected against unauthorized access or modification.

Emerging technologies like cloud-native infrastructure and global Anycast DNS networks are enhancing performance and resilience. By leveraging global Content Delivery Networks (CDNs) and distributed Anycast systems, registrars can ensure extremely low latency and high availability for DNS lookups globally, crucial for fast website loading times and resilience against DDoS attacks. Additionally, the nascent integration of blockchain technology is being explored to potentially decentralize domain ownership records, offering immutable proof of control and aiming to reduce reliance on central governing bodies, although this remains an experimental frontier in the current market cycle.

Regional Highlights

Geographical analysis of the Domain Name Registrar Market reveals distinct growth patterns and maturity levels across major global regions. North America currently dominates the market in terms of revenue and market maturity, driven by the presence of major technology hubs, high internet penetration, and a large population of tech-savvy SMEs and multinational corporations that require extensive domain portfolios and advanced security services. The region benefits from established regulatory frameworks and a culture of aggressive digital branding, contributing to a high demand for premium and specialized TLDs. The concentration of leading registrars and hosting providers in the US further consolidates North America’s position as a critical market.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is attributable to massive internet user base expansion, especially in emerging economies like India, Southeast Asia, and China, coupled with increasing governmental initiatives promoting digital literacy and e-commerce adoption among local businesses. APAC registrars often focus on localized ccTLDs and cater to mobile-first users, requiring tailored strategies for registration and management. Regulatory heterogeneity across nations, however, presents unique operational challenges that necessitate localized compliance solutions.

Europe holds a substantial market share, characterized by a mature and highly regulated environment. The implementation of the General Data Protection Regulation (GDPR) has profoundly influenced how European registrars handle WHOIS data, leading to stricter privacy standards and increased focus on transparency. Demand in Europe is stable, driven by cross-border e-commerce and high levels of technological infrastructure investment, particularly in Western Europe. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging regions, driven by improving infrastructure and economic diversification, leading to increased demand for basic domain services and local ccTLDs, though market penetration remains lower than in developed economies.

- North America: Market leader due to high digital maturity, major technology headquarters, and strong demand for enterprise domain management and security services.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid internet penetration, burgeoning e-commerce sectors, and increasing digitalization of SMEs in nations like China and India.

- Europe: Stable market characterized by stringent data privacy regulations (GDPR) influencing WHOIS policy and strong demand for multilingual and local ccTLDs.

- Latin America (LATAM): Emerging growth area, driven by infrastructure improvements and increasing localized content creation, emphasizing mobile accessibility for registration processes.

- Middle East and Africa (MEA): Growth driven by expanding mobile internet use and government initiatives pushing economic diversification and digital service adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Domain Name Registrar Market.- GoDaddy Inc.

- Namecheap Inc.

- Squarespace (acquiring Google Domains assets)

- Cloudflare Inc.

- Tucows Inc. (OpenSRS)

- Public Interest Registry (PIR)

- Web.com Group Inc.

- Enom Inc.

- Key-Systems GmbH

- Alibaba Cloud

- IONOS

- Wix.com Ltd.

- GMO Internet Group

- Register.com

- Dynadot

- InternetX

- HostGator

- Bluehost

- 1&1

- Name.com

Frequently Asked Questions

Analyze common user questions about the Domain Name Registrar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Domain Name Registrar Market?

The Domain Name Registrar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033, driven primarily by global digital transformation and increasing e-commerce adoption.

How is AI impacting the process of domain name registration and management?

AI significantly impacts the market through automated domain suggestion engines that analyze branding potential and SEO alignment, and by deploying machine learning models for advanced DNS security and real-time fraud detection, streamlining operations and enhancing resilience against cyber threats.

Which geographical region holds the largest market share in the Domain Name Registrar Market?

North America currently holds the largest market share, characterized by a high concentration of established technology companies and high maturity in the utilization of enterprise-level domain portfolio management and advanced cybersecurity solutions.

What are the primary challenges restraining the growth of the Domain Name Registrar industry?

Key restraints include the intense pricing pressure on basic registration services due to high competition, complex global regulatory compliance requirements (like GDPR), and persistent cybersecurity threats such as DNS hijacking and domain squatting, which necessitate continuous investment in protective infrastructure.

What are the critical segmentation categories used to analyze the Domain Name Registrar Market?

The market is critically segmented by Registration Type (New, Renewal, Transfer), Domain Type (gTLDs, ccTLDs, New gTLDs), End-User (SMEs, Large Enterprises, Individuals), and Deployment Model (On-Premise, Cloud-Based/SaaS), providing a comprehensive view of consumer behavior and technological adoption.

The comprehensive analysis presented here underscores the dynamic nature of the Domain Name Registrar market, which is continuously evolving in response to technological advancements, regulatory mandates, and global shifts in digital commerce. The imperative for businesses to establish a unique and secure online presence ensures sustained demand, positioning registrars at the forefront of the global internet infrastructure landscape. Future growth is expected to be concentrated in service integration, enhanced security offerings, and expansion into high-growth emerging regions, while technological innovations like AI and blockchain continue to reshape traditional registration paradigms. Focusing on customer lifecycle value and robust digital trust mechanisms will be crucial for market leaders seeking sustainable competitive advantages in this complex and high-volume digital domain.

Strategic success in this environment requires registrars to move beyond being transactional intermediaries and transform into holistic digital identity managers. This involves offering integrated platform solutions that seamlessly combine domain registration with web development tools, sophisticated email solutions, and enterprise-grade security products. Furthermore, navigating the intricate web of international policies, especially concerning data handling and domain abuse mitigation, demands continuous regulatory vigilance and investment in automated compliance systems. The market is increasingly polarizing between high-volume, low-cost commodity providers targeting individuals and SMEs, and specialized corporate registrars focusing on high-value portfolio management and brand protection for large global entities.

The influence of technology is pervasive, driving down costs in some areas while enabling premium service expansion in others. The widespread adoption of cloud infrastructure has allowed registrars to offer highly scalable and reliable DNS services globally, democratizing access to professional-grade digital assets. Meanwhile, the emergence of decentralized identifiers and alternative naming systems, although not yet mainstream, represents a potential long-term disruptor, forcing traditional registrars to monitor and potentially integrate these new protocols to remain relevant in a future where digital identities may transcend the current DNS framework. Maintaining a focus on user experience, offering multi-lingual support, and delivering unparalleled technical reliability will be paramount for securing market leadership through 2033 and beyond.

The investment landscape within the Domain Name Registrar market is highly attractive for providers of integrated digital services. Mergers and acquisitions are frequent, often aiming to consolidate customer bases, acquire specialized technological capabilities (especially in AI-powered security), or expand geographical reach. Companies are increasingly investing in proprietary technology stacks that allow for rapid deployment of new TLDs and customized service bundles tailored to specific industry verticals, such as financial technology or healthcare. The ability to effectively monetize renewal services, which represent the stable, recurring revenue backbone of the industry, is a critical performance indicator for stakeholders and investors evaluating market health and long-term viability.

The increasing dependence of the global economy on digital continuity places significant emphasis on the resilience of the DNS infrastructure. Consequently, registrars who excel in providing geographically dispersed, highly secure, and low-latency DNS resolution services gain a substantial competitive edge. Furthermore, the push towards establishing digital sovereignty in various jurisdictions is leading to a rise in demand for local hosting and registration services that comply explicitly with national data residency laws. This regionalization trend, while potentially fragmenting the market, creates specific high-value opportunities for registrars who can demonstrate strong local presence and specialized compliance expertise in key international markets, particularly in rapidly digitizing Asia and regulatory-heavy Europe.

In summary, the Domain Name Registrar Market stands at a pivotal junction, balancing rapid technological evolution with stringent regulatory oversight. Success depends on strategic diversification into value-added services, leveraging AI for improved efficiency and security, and maintaining relentless focus on the foundational pillars of reliability and trust. The forecast period anticipates strong growth, driven by the irreversible global commitment to digital transformation, ensuring that domain names remain indispensable assets for the global internet economy.

***

The current business landscape is characterized by constant innovation in customer acquisition strategies. Many large registrars leverage sophisticated performance marketing techniques and affiliate programs to drive high volumes of initial domain registrations, often offering significant discounts or promotional bundles, acknowledging that the real profit lies in the long-term revenue generated through renewals and upselling of ancillary services like professional email, web hosting, and advanced security certificates. This initial low-margin approach requires exceptional scale and operational efficiency, favoring incumbents with robust, automated backend systems and large existing customer bases that minimize customer churn.

Regional variations in competition are pronounced. In North America and Europe, competition revolves heavily around brand reputation, quality of customer support, and the richness of integrated product suites. Conversely, in developing markets, price sensitivity is often the dominant factor, leading to fierce competition among local providers and international players offering highly localized pricing tiers. The continuous launch of new Generic Top-Level Domains (gTLDs) provides periodic market stimuli, creating bursts of opportunity for registrars who can effectively market and secure these new digital real estates to niche communities and specialized industries, momentarily shifting focus away from the saturated .com market.

The shift towards cloud-based deployment models is nearly universal within the registrar industry, enabling service providers to offer instant scalability, higher uptime guarantees, and improved disaster recovery capabilities. This reliance on global cloud infrastructure (like AWS, Google Cloud, or Azure) allows registrars to effectively manage billions of DNS queries daily and efficiently process the high transaction volumes associated with annual renewals. The technological emphasis now lies in multi-cloud strategies to ensure service redundancy and compliance with varied regional data governance requirements, particularly concerning the storage and processing of registrant data.

Furthermore, the development of APIs and programmatic interfaces allowing developers and large digital agencies to manage domains in bulk is becoming a key feature, driving adoption among high-value corporate customers. These API-first approaches enable seamless integration of domain management tasks into corporate IT systems and continuous integration/continuous deployment (CI/CD) pipelines, treating domains as dynamic, managed digital assets rather than static entries. This technological alignment with modern DevOps practices ensures the registrar remains relevant to the needs of the technologically sophisticated large enterprise segment.

The regulatory trajectory for the Domain Name Registrar market is heavily influenced by global geopolitical tensions and increasing consumer demands for privacy. ICANN's ongoing policy development process, particularly regarding the next generation of WHOIS (often referred to as Thick WHOIS or similar privacy-respecting models), will mandate significant system overhauls for all accredited registrars. Compliance requires substantial technical re-engineering to handle data requests from legitimate parties (like law enforcement or intellectual property lawyers) while simultaneously protecting the personal information of general registrants, creating a continuous cycle of necessary infrastructure upgrades and legal framework adherence.

This evolving compliance environment creates both barriers to entry for smaller players and opportunities for established registrars to differentiate themselves through superior privacy-protecting features and transparent data governance policies. The market is thus becoming increasingly complex, requiring high levels of legal and technical expertise to navigate successfully. The competitive landscape will favor those who can master this balance between accessibility, security, and global regulatory adherence, turning compliance from a cost center into a competitive advantage in the trust economy.

In terms of forward-looking analysis, blockchain technology presents a compelling, albeit currently peripheral, challenge to the traditional registrar model. Decentralized domain systems, such as those leveraging Ethereum or specialized blockchain networks, promise censorship resistance and immutable ownership records, appealing to users concerned about centralized control or governmental interference. While these systems currently lack the global interoperability and established trust of the ICANN framework, their development trajectory suggests they could capture a specialized, high-security segment of the market, potentially forcing traditional registrars to develop hybrid solutions that bridge the gap between centralized DNS and decentralized web identities, securing their future relevance.

The expansion of digital services beyond traditional websites, encompassing areas like smart contracts, decentralized applications (dApps), and specific IoT device identifiers, implies that the definition of a "domain name" is broadening. Registrars who proactively develop infrastructure capable of managing these diverse digital identifiers will be positioned to capture next-generation revenue streams. This forward vision necessitates partnerships with emerging technology firms and a continuous R&D focus on non-traditional naming services, ensuring the registrar market adapts effectively to the technological shifts defining Web3 and beyond the current iteration of the internet.

The domain registration renewal process is arguably the most critical operational component for registrars, driving high-margin recurring revenue. Strategies focusing on reducing churn include sophisticated automated renewal notifications, offering multi-year registration discounts, and providing integrated, user-friendly control panels that simplify domain management. High customer satisfaction related to core services—DNS stability, speed, and security—directly correlates with high renewal rates, underlining the importance of continuous investment in core technical infrastructure over short-term promotional tactics. The ability to effectively monetize the renewal base separates the market leaders from the peripheral players, making customer retention strategy a paramount concern for executive teams.

The increasing complexity of domain portfolio management for large organizations is spurring the growth of specialized corporate registrars and enterprise-level management tools. These services cater to needs such as advanced litigation support, domain name recovery services, intellectual property monitoring across hundreds of TLDs, and stringent access control management, ensuring only authorized personnel can make critical DNS changes. As corporations face ever-increasing threats from phishing, trademark infringement, and cyber squatting, the demand for these premium, proactive protection services will continue to drive segment growth and high-value service revenues, justifying significantly higher price points than standard retail registration.

The growth in regional markets like APAC is closely tied to the availability and marketing of local ccTLDs (e.g., .cn, .in, .jp). Registrars operating in these territories must establish strong working relationships with the local registry operators and navigate unique national regulations regarding registrant eligibility and documentation requirements, which often involve complex local law compliance. Successful expansion in these dynamic markets relies on local partnerships, investment in culturally relevant marketing campaigns, and providing multi-lingual support, ensuring ease of access for the rapidly growing base of first-time online businesses in Asia.

Furthermore, sustainability and ethical considerations are gradually entering the purchasing criteria for certain customer segments, particularly in Europe. Some registrars are beginning to differentiate themselves by emphasizing green hosting practices, data transparency, and ethical governance policies, aligning with broader corporate social responsibility (CSR) trends. While currently a niche driver, this focus on ethical operations and environmental impact could become a more significant competitive factor, especially when targeting environmentally conscious SMEs and large governmental or educational institutions.

The robust market structure, supported by the foundational necessity of unique digital identification for every online venture, ensures continuous investment and growth. The future registrar will be defined less by the transaction of registration and more by the comprehensive, secure, and intelligent management of digital assets across an increasingly complex and interconnected global internet.

The shift towards an application-centric internet, driven by mobile technologies and sophisticated web applications, mandates that registrars evolve their service offerings beyond static domain mapping. Features such as integrated cloud load balancing, seamless integration with serverless computing platforms, and dynamic DNS updates are becoming standard expectations. This technological demand elevates the sophistication required of registrar infrastructure, moving the core competency from basic database management to complex, global network engineering and distributed service delivery, favoring large providers capable of massive-scale infrastructure investment.

The role of regulatory bodies, especially ICANN, remains central to the market's stability. Any major policy changes concerning pricing, data disclosure, or the introduction of new domain types can have immediate and far-reaching effects on operational models and profitability. Registrars must actively participate in policy development working groups and maintain continuous dialogue with governance bodies to anticipate regulatory shifts and ensure rapid compliance, mitigating risks associated with non-adherence and maintaining their accreditation status, which is fundamental to their operation.

The increasing prevalence of sophisticated cyber threats, ranging from highly targeted phishing campaigns aimed at domain transfer to large-scale DNS manipulation, necessitates that registrars assume a proactive defense posture. Offering mandatory multi-factor authentication, implementing domain lock features by default, and providing real-time alerting systems for unauthorized changes are crucial service components that add tangible value for security-conscious customers. The investment in threat intelligence feeds and rapid response capabilities is now a core operational expense for market leaders, driving up the quality floor for acceptable service levels across the industry.

The segmentation by Registration Type clearly shows the market's reliance on renewals. While new registrations provide initial market expansion, renewals sustain long-term revenue streams, emphasizing the importance of customer lifetime value (CLV) metrics in registrar strategic planning. Effective renewal strategies leverage customer data to offer personalized upsells and timely reminders, maximizing the predictability and sustainability of income streams, crucial for attracting investment and demonstrating market resilience against external economic volatility.

Finally, the growing maturity of the secondary domain market—the trading and brokerage of previously registered, high-value domains—significantly influences the overall valuation of the registrar sector. Registrars often facilitate these high-value transactions, either directly through dedicated premium marketplaces or via specialized brokerage services, capturing high margins on unique digital assets. The analysis of trends in premium domain sales, particularly those relevant to emerging technologies or popular generic keywords, provides leading indicators for brand strategy and investment focus within the broader digital economy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager