Drilling and Foundation Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432674 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Drilling and Foundation Equipment Market Size

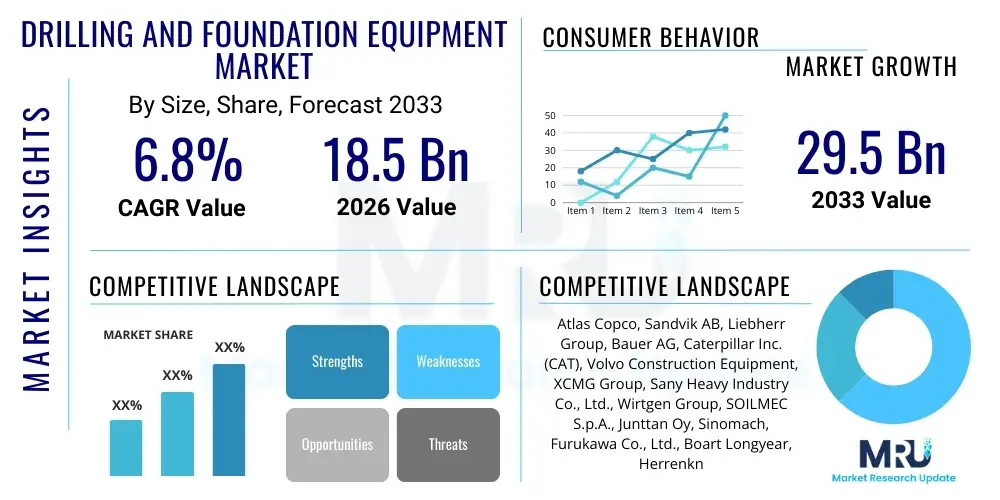

The Drilling and Foundation Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $29.5 Billion by the end of the forecast period in 2033.

Drilling and Foundation Equipment Market introduction

The Drilling and Foundation Equipment Market encompasses specialized machinery designed for geotechnical and structural preparation across various sectors, primarily construction, mining, and oil & gas. This equipment is critical for creating deep foundations, ground stabilization, and subsurface exploration necessary for large-scale infrastructure projects, high-rise buildings, bridges, and renewable energy installations (such as offshore wind farms). Key products include rotary drilling rigs, piling rigs (e.g., Continuous Flight Auger or CFA), hydraulic hammers, vibratory hammers, and specialized trenching equipment. The core function of this machinery is to efficiently penetrate diverse geological strata and install foundation elements that safely transfer structural loads to competent bearing layers.

Major applications driving market demand include rapid urbanization in developing economies, necessitating massive residential and commercial infrastructure construction, and global governmental investments in transportation networks (highways, railways, and ports). Furthermore, the transition toward sustainable energy sources requires heavy-duty foundation equipment for installing large turbine bases, both onshore and offshore, which often involve complex ground conditions and deep drilling capabilities. The technological evolution of this equipment focuses on enhanced power-to-weight ratios, improved fuel efficiency, and integration of telemetry systems for operational monitoring and safety compliance.

The principal benefits derived from advanced foundation equipment include reduced construction timelines, improved site safety through automation features, and superior precision in drilling depth and alignment, which minimizes material waste and rework. Driving factors for sustained market growth include stringent building codes requiring robust foundation solutions, the increasing complexity of construction sites (often necessitating deep foundations in challenging urban environments), and the replacement cycle of aging equipment fleets with newer, more environmentally compliant models featuring Tier 4 or equivalent engine standards. These integrated factors establish the market as a vital component of the global heavy construction and resource extraction industries.

Drilling and Foundation Equipment Market Executive Summary

The global Drilling and Foundation Equipment Market is experiencing robust growth fueled primarily by increasing capital expenditure on large-scale infrastructure development across Asia Pacific and technological advancements centered on operational efficiency and environmental sustainability. Key business trends indicate a strong move toward hybridization and electrification of equipment, addressing rising fuel costs and stricter emission regulations, particularly in North America and Europe. Equipment manufacturers are focused on integrating IoT and telematics to offer predictive maintenance services, thereby increasing machine uptime and reducing the Total Cost of Ownership (TCO) for end-users. Mergers, acquisitions, and strategic partnerships, particularly between traditional equipment manufacturers and specialized software providers, are shaping the competitive landscape toward integrated solutions providers.

Regionally, the Asia Pacific market is poised for the fastest expansion, driven by continuous high investment in residential infrastructure, urbanization projects in China and India, and major governmental initiatives like the Belt and Road Initiative (BRI). Europe and North America remain mature markets characterized by replacement demand, high technological adoption, and significant demand stemming from specialized sectors like tunneling and offshore wind farm construction, where large diameter and deep foundation solutions are mandatory. Conversely, markets in Latin America and the Middle East show volatility linked to fluctuating commodity prices, though diversification into non-oil sectors is creating niche opportunities for foundation equipment focused on commercial real estate and utility projects.

Segmentation trends highlight the dominance of rotary drilling rigs, crucial for large civil engineering projects, while the piling equipment segment is seeing rapid innovation, particularly in Continuous Flight Auger (CFA) technology due to its speed and reduced noise pollution, making it ideal for sensitive urban sites. The mining segment is increasingly adopting large-capacity exploration drilling rigs as exploration efforts move deeper and into more remote areas. Furthermore, equipment designed for geotechnical investigation is seeing steady demand, acting as a prerequisite for virtually all major construction and mining ventures, ensuring sustained market stability across diverse application areas.

AI Impact Analysis on Drilling and Foundation Equipment Market

Common user questions regarding AI's impact on the drilling and foundation equipment sector primarily revolve around how machine learning can enhance operational safety, predictive maintenance schedules, and improve the accuracy of subsurface data interpretation. Users are concerned about the integration costs, the required level of digital infrastructure maturity, and the ethical implications of autonomous decision- making in drilling processes. A central theme is the expectation that AI should transform geo-technical risk management by allowing real-time adjustments to drilling parameters based on instantaneous feedback from sensors, minimizing equipment failure and optimizing energy consumption. There is also significant user interest in utilizing AI to automate routine tasks, thereby addressing the persistent labor shortage faced by the construction industry and ensuring consistent quality control across heterogeneous job sites.

- AI-driven Predictive Maintenance: Utilizing sensor data (vibration, temperature, pressure) to forecast component failure, significantly reducing unplanned downtime.

- Optimized Drilling Parameters: Machine learning algorithms analyze soil composition and automatically adjust torque, feed rate, and rotation speed for maximum efficiency and reduced wear.

- Enhanced Geotechnical Interpretation: AI processes vast amounts of drilling logs and seismic data to create more accurate 3D subsurface models, improving foundation design reliability.

- Autonomous Operation: Implementation of AI systems enables semi-autonomous or fully autonomous drilling cycles, enhancing safety and operator efficiency.

- Supply Chain Optimization: AI models predict demand fluctuations for specialized tooling and spare parts, ensuring timely inventory management for manufacturers and dealers.

- Real-time Safety Monitoring: Computer vision and AI assess site conditions and worker proximity to moving machinery, issuing immediate alerts to prevent accidents.

DRO & Impact Forces Of Drilling and Foundation Equipment Market

The market is significantly influenced by macro-economic drivers, primarily rapid global urbanization and substantial public and private infrastructure spending, particularly in emerging markets focused on modernizing transportation and utility networks. However, growth is restrained by the high initial capital expenditure required for sophisticated, large-scale drilling machinery, coupled with the volatility of commodity prices which directly impacts the profitability and investment capacity within the mining and oil & gas segments. Opportunities lie predominantly in technological innovation, specifically the development and adoption of electric and hybrid equipment mandated by global sustainability targets, and the increasing demand for specialized foundation solutions tailored for renewable energy projects, such as complex monopile installations for offshore wind farms.

Key drivers include substantial investment in housing and commercial real estate, demanding reliable and deep foundation solutions, and government policies encouraging infrastructure development to stimulate economic recovery post-pandemic. The restraints primarily involve the global skilled labor shortage necessary to operate and maintain high-tech drilling equipment, delays in obtaining necessary environmental and operational permits for large projects, and fluctuating raw material costs that impact manufacturing expenses. These restraints necessitate innovative financing models and focused workforce development initiatives to mitigate their dampening effect on market expansion.

The underlying impact forces shaping this market involve intense regulatory pressure to reduce carbon emissions from heavy machinery, pushing manufacturers towards alternative power sources, and the necessity of high precision in foundation work due to stringent engineering standards. The substitution threat is relatively low, as conventional deep foundation methods cannot be easily replaced by other techniques for major structural loads, but the competitive rivalry is high, driven by differentiation based on automation features, efficiency metrics, and comprehensive after-sales service networks. This dynamic environment compels continuous investment in R&D to maintain market relevance and achieve compliance with evolving global safety and environmental mandates.

Segmentation Analysis

The Drilling and Foundation Equipment Market is segmented based on equipment type, operation method, application, and geographical region, providing a granular view of market dynamics and adoption patterns. Equipment type segmentation differentiates between machinery used primarily for drilling (such as exploration rigs, blast hole rigs) and equipment dedicated to foundation installation (such as piling rigs, hydraulic hammers, and vibrators). The application segmentation clearly delineates demand originating from the Construction sector (civil engineering, residential, commercial), the Mining sector (surface and underground extraction), and the Oil & Gas sector (onshore and offshore exploration and production), with construction consistently representing the largest market share due to global infrastructure demand.

Further analysis of segmentation by operation method reveals a distinction between rotary drilling methods, essential for deep boreholes and caissons, and percussion drilling or hammering methods, used extensively for driven piles and sheet piling applications. This operational distinction often dictates the choice of equipment based on the geological characteristics of the job site, with rotary techniques being favored in cohesive soils or rock formations, and percussion methods used more commonly in granular or softer strata. Understanding these segments is crucial for manufacturers tailoring product lines to specific regional geotechnical requirements and for investors assessing the highest growth potential areas within the heavy machinery ecosystem.

The technological sophistication within segments is rapidly increasing, with higher specifications demanded for depth, diameter, and load-bearing capacity. For instance, the demand for large-diameter drilling equipment (often exceeding 2.5 meters) is spiking due to massive bridge projects and the installation of increasingly larger offshore wind turbines. This market specificity ensures that segmentation remains a critical tool for strategic market positioning, allowing companies to focus their resources on high-value, high-precision foundation machinery segments that yield greater profitability margins and are less susceptible to general construction slowdowns.

- By Equipment Type:

- Drilling Rigs (Rotary Rigs, Blast Hole Rigs, Exploration Rigs)

- Piling Equipment (Hydraulic Piling Rigs, CFA Rigs, Rotary Piling Rigs)

- Foundation Equipment Accessories (Drilling Tools, Augers, Casings, Hammers, Vibrators)

- Trenching and Diaphragm Wall Equipment

- By Operation Method:

- Rotary Drilling

- Percussion Drilling

- Vibratory Driving

- By Application:

- Construction (Infrastructure, Commercial, Residential)

- Mining (Metal, Non-metal, Coal)

- Oil & Gas (Onshore and Offshore)

- Water Well Drilling

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Drilling and Foundation Equipment Market

The value chain for the Drilling and Foundation Equipment Market begins with upstream activities dominated by raw material suppliers (steel, hydraulic components, engine manufacturers) and specialized component fabricators. The quality and cost of high-grade steel are pivotal, as structural integrity is paramount for heavy-duty machinery subject to high stress and fatigue. Efficient procurement of Tier 4 or equivalent high-efficiency engines and sophisticated hydraulic systems from global leaders significantly determines the final product performance and compliance with emissions standards. Upstream stability is challenged by global supply chain bottlenecks and fluctuating commodity prices, necessitating strong contractual relationships between equipment manufacturers and key component providers to ensure reliable production schedules.

The core of the value chain involves the Original Equipment Manufacturers (OEMs) who handle design, assembly, and integration of complex systems. OEMs invest heavily in R&D to enhance automation, durability, and operational efficiency, integrating advanced telematics and safety features into their machines. Following manufacturing, the distribution channel plays a crucial role; this includes direct sales (often for large fleet orders or highly customized equipment) and indirect channels utilizing authorized dealerships and specialized rental companies. Dealerships provide essential services such as localized technical support, spare parts inventory management, and maintenance services, acting as the primary interface between the manufacturer and the end-user.

Downstream activities are defined by equipment operation, maintenance, and eventual disposal or refurbishment. Rental companies constitute a significant end-user segment, offering flexibility to contractors who may not wish to commit large capital outlay. Post-sale services, including extended warranties, specialized tooling provision, and digital service packages (telematics subscriptions), are increasingly vital revenue streams, contributing significantly to customer retention and brand loyalty. The cyclical nature of the construction and mining industries demands that the value chain be highly adaptable, ensuring that equipment supply can rapidly respond to sudden spikes in infrastructure investment or exploration activities globally.

Drilling and Foundation Equipment Market Potential Customers

Potential customers for drilling and foundation equipment are diverse, ranging from multinational engineering, procurement, and construction (EPC) firms to specialized geotechnical contractors and government infrastructure agencies. EPC firms, which manage large-scale turnkey projects like bridges, ports, and power plants, require comprehensive fleets of equipment for both preliminary ground investigation and final foundation installation. Geotechnical contractors, specializing in deep foundations, piling, and ground stabilization, represent another core customer base, relying on high-performance, specialized rigs that can handle challenging soil conditions such as hard rock or karst formations prevalent in certain geographies.

Furthermore, the energy sector is a crucial buyer; this includes large oil and gas exploration companies requiring robust drilling rigs for both onshore and increasingly complex offshore environments, as well as renewable energy developers demanding specialized piling and foundation equipment for solar farms and wind turbine installations. Mining companies, both those focused on surface extraction (requiring blast hole drilling) and underground operations (requiring exploration rigs), constitute a steady demand source. These customers prioritize equipment reliability, payload capacity, and the ability to operate effectively in remote or extreme environmental conditions, demanding highly ruggedized machinery.

A growing segment of potential customers includes equipment rental houses, which purchase equipment in bulk to serve smaller contractors or those with short-term project needs. This segment prioritizes machine versatility, ease of transport, and strong residual value. Ultimately, the purchasing decisions of all end-users are driven by maximizing efficiency, reducing operational downtime, adhering to strict safety standards, and ensuring compliance with project timelines, making equipment longevity, serviceability, and advanced automation features primary factors in procurement decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $29.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Sandvik AB, Liebherr Group, Bauer AG, Caterpillar Inc. (CAT), Volvo Construction Equipment, XCMG Group, Sany Heavy Industry Co., Ltd., Wirtgen Group, SOILMEC S.p.A., Junttan Oy, Sinomach, Furukawa Co., Ltd., Boart Longyear, Herrenknecht AG, TGS-NOPEC Geophysical Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drilling and Foundation Equipment Market Key Technology Landscape

The technological landscape of the drilling and foundation equipment market is rapidly evolving, driven by the need for higher precision, greater safety, and reduced environmental impact. A key development is the widespread integration of advanced telematics and Internet of Things (IoT) sensors, which allow for real-time monitoring of machine performance metrics such as fuel consumption, engine load, and hydraulic pressure. This data is leveraged for sophisticated predictive maintenance models, significantly reducing unexpected operational failures and optimizing maintenance schedules, thereby maximizing the utilization rate of expensive capital equipment. Furthermore, GPS and highly accurate guidance systems are increasingly standard, ensuring foundation elements are installed precisely to specified coordinates and depths, critical for complex civil engineering projects like long-span bridges and high-rise structures.

Another major technological shift involves the adoption of electrification and hybrid drive systems, particularly in densely populated urban areas where noise and exhaust emissions are strictly regulated. Hybrid drilling rigs utilize battery power to supplement engine output during peak load times or for silent operation, drastically improving fuel efficiency and reducing the carbon footprint. Concurrently, manufacturers are focusing on automation and semi-autonomous operational modes. Automated systems can manage routine drilling cycles, minimizing operator fatigue and ensuring consistent quality of boreholes or pile driving sequences, which is vital for maintaining structural integrity across an entire site.

Furthermore, digital twin technology is gaining traction. This involves creating virtual replicas of equipment and job sites, allowing contractors to simulate complex drilling procedures and predict machine behavior under varying soil conditions before commencing physical work. This simulation capability enhances safety protocols and optimizes workflow planning. Specialized tooling and accessories, such as advanced rock-drilling tools (DTH hammers, advanced drill bits) and noise-dampening pile driving systems, also represent critical technological innovations that enable contractors to tackle increasingly challenging geotechnical environments with greater speed and efficiency, solidifying the market's reliance on continuous technological upgrades.

Regional Highlights

The Drilling and Foundation Equipment Market exhibits significant regional disparities in terms of growth rates, technological maturity, and demand drivers. Asia Pacific (APAC) stands out as the primary growth engine, fueled by unprecedented rates of urbanization and massive government-led infrastructure investment, particularly in China, India, and Southeast Asian nations. The demand here is largely centered on large-scale construction projects, including residential complexes, commercial hubs, and extensive metro rail and highway systems. While cost-effectiveness remains a priority, there is a rapidly growing acceptance of medium- to high-tech equipment to meet stringent international quality standards, especially in foundation work for seismic zones.

North America and Europe represent mature markets characterized by replacement cycles, stringent environmental regulations, and high technological adoption. In these regions, demand is driven less by sheer volume of new construction and more by specialized high-value projects. The European market, in particular, is witnessing robust demand for deep foundation equipment necessitated by the aggressive build-out of offshore wind energy infrastructure, requiring complex jack-up rigs and deep-sea piling capabilities. Similarly, North America’s demand is sustained by consistent investment in oil and gas infrastructure modernization, combined with significant public works projects focused on repairing and replacing aging transportation infrastructure.

The Middle East and Africa (MEA) region presents a highly cyclical market, heavily influenced by fluctuating oil prices and government diversification strategies. While major construction hubs like the UAE and Saudi Arabia continue to drive demand for foundation equipment through mega-projects (e.g., NEOM, EXPO sites), the rest of the African market is slowly emerging, driven by localized mining exploration and development of basic utilities infrastructure. Latin America faces economic instability, limiting major capital expenditures, yet opportunities exist in specific countries like Brazil and Mexico where mining and renewable energy projects generate niche demand for robust, reliable drilling machinery capable of handling diverse geological complexity.

- Asia Pacific: Characterized by the highest volume demand due to urbanization, infrastructure development (BRI, Indian national highways), and rapid adoption of mid-range equipment.

- North America: Focuses on advanced, specialized machinery for regulatory compliance, oil & gas stability, and refurbishment of aging civil infrastructure.

- Europe: High demand for electric/hybrid equipment, driven by strict environmental policies, and specialized foundation rigs for large-scale offshore renewable energy projects.

- Middle East: Demand linked to high-profile real estate and tourism mega-projects, requiring high-capacity, robust equipment suitable for extreme temperatures and desert conditions.

- Latin America: Demand stability tied to commodity extraction (mining) and targeted national infrastructure modernization projects, often relying on rugged, proven technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drilling and Foundation Equipment Market.- Atlas Copco

- Sandvik AB

- Liebherr Group

- Bauer AG

- Caterpillar Inc. (CAT)

- Volvo Construction Equipment

- XCMG Group

- Sany Heavy Industry Co., Ltd.

- Wirtgen Group (John Deere)

- SOILMEC S.p.A.

- Junttan Oy

- Sinomach

- Furukawa Co., Ltd.

- Boart Longyear

- Herrenknecht AG

- TGS-NOPEC Geophysical Company

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Konecranes Oyj

- Cemco Inc.

Frequently Asked Questions

Analyze common user questions about the Drilling and Foundation Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the foundation equipment market?

The primary driver is the accelerating global investment in infrastructure, particularly sustained government and private sector capital expenditure on transportation networks, urban development projects, and the establishment of large-scale renewable energy facilities, especially offshore wind farms requiring specialized deep foundation solutions.

How is environmental regulation impacting the design of new drilling equipment?

Environmental regulations, such as stringent emission standards (e.g., Tier 4/Stage V) and noise limitations, are driving manufacturers to invest heavily in electric and hybrid power systems, improving engine efficiency, and developing quieter piling and drilling technologies suitable for operation in sensitive urban and protected natural environments.

Which geographical region holds the largest market share for drilling and foundation equipment?

Asia Pacific (APAC) currently holds the largest market share, characterized by its immense population, high rates of urbanization, and continuous, large-scale infrastructural development projects in major economies like China, India, and other emerging Southeast Asian nations.

What role does automation play in modern foundation equipment?

Automation plays a crucial role in enhancing site safety, improving operational precision, and increasing efficiency. Automated functions include self-leveling systems, integrated telemetry for real-time diagnostics, and semi-autonomous drilling cycles, which reduce reliance on manual control and minimize human error in complex geotechnical operations.

What is the estimated Compound Annual Growth Rate (CAGR) for this market?

The Drilling and Foundation Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between the forecast years of 2026 and 2033, reflecting stable global demand underpinned by long-term infrastructure and resource exploration requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager