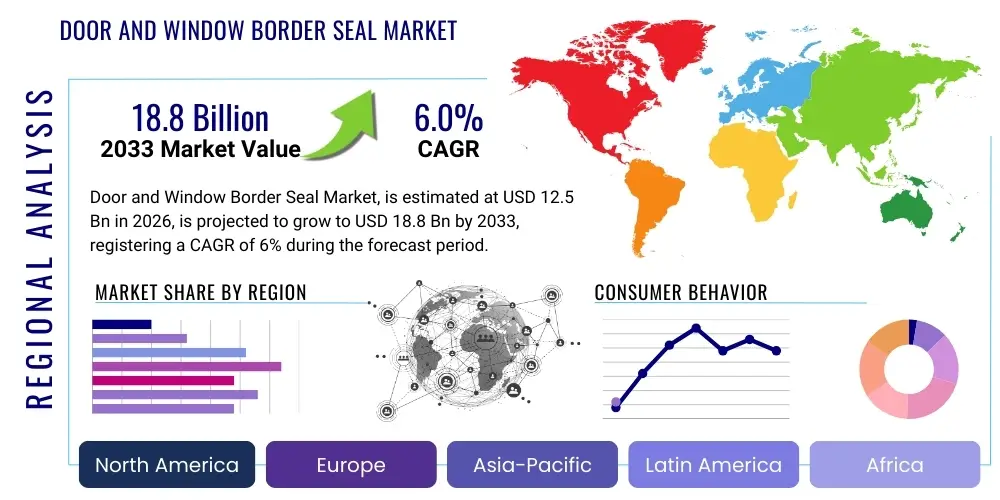

Door and Window Border Seal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438582 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Door and Window Border Seal Market Size

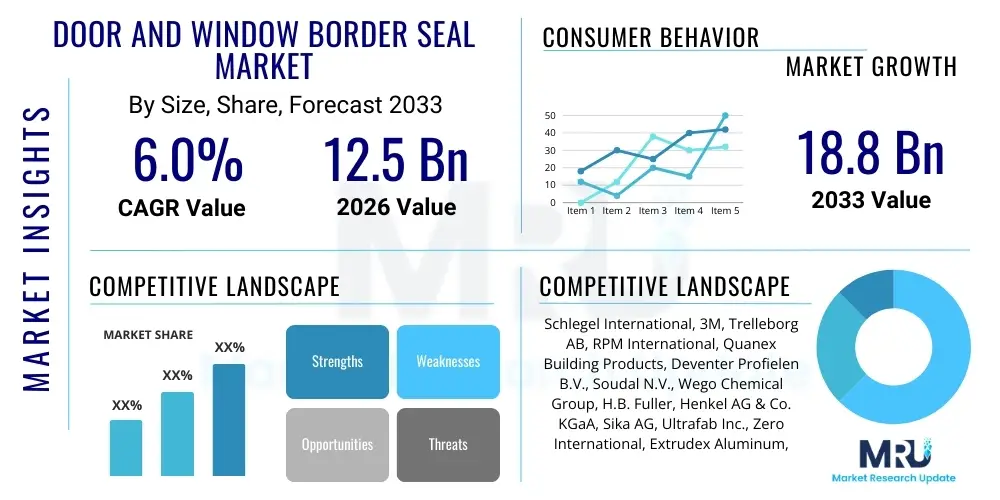

The Door and Window Border Seal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 18.8 Billion by the end of the forecast period in 2033.

Door and Window Border Seal Market introduction

The Door and Window Border Seal Market encompasses the manufacturing and distribution of various sealing solutions, primarily utilized to enhance energy efficiency, acoustic insulation, and weather resistance in residential, commercial, and industrial structures, as well as in the automotive sector. These essential components, often made from specialized polymers like EPDM, silicone, PVC, and TPE, create an airtight and watertight barrier between the frame and the moving parts of doors and windows. Market growth is fundamentally tied to global construction output, stringent energy conservation regulations, and increasing consumer awareness regarding sustainable building practices and indoor comfort standards. The demand for retrofit and replacement seals in aging infrastructure further stabilizes market dynamics across developed economies.

Product descriptions within this sector span a diverse range, including compression seals, sweep seals, bulb seals, and foam seals, each designed for specific application requirements—from extreme temperature resistance in industrial settings to aesthetic integration in high-end residential projects. Major applications are predominantly found in the building and construction industry, covering new builds and renovation projects focused on achieving green building certifications suchates LEED or BREEAM. Beyond construction, the automotive industry uses advanced seals for noise reduction, vibration control, and cabin integrity, driving innovation in material science and extrusion technologies.

The primary benefits driving market expansion include significant reductions in heating and cooling energy consumption dueating air leakage, substantial improvements in sound dampening contributing to enhanced occupant well-being, and protection against moisture intrusion, preventing structural damage and mold growth. Key driving factors involve governmental mandates, such as updated building codes requiring minimum U-values for windows and doors, the rising cost of energy globally, and technological advancements enabling manufacturers to produce highly durable, UV-resistant, and flexible sealing products with extended operational lifespans. Furthermore, the shift towards modular and prefabricated construction methods necessitates standardized, high-performance sealing systems that ensure quick installation and reliable performance.

Door and Window Border Seal Market Executive Summary

The Door and Window Border Seal Market is currently characterized by robust business trends driven by sustainability initiatives and urbanization, particularly in Asia Pacific and North America. Key business trends include a sustained shift toward high-performance materials like TPE and silicone, offering superior longevity and environmental profiles compared to traditional PVC. Major industry players are focusing on vertical integration and strategic acquisitions to secure raw material supply chains and expand their geographical footprint, aiming to capitalize on the booming renovation and retrofit segments across Europe and North America. Furthermore, product innovation centered on smart seals, incorporating sensors for monitoring air leakage or integrity, is beginning to emerge, positioning the market for moderate technological disruption.

Regional trends indicate that Asia Pacific (APAC) represents the fastest-growing market, propelled by rapid infrastructure development, increasing disposable incomes fueling luxury residential construction, and the adoption of modern sealing standards in countries like China and India. North America and Europe, while mature, maintain strong market demand, largely due to strict environmental regulations necessitating the replacement of older, inefficient windows and doors, focusing heavily on energy star compliance and passive house standards. The Middle East and Africa (MEA) region show substantial potential, driven by large-scale commercial and hospitality projects requiring durable seals capable of withstanding extreme climatic conditions and high temperatures, prompting demand for specialized EPDM and silicone formulations.

Segment trends reveal that the silicone segment is experiencing accelerated growth due to its outstanding thermal stability, UV resistance, and flexibility, making it ideal for high-exposure applications and high-end construction. The residential application segment remains the largest consumer, benefiting from increased home renovation activity and a focus on indoor air quality. In terms of end-use material, seals designed specifically for aluminum and vinyl windows are gaining traction, reflecting the growing market share of these materials over traditional wood in new construction. Manufacturers are increasingly utilizing digital channels for distribution, offering specialized cutting and customization services directly to contractors and specialized window fabricators, thus optimizing supply chain efficiency and reducing lead times.

AI Impact Analysis on Door and Window Border Seal Market

Common user inquiries concerning AI in this market domain frequently revolve around how artificial intelligence can optimize the manufacturing process, improve quality control, and enhance the supply chain resilience for sealing materials. Users express concerns about the potential displacement of skilled labor in extrusion and finishing lines but show high expectation regarding AI’s ability to predict material performance under various climatic stresses and streamline custom order fulfillment. There is significant interest in utilizing machine learning algorithms to analyze real-time production data from extrusion lines to minimize material waste, detect subtle imperfections in seal profiles, and dynamically adjust mixing ratios for complex polymer compounds to maintain consistent quality, especially for highly specific architectural projects. Additionally, users are keen to understand how AI-driven predictive maintenance can be applied to complex manufacturing machinery to minimize downtime and ensure continuous production of high-volume, standard profile seals.

The implementation of AI algorithms is poised to significantly transform material science and product development within the Door and Window Border Seal Market. AI can simulate the long-term performance and durability of new polymer blends far more efficiently than traditional lab testing, accelerating the time-to-market for seals designed for extreme environmental conditions or specific acoustic performance metrics. This computational approach allows manufacturers to rapidly iterate on designs, optimizing profile geometry for maximum compression efficiency and minimal material usage, ultimately reducing production costs and enhancing product competitive advantage. Furthermore, machine vision systems powered by deep learning are being deployed on manufacturing floors to perform automated, high-speed inspection of extruded profiles, detecting defects like uneven surfaces, dimensional inaccuracies, or contamination invisible to the human eye, thereby guaranteeing compliance with stringent quality standards such as ISO certification requirements.

In the downstream supply chain and customer service aspects, AI is expected to revolutionize demand forecasting and inventory management, critical for a market dealing with thousands of specific profiles and material types (SKUs). AI tools analyze seasonal construction cycles, regional building permits issued, and economic indicators to provide highly accurate demand predictions, allowing manufacturers to optimize raw material procurement and minimize costly warehousing of slow-moving items. Moreover, AI-powered configurators and chatbots are improving the customer experience for contractors and distributors, offering instant technical support, recommending the exact seal profile required based on door/window specifications and performance targets (e.g., sound transmission class or STC requirements), and facilitating complex, customized bulk orders, which enhances operational efficiency across the sales pipeline.

- AI-driven predictive quality control minimizing defect rates in polymer extrusion.

- Machine Learning optimization of compound material formulas for enhanced durability and thermal performance.

- Automated visual inspection (Machine Vision) ensuring dimensional accuracy of complex seal profiles.

- Predictive maintenance schedules for manufacturing equipment reducing operational downtime.

- Advanced AI demand forecasting improving inventory efficiency and raw material procurement strategies.

- AI-enabled custom product configuration tools enhancing the B2B purchasing experience for specialized orders.

- Simulation models predicting seal aging and performance degradation under extreme weather cycles.

DRO & Impact Forces Of Door and Window Border Seal Market

The dynamics of the Door and Window Border Seal Market are shaped by a complex interplay of drivers (D), restraints (R), and opportunities (O), collectively modulated by potent impact forces. A central driver is the global emphasis on energy efficiency, spurred by rising utility costs and binding international climate agreements, forcing stricter building energy codes (e.g., Passive House standards, net-zero mandates) that necessitate superior sealing technology to minimize air infiltration and thermal bridging losses. This regulatory environment creates a sustainable baseline demand, especially for high-performance materials like thermoplastic elastomers (TPEs) and advanced silicone formulations that offer exceptional durability and thermal insulation properties. Additionally, urbanization and the continuous expansion of construction activities in emerging economies, coupled with significant governmental spending on infrastructure modernization and retrofitting programs in developed nations, provide substantial impetus to market growth, ensuring a stable uptake across diverse building classes.

However, the market faces significant restraints, primarily related to the volatility and increasing cost of key raw materials, particularly petroleum-derived polymers and specialized chemical additives required for UV and ozone resistance. Fluctuations in global crude oil prices directly impact the production costs of EPDM, PVC, and other elastomer seals, pressuring manufacturers' profit margins and potentially leading to price increases passed on to end-users, which can slow adoption in price-sensitive markets. Another restraint is the long lifespan and high initial quality of modern windows and doors; while beneficial for the environment, this reduces the frequency of replacement demand for the sealing components themselves. Furthermore, the reliance on precision manufacturing and the need for specialized extrusion equipment create high barriers to entry, limiting the competitive landscape and occasionally leading to supply chain concentration risks for highly specialized profiles.

Opportunities for market growth lie prominently in technological innovation and diversification into adjacent applications. The opportunity to develop smart sealing solutions integrated with sensors for remote monitoring of air leakage or security breaches presents a new value proposition, particularly in the high-security commercial and smart home sectors. Furthermore, the growing demand for acoustic insulation, driven by increasingly dense urban environments, opens doors for specialized sound-dampening seals designed explicitly for high STC ratings. The significant expansion of the automotive sector, focusing on electric vehicles (EVs) that require superior sealing for battery protection, noise suppression, and lightweighting, offers a lucrative avenue for material suppliers capable of meeting stringent automotive performance standards. These opportunities, coupled with the inherent impact forces of technological change (e.g., 3D printing of custom seals) and environmental concerns, suggest a future characterized by performance-driven differentiation rather than volume-based competition.

Segmentation Analysis

The Door and Window Border Seal Market is meticulously segmented across product type, application, end-use material, and distribution channel, reflecting the diverse performance requirements and end-user needs globally. Understanding these segments is crucial for strategic market positioning, allowing companies to focus on materials (like silicone or TPE) offering high margins through superior performance or targeting high-volume application areas such as mass residential housing construction. The market structure emphasizes the importance of material science expertise, as different environments—from coastal regions requiring extreme salt resistance to continental areas needing robust temperature stability—dictate the choice of seal composition and profile geometry.

Analysis confirms that the residential application segment dominates the volume, driven by ongoing construction and extensive renovation cycles aimed at enhancing energy performance. However, the commercial and industrial segments often command higher pricing for customized, heavy-duty seals that must comply with strict fire safety codes, chemical resistance standards, or large-format architectural specifications. The trend towards modular construction is blurring traditional segmentation lines, creating demand for standardized yet highly durable sealing systems that facilitate fast, weather-tight assembly on site, compelling manufacturers to broaden their product offerings to cater to both traditional and industrialized building methods.

- By Product Type:

- EPDM (Ethylene Propylene Diene Monomer) Seals

- Silicone Seals (High heat and UV resistance)

- PVC (Polyvinyl Chloride) Seals

- TPE (Thermoplastic Elastomer) Seals (Recyclable, excellent flexibility)

- Thermoplastic Vulcanizates (TPV)

- Polyurethane Foam Seals

- Others (Felt, Rubberized fabrics)

- By Application:

- Residential Buildings (Houses, Apartments)

- Commercial Buildings (Offices, Retail, Hospitality)

- Industrial Facilities (Factories, Warehouses)

- Automotive Sector (Vehicles, Mass Transit)

- By End-Use Material:

- Aluminum Doors and Windows

- Vinyl/Plastic Doors and Windows

- Wooden Doors and Windows

- Composite Doors and Windows

- By Distribution Channel:

- Direct Sales (OEMs, Large Contractors)

- Distributors and Wholesalers

- Specialty Retail Stores

- Online Retail and E-commerce Platforms

Value Chain Analysis For Door and Window Border Seal Market

The value chain for the Door and Window Border Seal Market begins with the upstream sourcing and processing of raw materials. This stage is dominated by large petrochemical companies and specialized chemical suppliers who provide the base polymers (such as crude oil derivatives for EPDM, PVC resins, and silicone precursors), along with critical additives like plasticizers, UV stabilizers, vulcanizing agents, and colorants. Upstream analysis highlights that cost control and supply security are highly dependent on global commodity markets. Manufacturers must strategically manage supplier relationships to mitigate volatility in oil and gas prices, which directly affects the cost of production for elastomer-based seals. Key success factors at this stage include robust sourcing capabilities, establishing long-term contracts, and investing in material recycling infrastructure to reduce reliance on virgin petroleum products, particularly for TPE and PVC seals.

Midstream activities involve the core manufacturing processes: compounding and extrusion. Compounding involves mixing the raw polymers with additives to achieve the specific desired performance characteristics (e.g., hardness, flexibility, thermal rating). Extrusion is a precision operation where the compounded material is forced through specialized dies to create complex profiles, which must adhere to tight dimensional tolerances, often in micron ranges, to ensure effective sealing functionality. Manufacturers must invest heavily in high-precision, multi-co-extrusion machinery and utilize advanced quality control systems (including AI-based vision systems) to maintain consistency across millions of meters of product. Labor expertise in die design and process engineering is paramount at this stage, as efficient, low-waste production directly determines profitability and competitive pricing.

Downstream analysis focuses on distribution and the end-user application. Distribution channels are bifurcated, with direct sales serving Original Equipment Manufacturers (OEMs) of windows and doors, who require large volumes of custom-fit seals integrated into their production lines. Indirect sales utilize distributors, wholesalers, and specialized construction supply retailers, catering to the smaller fabricators, contractors, and the aftermarket renovation segment. The final application involves professional installers or consumers fitting the seals into the frame. Value-added services at the downstream stage include custom cutting, pre-applied adhesives (peel-and-stick applications), and technical training for installers. Success in the downstream market relies on rapid fulfillment, local inventory accessibility, and strong technical support, ensuring the correct seal is specified and installed properly to guarantee the intended energy efficiency and weather resistance performance.

Door and Window Border Seal Market Potential Customers

The primary potential customers and end-users of Door and Window Border Seals are concentrated in the high-volume manufacturing and professional construction sectors, spanning residential, commercial, and mobility markets. The largest group of customers consists of Window and Door Original Equipment Manufacturers (OEMs). These companies integrate seals directly into their products during the fabrication process. They require bulk, standardized, and highly customized profiles designed to fit specific frame systems (e.g., European tilt-and-turn windows or North American sliding patio doors). OEMs prioritize long-term supply agreements, consistent quality assurance, and seals that meet strict industry standards, such as those mandated by Fenestration Canada or AAMA certifications, ensuring compatibility with energy efficiency rating systems like Energy Star.

Another significant customer segment includes professional building contractors, renovation specialists, and facilities management companies. These customers primarily purchase seals through distribution channels for use in repair, retrofit, and renovation projects, where the seals are typically replaced after years of service to restore a building’s thermal envelope integrity. Demand in this segment is highly influenced by the age of the housing stock, local climate conditions, and consumer willingness to invest in home improvements that yield significant long-term energy savings. These buyers often require detailed technical specifications and seek durable, easy-to-install products, frequently preferring seals with strong brand recognition linked to reliability and performance guarantees.

Furthermore, specialized industrial buyers, including manufacturers of prefabricated housing modules and the automotive industry, represent growing, high-value customer bases. Modular construction companies require seals optimized for rapid, factory-controlled installation and transportation resilience. In the automotive sector, customers like car manufacturers and bus fabricators require highly advanced sealing systems (often TPV or specialized EPDM) to address stringent requirements for vehicle noise reduction (NVH), lightweighting, protection against engine fluids, and long-term exposure to extreme road conditions. These buyers are typically quality-driven, seeking suppliers with ISO/TS 16949 certification and the capability to innovate collaboratively on new material compositions and extrusion processes suitable for next-generation vehicle platforms, particularly electric and autonomous vehicles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 18.8 Billion |

| Growth Rate | 6.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlegel International, 3M, Trelleborg AB, RPM International, Quanex Building Products, Deventer Profielen B.V., Soudal N.V., Wego Chemical Group, H.B. Fuller, Henkel AG & Co. KGaA, Sika AG, Ultrafab Inc., Zero International, Extrudex Aluminum, Santoprene (ExxonMobil), Guangzhou Taita Chemical Co., Ltd., Shijiazhuang Jili Plastic Co., Ltd., Metro Rubber, Foshan Xingtaomei Aluminum Co., Ltd., Sealeze. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Door and Window Border Seal Market Key Technology Landscape

The technology landscape for the Door and Window Border Seal Market is primarily driven by advancements in polymer science and precision manufacturing techniques, aimed at maximizing durability, thermal performance, and ease of installation. A critical technology is multi-co-extrusion, which allows manufacturers to combine two or more materials with distinct properties into a single, complex seal profile. For instance, a soft, highly flexible sealing lip (often TPE or silicone) can be co-extruded with a rigid base (often PVC or harder TPE) that provides dimensional stability for secure retention within the frame channel. This technology is vital for creating hybrid seals that optimize performance, ensuring excellent compression set resistance while maintaining structural integrity for long-term operational effectiveness across a wide range of temperatures and mechanical stresses.

Significant technological effort is also focused on the development of high-performance polymer compounds, particularly advanced Thermoplastic Elastomers (TPEs) and Thermoplastic Vulcanizates (TPVs). TPEs offer the processing advantages of thermoplastics—ease of extrusion, weldability, and recyclability—combined with the flexibility and sealing efficiency of thermoset rubber (EPDM). Manufacturers are utilizing nanotechnology to enhance material properties, incorporating microscopic fillers to improve UV resistance, reduce friction, and increase the service life of seals exposed to harsh environmental factors, significantly delaying material degradation and maintaining sealing effectiveness over decades, thereby addressing the demanding warranty periods required by commercial builders and high-end residential developers.

Furthermore, innovations in surface treatments and adhesive systems are crucial market differentiators. Technologies such as high-tack pressure-sensitive adhesives (PSAs), pre-applied during the extrusion process, facilitate faster and cleaner installation, especially in retrofit applications where labor time is costly. Additionally, flocking technology, involving the application of tiny fibers onto the seal surface, is used to reduce friction, ensuring smooth operation of sliding doors and windows while maintaining a tight seal. These technological advancements not only improve the functional performance of the seals (air tightness, water resistance, noise reduction) but also contribute directly to streamlined construction processes and reduced installation errors, providing substantial value to downstream customers and specialized contractors.

Regional Highlights

- North America: This region is characterized by high demand for energy-efficient sealing solutions, primarily driven by stringent codes such as those mandated by Energy Star and state-level building efficiency targets. The retrofit market is exceptionally strong, accounting for a significant portion of seal replacement demand, especially across older housing stocks in the Northeast and Midwest. Manufacturers focus heavily on EPDM and advanced TPE seals engineered for extreme temperature fluctuations (from high summer heat to severe winter cold). The US market also exhibits a high degree of brand loyalty and quality expectation, favoring established international players with certified products and robust distribution networks capable of supplying large window and door OEMs and commercial construction projects throughout the region.

- Europe: Europe is a highly regulated and technically advanced market, strongly influenced by the EU's Energy Performance of Buildings Directive (EPBD) and the adoption of Passive House standards. The emphasis is on high-performance, sustainable, and recyclable materials, driving rapid adoption of TPE and TPV over traditional materials like PVC. Germany, France, and the UK are key markets demanding superior acoustic insulation due to high urban density. Local manufacturers often collaborate closely with specialized window fabricators to develop proprietary sealing systems tailored for specific European window formats (e.g., casement, tilt-and-turn), fostering continuous innovation in thermal bridge mitigation and airtightness solutions crucial for high energy rating compliance.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, fueled by exponential urbanization, massive government investment in infrastructure, and a burgeoning middle class demanding higher quality residential standards. China and India are the primary growth engines, transitioning rapidly from basic sealing materials to advanced EPDM and silicone options, particularly in high-rise commercial and luxury residential developments that prioritize weather resistance against monsoon climates and pollution ingress. Price sensitivity remains a factor in developing APAC markets, but the increasing awareness of energy efficiency, driven by government initiatives in countries like South Korea and Japan, is steadily shifting market preference toward performance over sheer cost, creating immense long-term growth opportunities.

- Latin America (LATAM): The LATAM market is heterogeneous, with pockets of high demand in countries like Brazil and Mexico, driven by industrial and large-scale residential construction. The region often imports specialized, high-performance seals, although local manufacturing is growing, particularly for PVC and standard EPDM profiles catering to mid-range construction projects. Climatic resilience is a key driver, focusing on seals capable of withstanding high humidity and tropical weather exposure, requiring specialized anti-fungal and UV-resistant additives. Economic instability and fluctuating construction cycles often pose challenges, necessitating flexible supply chain strategies and strong local partnerships to navigate regulatory differences and localized demand variations.

- Middle East and Africa (MEA): This region demands seals engineered to withstand extremely high temperatures, intense UV radiation, and severe dust infiltration (sand storms). Consequently, high-grade silicone and specialized, heat-stable EPDM are preferred, especially in large commercial, hospitality, and mega-project developments across the GCC states (Saudi Arabia, UAE). The African market is primarily driven by major infrastructure investments and population growth, with a focus on durable, cost-effective solutions. Fire safety regulations, particularly in high-rise buildings across the UAE, mandate the use of seals that meet stringent non-combustibility and low-smoke emission standards, creating niche opportunities for fire-rated intumescent seals and high-temperature polymers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Door and Window Border Seal Market.- Schlegel International

- 3M

- Trelleborg AB

- RPM International

- Quanex Building Products

- Deventer Profielen B.V.

- Soudal N.V.

- Wego Chemical Group

- H.B. Fuller

- Henkel AG & Co. KGaA

- Sika AG

- Ultrafab Inc.

- Zero International

- Extrudex Aluminum

- Santoprene (ExxonMobil)

- Guangzhou Taita Chemical Co., Ltd.

- Shijiazhuang Jili Plastic Co., Ltd.

- Metro Rubber

- Foshan Xingtaomei Aluminum Co., Ltd.

- Sealeze

Frequently Asked Questions

Analyze common user questions about the Door and Window Border Seal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of high-performance door and window seals?

The primary driver is the increasing global emphasis on energy efficiency and compliance with stringent building codes, such as Passive House and net-zero energy standards. High-performance seals significantly reduce air infiltration, minimizing energy loss from heating and cooling, which is crucial for reducing utility costs and achieving environmental certification goals in residential and commercial sectors globally. The escalating cost of energy also compels consumers and developers to seek superior thermal envelope solutions.

How do TPE (Thermoplastic Elastomer) seals compare to traditional EPDM (Ethylene Propylene Diene Monomer) seals?

TPE seals offer several key advantages over traditional EPDM, primarily in sustainability and recyclability, as TPE materials are thermoplastic and can be reformed, unlike thermoset EPDM rubber. TPE seals also often exhibit superior color stability, UV resistance, and excellent performance at low temperatures. While EPDM is historically known for its outstanding durability and ozone resistance, TPE is increasingly preferred due to its lighter weight, ease of welding/installation (which speeds up OEM assembly), and ability to meet strict modern environmental standards without compromising sealing performance or longevity.

Which application segment holds the largest market share for border seals, and why?

The Residential Building segment currently holds the largest market share by volume. This dominance is attributed to the sheer volume of global residential construction activity, coupled with extensive renovation and retrofit markets across North America and Europe. Homeowners are increasingly prioritizing comfort, noise reduction, and energy savings, driving continuous demand for high-quality replacement seals. Furthermore, regulatory push towards improving the thermal performance of new residential units ensures a stable and growing baseline demand.

What is the role of digitalization and AI in the manufacturing process of door and window seals?

Digitalization, coupled with AI-powered analytics, plays a crucial role in optimizing the precision manufacturing of seals. AI is used in predictive maintenance of complex extrusion machinery, reducing costly unplanned downtime, and ensuring continuity of supply. Machine vision systems utilize AI to perform real-time, high-speed dimensional quality control on extruded profiles, ensuring every meter adheres precisely to specified architectural tolerances. This integration minimizes material waste, enhances production speed, and guarantees the highest level of product consistency essential for effective thermal and acoustic performance.

What are the key technological advancements influencing the future design of border seals?

Future seal design is being influenced by multi-co-extrusion techniques that integrate multiple materials (rigid bases, soft sealing lips) into complex, hybrid profiles for optimal compression and retention. Additionally, the incorporation of smart materials and sensor technology is a major emerging trend, allowing for the development of "smart seals" capable of monitoring air leakage in real-time or acting as integrated security components. Furthermore, nanotechnology is being used to create ultra-durable, self-cleaning, and friction-reducing surface treatments, extending the service life and maintaining the peak performance of seals over decades of operational use in harsh environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager