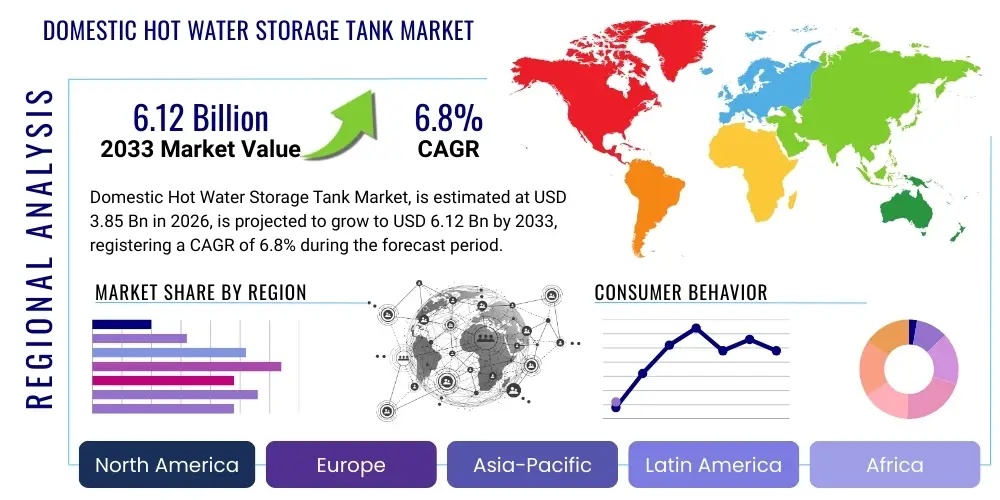

Domestic Hot Water Storage Tank Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436203 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Domestic Hot Water Storage Tank Market Size

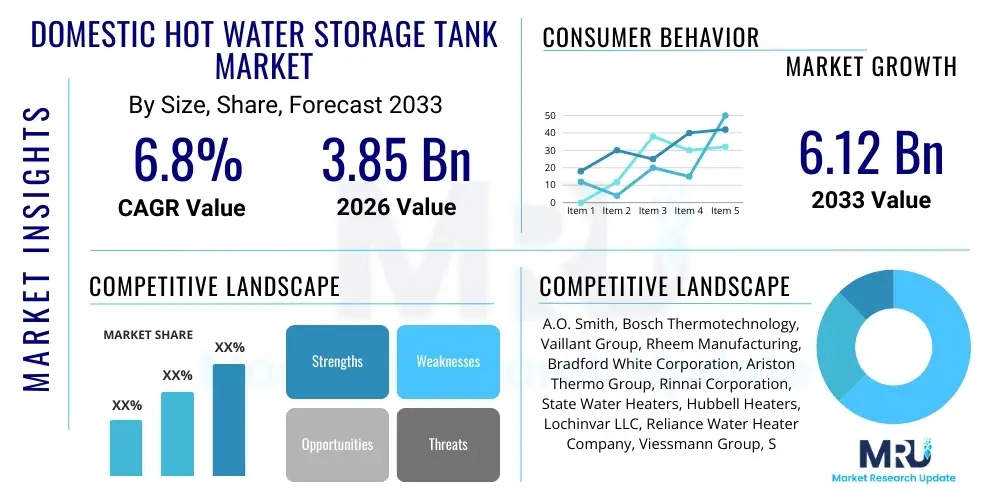

The Domestic Hot Water Storage Tank Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.85 Billion in 2026 and is projected to reach USD 6.12 Billion by the end of the forecast period in 2033.

Domestic Hot Water Storage Tank Market introduction

The Domestic Hot Water (DHW) Storage Tank Market encompasses various types of insulated vessels designed to store hot water for residential use, ensuring a readily available supply for heating, bathing, and cleaning purposes. These systems are foundational components of centralized domestic water heating infrastructure, accommodating traditional gas or electric heaters, solar thermal systems, and modern heat pump technologies. The core function is to maintain water temperature efficiently, minimizing standby heat loss while providing the necessary volume during peak demand periods. Innovations in insulation materials and internal lining technologies are continuously enhancing the durability and energy efficiency of these tanks, driving replacement cycles and new installation demand worldwide.

The principal applications for DHW storage tanks are concentrated in single-family homes, multi-family residences, and small commercial settings where high-volume, instantaneous hot water is required without placing excessive strain on the heating source. Key benefits driving market adoption include improved energy savings through effective thermal retention, enhanced system longevity due to corrosion-resistant internal coatings (such as glass-lined or stainless steel), and operational flexibility when paired with intermittent energy sources like solar or off-peak electricity. Furthermore, these tanks play a critical role in buffer systems for highly efficient appliances like heat pumps, optimizing their operational cycles and Coefficient of Performance (COP).

Major driving factors include stringent governmental regulations promoting energy conservation, particularly in the European Union and North America, which mandate high energy efficiency ratings for new water heating appliances. The increasing global adoption of renewable energy sources, such as solar thermal and geothermal heating systems, necessitates the use of high-performance storage tanks to store captured energy. Additionally, urbanization and the rising disposable income in developing economies fuel the construction of new residential buildings, naturally increasing the demand for reliable and efficient domestic hot water solutions. Technological advancements, specifically the integration of smart controls and superior insulating materials, further accelerate market growth.

Domestic Hot Water Storage Tank Market Executive Summary

The Domestic Hot Water Storage Tank Market is currently characterized by significant growth driven by sustainability mandates and rapid technological evolution toward smart, high-efficiency systems. Business trends indicate a strong shift from traditional electric and gas storage tanks toward advanced heat pump water heaters (HPWHs) and systems integrated with renewable energy sources. Manufacturers are focusing heavily on material science innovation, particularly exploring high-grade stainless steel and composite materials to extend product lifespan and improve corrosion resistance. Strategic mergers and acquisitions are consolidating the market, allowing major players to expand their product portfolios, especially in the smart home integration and high-capacity commercial-residential sectors. The market sees competitive pressure focusing on the highest possible energy factor (EF) ratings and seamless connectivity features.

Regional trends highlight Europe as a mature but highly innovative market, fueled by aggressive decarbonization goals and the widespread adoption of solar thermal and heat pump technologies, supported by substantial government subsidies. North America, characterized by larger residential properties, focuses on high-capacity tanks and robust insulation standards set by the Department of Energy (DOE). The Asia Pacific (APAC) region is poised for the fastest growth, primarily due to rapid residential construction, increasing electricity access, and growing awareness of energy-efficient solutions in populous economies like China and India, shifting demand from decentralized tankless heaters to centralized storage solutions in new developments.

Segmentation trends reveal that tanks paired with heat pumps (integrated or separate) are gaining substantial market share, driven by their superior energy efficiency compared to conventional methods. Material-wise, stainless steel tanks, despite their higher initial cost, are increasingly preferred due to their longevity and recyclability, particularly in premium markets. Volume capacity segmentation shows steady demand across mid-range capacities (80-150 liters), while the increasing installation of solar thermal systems boosts demand for larger, highly insulated buffer tanks. The integration of IoT capabilities for remote monitoring, fault detection, and optimization of heating schedules is a dominant segment trend, transforming the conventional storage tank into a smart, grid-responsive appliance.

AI Impact Analysis on Domestic Hot Water Storage Tank Market

Analysis of common user questions related to AI's impact on DHW storage tanks reveals consistent concerns regarding system efficiency, operational reliability, and potential savings. Users frequently inquire about how Artificial Intelligence can optimize heating cycles, predict component failures, and integrate the DHW system into smart home energy management ecosystems. Key expectations revolve around achieving "set-and-forget" heating efficiency, minimizing peak utility charges by learning household consumption patterns, and providing seamless integration with smart grids for demand-side management. Consumers are concerned about data privacy and the complexity of these new intelligent systems, but overwhelmingly seek quantifiable reductions in energy consumption and enhanced system lifespan via predictive analytics.

AI is fundamentally transforming the operational paradigm of DHW storage tanks, shifting them from passive storage units to active energy assets. In manufacturing, AI optimizes material consumption and quality control, leading to superior insulation consistency and reduced production waste. Operationally, AI-driven algorithms analyze historical consumption data, weather forecasts, and utility pricing signals to intelligently preheat water during off-peak hours or utilize solar gain most effectively, minimizing reliance on high-cost grid electricity. This predictive capability ensures user comfort is maintained while minimizing operating expenses, a key differentiator in competitive markets.

Furthermore, AI facilitates predictive maintenance by monitoring sensor data (temperature fluctuations, pressure changes, cycling frequency) in real-time. By identifying subtle anomalies, AI can alert homeowners or service technicians to potential issues, such as sediment buildup or incipient element failure, long before a catastrophic breakdown occurs. This capability reduces downtime, extends the useful life of the heating element and the tank itself, and significantly lowers long-term maintenance costs, thereby increasing the overall value proposition of smart DHW storage systems.

- AI-driven Predictive Maintenance: Reduces equipment failure rates by analyzing real-time sensor data and predicting necessary servicing.

- Optimized Energy Scheduling (GEO Optimization): Algorithms learn user habits and grid pricing to heat water predominantly during off-peak or high-renewable-generation periods.

- Enhanced Manufacturing Quality: AI vision systems and process optimization ensure uniform insulation quality and minimal defects in tank linings.

- Demand Response Integration: Enables smart tanks to communicate with utility grids, temporarily reducing energy consumption during system peaks for grid stability.

- Personalized Heating Profiles: Automatically adjusts temperature set points based on machine learning of household size, usage patterns, and daily schedules.

DRO & Impact Forces Of Domestic Hot Water Storage Tank Market

The Domestic Hot Water Storage Tank Market is influenced by a complex interplay of regulatory push for efficiency (Drivers), material and installation complexities (Restraints), integration with renewable technologies (Opportunities), and fluctuating energy prices (Impact Forces). The primary driving force remains global energy efficiency standards, which compel manufacturers to innovate constantly in insulation and heat transfer technology. However, the high initial cost associated with advanced materials like stainless steel and vacuum insulation panels, coupled with the reliance on skilled labor for proper installation, acts as a significant restraint, particularly in price-sensitive markets. Opportunities are vast in the retrofitting segment and the integration of smart tanks into comprehensive home energy management systems, aligning the sector with broader smart building trends.

Key drivers include government mandates for reduced carbon emissions and incentives for adopting renewable energy heating sources, making storage tanks essential buffers. The increasing adoption of highly efficient heat pumps, which require buffer tanks to operate optimally, is another critical market stimulant. Restraints encompass the relatively long replacement cycle of existing installed tanks (often 10–15 years), which dampens immediate market volume growth outside of new construction, and volatility in raw material costs, specifically steel and copper, which directly impacts manufacturing margins and final product pricing. Furthermore, the market faces competition from instantaneous tankless water heaters in certain high-density urban areas.

Opportunities are centered on geographical expansion into rapidly developing economies where residential construction is booming, coupled with the technological transition toward IoT-enabled smart tanks capable of interacting with the smart grid. The development of next-generation, non-metallic composite tanks offers a path to mitigate corrosion issues and reduce weight, broadening applications. Impact forces are dominated by fluctuating global energy prices; high energy costs accelerate the demand for highly efficient storage tanks, whereas temporary periods of low energy prices may reduce the immediate economic pressure on consumers to upgrade existing, less-efficient systems. Regulatory shifts, such as stricter minimum energy performance standards (MEPS), also exert powerful, immediate impacts on product design and market availability.

Segmentation Analysis

The Domestic Hot Water Storage Tank Market is comprehensively segmented based on material type, volume capacity, energy source compatibility, and end-use application, providing a granular view of market dynamics and consumer preferences. Understanding these segments is crucial for manufacturers to tailor product development, focusing on durability, efficiency, and integration capabilities specific to regional regulations and typical residential profiles. The shift towards higher-efficiency systems is evident across all segmentations, particularly in the adoption of stainless steel and composite materials to enhance product lifespan and reduce lifecycle costs. Segmentation by energy source reflects the broader transition from fossil fuels to electrified and renewable heating solutions globally.

By Material, the glass-lined steel tanks segment holds the largest historical share due to its cost-effectiveness and proven corrosion resistance, although high-performance stainless steel tanks are rapidly gaining traction, especially in commercial and premium residential applications requiring superior longevity and chemical resilience. Volume segmentation differentiates between standard residential use (80L to 300L) and specialized large-capacity applications (over 500L) often used in multi-family units or combined solar thermal systems. The primary driver for volume shifts is the average size of dwellings in a region and the mandated energy efficiency standards that sometimes necessitate larger volumes for efficient heat pump coupling.

Energy source compatibility is perhaps the most dynamic segment, including tanks optimized for electric heating, gas heating, solar thermal integration (often featuring multiple heat exchange coils), and heat pump systems. The heat pump compatible tank segment is experiencing the highest growth rate due to global electrification trends. End-use segmentation largely differentiates between single-family homes, which prioritize convenience and efficiency, and multi-family/centralized housing, which prioritize robust, low-maintenance, and high-volume systems that can manage simultaneous peak demand across multiple units effectively.

- By Material:

- Glass-Lined Steel

- Stainless Steel

- Copper

- Composite Materials (Plastics/Fiberglass)

- By Volume Capacity:

- Less than 100 Liters (Small Capacity)

- 100 Liters to 300 Liters (Standard Residential)

- 300 Liters to 500 Liters (High Capacity/Solar Buffer)

- Above 500 Liters (Commercial/Multi-Unit Residential)

- By Energy Source Compatibility:

- Electric

- Gas/Oil

- Solar Thermal

- Heat Pump (Dedicated Buffer Tanks)

- Indirectly Heated (Boiler Integration)

- By End-User:

- Single-Family Homes

- Multi-Family Residential Buildings

- Small Commercial/Institutional Settings

Value Chain Analysis For Domestic Hot Water Storage Tank Market

The value chain for Domestic Hot Water Storage Tanks begins with the upstream suppliers of critical raw materials, primarily steel (carbon and stainless), insulating foams (polyurethane), and internal lining materials (glass frit, enamels). Efficiency and cost management at this stage are heavily reliant on global commodity markets and robust supply chain agreements. Manufacturers focus on specialized fabrication, including welding, applying corrosion-resistant linings, and achieving high-density, uniform insulation application. Quality control, particularly around welding integrity and lining thickness, is crucial for product lifespan and compliance with safety and efficiency standards.

Downstream analysis highlights complex distribution channels essential for market reach. Direct distribution often occurs for large commercial projects or specialized OEM partnerships (e.g., supplying tanks directly to heat pump manufacturers). However, the residential market predominantly relies on indirect channels, which include a tiered system involving major national and international plumbing wholesalers, followed by regional distributors, and ultimately reaching certified plumbing and HVAC contractors who perform the final installation. The installer base (plumbing contractors) holds significant influence, often recommending specific brands based on reliability, ease of installation, and warranty support.

The effectiveness of the distribution channel is highly dependent on logistics, as these products are bulky and expensive to transport. Wholesalers maintain significant inventory to meet immediate demands for new construction and replacement markets. Direct channels are becoming increasingly important for manufacturers introducing smart or proprietary systems that require direct technical support and fewer layers of intermediary margin. End-users interact primarily with the installation service providers, meaning brand reputation and product availability within the contractor network are critical success factors. Post-sale services, including warranty fulfillment and technical troubleshooting, close the value loop, influencing future purchasing decisions and brand loyalty.

Domestic Hot Water Storage Tank Market Potential Customers

The primary consumers of Domestic Hot Water Storage Tanks span across the residential new construction sector, the residential replacement market, and, to a lesser extent, small commercial and institutional buyers focusing on decentralized systems. In the residential segment, potential customers are typically homeowners looking to upgrade outdated, inefficient systems, or builders specifying durable, high-efficiency tanks for new houses and apartment complexes. The demand is heavily influenced by energy costs and government incentives, making customers highly receptive to tanks optimized for integration with renewable energy sources like solar and heat pumps.

For the replacement market, which constitutes a significant portion of annual sales in mature economies, customers prioritize longevity, improved insulation properties (to reduce running costs), and compatibility with existing infrastructure. They often rely on the recommendation of professional plumbers or HVAC contractors when making purchase decisions. In multi-family dwellings, the decision-makers are typically property developers or facility managers who require robust, high-volume capacity tanks that offer excellent uptime and minimal maintenance requirements over a long operational lifespan, often preferring stainless steel or premium glass-lined options for enhanced durability.

A burgeoning segment includes owners of solar thermal systems and heat pumps. These customers specifically seek purpose-built, highly insulated storage tanks or buffer vessels designed to maximize the efficiency of the external heating appliance. These buyers are technologically sophisticated and value smart features, such as IoT connectivity for monitoring performance and integration into smart grid applications, positioning them as early adopters of premium, feature-rich products. The shift towards electrification positions nearly all residential property owners as potential customers for highly efficient DHW storage solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.85 Billion |

| Market Forecast in 2033 | USD 6.12 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | A.O. Smith, Bosch Thermotechnology, Vaillant Group, Rheem Manufacturing, Bradford White Corporation, Ariston Thermo Group, Rinnai Corporation, State Water Heaters, Hubbell Heaters, Lochinvar LLC, Reliance Water Heater Company, Viessmann Group, Stiebel Eltron, Electrolux, HTP Inc., NIBE Industrier, Gledhill, Heatrae Sadia, ACV International, BDR Thermea Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Domestic Hot Water Storage Tank Market Key Technology Landscape

The technological landscape of the Domestic Hot Water Storage Tank market is rapidly evolving, driven primarily by the pursuit of higher energy efficiency and integration capabilities. A significant shift involves advanced insulation technologies, moving beyond standard polyurethane foam to include high-performance Vacuum Insulation Panels (VIPs) and optimized foam matrices. VIPs offer dramatically reduced thermal conductivity, significantly lowering standby heat losses, which is crucial for compliance with increasingly strict global efficiency standards like the EU’s Ecodesign Directive and North American Energy Factor (EF) mandates. These technological enhancements are aimed at maximizing the thermal retention capacity over extended periods, thereby reducing overall energy consumption associated with re-heating cycles.

Another major technological advancement is the integration of digital controls and Internet of Things (IoT) connectivity. Modern DHW tanks are increasingly equipped with embedded sensors and Wi-Fi modules, allowing for remote monitoring, diagnostic checks, and precise temperature management. This technology enables features such as energy usage tracking and optimization through sophisticated scheduling algorithms that learn household demand patterns. Furthermore, smart tanks are essential components for demand response programs, allowing utilities to temporarily modulate heating loads to stabilize the electrical grid during peak demand, offering potential financial incentives to consumers while promoting system resilience and efficiency.

In terms of system design, the focus is on optimizing heat transfer mechanisms and corrosion resistance. The widespread adoption of heat pumps necessitates specialized buffer tanks optimized for lower operational temperatures and often requiring larger volume capacities to store heat efficiently. Materials science focuses on developing highly corrosion-resistant internal coatings, including advanced ceramics and duplex stainless steel, reducing the need for sacrificial anodes and extending the service life of the tank. Furthermore, the modular design of newer systems allows for easier integration with supplementary heating sources, such as solar collectors or backup boilers, ensuring maximum flexibility and energy utilization efficiency.

Regional Highlights

Regional dynamics within the Domestic Hot Water Storage Tank market are distinct, shaped by local climate, construction standards, energy policies, and the maturity of renewable energy adoption. Europe represents a highly advanced market, dominated by the strict Ecodesign requirements that favor highly insulated, high-efficiency models, particularly those compatible with heat pumps and solar thermal systems. Countries like Germany, France, and the Nordics show strong market saturation but high demand for replacements and upgrades to meet stringent decarbonization targets. Government subsidies for heat pump installations directly correlate with increased demand for specialized buffer tanks in this region.

North America is characterized by high average tank capacities, reflecting larger residential structures and centralized heating practices. The market here is driven by the DOE’s efficiency standards and robust new construction activity, particularly in the Southern and Western states. The competitive landscape focuses heavily on product durability and extensive warranty offerings. The increasing integration of smart home technologies and the shift towards integrated heat pump water heaters (HPWHs) are major trends impacting market sales in the US and Canada, positioning efficiency over initial cost for many mid-to-high-end consumers.

Asia Pacific (APAC) stands out as the primary growth engine due to rapid urbanization, massive residential construction projects, and improving standards of living. While markets like Japan and South Korea are mature and focus on compact, high-tech systems, emerging economies like China and India are seeing explosive growth. This growth is accelerating the replacement of decentralized, instant heating solutions with centralized storage systems, particularly in large apartment complexes. Local manufacturers are gaining market share, emphasizing cost-effective, durable solutions tailored to varied electrical infrastructure and space constraints, often integrating electric heating elements efficiently.

- North America: Focus on large capacity (40+ gallons), integration of HPWHs, and adherence to US DOE energy factor ratings. Key markets include the US and Canada.

- Europe: Driven by strict EU Ecodesign and ErP Directives, strong uptake of solar thermal and heat pump buffer tanks, and emphasis on low standby heat loss.

- Asia Pacific (APAC): Highest growth rate due to rapid new residential construction, increasing consumer wealth, and shift towards centralized systems in urban areas (China, India).

- Latin America: Growing demand driven by infrastructure improvements and increasing middle-class access to modern appliances; market often price-sensitive.

- Middle East and Africa (MEA): Significant potential for solar thermal integrated systems due to high solar irradiance, particularly in residential and hotel sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Domestic Hot Water Storage Tank Market.- A.O. Smith

- Bosch Thermotechnology

- Vaillant Group

- Rheem Manufacturing

- Bradford White Corporation

- Ariston Thermo Group

- Rinnai Corporation

- State Water Heaters

- Hubbell Heaters

- Lochinvar LLC

- Reliance Water Heater Company

- Viessmann Group

- Stiebel Eltron

- Electrolux

- HTP Inc.

- NIBE Industrier

- Gledhill

- Heatrae Sadia

- ACV International

- BDR Thermea Group

Frequently Asked Questions

Analyze common user questions about the Domestic Hot Water Storage Tank market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of high-efficiency domestic hot water storage tanks?

The primary driver is increasingly stringent global energy efficiency regulations, such as the EU’s Ecodesign Directive and U.S. DOE mandates, coupled with rising consumer demand for renewable energy compatibility (like heat pumps and solar thermal systems) to reduce long-term operational costs and carbon footprints.

How does the choice of tank material (e.g., glass-lined vs. stainless steel) affect system longevity and cost?

Glass-lined steel tanks are typically more cost-effective initially but require periodic anode replacement and have a shorter average lifespan (10-15 years). Stainless steel tanks, while having a higher upfront cost, offer superior corrosion resistance, eliminating the need for anodes and often doubling the service life, providing better long-term value.

What role does AI and IoT technology play in modern DHW storage tank systems?

AI and IoT enable smart functionality, including predictive maintenance, optimized energy scheduling based on usage patterns and utility rates, and seamless integration with smart grids for demand response, significantly improving energy efficiency and system reliability.

Which geographical region exhibits the highest growth potential for DHW storage tanks in the next decade?

The Asia Pacific (APAC) region is projected to have the highest growth due to massive residential infrastructure development, rapid urbanization, and the increasing shift from localized instant heating to centralized, energy-efficient storage solutions in key developing economies like China and India.

Are storage tanks still necessary given the rising popularity of tankless (on-demand) water heaters?

Yes, storage tanks remain necessary, particularly for high-volume residential usage, systems utilizing solar thermal or heat pumps (which require a thermal buffer to maximize efficiency), and installations where utility infrastructure cannot support the high instantaneous power draw of tankless electric heaters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager