Double Oiler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438186 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Double Oiler Market Size

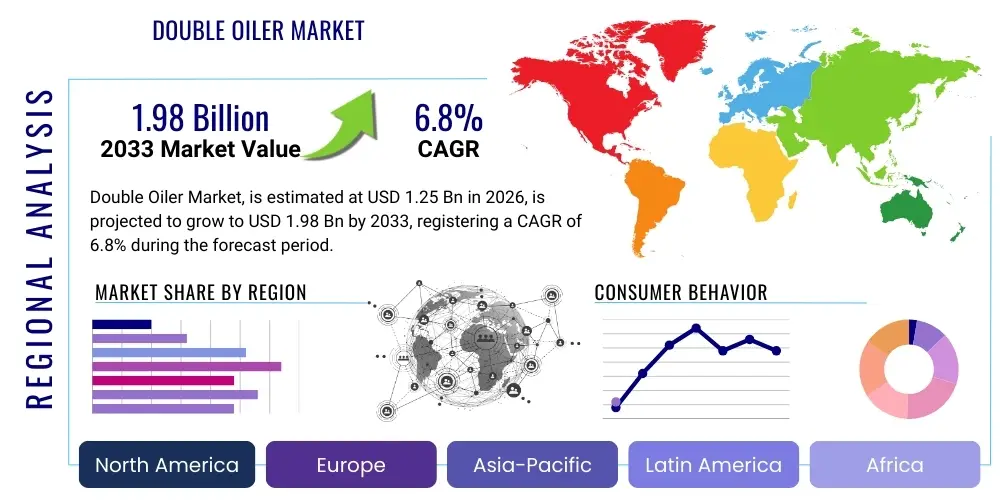

The Double Oiler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.98 Billion by the end of the forecast period in 2033.

Double Oiler Market introduction

The Double Oiler Market encompasses sophisticated lubrication and fluid delivery systems designed to provide precision, simultaneous oiling to two distinct points or components within industrial machinery, often critical for enhancing operational efficiency and prolonging equipment lifespan. These systems typically utilize advanced pumping mechanisms, integrated sensors, and monitoring capabilities to ensure accurate lubricant volume and timing, drastically reducing the risks associated with manual or conventional single-point lubrication. Key applications span high-speed manufacturing, robotics, power generation turbines, and specialized processing equipment where failure due to friction is costly. The primary benefits include reduced maintenance downtime, optimized fluid consumption, improved equipment reliability, and compliance with stringent industrial safety standards. The market growth is fundamentally driven by the global surge in industrial automation, the pervasive adoption of Industry 4.0 principles, and the increasing demand for ultra-precise manufacturing techniques across sectors such as automotive, aerospace, and heavy machinery production.

Double Oiler Market Executive Summary

The global Double Oiler Market is experiencing robust expansion driven by pronounced business trends favoring digitalization and predictive maintenance protocols across industrial landscapes. Manufacturers are increasingly integrating IoT connectivity into oiling systems, enabling remote diagnostics and real-time performance monitoring, thereby creating new revenue streams focused on service and data analytics rather than solely hardware sales. Regionally, Asia Pacific is maintaining its lead due to aggressive investments in factory automation and infrastructure development, particularly in China and India, while North America and Europe prioritize the replacement of older, inefficient systems with high-precision, environmentally compliant double oiler technologies. Segment trends highlight a significant shift towards centralized automatic double oiling systems over manual units, predominantly in the heavy-duty machinery sector, alongside a rising preference for bio-based and synthetic lubricants specifically designed for these advanced delivery systems, positioning system complexity and material compatibility as key differentiating factors in the competitive landscape.

AI Impact Analysis on Double Oiler Market

User inquiries regarding AI's influence on the Double Oiler Market frequently center on predictive maintenance capabilities, optimal lubrication scheduling, and the integration of machine learning models for anomaly detection within complex industrial environments. Users are keen to understand how AI can minimize lubricant wastage, predict component failure with higher accuracy than current sensor-based systems, and autonomously adjust flow rates based on dynamic operational loads and environmental variables. The primary concern revolves around data security, the complexity of retrofitting existing machinery with necessary sensor arrays for effective AI input, and the return on investment (ROI) associated with implementing sophisticated algorithms. Furthermore, end-users are exploring AI-driven supply chain management for lubricants, seeking systems that automatically forecast consumption and trigger procurement, ensuring just-in-time inventory management for specialized fluids used in double oiler applications.

- AI algorithms facilitate highly accurate predictive maintenance schedules for oiled components, moving beyond scheduled maintenance to condition-based servicing.

- Machine learning optimizes lubricant consumption by analyzing variables such as temperature, vibration, load cycles, and fluid viscosity in real-time, reducing waste.

- AI integration enables autonomous adjustment of double oiler flow rates and pressure settings, maintaining ideal lubrication films even under rapidly changing operational conditions.

- Generative AI models assist in designing bespoke double oiling systems by simulating fluid dynamics and thermal properties across diverse machine architectures.

- Enhanced fault diagnostics powered by deep learning detect subtle anomalies in flow patterns or pressure drops, significantly lowering the probability of catastrophic equipment failure.

- Smart supply chain management utilizes AI to forecast lubricant demands based on predictive usage patterns, ensuring optimal inventory levels and reducing procurement costs.

DRO & Impact Forces Of Double Oiler Market

The trajectory of the Double Oiler Market is fundamentally shaped by a balanced set of driving forces, inherent restraints, and compelling strategic opportunities that collectively determine market impact. Key drivers include the global push for industrial efficiency, mandatory regulatory compliance surrounding environmental waste, and the accelerating adoption of high-precision CNC machines and robotic systems that necessitate impeccable lubrication accuracy to function optimally. Restraints primarily involve the substantial initial capital investment required for implementing sophisticated double oiling systems, particularly the complex sensor arrays and control units, alongside the specialized technical expertise needed for their calibration and routine maintenance. Opportunities are expansive, centered on the development of smart, connected oiling systems leveraging IoT and AI for diagnostics, the shift towards sustainable, bio-degradable lubricant compatibility, and expansion into emerging markets requiring rapid industrialization. These forces generate a profound impact, compelling manufacturers to innovate system reliability and efficiency while addressing the critical needs for sustainability and operational uptime across industrial sectors worldwide.

Segmentation Analysis

The Double Oiler Market is comprehensively segmented based on System Type, Operation Mode, Lubricant Type, and End-Use Industry, reflecting the diverse application requirements and technological preferences across the global industrial landscape. Analyzing these segments provides critical insights into purchasing patterns and technological adoption rates. For instance, while high-volume industries prefer automated, centralized systems for consistency, specialized precision sectors often opt for smaller, high-accuracy units. The increasing focus on sustainability is driving rapid growth in segments utilizing synthetic and bio-based lubricants, particularly in environmentally sensitive regions like Europe. This granular segmentation allows market participants to tailor their product offerings and strategic marketing efforts to specific user needs, optimizing resource allocation and maximizing market penetration potential.

- By System Type:

- Centralized Double Oiling Systems

- Decentralized/Stand-Alone Units

- Single-Line Systems Adapted for Dual Output

- Dual-Line Progressive Systems

- By Operation Mode:

- Automatic (Sensor/PLC Controlled)

- Manual/Semi-Automatic

- By Lubricant Type:

- Mineral Oil Based

- Synthetic Oil Based

- Bio-based/Environmentally Friendly Lubricants

- Grease Compatibility Systems

- By End-Use Industry:

- Automotive and Transportation

- Aerospace and Defense

- Metalworking and Machinery

- Power Generation (Wind, Gas Turbines)

- Mining and Construction

- Food and Beverage Processing

Value Chain Analysis For Double Oiler Market

The value chain of the Double Oiler Market begins with the upstream suppliers responsible for raw materials, including specialized metals, polymers for reservoirs and seals, and the complex electronics required for sensors, control boards (PLCs), and pumping mechanisms. Precision component manufacturers, who focus on high-tolerance metering valves and piston pumps, form a critical midstream link. The market is highly reliant on sophisticated upstream analysis ensuring the quality and consistency of materials, as failure in critical components like seals or valves can lead to catastrophic system breakdown in high-pressure industrial environments. Downstream activities involve system integration, focusing on customizing standard units to fit unique machinery requirements, followed by meticulous installation, commissioning, and validation processes that often require specialized engineering firms. The distribution channel is bifurcated, utilizing direct sales channels for large industrial clients (e.g., major automotive manufacturers) requiring customized solutions and intensive technical support, while indirect channels, relying on regional distributors and MRO (Maintenance, Repair, and Operations) suppliers, handle standardized products and aftermarket spares, effectively maximizing market reach and facilitating prompt service delivery.

Double Oiler Market Potential Customers

Potential customers for Double Oiler systems are predominantly organizations operating capital-intensive machinery where operational uptime, precision, and longevity are non-negotiable economic drivers. Primary end-users span the automotive manufacturing sector, utilizing these systems in high-speed transfer lines and robotic welding cells where simultaneous, precise lubrication is essential for synchronized movement and consistent component quality. The aerospace and defense industries are significant buyers, focusing on systems compatible with exotic lubricants and demanding extremely low tolerance for error in applications like turbine balancing and specialized tooling. Furthermore, the power generation sector, particularly wind farms and gas turbine operators, requires double oilers for maintaining critical gearboxes and bearings, often under severe environmental conditions, prioritizing durability and remote monitoring capabilities. The increasing sophistication of CNC machining centers and advanced robotics across general manufacturing also positions medium-sized precision engineering firms as rapidly growing consumers of these specialized lubrication solutions, driven by the need to maintain competitive edge through reduced waste and enhanced production speed.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Graco Inc., Lincoln Industrial (SKF Group), Timken Company, Bijur Delimon, Perma-Tec GmbH & Co. KG, DropsA SpA, Alemite LLC, Lube Corporation, Klüber Lubrication, Interflon, Rota Teknik, LUBRICATION ENGINEERS, Lubecore International, Noria Corporation, FUCHS PETROLUB SE, Petro-Canada Lubricants Inc., Chevron Corporation, ExxonMobil Corporation, TotalEnergies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Double Oiler Market Key Technology Landscape

The technological landscape of the Double Oiler Market is defined by the integration of mechanical precision with advanced digital control systems, fundamentally moving away from simple gravity or plunger-based oiling towards highly regulated, adaptive fluid dispensing. Core technology revolves around positive displacement pumps, often utilizing piston or gear mechanisms, capable of delivering extremely accurate and repeatable volumes of lubricant, crucial for dual-point systems where flow balancing is paramount. Modern double oilers extensively employ sophisticated sensor technologies, including flow meters based on Coriolis or ultrasonic principles, pressure transducers, and viscosity sensors, which provide real-time feedback to the central control unit (PLC or microcontrollers). This data enables instantaneous adjustments, ensuring the two delivery points receive the required volume regardless of temperature fluctuations or changing operational loads. Furthermore, IoT integration, utilizing technologies like LoRaWAN and cellular connectivity, allows for remote monitoring and predictive diagnostics, seamlessly connecting the oiler system to broader Industry 4.0 platforms and maintenance management software (CMMS), significantly enhancing transparency and enabling data-driven optimization strategies that were previously unattainable.

Regional Highlights

The Asia Pacific region (APAC) dominates the Double Oiler Market, primarily fueled by massive, ongoing expansion in manufacturing capacity, particularly in the automotive, electronics, and heavy machinery sectors across China, India, South Korea, and Japan. Governments in these economies are heavily investing in smart factory initiatives and digitalization, creating a substantial demand for automated, high-precision lubrication systems that support high-volume, continuous operation. The rapid urbanization and infrastructural projects across Southeast Asia further drive the necessity for reliable heavy machinery, where double oilers are essential for minimizing construction and mining equipment downtime, making APAC the key growth engine for global market expansion and technology adoption in areas such as remote monitoring and embedded AI diagnostics.

North America and Europe represent mature markets characterized by stringent regulatory environments and a high propensity for adopting premium, high-technology solutions. In these regions, the demand is primarily driven by system replacement, modernization, and the imperative for energy efficiency and environmental compliance. European manufacturers, in particular, are leading the charge in adopting bio-based lubricant compatible double oilers to meet strict REACH regulations and corporate sustainability mandates. The emphasis in both regions is less on capacity expansion and more on technological refinement—specifically focusing on system reliability, predictive analytics integration, and cyber-secure remote operation capabilities, justifying higher initial investment costs through guaranteed long-term operational savings and enhanced safety profiles.

Latin America and the Middle East & Africa (MEA) are emerging markets exhibiting significant potential, largely influenced by growth in mining, oil and gas extraction, and specialized industrial processing. While price sensitivity remains a constraint, the harsh operating environments—characterized by extreme temperatures, dust, and high humidity—necessitate robust, highly effective lubrication systems to ensure equipment integrity. Investments in these regions are increasingly favoring centralized double oiling systems that offer enhanced durability and require less frequent manual intervention, aligning with strategic goals to improve operational safety and maximize asset lifespan in remote and challenging geographic areas. This emerging demand provides manufacturers with opportunities for offering mid-range, resilient, and standardized system packages tailored to specific regional challenges.

- Asia Pacific (APAC): Leading market, driven by industrial automation, rapid infrastructure development, and mass manufacturing expansion, notably in China and India.

- North America: Focuses on adopting advanced IoT and AI-enabled predictive maintenance features, prioritizing reliability and high-end synthetic lubricant compatibility in aerospace and high-tech manufacturing.

- Europe: High adoption rate of eco-friendly and bio-based lubricant double oilers, driven by strict environmental regulations (REACH) and strong emphasis on sustainability in the machinery sector.

- Latin America & MEA: Emerging growth centers primarily driven by the mining, oil & gas, and heavy construction sectors, seeking robust, durable systems suitable for severe operating conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Double Oiler Market.- SKF

- Graco Inc.

- Lincoln Industrial (SKF Group)

- Timken Company

- Bijur Delimon

- Perma-Tec GmbH & Co. KG

- DropsA SpA

- Alemite LLC

- Lube Corporation

- Klüber Lubrication

- Interflon

- Rota Teknik

- LUBRICATION ENGINEERS

- Lubecore International

- Noria Corporation

- FUCHS PETROLUB SE

- Petro-Canada Lubricants Inc.

- Chevron Corporation

- ExxonMobil Corporation

- TotalEnergies

Frequently Asked Questions

Analyze common user questions about the Double Oiler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary operational advantage of implementing a Double Oiler system over conventional lubrication methods?

The primary advantage of a Double Oiler system is its ability to deliver precise, metered volumes of lubricant simultaneously and independently to two critical points, drastically reducing friction, minimizing lubricant waste, and ensuring enhanced consistency and reliability, which directly translates to reduced maintenance downtime and extended machinery life.

How do IoT and AI integration affect the maintenance cycles of Double Oiler systems?

IoT and AI integration transform maintenance from time-based scheduling to condition-based and predictive maintenance. Real-time data monitoring allows AI algorithms to detect subtle operational anomalies, predicting potential failures before they occur, optimizing fluid consumption, and ensuring the system only requires intervention when actual performance degradation is detected, maximizing operational efficiency.

Which end-use industries are showing the highest adoption rate for automatic Double Oiler technology?

The Automotive and Metalworking industries exhibit the highest adoption rates due to their reliance on high-speed CNC machinery and robotic production lines requiring ultra-precise, continuous lubrication to maintain tight manufacturing tolerances and minimize costly production stoppages associated with component wear.

What are the key technical specifications to consider when selecting a Double Oiler system for heavy-duty machinery?

Key specifications include the maximum operating pressure, the viscosity range compatibility of the pump mechanism, the accuracy and repeatability of the metering valves, system reservoir capacity suitable for the duty cycle, and the ingress protection (IP) rating to ensure durability against dust and water in harsh industrial environments like mining or construction.

Is there a growing market trend favoring bio-based lubricants within Double Oiler applications?

Yes, there is a significant and accelerating trend, particularly in Europe and North America, driven by corporate sustainability mandates and environmental regulations (like the European Union’s push for bio-based industrial fluids). Manufacturers are adapting Double Oiler materials and seal compounds to ensure compatibility and optimal performance with these increasingly popular environmentally friendly lubricants.

Detailed Market Dynamics and Competitive Landscape

The competitive ecosystem of the Double Oiler Market is characterized by intense rivalry among established global players and niche manufacturers specializing in high-precision fluid dynamics. Market leadership is often determined not just by product innovation but by the capacity to provide comprehensive integration services, software support for predictive analytics, and robust global aftermarket service networks. Key market participants are aggressively pursuing mergers and acquisitions to expand their geographical footprint and integrate specialized sensor and control technologies, thereby offering end-to-end lubrication management solutions rather than just hardware components. Furthermore, the push towards standardized communication protocols (like OPC UA) facilitates easier integration of double oilers into existing plant-wide control systems, a crucial factor for large industrial clients making long-term capital expenditure decisions.

Technological advancement is heavily focused on developing modular double oiler systems that offer flexibility and scalability for various machinery configurations, allowing users to adapt the system output based on changing production needs without costly overhauls. A critical dimension of competitive strategy involves specializing in systems compatible with extreme operational requirements, such as those used in high-temperature steel processing or cryogenic applications. Companies that successfully combine durability, precision, and smart connectivity capabilities are poised to capture premium market share. Patent protection surrounding metering valve technology and novel pump designs remains a significant barrier to entry, forcing smaller players to focus on specialized regional distribution or niche industrial applications where customization is valued over large-scale standardization.

In terms of pricing strategy, manufacturers often employ a tiered approach: high-end automated systems with full IoT capabilities command premium pricing, targeting sectors like aerospace and advanced automotive. Conversely, standardized manual or semi-automatic double oilers are competitively priced to appeal to small to medium enterprises (SMEs) and developing markets. The market dynamics are also heavily influenced by the availability and cost fluctuations of petroleum-based raw materials, which affect both the price of the final product components (polymers, plastics) and the operating expenses (lubricant costs) for end-users, requiring manufacturers to continuously optimize material sourcing and supply chain resilience.

COVID-19 Impact and Recovery Analysis

The initial phase of the COVID-19 pandemic severely impacted the Double Oiler Market, primarily through massive disruptions in global supply chains and a sharp, temporary deceleration in capital expenditure across major industrial sectors, particularly automotive and construction. Factory shutdowns and restrictions on movement hindered installation and commissioning activities, leading to delayed project completions and a significant reduction in new system orders during 2020. Upstream supply of microprocessors and specialized electronic components necessary for automated systems experienced severe bottlenecks, escalating lead times and procurement costs for smart double oiler units.

However, the recovery phase demonstrated a structural shift in demand. The enforced downtime encouraged industries to accelerate digitalization and automation efforts to reduce reliance on manual labor, bolstering the long-term adoption of automated, remote-monitored double oiler systems. The need for predictive maintenance became paramount, as manufacturers sought to maximize the operational uptime of existing assets while facing labor shortages and logistical uncertainties. This accelerated trend towards Industry 4.0 applications significantly boosted the market segment for IoT-enabled and smart oiling solutions from late 2021 onwards, effectively compensating for the initial slowdown and creating a more robust, technology-driven growth trajectory for the forecast period.

Furthermore, the pandemic highlighted the fragility of relying on single-source suppliers, leading market participants to focus intensely on diversifying their supply chains and regionalizing manufacturing capabilities. End-users began prioritizing system durability and ease of maintenance, favoring oiler solutions that required minimal physical oversight. Government stimulus packages aimed at infrastructure recovery in several key regions (e.g., North America and Europe) injected capital into sectors like construction and utilities, indirectly boosting demand for heavy-duty machinery and, consequently, the specialized lubrication systems required to maintain them, ensuring a strong rebound characterized by an emphasis on resilience and remote functionality.

Future Outlook and Growth Opportunities

The future outlook for the Double Oiler Market is exceptionally positive, underpinned by the ongoing global shift toward precision engineering and the indispensable role of highly automated lubrication in supporting complex industrial machinery. A key growth avenue lies in the expansion of system compatibility with novel, highly specialized synthetic lubricants tailored for extreme operational conditions, such as those found in high-pressure hydrogen compressors or hyperloop technologies. Manufacturers must invest heavily in R&D to develop elastomers and sealing materials that withstand aggressive chemical environments and ultra-low temperatures, catering to emerging industries that demand performance far beyond traditional industrial standards.

Strategic growth opportunities are highly concentrated in the service sector surrounding the installed base. Instead of solely selling hardware, key players are transitioning towards offering Subscription-as-a-Service (SaaS) models for lubrication management, bundling hardware, software analytics, remote monitoring, and lubricant supply into comprehensive contracts. This recurring revenue model ensures predictable cash flow and establishes deep, continuous relationships with major clients, acting as a strong competitive differentiator. Furthermore, green technology mandates will continue to propel the bio-based lubricant compatible segment, compelling market penetration into agriculture and marine industries previously dominated by conventional mineral oils.

Geographically, while APAC remains the largest consumer, significant untapped potential exists in secondary cities and decentralized industrial clusters across Latin America and Africa where basic automation is just beginning to take hold. Manufacturers who can offer robust, cost-effective, and easy-to-install decentralized double oiler units, backed by adequate local support infrastructure, will successfully capture these emerging segments. The continuous miniaturization and increased efficiency of pumping technology will also open new markets in smaller, portable equipment and specialized robotics, expanding the traditional industrial footprint of double oiler applications significantly over the next five to seven years.

Regulatory and Compliance Environment

The Double Oiler Market operates under a strict and complex framework of international and regional regulations primarily concerning environmental protection, worker safety, and machine performance standards. Compliance with ISO standards, such particularly ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health and Safety), is mandatory for system manufacturers seeking global acceptance. Regulations concerning fluid discharge and waste management, such as the European Union’s Waste Framework Directive, heavily influence system design, pushing for leak-proof, closed-loop systems that minimize environmental contamination risk associated with conventional oiling methods. In Europe, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation dictates the composition and labeling of lubricants and the materials used in the oiler components themselves, driving the adoption of certified, less hazardous substances.

Safety certifications, including CE marking in Europe and various regional electrical standards (UL, CSA), are critical for automated systems integrating electronic controls and sensors. Furthermore, specialized end-use sectors, such as food and beverage processing, require components and lubricants that adhere to NSF H1 guidelines for incidental contact, necessitating the use of specific, food-grade synthetic oils and dedicated non-toxic materials within the double oiler unit. Failure to meet these rigorous compliance standards can result in product recalls, heavy fines, and significant reputational damage, making proactive adherence to evolving global safety and environmental laws a core operational priority for all industry participants and a key component of market strategy.

The enforcement of machine safety directives, such as the Machinery Directive in the EU, mandates that new industrial equipment must incorporate features that inherently reduce risk, which includes ensuring reliable and constant lubrication to prevent mechanical failures that could injure operators. This regulatory pressure directly boosts demand for highly monitored and fault-tolerant double oiler systems, as they contribute significantly to overall machine safety compliance. Manufacturers must also navigate complex international trade regulations, including tariffs and local content requirements in countries like India and China, which impact supply chain structure and final product pricing, demanding careful geopolitical analysis alongside product development strategies to ensure sustained global market access.

The preceding analysis represents a high-level summary of the complex dynamics shaping the Double Oiler Market, emphasizing the convergence of industrial automation, sustainability mandates, and digital transformation. The projected growth trajectory reflects a market moving decisively towards precision, integration, and predictive capabilities, fundamentally altering the traditional paradigm of industrial lubrication management. The continued emphasis on reducing operational expenditure through efficiency gains and maximizing asset longevity positions advanced double oiler systems as indispensable components in the modern manufacturing ecosystem, ensuring their sustained importance across all major industrial regions globally through the forecast period to 2033 and beyond.

Further detailed examination of segment-specific CAGR, deep dive into competitor strategies, and exhaustive geopolitical risk assessment across key manufacturing hubs are necessary for stakeholders formulating long-term capital investment and market entry strategies within this technologically sophisticated and rapidly evolving industrial segment. The successful navigation of this market requires not just robust product engineering but also expertise in data science, regulatory compliance, and localized service support to capture maximum value from the growing global installed base of automated machinery.

The adoption of standardized industrial communication protocols such as PROFINET and EtherNet/IP is becoming a prerequisite for participation in major supply chains, especially in the automotive and aerospace sectors. Double Oiler systems that integrate seamlessly into existing Industrial Internet of Things (IIoT) architectures, offering plug-and-play functionality and standardized data outputs, gain a distinct competitive advantage by minimizing integration costs and complexity for the end-user. This trend signifies a shift in competitive focus from purely hydraulic or mechanical performance towards software and connectivity excellence, forcing traditional hardware manufacturers to acquire or develop substantial internal software competencies to remain relevant in the evolving digital marketplace, dictating future R&D spending and strategic alliances.

Emerging markets present both opportunities and challenges. While the demand for basic lubrication systems is high due to rapid industrialization, often coupled with a strong sensitivity to initial capital outlay, the installed machinery base in these regions frequently operates under more severe conditions (e.g., higher dust loads, lack of climate control). This necessitates the development of specialized, robust, and often over-engineered double oiler solutions that prioritize sheer durability and minimum maintenance requirements over the hyper-precision features sought in developed markets. Manufacturers must adapt their sales models to offer financing solutions and localized training programs to facilitate adoption among smaller, less technologically advanced enterprises in these developing regions, ensuring accessibility and ease of use remains paramount.

The lifecycle management of Double Oiler systems is also becoming a critical factor. End-users are increasingly demanding systems designed for circularity, including ease of disassembly, material recycling, and the capability for high-level refurbishment. This trend aligns with global corporate responsibility goals and addresses the rising cost of raw materials by promoting the reuse of non-consumable components. Manufacturers pioneering modular designs with readily replaceable, standardized internal components and offering certified refurbishment programs will gain favor, especially from large corporations committed to sustainable supply chain practices and net-zero targets, creating a secondary revenue stream focused on asset renewal and extending product lifespan far beyond the initial warranty period.

Furthermore, the specialization of lubricant types, moving beyond generic industrial oils to highly engineered synthetic esters and specialized polyalphaolefins (PAOs), requires Double Oiler systems to handle a wider spectrum of viscosities and chemical compatibilities without component degradation or leakage. This dictates stringent material selection for pumps, seals, and conduits, particularly when dealing with aggressive synthetic fluids or high-performance additives. The integration of on-board fluid condition monitoring sensors—capable of detecting water contamination, oxidation levels, and particle counts directly within the flow path—is becoming standard for high-end automatic double oilers, ensuring the lubricant itself remains within optimal operational parameters, thereby maximizing component protection and minimizing unnecessary fluid replacement.

Geopolitical risks, particularly trade tensions and shifts in international manufacturing policies, pose continuous challenges to the market's stability. Any disruptions to the supply chain of rare earth minerals or specialized electronic chips—critical for the advanced sensors and control units in automated double oilers—can severely impact production timelines and profitability. Companies are mitigating this risk by establishing dual-sourcing strategies and increasing inventory buffers for long-lead-time components. Moreover, the varying levels of intellectual property (IP) protection across different jurisdictions necessitate careful legal strategy, particularly when entering high-growth markets where technological replication is a known concern, reinforcing the importance of localized manufacturing and robust patent enforcement strategies to protect core innovations in pump and metering technology.

In summary, the Double Oiler Market is transitioning into a mature, yet highly dynamic, technological segment where success relies on a dual focus: mechanical robustness and digital intelligence. The alignment of product development with global mega-trends—automation, sustainability, and connectivity—will define competitive leadership. Stakeholders must continuously adapt their business models, embracing service-oriented approaches and mastering the complexity of modern industrial IT infrastructure, ensuring their offerings not only lubricate machinery efficiently but also contribute valuable data and intelligence back into the broader industrial ecosystem for predictive operational optimization.

The penetration of Double Oiler technology in previously underserved sectors, such as precision agricultural equipment and specialized marine vessels, offers substantial, though fragmented, expansion opportunities. Modern farming implements, particularly those with complex automated steering and harvesting mechanisms, require precise, rugged lubrication systems to withstand outdoor exposure and long operating hours, presenting a niche for durable, decentralized oiler units. Similarly, the maritime industry’s push for fuel efficiency and reduced environmental impact necessitates advanced lubrication systems for propulsion units and auxiliary machinery, driving demand for heavy-duty, corrosion-resistant double oilers compatible with specialized marine bio-lubricants, opening a distinct and highly regulated vertical market requiring bespoke system certification and material specifications tailored for seawater environments and strict IMO regulations regarding environmental discharge.

Furthermore, the integration of 5G connectivity into industrial infrastructure promises to unlock the full potential of remote monitoring capabilities for Double Oiler systems. The high bandwidth and low latency offered by 5G enable near-instantaneous transmission of large datasets (vibration analysis, oil particle counts, pressure fluctuations) from remote machinery directly to cloud-based predictive analytics platforms. This technological leap facilitates ultra-responsive control systems, allowing the double oiler to dynamically adjust flow rates in milliseconds based on real-time operational shifts, a capability essential for maintaining optimal friction levels in high-velocity processes like metal stamping or high-speed gear shifting in heavy transportation. Manufacturers who successfully leverage these advanced communication infrastructures will be able to offer unparalleled service agreements guaranteeing uptime and performance fidelity across globally distributed industrial assets, further cementing the shift towards highly integrated, data-driven lubrication management solutions.

Investment in human capital is also a critical dimension of the market's future. The complexity of modern automated double oiler systems requires highly trained technical personnel for installation, commissioning, and ongoing maintenance. The market faces a shortage of technicians skilled in both industrial mechanics and IIoT data analytics. Companies that invest in comprehensive training programs, certification standards, and virtual reality (VR) guided maintenance protocols for their clients and distribution partners will differentiate themselves by lowering the operational barriers for adopting these complex technologies. This focus on expertise transfer and simplifying user interaction through intuitive human-machine interfaces (HMIs) will be crucial for accelerating adoption rates, especially in regions with limited local technical expertise or rapid staff turnover within manufacturing plants, turning technical complexity into a manageable operational advantage for end-users committed to efficiency.

The emergence of additive manufacturing (3D printing) is beginning to influence the production of specialized Double Oiler components. While high-volume components remain conventionally manufactured, 3D printing allows for rapid prototyping and the creation of highly customized internal manifold designs and unique mounting brackets tailored precisely to unconventional machine geometries. This technology reduces lead times for bespoke orders and enables manufacturers to optimize fluid flow paths within the unit itself, enhancing volumetric accuracy and minimizing internal turbulence. The application of 3D printing, particularly with specialized engineering plastics and metal alloys, provides an avenue for customizing low-volume, high-value systems required by niche sectors like specialized defense equipment or deep-sea drilling apparatus, offering a flexible manufacturing solution that supports the trend toward highly customized industrial machinery architectures and reinforces the supplier’s role as an agile engineering partner rather than merely a component provider.

Lastly, cybersecurity is rapidly evolving from a peripheral concern to a core design requirement for networked Double Oiler systems. As these devices are connected to the central IT network for monitoring and control, they represent potential entry points for cyber threats targeting industrial control systems (ICS). Manufacturers are integrating robust security features, including secure boot mechanisms, encrypted communication protocols, and continuous firmware update capabilities, to protect the operational technology (OT) environment. Compliance with global cybersecurity standards, such as IEC 62443, is becoming mandatory for smart oiler adoption by critical infrastructure operators (e.g., power generation plants), ensuring the integrity and availability of these essential lubrication systems against sophisticated cyber attacks, thereby strengthenin

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager