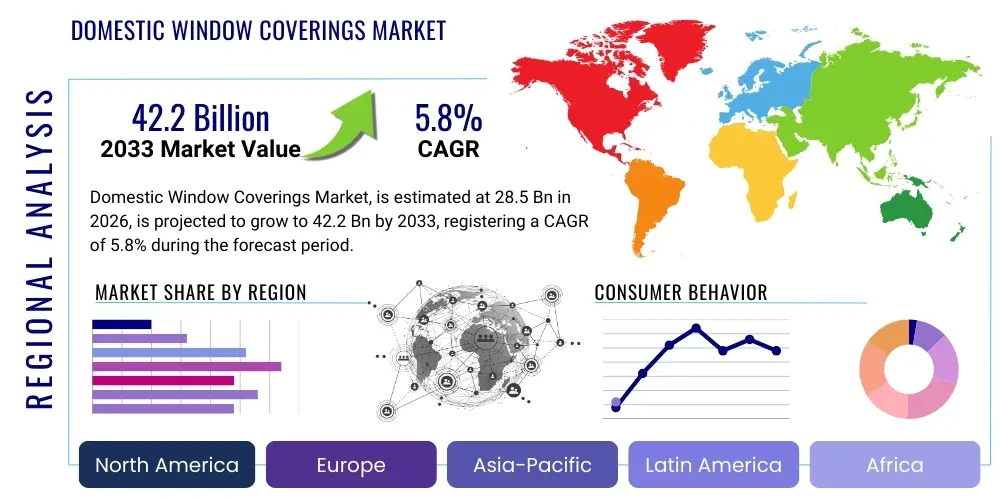

Domestic Window Coverings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439668 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Domestic Window Coverings Market Size

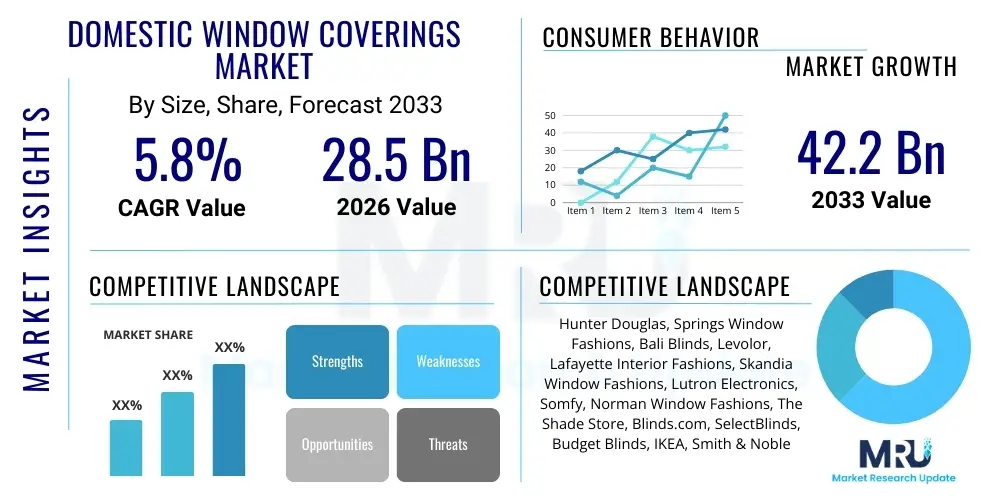

The Domestic Window Coverings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 42.2 Billion by the end of the forecast period in 2033.

Domestic Window Coverings Market introduction

The domestic window coverings market encompasses a diverse range of products designed to enhance the aesthetic appeal, privacy, and energy efficiency of residential spaces. This segment includes various types of blinds, shades, curtains, drapes, and shutters, each offering unique functionalities and design versatility. These products are essential components of modern home decor, serving not only practical purposes such as light control and thermal insulation but also significantly contributing to the overall interior design scheme and ambiance of a living environment. The market is characterized by continuous innovation, driven by evolving consumer preferences for smart home integration, sustainable materials, and personalized solutions that reflect individual styles and functional needs within contemporary homes.

Products within this market range from traditional fabric curtains and wooden blinds to advanced motorized shades and smart window films, catering to a wide spectrum of consumer demands and budgets. Major applications primarily involve residential settings, including single-family homes, multi-family units, and apartments, where these coverings provide critical benefits such as UV protection, glare reduction, sound absorption, and enhanced security. The functionality extends beyond mere decoration, addressing practical homeowner concerns like energy conservation through improved insulation, leading to reduced heating and cooling costs. Furthermore, specialized options like blackout blinds contribute to better sleep environments, while sheer shades offer privacy without sacrificing natural light, illustrating the multifaceted utility of these household staples.

Several key factors are currently driving the expansion of the domestic window coverings market. A significant driver is the increasing disposable income among consumers, which fuels investment in home renovations and interior design upgrades. The rising trend of smart homes and automation also plays a crucial role, with growing demand for motorized and app-controlled window coverings offering convenience and enhanced energy management. Furthermore, a heightened consumer awareness regarding energy efficiency and sustainable living is propelling the adoption of insulating and eco-friendly window treatment options. Urbanization and the burgeoning real estate sector, particularly in developing regions, are also contributing to market growth by creating new demand for residential furnishings and decor.

Domestic Window Coverings Market Executive Summary

The domestic window coverings market is currently undergoing a dynamic transformation, driven by a confluence of evolving business trends, distinct regional market characteristics, and significant shifts across product segments. A primary business trend observed is the accelerating pace of technological integration, particularly in the realm of smart home systems, leading to a surge in demand for motorized and automated window treatments. Manufacturers are increasingly focusing on incorporating Wi-Fi, Bluetooth, and voice control capabilities, positioning these products as integral components of the connected home ecosystem. Furthermore, there is a growing emphasis on customization and personalization, with brands offering a myriad of material, color, and design options to cater to diverse aesthetic preferences and interior design schemes. Sustainability is also emerging as a pivotal business trend, prompting the development of eco-friendly materials and energy-efficient designs, aligning with global environmental concerns and consumer demand for greener products.

Regional trends exhibit considerable variation, reflecting economic disparities, cultural preferences, and housing market dynamics. North America and Europe, as mature markets, demonstrate a strong inclination towards premium, smart, and energy-efficient window coverings, with a high adoption rate of motorized solutions in urban areas. These regions also show a preference for minimalist and functional designs, aligning with modern architectural trends. In contrast, the Asia Pacific region is experiencing rapid growth, fueled by increasing disposable incomes, burgeoning urbanization, and a robust construction sector. Countries like China and India are witnessing a surge in demand for both traditional and contemporary window coverings, with a growing interest in innovative and technologically advanced options. Latin America and the Middle East & Africa regions are also showing steady growth, driven by residential infrastructure development and rising living standards, albeit with a stronger preference for cost-effective and traditional solutions.

Segment-wise, the market is witnessing notable shifts. The motorized and smart window coverings segment is projected to experience the most significant growth, driven by convenience, security, and energy management benefits. Within product types, shades, particularly roller and cellular shades, are gaining popularity due to their sleek design, versatility, and insulating properties, appealing to modern homeowners. Blinds, especially faux wood and aluminum varieties, continue to hold a substantial market share owing to their durability and classic appeal. Material preferences are also evolving, with a strong move towards sustainable fabrics and composite materials that offer enhanced performance and environmental benefits. The online distribution channel is rapidly expanding, offering consumers greater access to a wider product selection, competitive pricing, and the convenience of direct home delivery, thereby challenging traditional brick-and-mortar retail models and driving market accessibility.

AI Impact Analysis on Domestic Window Coverings Market

Users frequently inquire about how Artificial Intelligence (AI) will revolutionize the domestic window coverings market, expressing a strong interest in enhanced convenience, personalized experiences, and optimized home environments. Common questions revolve around the potential for AI to automate light and temperature control, integrate seamlessly with existing smart home ecosystems, and offer predictive functionalities that anticipate user needs. There is significant curiosity about AI's role in design and customization, with users keen to know if AI can recommend suitable window treatments based on room aesthetics, sunlight exposure, and personal preferences. Additionally, concerns are often raised regarding data privacy, system complexity, and the cost implications of AI-powered solutions. Users also anticipate AI contributing to improved energy efficiency through adaptive control and better maintenance of motorized systems, signifying a desire for smarter, more efficient, and effortless living solutions.

- AI enables predictive light and temperature control by learning user routines and external environmental conditions, optimizing indoor comfort and energy consumption.

- Seamless integration with broader smart home ecosystems (e.g., Google Home, Amazon Alexa) through AI-powered central hubs, allowing for unified control.

- Personalized design recommendations and virtual try-on experiences facilitated by AI algorithms analyzing room dimensions, decor styles, and user preferences.

- AI-driven optimization of manufacturing processes and supply chain logistics, leading to reduced costs and faster delivery of customized window coverings.

- Enhanced customer support through AI-powered chatbots and virtual assistants, providing instant answers to product queries and installation guidance.

- Predictive maintenance for motorized window coverings, with AI monitoring system performance and alerting users to potential issues before they escalate.

- Development of adaptive privacy settings, where AI adjusts window coverings based on external activity or time of day, ensuring optimal personal space.

- AI contributes to more sophisticated energy management by dynamically adjusting coverings to minimize heat gain in summer and heat loss in winter, based on real-time data.

Segmentation Analysis

The Domestic Window Coverings Market is meticulously segmented to provide a granular understanding of its diverse components and consumer behaviors, encompassing various product types, materials, operating mechanisms, distribution channels, and end-use applications. This comprehensive segmentation allows market participants to identify niche markets, tailor product offerings, and devise targeted marketing strategies that resonate with specific consumer needs and preferences. Analyzing these distinct segments reveals underlying market trends, growth drivers, and competitive landscapes, offering a strategic framework for businesses operating within this dynamic industry. The segmentation highlights the breadth of choices available to consumers, ranging from basic functional solutions to sophisticated, integrated smart home systems, all designed to enhance residential aesthetics, comfort, and energy efficiency across a wide spectrum of dwelling types.

The market's product segmentation captures the variety of window treatments available, from classic blinds and shades to modern curtains, drapes, and specialized window films, each serving distinct purposes and aesthetic appeals. Material segmentation provides insight into the popular choices among consumers, including natural fabrics, various woods, durable vinyls, and innovative composite materials, influenced by factors such as durability, cost, and environmental considerations. Operating mechanisms define how these coverings are controlled, differentiating between traditional manual systems and the rapidly growing segment of motorized solutions that integrate with smart home technologies. Distribution channels delineate how products reach the end-user, illustrating the balance between traditional retail outlets and the burgeoning e-commerce platforms. Finally, the end-use segmentation reaffirms the market's focus on residential applications, breaking down demand across different housing types, enabling a precise understanding of consumer needs within the domestic sphere.

Understanding these segmentations is paramount for strategic planning, allowing companies to allocate resources effectively and develop products that align with specific market demands. For instance, the rise of motorized operating mechanisms signifies a shift towards convenience and technology, while the increasing demand for sustainable materials indicates an evolving consumer consciousness. By dissecting the market along these lines, stakeholders can identify high-growth areas, such as smart shades for new builds, or evergreen segments like traditional curtains for renovations. This detailed analytical approach not only informs product development and pricing strategies but also aids in identifying potential gaps in the market, fostering innovation, and driving competitive advantage in a continuously evolving domestic window coverings landscape, ultimately leading to more informed business decisions and sustained market penetration across diverse consumer demographics.

- By Product Type:

- Blinds

- Vertical Blinds

- Horizontal Blinds

- Roman Blinds

- Pleated Blinds

- Panel Blinds

- Shades

- Roller Shades

- Cellular Shades

- Roman Shades

- Pleated Shades

- Woven Wood Shades

- Sheer Shades

- Curtains & Drapes

- Shutters

- Plantation Shutters

- Cafe Shutters

- Solid Shutters

- Window Films

- Blinds

- By Material:

- Fabric

- Cotton

- Linen

- Silk

- Polyester

- Blends

- Wood

- Hardwood

- Faux Wood

- Vinyl

- Aluminum

- Composite Materials

- Fabric

- By Operating Mechanism:

- Manual

- Motorized

- Smart Home Integration

- Remote Control

- By Distribution Channel:

- Offline

- Specialty Stores

- Department Stores

- Home Improvement Stores

- Hypermarkets/Supermarkets

- Online

- E-commerce Platforms

- Brand Websites

- Offline

- By End-Use:

- Residential

- Single-Family Homes

- Multi-Family Homes

- Apartments

- Residential

Value Chain Analysis For Domestic Window Coverings Market

The value chain for the Domestic Window Coverings Market is a multi-tiered process encompassing several key stages, from raw material sourcing to final product delivery and installation. Upstream analysis focuses on the procurement of essential raw materials such as various types of fabrics (cotton, linen, polyester, silk blends), wood (hardwood, faux wood), metals (aluminum), plastics (vinyl), and specialized components like motors, control systems, and hardware. Suppliers in this segment provide the fundamental inputs, and their efficiency, cost-effectiveness, and quality directly influence the manufacturing process and the final product's attributes. Relationships with these suppliers are critical for maintaining supply chain stability, managing costs, and ensuring the availability of diverse materials required for the wide array of window covering products, including those with sustainable or advanced functional properties.

Midstream activities primarily involve manufacturing and assembly, where raw materials are transformed into finished window coverings. This stage includes design, cutting, fabrication, assembly of blinds, shades, curtains, and shutters, and the integration of operating mechanisms, especially for motorized and smart solutions. Manufacturers often specialize in certain product types or material categories, leveraging advanced machinery and skilled labor to ensure product quality and adherence to design specifications. Downstream analysis then concentrates on the distribution and sales channels, which bridge the gap between manufacturers and end-users. These channels can be broadly categorized into direct and indirect methods, each with its own advantages and reach. The efficiency of these channels, including logistics, inventory management, and customer service, is paramount for timely delivery and customer satisfaction in a market that often demands customization and prompt installation.

Distribution channels are critical for market penetration and customer accessibility. Direct channels include manufacturers' own showrooms, brand websites, and direct-to-consumer e-commerce platforms, offering greater control over branding and customer experience. These channels often cater to custom orders and premium segments, providing personalized consultations. Indirect channels comprise a wider network of intermediaries such as specialty window covering stores, home improvement retail giants (e.g., Home Depot, Lowe's), department stores, and increasingly, large online marketplaces (e.g., Amazon, Wayfair). These indirect channels offer broader reach, economies of scale, and convenience for consumers seeking off-the-shelf or semi-custom options. The interplay between direct and indirect channels is evolving, with a growing shift towards online platforms due to their convenience and extensive product offerings, driving manufacturers to optimize their digital presence and logistics to remain competitive in the increasingly digitalized domestic window coverings market.

Domestic Window Coverings Market Potential Customers

The primary potential customers for the Domestic Window Coverings Market are homeowners and residential property developers who seek to enhance the functionality, aesthetics, and energy efficiency of their living spaces. This broad category includes first-time homebuyers looking to furnish new residences, existing homeowners undertaking renovation projects to update their interiors, and individuals seeking to replace outdated or damaged window treatments. Consumers in this segment value products that offer a blend of style, privacy, light control, and insulation, often influenced by current interior design trends, personal preferences, and the specific architectural style of their homes. A significant portion of these buyers are discerning individuals who prioritize product quality, durability, and the long-term value provided by their investment in window coverings, increasingly favoring solutions that offer a balance of aesthetic appeal and practical benefits such as UV protection and glare reduction.

Beyond individual homeowners, another substantial segment of potential customers includes developers and contractors involved in residential construction, ranging from single-family homes to large multi-family residential complexes and apartment buildings. These buyers typically purchase in bulk and prioritize cost-effectiveness, timely delivery, and ease of installation, while still requiring products that meet certain aesthetic and functional standards for the properties they develop. They often work with specific architects and interior designers, who also act as influential indirect customers, recommending particular brands and styles based on project specifications and design visions. The growing trend of smart homes and sustainable building practices further attracts a tech-savvy and environmentally conscious clientele, who are willing to invest in advanced motorized and energy-efficient window coverings that integrate seamlessly with modern home automation systems and contribute to green building certifications, highlighting a shift towards more sophisticated and integrated home solutions.

Furthermore, property management companies for rental units and interior decorators working on residential projects represent an important subset of potential customers. Property managers often seek durable, easy-to-maintain, and cost-effective window coverings that can withstand frequent tenant turnover, ensuring longevity and reducing replacement costs. Interior decorators, on the other hand, prioritize design versatility, material quality, and the ability to customize products to achieve specific client visions, often working with high-end brands that offer extensive customization options. This diverse customer base, encompassing both direct consumers and various professional entities within the housing sector, underscores the wide-ranging demand for domestic window coverings. Understanding the distinct needs and purchasing drivers of each customer segment is crucial for manufacturers and retailers to develop targeted products, refine marketing strategies, and optimize distribution channels to effectively capture market share across the entire residential landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 42.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hunter Douglas, Springs Window Fashions, Bali Blinds, Levolor, Lafayette Interior Fashions, Skandia Window Fashions, Lutron Electronics, Somfy, Norman Window Fashions, The Shade Store, Blinds.com, SelectBlinds, Budget Blinds, IKEA, Smith & Noble, TimberBlindMetroShade, Alta Window Fashions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Domestic Window Coverings Market Key Technology Landscape

The Domestic Window Coverings Market is increasingly defined by a sophisticated technology landscape, driven by consumer demand for convenience, energy efficiency, and seamless integration with modern living. A pivotal development is the widespread adoption of motorization, which has transformed manual operations into effortless control via remote controls, wall switches, or even voice commands. This motorization leverages various communication protocols such as Bluetooth, Wi-Fi, Z-Wave, and Zigbee, enabling robust connectivity. Further enhancing this trend is the profound integration with smart home ecosystems like Google Assistant, Amazon Alexa, and Apple HomeKit, allowing window coverings to be part of broader automated routines, synchronized with lighting, climate control, and security systems. This connectivity not only offers unparalleled convenience but also supports sophisticated energy management strategies, dynamically adjusting coverings based on sunlight, temperature, and occupancy.

Beyond control mechanisms, advancements in material science are significantly impacting the technological landscape. Innovations in energy-efficient designs, such as cellular shades with their honeycomb structures, and specialized low-emissivity (low-e) coatings on window films, are critical for improving thermal insulation, reducing heat transfer, and thereby lowering heating and cooling costs in homes. The market is also seeing a strong push towards sustainable materials, with manufacturers developing products from recycled fabrics, bamboo, and wood sourced from sustainably managed forests, aligning with growing environmental consciousness. Advanced fabric technologies are introducing features like enhanced UV protection, superior blackout capabilities, improved sound dampening, and even antimicrobial properties, offering multifaceted benefits that extend beyond basic light and privacy control, addressing health and wellness aspects for homeowners.

Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is beginning to redefine the intelligence of window coverings. AI algorithms can learn user preferences and external conditions to predictively adjust coverings, optimizing comfort and energy use without direct human intervention. This extends to predictive maintenance for motorized systems, where AI monitors performance to flag potential issues before they become critical failures. For customization and sales, augmented reality (AR) tools and 3D visualization software are becoming common, allowing customers to virtually "try on" different window coverings in their homes before purchase, significantly enhancing the buying experience. These technological innovations collectively create a dynamic and competitive market, pushing manufacturers to continuously invest in research and development to meet the evolving demands for smart, efficient, sustainable, and personalized domestic window covering solutions, thereby shaping the future of interior design and home automation.

Regional Highlights

- North America: A mature market characterized by high disposable incomes and a strong inclination towards smart home technology. Significant demand for motorized and energy-efficient window coverings. The United States and Canada are key contributors, driven by home renovation trends and new construction.

- Europe: Exhibits a preference for sophisticated designs and sustainable materials, with stringent energy efficiency regulations driving adoption of insulating window treatments. Germany, the UK, and France are leading markets, focusing on aesthetics, functionality, and smart integration.

- Asia Pacific (APAC): The fastest-growing region due to rapid urbanization, increasing disposable incomes, and a booming residential construction sector. China, India, and Japan are pivotal, showing rising demand for both traditional and modern, technologically advanced window coverings.

- Latin America: Characterized by steady growth driven by expanding middle-class populations and residential development. Brazil and Mexico are primary markets, with a growing interest in stylish and affordable window covering solutions.

- Middle East and Africa (MEA): Emerging market with potential fueled by significant real estate investments and luxury housing projects, particularly in the UAE and Saudi Arabia. Demand for premium, custom, and privacy-focused window coverings is notable.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Domestic Window Coverings Market.- Hunter Douglas

- Springs Window Fashions

- Bali Blinds

- Levolor

- Lafayette Interior Fashions

- Skandia Window Fashions

- Lutron Electronics

- Somfy

- Norman Window Fashions

- The Shade Store

- Blinds.com

- SelectBlinds

- Budget Blinds

- IKEA

- Smith & Noble

- TimberBlindMetroShade

- Alta Window Fashions

Frequently Asked Questions

Analyze common user questions about the Domestic Window Coverings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of installing smart window coverings in a domestic setting?

Smart window coverings offer enhanced convenience through remote and automated control, improved energy efficiency by optimizing light and temperature regulation, increased home security, and seamless integration with existing smart home systems, ultimately contributing to a more comfortable and intelligent living environment.

How do domestic window coverings contribute to a home's energy efficiency?

Domestic window coverings contribute to energy efficiency by providing insulation against heat loss in winter and reducing heat gain in summer. Products like cellular shades, drapes with thermal linings, and specialized window films minimize thermal transfer, reducing the reliance on heating and air conditioning systems and leading to lower energy bills.

What are the latest trends in materials for domestic window coverings?

The latest material trends in domestic window coverings include a strong emphasis on sustainable and eco-friendly options such as recycled fabrics, organic cotton, bamboo, and wood from certified sustainable sources. Additionally, advancements in synthetic blends offer enhanced durability, UV protection, and blackout capabilities, catering to both aesthetic and functional demands.

What should homeowners consider when choosing between manual and motorized window coverings?

Homeowners should consider convenience, cost, and integration needs. Motorized coverings offer effortless control, ideal for hard-to-reach windows or smart home setups, but come at a higher price. Manual options are more budget-friendly and simpler to install, suitable for those who prefer traditional operation and do not require automation.

How can window coverings enhance privacy and light control in different rooms?

Window coverings enhance privacy and light control through various designs and opacities. Blackout blinds or drapes are ideal for bedrooms needing complete darkness, while sheer shades offer privacy with diffused natural light in living areas. Adjustable blinds and shutters provide flexible light filtering and privacy levels, adapting to different room requirements throughout the day.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager