Drilling Motors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433817 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Drilling Motors Market Size

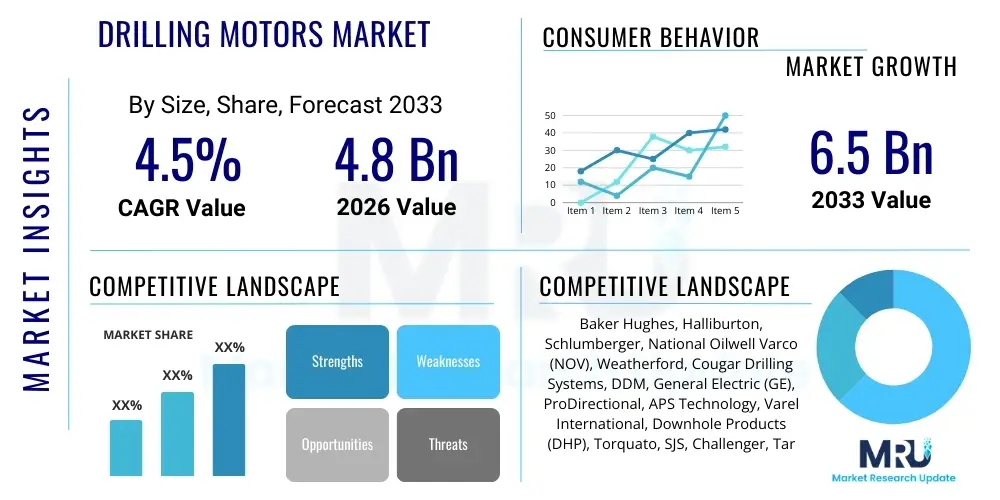

The Drilling Motors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Drilling Motors Market introduction

The Drilling Motors Market encompasses downhole tools, primarily Positive Displacement Motors (PDMs) and turbine motors, crucial for rotary drilling operations, particularly in directional and horizontal drilling applications. These specialized tools convert the hydraulic energy of the drilling fluid (mud) into mechanical power (torque and rotational speed) to drive the drill bit at the bottom of the wellbore, independent of the rotation of the drill string from the surface. The efficiency and reliability of these motors directly influence drilling speed (Rate of Penetration or ROP), wellbore quality, and the overall success of complex well profiles, making them indispensable components in the upstream oil and gas sector.

Major applications of drilling motors include high-angle and horizontal well construction, multilateral drilling, and navigating complex geological formations where conventional rotary drilling is inefficient or impossible. The sustained global demand for energy, coupled with the necessity to exploit unconventional reserves (such as shale gas and tight oil) and deepwater offshore fields, serves as the foundational driving factor for market expansion. Furthermore, technological advancements focused on enhancing motor performance, durability, and compatibility with sophisticated measurement-while-drilling (MWD) and logging-while-drilling (LWD) systems are continuously reshaping the product landscape, pushing manufacturers toward higher torque capacities and superior operational limits under extreme temperatures and pressures.

The primary benefits derived from utilizing modern drilling motors include achieving precise directional control, which is critical for maximizing reservoir contact; improving ROP, thereby reducing total drilling time and associated operational costs; and minimizing wear on surface equipment, as downhole motors isolate the drill bit from surface vibrations and inconsistencies. The adoption of robust drilling motor technologies is intrinsically linked to maximizing the economic viability of complex drilling campaigns globally. Factors such as the resurgence of offshore exploration activities, particularly in regions like the Gulf of Mexico, Brazil, and West Africa, and the continued maturity of unconventional resource plays in North America, solidify the market's trajectory.

Drilling Motors Market Executive Summary

The global Drilling Motors Market is characterized by robust investment cycles tied directly to global crude oil and natural gas prices, emphasizing efficiency, durability, and operational precision. Current business trends indicate a strong move towards motors designed for harsh environments, capable of withstanding high temperatures and pressures common in deepwater and ultra-deep drilling operations. Furthermore, the integration of real-time data feedback mechanisms, facilitated by advanced sensors and telemetry systems embedded within the bottom hole assembly (BHA), is a paramount trend, allowing operators to make immediate adjustments to drilling parameters, thus enhancing safety and performance. Consolidation among major oilfield service providers (OFS) and specialized equipment manufacturers is also influencing the competitive landscape, focusing on integrated solutions rather than standalone tool provision, which streamlines supply chains and optimizes field operations.

Regionally, North America maintains its dominance, driven primarily by the high concentration of horizontal drilling activities targeting vast shale reserves across the Permian Basin, Bakken, and Eagle Ford formations. However, the Asia Pacific (APAC) region, particularly China and India, represents the fastest-growing market segment, fueled by increasing domestic energy consumption and significant investments in both onshore conventional exploration and emerging offshore gas fields. Europe and Latin America are showing steady growth, often linked to deepwater projects and the exploitation of challenging offshore basins, necessitating the use of specialized, high-performance drilling motor technologies capable of navigating complex subterranean profiles efficiently and reliably. The Middle East and Africa (MEA) continue to provide foundational market stability, backed by long-term national oil company (NOC) investment strategies focused on maintaining and moderately expanding production capacity, utilizing large-scale drilling campaigns that demand proven and robust motor designs.

In terms of segmentation, the Positive Displacement Motors (PDM) segment currently holds the largest market share due to its versatility, high torque output at low speeds, and suitability for complex directional applications, especially in softer formations. However, the turbine motor segment is gaining traction, particularly in applications requiring ultra-high rotational speeds in hard rock drilling, although typically providing lower torque than PDMs. The application segment continues to be dominated by onshore activities globally, reflecting the accessibility and scale of shale plays. Yet, offshore drilling is expected to exhibit a higher compound annual growth rate (CAGR) throughout the forecast period, driven by renewed exploration licensing rounds and the imperative to secure long-term deepwater reserves that require more powerful and resilient motor systems engineered for extreme downhole conditions.

AI Impact Analysis on Drilling Motors Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Drilling Motors Market frequently center on predictive maintenance, optimization of drilling parameters, and the pathway towards fully automated drilling operations. Users are keenly interested in how machine learning algorithms can analyze vast datasets—including real-time MWD data, motor operational logs (RPM, pressure differential, temperature), and geological formation characteristics—to predict potential motor failure before it occurs, thereby minimizing non-productive time (NPT) which is a significant operational cost. There is also substantial interest in AI's role in optimizing the motor's performance curve dynamically, adjusting flow rates and weight on bit (WOB) in real-time to maximize the Rate of Penetration (ROP) and extend the motor's lifespan. The overarching theme is the transition from reactive maintenance and standardized operating procedures to proactive, data-driven, and highly customized drilling execution facilitated by advanced analytical tools, ultimately leading to significant cost reductions and improved well quality.

AI is fundamentally shifting the value proposition of drilling motors from simple mechanical tools to intelligent components within a smart drilling system. By employing machine learning models, operators can leverage historical performance data across thousands of wells to refine motor selection and usage profiles for specific geological regions, improving the consistency and predictability of drilling operations. This integration is not just about better maintenance; it is about creating an adaptive BHA system where the drilling motor communicates its health status and required adjustments continuously. This capability reduces human error, allows for immediate identification and mitigation of downhole dysfunctions (like stick-slip or whirl), and ensures that the motor operates within its most efficient performance window, which is crucial for deep and complex directional wells where intervention costs are extremely high.

The impact of AI extends to the design and manufacturing phase as well. Generative design principles, powered by AI, are being utilized to optimize the internal geometry of PDMs and turbine components, maximizing hydraulic efficiency and torque output while minimizing material stress. This focus on digital twins and simulation allows manufacturers to rapidly prototype and test motors for specific regional demands (e.g., high-abrasion environments or extreme heat) with unprecedented speed. Consequently, the future drilling motor will be an interconnected device, heavily reliant on sophisticated embedded sensors and AI-driven data analysis platforms to deliver high performance, pushing the industry toward true automated drilling systems where the motor's actions are guided instantaneously by complex optimization algorithms, promising radical improvements in drilling economics.

- AI-Driven Predictive Maintenance: Enables real-time monitoring and failure anticipation of drilling motor components, drastically reducing non-productive time (NPT).

- Real-Time Performance Optimization: Machine learning algorithms dynamically adjust drilling parameters (WOB, RPM, flow rate) to maximize ROP and motor efficiency based on downhole conditions.

- Automated Operational Control: Facilitates the development of autonomous drilling systems where AI guides directional changes and mitigates downhole vibrations (stick-slip).

- Enhanced Design and Material Selection: AI optimizes motor geometry and material composition (e.g., elastomer selection) for specific geological challenges and operating envelopes.

- Improved Logging and Data Interpretation: AI processes vast sensor data from MWD/LWD systems integrated with the motor, providing clearer insights into subterranean characteristics.

DRO & Impact Forces Of Drilling Motors Market

The Drilling Motors Market is fundamentally driven by the sustained global increase in energy demand, which necessitates aggressive exploration and production (E&P) activities, particularly focusing on challenging and previously untapped reserves such as ultra-deepwater and unconventional tight oil and gas formations. The necessity for precise directional and horizontal drilling techniques in these reservoirs directly mandates the use of reliable downhole motors. Key drivers include the technological evolution allowing motors to handle higher torque and temperature differentials, thereby expanding their operational envelopes. Furthermore, governmental incentives and increased investments by national oil companies (NOCs) and international oil companies (IOCs) into capital-intensive drilling campaigns globally significantly impact demand. Conversely, the market faces restraints primarily stemming from the inherent volatility of global crude oil prices; prolonged periods of low prices can rapidly curtail E&P spending, leading to reduced demand for drilling services and associated equipment like motors. Strict environmental regulations and increasing public scrutiny regarding hydrocarbon exploration also impose restrictions, raising operational complexities and compliance costs, particularly in sensitive offshore regions.

Opportunities for growth are heavily concentrated in technological innovation and geographical expansion. The development of specialized motors utilizing advanced materials, such as robust elastomers and specialized rotor-stator combinations, that offer extended lifespan and superior resistance to harsh drilling fluids and high pressures, presents a key avenue for market penetration. The burgeoning natural gas sector, particularly the extraction of shale gas, which relies extensively on multi-well pad drilling and long laterals, provides sustained, high-volume demand. Furthermore, the integration of digital technologies, including sensors and telemetry for real-time diagnostics (part of the overall digital oilfield initiative), offers manufacturers the opportunity to provide premium, data-enabled motor solutions that command higher value and establish stronger customer loyalty through enhanced reliability guarantees. Market impact forces are characterized by moderate-to-high bargaining power of buyers (major OFS companies and IOCs) who demand performance guarantees and competitive pricing, balanced by the high barrier to entry for new suppliers due to the specialized technology and strict safety certifications required.

The long-term impact forces are favorable, driven by global population growth and industrialization, ensuring a continuous underlying need for energy, sustaining E&P activities even during short-term price fluctuations. While the transition toward renewable energy sources represents a future constraint, the intermediate necessity of gas as a transition fuel and the non-substitutable nature of oil in many industrial processes ensure market resilience. Strategic differentiation through motor customization for specific geological basins—such as high-abrasion motors for specific geological formations in the Middle East or ultra-high-pressure motors for deepwater Gulf of Mexico projects—remains a critical determinant of competitive success and market share growth. The continuous refinement of drilling motor technology, coupled with the geopolitical stability of major oil-producing regions, acts as a primary stabilizer against cyclical economic downturns affecting the broader oilfield services sector.

Segmentation Analysis

The Drilling Motors Market is meticulously segmented based on product type, application, and end-user, reflecting the diverse and highly technical requirements of the upstream energy sector. This segmentation highlights the critical differences in motor technology required for varied geological environments and drilling objectives, ranging from shallow conventional wells to complex ultra-deepwater exploration. The largest and most influential segmentation is by Product Type, differentiating between Positive Displacement Motors (PDMs) and Turbine Motors, each offering distinct performance characteristics vital for maximizing drilling efficiency in specific conditions. The application segment dictates the market size distribution between Onshore and Offshore activities, reflecting the scale of activity across different operating environments and the distinct technical challenges, such as pressure control and logistics, inherent in each.

The segmentation based on Product Type reveals that PDMs currently dominate the market. This dominance is attributable to their ability to generate high torque at relatively low speeds, making them ideal for drilling precise directional trajectories and handling varied geological strata often encountered in unconventional resource plays. PDM technology, despite requiring periodic maintenance related to elastomers, provides the flexibility necessary for integrating with complex Measurement-While-Drilling (MWD) systems. Turbine Motors, conversely, capture market share in regions requiring ultra-high rotational speeds for drilling hard, abrasive formations efficiently, though they typically offer lower maximum torque. Strategic investment is seen in enhancing both types—PDMs focusing on higher temperature and pressure ratings, and Turbine Motors on improved power output and reliability at lower pressure drops.

In the application domain, onshore drilling, propelled by the shale revolution in North America and intensive conventional drilling in the Middle East, maintains the highest volume share. However, the Offshore segment—including shallow water, deepwater, and ultra-deepwater—is anticipated to demonstrate a higher CAGR, driven by the higher capital expenditure per well and the necessity for premium, highly durable drilling motors capable of extended runs and minimal failure rates under severe conditions. The End-User analysis confirms that the Oil & Gas sector remains the primary consumer, although niche demand from mining (for exploratory boreholes) and specialized geotechnical applications also contributes to overall market valuation, demanding smaller, precision-oriented motor systems.

- Product Type:

- Positive Displacement Motors (PDM)

- Turbine Motors

- Application:

- Onshore

- Offshore (Shallow Water, Deepwater, Ultra-Deepwater)

- End-User:

- Oil & Gas Companies (NOCs, IOCs)

- Contract Drilling Companies

- Mining and Exploration Services

Value Chain Analysis For Drilling Motors Market

The value chain for the Drilling Motors Market is highly specialized, beginning with the upstream supply of advanced raw materials, progressing through precision manufacturing, and culminating in delivery and high-intensity field services. Upstream analysis focuses heavily on the procurement of specialized alloys (for rotors, shafts, and bearings) capable of resisting extreme downhole corrosion and wear, and the sourcing of highly engineered elastomers (for PDM stators) which are performance-critical components dictating motor lifespan and efficiency. The quality and specification of these input materials are paramount, subjecting the upstream segment to stringent quality control and requiring strong relationships with certified metallurgical and polymer suppliers. The complexity of material science in this field ensures that only a limited number of specialized manufacturers can meet the required specifications, creating significant upstream reliance and cost sensitivity related to raw material price fluctuations.

The core of the value chain resides in the manufacturing and assembly phase, where high-precision machining, assembly, and rigorous testing processes convert raw materials into functional drilling motors. This phase involves sophisticated engineering design (often utilizing advanced CAD/CAM and fluid dynamics simulations) to optimize internal geometries for maximum power output and durability. Most drilling motor systems are highly customized or modular, requiring flexibility in production. Direct distribution channels are predominantly favored, involving the sale or, more commonly, the long-term rental or service provision of motors directly from the Original Equipment Manufacturers (OEMs) or major Oilfield Service (OFS) providers (like Halliburton or Schlumberger) to the end-user (E&P companies or drilling contractors). This direct relationship ensures technical support, maintenance, and seamless integration into larger Bottom Hole Assembly (BHA) service contracts.

Downstream analysis highlights the crucial role of maintenance, repair, and overhaul (MRO) services, which constitute a significant revenue stream. Given that drilling motors are routinely subjected to immense mechanical stress and extreme downhole environments, their operating life is limited, necessitating frequent teardown, inspection, and rebuilding. Specialized service centers, often owned by the OEMs or certified third-party repair shops, manage this cyclical maintenance process. Indirect distribution, while less common for complex, high-value drilling motors, sometimes involves regional distributors or rental houses that cater to smaller, independent E&P companies, providing localized inventory and support. The overall value chain is characterized by high capital investment requirements, strong technological barriers to entry, and a services-heavy model that emphasizes reliability and rapid field responsiveness.

Drilling Motors Market Potential Customers

The primary customers in the Drilling Motors Market are categorized into three main groups, all deeply integrated within the upstream hydrocarbon extraction industry. The largest segment comprises International Oil Companies (IOCs) and National Oil Companies (NOCs), such as ExxonMobil, Saudi Aramco, Petrobras, and Equinor. These entities initiate and finance large-scale exploration and development projects, and while they may not always directly purchase the motors, they are the ultimate buyers of the comprehensive drilling services provided by oilfield service companies, dictating the technical specifications and performance requirements for the downhole equipment utilized, especially for complex deepwater and unconventional resource development projects where precision and reliability are non-negotiable economic factors.

The second, and arguably most direct, customer base consists of Major Oilfield Service (OFS) providers like Baker Hughes, Halliburton, and Schlumberger. These companies often purchase or maintain vast fleets of drilling motors as part of their integrated drilling and measurement services portfolio. They bundle the drilling motor technology with Measurement-While-Drilling (MWD), Logging-While-Drilling (LWD), and directional drilling expertise, providing a comprehensive solution to the E&P companies. For these OFS providers, motor selection is driven by fleet efficiency, global logistical support needs, and the ability to operate across diverse geological and climate zones, requiring standardized, yet high-performance, product lines capable of quick deployment and minimal field failure rates.

The third significant customer group includes independent and specialized drilling contractors and rental tool companies. These firms focus specifically on executing the physical drilling operations or providing specialized BHA rental services to smaller independent E&P operators, particularly in highly localized onshore fields (e.g., North American shale basins). For these customers, factors such as the initial cost-to-performance ratio, motor durability under continuous usage, and rapid availability of replacement parts or service are paramount considerations. Additionally, specialized mining and geothermal energy companies represent niche but growing potential customers, utilizing scaled-down or uniquely adapted drilling motor technology for high-temperature and extreme-depth applications beyond traditional hydrocarbon extraction, signaling a moderate diversification of the end-user base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Baker Hughes, Halliburton, Schlumberger, National Oilwell Varco (NOV), Weatherford, Cougar Drilling Systems, DDM, General Electric (GE), ProDirectional, APS Technology, Varel International, Downhole Products (DHP), Torquato, SJS, Challenger, Target Drilling, BICO Drilling Tools, Voss, Rubicon Oilfield International, Bench Tree. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drilling Motors Market Key Technology Landscape

The technological landscape of the Drilling Motors Market is primarily defined by continuous innovation aimed at increasing durability, efficiency, and intelligence within the Bottom Hole Assembly (BHA). A crucial area of development involves material science, particularly the advancement of stator elastomers used in Positive Displacement Motors (PDMs). Traditional elastomers degrade rapidly under high temperature, high pressure (HTHP), and aggressive drilling fluid chemistries. The development of advanced, proprietary elastomers and composite materials capable of operating continuously above 350°F and resisting highly abrasive mud environments is critical for extending motor run life and improving reliability in deep wells. Furthermore, enhanced bearing technology, including mud-lubricated bearing assemblies and ceramic bearings, is employed to handle higher axial and radial loads, leading to higher available torque at the drill bit and reduced friction-induced wear.

Another major technological focal point is the seamless integration of drilling motors with sophisticated Measurement-While-Drilling (MWD) and Logging-While-Drilling (LWD) systems. Modern drilling motors are designed with shorter overall lengths and minimal interference to allow space for highly complex sensor packages immediately above the bit. This integration facilitates real-time data acquisition concerning toolface orientation, vibration levels, and downhole pressure differentials. This data stream is essential for directional drillers to make immediate course corrections and for optimizing the motor’s operational envelope. Manufacturers are also focusing on designing motors that mitigate severe downhole vibrations, such as "stick-slip" (cyclical torsional oscillation), through design modifications and specialized shock absorbers, which not only improves drilling efficiency (ROP) but also protects the sensitive MWD electronics and extends the life of the motor components.

The industry is also witnessing significant development in the high-speed turbine motor segment, traditionally challenged by lower torque output compared to PDMs. New turbine designs incorporate optimized stage geometry and flow dynamics to maximize horsepower density and improve hydraulic efficiency, making them more competitive in hard-rock, non-directional applications where high RPM is paramount. Concurrently, modularity and standardization are becoming key design principles, allowing drilling contractors to rapidly swap out motor components (rotors, stators, driveshafts) in the field, reducing maintenance turnaround time. The overarching technological trajectory is towards the creation of robust, digitally enabled, and highly reliable motor systems that act as intelligent nodes within the wider digital oilfield infrastructure, minimizing human intervention and maximizing continuous operational time under challenging conditions.

Regional Highlights

- North America (Dominance in Onshore Unconventional): North America, particularly the United States (US) and Canada, constitutes the largest market share for drilling motors, driven by the maturity and scale of the unconventional resource revolution. The continuous development of shale plays (Permian, Marcellus, Bakken) necessitates thousands of long-lateral horizontal wells annually, creating perpetual high demand for high-performance Positive Displacement Motors (PDMs) that can handle aggressive curve building and extended reach drilling (ERD). Technological adoption is rapid here, with operators quickly integrating motors capable of high-torque output and compatible with advanced rotary steerable systems (RSS) and sophisticated real-time monitoring. Although market activity is highly susceptible to WTI crude price fluctuations, the underlying structural demand for efficiency and long-run capability stabilizes the need for robust drilling motor technology.

- Middle East and Africa (MEA) (Stable Growth and High Durability Demand): The MEA region is characterized by stable, large-scale drilling programs led by National Oil Companies (NOCs) like Saudi Aramco, ADNOC, and KOC, focusing on maintaining long-term production capacity. Drilling campaigns are intensive, often involving complex onshore super-fields and deeper, high-pressure reservoirs requiring high-abrasion-resistant motors. The market here demands proven reliability and durability over innovative complexity, leading to sustained demand for large-diameter, high-power PDMs. African sub-regions, especially offshore West Africa, contribute significantly through deepwater exploration activities, driving demand for specialized HTHP-rated motors suited for challenging deepwater conditions and extended offshore deployment cycles.

- Asia Pacific (APAC) (Fastest Growth Trajectory): APAC is projected to be the fastest-growing market, fueled by rapidly rising domestic energy consumption in populous economies like China, India, and Australia. China's focus on exploiting its extensive shale gas reserves and deep onshore gas fields is boosting directional drilling activity. Australia’s robust LNG sector, which involves both onshore and offshore gas development, along with Southeast Asian shallow-water exploration, drives diverse demand. The market is characterized by a mix of localized conventional drilling and increasing adoption of advanced directional drilling techniques, providing substantial opportunities for specialized motor manufacturers to penetrate rapidly developing service markets.

- Europe (Deep Gas and Geothermal Focus): The European market is mature, with stable, focused activity primarily concentrated on North Sea decommissioning, remaining gas fields (Norway, UK), and emerging geothermal energy projects. Demand for drilling motors in Europe tends towards high-specification, environmentally compliant motors suitable for stringent regulatory environments. Key growth opportunities lie in specialized high-temperature motors used in geothermal energy drilling, where the required operating temperatures and pressures often exceed those of conventional hydrocarbon drilling, pushing the technological limits of stator and sealing materials.

- Latin America (Offshore Revival and Pre-Salt Focus): Latin America, particularly Brazil and Guyana, is driven by large-scale offshore deepwater and pre-salt exploration projects. The market is recovering from previous downturns, with major investments in complex, high-pressure, high-temperature (HPHT) environments that necessitate premium drilling motors capable of high reliability and performance across challenging formations. Mexico's ongoing energy reform and increasing activity in the Gulf of Mexico basin also contribute to robust demand for deepwater drilling technology and associated high-power, high-torque downhole motors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drilling Motors Market.- Baker Hughes

- Halliburton

- Schlumberger

- National Oilwell Varco (NOV)

- Weatherford

- Cougar Drilling Systems

- DDM

- General Electric (GE)

- ProDirectional

- APS Technology

- Varel International

- Downhole Products (DHP)

- Torquato

- SJS

- Challenger

- Target Drilling

- BICO Drilling Tools

- Voss

- Rubicon Oilfield International

- Bench Tree

Frequently Asked Questions

Analyze common user questions about the Drilling Motors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Positive Displacement Motors (PDM) and Turbine Motors?

PDMs (Moineau motors) use the flow of drilling fluid to rotate a helical rotor within a stator, providing high torque output at relatively low rotational speeds (RPM). They are ideal for precise directional drilling and softer formations. Turbine motors, conversely, rely on multiple turbine stages driven by fluid flow to achieve very high RPM but typically deliver lower torque, making them suitable for hard rock drilling and vertical applications requiring fast ROP.

How does the volatility of oil prices affect the Drilling Motors Market?

Oil price volatility directly impacts upstream capital expenditure (CapEx). Low, unstable prices cause E&P companies to reduce drilling activity and defer new projects, leading to decreased utilization rates and lower demand for new drilling motors and associated services. Conversely, sustained high prices encourage aggressive drilling campaigns, rapidly boosting market demand.

Which geographical region exhibits the highest growth potential for drilling motors?

The Asia Pacific (APAC) region, driven by large-scale shale gas development in China and increased offshore exploration across Southeast Asia and Australia, is projected to register the fastest compound annual growth rate (CAGR) due to rising energy security concerns and extensive domestic investment in complex drilling operations.

What role does advanced material science play in modern drilling motors?

Advanced material science is critical for improving motor durability and operational limits. Innovations in high-performance elastomers for PDM stators allow motors to withstand extreme High Temperature, High Pressure (HTHP) environments and abrasive drilling fluids, extending the time between maintenance cycles and minimizing costly non-productive time (NPT).

How is directional drilling influencing the demand for drilling motors?

Directional and horizontal drilling techniques are essential for accessing unconventional reservoirs and maximizing reservoir contact, particularly in shale and deepwater fields. Since drilling motors provide the necessary torque and precise control for steering the bottom hole assembly (BHA), the global increase in complex well profiles directly corresponds to a fundamental, sustained growth in demand for high-specification drilling motors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager