Drawn Over Mandrel (DOM) Steel Pipe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437365 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Drawn Over Mandrel (DOM) Steel Pipe Market Size

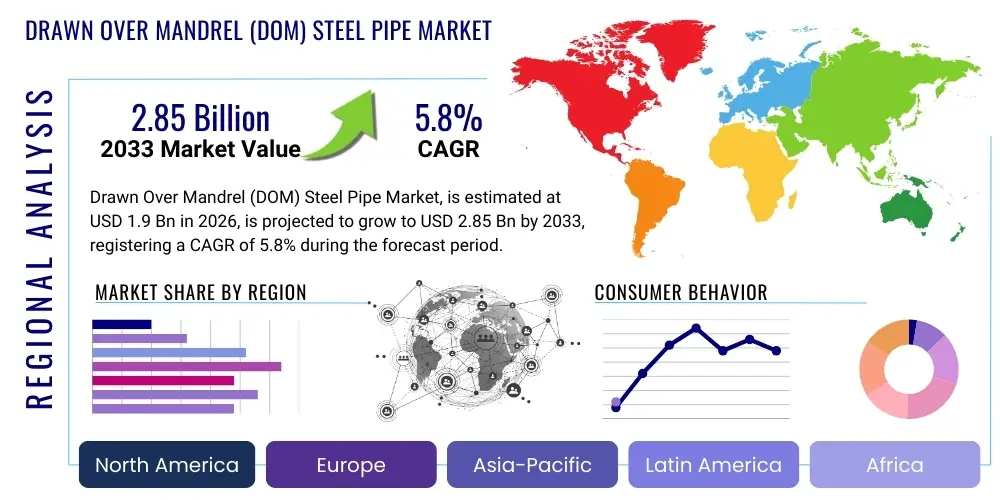

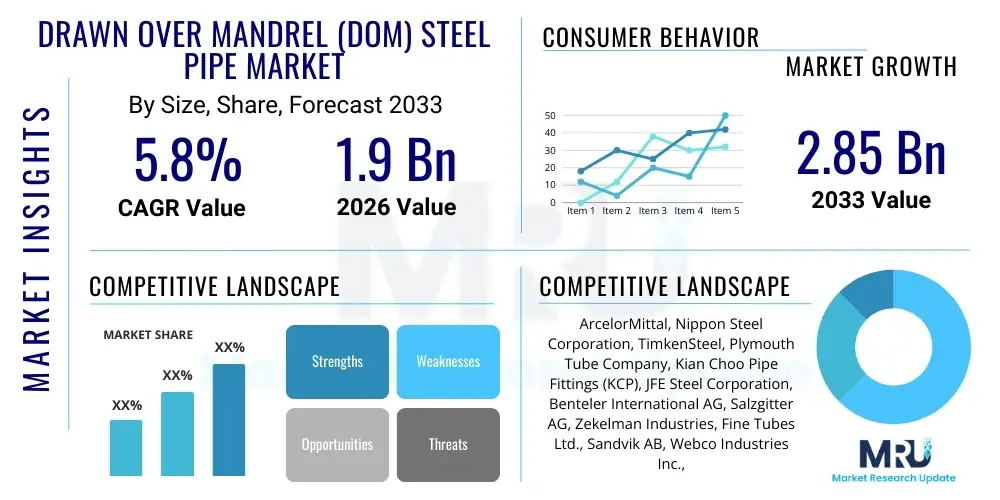

The Drawn Over Mandrel (DOM) Steel Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.9 Billion in 2026 and is projected to reach $2.85 Billion by the end of the forecast period in 2033.

Drawn Over Mandrel (DOM) Steel Pipe Market introduction

The Drawn Over Mandrel (DOM) steel pipe market encompasses high-precision tubing utilized primarily in applications requiring superior wall thickness consistency, excellent surface finish, and enhanced mechanical properties compared to standard electric resistance welded (ERW) or seamless tubing. DOM steel pipe is manufactured by cold working electric-resistance welded pipe through a die and over a mandrel, a process that significantly refines the grain structure, improves concentricity, and increases dimensional accuracy. This extensive cold drawing provides the finished product with a smooth, bright internal and external surface, making it an ideal choice for critical hydraulic and structural applications where tight tolerances are non-negotiable.

Major applications for DOM steel pipes span the heavy machinery, automotive, and construction sectors. In the automotive industry, these pipes are crucial for manufacturing shock absorbers, suspension components, and drive shafts due to their high strength-to-weight ratio and fatigue resistance. For hydraulic systems, DOM tubing is preferred for cylinders and accumulators because the consistent wall thickness and smooth internal diameter minimize friction, reduce leakage risk, and facilitate efficient fluid power transmission. The benefits of using DOM pipe include superior mechanical strength, precise dimensional control, and excellent ductility, which allows for complex bending and forming operations without failure.

Key driving factors accelerating market growth include the robust expansion of the global construction and infrastructure development sector, particularly in emerging economies, which necessitates high-quality, reliable structural steel components. Furthermore, the stringent safety and performance standards imposed on automotive and aerospace components worldwide necessitate the use of high-integrity materials like DOM tubing. The increasing automation and complexity of industrial machinery, particularly heavy-duty excavators and agricultural equipment, also fuel demand for high-pressure hydraulic cylinders manufactured using DOM steel.

Drawn Over Mandrel (DOM) Steel Pipe Market Executive Summary

The Drawn Over Mandrel (DOM) Steel Pipe Market exhibits strong growth driven by persistent demand from the global hydraulic cylinder and heavy equipment manufacturing industries. Current business trends indicate a critical shift towards higher strength low alloy (HSLA) steel grades within the DOM manufacturing process to meet increasing requirements for weight reduction and operational efficiency in transportation and aerospace applications. Geographically, Asia Pacific remains the dominant market segment, fueled by massive government investments in infrastructure, rapid urbanization, and the sustained growth of automotive production hubs in China and India. Europe and North America, while mature markets, emphasize technological innovation, focusing on specialized, smaller-diameter DOM tubing for precision machinery and robotics, thereby maintaining stable revenue growth through high-value product offerings.

In terms of segment trends, the hydraulic cylinder application segment commands the largest market share due to the non-negotiable requirement for high concentricity and superior internal surface finish necessary for efficient sealing and longevity of hydraulic pistons. Simultaneously, the material type segment shows a rising preference for carbon steel and specialized alloys, particularly 4130 and 4140 series steels, offering enhanced tensile strength for demanding structural components in oil and gas extraction equipment. Manufacturers are increasingly adopting advanced non-destructive testing (NDT) techniques, such as eddy current and ultrasonic testing, directly integrated into the production line to ensure zero-defect material quality, reinforcing consumer confidence in DOM products for critical safety applications.

Competitive intensity in the DOM steel pipe market is characterized by a strong focus on capacity expansion and vertical integration among key regional players, aimed at securing reliable raw material supply (hot-rolled steel coils or electric resistance welded shells) and optimizing cost structures. Strategic collaborations between DOM pipe producers and Tier 1 automotive suppliers are becoming commonplace to co-develop custom-engineered tubing solutions tailored for electric vehicle platforms, which often require unique material properties to manage battery weight and structural integrity. Overall market performance is resilient, balancing macroeconomic pressures with unavoidable requirements for high-quality tubing across indispensable industrial sectors.

AI Impact Analysis on Drawn Over Mandrel (DOM) Steel Pipe Market

User inquiries regarding AI's influence in the DOM steel pipe sector frequently revolve around optimization of cold drawing processes, predictive maintenance for machinery downtime, and enhanced quality control inspection systems. Key themes highlight expectations that AI and machine learning (ML) algorithms can drastically reduce material waste by optimizing the number of drawing passes and mandrel lubrication parameters based on real-time feedback regarding material hardness and deformation characteristics. Concerns often center on the capital expenditure required to integrate sophisticated sensor technology and edge computing capabilities into existing high-throughput production lines. Users expect AI to minimize surface defects, predict equipment failures (such as die wear), and ultimately reduce the overall cost of producing high-precision DOM tubing while maintaining the strict quality standards required by hydraulic and automotive clients.

- AI-powered predictive modeling optimizes cold drawing parameters (drafting schedules, lubrication rates) to minimize defects and reduce energy consumption.

- Machine Vision systems, coupled with deep learning, enable real-time, high-speed detection of micro-surface imperfections and dimensional anomalies during the production process, enhancing quality assurance.

- Predictive maintenance schedules, managed by ML algorithms analyzing vibration and temperature data from drawing equipment, significantly reduce unexpected downtime and extend die life.

- Integration of AI in inventory management and supply chain logistics optimizes the sourcing of raw ERW shells and improves delivery times for specific diameter/wall thickness combinations.

- Generative AI tools assist engineers in designing complex tube profiles and simulating mechanical performance under various stress conditions, accelerating product development cycles for specialized applications.

DRO & Impact Forces Of Drawn Over Mandrel (DOM) Steel Pipe Market

The market dynamics for DOM steel pipe are shaped by a complex interplay of demand-side drivers, supply-side constraints, and overarching macro-economic opportunities. A major driver is the accelerating demand for fluid power systems in emerging markets, necessitating reliable, high-pressure tubing for construction, agriculture, and mining equipment. Simultaneously, stringent regulatory mandates regarding vehicle safety and emissions are compelling manufacturers to adopt lightweight, high-strength materials, further solidifying the role of DOM tubing in structural automotive parts. These drivers contribute to high investment returns for producers capable of meeting specialized quality requirements and tight lead times.

Restraints primarily include the volatile pricing of raw materials, specifically hot-rolled steel coils, which introduces unpredictability into manufacturing costs and profit margins. Furthermore, the high capital investment required for cold drawing equipment and specialized heat treatment facilities acts as a significant barrier to entry for new competitors. The market also faces competition from alternative materials, such as precision-honed seamless tubes and high-strength aluminum alloys, particularly in aerospace and lightweight component manufacturing, although DOM retains a cost-effectiveness advantage in many large-volume industrial applications.

Opportunities for growth are abundant in the electric vehicle (EV) sector, where specialized DOM tubing is required for structural frames, battery enclosures, and innovative thermal management systems. The expansion of automated warehousing and logistics systems (robotics) also presents a niche opportunity, as these complex machines rely heavily on compact, high-precision hydraulic and pneumatic components. Impact forces across the market include the bargaining power of major buyers (large OEMs), which is high due to the standardized nature of many DOM products, and the intense rivalry among established players focused on quality accreditation (e.g., ISO certifications) and technical service provision.

Segmentation Analysis

The Drawn Over Mandrel (DOM) Steel Pipe Market is segmented based on critical attributes including the material type used, the application sector served, and the size specifications (outer diameter and wall thickness). Analyzing these segments provides strategic insights into high-growth areas. The primary material segments include carbon steel, alloy steel (such as chromoly), and specialized high-strength low-alloy (HSLA) variants, each catering to different mechanical property requirements. Application segmentation highlights the dominance of hydraulic cylinders, followed closely by automotive components (axles, chassis), structural supports, and general engineering uses. Geographical segmentation focuses on key consumption regions such as North America, Europe, and the dominant Asia Pacific market, reflecting variations in industrial maturity and regulatory environments. This detailed segmentation facilitates targeted product development and competitive positioning.

- By Material Type:

- Carbon Steel (e.g., ASTM A513 Type 5)

- Alloy Steel (e.g., 4130, 4140)

- Stainless Steel (Niche Applications)

- By Outer Diameter (OD):

- Up to 2.0 inches

- 2.0 inches to 4.0 inches

- Above 4.0 inches

- By Application:

- Hydraulic Cylinders (Barrels, Shafts)

- Automotive Components (Axles, Drive Shafts, Suspension)

- Construction and Agricultural Equipment

- Mining and Oilfield Equipment

- General Machinery and Structural Components

- By End-Use Industry:

- Automotive

- Construction and Infrastructure

- Oil and Gas

- Aerospace and Defense

- Industrial Manufacturing

Value Chain Analysis For Drawn Over Mandrel (DOM) Steel Pipe Market

The value chain for the DOM steel pipe market begins with upstream analysis focusing on the procurement of raw materials, primarily hot-rolled steel coils or strips. These materials are sourced from large integrated steel mills, and pricing volatility in the global steel commodity market significantly impacts the initial cost structure. Key activities at this stage involve slitting the coils into appropriate widths and running them through an Electric Resistance Welding (ERW) process to form the initial "mother tube" or welded shell. Efficiency in the upstream segment relies heavily on long-term procurement contracts and the strategic location of the DOM producer relative to major steel suppliers to minimize logistical costs and secure material quality compliance.

The core manufacturing process constitutes the midstream segment, encompassing several critical, high-precision steps: cleaning, cold drawing over a mandrel (the defining step), stress relieving or annealing heat treatments, and precision cutting/straightening. The complexity and high capital requirement of the cold drawing process necessitate significant internal expertise and strict quality control measures, including multiple non-destructive testing stages (NDT) such as hydrostatic testing and ultrasonic examination. Successful midstream operations depend on maximizing throughput while maintaining the tight dimensional tolerances and superior surface finish characteristic of DOM products.

Downstream analysis involves the distribution channels and end-user engagement. DOM pipes are distributed through both direct sales to large Original Equipment Manufacturers (OEMs), particularly in the automotive and heavy machinery sectors, and indirectly via specialized metal service centers and distributors. Distributors play a crucial role by providing value-added services such such as cutting, honing, and special coatings, allowing smaller manufacturers access to precise quantities and specifications. The direct sales channel is favored by major producers for large volume, customized orders, ensuring close collaboration on specific material and mechanical property requirements, whereas indirect channels offer market breadth and local inventory management for general engineering applications.

Drawn Over Mandrel (DOM) Steel Pipe Market Potential Customers

Potential customers for Drawn Over Mandrel (DOM) steel pipes are predominantly large-scale industrial manufacturers who require materials with high precision, exceptional strength, and reliable performance under high stress or pressure conditions. The most significant end-user segment is the fluid power industry, where manufacturers of hydraulic and pneumatic cylinders are primary consumers. These companies demand DOM tubing for the cylinder barrels due to its superior internal diameter uniformity and surface finish, which minimizes wear on seals and extends the operational life of the equipment in demanding environments like mining and construction.

Another major customer cluster is the global automotive and heavy transportation industry. Automotive OEMs and their Tier 1 suppliers use DOM tubing for structurally critical components, including steering columns, propeller shafts, axles, and highly stressed suspension components. The consistency of wall thickness and superior mechanical properties achieved through the cold drawing process are essential for meeting stringent automotive crash safety standards and vehicle weight reduction targets. As the electric vehicle market grows, demand for DOM pipes in battery housing and frame reinforcement is also rising.

Beyond these core industries, potential buyers include manufacturers in the agricultural machinery sector (tractors, harvesters), who utilize the product for robust chassis and lifting mechanisms; the energy sector, particularly for drilling equipment and downhole tooling where precise, high-strength tubular components are required; and general engineering firms producing industrial rollers, bushings, and other precision machine components where dimensional stability is paramount. The procurement decision for these customers is driven by documented technical specifications, material certifications, competitive pricing, and the supplier's ability to consistently deliver zero-defect products tailored to precise specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.9 Billion |

| Market Forecast in 2033 | $2.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, Nippon Steel Corporation, TimkenSteel, Plymouth Tube Company, Kian Choo Pipe Fittings (KCP), JFE Steel Corporation, Benteler International AG, Salzgitter AG, Zekelman Industries, Fine Tubes Ltd., Sandvik AB, Webco Industries Inc., Allied Tube & Conduit (Atkore), TATA Steel, Marmon/Keystone LLC, United Seamless Tubulaar Private Limited (USTPL), Hannibal Industries, Sumitomo Metal Industries, Shenyang Zhongshun High Strength Pipe Co., and Northwest Pipe Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drawn Over Mandrel (DOM) Steel Pipe Market Key Technology Landscape

The technology landscape for the DOM steel pipe market is characterized by advancements focused on improving dimensional consistency, surface quality, and the mechanical properties of the final product. A foundational technology involves sophisticated Electric Resistance Welding (ERW) processes, which utilize high-frequency induction heating to create a mother tube with a high-integrity, clean weld seam, minimizing residual stress before the cold working stage. Subsequent developments focus on in-line ultrasonic and eddy current testing equipment integrated immediately after the welding process to ensure zero-defect material enters the cost-intensive cold drawing stage, thereby reducing scrap rates and improving overall operational efficiency.

The core technological advancement revolves around the cold drawing machinery itself. Modern drawing benches employ advanced hydraulic systems and precise mandrel designs that facilitate optimized material reduction and elongation with minimal surface scoring. Furthermore, specialized lubrication technologies, including polymer-based and reactive soaps, are critical for managing the high friction and heat generated during the drawing process. The appropriate selection of lubricant directly impacts the finished product's internal and external surface finish, which is paramount for hydraulic applications where smooth surfaces reduce seal wear and friction.

Post-drawing heat treatment, such as normalization or annealing in controlled atmosphere furnaces, constitutes another critical technological area. These processes are essential for stress relief and for achieving specific, customer-required mechanical properties, such as high yield strength or improved ductility for subsequent forming. The shift towards manufacturing DOM tubes from High-Strength Low-Alloy (HSLA) steels requires tighter control over these thermal cycles to ensure the final micro-structure provides the necessary strength while maintaining adequate weldability and formability for customer use. Adoption of Industry 4.0 concepts, including real-time data acquisition and IoT sensors, allows for granular control over temperature uniformity and time-at-temperature, enhancing traceability and quality consistency across large batches.

Regional Highlights

- Asia Pacific (APAC): The APAC region dominates the global DOM steel pipe market, fueled primarily by unparalleled infrastructural expansion and the rapid growth of the automotive manufacturing sector, especially in China and India. Government initiatives promoting domestic high-speed rail networks, massive road development projects, and mechanized agriculture contribute significantly to the demand for hydraulic and structural DOM components. Local manufacturers benefit from lower operating costs but must continually upgrade their cold drawing technology to meet the increasingly strict quality standards set by multinational OEMs establishing production facilities in the region. The high volume of basic construction activity ensures consistent demand for standard carbon steel DOM specifications, while the burgeoning electric vehicle ecosystem in East Asia drives demand for specialized, lightweight alloy DOM tubing. This region is the primary engine of global volume growth.

- North America: North America represents a mature, high-value market characterized by stringent quality demands, particularly from the aerospace, defense, and heavy equipment industries. Demand is highly concentrated on high-specification products, often utilizing specialized alloy steels (like 4130 chromoly) for applications requiring exceptional strength and fatigue resistance, such as downhole oil and gas equipment and large-scale agricultural machinery. The US market emphasizes traceability and domestically sourced materials, leading to competition based on technical service and certification compliance rather than purely on price. Investment in advanced manufacturing techniques, including automated honing and finishing processes, is common to cater to the critical hydraulic cylinder segment, maintaining North America as a leader in high-precision DOM applications.

- Europe: The European DOM steel pipe market is highly specialized and technologically advanced, driven by strict environmental regulations and the strong presence of premium automotive manufacturers (Germany, Italy) and high-precision industrial machinery producers. There is significant focus on developing cold-drawn precision tubes (CDPT) that meet Euro standards for pressure equipment and vehicle safety. The market growth here is modest but stable, centering on innovation in material science, such as developing lighter grades suitable for EV platforms and robotics. The emphasis on localized supply chains and rapid prototyping capability gives European manufacturers a competitive edge in niche, custom-specification orders requiring extremely tight geometric tolerances and specific surface roughness characteristics.

- Latin America, Middle East, and Africa (LAMEA): This heterogeneous region offers varied opportunities. Latin America, particularly Brazil and Mexico, demonstrates strong demand linked to mining, agriculture, and increasing domestic vehicle production, relying heavily on imports or localized manufacturing using imported raw materials. The Middle East segment is driven primarily by sustained oil and gas investment, requiring robust, corrosion-resistant DOM tubing for hydraulic controls and structural elements in offshore platforms and refining operations. Africa's market remains largely focused on construction and resource extraction equipment maintenance, with growth linked to large-scale infrastructure projects requiring durable, standard-specification DOM piping.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drawn Over Mandrel (DOM) Steel Pipe Market.- ArcelorMittal

- Nippon Steel Corporation

- TimkenSteel

- Plymouth Tube Company

- Kian Choo Pipe Fittings (KCP)

- JFE Steel Corporation

- Benteler International AG

- Salzgitter AG

- Zekelman Industries

- Fine Tubes Ltd.

- Sandvik AB

- Webco Industries Inc.

- Allied Tube & Conduit (Atkore)

- TATA Steel

- Marmon/Keystone LLC

- United Seamless Tubulaar Private Limited (USTPL)

- Hannibal Industries

- Sumitomo Metal Industries

- Shenyang Zhongshun High Strength Pipe Co.

- Northwest Pipe Company

Frequently Asked Questions

Analyze common user questions about the Drawn Over Mandrel (DOM) Steel Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of DOM steel pipe over standard ERW or seamless pipe?

The primary advantage of DOM steel pipe is its superior dimensional accuracy, particularly concentricity and uniform wall thickness, achieved through the cold drawing process. This precision minimizes material needed for machining and ensures optimal performance in high-pressure hydraulic cylinders.

Which industry applications drive the highest volume demand for DOM tubing globally?

The highest volume demand is consistently driven by the manufacturing of hydraulic cylinders for heavy construction, agricultural, and mining equipment, followed closely by structural components required in the automotive industry, particularly axles and suspension systems.

How does the volatility of steel commodity prices affect the DOM pipe market?

Volatile steel commodity prices directly impact the upstream manufacturing costs, leading to fluctuating final product prices and challenging inventory management for DOM pipe manufacturers. Producers often mitigate this through long-term supply contracts or implementing surcharge mechanisms.

What role does cold working play in determining the final properties of DOM steel pipe?

Cold working drastically enhances the mechanical properties of the pipe, increasing its yield strength and tensile strength while simultaneously improving surface finish and microstructure uniformity, making it suitable for applications requiring high integrity under dynamic stress.

Is the transition to electric vehicles (EVs) creating new opportunities for DOM steel pipe manufacturers?

Yes, the EV transition creates significant opportunities, particularly in supplying specialized, high-strength, lightweight DOM tubing for structural battery enclosures, frame reinforcement, and advanced thermal management systems where weight savings are critical.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager