Double Block & Bleed Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432310 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Double Block & Bleed Valves Market Size

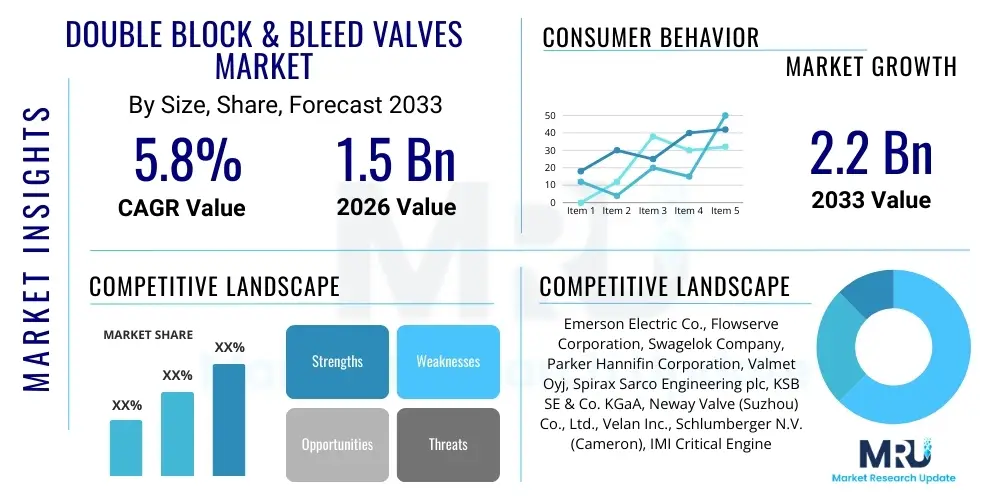

The Double Block & Bleed Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at 1.5 Billion USD in 2026 and is projected to reach 2.2 Billion USD by the end of the forecast period in 2033.

Double Block & Bleed Valves Market introduction

The Double Block & Bleed (DB&B) Valves Market encompasses specialized valve configurations designed to provide fail-safe isolation of fluid lines, ensuring maximum safety and operational efficiency in high-hazard environments. These valves integrate two isolation valves and a single bleed valve, typically situated between the two isolation valves, into one compact body structure. This configuration allows for the draining or venting of pressure trapped between the primary and secondary seals, offering a verifiable seal integrity check—a critical requirement in industries handling volatile or toxic media. The design reduces installation space, minimizes leak paths, and lowers overall system weight compared to traditional flange-coupled multi-valve assemblies, driving its adoption across complex industrial landscapes where pipeline integrity and zero-leakage mandates are paramount.

Double Block & Bleed valves are primarily utilized in applications demanding absolute positive isolation, such as upstream oil and gas production, critical pipeline transportation systems, petrochemical processing facilities, and high-integrity fluid systems within the power generation sector. Product variations range significantly based on the operating environment, including specialized valves built from robust materials like duplex stainless steel or exotic alloys to withstand extreme pressures, high temperatures, and corrosive media. The core function of providing verifiable tight shut-off isolation makes them indispensable in metering stations, pig launchers and receivers, tank isolation, and sampling points where cross-contamination or unplanned process bypass must be prevented. Market growth is fundamentally tied to global energy demand and the continuous modernization and expansion of pipeline infrastructure worldwide, particularly in emerging economies.

Major driving factors include increasingly stringent global safety and environmental regulations, particularly those established by bodies like API and ISO, which favor verifiable isolation methods. Furthermore, the persistent need for operational optimization and reduction of maintenance downtime compels operators to invest in integrated valve solutions that offer superior reliability and ease of maintenance access. The continuous development of unconventional oil and gas resources, such as deepwater drilling and shale extraction, mandates the use of highly reliable pressure management systems, consequently boosting the demand for high-performance DB&B valves capable of handling abrasive fluids and high differential pressures over prolonged periods. These market dynamics collectively position the DB&B valve sector for consistent expansion over the forecast horizon.

Double Block & Bleed Valves Market Executive Summary

The Double Block & Bleed Valves Market is characterized by robust growth, driven primarily by escalating regulatory scrutiny over process safety across the energy and chemical sectors. Key business trends indicate a strong shift towards modular and compact valve designs, allowing for easier integration into complex skids and existing infrastructure retrofitting projects. Vendors are increasingly focusing on materials science innovation, developing valves utilizing advanced alloys that offer enhanced resistance to sulfide stress corrosion cracking (SSCC) and high-temperature oxidation, essential for sour gas applications and extreme processing environments. Consolidation remains a significant theme, with major global players acquiring smaller, specialized manufacturers to gain access to proprietary sealing technologies and expand their geographic footprints, particularly in fast-growing industrial hubs across Asia Pacific and the Middle East. Furthermore, digitalization is influencing business strategies, leading to the integration of sensors and smart monitoring capabilities within DB&B assemblies for predictive maintenance and real-time performance diagnostics.

Regionally, the market exhibits differential growth rates, with Asia Pacific (APAC) emerging as the fastest-growing region due to massive investments in new chemical plants, refining capacity expansion, and the build-out of intra-regional gas pipelines. North America, while mature, continues to represent a significant market share, fueled by ongoing expansion in LNG liquefaction terminals and the revitalization of aging pipeline networks under heightened federal safety standards. The Middle East remains a crucial driver, underpinned by ambitious national energy diversification projects and sustained high levels of crude oil production and export infrastructure development, requiring specialized DB&B valves for severe service applications. European demand is stable, primarily driven by maintenance, repair, and overhaul (MRO) activities and the shift towards cleaner energy infrastructure, necessitating high-integrity valves for carbon capture and storage (CCS) projects.

Segment trends highlight the dominance of the Ball Valve type within the DB&B configuration due to its excellent shut-off capabilities and quick quarter-turn operation, making it ideal for large-bore pipeline applications. However, Needle Valves are experiencing strong adoption in precision metering and instrumentation applications where highly controlled low-flow isolation is required. The Oil & Gas segment retains the largest application share, encompassing Upstream (drilling and wellhead isolation), Midstream (pipeline transportation and storage), and Downstream (refining and petrochemicals). Future growth is anticipated in specialized segments like Hydrogen transportation and industrial gas processing, requiring DB&B valves certified for cryogenic and ultra-high-purity applications, pushing manufacturers to adapt existing designs to new fluid dynamics and material compatibility challenges.

AI Impact Analysis on Double Block & Bleed Valves Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Double Block & Bleed Valves market primarily center on maintenance optimization, operational safety enhancement, and design efficiency improvements. Users frequently ask about the implementation of predictive maintenance algorithms to anticipate valve failure before it occurs, questioning how AI processes large volumes of sensor data (vibration, temperature, pressure changes) collected from "smart" DB&B valves. There is significant interest regarding the use of machine learning (ML) in risk assessment models to prioritize valve integrity checks across vast pipeline networks, thereby maximizing operational uptime and minimizing catastrophic failure risk. Furthermore, users are exploring how generative design tools powered by AI can optimize valve body geometries, reducing material usage while maintaining or increasing pressure resistance, thus lowering manufacturing costs and accelerating product development cycles in this traditionally highly engineered sector.

- AI-driven Predictive Maintenance: Utilizing sensor data from smart DB&B valves to forecast seal degradation, stem fatigue, or actuator failure, moving maintenance strategies from reactive/scheduled to condition-based.

- Optimized Inventory Management: AI algorithms analyze usage patterns and failure rates across different operational sites to optimize spare parts inventory (e.g., replacement seats, seals, gaskets), reducing warehousing costs and logistical delays.

- Enhanced Leak Detection and Diagnostics: Machine learning models analyze pressure signatures and acoustic emissions to detect micro-leaks in the bleed section earlier and more accurately than traditional methods.

- Generative Design Optimization: AI assists engineers in designing lighter, more robust valve bodies and internal components that minimize turbulence and pressure drop while complying with complex industry standards (API 6D, API 6A).

- Automated Compliance Monitoring: AI systems track operational parameters against required safety limits (e.g., Maximum Allowable Operating Pressure, isolation testing frequency) and automatically flag deviations, ensuring continuous regulatory adherence.

DRO & Impact Forces Of Double Block & Bleed Valves Market

The market dynamics for Double Block & Bleed Valves are dictated by a confluence of stringent regulatory requirements, global infrastructure investment cycles, and inherent technical complexities associated with high-integrity isolation. Drivers include mandatory compliance standards for verifiable isolation in hazardous fluid handling, particularly in oil and gas pipelines and chemical facilities, where leakage poses extreme environmental and safety risks. Opportunities arise from the global energy transition, specifically the build-out of infrastructure for new energy vectors such as hydrogen, carbon capture, utilization, and storage (CCUS), which necessitate highly specialized, reliable isolation valves. Restraints often revolve around the high initial capital expenditure associated with certified, high-performance DB&B valves compared to standard valve configurations, alongside the technical challenge of ensuring absolute seal integrity in valves exposed to abrasive media and thermal cycling. These forces create a balanced market environment where investment in safety and compliance consistently outweighs cost concerns, leading to sustained, albeit specialized, market expansion.

Key drivers significantly propelling the market forward include the rapid expansion of midstream infrastructure, particularly long-distance oil and gas pipelines across regions like Russia, China, and Africa, each demanding thousands of DB&B units for critical sectional isolation and metering. Furthermore, the increasing complexity of petrochemical processes, involving higher temperatures and pressures to maximize yield, mandates the use of advanced metallic materials and superior sealing technologies inherent in premium DB&B valve designs. Government-mandated pipeline integrity management programs following several high-profile industrial incidents have reinforced the necessity for positive, verifiable double isolation across all critical process points. These regulations solidify the demand floor for DB&B technology, as it often provides the most efficient and compliant way to achieve process segregation during maintenance or unplanned shutdowns, minimizing the risk profile for major operators.

Restraints, however, temper this growth. The long procurement and certification cycles required for specialized valves, coupled with the reliance on highly skilled manufacturers, can lead to supply chain bottlenecks, particularly during peak infrastructure development phases. Technical hurdles include managing fugitive emissions effectively; while DB&B valves reduce external leak points compared to traditional setups, maintaining the long-term integrity of the numerous internal sealing surfaces under severe dynamic loading remains a continuous engineering challenge. The potential opportunities are vast: the proliferation of small-scale LNG and micro-refineries globally presents niche markets. Moreover, the replacement cycle for aging infrastructure in mature markets (North America, Europe) represents a predictable and substantial opportunity, driven by operators seeking to upgrade older, less efficient valve assemblies with modern, compact, and smart DB&B units capable of supporting digitalized asset management systems. The collective impact forces push the market toward innovation in materials, smart integration, and miniaturization.

Segmentation Analysis

The Double Block & Bleed Valves market is systematically segmented based on Type, Material, Application, and End-Use Sector, reflecting the diverse operational requirements across various industrial domains. Understanding these segments is crucial as the performance requirements for a DB&B valve used in a high-pressure subsea environment differ vastly from one used in a low-pressure municipal water treatment plant. Segmentation by Type, such as Ball, Gate, or Needle valves, is dictated by the required flow control characteristics and operational speed. Ball DB&B valves, known for their tight shut-off and quick actuation, dominate pipeline applications, while Gate DB&B valves are preferred for demanding slurry or high-temperature steam applications where minimal pressure drop is essential. The complexity and criticality of the end-use environment heavily influence the choice of configuration, materials, and pressure rating, consequently affecting the pricing and overall market volume distribution.

Segmentation by Material—Carbon Steel, Stainless Steel, and Exotic Alloys—reflects the chemical and thermal compatibility required for the media being handled. Standard carbon steel is cost-effective for benign, low-corrosivity fluids like natural gas, while stainless steel is mandatory for chemical processing and severe service water applications. The growing use of exotic alloys (e.g., Inconel, Monel, Hastelloy) underscores the market's response to highly aggressive media, such as high-concentration acids or sour gas (H2S), driven by unconventional resource extraction and complex chemical manufacturing processes. The high cost of these exotic materials means that manufacturers must offer highly engineered solutions optimized for longevity and minimal maintenance, focusing on Total Cost of Ownership (TCO) rather than upfront price.

Application segmentation confirms the Oil & Gas sector as the largest consumer, split across Upstream (drilling and production), Midstream (transmission and storage), and Downstream (refining and petrochemical processing). Within Midstream, DB&B valves are integral for metering stations, manifold isolation, and pig launching systems, where accurate measurement and assured isolation are non-negotiable. The Power Generation sector also holds a significant share, particularly in high-pressure steam lines and cooling water circuits. Emerging applications in renewable energy infrastructure, such as green hydrogen production and storage facilities, represent the next frontier for growth, requiring DB&B valves certified for hydrogen service—a segment necessitating extreme material purity and advanced sealing technologies to prevent embrittlement and leakage of the highly diffusive gas.

- By Type:

- Ball Double Block & Bleed Valves

- Needle Double Block & Bleed Valves

- Globe Double Block & Bleed Valves

- Gate Double Block & Bleed Valves

- By Material:

- Stainless Steel (304, 316, Duplex)

- Carbon Steel (A105, A216 WCB)

- Alloy Steel and Exotic Materials (e.g., Monel, Inconel)

- By Application:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical & Petrochemical

- Power Generation (Thermal, Nuclear)

- Water & Wastewater Treatment

- Pulp & Paper and Mining

- Industrial Gases and Cryogenics

- By End-Use Sector:

- Infrastructure & Pipelines

- Processing & Manufacturing Facilities

Value Chain Analysis For Double Block & Bleed Valves Market

The value chain for the Double Block & Bleed Valves Market begins with the upstream segment involving raw material sourcing, primarily specialized metal alloys and advanced polymer/graphite sealing compounds. Manufacturers rely heavily on certified foundries and material suppliers who adhere to stringent international standards (e.g., NACE MR0175 for sour service) to ensure the integrity and compatibility of the materials under severe service conditions. Quality control at this stage is paramount, as material flaws can lead to catastrophic failure in high-pressure applications. Upstream activities also include the design and engineering phase, where intellectual property related to sealing technology, pressure balancing mechanisms, and compact body design provides a competitive advantage. Manufacturers often engage in intense R&D to optimize flow dynamics and reduce fugitive emissions, maintaining compliance with increasingly strict environmental mandates.

The midstream phase involves manufacturing, assembly, and rigorous testing. Manufacturing processes for DB&B valves are complex, involving precision machining, welding, and heat treatment to achieve the required dimensional accuracy and material properties. Crucially, every finished valve must undergo extensive pressure testing (hydrostatic and pneumatic testing) and isolation testing (Double Block and Bleed test) before shipment to verify compliance with industry certifications (e.g., API 6D, ISO 15848-1 for low fugitive emissions). The distribution channel significantly impacts the final price and delivery time. Direct sales channels are common for large, customized, or highly complex projects, where manufacturers work closely with EPC (Engineering, Procurement, and Construction) firms and major end-users (e.g., national oil companies) to ensure specific operational requirements are met.

Indirect distribution involves a network of specialized distributors and valve maintenance service providers, particularly for standard inventory items, replacement parts, and MRO (Maintenance, Repair, and Overhaul) services. These distributors often maintain regional warehouses and offer local technical support, which is critical for minimizing downtime. Downstream activities focus on installation, commissioning, and post-sales servicing. Service contracts, predictive maintenance systems, and rapid replacement services form a growing part of the value proposition, providing recurring revenue streams for manufacturers. The longevity and criticality of DB&B valves mean that brand reputation, service reliability, and long-term parts availability are vital differentiating factors in competitive procurement scenarios, reinforcing the importance of a robust, certified distribution and service network.

Double Block & Bleed Valves Market Potential Customers

The primary customers for Double Block & Bleed Valves are organizations operating facilities where the isolation of hazardous, high-pressure, or critical fluids is essential for safety, maintenance, or process control. The most significant segment of potential buyers resides within the global energy complex. This includes national and international oil companies (NOCs and IOCs) such as Saudi Aramco, ExxonMobil, and Shell, who purchase large volumes for greenfield projects and continuous MRO of existing assets like refineries, offshore platforms, and upstream production facilities. Midstream pipeline operators—like TC Energy, Kinder Morgan, and Gazprom—represent another core customer base, requiring DB&B valves for mainline isolation, compressor stations, and metering skids, prioritizing reliability and high pressure ratings (up to ANSI Class 2500).

Beyond the traditional energy sector, key customers include major EPC firms (e.g., Fluor, TechnipFMC, Bechtel) that specify and procure valves on behalf of end-users during the construction phases of large industrial plants. These firms value supplier relationships that guarantee compliance, timely delivery, and competitive total cost of ownership across extensive Bill of Materials (BOMs). The Chemical and Petrochemical industry constitutes a robust market segment, encompassing manufacturers of bulk chemicals, specialty chemicals, and polymers. These buyers require materials tailored to extreme corrosivity and temperature ranges, often demanding exotic alloy valves and strict fugitive emission control certifications to comply with environmental mandates regarding volatile organic compounds (VOCs).

Furthermore, the Power Generation sector, including both traditional thermal power plants (coal and natural gas) and new nuclear facilities, are significant buyers, utilizing DB&B technology for high-integrity steam and boiler feedwater isolation. The emerging green energy ecosystem, including developers of utility-scale hydrogen production and distribution networks, also represents a rapidly growing customer demographic. These new end-users place a premium on valves designed specifically for hydrogen service, which require unique sealing methods to prevent molecular leakage and advanced materials to mitigate hydrogen embrittlement risks. Ultimately, any industrial entity operating critical fluid infrastructure where product cross-contamination or unauthorized bypass poses a severe risk is a potential buyer of certified DB&B valve technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 1.5 Billion USD |

| Market Forecast in 2033 | 2.2 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Flowserve Corporation, Swagelok Company, Parker Hannifin Corporation, Valmet Oyj, Spirax Sarco Engineering plc, KSB SE & Co. KGaA, Neway Valve (Suzhou) Co., Ltd., Velan Inc., Schlumberger N.V. (Cameron), IMI Critical Engineering, WIKA Group, L&T Valves Limited, TLV International Inc., BFE Group Co., Ltd., Zwick Armaturen GmbH, M&M International, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Double Block & Bleed Valves Market Key Technology Landscape

The technological landscape of the Double Block & Bleed Valves market is defined by continuous advancements focused on achieving zero fugitive emissions, enhancing operational reliability in severe service, and integrating smart capabilities. A primary area of innovation is in sealing technology. Manufacturers are utilizing advanced materials such as PEEK, specialized PTFE, and proprietary metal-to-metal seating arrangements capable of maintaining tight shut-off under extreme thermal cycling and differential pressures. For soft-seated DB&B valves, development focuses on resilient seal designs that compensate for wear and temperature fluctuations, significantly extending the service life and reducing the frequency of costly isolation checks. Furthermore, design optimization techniques, including computational fluid dynamics (CFD) simulations, are standard practice to minimize pressure drop and erosion within the valve body, particularly crucial for high-velocity or abrasive services.

Another crucial technological development involves the integration of monitoring and diagnostic technologies, ushering in the era of 'smart' valves. Modern DB&B valves are increasingly equipped with non-intrusive sensors (e.g., acoustic sensors, vibration monitors, and embedded temperature and pressure transmitters) that communicate real-time operational status via wireless protocols or fieldbus systems. These smart capabilities facilitate predictive maintenance strategies by providing early warnings of seal degradation or stem packing failure, thus avoiding unplanned downtime. Actuation technology is also evolving, with increasing deployment of advanced electric and pneumatic actuators offering precise modulation and fail-safe functionalities, often packaged compactly to align with the space-saving benefits of the integrated DB&B design itself. This technological convergence enables asset owners to achieve better operational visibility and compliance tracking across their vast valve infrastructure.

Material science remains at the core of competitive advantage. The industry is constantly exploring novel alloys, coatings, and internal surface treatments to combat highly corrosive media, such as high-concentration hydrogen sulfide (H2S) in sour gas extraction or highly oxygenated fluids in water treatment. For subsea applications, specialized coating technologies are employed to resist corrosion and biofouling. Furthermore, the push for standardization and modularity is a key technology trend. Manufacturers are developing modular DB&B designs where different valve types or end connections can be easily interchanged, simplifying inventory management for end-users and accelerating configuration deployment for customized systems. This focus on materials and digital integration collectively ensures that DB&B valves maintain their position as the gold standard for high-integrity process isolation in the most demanding industrial environments globally.

Regional Highlights

Regional dynamics play a crucial role in shaping the Double Block & Bleed Valves Market, driven by localized infrastructure spending, varying regulatory landscapes, and the maturity of the regional energy sectors. North America, encompassing the U.S. and Canada, represents a mature but technologically advanced market, heavily focused on replacing aging pipeline infrastructure and investing in LNG export facilities. Strict pipeline safety mandates and continued development in the Permian Basin and Canadian oil sands necessitate high-pressure, high-specification DB&B valves. The region leads in the adoption of smart valve technology and predictive maintenance services, setting high standards for reliability and emissions control, leading to premium pricing for specialized, certified products.

Asia Pacific (APAC) stands out as the primary growth engine for the DB&B market globally. This growth is fueled by massive infrastructure projects, particularly in China, India, and Southeast Asia, encompassing new oil and gas pipelines, refinery expansions, and chemical plant construction to meet surging domestic energy and industrial demand. Government backing for large-scale energy projects and rapidly growing petrochemical capacity mean high volume procurement of valves. While cost-sensitivity exists, the increasing adoption of international safety standards, especially among large state-owned enterprises, drives demand for high-quality, certified DB&B units. Local manufacturing capacity is rapidly expanding, but complex, high-pressure specifications often still rely on imports from established European and North American suppliers.

The Middle East and Africa (MEA) region is critical due to its massive crude oil and natural gas production capabilities. Major national oil companies (NOCs) are investing heavily in upstream and midstream expansion, including the development of new fields and complex processing plants. These environments often demand specialized DB&B valves capable of handling extreme heat, high pressures, and sour service conditions. Long-term, high-value contracts with major international suppliers are common. In Europe, market activity is dominated by MRO activities, modernization efforts in the chemical industry, and foundational investments in the green transition, particularly in hydrogen and CCUS projects. This focus on new energy infrastructure drives demand for niche DB&B products certified for unique service requirements like cryogenic temperatures or specialized material compatibility.

- North America: Strong demand driven by pipeline replacement, LNG facility construction, and stringent regulatory environment promoting smart valve integration and high-pressure ratings for shale extraction.

- Asia Pacific (APAC): Highest growth rate globally, propelled by substantial investments in petrochemical expansion, new domestic and regional pipeline networks (China, India), and increasing adherence to global safety standards.

- Middle East & Africa (MEA): Consistent high-volume demand linked to sustained oil and gas production, requiring severe service valves for high-temperature and high-H2S content applications, centered around NOC infrastructure expansion.

- Europe: Stable demand focused on MRO, modernization of chemical processing facilities, and the rapid deployment of specialized DB&B valves for emerging hydrogen and Carbon Capture and Storage (CCS) projects.

- Latin America: Moderate growth tied to offshore exploration (Brazil, Mexico) and the development of regional gas infrastructure, highly sensitive to fluctuations in global commodity prices and political stability affecting large capital projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Double Block & Bleed Valves Market.- Emerson Electric Co.

- Flowserve Corporation

- Swagelok Company

- Parker Hannifin Corporation

- Valmet Oyj

- Spirax Sarco Engineering plc

- KSB SE & Co. KGaA

- Neway Valve (Suzhou) Co., Ltd.

- Velan Inc.

- Schlumberger N.V. (Cameron)

- IMI Critical Engineering

- WIKA Group

- L&T Valves Limited

- TLV International Inc.

- BFE Group Co., Ltd.

- Zwick Armaturen GmbH

- M&M International, Inc.

- PetrolValves S.p.A.

- Techno Valvole S.r.l.

- Hawa Valves

Frequently Asked Questions

Analyze common user questions about the Double Block & Bleed Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and advantage of a Double Block & Bleed valve?

The DB&B valve's primary function is to provide verifiable positive isolation of a process line using two primary seating mechanisms and a bleed port in between. The key advantage is enhanced safety, reduced installation space, and the ability to test the isolation seal integrity without shutting down the entire system, critical for maintenance in hazardous environments.

Which industrial sectors are the largest consumers of DB&B valves?

The Oil & Gas sector, encompassing upstream production, midstream pipeline transportation, and downstream refining/petrochemical processing, represents the largest consuming segment due to stringent regulatory requirements for verifiable isolation in high-pressure and volatile fluid services.

How do regulatory standards influence the Double Block & Bleed Valves market?

Strict regulatory standards, such as those imposed by API (e.g., API 6D) and environmental agencies regarding fugitive emissions (e.g., ISO 15848-1), mandate the use of high-integrity valves like DB&B configurations, thereby driving demand and influencing design specifications, particularly concerning material traceability and leak tightness.

What technological advancements are shaping the future of DB&B valves?

Future advancements focus heavily on digitalization, including the integration of smart sensors for predictive maintenance, advanced material science for improved corrosion resistance (especially for hydrogen service), and optimized, compact designs that reduce overall weight and installation complexity.

How is the growth of green energy impacting demand for specialized DB&B products?

The green energy transition, specifically the expansion of Hydrogen and Carbon Capture, Utilization, and Storage (CCUS) infrastructure, creates new demand for highly specialized DB&B valves. These applications require unique material compatibility (to prevent hydrogen embrittlement) and certification for cryogenic or high-purity service.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager